Asia Pacific Digital Payment Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

40,322.02 Million

USD

181,635.38 Million

2022

2030

USD

40,322.02 Million

USD

181,635.38 Million

2022

2030

| 2023 –2030 | |

| USD 40,322.02 Million | |

| USD 181,635.38 Million | |

|

|

|

Asia-Pacific Digital Payment Market, By Deployment Model (On Premises, Cloud), Offering (Solutions, Services), Organization Size (Large Enterprises, Small and Medium Enterprises (SMEs)), Mode of Payment (Payment Cards, Point of Sale, Unified Payments Interface (UPI) Service, Mobile Payment, Online Payment), Mode of Usage (Mobile Application, Desktop/Web Browser), Technology (Application Programming Interface (API), Data Analytics and ML, Digital Ledger Technology (DLT), AI and IoT, Biometric Authentication), Use Case (Person (P/C), Merchant/ Business, Government), End User (Commercial, Consumer) – Industry Trends and Forecast to 2030.

Asia-Pacific Digital Payment Market Analysis and Size

Digital payment refers to the process of making financial transactions electronically, typically using digital devices such as smartphones, computers, or tablets, and digital channels like the internet. It involves the transfer of money or the exchange of value between parties without the use of physical cash or checks. “Deployment model” segment is expected to dominate the market because of its scalability, cost-efficiency, and accessibility, aligning with the region's diverse markets and rapid digital adoption trends.

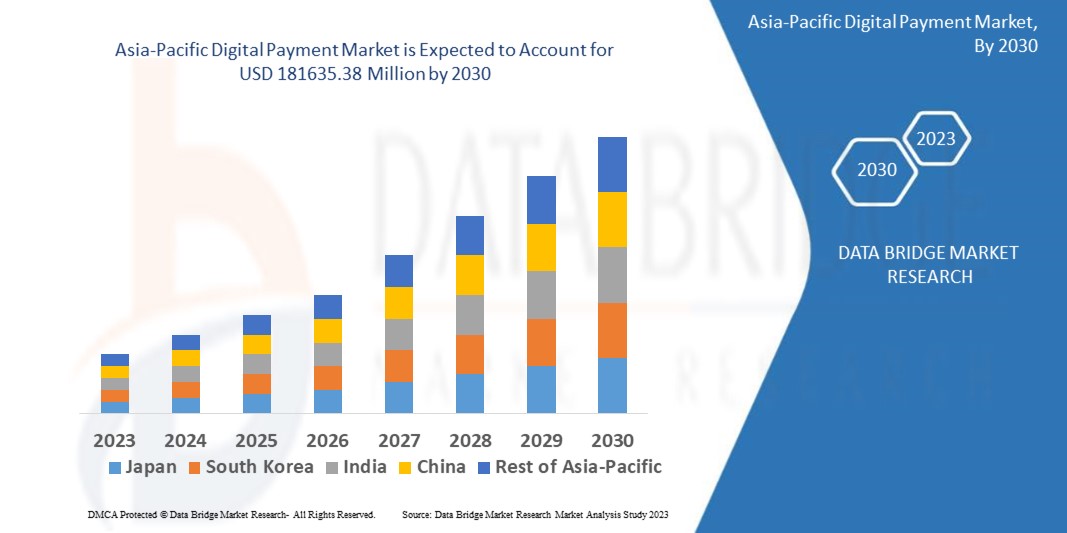

Data Bridge Market Research analyses that the Asia-Pacific digital payment market which was USD 40322.02 million in 2021, is expected to reach USD 181635.38 million by 2030, and is expected to undergo a CAGR of 20.70% during the forecast period 2023-2030. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Asia-Pacific Digital Payment Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Deployment Model (On Premises, Cloud), Offering (Solutions, Services), Organization Size (Large Enterprises, Small and Medium Enterprises (SMEs)), Mode of Payment (Payment Cards, Point of Sale, Unified Payments Interface (UPI) Service, Mobile Payment, Online Payment), Mode of Usage (Mobile Application, Desktop/Web Browser), Technology (Application Programming Interface (API), Data Analytics and ML, Digital Ledger Technology (DLT), AI and IoT, Biometric Authentication), Use Case (Person (P/C), Merchant/ Business, Government), End User (Commercial, Consumer) |

|

Countries Covered |

China, India, Japan, South Korea, Australia, Indonesia, Malaysia, Thailand, Singapore, Philippines, and Rest of Asia-Pacific |

|

Market Players Covered |

ACI Worldwide (U.S.), PayPal, Inc. (U.S.), Novatti Group Ltd (Australia), Global Payments Inc. (U.S.), Visa (U.S.), Stripe, Inc. (Ireland), Google, LLC (U.S.), Finastra. (U.K.), SAMSUNG (South Korea), Amazon Web Services, Inc. (U.S.), Financial Software & Systems Pvt. Ltd. (U.S.), Aurus Inc. (U.S.), Adyen (Netherlands), Apple Inc. (U.S.), Fiserv, Inc. (U.S.), WEX Inc. (U.S.), wirecard (U.S.), Mastercard. (U.S.) |

|

Market Opportunities |

|

Market Definition

Digital payment refers to the extensive ecosystem of electronic financial transactions encompassing online purchases, mobile payments, contactless payments, digital wallets, and peer-to-peer transfers. It involves both consumers and businesses utilizing digital payment methods, such as credit cards, mobile apps, and cryptocurrencies, to facilitate transactions, making it a dynamic and evolving market. The region's diverse economies, varying levels of technological adoption, and regulatory frameworks contribute to the complexity and growth potential of this market, making it a key focus for businesses and investors alike.

Asia-Pacific Digital Payment Market Dynamics

Drivers

- Growing E-commerce Industry

The rise of online shopping and e-commerce platforms has led to an increased demand for digital payment solutions. As consumers and businesses increasingly conduct transactions online, digital payments have become essential.

- Smartphone Penetration

The Asia-Pacific region has witnessed a significant increase in smartphone adoption, enabling more people to access digital payment services through mobile apps. This widespread smartphone usage has facilitated the growth of mobile wallets and mobile banking.

- Government Initiatives

Several governments in the Asia-Pacific region have been actively promoting digital payments to reduce cash transactions and promote financial inclusion. Initiatives include subsidies, incentives, and regulatory changes to encourage the use of digital payment methods.

Opportunity

- Fintech Innovation

The region has seen a surge in fintech startups offering innovative digital payment solutions. These startups are often more agile and responsive to market needs, contributing to the growth of the digital payment ecosystem.

Restraints/Challenges

- Regulatory Hurdles

Regulatory environments vary widely across Asia-Pacific countries. Navigating diverse regulatory requirements and compliance standards can be complex for digital payment providers, leading to delays and increased operational costs.

- Security Concerns

As digital payment transactions increase, so does the risk of fraud, cyberattacks, and data breaches. Ensuring the security of digital payment systems is a significant challenge, and any breach can erode consumer trust.

Recent Development

- In June 2022, Samsung Pay introduced the Samsung Wallet by combining Samsung Pay and Samsung Pass. This wallet could securely save passwords and monitor digital assets like cryptocurrencies. Moreover, the Samsung Wallet included features to store driving licenses and student IDs

- In March 2022, Mastercard, DBS Bank, and Pine Labs partnered to launch Mastercard Installation Payments with Pine Labs. This new program allows DBS/POSB credit cardholders to pay interest-free installments with merchants by simply presenting the DBS / POSB and using a later pay identifier card at checkout

Asia-Pacific Digital Payment Market Scope

The Asia-Pacific digital payment market is segmented on the basis of deployment model, offering, organization size, mode of payment, mode of usage, technology, use case and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Deployment Model

- On Premises

- Cloud

Offering

- Solutions

- Services

Organization Size

- Large Enterprises

- Small and Medium Enterprises (SMEs)

Mode of Payment

- Payment Cards

- Point of Sale

- Unified Payments Interface (UPI) Service

- Mobile Payment

- Online Payment

Mode of Usage

- Mobile Application

- Desktop/Web Browser

Technology

- Application Programming Interface (API)

- Data Analytics and ML

- Digital Ledger Technology (DLT)

- AI and IoT

- Biometric Authentication

Use Case

- Person (P/C)

- Merchant/ Business

- Government

End User

- Commercial

- Consumer

Asia-Pacific Digital Payment Market Regional Analysis/Insights

The Asia-Pacific digital payment market is analyzed and market size insights and trends are provided by deployment model, offering, organization size, mode of payment, mode of usage, technology, use case and end user as referenced above.

The countries covered in the Asia-Pacific digital payment market report are China, India, Japan, South Korea, Australia, Indonesia, Malaysia, Thailand, Singapore, Philippines, and Rest of Asia-Pacific.

India dominates the Asia-Pacific digital payment market due to its vast population, increasing smartphone penetration, and government initiatives such as "Digital India," which promote digital payment adoption. The presence of major players like Paytm, PhonePe, and Google Pay, combined with a thriving e-commerce industry, drives India's prominence in the region's digital payment landscape. Additionally, the country's diverse range of digital payment methods caters to various consumer preferences, contributing to its dominance.

The country section of the report also provides individual market-impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends, and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and the challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Digital Payment Market Share Analysis

The Asia-Pacific digital payment market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus related to Asia-Pacific digital payment market.

Some of the major players operating in the Asia-Pacific digital payment market are:

- ACI Worldwide (U.S.)

- PayPal, Inc. (U.S.)

- Novatti Group Ltd (Australia)

- Global Payments Inc. (U.S.)

- Visa (U.S.)

- Stripe, Inc. (Ireland)

- Google, LLC (U.S.)

- Finastra. (U.K.)

- SAMSUNG (South Korea)

- Amazon Web Services, Inc. (U.S.)

- Financial Software & Systems Pvt. Ltd. (U.S.)

- Aurus Inc. (U.S.)

- Adyen (Netherlands)

- Apple Inc. (U.S.)

- Fiserv, Inc. (U.S.)

- WEX Inc. (U.S.)

- wirecard (U.S.)

- Mastercard. (U.S.)

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.