Asia Pacific Digital Twin Financial Services And Insurance Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

195.91 Million

USD

726.47 Million

2022

2030

USD

195.91 Million

USD

726.47 Million

2022

2030

| 2023 –2030 | |

| USD 195.91 Million | |

| USD 726.47 Million | |

|

|

|

|

Asia-Pacific Digital Twin Financial Services and Insurance Market, By Type (System, Process, Product), Technology (Internet of Things (IoT) and Industrial Internet of Things (IIoT), Artificial Intelligence and Machine Learning, 5G, Big Data Analytics, Blockchain and Augmented Reality, Virtual Reality, Mixed Reality), Deployment (Cloud, On Premises), Application (Bank Account Funds Checking, Digital Fund Transfer Checks, Policy Generation, Other Applications) – Industry Trends and Forecast to 2030.

Asia-Pacific Digital Twin Financial Services and Insurance Market Analysis and Size

In the initial days, digital twin models were confined in complexity and size, but the scale of them is increasing rapidly now with the addition of advanced technologies such artificial intelligence (AI), big data, the internet of things (IoT), and processing power. With these advanced technologies, digital twins allow the use of data to simulate and anticipate coming asset conditions and performance in financial services and insurance sector. As a result, the demand for the digital twins increases in financial services and insurance sector which enhances the market growth.

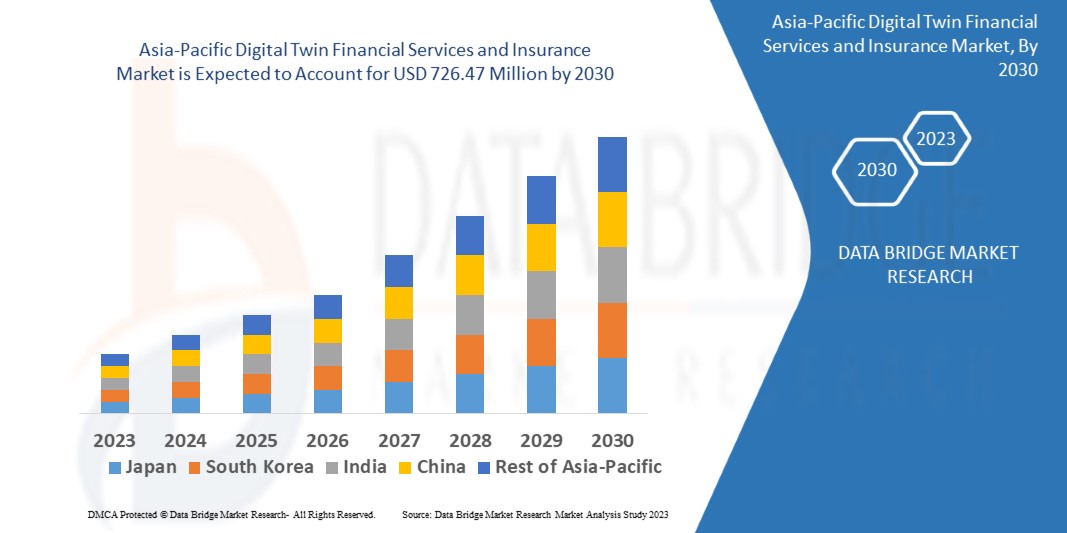

Data Bridge Market Research analyses that the digital twin financial services and insurance market is expected to reach USD 726.47 million by 2030, which is USD 195.91 million in 2022, at a CAGR of 17.80% during the forecast period. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Asia-Pacific Digital Twin Financial Services and Insurance Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (System, Process, Product), Technology (Internet of Things (IoT) and Industrial Internet of Things (IIoT), Artificial Intelligence and Machine Learning, 5G, Big Data Analytics, Blockchain and Augmented Reality, Virtual Reality, Mixed Reality), Deployment (Cloud, On Premises), Application (Bank Account Funds Checking, Digital Fund Transfer Checks, Policy Generation, Other Applications) |

|

Countries Covered |

China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC). |

|

Market Players Covered |

Microsoft (U.S.), IBM (U.S.), SAP (Germany), Siemens (Germany), General Electric (U.S.), Atos SE (France), ABB (Switzerland), TIBCO Software Inc. (U.S.), Oracle (U.S ), Robert Bosch GmbH (Germany), DXC Technology Company (U.S.), Hexaware Technologies Limited (India), Tata Consultancy Services Limited (India), Infosys Limited (India), AVEVA Group plc (U.K.), Altair Engineering Inc. (U.S.), NTT DATA, Inc. (Japan), KELLTON TECH (India), AVEVA Group plc (U.K.), ANSYS, Inc. (U.S.) |

|

Market Opportunities |

|

Market Definition

The digital twin financial services and insurance refers to a technology which is used for assisting customers with policy buying and management, loan management, mitigating risks, and many more. Digital twins are digital copies of physical products. The data is visualized and stored on a digital platform for better growth of businesses. The digital twin financial services and insurance sector is providing more optimized solutions to customers.

Asia-Pacific Digital Twin Financial Services and Insurance Market

Drivers

- Increasing urbanization and growing disposable income will widen the scope of growth

Rising urbanization in this region is expected to drive the growth of the digital twin financial services and insurance market during the forecast period. As a result of increasing urbanization and growing net income, people can easily afford to pay for digital services at the place of physically visiting the banks. Therefore, the increasing urbanization and growing disposable income will widen the scope of growth.

- Growing adoption of cloud technologies

Cloud technologies are hosted in the cloud platform and are accessed through web browser by using internet. The use of cloud technologies in digital insurance and financial services offers greater security, and quicker processing times with reduced prices. Therefore, the growing adoption of cloud technologies is expected to propel the growth of the digital twin financial services and insurance market.

Opportunities

- Increasing usage of digital twin financial services and insurance to identify a cross-sell upsell opportunity

Existing data in the insurer landscape can be leveraged to find the cross-sell upsell opportunity. Digital technology will increase revenue for the insurers by upsell and cross sell. Machine learning models can tap into the present customer datasets such as their buying patterns and other factors to identify a cross-sell upsell opportunity. Thus, the increasing usage of digital twin financial services and insurance to identify a cross-sell upsell opportunity will create ample opportunities for the market growth of the market.

- Increasing integration of advanced technology in digital twins

Digital twin financial services and insurance connected technologies such as IoT, sensors, real-time data monitoring systems help insurers to define new policies or packages, reduce administration costs, mitigate risks and enhance core insurance operations such as fraud detection, customer assets evaluation, underwriting, claims processing, new policy creation and other. Thus, the increasing integration of advanced technology in digital twins leverage will create lucrative opportunities for the market growth.

Restraints

- Increasing concern regarding data security

Increasing concern regarding data security in financial services and insurance sector due to the use of cloud platforms and internet of things (IoT) will hamper the growth of the digital twin financial services and insurance market.

- Issue associated with affordability of digital twin technology for small companies

Digital twin technologies become more prevalent across all industries, but the installation and adoption cost is very high. As a result, small companies are not able to afford digital twin technology. The cost of digital twin technology is also high due to the presence of expensive integrated software and digital twin software which will hamper the market growth.

This digital twin financial services and insurance market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the digital twin financial services and insurance market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Development

- In 2021, Siemens Smart Infrastructure acquired EcoDomus’s digital twin software platform for an undisclosed amount. With this acquisition, they will support Siemens to increase its digital building offerings with the help of cloud-based building operations twin software.

- In 2020, HBF has been chosen by Oracle Health Insurance to serve as core platform for its health insurance products. This platform will allow HBF to increase operational efficiency. Oracle aids health insurers in improving operational performance, lowering administrative expenses, streamlining claim processing, improving billing accuracy, and enhancing member satisfaction.

Asia-Pacific Digital Twin Financial Services and Insurance Market Scope

The digital twin financial services and insurance market is segmented on the basis of type, technology, deployment and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- System

- Process

- Product

Technology

- Internet of Things (IoT) and Industrial Internet of Things (IIoT)

- Artificial Intelligence and Machine Learning

- 5G

- Big Data Analytics

- Blockchain and Augmented Reality

- Virtual Reality

- Mixed Reality

Deployment

- Cloud

- On Premises

Application

- Bank Account Funds Checking

- Digital Fund Transfer Checks

- Policy Generation

- Other Applications

Digital Twin Financial Services and Insurance Market Regional Analysis/Insights

The digital twin financial services and insurance market is analyzed and market size insights and trends are provided by country, type, technology, deployment and application as referenced above.

The countries covered in the digital twin financial services and insurance market report are China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC).

China dominates the digital twin financial services and insurance market due to increasing focus toward the utilization of 5G and high usage of cloud database in this region. Moreover, d increased adoption of advance technologies and improved infrastructural development will further boost the market growth.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Digital Twin Financial Services and Insurance Market Share Analysis

The digital twin financial services and insurance market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to digital twin financial services and insurance market.

Some of the major players operating in the digital twin financial services and insurance market are:

- Microsoft (U.S.)

- IBM (U.S.)

- SAP (Germany)

- Siemens (Germany)

- General Electric (U.S.)

- Atos SE (France)

- ABB (Switzerland)

- TIBCO Software Inc. (U.S.)

- Oracle (U.S)

- Robert Bosch GmbH (Germany)

- DXC Technology Company (U.S.)

- Hexaware Technologies Limited (India)

- Tata Consultancy Services Limited (India)

- Infosys Limited (India)

- AVEVA Group plc (U.K.)

- Altair Engineering Inc. (U.S.)

- NTT DATA, Inc. (Japan)

- KELLTON TECH (India)

- AVEVA Group plc (U.K.)

- ANSYS, Inc. (U.S.)

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.