Инновации на рынке микроконтроллеров с ультранизким энергопотреблением вращаются вокруг энергоэффективности, возможностей подключения и обработки. Эти микроконтроллеры находят широкое применение в устройствах IoT, носимых устройствах и приложениях с батарейным питанием. Доминирующим сегментом является сектор IoT (Интернет вещей), где устройства требуют минимального потребления энергии для длительной работы. Приложения IoT в умных домах , здравоохранении и промышленной автоматизации стимулируют рынок, поскольку микроконтроллеры обеспечивают эффективную обработку данных, связь и интеграцию датчиков, способствуя быстрому росту этого сегмента.

Доступ к полному отчету по адресу https://www.databridgemarketresearch.com/reports/global-ultra-low-power-microcontroller-market

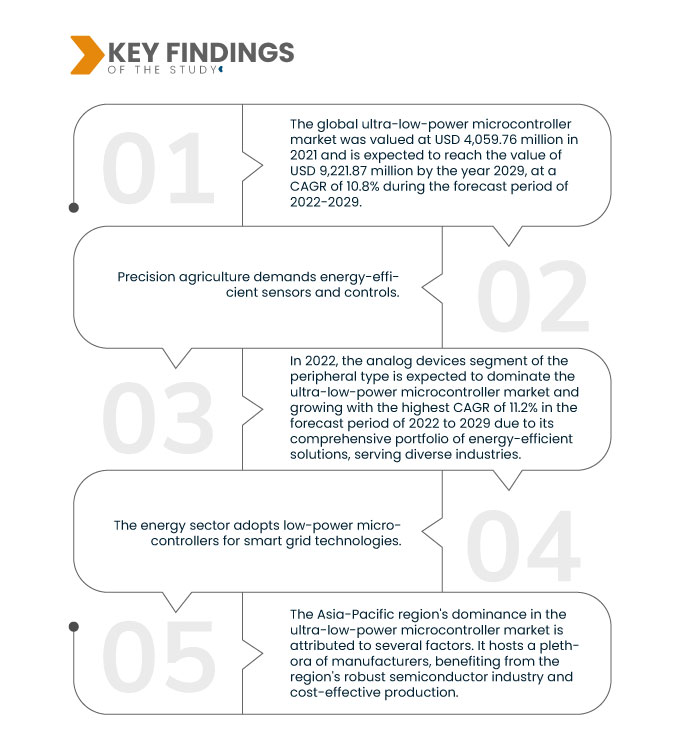

Data Bridge Market Research анализирует, что глобальный рынок сверхмаломощных микроконтроллеров оценивался в 4 059,76 млн долларов США в 2021 году и, как ожидается, достигнет значения 9 221,87 млн долларов США к 2029 году при среднегодовом темпе роста 10,8% в прогнозируемый период 2022-2029 годов. Расширенные функции безопасности в микроконтроллерах включают аппаратное шифрование, безопасные механизмы загрузки и доверенные среды выполнения. Эти меры защиты защищают устройства IoT от киберугроз, защищая данные, проверяя целостность устройства и предотвращая несанкционированный доступ, обеспечивая безопасность и конфиденциальность экосистем IoT.

Основные выводы исследования

Ожидается, что миниатюризация будет способствовать росту рынка

Рынок микроконтроллеров с ультранизким энергопотреблением выигрывает от растущей тенденции миниатюризации в электронике. Поскольку потребители и отрасли требуют более компактных и меньших устройств, микроконтроллеры с низким энергопотреблением играют ключевую роль. Эти микроконтроллеры предлагают основные возможности обработки при минимальном потреблении энергии, что делает их идеальными для таких устройств, как носимые устройства, датчики и гаджеты IoT. Эта тенденция стимулирует рост рынка, поскольку производители все больше полагаются на микроконтроллеры с низким энергопотреблением для удовлетворения спроса на более компактную и энергоэффективную электронику.

Область отчета и сегментация рынка

Отчет Метрика

|

Подробности

|

Прогнозируемый период

|

2022-2029

|

Базовый год

|

2021

|

Исторические годы

|

2020 (Можно настроить на 2014-2019)

|

Количественные единицы

|

Доход в млн. долл. США, объемы в единицах, цены в долл. США

|

Охваченные сегменты

|

Тип периферийного устройства (аналоговые устройства, цифровые устройства), тип (универсальные микроконтроллеры для измерения и измерения, микроконтроллеры для емкостного сенсорного измерения, микроконтроллеры для ультразвукового сенсорного измерения), компонент (аппаратное обеспечение, программное обеспечение, услуги), тип упаковки (32-битная упаковка, 16-битная упаковка, 8-битная упаковка), сетевое подключение (беспроводное, проводное), емкость ОЗУ (более 512 Кб, 96-512 Кб, менее 96 Кб), режим сохранения мощности (2,4 мкВт- 3,5 мкВт, 1,6 мкВт- 2,4 мкВт, более 3,5 мкВт), применение (общее тестирование и измерение, зондирование, измерение расхода, другое)

|

Страны, охваченные

|

США, Канада и Мексика в Северной Америке, Германия, Франция, Великобритания, Нидерланды, Швейцария, Бельгия, Россия, Италия, Испания, Турция, Остальная Европа в Европе, Китай, Япония, Индия, Южная Корея, Сингапур, Малайзия, Австралия, Таиланд, Индонезия, Филиппины, Остальная часть Азиатско-Тихоокеанского региона (APAC) в Азиатско-Тихоокеанском регионе (APAC), Саудовская Аравия, ОАЭ, Южная Африка, Египет, Израиль, Остальной Ближний Восток и Африка (MEA) как часть Ближнего Востока и Африки (MEA), Бразилия, Аргентина и Остальная часть Южной Америки как часть Южной Америки.

|

Охваченные участники рынка

|

Texas Instruments Incorporated (США), STMicroelectronics (Швейцария), Analog Devices, Inc. (США), NXP Semiconductors (Нидерланды), EM Microelectronic (Швейцария), Nuvoton Technology Corporation (Китай), Seiko Epson Corporation (Япония), Microchip Technology Inc. (США), Broadcom (США), Semiconductor Components Industries, LLC (США), Holtek Semiconductor Inc. (Китай), Zilog, Inc. (США), Silicon Laboratories (США), LAPIS Semiconductor, Co., Ltd. (Япония), Infineon Technologies AG (Германия), Renesas Electronics Corporation (Япония), ESPRESSIF SYSTEMS (SHANGHAI) CO., LTD. (Китай), Profichip USA (США), e-peas (Бельгия), Ambiq Micro, Inc. (США), TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION (Япония)

|

Данные, отраженные в отчете

|

Помимо аналитических данных о рыночных сценариях, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, рыночные отчеты, подготовленные Data Bridge Market Research, также включают в себя углубленный экспертный анализ, географически представленные данные о производстве и мощностях компаний, схемы сетей дистрибьюторов и партнеров, подробный и обновленный анализ ценовых тенденций и анализ дефицита цепочки поставок и спроса.

|

Анализ сегмента:

Мировой рынок микроконтроллеров со сверхнизким энергопотреблением сегментирован по типу периферийного устройства, типу, компоненту, типу корпуса, сетевому подключению, объему оперативной памяти, режиму сохранения мощности, области применения и конечному пользователю.

- На основе типа периферии рынок микроконтроллеров сверхнизкого энергопотребления сегментируется на аналоговые устройства, цифровые устройства. Ожидается, что в 2022 году сегмент аналоговых устройств будет доминировать на рынке микроконтроллеров сверхнизкого энергопотребления и расти с самым высоким среднегодовым темпом роста в 11,2% в прогнозируемый период с 2022 по 2029 год благодаря своему комплексному портфелю энергоэффективных решений, обслуживающих различные отрасли.

Ожидается , что в 2022 году сегмент аналоговых устройств периферийного типа будет доминировать на рынке микроконтроллеров сверхмалого энергопотребления.

Ожидается, что в 2022 году сегмент аналоговых устройств будет доминировать на рынке микроконтроллеров с ультранизким энергопотреблением и будет расти с самым высоким среднегодовым темпом роста в 11,2% в прогнозируемый период с 2022 по 2029 год благодаря своему комплексному портфелю энергоэффективных решений, обслуживающих различные отрасли. Их микроконтроллеры обеспечивают превосходную производительность при минимальном энергопотреблении, что делает их идеальными для приложений на основе Интернета вещей и датчиков, укрепляя их позицию как доминирующего игрока на рынке.

- На основе типа рынок микроконтроллеров сверхнизкого энергопотребления сегментируется на универсальные датчики и измерительные MCUS, емкостные датчики касания MCUS и ультразвуковые датчики MCUS. Ожидается, что в 2022 году сегмент универсальных датчиков и измерительных MCU будет доминировать на рынке микроконтроллеров сверхнизкого энергопотребления и расти с самым высоким среднегодовым темпом роста в 11,4% в прогнозируемый период с 2022 по 2029 год из-за растущего спроса на универсальные микроконтроллеры для различных приложений.

Ожидается, что в 2022 году сегмент микроконтроллеров общего назначения для измерения и измерения будет доминировать на рынке микроконтроллеров со сверхнизким энергопотреблением.

Ожидается, что в 2022 году сегмент микроконтроллеров общего назначения для измерения и измерения будет доминировать на рынке микроконтроллеров с ультранизким энергопотреблением и будет расти с самым высоким среднегодовым темпом роста в 11,4% в прогнозируемый период с 2022 по 2029 год из-за растущего спроса на универсальные микроконтроллеры в различных приложениях. Эти микроконтроллеры обеспечивают гибкость и эффективность в сборе и обработке данных, что делает их необходимыми для широкого спектра основанных на датчиках и ориентированных на измерения устройств, таких как датчики IoT, мониторы окружающей среды и медицинские приборы, что обуславливает их доминирование на рынке.

- На основе компонентов рынок микроконтроллеров сверхнизкого энергопотребления сегментируется на оборудование, программное обеспечение и услуги. В 2022 году сегмент оборудования доминирует на рынке микроконтроллеров сверхнизкого энергопотребления и растет с самым высоким среднегодовым темпом роста в 11,1% в прогнозируемый период с 2022 по 2029 год. Это обусловлено решающей ролью компонентов оборудования, включая процессоры и блоки управления питанием, в достижении энергоэффективности и производительности микроконтроллеров. Эти компоненты имеют основополагающее значение для обеспечения работы с низким энергопотреблением, что делает сегмент оборудования ключевым в доминировании на рынке.

- На основе типа корпуса рынок микроконтроллеров со сверхнизким энергопотреблением сегментируется на 8-битный корпус, 16-битный корпус и 32-битный корпус. В 2022 году сегмент 32-битного корпуса доминирует на рынке микроконтроллеров со сверхнизким энергопотреблением и растет с самым высоким среднегодовым темпом роста в 11,2% в прогнозируемый период с 2022 по 2029 год. Он обусловлен его способностью обеспечивать улучшенные возможности обработки и энергоэффективность, что делает его предпочтительным выбором для различных приложений.

- По принципу сетевого подключения рынок микроконтроллеров со сверхнизким энергопотреблением сегментируется на беспроводные и проводные.

- На основе емкости ОЗУ рынок микроконтроллеров сверхнизкого энергопотребления сегментируется на менее 96 кб, 96 кб-512 кб и более 512 кб. В 2022 году сегмент «более 512 кб» будет доминировать на рынке микроконтроллеров сверхнизкого энергопотребления и расти с самым высоким среднегодовым темпом роста в 11,4% в прогнозируемый период с 2022 по 2029 год из-за его способности вмещать большие объемы памяти, позволяя выполнять сложные приложения и задачи с интенсивным использованием данных, сохраняя при этом энергозатраты.

- На основе режима сохранения мощности рынок микроконтроллеров сверхнизкого энергопотребления сегментируется на 1,6 мкВт - 2,4 мкВт, 2,4 мкВт - 3,5 мкВт и более 3,5 мкВт. В 2022 году сегмент «2,4 мкВт - 3,5 мкВт» будет доминировать на рынке микроконтроллеров сверхнизкого энергопотребления и расти с самым высоким среднегодовым темпом роста в 11,5% в прогнозируемый период с 2022 по 2029 год. Он обусловлен своей исключительной энергоэффективностью, что делает его подходящим для устройств с батарейным питанием и приложений IoT, которым требуется длительный срок службы при минимальном потреблении энергии.

- На основе применения рынок микроконтроллеров сверхнизкого энергопотребления сегментируется на общие испытания и измерения, зондирование, измерение расхода и другие. В 2022 году сегмент общих испытаний и измерений будет доминировать на рынке микроконтроллеров сверхнизкого энергопотребления, растущий с самым высоким среднегодовым темпом роста в 11,3% в прогнозируемый период с 2022 по 2029 год из-за его универсальности в обслуживании различных приложений измерения и сбора данных. Эти микроконтроллеры предлагают эффективную и точную обработку данных, что делает их ключевыми в этом сегменте.

- На основе конечного пользователя рынок микроконтроллеров сверхнизкого энергопотребления сегментируется на здравоохранение, промышленность, производство, ИТ и телекоммуникации, военную и оборонную промышленность, аэрокосмическую промышленность, медиа и развлечения, автомобилестроение, серверы и центры обработки данных, бытовую электронику и другие. В 2022 году сегмент бытовой электроники доминирует на рынке микроконтроллеров сверхнизкого энергопотребления и растет с самым высоким среднегодовым темпом роста в 11,4% в прогнозируемый период с 2022 по 2029 год. Это объясняется его широким внедрением в гаджеты с батарейным питанием, носимые устройства и устройства IoT. Эти микроконтроллеры обеспечивают энергоэффективную обработку, что является решающим фактором в бытовой электронике.

Основные игроки

Компания Data Bridge Market Research выделяет следующие компании в качестве игроков на мировом рынке микроконтроллеров со сверхнизким энергопотреблением: Texas Instruments Incorporated (США), STMicroelectronics (Швейцария), Analog Devices, Inc. (США), NXP Semiconductors (Нидерланды), EM Microelectronic (Швейцария), Nuvoton Technology Corporation (Китай), Seiko Epson Corporation (Япония), Microchip Technology Inc. (США).

Развитие рынка

- В феврале 2022 года Infineon Technologies AG объединила усилия с SensiML, компанией, специализирующейся на инструментах ИИ для создания интеллектуальных конечных точек IoT. Их сотрудничество было направлено на упрощение процесса сбора данных с датчиков Infineon XENSIV, что позволило разработчикам обучать модели машинного обучения (ML) и развертывать модели вывода в реальном времени на сверхнизкопотребляющих микроконтроллерах PSoC 6 (MCU). Это партнерство предоставило разработчикам необходимые инструменты для создания интеллектуальных приложений для устройств IoT в различных секторах, включая умные дома, промышленность и фитнес.

- В октябре 2020 года Microchip Technology Inc. завершила приобретение Tekron International Limited, известного поставщика высокоточных технологий GPS и атомных часов для измерения времени. Этот стратегический шаг был направлен на укрепление предложений Microchip по синхронизации и хронометрированию, расширение их возможностей в обслуживании интеллектуальной сети и различных промышленных приложений. Приобретение позволило интегрировать опыт Tekron и широко используемые продукты, еще больше укрепив позиции Microchip в области точных решений для измерения времени.

Региональный анализ

Географически в отчете о мировом рынке микроконтроллеров со сверхнизким энергопотреблением рассматриваются следующие страны: США, Канада и Мексика в Северной Америке, Германия, Франция, Великобритания, Нидерланды, Швейцария, Бельгия, Россия, Италия, Испания, Турция, остальные страны Европы в Европе, Китай, Япония, Индия, Южная Корея, Сингапур, Малайзия, Австралия, Таиланд, Индонезия, Филиппины, остальные страны Азиатско-Тихоокеанского региона (APAC) в Азиатско-Тихоокеанском регионе (APAC), Саудовская Аравия, ОАЭ, Южная Африка, Египет, Израиль, остальные страны Ближнего Востока и Африки (MEA) как часть Ближнего Востока и Африки (MEA), Бразилия, Аргентина и остальные страны Южной Америки как часть Южной Америки.

Согласно анализу Data Bridge Market Research:

Азиатско-Тихоокеанский регион будет доминирующим регионом на мировом рынке микроконтроллеров со сверхнизким энергопотреблением в прогнозируемый период 2022–2029 гг.

Доминирование Азиатско-Тихоокеанского региона на рынке микроконтроллеров с ультранизким энергопотреблением объясняется несколькими факторами. Он содержит множество производителей, которые извлекают выгоду из мощной полупроводниковой промышленности региона и рентабельного производства. Более того, значительное потребление потребительской электроники в густонаселенных странах, таких как Китай и Индия, подпитывает рыночный спрос. Совпадение этих факторов позиционирует Азиатско-Тихоокеанский регион как основной центр производства и внедрения микроконтроллеров с ультранизким энергопотреблением, поддерживая его доминирование в отрасли.

Для получения более подробной информации об отчете о мировом рынке микроконтроллеров со сверхнизким энергопотреблением нажмите здесь – https://www.databridgemarketresearch.com/reports/global-ultra-low-power-microcontroller-market