По мере роста глобальной осведомленности об изменении климата и энергосбережении компании и домовладельцы ищут решения HVAC, которые минимизируют потребление энергии и снижают эксплуатационные расходы. Системы VRF, известные своей превосходной энергоэффективностью по сравнению с традиционными системами HVAC, набирают популярность благодаря своей способности обеспечивать точный контроль температуры при оптимизации использования энергии. Модулируя поток хладагента в соответствии с потребностью в отоплении или охлаждении отдельных зон, системы VRF значительно снижают потребление энергии, что делает их привлекательным вариантом как для новых установок, так и для модернизации коммерческих и жилых зданий.

Доступ к полному отчету по адресу https://www.databridgemarketresearch.com/reports/us-variable-refrigerant-flow-vrf-systems-market

По данным исследования рынка Data Bridge, ожидается, что объем рынка систем переменного расхода хладагента (VRF) в США к 2031 году достигнет 20,38 млрд долларов США по сравнению с 12,80 млрд долларов США в 2023 году, а среднегодовой темп роста составит 6,3% в прогнозируемый период с 2024 по 2031 год.

Основные выводы исследования

Растущее внедрение интеллектуальных зданий/систем VRF на базе Интернета вещей

Поскольку здания становятся все более связанными и интеллектуальными, интеграция систем VRF с IoT обеспечивает точный контроль, мониторинг и оптимизацию функций отопления и охлаждения в режиме реального времени. Эти системы позволяют осуществлять бесперебойное управление потреблением энергии, повышая эффективность и сокращая расходы, что особенно привлекательно в коммерческих и крупномасштабных жилых проектах. Возможность удаленной настройки параметров, прогнозирования потребностей в обслуживании и анализа данных о производительности повышает привлекательность систем VRF в среде интеллектуальных зданий.

Область отчета и сегментация рынка

Отчет Метрика

|

Подробности

|

Прогнозируемый период

|

2024-2031

|

Базовый год

|

2023

|

Исторический год

|

2022 (Можно настроить на 2016-2021)

|

Количественные единицы

|

Доход в миллиардах

|

Охваченные сегменты

|

Компоненты (наружные блоки, внутренние блоки, системы управления и аксессуары), грузоподъемность (до 10 тонн, от 11 до 18 тонн, от 19 до 26 тонн и более 26 тонн), тип системы ( системы тепловых насосов и системы рекуперации тепла), применение (коммерческие, жилые и другие)

|

Страна покрытия

|

ВШЬ

|

Охваченные участники рынка

|

Samsung HVAC, LLC (дочерняя компания Samsung Electronics) (США), DAIKIN INDUSTRIES, Ltd. (Япония), Panasonic Holdings Corporation (Япония), Mitsubishi Electric Corporation (Япония), LG Electronics (Южная Корея), FUJITSU GENERAL (Япония), Ingersoll Rand (США), Johnson Controls Inc. (Ирландия), Lennox International Inc (США) и Midea (Китай) и другие.

|

Данные, отраженные в отчете

|

Помимо аналитических данных о рыночных сценариях, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, рыночные отчеты, подготовленные Data Bridge Market Research, также включают в себя углубленный экспертный анализ, географически представленные данные о производстве и мощностях компаний, схемы сетей дистрибьюторов и партнеров, подробный и обновленный анализ ценовых тенденций и анализ дефицита цепочки поставок и спроса.

|

Анализ сегмента

Рынок систем с переменным расходом хладагента (VRF) в США разделен на четыре основных сегмента, которые различаются по компонентам, производительности, типу системы и области применения.

- На основе компонентов рынок сегментируется на наружные блоки, внутренние блоки, системы управления и аксессуары.

Ожидается, что в 2024 году сегмент наружных блоков будет доминировать на рынке систем с переменным расходом хладагента (VRF) в США.

Ожидается, что в 2024 году сегмент наружных блоков будет доминировать на рынке с долей рынка 39,15% благодаря своей важнейшей роли в общей эффективности и производительности системы, предлагая передовые функции, такие как улучшенный теплообмен и возможности энергосбережения.

- По грузоподъемности рынок сегментирован на: до 10 тонн, от 11 до 18 тонн, от 19 до 26 тонн и свыше 26 тонн.

Ожидается, что в 2024 году сегмент до 10 тонн будет доминировать на рынке систем с переменным расходом хладагента (VRF) в США.

Ожидается, что в 2024 году сегмент грузоподъемностью до 10 тонн будет доминировать на рынке с долей рынка 45,25% благодаря своей универсальности и пригодности для широкого спектра применений, включая жилые и небольшие коммерческие здания.

- На основе типа системы рынок сегментируется на системы тепловых насосов и системы рекуперации тепла. В 2024 году сегмент систем тепловых насосов, как ожидается, будет доминировать на рынке с 57,94% рынка

- На основе сферы применения рынок сегментируется на коммерческий, жилой и др. Ожидается, что в 2024 году коммерческий сегмент будет доминировать на рынке с долей рынка 61,89%.

Основные игроки

Data Bridge Market Research анализирует Samsung HVAC, LLC (дочернюю компанию Samsung Electronics) (США), DAIKIN INDUSTRIES, Ltd. (Япония), Panasonic Holdings Corporation (Япония), Mitsubishi Electric Corporation (Япония), LG Electronics (Южная Корея) как основных игроков, работающих на рынке.

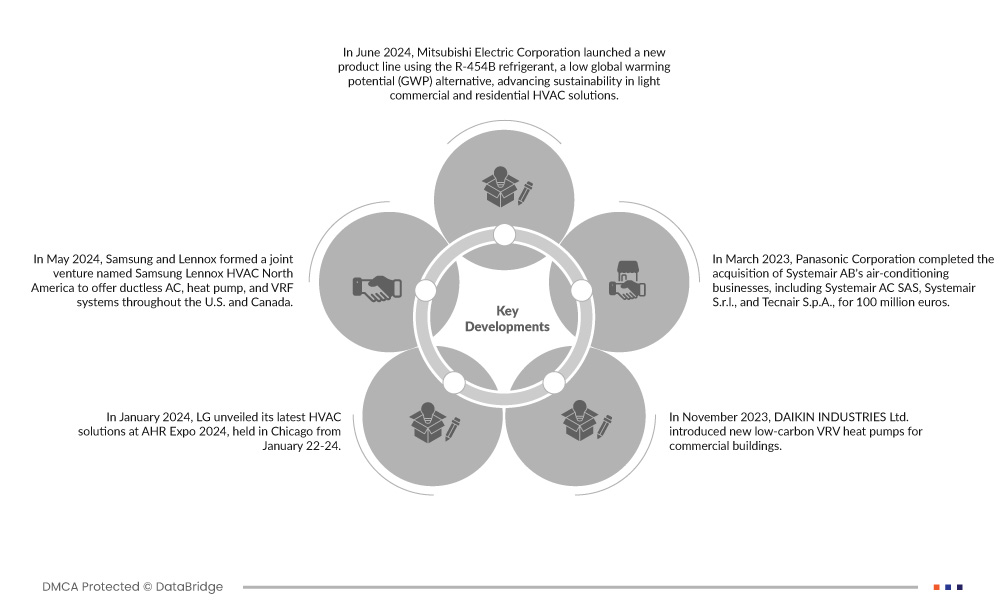

Развитие рынка

- В июне 2024 года корпорация Mitsubishi Electric запустила новую линейку продукции с использованием хладагента R-454B, альтернативы с низким потенциалом глобального потепления (GWP), что способствует повышению устойчивости в легких коммерческих и жилых решениях HVAC. Эти продукты, доступные в начале 2025 года, превосходят нормативные требования и отличаются улучшенными характеристиками и безопасностью в холодном климате. Этот запуск укрепил приверженность Mitsubishi Electric охране окружающей среды, укрепив ее позицию на рынке как лидера в области устойчивых решений HVAC

- В мае 2024 года Samsung и Lennox создали совместное предприятие под названием Samsung Lennox HVAC North America, чтобы предложить системы кондиционирования воздуха без воздуховодов, тепловые насосы и VRF-системы по всей территории США и Канады. Это партнерство расширяет дистрибуцию и рыночный охват Samsung для своих систем с переменным расходом хладагента (VRF), используя налаженную сеть продаж и присутствие Lennox на рынке

- В январе 2024 года LG представила свои новейшие решения HVAC на выставке AHR Expo 2024, которая прошла в Чикаго с 22 по 24 января. На мероприятии были представлены энергоэффективные жилые и коммерческие линейки HVAC LG, включая тепловой насос R32 «воздух-вода» и решение Multi V i VRF. Эти инновации подчеркнули приверженность LG принципам устойчивого развития и электрификации всего дома. Эта стратегическая выставка укрепила прочные позиции LG на рынке и укрепила ее репутацию лидера в области решений для умного дома

- В ноябре 2023 года компания DAIKIN INDUSTRIES Ltd. представила новые низкоуглеродные тепловые насосы VRV для коммерческих зданий. Тепловые насосы VRV 5, выпуск которых запланирован на начало 2024 года, включают систему Mini-VRV мощностью до 33,5 кВт и серию Top-Blow мощностью до 56 кВт. В этих системах используется хладагент R-32, имеющий потенциал глобального потепления 675, что позволяет сократить выбросы CO2-эквивалента до 71% в соответствии с европейскими нормами. Это достижение поддерживает цель Daikin — стать лидером в области декарбонизации и укрепить свои позиции на рынке решений для устойчивых зданий.

- В марте 2023 года Panasonic Corporation завершила приобретение подразделений Systemair AB по кондиционированию воздуха, включая Systemair AC SAS, Systemair Srl и Tecnair SpA, за 100 миллионов евро. Это приобретение выгодно Panasonic Holdings Corporation, поскольку повышает ее способность соответствовать растущим экологическим требованиям и нормам в Европе. Интегрируя коммерческие гидравлические системы Systemair с собственными системами VRF, Panasonic может разрабатывать более эффективные и экологически чистые решения для кондиционирования воздуха, укрепляя свои позиции на рынке и расширяя ассортимент продукции.

Более подробную информацию об отчете о рынке систем с переменным расходом хладагента (VRF) в США можно получить здесь – https://www.databridgemarketresearch.com/reports/us-variable-refrigerant-flow-vrf-systems-market