The Philippines' Private Health Insurance Market is witnessing significant growth, driven by rising healthcare costs and increasing demand for quality medical services. Insurers are offering a wide range of plans and benefits, tailoring packages to meet diverse needs. This burgeoning market is empowering Filipinos with financial security and improved healthcare access, making private health insurance a crucial aspect of their overall well-being.

Access Full Report @ https://www.databridgemarketresearch.com/reports/philippines-private-health-insurance-market

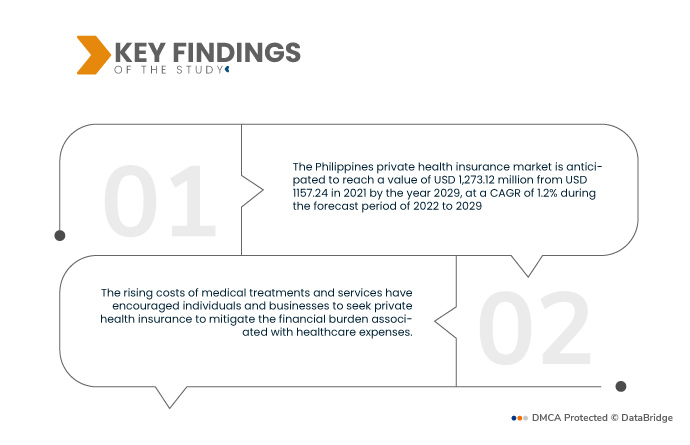

Data Bridge Market Research analyses that the Philippines Private Health Insurance Market is expected to grow to USD 1,273.12 million by the year 2029 from USD 1,157.24 in 2021, at a CAGR of 1.2% during the forecast period of 2022 to 2029. The population's increasing awareness of health and well-being has led to a higher demand for comprehensive health insurance coverage to access better healthcare facilities and services.

Key Findings of the Study

Expanding middle class is expected to drive the market's growth rate

As the middle-class population in the Philippines continues to expand, more individuals have the financial capacity to seek improved healthcare options. With a higher disposable income and a desire for better healthcare access and services, this segment of the population is increasingly turning to private health insurance to secure comprehensive coverage and gain access to higher-quality medical facilities. The growing middle-class demographic has become a significant driver of the increased demand for private health insurance products in the country.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2022 to 2029

|

|

Base Year

|

2021

|

|

Historic Years

|

2020 (Customizable to 2014-2019)

|

|

Quantitative Units

|

Revenue in USD Million, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Type (Critical Illness Insurance, Individual Health Insurance, Family Health Insurance, Disease-Specific Insurance, and Others), Health Plan Category/Metal Levels (Bronze, Silver, Gold Platinum, and Others), Provider Type (Health Maintenance Organizations (HMOS), Preferred Provider Organizations (PPOS), Exclusive Provider Organizations (EPOS), Point-Of-Service (POS) Plans, High-Deductible Health Plans (HDHPS), and Others), Age Group (Young Adulthood (19-44 Years), Middle Adulthood (45-64 Years), and Older Adulthood (65 Years And Above)), Distribution Channel (Direct Insurance Companies, Insurance Aggregators, and Others)

|

|

Market Players Covered

|

Aetna Inc. (A subsidiary of CVS Health) (U.S.), AIA Group Limited (Hong Kong), Allianz (Germany), HSBC Group (Hong Kong), Pacific Cross (Philippines), ASSICURAZIONI GENERALI S.P.A. (Italy)

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

|

Segment Analysis:

The Philippines private health insurance market is segmented on the basis of type, health plan category/metal levels, provider type, age group, and distribution channel.

- On the basis of type, Philippines private health insurance market is segmented into critical illness insurance, individual health insurance, family health insurance, disease-specific insurance, and others

- On the basis of health plan category/metal levels, Philippines private health insurance market is segmented into Bronze, silver, gold platinum and others.

- On the basis of provider type, Philippines private health insurance market is segmented into health maintenance organizations (HMOS), preferred provider organizations (PPOS), exclusive provider organizations (EPOS), point-of-service (POS) plans, high-deductible health plans (HDHPS) and others.

- On the basis of age group, Philippines private health insurance market is segmented into young adulthood (19-44 years), middle adulthood (45-64 years) and older adulthood (65 years and above).

- On the basis of distribution channel, Philippines private Health Insurance market is segmented direct insurance companies, insurance aggregators, and others.

Major Players

Data Bridge Market Research recognizes the following companies as the major Philippines Private Health Insurance market players in Philippines Private Health Insurance market are AIA Group Limited (Hong Kong), Allianz (Germany), HSBC Group (Hong Kong), Pacific Cross (Philippines), ASSICURAZIONI GENERALI S.P.A. (Italy)

Market Developments

- In 2022, Assicuranzioni Generali S.P.A. signed an agreement for the acquisition of La Me´dicale, which is an insurance company for healthcare professionals. This development also foresees the sale of Predica’s1 death coverage portfolio, marketed and managed by La Me´dicale.

- In 2022, Allianz Real Estate, one of the world’s largest real estate investment managers, entered into an agreement to acquire a portfolio of prime multi-family residential assets in Tokyo for approximately USD 90 million, on behalf of the Allianz Real Estate Asia-Pacific Japan Multi-Family Fund.

For more detailed information about the Philippines private health insurance market report, click https://www.databridgemarketresearch.com/reports/philippines-private-health-insurance-market