Le marché des robots médicaux, qui comprend différents types de robots externes de grande taille, de robots gériatriques et bien d'autres, offre une gamme complète de produits, notamment des robots chirurgicaux, de rééducation et de téléprésence. Cette gamme diversifiée répond à des besoins de santé critiques, allant des interventions chirurgicales de précision à la rééducation et à l'hygiène des patients. La vaste gamme de produits du marché reflète l'engagement du secteur en faveur de l'innovation technologique, de l'amélioration des procédures médicales et de la prise en charge globale des patients dans différents domaines de la santé.

Accéder au rapport complet sur https://www.databridgemarketresearch.com/reports/global-medical-robots-market

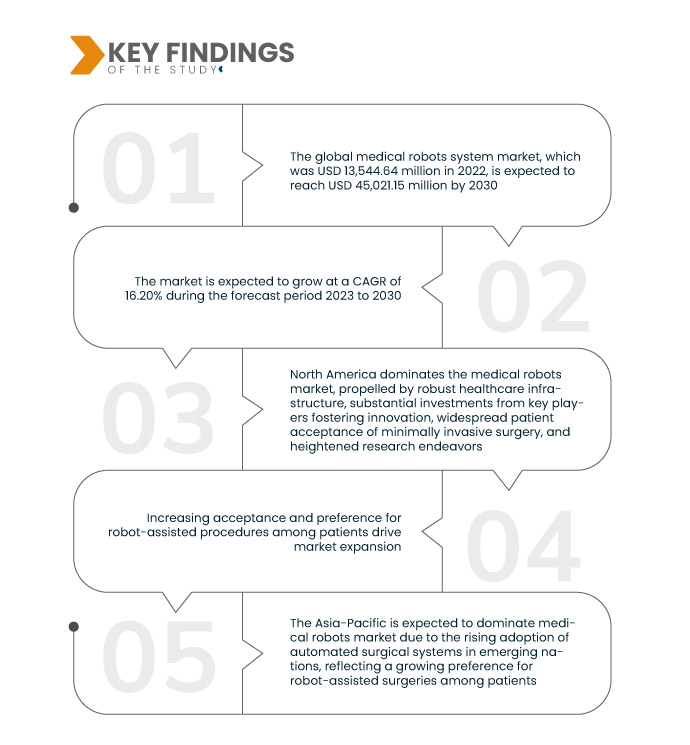

Data Bridge Market Research analyse que le marché mondial des systèmes de robots médicaux , qui s'élevait à 13 544,64 millions USD en 2022, devrait atteindre 45 021,15 millions USD d'ici 2030, à un TCAC de 16,20 % sur la période de prévision 2023-2030. Le marché des robots médicaux est stimulé par l'augmentation des investissements des organismes de santé et des entreprises technologiques. Des financements substantiels soutiennent les initiatives de recherche et développement, favorisant la création de technologies robotiques avancées, favorisant l'innovation et contribuant à la croissance et à l'expansion globales du marché.

Principales conclusions de l'étude

Le vieillissement de la population devrait stimuler le taux de croissance du marché

Le vieillissement de la population est un moteur essentiel du marché des robots médicaux. Face à l'augmentation du nombre de personnes âgées, la demande de robots médicaux pour l'assistance chirurgicale, la rééducation et les soins aux personnes âgées est en hausse . Ces robots jouent un rôle crucial dans l'amélioration de la précision et de l'efficacité des procédures médicales, répondant ainsi aux besoins spécifiques de santé de cette population vieillissante. Cette tendance souligne le rôle du marché pour relever les défis liés au vieillissement de la population et améliorer les résultats globaux en matière de soins de santé.

Portée du rapport et segmentation du marché

Rapport métrique

|

Détails

|

Période de prévision

|

2023 à 2030

|

Année de base

|

2022

|

Années historiques

|

2021 (personnalisable de 2015 à 2020)

|

Unités quantitatives

|

Chiffre d'affaires en millions USD, volumes en unités, prix en USD

|

Segments couverts

|

Type (robots externes de grande taille, robots gériatriques, robots d'assistance, robots miniatures in vivo), produit ( robots chirurgicaux , robots de rééducation, robots hospitaliers et pharmaceutiques, biorobotique, robots de radiochirurgie non invasive, robots de téléprésence, robots de transport médical, robots d'assainissement et de désinfection), modalité (compacte, portable), composants (actionneurs, capteurs , contrôleur de robot, chariot patient, console chirurgicale, chariot de vision, système de distribution, produits supplémentaires), application (applications neurologiques, applications cardiologiques, applications orthopédiques, applications laparoscopiques, rééducation physique, applications pharmaceutiques), utilisateur final (hôpitaux, cliniques spécialisées, instituts de recherche, centres de chirurgie ambulatoire , laboratoires, centres de rééducation, autres), canal de distribution (appel d'offres direct, vente au détail, distributeurs tiers, autres)

|

Pays couverts

|

États-Unis, Canada et Mexique en Amérique du Nord, Allemagne, France, Royaume-Uni, Pays-Bas, Suisse, Belgique, Russie, Italie, Espagne, Turquie, reste de l'Europe en Europe, Chine, Japon, Inde, Corée du Sud, Singapour, Malaisie, Australie, Thaïlande, Indonésie, Philippines, reste de l'Asie-Pacifique (APAC) en Asie-Pacifique (APAC), Arabie saoudite, Émirats arabes unis, Afrique du Sud, Égypte, Israël, reste du Moyen-Orient et de l'Afrique (MEA) en tant que partie du Moyen-Orient et de l'Afrique (MEA), Brésil, Argentine et reste de l'Amérique du Sud en tant que partie de l'Amérique du Sud.

|

Acteurs du marché couverts

|

iRobot Corporation (États-Unis), Titan Medical Inc. (Canada), Hansen Technologies (Australie), Renishaw plc (Royaume-Uni), Intuitive Surgical (États-Unis), Medtronic (Irlande), DENSO Products and Services Americas, Inc. (États-Unis), Accuray Incorporated (États-Unis), Stryker (États-Unis), Varian Medical Systems, Inc. (Royaume-Uni), Stereotaxis, Inc. (États-Unis), Ekso Bionics (États-Unis), CYBERDYNE INC. (Japon), BIONIK (États-Unis), Smith+Nephew (Royaume-Uni), Zimmer Biomet (États-Unis), Omnicell. Inc. (États-Unis), ARxIUM (Canada)

|

Points de données couverts dans le rapport

|

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research incluent également une analyse approfondie des experts, une épidémiologie des patients, une analyse du pipeline, une analyse des prix et un cadre réglementaire.

|

Analyse des segments :

Le marché mondial des robots médicaux est segmenté en fonction du type, du produit, de la modalité, des composants, de l'application, de l'utilisateur final et du canal de distribution.

- Sur la base du type, le marché mondial des robots médicaux est segmenté en grands robots externes, robots gériatriques, robots d'assistance et robots miniatures in vivo.

- Sur la base du produit, le marché mondial des robots médicaux est segmenté en robots chirurgicaux, robots de rééducation, robots hospitaliers et pharmaceutiques, biorobotique, robots de radiochirurgie non invasive, robots de téléprésence, robots de transport médical, robots d'assainissement et de désinfection.

- Sur la base de la modalité, le marché mondial des robots médicaux est segmenté en robots compacts et portables.

- Sur la base des composants, le marché mondial des robots médicaux est segmenté en actionneurs, capteurs, contrôleur de robot, chariot patient, console chirurgicale, chariot de vision, système de distribution et produits supplémentaires.

- Sur la base de l'application, le marché mondial des robots médicaux est segmenté en applications neurologiques, applications cardiologiques, applications orthopédiques, applications laparoscopiques, rééducation physique et applications pharmaceutiques.

- Sur la base de l'utilisateur final, le marché mondial des robots médicaux est segmenté en hôpitaux, cliniques spécialisées, instituts de recherche, centres de chirurgie ambulatoire, laboratoires, centres de rééducation et autres.

- Sur la base du canal de distribution, le marché mondial des robots médicaux est segmenté en appels d'offres directs, ventes au détail, distributeurs tiers et autres.

Acteurs majeurs

Data Bridge Market Research reconnaît les entreprises suivantes comme les acteurs du marché mondial des robots médicaux sur le marché mondial des robots médicaux : iRobot Corporation (États-Unis), Titan Medical Inc. (Canada), Hansen Technologies (Australie), Renishaw plc (Royaume-Uni), Intuitive Surgical (États-Unis), Medtronic (Irlande), DENSO Products and Services Americas, Inc. (États-Unis).

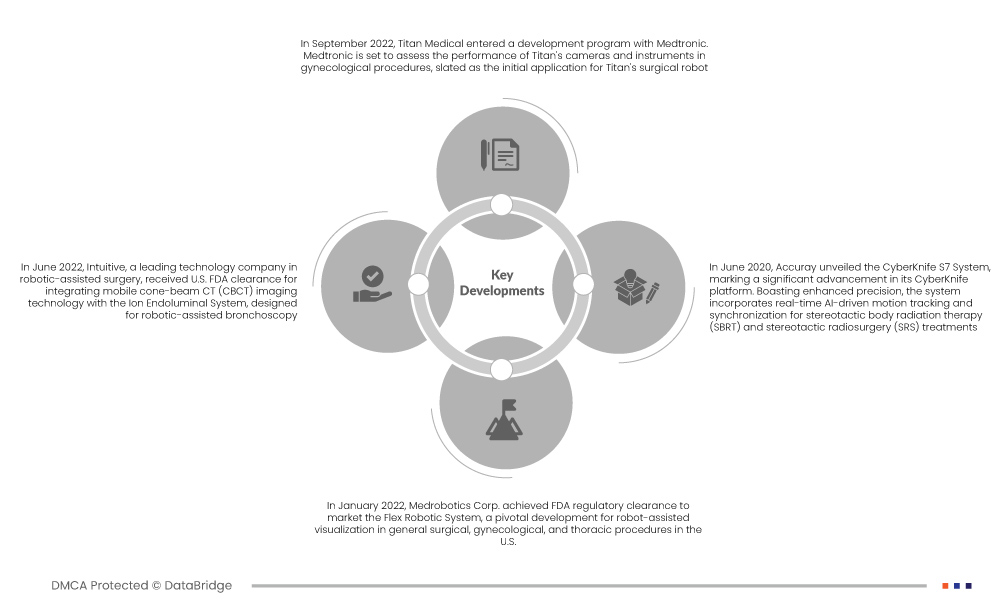

Évolution du marché

- En septembre 2022, Titan Medical a entamé un programme de développement avec Medtronic. Medtronic s'apprête à évaluer les performances des caméras et instruments Titan lors d'interventions gynécologiques, ce qui constituera la première application du robot chirurgical Titan. Cette collaboration illustre un partenariat stratégique qui permet à Titan de tirer parti de l'expertise de Medtronic dans l'évaluation et le développement de sa technologie, ouvrant potentiellement de nouvelles perspectives pour la chirurgie robotisée en gynécologie.

- En juin 2022, Intuitive, entreprise technologique leader en chirurgie robotisée, a reçu l'autorisation de la FDA américaine pour intégrer la technologie d'imagerie mobile Cone Beam CT (CBCT) au système endoluminal Ion, conçu pour la bronchoscopie robotisée. Cette autorisation renforce les capacités du système Ion, permettant une imagerie avancée lors des interventions bronchoscopiques. Cette intégration représente une avancée significative vers plus de précision et d'efficacité dans les soins mini-invasifs.

- En janvier 2022, Medrobotics Corp. a obtenu l'autorisation réglementaire de la FDA pour commercialiser le système robotique Flex, un développement majeur pour la visualisation assistée par robot en chirurgie générale, gynécologique et thoracique aux États-Unis. Cette autorisation souligne l'engagement de l'entreprise en faveur de l'innovation dans des produits innovants, spécialement conçus pour les chirurgies mono-port dans divers domaines médicaux, notamment la chirurgie générale, la gynécologie, la chirurgie thoracique et l'urologie.

- En juin 2020, Accuray a dévoilé le système CyberKnife S7, marquant une avancée significative pour sa plateforme CyberKnife. Doté d'une précision accrue, ce système intègre un suivi et une synchronisation des mouvements en temps réel, pilotés par l'IA, pour les traitements de radiothérapie stéréotaxique corporelle (SBRT) et de radiochirurgie stéréotaxique (SRS). Cette technologie de nouvelle génération renforce l'engagement d'Accuray en faveur de solutions de pointe en radiothérapie, offrant une précision et une administration des traitements améliorées pour de meilleurs résultats pour les patients.

Analyse régionale

Géographiquement, les pays couverts dans le rapport sur le marché mondial des robots médicaux sont les États-Unis, le Canada et le Mexique en Amérique du Nord, l'Allemagne, la France, le Royaume-Uni, les Pays-Bas, la Suisse, la Belgique, la Russie, l'Italie, l'Espagne, la Turquie, le reste de l'Europe en Europe, la Chine, le Japon, l'Inde, la Corée du Sud, Singapour, la Malaisie, l'Australie, la Thaïlande, l'Indonésie, les Philippines, le reste de l'Asie-Pacifique (APAC) en Asie-Pacifique (APAC), l'Arabie saoudite, les Émirats arabes unis, l'Afrique du Sud, l'Égypte, Israël, le reste du Moyen-Orient et de l'Afrique (MEA) dans le cadre du Moyen-Orient et de l'Afrique (MEA), le Brésil, l'Argentine et le reste de l'Amérique du Sud dans le cadre de l'Amérique du Sud.

Selon l'analyse de Data Bridge Market Research :

L'Amérique du Nord est la région dominante sur le marché mondial des robots médicaux au cours de la période de prévision 2023-2030

L'Amérique du Nord domine le marché des robots médicaux, grâce à une infrastructure de santé robuste, aux investissements substantiels d'acteurs clés favorisant l'innovation, à l'acceptation généralisée de la chirurgie mini-invasive par les patients et à l'intensification des efforts de recherche. L'ancrage solide de la région et son engagement envers les avancées technologiques la positionnent comme un pionnier dans l'adoption et le développement de la robotique médicale, contribuant à l'amélioration des soins aux patients et stimulant la croissance du marché de l'automatisation des soins de santé.

L'Asie-Pacifique devrait dominer le marché mondial des robots médicaux au cours de la période de prévision 2023-2030

La région Asie-Pacifique devrait dominer le marché des robots médicaux en raison de l'adoption croissante des systèmes chirurgicaux automatisés dans les pays émergents, reflétant une préférence croissante des patients pour les chirurgies assistées par robot. L'accent mis par la région sur le développement des infrastructures de santé, conjugué à l'essor du tourisme médical, alimente la croissance du marché. Alors que l'Asie-Pacifique privilégie les solutions de santé modernes, l'intégration croissante des technologies robotiques témoigne d'une transformation profonde des pratiques chirurgicales, améliorant la précision et les résultats pour les patients dans divers contextes de soins.

Pour plus d'informations sur le marché mondial des robots médicaux, cliquez ici : https://www.databridgemarketresearch.com/reports/global-medical-robots-market