Global Anhydrous Hydrofluoric Acid Market, By Type (UP Grade, UP-S Grade, UP-SS Grade, EL Grade), Application (Fluorocarbon Production, Fluorinated Derivative Production, Metal Pickling, Glass Etching and Cleaning, Oil Refining, Uranium Fuel Production, Others) – Industry Trends and Forecast to 2029

Market Analysis and Size

Anhydrous hydrogen fluoride is the building-block material for the manufacture of fluorine and fluorine containing compounds such as flupropolymers, fluorochemicals and surfactants. The main use for anhydrous hydrogen fluoride is in the preparation of other inorganic fluorides compound for fluoridation of water, used as fluxes and catalysts, and manufactured ceramics and glass. The anhydrous hydrofluoric acid is used as an intermediate for manufacture fluorochemicals. Other applications such as steel pickling, metal processing, and metal surface treatment amongst others are expected to increase significantly over the forecast period.

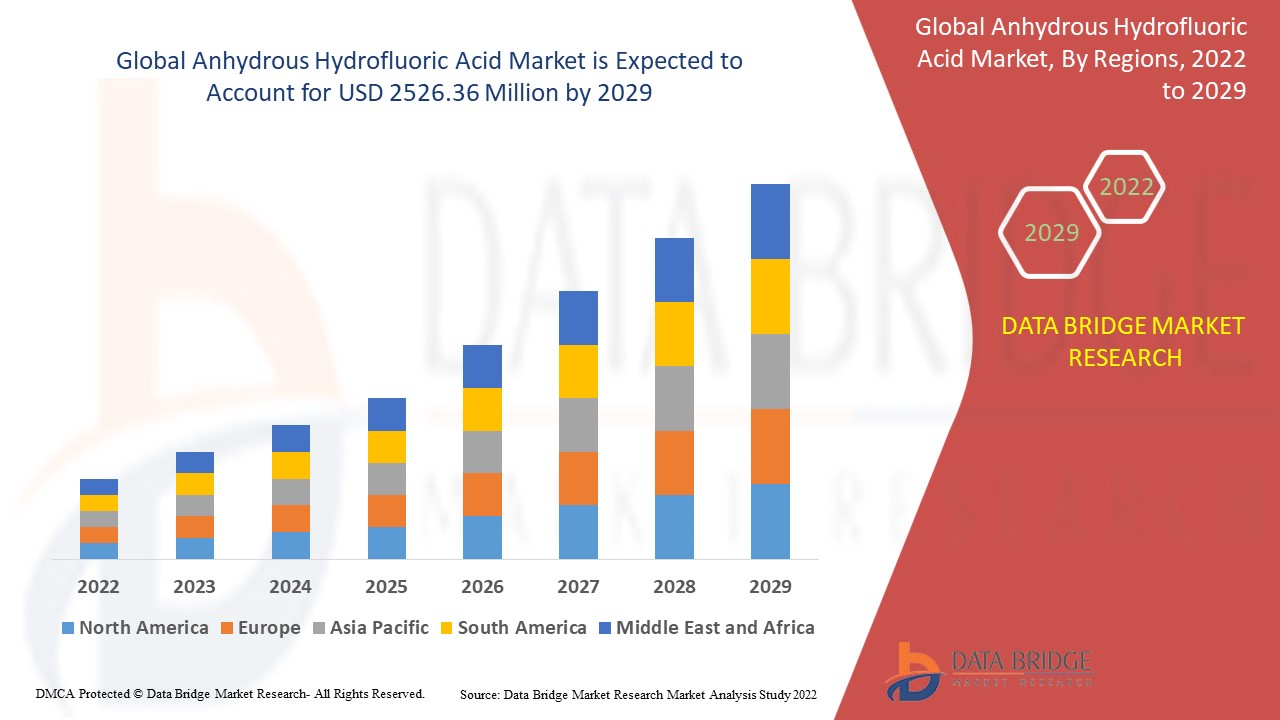

Data Bridge Market Research analyses that the anhydrous hydrofluoric acid market was valued at USD 1700.00 million in 2021 and is expected to reach USD 2526.36 million by 2029, registering a CAGR of 4.50 % during the forecast period of 2022 to 2029. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and climate chain scenario.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (UP Grade, UP-S Grade, UP-SS Grade, EL Grade), Application (Fluorocarbon Production, Fluorinated Derivative Production, Metal Pickling, Glass Etching and Cleaning, Oil Refining, Uranium Fuel Production, Others) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

Honeywell International Inc. (U.S.), Solvay (Belgium), INEOS (U.K.), DERIVADOS DEL FLUOR (DDF) (Spain), Air Products Inc. (U.S.), Morita chemical industries co. ltd (Japan), Sinochem Lantian Co., Ltd. (China), Zhejiang Sanmei Chemical Ind. Co. Ltd. (China), Yingpeng Chemical Co. Ltd. (China), Do-Fluoride New Materials Co., Ltd. (China), dongyue Group Co, Ltd (China), Fujian Shaowu Yongfei Chemical, Fujian Shaowu Yongfei Chemical Co., Ltd. (China), ,Shaowu Huaxin Chemical CO.,LTD. (China), Juhua Group Corporation (China), 3F Industries Limited (India), Fubao Group (China) |

|

Market Opportunities |

|

Market Definition

Anhydrous hydrogen fluoride is a colourless toxic gas with a sharp odour at room temperature and exists mainly in the form of H2F2 dimer below temperature of 19.9 ° C. It is a colourless mobile volatile liquid. It is miscible with water in any ratio with the formation of hydrofluoric acid. It forms an azeotropic mixture with water at 35.4% concentration of HF. Anhydrous hydrogen fluoride is formed from natural raw materials such as fluorspar.

Anhydrous Hydrofluoric Acid Market Dynamics

Drivers

- Rise the demand in chemical industry

Chemical industry widely used anhydrous hydrofluoric acid. Anhydrous hydrofluoric acid is used as an intermediate material for the production of fluoropolymers and fluorocarbons which displays high potential for revenue generation. This includes the manufacture of HFCs, CFCs, HCFCs, and HFO, amongst others. This in turn, it is driven by demand in air conditioning and refrigeration products which are expected to drive the growth of the anhydrous hydrofluoric acid.

- Highly used in surfactants

Anhydrous hydrofluoric acid (HF) is a common ingredient in car wash cleaning solutions because it is relatively inexpensive and highly effective. Particulate matter from brake tire wear, pads and discs and abrasion of road surface accumulated on the exterior of automobiles which are aggressively removed by the use of car wash cleaning solutions which is containing HF. The unique properties of anhydrous HF to dissolve most metals, silica, concrete, and metallic oxides cause effective breakdown of road dust, rust and grime on automobiles.

Opportunities

- Increase in the number of emerging markets

Major market players are focusing on acquisition and mergers to increase their presence throughout the value chain. The majority of the industry market players are concentrating on product advancements and are targeting the development of new products with eco-friendly properties to cater to a broader application market, which will create profitable opportunities for market growth.

- Rising demand in cleaning and etching application

The rising demand of anhydrous hydrofluoric acid in the glass cleaning and etching applications will further provide the potential opportunities for the growth of the anhydrous hydrofluoric acid market in upcoming period.

Restraints/ Challenges

- Environmental concern

The use of fluorochemicals which has produced by anhydrous hydrofluoric acid cause major concern in the environment due to ozone depletion and the high global warming potential of fluorochemicals. CFCs have been banned in most countries due to these factors and restricting the demand for anhydrous hydrofluoric acid in the market.

Furthermore, rise in the transportation price of AHF grade and the dangerous effects of hydrofluoric acid might further challenge the growth of the anhydrous hydrofluoric acid market during forecast period.

This anhydrous hydrofluoric acid market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the anhydrous hydrofluoric acid market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Anhydrous Hydrofluoric Acid Market

The outbreak of COVID-19 pandemic has contrarily affected the global anhydrous hydrogen fluoride (AHF) market. Several organizations in the anhydrous hydrogen fluoride (AHF) market are required to end their creation and assembling activities, attributable to spread of the infection. Moreover, attributable to new government decisions, business activities have been stopped, which straightforwardly impacts the income float of the anhydrous hydrogen fluoride (AHF) market.

Global Anhydrous Hydrofluoric Acid Market Scope

The anhydrous hydrofluoric acid market is segmented on the basis of type and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- UP Grade

- UP-S Grade

- UP-SS Grade

- EL Grade

Application

- Fluorocarbon Production

- Fluorinated Derivative Production

- Metal Pickling

- Glass Etching and Cleaning

- Oil Refining

- Uranium Fuel Production

- Others

Anhydrous Hydrofluoric Acid Market Regional Analysis/Insights

The anhydrous hydrofluoric acid market is analysed and market size insights and trends are provided by country, type and application as referenced above.

The countries covered in the anhydrous hydrofluoric acid market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America

Asia-Pacific dominates the anhydrous hydrofluoric acid market in terms of market share during the forecast period. This is due to the growing demand for anhydrous hydrofluoric acid in this region. The Asia-Pacific region leads the anhydrous hydrofluoric acid market due to the rapid growth of semiconductor devices industries, technological advancements, and industrialisation in this region.

During the estimated period, Europe is projected to be the fastest developing region due to the increase in the fluorochemical production and the presence of major key players in this region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Anhydrous Hydrofluoric Acid Market Share Analysis

The anhydrous hydrofluoric acid market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to anhydrous hydrofluoric acid market.

Some of the major players operating in the anhydrous hydrofluoric acid market are:

- Honeywell International Inc. (U.S.)

- Solvay (Belgium)

- INEOS (U.K.)

- DERIVADOS DEL FLUOR (DDF) (Spain)

- Air Products Inc. (U.S.)

- Morita chemical industries co. ltd (Japan)

- Sinochem Lantian Co., Ltd. (China)

- Zhejiang Sanmei Chemical Ind. Co. Ltd. (China)

- Yingpeng Chemical Co. Ltd. (China)

- Do-Fluoride New Materials Co., Ltd. (China)

- dongyue Group Co, Ltd (China)

- Fujian Shaowu Yongfei Chemical

- Fujian Shaowu Yongfei Chemical Co., Ltd. (China)

- ,Shaowu Huaxin Chemical CO.,LTD. (China)

- Juhua Group Corporation (China)

- 3F Industries Limited (India)

- Fubao Group (China)

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1. INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL ANHYDROUS HYDROFLUORIC ACID MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2. MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL ANHYDROUS HYDROFLUORIC ACID MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.10 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 SECONDARY SOURCES

2.15 GLOBAL ANHYDROUS HYDROFLUORIC ACID MARKET: RESEARCH SNAPSHOT

2.16 ASSUMPTIONS

3. MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4. PRICE INDEX OVERVIEW

5. EXECUTIVE SUMMARY

6. PREMIUM INSIGHTS

6.1 RAW MATERIAL COVERAGE

6.2 PRODUCTION CONSUMPTION ANALYSIS

6.3 IMPORT EXPORT SCENARIO

6.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

6.5 PORTER’S FIVE FORCES

6.6 VENDOR SELECTION CRITERIA

6.7 PESTEL ANALYSIS

6.8 REGULATION COVERAGE

6.8.1 PRODUCT CODES

6.8.2 CERTIFIED STANDARDS

6.8.3 SAFETY STANDARDS

6.8.3.1. MATERIAL HANDLING & STORAGE

6.8.3.2. TRANSPORT & PRECAUTIONS

6.8.3.3. HARAD IDENTIFICATION

7. SUPPLY CHAIN ANALYSIS

7.1 OVERVIEW

7.2 LOGISTIC COST SCENARIO

7.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

8. CLIMATE CHANGE SCENARIO

8.1 ENVIRONMENTAL CONCERNS

8.2 INDUSTRY RESPONSE

8.3 GOVERNMENT’S ROLE

8.4 ANALYST RECOMMENDATIONS

9. GLOBAL ANHYDROUS HYDROFLUORIC ACID MARKET, BY GRADE, (2020-2029), (USD MILLION) (TONS)

(Value, volume and ASP for each segment will be provided)

9.1 OVERVIEW

9.2 UP GRADE

9.2.1 ASP

9.2.2 VALUE

9.2.3 VOLUME

9.2.4 UP GRADE, TYPE

9.2.4.1. UP-S GRADE

9.2.4.2. UP-SS GRADE

9.3 EL GRADE

9.3.1 ASP

9.3.2 VALUE

9.3.3 VOLUME

9.4 AQUEOUS HF — 70% SOLUTION

9.4.1 ASP

9.4.2 VALUE

9.4.3 VOLUME

9.5 AQUEOUS HF — 49% SOLUTION

9.5.1 ASP

9.5.2 VALUE

9.5.3 VOLUME

10. GLOBAL ANHYDROUS HYDROFLUORIC ACID MARKET, BY FORM, (2020-2029), (USD MILLION) (TONS)

(Value, volume and ASP for each segment will be provided)

10.1 OVERVIEW

10.2 GAS

10.2.1 ASP

10.2.2 VALUE

10.2.3 VOLUME

10.3 LIQUID

10.3.1 ASP

10.3.2 VALUE

10.3.3 VOLUME

11. GLOBAL ANHYDROUS HYDROFLUORIC ACID MARKET, BY APPLICATION PROCESS, (2020-2029), (USD MILLION) (TONS)

(Value, volume and ASP for each segment will be provided)

11.1 OVERVIEW

11.2 FLUOROCARBON PRODUCTION

11.2.1 ASP

11.2.2 VALUE

11.2.3 VOLUME

11.3 FLUORINATED DERIVATIVE PRODUCTION

11.3.1 ASP

11.3.2 VALUE

11.3.3 VOLUME

11.4 METAL PICKLING

11.4.1 ASP

11.4.2 VALUE

11.4.3 VOLUME

11.5 GLASS ETCHING

11.5.1 ASP

11.5.2 VALUE

11.5.3 VOLUME

11.6 CLEANING PRODUCTS

11.6.1 ASP

11.6.2 VALUE

11.6.3 VOLUME

11.7 OIL REFINING

11.7.1 ASP

11.7.2 VALUE

11.7.3 VOLUME

11.8 URANIUM FUEL PRODUCTION

11.8.1 ASP

11.8.2 VALUE

11.8.3 VOLUM

11.9 OTHERS

11.9.1 ASP

11.9.2 VALUE

11.9.3 VOLUME

12. GLOBAL ANHYDROUS HYDROFLUORIC ACID MARKET, BY END USE, (2020-2029), (USD MILLION) (TONS)

(Value, volume and ASP for each segment will be provided)

12.1 OVERVIEW

12.2 ELECTRONICS INDUSTRY

12.2.1 ASP

12.2.2 VALUE

12.2.3 VOLUME

12.3 METALLURGICAL INDUSTRY

12.3.1 ASP

12.3.2 VALUE

12.3.3 VOLUME

12.4 GLASS INDUSTRY

12.4.1 ASP

12.4.2 VALUE

12.4.3 VOLUME

12.5 REFRIGERANTS INDUSTRY

12.5.1 ASP

12.5.2 VALUE

12.5.3 VOLUME

12.6 EXTINGUISHING AGENTS INDUSTRY

12.6.1 ASP

12.6.2 VALUE

12.6.3 VOLUME

12.7 CHEMICAL INDUSTRY

12.7.1 ASP

12.7.2 VALUE

12.7.3 VOLUM

12.8 MEDICAL INDUSTRY

12.8.1 ASP

12.8.2 VALUE

12.8.3 VOLUME

12.9 NUCLEAR INDUSTRY

12.9.1 ASP

12.9.2 VALUE

12.9.3 VOLUME

12.10 AGROCHEMICAL INDUSTRY

12.10.1 ASP

12.10.2 VALUE

12.10.3 VOLUME

12.11 OTHERS

12.11.1 ASP

12.11.2 VALUE

12.11.3 VOLUME

13. GLOBAL ANHYDROUS HYDROFLUORIC ACID MARKET, BY REGION, (2020-2029), (USD MILLION) (TONS)

13.1 GLOBAL ANHYDROUS HYDROFLUORIC ACID MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

13.2 NORTH AMERICA

13.2.1 U.S.

13.2.2 CANADA

13.2.3 MEXICO

13.3 EUROPE

13.3.1 GERMANY

13.3.2 U.K.

13.3.3 ITALY

13.3.4 FRANCE

13.3.5 SPAIN

13.3.6 RUSSIA

13.3.7 SWITZERLAND

13.3.8 TURKEY

13.3.9 BELGIUM

13.3.10 NETHERLANDS

13.3.11 REST OF EUROPE

13.4 ASIA-PACIFIC

13.4.1 JAPAN

13.4.2 CHINA

13.4.3 SOUTH KOREA

13.4.4 INDIA

13.4.5 SINGAPORE

13.4.6 THAILAND

13.4.7 INDONESIA

13.4.8 MALAYSIA

13.4.9 PHILIPPINES

13.4.10 AUSTRALIA & NEW ZEALAND

13.4.11 REST OF ASIA-PACIFIC

13.5 SOUTH AMERICA

13.5.1 BRAZIL

13.5.2 ARGENTINA

13.5.3 REST OF SOUTH AMERICA

13.6 MIDDLE EAST AND AFRICA

13.6.1 SOUTH AFRICA

13.6.2 EGYPT

13.6.3 SAUDI ARABIA

13.6.4 UNITED ARAB EMIRATES

13.6.5 ISRAEL

13.6.6 REST OF MIDDLE EAST AND AFRICA

14. GLOBAL ANHYDROUS HYDROFLUORIC ACID MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

14.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.3 COMPANY SHARE ANALYSIS: EUROPE

14.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14.5 MERGERS AND ACQUISITIONS

14.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

14.7 EXPANSIONS

14.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

15. SWOT AND DATA BRIDGE MARKET RESEARCH ANALYSIS

16. GLOBAL ANHYDROUS HYDROFLUORIC ACID MARKET - COMPANY PROFILES

16.1 BUSS CHEMTECH AG

16.1.1 COMPANY SNAPSHOT

16.1.2 PRODUCT PORTFOLIO

16.1.3 PRODUCTION CAPACITY OVERVIEW

16.1.4 SWOT ANALYSIS

16.1.5 REVENUE ANALYSIS

16.1.6 RECENT UPDATES

16.2 DERIVADOS DEL FLUOR, S.A.U.

16.2.1 COMPANY SNAPSHOT

16.2.2 PRODUCT PORTFOLIO

16.2.3 PRODUCTION CAPACITY OVERVIEW

16.2.4 SWOT ANALYSIS

16.2.5 REVENUE ANALYSIS

16.2.6 RECENT UPDATES

16.3 HALO POLYMER

16.3.1 COMPANY SNAPSHOT

16.3.2 PRODUCT PORTFOLIO

16.3.3 PRODUCTION CAPACITY OVERVIEW

16.3.4 SWOT ANALYSIS

16.3.5 REVENUE ANALYSIS

16.3.6 RECENT UPDATES

16.4 HONEYWELL INTERNATIONAL INC.

16.4.1 COMPANY SNAPSHOT

16.4.2 PRODUCT PORTFOLIO

16.4.3 PRODUCTION CAPACITY OVERVIEW

16.4.4 SWOT ANALYSIS

16.4.5 REVENUE ANALYSIS

16.4.6 RECENT UPDATES

16.5 SOLVAY

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 PRODUCTION CAPACITY OVERVIEW

16.5.4 SWOT ANALYSIS

16.5.5 REVENUE ANALYSIS

16.5.6 RECENT UPDATES

16.6 INEOS

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 PRODUCTION CAPACITY OVERVIEW

16.6.4 SWOT ANALYSIS

16.6.5 REVENUE ANALYSIS

16.6.6 RECENT UPDATES

16.7 LANXESS DEUTSCHLAND GMBH

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 PRODUCTION CAPACITY OVERVIEW

16.7.4 SWOT ANALYSIS

16.7.5 REVENUE ANALYSIS

16.7.6 RECENT UPDATES

16.8 FLUORCHEMIE STULLN GMBH

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 PRODUCTION CAPACITY OVERVIEW

16.8.4 SWOT ANALYSIS

16.8.5 REVENUE ANALYSIS

16.8.6 RECENT UPDATES

16.9 MORITA CHEMICAL INDUSTRIES CO. LTD

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 PRODUCTION CAPACITY OVERVIEW

16.9.4 SWOT ANALYSIS

16.9.5 REVENUE ANALYSIS

16.9.6 RECENT UPDATES

16.10 SINOCHEM LANTIAN CO., LTD.

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 PRODUCTION CAPACITY OVERVIEW

16.10.4 SWOT ANALYSIS

16.10.5 REVENUE ANALYSIS

16.10.6 RECENT UPDATES

16.11 ZHEJIANG SANMEI CHEMICAL IND. CO. LTD.

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 PRODUCTION CAPACITY OVERVIEW

16.11.4 SWOT ANALYSIS

16.11.5 REVENUE ANALYSIS

16.11.6 RECENT UPDATES

16.12 SHAOWU HUAXIN CHEMICAL CO.,LTD.

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 PRODUCTION CAPACITY OVERVIEW

16.12.4 SWOT ANALYSIS

16.12.5 REVENUE ANALYSIS

16.12.6 RECENT UPDATES

16.13 DO-FLUORIDE NEW MATERIALS CO., LTD.

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 PRODUCTION CAPACITY OVERVIEW

16.13.4 SWOT ANALYSIS

16.13.5 REVENUE ANALYSIS

16.13.6 RECENT UPDATES

16.14 DONGYUE GROUP CO, LTD

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 PRODUCTION CAPACITY OVERVIEW

16.14.4 SWOT ANALYSIS

16.14.5 REVENUE ANALYSIS

16.14.6 RECENT UPDATES

16.15 FUJIAN SHAOWU YONGFEI CHEMICAL

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 PRODUCTION CAPACITY OVERVIEW

16.15.4 SWOT ANALYSIS

16.15.5 REVENUE ANALYSIS

16.15.6 RECENT UPDATES

16.16 FUBAO GROUP

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 PRODUCTION CAPACITY OVERVIEW

16.16.4 SWOT ANALYSIS

16.16.5 REVENUE ANALYSIS

16.16.6 RECENT UPDATES

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

17. RELATED REPORTS

18. QUESTIONNAIRE

19. CONCLUSION

20. ABOUT DATA BRIDGE MARKET RESEARCH

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.