Электротехническая сталь находит разнообразное применение благодаря своим уникальным свойствам. Она служит в качестве основного материала в трансформаторах, повышая энергоэффективность за счет снижения магнитных потерь. В двигателях и генераторах она оптимизирует магнитные характеристики, обеспечивая надежную и плавную работу. Низкие потери в сердечнике и высокая магнитная проницаемость материала делают его жизненно важным для систем распределения электроэнергии, электромобилей и решений в области возобновляемой энергии. От улучшения преобразования энергии в приборах до обеспечения стабильности сети электротехническая сталь играет ключевую роль в различных отраслях промышленности, поддерживая эффективное и устойчивое использование энергии.

Доступ к полному отчету по адресу https://www.databridgemarketresearch.com/reports/asia-pacific-electrical-steel-market

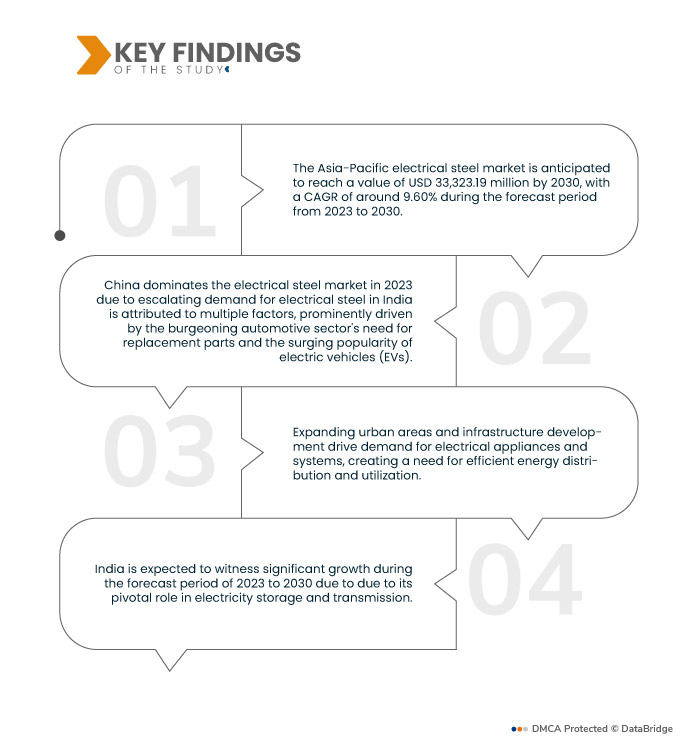

Data Bridge Market Research анализирует, что рынок электротехнической стали в Азиатско-Тихоокеанском регионе оценивается в 16 005,24 млн долларов США в 2022 году и, как ожидается, достигнет 33 323,19 млн долларов США к 2030 году, регистрируя среднегодовой темп роста в 9,60% в прогнозируемый период с 2023 по 2030 год. Всплеск внедрения электромобилей стимулирует спрос на уникальную электротехническую сталь, предназначенную для сердечников двигателей и аккумуляторов. Эти специализированные стальные компоненты повышают эффективность и производительность систем электромобилей, ускоряя рост рынка, поскольку производители ищут материалы, которые соответствуют требованиям меняющегося автомобильного ландшафта.

Основные выводы исследования

Ожидается, что возобновляемая энергия будет движущей силой темпов роста рынка

Переход к возобновляемым источникам энергии, таким как энергия ветра и солнца, требует оптимизированных электрических систем и трансформаторов для эффективного преобразования и распределения энергии. Низкие потери энергии и высокие характеристики магнитной проницаемости электротехнической стали делают ее критически важной для этих применений. По мере расширения сектора возобновляемых источников энергии для достижения целей устойчивого развития потребность в передовой электротехнической стали усиливается. Эта тенденция стимулирует рост спроса, поскольку производители ищут материалы, которые обеспечивают эффективную передачу энергии и минимизируют потери, поддерживая рост рынка электротехнической стали.

Область отчета и сегментация рынка

Отчет Метрика

|

Подробности

|

Прогнозируемый период

|

2023-2030

|

Базовый год

|

2022

|

Исторические годы

|

2021 (Можно настроить на 2015-2020)

|

Количественные единицы

|

Доход в млн. долл. США, объемы в единицах, цены в долл. США

|

Охваченные сегменты

|

Тип продукта (зернистая электротехническая сталь, незернистая электротехническая сталь), применение (индукторы, двигатели, трансформаторы), толщина (0,23 мм, 0,27 мм, 0,30 мм, 0,35 мм, 0,5 мм, 0,65 мм, другие), потери в сердечнике (менее 0,9 Вт/кг, от 90 Вт/кг до 0,99 Вт/кг, от 1,00 Вт/кг до 1,29 Вт/кг, от 1,30 Вт/кг до 1,39 Вт/кг и выше 1,39 Вт/кг), плотность потока (менее 1,65 Тесла, от 1,65 Тесла до 1,69 Тесла, от 1,69 Тесла до 1,73 Тесла, от 1,73 Тесла до 1,76 Тесла и выше 1,76 Тесла), конечный пользователь (автомобилестроение, производство, энергетика, бытовая техника , Строительство, Изготовление)

|

Страны, охваченные

|

Япония, Китай, Южная Корея, Индия, Австралия и Новая Зеландия, Тайвань, Гонконг, Сингапур, Таиланд, Малайзия, Индонезия, Филиппины и остальные страны Азиатско-Тихоокеанского региона

|

Охваченные участники рынка

|

ArcelorMittal (Люксембург), POSCO (Южная Корея), Voestalpine AG (Австрия), Baosteel Group (Китай), NIPPON STEEL CORPORATION (Япония), United States Steel Corporation (США), SAIL (Индия), TATA Steel (Индия), Thyssenkrupp AG (Германия), JFE Steel Corporation (Япония), E Steel Sdn.Bhd (Малайзия), Hesteel Group Tangsteel Company (Китай), ChinaSteel (Тайвань), ESL Steel Ltd. (Индия), Jiangsu Shagang Group Su ICP (Китай)., Union Electric Steel Corporation (США), Aperam (Люксембург), Cleveland-Cliffs Inc. (США), Slovenian Steel Group (Словения), Sko-Die Inc. (США)

|

Данные, отраженные в отчете

|

Помимо аналитических данных о рыночных сценариях, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, рыночные отчеты, подготовленные Data Bridge Market Research, также включают в себя углубленный экспертный анализ, географически представленные данные о производстве и мощностях компаний, схемы сетей дистрибьюторов и партнеров, подробный и обновленный анализ ценовых тенденций и анализ дефицита цепочки поставок и спроса.

|

Анализ сегмента:

Рынок электротехнической стали в Азиатско-Тихоокеанском регионе сегментирован по типу продукции, области применения, толщине, потерям в сердечнике, плотности потока и конечному пользователю.

- По типу продукции рынок электротехнической стали сегментируется на электротехническую сталь с ориентированной зернистой структурой и электротехническую сталь без ориентированной зернистой структуры.

- По области применения рынок электротехнической стали подразделяется на индукторы, двигатели и трансформаторы.

- По толщине рынок электротехнической стали сегментируется на 0,23 мм, 0,27 мм, 0,30 мм, 0,35 мм, 0,5 мм, 0,65 мм и другие.

- На основе потерь в сердечнике рынок электротехнической стали сегментируется на следующие категории: менее 0,9 Вт/кг, от 90 Вт/кг до 0,99 Вт/кг, от 1,00 Вт/кг до 1,29 Вт/кг, от 1,30 Вт/кг до 1,39 Вт/кг и выше 1,39 Вт/кг.

- По плотности потока рынок электротехнической стали сегментируется на следующие категории: менее 1,65 Тесла, от 1,65 Тесла до 1,69 Тесла, от 1,69 Тесла до 1,73 Тесла, от 1,73 Тесла до 1,76 Тесла и выше 1,76 Тесла.

- По конечному потребителю рынок электротехнической стали подразделяется на автомобилестроение, обрабатывающую промышленность, энергетику, производство бытовой техники, строительство и машиностроение.

Основные игроки

Data Bridge Market Research recognizes the following companies as the major Asia-Pacific electrical steel market players in Asia-Pacific electrical steel market are ArcelorMittal (Luxembourg), POSCO (South Korea), Voestalpine AG (Austria), Baosteel Group (China), NIPPON STEEL CORPORATION (Japan), United States Steel Corporation (U.S.), SAIL (India), TATA Steel (India), Thyssenkrupp AG (Germany), JFE Steel Corporation (Japan), E Steel Sdn.Bhd (Malaysia)

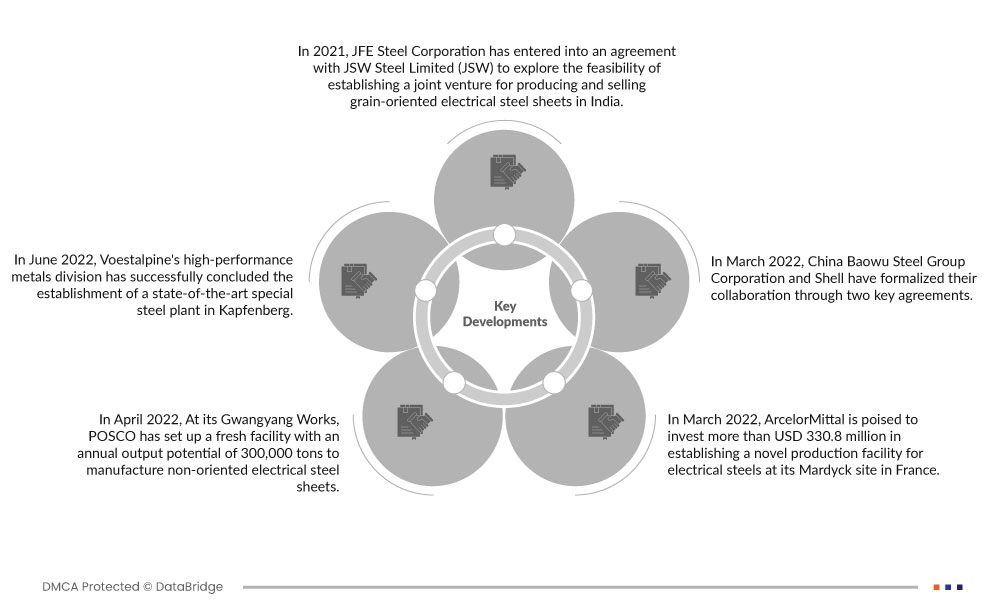

Market Developments

- In 2021, JFE Steel Corporation entered into an agreement with JSW Steel Limited (JSW) to explore the feasibility of establishing a joint venture for producing and selling grain-oriented electrical steel sheets in India.

- In June 2022, Voestalpine's high-performance metals division has successfully concluded the establishment of a state-of-the-art special steel plant in Kapfenberg. This advanced facility is poised to manufacture 205,000 tons of steel annually, catering to diverse industries including aerospace, automotive, and oil and gas.

- In April 2022, At its Gwangyang Works, POSCO has set up a fresh facility with an annual output potential of 300,000 tons to manufacture non-oriented electrical steel sheets. With the objective of bolstering its high-efficiency non-oriented electrical steel sheet production, the company intends to elevate its annual capacity from 100,000 tons to 400,000 tons by 2025.

- In March 2022, ArcelorMittal is poised to invest more than USD 330.8 million in establishing a novel production facility for electrical steels at its Mardyck site in France. This unit's output is anticipated to cater to steel requirements for electric and hybrid vehicles as well as industrial machinery. With the support of the French government, this initiative is set to generate over 100 job opportunities and play a significant role in attaining the European Union's CO2 emission reduction targets. Commencing in 2024, the production unit is set to yield 200,000 tons annually.

- In March 2022, China Baowu Steel Group Corporation and Shell have formalized their collaboration through two key agreements. These include an enterprise framework cooperation agreement (EFA) for the supply of environmentally friendly steel products, and a master agreement on emission trading. This marks a significant milestone, signifying the elevation of their joint efforts in low-carbon development to a more advanced stage.

Regional Analysis

Geographically, the countries covered in the Asia-Pacific electrical steel market report are Japan, China, South Korea, India, Australia and New Zealand, Taiwan, Hong-Kong, Singapore, Thailand, Malaysia, Indonesia, Philippines and Rest of Asia-Pacific

As per Data Bridge Market Research analysis:

China dominates Asia-Pacific in electrical steel market during the forecast period 2023 to 2030

В 2023 году Китай будет доминировать на рынке электротехнической стали Азиатско-Тихоокеанского региона благодаря роли электротехнической стали в сердечниках двигателей и аккумуляторных системах, соответствующих переходу на электромобили. Кроме того, по мере роста числа владельцев и производства транспортных средств потребность в компонентах на основе электротехнической стали, обеспечивающих оптимальную производительность и энергоэффективность, становится первостепенной. Этот всплеск спроса отражает меняющийся автомобильный ландшафт, подчеркивая решения для устойчивой мобильности и стимулируя потребность в передовых решениях для электротехнической стали.

Ожидается, что в Индии будет наблюдаться значительный рост в прогнозируемый период с 2023 по 2030 год.

Ожидается, что в 2023 году Индия станет свидетелем значительного роста, поскольку электросети генерируют электроэнергию, а эффективное преобразование и передача в дома требуют компонентов из электротехнической стали, таких как трансформаторы и линии электропередачи. Эти материалы оптимизируют передачу энергии, минимизируя потери при передаче и обеспечивая стабильное распределение электроэнергии. Поскольку глобальный энергетический ландшафт развивается, включая возобновляемые источники и децентрализованную генерацию электроэнергии, значение электротехнической стали в обеспечении бесперебойного и эффективного потока электроэнергии от электростанций к домам становится все более очевидным.

Более подробную информацию об отчете по рынку электротехнической стали можно получить здесь – https://www.databridgemarketresearch.com/reports/asia-pacific-electrical-steel-market