مع النمو الاقتصادي للمستهلكين وزيادة الوعي بالتوجهات الاجتماعية بين السكان، يشهد سوق بطاقات الهدايا الرقمية والبطاقات مسبقة الدفع في أوروبا والولايات المتحدة وأمريكا اللاتينية والشرق الأوسط وأفريقيا وآسيا تغيرات ملحوظة. وقد اكتسبت الهدايا عبر الإنترنت شعبية واسعة بفضل سهولة الوصول إليها وسهولة استخدامها. فببضع نقرات فقط، يمكن للعملاء شراء الهدايا الرقمية وإرسالها إلى أي مكان في العالم. وهذا يجعل بطاقات الهدايا الرقمية والبطاقات مسبقة الدفع خيارًا جذابًا لشراء الهدايا في اللحظات الأخيرة. ويواصل التوجه المتزايد نحو التسوق عبر الإنترنت والمعاملات الرقمية تعزيز تفضيل بطاقات الهدايا الرقمية والبطاقات مسبقة الدفع.

يمكنك الوصول إلى التقرير الكامل على https://www.databridgemarketresearch.com/reports/europe-us-latin-america-mea-and-asia-digital-gift-cards-and-prepaid-card-market

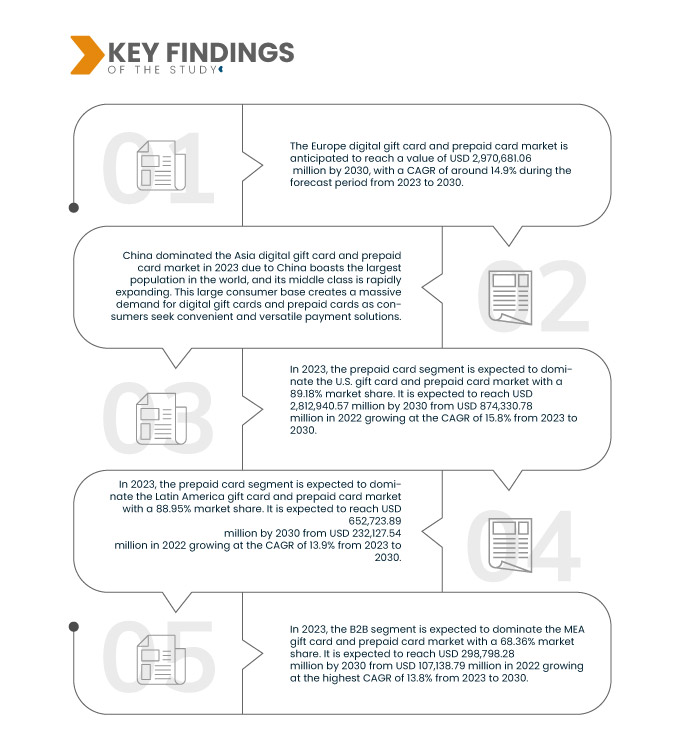

تشير تحليلات Data Bridge Market Research إلى أن سوق بطاقات الهدايا الرقمية والبطاقات المدفوعة مسبقًا في أوروبا من المتوقع أن ينمو بمعدل نمو سنوي مركب قدره 14.9٪ في الفترة المتوقعة من 2023 إلى 2030 ومن المتوقع أن يصل إلى 2،970،681.06 مليون دولار أمريكي بحلول عام 2030.

من المتوقع أن ينمو سوق بطاقات الهدايا الرقمية والبطاقات المدفوعة مسبقًا في الولايات المتحدة بمعدل نمو سنوي مركب قدره 16.1٪ في الفترة المتوقعة من 2023 إلى 2030 ومن المتوقع أن يصل إلى 3،193،811.02 مليون دولار أمريكي بحلول عام 2030.

من المتوقع أن ينمو سوق بطاقات الهدايا الرقمية وبطاقات الدفع المسبق في أمريكا اللاتينية بمعدل نمو سنوي مركب قدره 14.1٪ في الفترة المتوقعة من 2023 إلى 2030 ومن المتوقع أن يصل إلى 742،120.65 مليون دولار أمريكي بحلول عام 2030.

من المتوقع أن ينمو سوق بطاقات الهدايا الرقمية والبطاقات المدفوعة مسبقًا في الشرق الأوسط وأفريقيا بمعدل نمو سنوي مركب قدره 13.6٪ في الفترة المتوقعة من 2023 إلى 2030 ومن المتوقع أن يصل إلى 432،775.83 مليون دولار أمريكي بحلول عام 2030.

من المتوقع أن ينمو سوق بطاقات الهدايا الرقمية والبطاقات المدفوعة مسبقًا في آسيا بمعدل نمو سنوي مركب قدره 16.2٪ في الفترة المتوقعة من 2023 إلى 2030 ومن المتوقع أن يصل إلى 2،875،435.95 مليون دولار أمريكي بحلول عام 2030.

يشهد قطاع تغليف الأغذية نموًا متسارعًا. ويُعد تزايد شعبية بطاقات الهدايا الرقمية والبطاقات مسبقة الدفع بين المستهلكين محركًا رئيسيًا للسوق. ومن المتوقع أن يُعزز التوجه الاجتماعي المتنامي لتقديم الهدايا عبر الإنترنت نمو السوق. ومن المتوقع أن يُتيح تزايد انتشار الإنترنت والهواتف الذكية عالميًا، والتحالفات الاستراتيجية لزيادة انتشار أعمال الشركات، فرصًا واعدة في السوق. ومع ذلك، من المتوقع أن يُشكل توافر بدائل، مثل السلع والمنتجات الإلكترونية، تحديًا لنمو السوق.

النتائج الرئيسية للدراسة

زيادة استخدام البطاقات المدفوعة مسبقًا وبطاقات الهدايا

يرتبط قطاع بطاقات الهدايا الرقمية والبطاقات مسبقة الدفع بالعالم الرقمي. منذ انتشار هذه البطاقات، تتواصل الشركات مع عملائها افتراضيًا باستخدام استراتيجيات التسويق الرقمي والمنصات الرقمية . في السنوات الأخيرة، شهد قطاع بطاقات الهدايا الرقمية والبطاقات مسبقة الدفع تحسنًا في علاقاته مع المستهلكين الحاليين من خلال التسويق والترويج الرقمي، بدلًا من التوسع عبر القنوات الجغرافية وتوسيع شبكة المتاجر.

يتجه جيل الألفية نحو بطاقات الهدايا الإلكترونية والبطاقات مسبقة الدفع. ومع هذا التحول، سيزداد اعتماد هذه البطاقات بين الأجيال الأكبر سنًا. إضافةً إلى ذلك، من المتوقع أن تُتيح منصات وقنوات التسوق الإلكترونية فرصًا لنمو السوق.

من الاتجاهات الإيجابية الأخرى التي تُسهم في تطوير بطاقات الهدايا الرقمية والبطاقات مسبقة الدفع في التجارة الإلكترونية استخدام منصات التسوق الإلكتروني. لذلك، من المتوقع أن يشهد السوق نموًا متزايدًا خلال فترة التوقعات.

نطاق التقرير وتقسيم السوق

مقياس التقرير

|

تفاصيل

|

فترة التنبؤ

|

من 2023 إلى 2030

|

سنة الأساس

|

2022

|

السنوات التاريخية

|

2021 (قابلة للتخصيص حتى 2015-2020)

|

الوحدات الكمية

|

الإيرادات بالملايين من الدولارات الأمريكية

|

القطاعات المغطاة

|

النوع (بطاقة مسبقة الدفع وبطاقة هدايا رقمية)، قناة التوزيع (B2B وB2C)، القطاع الرأسي (المؤسسات التجارية، تجارة التجزئة، الحكومة، الضيافة والسفر، الإعلام والترفيه، السلع الاستهلاكية، وغيرها)

|

الدول المغطاة

|

الولايات المتحدة، الصين، اليابان، الهند، كوريا الجنوبية، سنغافورة، تايوان، إندونيسيا، تايلاند، فيتنام، ماليزيا، الفلبين، بقية آسيا، البرازيل، المكسيك، الأرجنتين، كولومبيا، تشيلي، بيرو، كوستاريكا، وبقية أمريكا اللاتينية، المملكة المتحدة، ألمانيا، فرنسا، إيطاليا، إسبانيا، روسيا، هولندا، بولندا، بلجيكا، تركيا، السويد، النرويج، الدنمارك، سويسرا، فنلندا، بقية أوروبا، المملكة العربية السعودية، الإمارات العربية المتحدة، إيران، جنوب أفريقيا، مصر، العراق، إسرائيل، قطر، الكويت، الأردن، بقية الشرق الأوسط وأفريقيا

|

الجهات الفاعلة في السوق المغطاة

|

ماستركارد (الولايات المتحدة)، أمريكان إكسبريس (الولايات المتحدة)، باي بال (الولايات المتحدة)، بلاك هوك نتورك (الولايات المتحدة)، أمازون (الولايات المتحدة)، جوجل (شركة تابعة لشركة ألفابت) (الولايات المتحدة)، بنك ICICI (الهند)، بنك HDFC المحدود (الهند)، سوني إنتراكتيف إنترتينمنت (اليابان)، بنك أكسيس (الهند)، جو جيفت إيه/إس (الدنمارك)، تانجو كارد (الولايات المتحدة)، فليبكارت، فليكسبين (شركة تابعة لمجموعة نوفاتي المحدودة) (الهند)، إن إس كاردز فرانس إس إيه إس (نيو سيرف) (فرنسا)، كليفر كارد (أيرلندا)، جيفتوغرام (الولايات المتحدة)، إنفوس للخدمات المالية المحدودة (فنلندا)، جيتون (المملكة المتحدة)، يونيفيد إنسينتيفز بي تي واي المحدودة (الولايات المتحدة)، فالف كوربوريشن (الولايات المتحدة)، وغيرها.

|

نقاط البيانات التي يغطيها التقرير

|

بالإضافة إلى رؤى السوق مثل القيمة السوقية ومعدل النمو وشرائح السوق والتغطية الجغرافية واللاعبين في السوق وسيناريو السوق، فإن تقرير السوق الذي أعده فريق أبحاث السوق في Data Bridge يتضمن تحليلًا متعمقًا من الخبراء وتحليل الاستيراد / التصدير وتحليل التسعير وتحليل استهلاك الإنتاج وتحليل المدقة.

|

تحليل القطاعات

يتم تقسيم سوق بطاقات الهدايا الرقمية وبطاقات الدفع المسبق في أوروبا والولايات المتحدة وأمريكا اللاتينية والشرق الأوسط وأفريقيا وآسيا على أساس النوع وقناة التوزيع والقطاع الرأسي للصناعة.

- على أساس النوع، يتم تقسيم سوق بطاقات الهدايا الرقمية وبطاقات الدفع المسبق في أوروبا والولايات المتحدة وأمريكا اللاتينية والشرق الأوسط وأفريقيا وآسيا إلى بطاقة مدفوعة مسبقًا وبطاقة هدايا رقمية.

من المتوقع أن تهيمن شريحة بطاقات الدفع المسبق على سوق بطاقات الهدايا الرقمية وبطاقات الدفع المسبق في أوروبا والولايات المتحدة وأمريكا اللاتينية والشرق الأوسط وأفريقيا وآسيا في عام 2023.

في عام 2023، من المتوقع أن تهيمن بطاقات الدفع المسبق على سوق بطاقات الهدايا الرقمية في أوروبا بحصة سوقية تبلغ 89.40%، وعلى سوق بطاقات الهدايا الرقمية في الولايات المتحدة بحصة سوقية تبلغ 89.18%، وعلى سوق بطاقات الهدايا الرقمية في أمريكا اللاتينية بحصة سوقية تبلغ 88.95%، وعلى سوق بطاقات الهدايا الرقمية في منطقة الشرق الأوسط وأفريقيا بحصة سوقية تبلغ 88.61%، وعلى سوق بطاقات الهدايا الرقمية في آسيا بحصة سوقية تبلغ 89.36%. ويعود هذا التفوق إلى تعدد استخدامات بطاقات الدفع المسبق، وإمكانية استخدامها في مجموعة واسعة من الأغراض، من التسوق عبر الإنترنت إلى الإنفاق اليومي. فهي توفر طريقة مريحة وسهلة الاستخدام للمستهلكين لإدارة شؤونهم المالية دون الحاجة إلى حسابات مصرفية تقليدية أو فحوصات ائتمانية، مما يجعلها جذابة لشريحة واسعة من الجمهور.

- على أساس قناة التوزيع، يتم تقسيم سوق بطاقات الهدايا الرقمية وبطاقات الدفع المسبق في أوروبا والولايات المتحدة وأمريكا اللاتينية والشرق الأوسط وأفريقيا وآسيا إلى B2B وB2C.

في عام 2023، من المتوقع أن تهيمن شريحة قنوات التوزيع B2B على سوق بطاقات الهدايا الرقمية وبطاقات الدفع المسبق في أوروبا والولايات المتحدة وأمريكا اللاتينية والشرق الأوسط وأفريقيا وآسيا.

في عام 2023، من المتوقع أن تهيمن B2B على سوق بطاقات الهدايا الرقمية والبطاقات المدفوعة مسبقًا في أوروبا، بحصة سوقية تبلغ 67.73٪. ومن المتوقع أن تهيمن B2B على سوق بطاقات الهدايا الرقمية والبطاقات المدفوعة مسبقًا في الولايات المتحدة، بحصة سوقية تبلغ 67.30٪، ومن المتوقع أن تهيمن B2B على سوق بطاقات الهدايا الرقمية والبطاقات المدفوعة مسبقًا في أمريكا اللاتينية، بحصة سوقية تبلغ 68.00٪، ومن المتوقع أن تهيمن B2B على سوق بطاقات الهدايا الرقمية والبطاقات المدفوعة مسبقًا في منطقة الشرق الأوسط وأفريقيا، بحصة سوقية تبلغ 68.36٪، ومن المتوقع أن تهيمن B2B على سوق بطاقات الهدايا الرقمية والبطاقات المدفوعة مسبقًا في آسيا، بحصة سوقية تبلغ 67.64٪. والسبب في هيمنة قطاع B2B هو أن العديد من الشركات تقدم بطاقات الهدايا الرقمية والبطاقات المدفوعة مسبقًا كجزء من مزايا موظفيها وحزم التعويضات. ويمكن استخدامها للمكافآت أو مكافآت الأداء أو حتى كبديل للشيكات التقليدية للرواتب، مما يعزز جاذبية صاحب العمل.

- على أساس القطاع الصناعي، يتم تقسيم سوق بطاقات الهدايا الرقمية والبطاقات المدفوعة مسبقًا في أوروبا والولايات المتحدة وأمريكا اللاتينية والشرق الأوسط وأفريقيا وآسيا إلى مؤسسات الشركات وتجارة التجزئة والحكومة والضيافة والسفر والإعلام والترفيه والسلع الاستهلاكية وغيرها. في عام 2023، من المتوقع أن يهيمن قطاع المؤسسات التجارية على سوق بطاقات الهدايا الرقمية والبطاقات المدفوعة مسبقًا في أوروبا بنسبة 38.85٪ من حصة السوق. في عام 2023، من المتوقع أن يهيمن قطاع المؤسسات التجارية على سوق بطاقات الهدايا الرقمية والبطاقات المدفوعة مسبقًا في الولايات المتحدة بنسبة 36.44٪ من حصة السوق. في عام 2023، من المتوقع أن يهيمن قطاع المؤسسات التجارية على سوق بطاقات الهدايا الرقمية والبطاقات المدفوعة مسبقًا في أمريكا اللاتينية بنسبة 38.71٪ من حصة السوق. في عام 2023، من المتوقع أن يهيمن قطاع المؤسسات التجارية على سوق بطاقات الهدايا الرقمية والبطاقات المدفوعة مسبقًا في منطقة الشرق الأوسط وأفريقيا بنسبة 39.59٪ من حصة السوق. في عام 2023، من المتوقع أن يهيمن قطاع المؤسسات التجارية على سوق بطاقات الهدايا الرقمية والبطاقات المدفوعة مسبقًا في آسيا بنسبة 37.55٪ من حصة السوق.

اللاعبون الرئيسيون

تعترف شركة Data Bridge Market Research بالشركات التالية باعتبارها اللاعبين الرئيسيين في سوق بطاقات الهدايا الرقمية والبطاقات المدفوعة مسبقًا في أوروبا والولايات المتحدة وأمريكا اللاتينية والشرق الأوسط وأفريقيا وآسيا، MasterCard (الولايات المتحدة)، American Express (الولايات المتحدة)، PayPal (الولايات المتحدة)، Blackhawk Network (الولايات المتحدة)، Amazon.com، Inc. (الولايات المتحدة)، وغيرها.

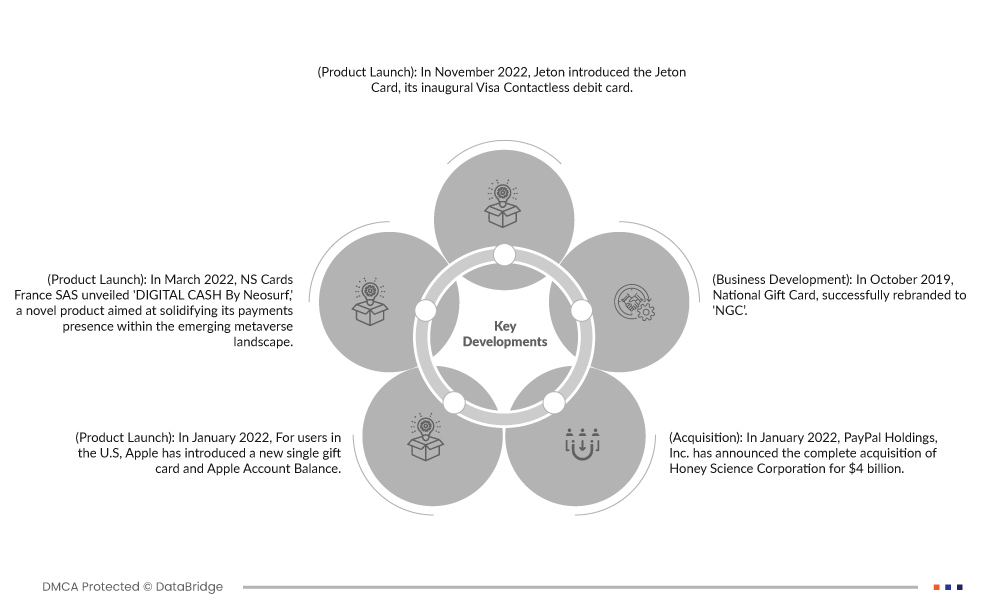

تطورات السوق

- في مارس 2023، أقامت مجموعة نوفاتي المحدودة، الشركة الأم لشركة فليكسبين، شراكة استراتيجية مع شركة وايركس، مما أتاح إصدار بطاقات مبتكرة متعددة العملات مباشرةً للأستراليين. وقد سهّلت هذه الشراكة رفع حدود إنفاق البطاقات، ومكافآت فورية تصل إلى 8%، وعدم وجود رسوم صرف أو رسوم صيانة، وسحب الأموال دوليًا من أجهزة الصراف الآلي، والوصول إلى عروض حصرية للتجار، مما سدّ الفجوة بين الاقتصادين التقليدي والرقمي، مستفيدًا من التبني القوي للعملات المشفرة في أستراليا.

- في مارس 2022، كشفت شركة NS Cards France SAS عن منتجها الجديد "DIGITAL CASH By Neosurf"، وهو منتجٌ مبتكرٌ يهدف إلى تعزيز حضورها في مجال المدفوعات ضمن عالم الميتافيرس الناشئ. وقد مكّنت هذه الخطوة Neosurf من الاستفادة من الاقتصاد الرقمي المتطور والاستفادة من الطلب المتزايد على المعاملات والعملات الافتراضية.

- في أغسطس 2021، أطلقت شركة Tango Card Inc. بنجاح شراكة استراتيجية مع HubEngage, Inc. لتعزيز مشاركة الموظفين ومكافآتهم من خلال منصة متكاملة لتجربة الموظفين. وقد تعززت حلول HubEngage المتميزة للتواصل والتفاعل من خلال التكامل السلس مع منصة حوافز Tango Card، مما يتيح للعملاء العالميين الوصول بسهولة إلى مجموعة متنوعة من بطاقات الهدايا لمكافآت الموظفين، مما أدى إلى تعزيز مشاركة الموظفين وتبسيط تواصلهم معهم.

- في أبريل 2021، نشرت ThoughtWorks مدونةً أشارت فيها إلى أن بطاقات هدايا تجار التجزئة أصبحت نقاط دخول محتملة لإرشاد العملاء إلى نظام الدفع والعضوية والطلبات. ويمكنها غرس عادات إنفاق جديدة لدى المستخدمين. على سبيل المثال، لا تقتصر بطاقة هدايا ستاربكس على تقديم الهدايا فحسب، بل توفر للعملاء أيضًا طريقة دفع سهلة، وتزيد من وتيرة زياراتهم للمتاجر، مما أدى إلى زيادة مبيعاتهم تلقائيًا.

- في يوليو 2020، أطلقت آبل بطاقة هدايا جديدة في السوق باسم "كل شيء آبل". يمكن استخدام هذه البطاقة في متجر التطبيقات وغيره من الخدمات الإلكترونية. إلى جانب هذه البطاقات، كانت هناك بطاقتا هدايا أخريان متوفرتان في السوق سابقًا. هذا النوع من الطرح المبتكر من الشركات العملاقة سيقود السوق إلى النمو.

التحليل الإقليمي

جغرافيًا، البلدان التي يغطيها تقرير سوق بطاقات الهدايا الرقمية والبطاقات المدفوعة مسبقًا في أوروبا والولايات المتحدة وأمريكا اللاتينية والشرق الأوسط وآسيا هي الولايات المتحدة والصين واليابان والهند وكوريا الجنوبية وسنغافورة وتايوان وإندونيسيا وتايلاند وفيتنام وماليزيا والفلبين وبقية آسيا والبرازيل والمكسيك والأرجنتين وكولومبيا وتشيلي وبيرو وكوستاريكا وبقية أمريكا اللاتينية والمملكة المتحدة وألمانيا وفرنسا وإيطاليا وإسبانيا وروسيا وهولندا وبولندا وبلجيكا وتركيا والسويد والنرويج والدنمارك وسويسرا وفنلندا وبقية أوروبا والمملكة العربية السعودية والإمارات العربية المتحدة وإيران وجنوب إفريقيا ومصر والعراق وإسرائيل وقطر والكويت والأردن وبقية الشرق الأوسط وأفريقيا.

وفقًا لتحليل Data Bridge Market Research:

أوروبا هي المنطقة المهيمنة في سوق بطاقات الهدايا الرقمية والبطاقات المدفوعة مسبقًا في أوروبا والولايات المتحدة وأمريكا اللاتينية والشرق الأوسط وأفريقيا وآسيا خلال الفترة المتوقعة 2023 - 2030

في عام ٢٠٢٣، تُعدّ أوروبا المنطقة المهيمنة في سوق بطاقات الهدايا الرقمية والبطاقات مسبقة الدفع في أوروبا والولايات المتحدة وأمريكا اللاتينية والشرق الأوسط وأفريقيا وآسيا، نظرًا لريادة الدول الأوروبية في تبني وسائل الدفع الرقمية، بما في ذلك بطاقات الهدايا الرقمية والبطاقات مسبقة الدفع. ويعود ذلك إلى بنية تحتية مصرفية قوية، وانتشار واسع للهواتف الذكية، وشعب مُلِمٍّ بالتكنولوجيا.

آسيا هي المنطقة الأسرع نموًا في سوق بطاقات الهدايا الرقمية والبطاقات المدفوعة مسبقًا في أوروبا والولايات المتحدة وأمريكا اللاتينية والشرق الأوسط وأفريقيا وآسيا خلال الفترة المتوقعة 2023 - 2030

آسيا هي أسرع المناطق نموًا في سوق بطاقات الهدايا الرقمية والبطاقات مسبقة الدفع في أوروبا والولايات المتحدة وأمريكا اللاتينية والشرق الأوسط وأفريقيا وآسيا، نظرًا للنمو الاقتصادي السريع الذي شهدته العديد من الدول الآسيوية، مثل الصين والهند، في السنوات الأخيرة. وقد أدى ذلك إلى زيادة الدخل المتاح للإنفاق الاستهلاكي، مما عزز الطلب على بطاقات الهدايا الرقمية والبطاقات مسبقة الدفع.

لمزيد من المعلومات التفصيلية حول تقرير سوق بطاقات الهدايا الرقمية والبطاقات المدفوعة مسبقًا في أوروبا والولايات المتحدة وأمريكا اللاتينية والشرق الأوسط وأفريقيا وآسيا، انقر هنا - https://www.databridgemarketresearch.com/reports/europe-us-latin-america-mea-and-asia-digital-gift-cards-and-prepaid-card-market