El mercado estadounidense de tractores de terminal es vital en la industria del transporte y la logística, impulsado por la necesidad de vehículos especializados para optimizar el manejo de la carga en las terminales. Los tractores de terminal, también conocidos como camiones de patio o de maniobras, mueven eficientemente remolques y contenedores en distancias cortas y agilizan las operaciones en los almacenes. Estos semirremolques están diseñados para la carga y descarga de materiales, especialmente en actividades portuarias. Su papel estratégico en la mejora de la eficiencia de la cadena de suministro los hace indispensables en el dinámico panorama del movimiento de carga en terminales y patios de carga.

Acceda al informe completo en https://www.databridgemarketresearch.com/reports/us-terminal-tractor-market

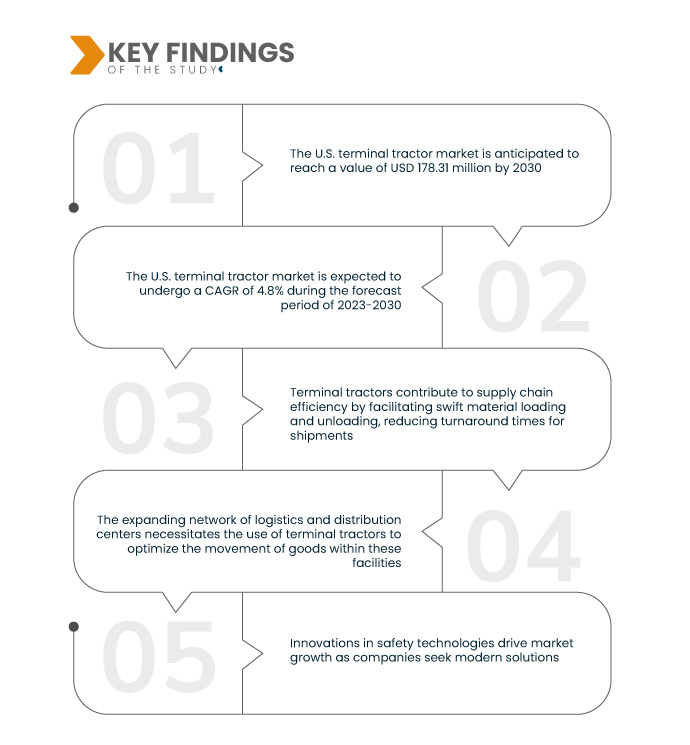

Data Bridge Market Research analiza que el valor del mercado estadounidense de tractores de terminal fue de 122,54 millones de dólares en 2022 y se espera que alcance los 178,31 millones de dólares para 2030, con una tasa de crecimiento anual compuesta (TCAC) del 4,8 % durante el período de pronóstico 2023-2030. El auge del transporte marítimo en contenedores subraya el papel fundamental de los tractores de terminal, esenciales para el transporte eficiente de remolques y contenedores en espacios reducidos. Esta tendencia refuerza la importancia de estos vehículos especializados en los procesos logísticos y de distribución modernos.

Principales hallazgos del estudio

Se espera que la alta demanda del comercio electrónico impulse la tasa de crecimiento del mercado.

Un aumento significativo de la demanda del sector del comercio electrónico sustenta el mercado estadounidense de tractores de terminal. Con el auge del comercio minorista en línea, aumenta la necesidad de una gestión eficiente de la carga en los centros de distribución. Los tractores de terminal desempeñan un papel crucial en la optimización de las operaciones, facilitando el movimiento de remolques y contenedores, satisfaciendo así las necesidades dinámicas de la creciente industria del comercio electrónico. Esta demanda subraya la importancia de estos vehículos para respaldar la columna vertebral logística de las cadenas de suministro del comercio electrónico.

Alcance del informe y segmentación del mercado

Métrica del informe

|

Detalles

|

Período de pronóstico

|

2023 a 2030

|

Año base

|

2022

|

Años históricos

|

2021 (personalizable para 2015-2020)

|

Unidades cuantitativas

|

Ingresos en millones de USD, volúmenes en unidades, precios en USD

|

Segmentos cubiertos

|

Tipo (manual, automatizado), eje (4x2, 4x4), tonelaje (<50 toneladas, 50–100 toneladas, >100 toneladas), tipo de propulsión (diésel, eléctrico, híbrido, GNC ), modelos (camiones de carretera, camiones todoterreno), aplicación (aeropuerto, puerto marítimo, petróleo y gas, logística), usuario final (industria minorista, alimentos y bebidas, vías navegables interiores y servicios marítimos, logística ferroviaria, RORO, otros)

|

Actores del mercado cubiertos

|

Deere & Company (EE. UU.), Tractors and Farm Equipment Limited (India), Kubota Corporation (Japón), CLAAS KGaA GmbH (Alemania), AGCO Corporation (EE. UU.), CNH Industrial NV (Reino Unido), Enerpac Tool Group (EE. UU.), JCB (Reino Unido), Mahindra & Mahindra Ltd. (India), SDF Group (Italia), Bucher Industries (Suiza), Alamo Group, Inc. (EE. UU.)

|

Puntos de datos cubiertos en el informe

|

Además de los conocimientos del mercado, como el valor de mercado, la tasa de crecimiento, los segmentos del mercado, la cobertura geográfica, los actores del mercado y el escenario del mercado, el informe de mercado elaborado por el equipo de investigación de mercado de Data Bridge incluye un análisis en profundidad de expertos, análisis de importación/exportación, análisis de precios, análisis de consumo de producción y análisis pestle.

|

Análisis de segmentos:

El mercado de tractores de terminal de EE. UU. está segmentado según tipo, eje, tonelaje, tipo de propulsión, modelos, aplicación y usuario final.

- Según el tipo, el mercado estadounidense de tractores de terminal se segmenta en manual y automatizado.

- Sobre la base del eje, el mercado estadounidense de tractores de terminal está segmentado en 4x2 y 4x4.

- Sobre la base del tonelaje, el mercado estadounidense de tractores de terminal se segmenta en <50 toneladas, 50-100 toneladas y >100 toneladas.

- Sobre la base del tipo de propulsión, el mercado estadounidense de tractores de terminal está segmentado en diésel, eléctrico, híbrido y GNC.

- Sobre la base de los modelos, el mercado estadounidense de tractores de terminal está segmentado en camiones de carretera y camiones todoterreno.

- Sobre la base de la aplicación, el mercado estadounidense de tractores de terminal está segmentado en aeropuertos, puertos marítimos, petróleo y gas, y logística.

- Sobre la base del usuario final, el mercado estadounidense de tractores de terminal está segmentado en industria minorista, alimentos y bebidas, vías navegables interiores y servicios marítimos, logística ferroviaria, RORO y otros.

Actores principales

Data Bridge Market Research reconoce a las siguientes empresas como los principales actores del mercado de tractores de terminal de EE. UU. en el mercado de tractores de terminal de EE. UU.: AGCO Corporation (EE. UU.), CNH Industrial NV (Reino Unido), Enerpac Tool Group (EE. UU.), JCB (Reino Unido), Mahindra & Mahindra Ltd. (India), SDF Group (Italia), Bucher Industries (Suiza), Alamo Group, Inc. (EE. UU.)

Desarrollos del mercado

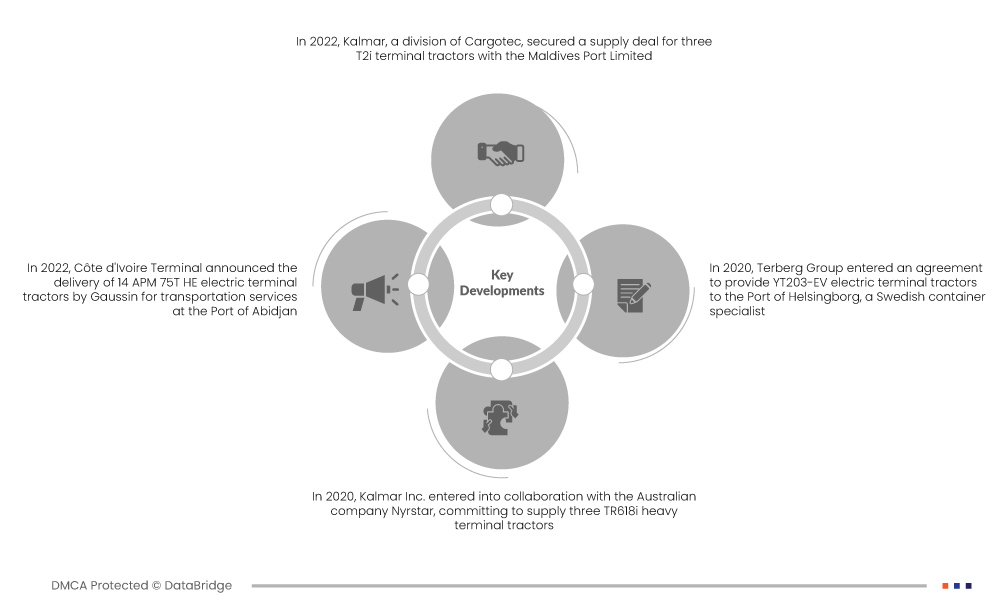

- En 2022, Kalmar, una división de Cargotec, cerró un contrato de suministro de tres cabezas tractoras de terminal T2i con Maldives Port Limited. La entrega de los pedidos está prevista para el primer trimestre de 2023, lo que demuestra la continua presencia de Kalmar en la prestación de soluciones eficientes de manipulación de carga para las operaciones portuarias en Maldivas.

- En 2022, Costa de Marfil Terminal anunció la entrega de 14 cabezas tractoras eléctricas APM 75T HE de Gaussin para servicios de transporte en el puerto de Abiyán. Esto forma parte de un pedido mayor de 36 cabezas tractoras, que se entregarán por fases hasta finales de 2022, lo que mejorará las capacidades del puerto y contribuirá a unas operaciones más sostenibles y eficientes.

- En 2020, Kalmar Inc. colaboró con la empresa australiana Nyrstar, comprometiéndose a suministrar tres cabezas tractoras para terminales pesadas TR618i. Diseñados específicamente para manipular cargas considerables en diversas condiciones, estos tractores cumplen con la normativa de emisiones Stage V de la UE. Esta colaboración pone de manifiesto el compromiso de Kalmar de ofrecer soluciones robustas y respetuosas con el medio ambiente para una manipulación eficiente de la carga en el sector industrial.

- En 2020, el Grupo Terberg firmó un acuerdo para suministrar tractores de terminal eléctricos YT203-EV al Puerto de Helsingborg, empresa sueca especializada en contenedores. Con una potente batería de 222 kWh, estos tractores eléctricos no solo promueven la sostenibilidad, sino que también ofrecen ahorros al reducir los gastos de mantenimiento y eliminar la necesidad de combustible diésel, en consonancia con el compromiso del puerto con la eficiencia ambiental y económica.

Para obtener información más detallada sobre el informe del mercado de tractores de terminal de EE. UU., haga clic aquí: https://www.databridgemarketresearch.com/reports/us-terminal-tractor-market