Global Glyoxal Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

673.33 Million

USD

1,027.34 Million

2025

2033

USD

673.33 Million

USD

1,027.34 Million

2025

2033

| 2026 –2033 | |

| USD 673.33 Million | |

| USD 1,027.34 Million | |

|

|

|

|

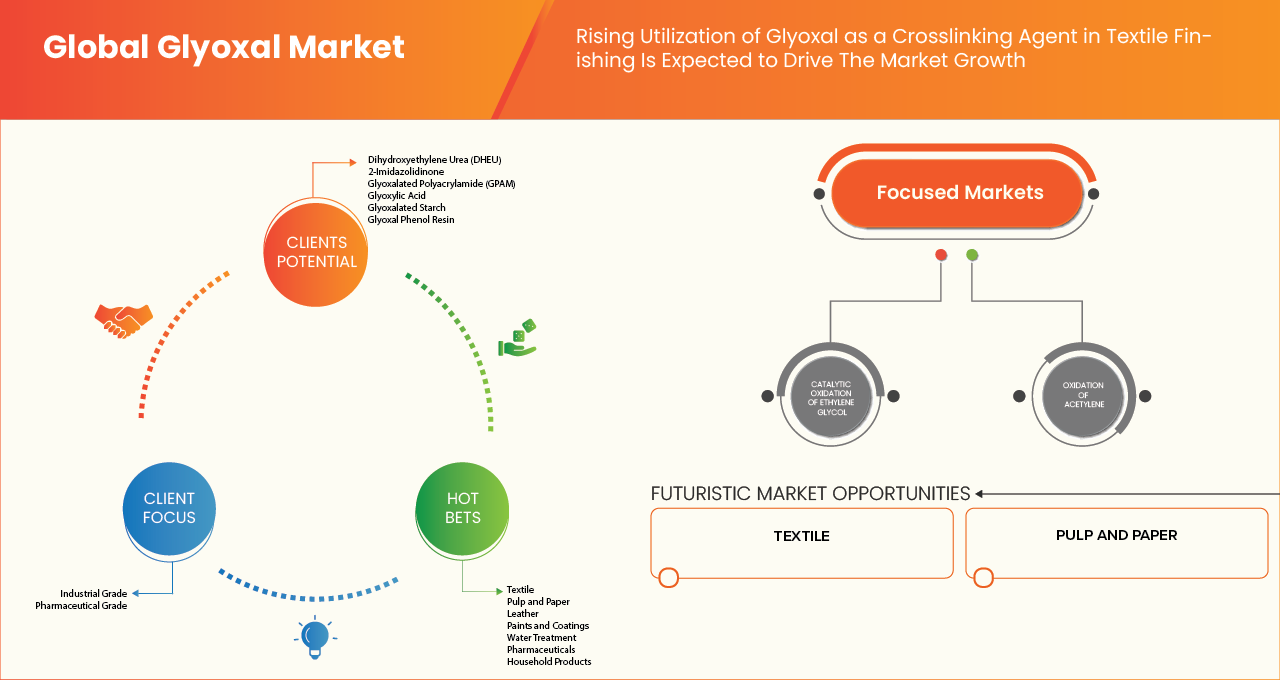

Segmentação do mercado global de glioxal, por grau (grau industrial, grau farmacêutico), por pureza (90%–99%, 40%–60%, outros), processo de produção (oxidação catalítica de etilenoglicol, oxidação de acetileno, outros), embalagem (garrafas, tambores, galões, IBC composto, a granel), aplicação (reticulação, intermediários químicos e outros), produtos químicos de uso final (2-imidazolidinona, 2-metilimidazol, alantoína, di-hidroxietileno ureia (DHEU), diformato de etilenoglicol, glicoluril, resina de glioxal-fenol, bissulfito de sódio de glioxal, resina de glioxal-ureia, poliacrilamida glioxalada (GPAM), amido glioxalado, glioxal-bis(2-hidroxianil), ácido glioxílico, imidazol, metilol glioxal). Quinoxalina, derivados de quinoxalina, tetrametilol acetilenodiureia, concentrado de ureia-glioxal), indústrias de uso final (têxtil, couro, farmacêutica, tratamento de água, tintas e revestimentos, cosméticos e cuidados pessoais, produtos domésticos, celulose e papel, elétrica e eletrônica, embalagens, petróleo e gás, outras) - tendências e previsões do setor até 2033

Tamanho do mercado de glioxal

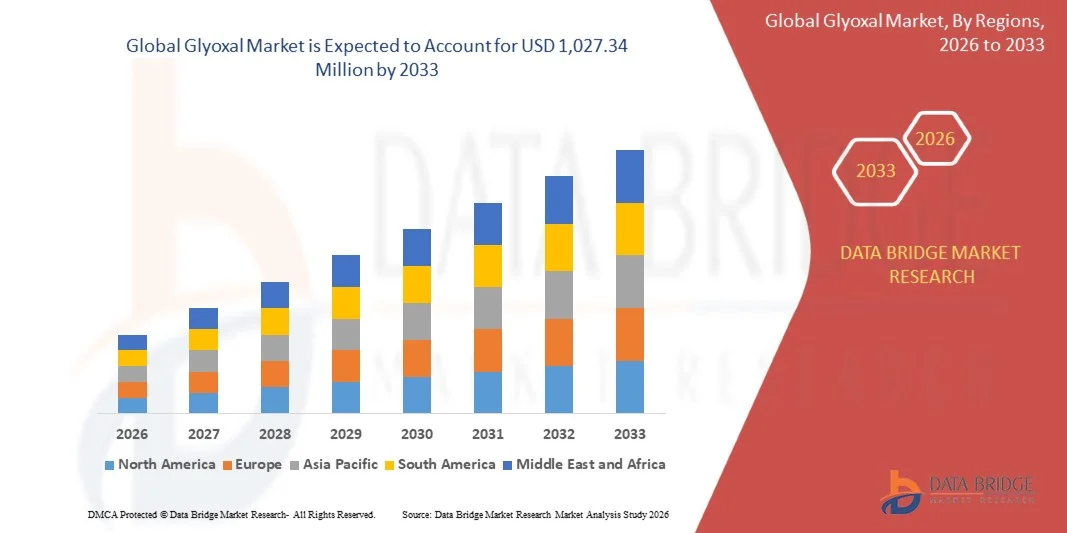

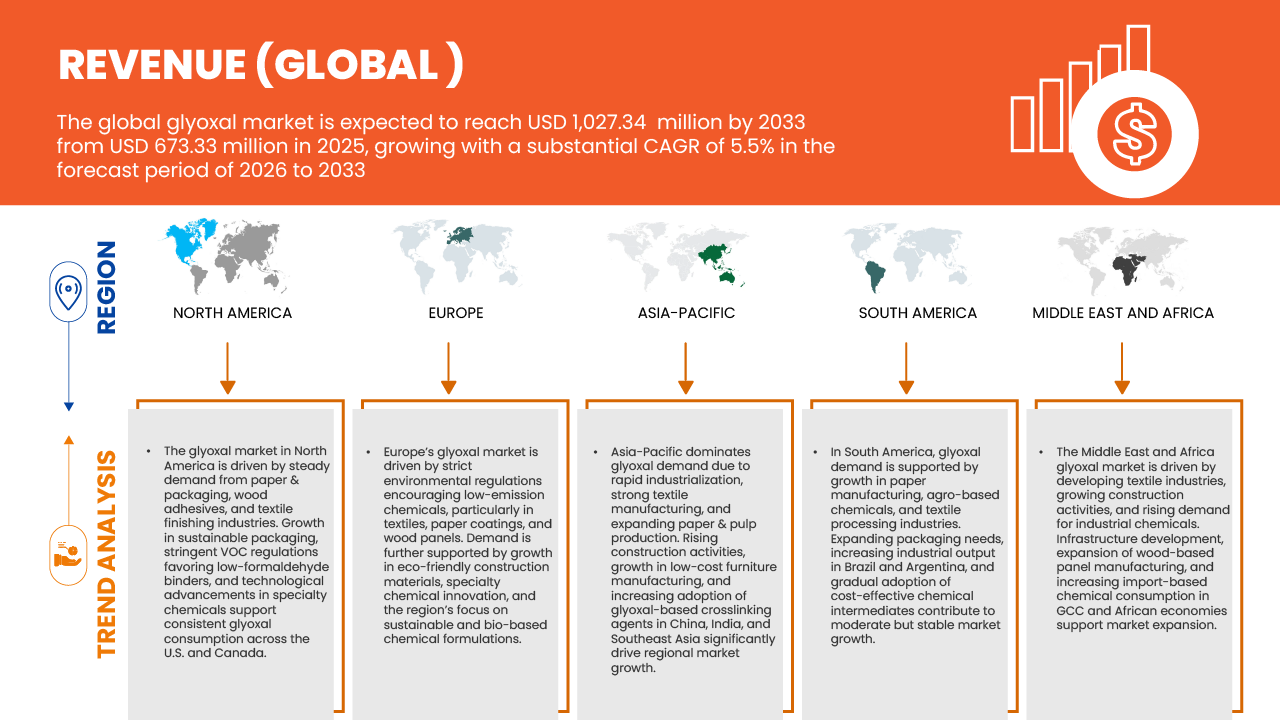

- Prevê-se que o mercado de glioxal atinja USD 1.027,34 milhões em 2033, partindo de USD 673,33 milhões em 2025, crescendo a uma taxa composta anual (CAGR) de 5,5% no período de previsão de 2026 a 2033.

- O mercado de glioxal está testemunhando um crescimento constante, impulsionado por seu uso crescente nas indústrias têxtil, de papel, couro, farmacêutica, agroquímica e de petróleo e gás, onde o glioxal é valorizado por suas propriedades de reticulação, ligação e acabamento.

- Os avanços nas tecnologias de processamento químico e na eficiência da formulação, juntamente com graus de pureza aprimorados, estão permitindo uma adoção mais ampla do glioxal em aplicações de alto desempenho, como resinas, revestimentos, acabamento têxtil e produtos químicos especiais, aumentando assim a eficácia do produto e o desempenho no uso final.

- Quadros regulatórios favoráveis que promovem alternativas químicas com baixa toxicidade e redução de formaldeído, juntamente com exigências crescentes de conformidade ambiental, estão incentivando os fabricantes a adotar soluções à base de glioxal como opções mais seguras e sustentáveis.

Análise do mercado de glioxal

- O mercado de glioxal atende a diversos setores, incluindo têxtil, papel, resinas, farmacêutico, cosmético e tratamento de água. A demanda é impulsionada por suas fortes propriedades de reticulação e por seu papel como intermediário fundamental em formulações químicas especiais e de alto desempenho.

- O mercado de glioxal na região Ásia-Pacífico atende a diversos setores, incluindo têxtil, papel, resinas, farmacêutico, cosmético e tratamento de água. A demanda é impulsionada por suas fortes propriedades de reticulação e por seu papel como intermediário fundamental em formulações químicas especiais e de alto desempenho.

- Em 2025, espera-se que o segmento de Grau Industrial domine o mercado de glioxal com uma participação de 81,49%, devido ao seu uso generalizado na fabricação de resinas, adesivos e produtos químicos para tratamento de papel. O segmento se beneficia da alta demanda em aplicações industriais de grande escala e da relação custo-benefício para produção em massa, tornando-se a escolha preferencial em relação a outros graus.

- O mercado de glioxal na região Ásia-Pacífico deverá crescer a uma taxa composta de crescimento anual (CAGR) de cerca de 6,1% entre 2026 e 2033, impulsionado pela crescente demanda das indústrias têxtil e agroquímica e pelo aumento do uso em resinas e revestimentos para aplicações industriais. A expansão da industrialização e da urbanização na região também impulsiona o crescimento do mercado.

Escopo do relatório e segmentação do mercado de glioxal

|

Atributos |

Análise do Mercado de Glioxal |

|

Segmentos abrangidos |

|

|

Países abrangidos |

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além de informações de mercado como valor de mercado, taxa de crescimento, segmentos de mercado, cobertura geográfica, participantes do mercado e cenário de mercado, o relatório de mercado elaborado pela equipe da Data Bridge Market Research inclui análises aprofundadas de especialistas, análises de importação/exportação, análises de preços, análises de produção e consumo e análises PESTEL. |

Tendências do mercado de glioxal

“ Integração com ecossistemas de manufatura inteligente, processamento em armazém e embalagens para comércio eletrônico ”

- O glioxal é cada vez mais utilizado em ambientes de manufatura inteligente para acabamento têxtil, tratamento de papel e aplicações em resina, proporcionando controle de qualidade consistente, otimização de processos e decisões de produção baseadas em dados, alinhadas às iniciativas da Indústria 4.0.

- Em armazéns e instalações de processamento, as formulações à base de glioxal auxiliam na estabilização do material, no desempenho do revestimento e na resistência à umidade, melhorando a eficiência do manuseio, a durabilidade do armazenamento e a confiabilidade do processamento subsequente.

- O uso crescente de glioxal em adesivos para embalagens, reforço de papel e tratamentos de superfície apoia a expansão do comércio eletrônico, melhorando a integridade da embalagem, a estabilidade da carga e a proteção do produto em redes logísticas.

Por exemplo,

- Em janeiro de 2025, as soluções químicas à base de glioxal foram cada vez mais integradas em linhas automatizadas de processamento têxtil e de papel, combinadas com controles de processo avançados e sistemas de monitoramento digital para melhorar a eficiência, a consistência e a sustentabilidade em todas as operações industriais, destacando o papel do glioxal nos ecossistemas de fabricação da próxima geração.

- Os recentes desenvolvimentos do setor indicam uma crescente adoção de produtos químicos especiais à base de aldeídos, incluindo o glioxal, em embalagens de alto desempenho e aplicações industriais, à medida que os volumes de comércio eletrônico e logística aumentam, reforçando seu papel em expansão para além dos setores de uso final tradicionais.

Dinâmica do mercado de glioxal

Motorista

“ Crescente modernização industrial e exigências de aplicações químicas orientadas para o desempenho ”

- O setor industrial global está testemunhando uma adoção acelerada de soluções à base de glioxal, impulsionada por requisitos de desempenho cada vez mais complexos em aplicações têxteis, de papel, resinas, couro e produtos químicos especiais. Os fabricantes estão priorizando o glioxal por suas propriedades de reticulação, ligação e acabamento, que aprimoram a resistência, a durabilidade e o desempenho funcional do produto. À medida que os processos industriais evoluem para maior eficiência e consistência de qualidade, cresce a demanda por formulações químicas que suportem reações controladas, redução de emissões e maior confiabilidade do produto final.

- O papel crescente do glioxal nas iniciativas de modernização industrial criou um ambiente dinâmico para que os produtores químicos inovem, resultando em avanços na pureza da formulação, versatilidade de aplicação e compatibilidade de processos. Em resposta a essa mudança impulsionada pela demanda, os fabricantes estão investindo no desenvolvimento de graus de glioxal personalizados, adaptados a requisitos específicos de uso final, incluindo sistemas com baixo teor de formaldeído, resinas especiais e tratamentos têxteis de alto desempenho.

- Essas inovações são impulsionadas principalmente pelas necessidades operacionais das indústrias modernas, que exigem soluções químicas adaptáveis, capazes de apresentar desempenho confiável sob diversas condições de processamento e restrições regulatórias. À medida que as indústrias continuam a integrar o glioxal em fluxos de trabalho avançados de fabricação e acabamento, esse movimento não apenas influencia as estratégias de investimento dos fornecedores, mas também reforça o papel do glioxal como um intermediário crucial para aumentar a produtividade industrial e o desempenho dos materiais.

Por exemplo,

- Em setembro de 2023, publicações do setor destacaram a crescente adoção do glioxal em processos avançados de acabamento têxtil, visando melhorar a resistência do tecido e a sua capacidade de evitar rugas, ao mesmo tempo que atendem a padrões de conformidade ambiental mais rigorosos.

- Em fevereiro de 2024, informações da indústria química indicavam que fabricantes em toda a Europa intensificaram o uso de resinas à base de glioxal e soluções para tratamento de papel, visando apoiar práticas de produção sustentáveis e reduzir a dependência de alternativas com maior toxicidade.

- Em fevereiro de 2025, os desenvolvimentos industriais regionais na região Ásia-Pacífico enfatizaram os crescentes investimentos na produção de aldeídos especiais, incluindo o glioxal, para atender à crescente demanda dos setores de embalagens, construção e manufatura industrial, com foco na melhoria do desempenho e no alinhamento regulatório.

- A crescente adoção do glioxal no setor industrial global ressalta sua importância cada vez maior como uma solução química multifuncional alinhada às crescentes exigências de desempenho, eficiência e sustentabilidade. À medida que as indústrias continuam avançando em direção a produtos de maior qualidade e processos de fabricação mais controlados, as capacidades de reticulação, ligação e acabamento do glioxal o posicionam como um facilitador essencial para o aumento da resistência, durabilidade e consistência funcional dos materiais.

Restrição/Desafio

“Falta de estruturas regulatórias globais harmonizadas para a fabricação e o uso de produtos químicos”

- A ausência de regulamentações globais harmonizadas que regem a fabricação, o manuseio e as aplicações finais de produtos químicos representa um desafio considerável para o mercado de glioxal, uma vez que os requisitos regulatórios diferem significativamente entre países e regiões.

- As autoridades reguladoras aplicam normas variáveis relacionadas à classificação química, limites de exposição permitidos, conformidade ambiental, rotulagem, transporte e descarte de efluentes. Essa fragmentação regulatória obriga os fabricantes de glioxal e os usuários subsequentes a modificar formulações, documentação, protocolos de segurança e estratégias de conformidade para cada mercado, aumentando a complexidade operacional, os custos de conformidade e o tempo de lançamento no mercado.

- Como resultado, as empresas enfrentam limitações na expansão da produção e distribuição de glioxal em nível global, particularmente no comércio internacional e nas cadeias de suprimentos multinacionais que atendem aos setores têxtil, de papel, de resinas e de produtos químicos especiais.

Por exemplo,

- No final de 2025, as autoridades ambientais regionais da Ásia e da Europa introduziram diferentes requisitos de conformidade para produtos químicos à base de aldeídos, incluindo o glioxal, com variações nos limites de emissão e nas obrigações de notificação, ilustrando inconsistências regulamentares que complicam as estratégias padronizadas de produção e exportação.

- Em maio de 2025, órgãos reguladores nacionais e locais em mercados emergentes impuseram restrições mais rigorosas ao manuseio e transporte de produtos químicos, além das diretrizes centrais existentes, causando interrupções operacionais temporárias para fabricantes e distribuidores de glioxal, que precisaram obter aprovações adicionais e modificar os fluxos de trabalho logísticos durante o período de vigência das normas.

- A falta de estruturas regulatórias globais harmonizadas continua a representar um desafio estrutural para o mercado de glioxal, limitando a facilidade de produção, distribuição e comércio transfronteiriço padronizados.

Escopo do mercado de glioxal

O mercado de glioxal é categorizado em sete segmentos principais, com base em grau de pureza, processo de produção, embalagem, aplicação, produtos químicos de uso final e setor industrial de uso final.

• Por série

Com base na qualidade, o mercado de glioxal é segmentado em grau industrial e grau farmacêutico.

Em 2026, espera-se que o segmento de glioxal de grau industrial domine o mercado, representando a maior participação, com 81,49%, refletindo sua profunda integração em uma ampla gama de aplicações industriais. Essa dominância é impulsionada principalmente pelo uso extensivo de glioxal de grau industrial no acabamento têxtil, processamento de papel, formulação de resinas, tratamento de couro e tratamento de água, onde o consumo contínuo em larga escala é essencial para manter a eficiência do processo e o desempenho do produto. Sua capacidade de fornecer propriedades confiáveis de reticulação, ligação e condicionamento em escala industrial o torna a escolha preferida para fabricantes que operam em ambientes de produção de alto rendimento.

Além disso, a forte posição de mercado do segmento de grau industrial é reforçada por sua relação custo-benefício e disponibilidade em grandes volumes, o que se alinha bem com as estratégias de aquisição de grandes usuários industriais que buscam otimizar os custos operacionais sem comprometer o desempenho funcional. À medida que os setores industrial e de manufatura continuam a se expandir rapidamente tanto em economias desenvolvidas quanto emergentes, a demanda por insumos químicos padronizados e de alto volume, como o glioxal de grau industrial, deverá permanecer robusta. Essa demanda sustentada, combinada com sua versatilidade e compatibilidade com diversos processos industriais, posiciona o segmento de grau industrial como o principal contribuinte para a receita do mercado de glioxal em 2026.

• Por Pureza

Com base na pureza, o mercado de glioxal é segmentado em 90%–99%, 40%–60% e Outros.

Em 2026, espera-se que o segmento de pureza entre 40% e 60% domine o mercado de glioxal, representando a maior participação, com 62,38%, impulsionado por seu desempenho químico superior e maior confiabilidade funcional em aplicações avançadas de uso final. O glioxal nessa faixa de alta pureza oferece maior reatividade, estabilidade aprimorada e comportamento molecular consistente, tornando-o particularmente adequado para processos onde o controle químico preciso e resultados repetíveis são essenciais. Essas características aumentam significativamente sua adoção na fabricação farmacêutica, produção de resinas especiais, acabamento têxtil de alto desempenho e formulações cosméticas, onde níveis mais baixos de impurezas se traduzem diretamente em maior eficácia e segurança do produto.

Além disso, a forte posição de mercado do segmento de pureza de 90% a 99% é reforçada por sua qualidade consistente e alinhamento com os rigorosos padrões regulatórios e da indústria, incluindo aqueles que regem as aplicações farmacêuticas, de cuidados pessoais e de especialidades químicas. Os fabricantes estão cada vez mais optando pelo glioxal de alta pureza para atender aos requisitos de conformidade em constante evolução relacionados à segurança do produto, ao impacto ambiental e à transparência do processo. À medida que as indústrias continuam a migrar para formulações de maior valor agregado e desempenho, espera-se que a demanda por glioxal de alta pureza permaneça robusta, consolidando a dominância desse segmento no mercado de glioxal em 2026.

• Por processo de produção

Com base no processo de produção, o mercado de glioxal é segmentado em oxidação catalítica de etilenoglicol, oxidação de acetileno e outros.

Em 2026, espera-se que o segmento de oxidação catalítica do etilenoglicol domine o mercado de glioxal, representando a maior participação, com 89,66%, impulsionado por sua eficiência de produção superior e forte alinhamento com as exigências da fabricação moderna. Essa rota de produção permite melhor controle do rendimento, qualidade consistente do produto final e níveis de impurezas mais baixos, tornando-a particularmente adequada para aplicações que demandam graus de glioxal confiáveis e padronizados. Comparada aos processos tradicionais à base de acetileno, a oxidação catalítica oferece um ambiente de reação mais controlado, permitindo uma produção estável em larga escala com menor variabilidade do processo.

Além disso, a forte posição de mercado do segmento de Oxidação Catalítica de Etilenoglicol é reforçada pela sua maior segurança operacional, eficiência de custos e conformidade com as regulamentações ambientais, que se tornaram cada vez mais importantes para os fabricantes de produtos químicos. Essa rota de produção reduz o manuseio de matérias-primas perigosas e contribui para níveis de emissão mais baixos, permitindo que os produtores cumpram os rigorosos padrões regulatórios em regiões-chave. À medida que a demanda global por glioxal continua a crescer nos setores têxtil, de resinas, de papel e de especialidades químicas, os fabricantes estão adotando cada vez mais esse método escalável e sustentável, consolidando sua posição de liderança no mercado em 2026.

Por embalagem

Com base na embalagem, o mercado de glioxal é segmentado em garrafas, tambores, galões, IBCs compostos e a granel.

Em 2026, espera-se que o segmento de tambores domine o mercado, representando a maior participação, com 38,60%, impulsionado por sua grande versatilidade e vantagens práticas em uma ampla gama de aplicações finais. As garrafas são amplamente preferidas devido à sua facilidade de manuseio, características de armazenamento seguro e adequação para dispensação de pequenas quantidades, tornando-as particularmente adequadas às necessidades das indústrias farmacêutica, cosmética e de especialidades químicas, onde o uso controlado e a prevenção da contaminação são cruciais.

Além disso, a forte posição de mercado do segmento de IBCs compostos é reforçada por sua ampla disponibilidade e produção com custo-benefício, o que permite distribuição e aquisição simplificadas tanto em mercados desenvolvidos quanto emergentes. Fabricantes e usuários finais dependem cada vez mais de formatos de embalagem padronizados que simplificam o armazenamento, o transporte e a conformidade regulatória, garantindo a integridade do produto. À medida que as indústrias continuam a exigir soluções de embalagem convenientes e confiáveis para aplicações químicas de alto valor agregado, espera-se que os IBCs compostos mantenham sua posição de liderança no mercado global de embalagens em 2026.

Por meio de aplicação

Com base na aplicação, o mercado de glioxal é segmentado em reticulação, intermediários químicos e outros.

Em 2026, espera-se que o segmento de reticulação domine o mercado, representando a maior participação, com 64,49%, impulsionado por sua ampla aplicação no aumento da durabilidade têxtil, da resistência do papel e do desempenho da resina. A reticulação com glioxal desempenha um papel fundamental na melhoria da estabilidade do material, da eficiência de adesão e da resistência ao desgaste, tornando-se um processo essencial em diversas cadeias de valor industriais.

Além disso, o segmento de intermediários químicos, que apresenta o crescimento mais rápido, é impulsionado pela forte demanda por poliacrilamida glioxalada (GPAM) e amido glioxalado, principalmente nos processos de fabricação de papel, tratamento de efluentes e aplicações em resinas especiais. Esses derivados à base de glioxal aprimoram o desempenho, permitindo um processamento industrial eficiente e econômico. À medida que as indústrias continuam a priorizar o desempenho dos materiais, a confiabilidade dos processos e a longevidade dos produtos, espera-se que o segmento de reticulação permaneça como um dos principais motores de crescimento do mercado em 2026.

Por Produtos Químicos de Uso Final

Com base nos produtos químicos de uso final, o mercado de glioxal é segmentado em 2-imidazolidinona, 2-metilimidazol, alantoína, di-hidroxietileno ureia (DHEU), diformato de etilenoglicol, glicoluril, resina de glioxal-fenol, bissulfito de sódio de glioxal, resina de glioxal-ureia, poliacrilamida glioxalada (GPAM), amido glioxalado, glioxal-bis(2-hidroxianil), ácido glioxílico, imidazol, metilol glioxal, quinoxalina, derivados de quinoxalina, tetrametilol acetilenodiureia e concentrado de ureia-glioxal.

Em 2026, espera-se que o segmento de 2-imidazolidinona domine o mercado, representando a maior participação, com 18,22%, impulsionado por sua ampla utilização em acabamento têxtil, síntese de resinas e tratamento de papel. Este composto desempenha um papel crucial no aumento da durabilidade dos tecidos, na melhoria do desempenho das resinas e no fortalecimento de produtos de papel, tornando-se uma escolha preferencial em ambientes de processamento industrial de alto volume.

Além disso, o segmento de amido glioxalado, que apresenta o crescimento mais rápido, é reforçado por sua eficiência superior de reticulação, alta estabilidade química e excelente compatibilidade com processos industriais estabelecidos, garantindo desempenho consistente em diversas condições operacionais. À medida que a demanda por intermediários químicos confiáveis e de alto desempenho continua a aumentar em vários setores de uso final, espera-se que esse segmento mantenha uma forte adoção, conservando sua liderança de mercado em 2026.

Por setor de uso final

Com base no setor de uso final, o mercado de glioxal é segmentado em têxtil, couro, produtos farmacêuticos, tratamento de água, tintas e revestimentos, cosméticos e cuidados pessoais, produtos domésticos, celulose e papel, elétrico e eletrônico, embalagens, petróleo e gás e outros.

Em 2026, espera-se que o segmento têxtil domine o mercado, representando a maior participação, com 33,89%, impulsionado por sua ampla aplicação no acabamento de tecidos, resistência a rugas e tratamentos anti-vincos. As soluções à base de glioxal são amplamente utilizadas para aumentar a durabilidade, a estabilidade dimensional e a qualidade estética dos tecidos, tornando-as essenciais para as operações modernas de processamento e acabamento têxtil.

Além disso, o segmento de Tratamento de Água está em crescimento, impulsionado pela demanda cada vez maior por têxteis duráveis e de alta qualidade e pela rápida expansão das indústrias de vestuário e decoração de interiores, tanto em mercados desenvolvidos quanto emergentes. À medida que os fabricantes continuam priorizando o aprimoramento do desempenho dos tecidos, garantindo ao mesmo tempo a relação custo-benefício e o cumprimento dos padrões de qualidade, espera-se que o segmento de Tratamento de Água permaneça como um dos principais motores do crescimento do mercado em 2026.

Análise Regional do Mercado de Glioxal

- Em 2025, a região Ásia-Pacífico representará a maior fatia do mercado de glioxal, respondendo por 40,72% da demanda global. Com uma taxa de crescimento anual composta (CAGR) projetada de 6,1%, o crescimento é impulsionado pela rápida industrialização, expansão das atividades de manufatura, aumento da demanda das indústrias têxtil e de papel e crescente adoção do glioxal em aplicações químicas, de embalagens e industriais.

- A região se beneficia da melhoria da infraestrutura industrial, de estruturas regulatórias favoráveis e de investimentos crescentes em produção química sustentável e processamento subsequente. A expansão das aplicações finais em têxteis, processamento de papel, resinas e especialidades químicas continua a sustentar uma forte penetração de mercado e um potencial de crescimento a longo prazo em toda a região da Ásia-Pacífico.

Análise do Mercado de Glioxal na China

O mercado chinês de glioxal está em rápida expansão, impulsionado pela grande capacidade de produção química, pela forte demanda dos setores têxtil, de papel, de produtos químicos para construção e de agroquímicos, além de políticas governamentais favoráveis. Os avanços tecnológicos e a produção com custos competitivos posicionam a China como um dos principais fornecedores globais de glioxal, com significativo potencial de crescimento.

Análise do Mercado de Glioxal na Índia

O mercado de glioxal na Índia está testemunhando um crescimento robusto, impulsionado pela expansão das indústrias têxtil e de papel, pelo aumento da atividade de fabricação de produtos químicos e pela crescente adoção do glioxal em resinas e aplicações especiais. As iniciativas governamentais que promovem a produção química nacional e o crescimento industrial continuam a impulsionar o mercado.

Análise do Mercado de Glioxal na América do Norte

O mercado de glioxal na América do Norte está em constante expansão, liderado pelos EUA e Canadá, impulsionado por infraestrutura industrial avançada, inovação tecnológica no processamento químico e regulamentações favoráveis. A crescente demanda dos setores têxtil, de resinas, de processamento de papel e de especialidades químicas continua a fortalecer as perspectivas de crescimento regional a longo prazo.

Análise do Mercado de Glioxal nos EUA

O mercado de glioxal dos EUA é um importante contribuinte global, sustentado por uma infraestrutura industrial robusta, capacidades avançadas de fabricação de produtos químicos e demanda constante dos setores têxtil, de papel, resinas, farmacêutico e de especialidades químicas. A alta adoção de formulações de glioxal de valor agregado, a otimização de processos e o uso de produtos químicos voltados para a sustentabilidade continuam a impulsionar o crescimento e a inovação do mercado.

Análise do Mercado de Glioxal no Canadá

O mercado canadense de glioxal está crescendo de forma constante, impulsionado por atividades de processamento industrial, iniciativas de conformidade ambiental e demanda dos setores de fabricação de papel, produtos de madeira e produtos químicos. A crescente ênfase em soluções químicas de baixa toxicidade e ecologicamente corretas está aumentando a adoção em diversos setores de uso final.

Análise do Mercado de Glioxal na Alemanha

O mercado alemão de glioxal está testemunhando um crescimento constante, impulsionado pela forte capacidade de produção química, automação industrial e demanda por aplicações de alto desempenho nos setores têxtil, de papel e de resinas. Regulamentações ambientais favoráveis e a inovação em especialidades químicas posicionam a Alemanha como um mercado-chave de glioxal na Europa.

Análise do Mercado de Glioxal na França

O mercado francês de glioxal está em expansão, impulsionado pela crescente demanda dos setores de processamento de papel, acabamento têxtil, farmacêutico e de especialidades químicas. O foco governamental no uso sustentável de produtos químicos e a maior adoção de formulações de baixa emissão estão contribuindo para o desenvolvimento do mercado em diversos setores industriais.

Análise do Mercado Europeu de Glioxal

O mercado europeu de glioxal está crescendo de forma constante, impulsionado por uma forte supervisão regulatória, infraestrutura avançada de produção química e crescente adoção nos setores têxtil, de papel, de produtos químicos para construção e de resinas. O investimento contínuo em soluções químicas sustentáveis e de alta pureza sustenta a expansão do mercado regional a longo prazo.

Participação de mercado do glioxal

O mercado de glioxal é liderado principalmente por empresas já consolidadas, incluindo:

- Amzole India Pvt. Ltd (Índia)

- Asis Scientific Pty Ltd (Austrália)

- Ataman Chemicals (Índia)

- BASF SE (Alemanha)

- Bidvest Chemical (África do Sul)

- Bisley Asia (M) Sdn Bhd (Malásia)

- Eastman Chemical Company (EUA)

- Fluorochem Limited (Reino Unido)

- Fujifilm Wako Pure Chemical Corporation (Japão)

- Glentham Life Sciences Limited (Reino Unido)

- Indústria Haihang (China)

- Hanna Instruments Ltd (EUA)

- Himedia Laboratories (Índia)

- Kanto Kagaku (Japão)

- Kemira Oyj (Finlândia)

- Merck KGaA (Alemanha)

- Meru Chem Pvt. Ltd (Índia)

- Muby Chemicals (Índia)

- Multichem Specialities Private Limited (Índia)

- Oakwood Products Inc. (EUA)

- Otto Chemie Pvt. Ltd (Índia)

- Oxford Lab Fine Chem LLP (Índia)

- Santa Cruz Biotechnology Inc. (EUA)

- Sasol (África do Sul)

- Silver Fern Chemical, Inc. (EUA)

- Thermo Fisher Scientific Inc. (EUA)

- Univar Solutions LLC (EUA)

- Weylchem International GmbH (Alemanha)

- Zhishang Química (China)

Últimos desenvolvimentos no mercado de glioxal

- Em outubro de 2025, a Multichem Specialities Private Limited foi reconhecida entre as 10 principais distribuidoras de produtos químicos especiais de 2025 pela revista Industry Outlook, destacando sua qualidade, inovação e serviço confiável no setor de produtos químicos especiais. Em julho de 2025, a empresa também organizou uma campanha de doação de sangue bem-sucedida em colaboração com o Breach Candy Hospital Trust, envolvendo funcionários e membros da comunidade para apoiar as necessidades de saúde.

- Em fevereiro de 2024, a Multichem Specialities Private Limited participou da Vitafoods India, fortalecendo sua presença no segmento de nutracêuticos e ingredientes especiais, ao mesmo tempo em que interagia com clientes e parceiros para apresentar seu portfólio químico em expansão.

- Em outubro de 2024, a Otto Chemie Pvt. Ltd. expandiu seu portfólio de reagentes e produtos químicos de alta pureza para laboratório, consolidando sua presença nos setores farmacêutico, de pesquisa e industrial. A empresa também fortaleceu sua rede de distribuição e sua cadeia de suprimentos para atender à crescente demanda na Índia e em mercados internacionais.

- Em julho de 2024, a Otto Chemie Pvt. Ltd. organizou uma campanha de doação de sangue e conscientização sobre saúde em colaboração com hospitais locais, refletindo o compromisso da empresa com o bem-estar da comunidade e a participação dos funcionários em iniciativas de responsabilidade social.

- Em março de 2025, a Oxford Lab Fine Chem LLP implementou soluções de embalagens ecológicas e otimizou as práticas de gestão de resíduos em seus processos de produção e distribuição, reforçando o compromisso da empresa com a fabricação de produtos químicos sustentável e responsável.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL GLYOXAL MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 GLOBAL GLYOXAL MARKET: VALUE CHAIN ANALYSIS

4.1.1 RAW MATERIAL & FEEDSTOCK SUPPLY (5%–10% VALUE SHARE)

4.1.2 MANUFACTURING & PROCESSING (15%–25% VALUE SHARE)

4.1.3 DISTRIBUTION & LOGISTICS (30%–40% VALUE SHARE)

4.1.4 END-USE INDUSTRIES & SALES CHANNELS (10%–20% VALUE SHARE)

4.2 SUPPLY CHAIN ANALYSIS

4.2.1 RAW MATERIAL SOURCING & PROCUREMENT

4.2.2 PROCESSING & PRODUCT MANUFACTURING (PRODUCTION)

4.2.3 SUPPLY CHAIN & DISTRIBUTION LOGISTICS (TRANSPORTATION)

4.2.4 RETAIL & COMMERCIAL BUYER CHANNELS (DISTRIBUTION & SALES)

4.3 PORTER’S FIVE FORCES ANALYSIS

4.3.1 BARGAINING POWER OF BUYERS / CONSUMERS – HIGH

4.3.2 THREAT OF NEW ENTRANTS – LOW TO MODERATE

4.3.3 THREAT OF SUBSTITUTE PRODUCTS – MODERATE TO HIGH

4.3.4 BARGAINING POWER OF SUPPLIERS – MODERATE

4.3.5 INTENSITY OF COMPETITIVE RIVALRY – HIGH

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING UTILIZATION OF GLYOXAL AS A CROSSLINKING AGENT IN TEXTILE FINISHING.

5.1.2 GROWING ADOPTION IN PAPER & PACKAGING FOR WET-STRENGTH AND SURFACE TREATMENT APPLICATIONS.

5.1.3 EXPANSION OF INTERMEDIATE CHEMICAL DEMAND IN PHARMACEUTICALS AND AGROCHEMICALS.

5.1.4 INCREASING PREFERENCE FOR LOW-MOLECULAR-WEIGHT ALDEHYDES IN RESIN AND ADHESIVE SYSTEMS.

5.2 RESTRAINTS

5.2.1 HANDLING COMPLEXITY DUE TO HIGH REACTIVITY AND STABILITY SENSITIVITY

5.2.2 AVAILABILITY OF APPLICATION-SPECIFIC CHEMICAL SUBSTITUTES.

5.3 OPPORTUNITY

5.3.1 VOLATILITY IN FEEDSTOCK PRICING AFFECTING COST STRUCTURE

5.3.2 STRINGENT ENVIRONMENTAL AND OCCUPATIONAL SAFETY REGULATIONS.

5.3.3 LIMITED PRODUCT DIFFERENTIATION IN A PRICE-COMPETITIVE MARKET

5.4 CHALLENGES

5.4.1 DEVELOPMENT OF MODIFIED AND APPLICATION-SPECIFIC GLYOXAL GRADES.

5.4.2 RISING DEMAND FROM EMERGING INDUSTRIAL ECONOMIES

6 GLOBAL GLYOXAL MARKET, BY GRADE

6.1 OVERVIEW

6.2 INDUSTRIAL GRADE

6.3 PHARMACEUTICAL GRADE

6.4 GLOBAL GLYOXAL MARKET, BY GRADE, 2018-2033 (THOUSAND TONS

6.4.1 INDUSTRIAL GRADE

6.4.2 PHARMACEUTICAL GRADE

6.5 GLOBAL INDUSTRIAL GRADE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

6.5.1 ASIA-PACIFIC

6.5.2 NORTH AMERICA

6.5.3 EUROPE

6.5.4 MIDDLE EAST & AFRICA

6.5.5 SOUTH AMERICA

6.6 GLOBAL PHARMACEUTICAL GRADE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

6.6.1 ASIA-PACIFIC

6.6.2 NORTH AMERICA

6.6.3 EUROPE

6.6.4 MIDDLE EAST & AFRICA

6.6.5 SOUTH AMERICA

7 GLOBAL GLYOXAL MARKET, BY PURITY

7.1 OVERVIEW

7.1.1 40%-60%

7.1.2 90%-99%

7.1.3 OTHERS

7.2 GLOBAL 40%-60% IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

7.2.1 ASIA-PACIFIC

7.2.2 NORTH AMERICA

7.2.3 EUROPE

7.2.4 MIDDLE EAST & AFRICA

7.2.5 SOUTH AMERICA

7.3 GLOBAL 90%-99% IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

7.3.1 ASIA-PACIFIC

7.3.2 NORTH AMERICA

7.3.3 EUROPE

7.3.4 MIDDLE EAST & AFRICA

7.3.5 SOUTH AMERICA

7.4 GLOBAL OTHERS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

7.4.1 ASIA-PACIFIC

7.4.2 NORTH AMERICA

7.4.3 EUROPE

7.4.4 MIDDLE EAST & AFRICA

7.4.5 SOUTH AMERICA

8 GLOBAL GLYOXAL MARKET, BY PRODUCTION PROCESS

8.1 OVERVIEW

8.1.1 CATALYTIC OXIDATION OF ETHYLENE GLYCOL

8.1.2 OXIDATION OF ACETYLENE

8.1.3 OTHERS

8.2 GLOBAL CATALYTIC OXIDATION OF ETHYLENE GLYCOL IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.2.1 ASIA-PACIFIC

8.2.2 NORTH AMERICA

8.2.3 EUROPE

8.2.4 MIDDLE EAST & AFRICA

8.2.5 SOUTH AMERICA

8.3 GLOBAL OXIDATION OF ACETYLENE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.3.1 ASIA-PACIFIC

8.3.2 NORTH AMERICA

8.3.3 EUROPE

8.3.4 MIDDLE EAST & AFRICA

8.3.5 SOUTH AMERICA

8.4 GLOBAL OTHERS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.4.1 ASIA-PACIFIC

8.4.2 NORTH AMERICA

8.4.3 EUROPE

8.4.4 MIDDLE EAST & AFRICA

8.4.5 SOUTH AMERICA

9 GLOBAL GLYOXAL MARKET, BY PACKAGING

9.1 OVERVIEW

9.2 DRUMS

9.3 COMPOSITE IBC

9.4 BULK

9.5 JERRYCANS

9.6 BOTTLES

9.7 GLOBAL DRUMS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.7.1 PLASTIC DRUMS (HDPE)

9.7.2 TIGHT-HEAD DRUMS

9.7.3 LINERS INSIDE DRUMS

9.7.4 DRUMS WITH CHEMICAL COMPATIBILITY COATINGS

9.7.5 OPEN-TOP DRUMS

9.8 GLOBAL DRUMS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.8.1 ASIA-PACIFIC

9.8.2 NORTH AMERICA

9.8.3 EUROPE

9.8.4 MIDDLE EAST & AFRICA

9.8.5 SOUTH AMERICA

9.9 GLOBAL COMPOSITE IBC IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.9.1 COMPOSITE IBCS

9.9.2 RIGID IBCS

9.9.3 IBCS WITH INSULATION

9.9.4 OTHERS

9.1 GLOBAL COMPOSITE IBC IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.10.1 ASIA-PACIFIC

9.10.2 NORTH AMERICA

9.10.3 EUROPE

9.10.4 MIDDLE EAST & AFRICA

9.10.5 SOUTH AMERICA

9.11 GLOBAL BULK IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.11.1 ASIA-PACIFIC

9.11.2 NORTH AMERICA

9.11.3 EUROPE

9.11.4 MIDDLE EAST & AFRICA

9.11.5 SOUTH AMERICA

9.12 GLOBAL JERRYCANS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.12.1 PLASTIC JERRYCANS

9.12.2 STACKABLE JERRYCANS

9.12.3 METAL JERRYCANS

9.12.4 OTHER JERRYCANS

9.13 GLOBAL JERRYCANS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.13.1 ASIA-PACIFIC

9.13.2 NORTH AMERICA

9.13.3 EUROPE

9.13.4 MIDDLE EAST & AFRICA

9.13.5 SOUTH AMERICA

9.14 GLOBAL BOTTLES IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.14.1 SMALL LABORATORY BOTTLES

9.14.2 COSMETIC / PERSONAL CARE USE BOTTLES

9.14.3 SPECIAL FEATURE BOTTLES

9.14.4 OTHER BOTTLES

9.15 GLOBAL BOTTLES IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.15.1 ASIA-PACIFIC

9.15.2 NORTH AMERICA

9.15.3 EUROPE

9.15.4 MIDDLE EAST & AFRICA

9.15.5 SOUTH AMERICA

10 GLOBAL GLYOXAL MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 CROSS-LINKING

10.3 CHEMICAL INTERMEDIATES

10.4 OTHERS

10.5 GLOBAL CROSS-LINKING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.5.1 GLYOXALATED POLYACRYLAMIDE (GPAM)

10.5.2 GLYOXALATED STARCH

10.6 GLOBAL CROSS-LINKING IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.6.1 ASIA-PACIFIC

10.6.2 NORTH AMERICA

10.6.3 EUROPE

10.6.4 MIDDLE EAST & AFRICA

10.6.5 SOUTH AMERICA

10.7 GLOBAL CHEMICAL INTERMEDIATES, IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.7.1 BULK CHEMICALS MANUFACTURING

10.7.2 POLYMER PROCESSING

10.8 GLOBAL BULK CHEMICALS MANUFACTURING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.8.1 2-IMIDAZOLIDINONE

10.8.2 ETHYLENE GLYCOL DIFORMATE

10.8.3 QUINOXALINE DERIVATIVES

10.9 GLOBAL POLYMER PROCESSING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.9.1 GLYOXAL UREA RESIN

10.9.2 GLYOXAL PHENOL RESIN

10.9.3 GLYOXAL-BIS(2-HYDROXYANIL)

10.1 GLOBAL CHEMICAL INTERMEDIATES IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.10.1 ASIA-PACIFIC

10.10.2 NORTH AMERICA

10.10.3 EUROPE

10.10.4 MIDDLE EAST & AFRICA

10.10.5 SOUTH AMERICA

10.11 GLOBAL OTHERS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.11.1 DIHYDROXYETHYLENE UREA (DHEU)

10.11.2 METHYLOL GLYOXAL

10.12 GLOBAL OTHERS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.12.1 ASIA-PACIFIC

10.12.2 NORTH AMERICA

10.12.3 EUROPE

10.12.4 MIDDLE EAST & AFRICA

10.12.5 SOUTH AMERICA

11 GLOBAL GLYOXAL MARKET, BY END-USE CHEMICALS

11.1 OVERVIEW

11.2 DIHYDROXYETHYLENE UREA (DHEU)

11.3 2-IMIDAZOLIDINONE

11.4 GLYOXALATED POLYACRYLAMIDE (GPAM)

11.5 GLYOXYLIC ACID

11.6 GLYOXALATED STARCH

11.7 GLYOXAL PHENOL RESIN

11.8 GLYOXAL UREA RESIN

11.9 ETHYLENE GLYCOL DIFORMATE

11.1 UREA-GLYOXAL CONCENTRATE

11.11 QUINOXALINE DERIVATIVES

11.12 METHYLOL GLYOXAL

11.13 GLYOXAL-BIS(2-HYDROXYANIL)

11.14 GLYOXAL SODIUM BISULFITE

11.15 QUINOXALINE

11.16 2-METHYLIMIDAZOLE

11.17 IMIDAZOLE

11.18 GLYCOLURIL

11.19 ALLANTOIN

11.2 TETRAMETHYLOL ACETYLENEDIUREA

11.21 GLOBAL DIHYDROXYETHYLENE UREA (DHEU) IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.21.1 ASIA-PACIFIC

11.21.2 NORTH AMERICA

11.21.3 EUROPE

11.21.4 MIDDLE EAST & AFRICA

11.21.5 SOUTH AMERICA

11.22 GLOBAL 2-IMIDAZOLIDINONE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.22.1 ASIA-PACIFIC

11.22.2 NORTH AMERICA

11.22.3 EUROPE

11.22.4 MIDDLE EAST & AFRICA

11.22.5 SOUTH AMERICA

11.23 GLOBAL GLYOXALATED POLYACRYLAMIDE (GPAM) IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.23.1 ASIA-PACIFIC

11.23.2 NORTH AMERICA

11.23.3 EUROPE

11.23.4 MIDDLE EAST & AFRICA

11.23.5 SOUTH AMERICA

11.24 GLOBAL GLYOXYLIC ACID IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.24.1 ASIA-PACIFIC

11.24.2 NORTH AMERICA

11.24.3 EUROPE

11.24.4 MIDDLE EAST & AFRICA

11.24.5 SOUTH AMERICA

11.25 GLOBAL GLYOXALATED STARCH IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.25.1 ASIA-PACIFIC

11.25.2 NORTH AMERICA

11.25.3 EUROPE

11.25.4 MIDDLE EAST & AFRICA

11.25.5 SOUTH AMERICA

11.26 GLOBAL GLYOXAL PHENOL RESIN IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.26.1 ASIA-PACIFIC

11.26.2 NORTH AMERICA

11.26.3 EUROPE

11.26.4 MIDDLE EAST & AFRICA

11.26.5 SOUTH AMERICA

11.27 GLOBAL GLYOXAL UREA RESIN IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.27.1 ASIA-PACIFIC

11.27.2 NORTH AMERICA

11.27.3 EUROPE

11.27.4 MIDDLE EAST & AFRICA

11.27.5 SOUTH AMERICA

11.28 GLOBAL ETHYLENE GLYCOL DIFORMATE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.28.1 ASIA-PACIFIC

11.28.2 NORTH AMERICA

11.28.3 EUROPE

11.28.4 MIDDLE EAST & AFRICA

11.28.5 SOUTH AMERICA

11.29 GLOBAL UREA-GLYOXAL CONCENTRATE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.29.1 ASIA-PACIFIC

11.29.2 NORTH AMERICA

11.29.3 EUROPE

11.29.4 MIDDLE EAST & AFRICA

11.29.5 SOUTH AMERICA

11.3 GLOBAL QUINOXALINE DERIVATIVES IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.30.1 ASIA-PACIFIC

11.30.2 NORTH AMERICA

11.30.3 EUROPE

11.30.4 MIDDLE EAST & AFRICA

11.30.5 SOUTH AMERICA

11.31 GLOBAL METHYLOL GLYOXAL IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.31.1 ASIA-PACIFIC

11.31.2 NORTH AMERICA

11.31.3 EUROPE

11.31.4 MIDDLE EAST & AFRICA

11.31.5 SOUTH AMERICA

11.32 GLOBAL GLYOXAL-BIS(2-HYDROXYANIL) IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.32.1 ASIA-PACIFIC

11.32.2 NORTH AMERICA

11.32.3 EUROPE

11.32.4 MIDDLE EAST & AFRICA

11.32.5 SOUTH AMERICA

11.33 GLOBAL GLYOXAL SODIUM BISULFITE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.33.1 ASIA-PACIFIC

11.33.2 NORTH AMERICA

11.33.3 EUROPE

11.33.4 MIDDLE EAST & AFRICA

11.33.5 SOUTH AMERICA

11.34 GLOBAL QUINOXALINE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.34.1 ASIA-PACIFIC

11.34.2 NORTH AMERICA

11.34.3 EUROPE

11.34.4 MIDDLE EAST & AFRICA

11.34.5 SOUTH AMERICA

11.35 GLOBAL 2-METHYLIMIDAZOLE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.35.1 ASIA-PACIFIC

11.35.2 NORTH AMERICA

11.35.3 EUROPE

11.35.4 MIDDLE EAST & AFRICA

11.35.5 SOUTH AMERICA

11.36 GLOBAL IMIDAZOLE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.36.1 ASIA-PACIFIC

11.36.2 NORTH AMERICA

11.36.3 EUROPE

11.36.4 MIDDLE EAST & AFRICA

11.36.5 SOUTH AMERICA

11.37 GLOBAL GLYCOLURIL IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.37.1 ASIA-PACIFIC

11.37.2 NORTH AMERICA

11.37.3 EUROPE

11.37.4 MIDDLE EAST & AFRICA

11.37.5 SOUTH AMERICA

11.38 GLOBAL ALLANTOIN IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.38.1 ASIA-PACIFIC

11.38.2 NORTH AMERICA

11.38.3 EUROPE

11.38.4 MIDDLE EAST & AFRICA

11.38.5 SOUTH AMERICA

11.39 GLOBAL TETRAMETHYLOL ACETYLENEDIUREA IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.39.1 ASIA-PACIFIC

11.39.2 NORTH AMERICA

11.39.3 EUROPE

11.39.4 MIDDLE EAST & AFRICA

11.39.5 SOUTH AMERICA

12 GLOBAL GLYOXAL MARKET, BY END USER

12.1 OVERVIEW

12.2 TEXTILE

12.3 PULP AND PAPER

12.4 LEATHER

12.5 PAINTS AND COATINGS

12.6 WATER TREATMENT

12.7 PHARMACEUTICALS

12.8 HOUSEHOLD PRODUCTS

12.9 COSMETICS AND PERSONAL CARE

12.1 PACKAGING

12.11 ELECTRICAL AND ELECTRONICS

12.12 OIL AND GAS

12.13 OTHERS

12.14 GLOBAL TEXTILE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.14.1 ASIA-PACIFIC

12.14.2 NORTH AMERICA

12.14.3 EUROPE

12.14.4 MIDDLE EAST & AFRICA

12.14.5 SOUTH AMERICA

12.15 GLOBAL PULP AND PAPER IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.15.1 ASIA-PACIFIC

12.15.2 NORTH AMERICA

12.15.3 EUROPE

12.15.4 MIDDLE EAST & AFRICA

12.15.5 SOUTH AMERICA

12.16 GLOBAL LEATHER IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.16.1 ASIA-PACIFIC

12.16.2 NORTH AMERICA

12.16.3 EUROPE

12.16.4 MIDDLE EAST & AFRICA

12.16.5 SOUTH AMERICA

12.17 GLOBAL PAINTS AND COATINGS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.17.1 ASIA-PACIFIC

12.17.2 NORTH AMERICA

12.17.3 EUROPE

12.17.4 MIDDLE EAST & AFRICA

12.17.5 SOUTH AMERICA

12.18 GLOBAL WATER TREATMENT IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.18.1 ASIA-PACIFIC

12.18.2 NORTH AMERICA

12.18.3 EUROPE

12.18.4 MIDDLE EAST & AFRICA

12.18.5 SOUTH AMERICA

12.19 GLOBAL PHARMACEUTICALS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.19.1 ASIA-PACIFIC

12.19.2 NORTH AMERICA

12.19.3 EUROPE

12.19.4 MIDDLE EAST & AFRICA

12.19.5 SOUTH AMERICA

12.2 GLOBAL HOUSEHOLD PRODUCTS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.20.1 ASIA-PACIFIC

12.20.2 NORTH AMERICA

12.20.3 EUROPE

12.20.4 MIDDLE EAST & AFRICA

12.20.5 SOUTH AMERICA

12.21 GLOBAL COSMETICS AND PERSONAL CARE IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

12.21.1 LOTIONS AND CREAMS

12.21.2 PERFUMES AND DEODORANTS

12.21.3 OTHERS

12.22 GLOBAL COSMETICS AND PERSONAL CARE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.22.1 ASIA-PACIFIC

12.22.2 NORTH AMERICA

12.22.3 EUROPE

12.22.4 MIDDLE EAST & AFRICA

12.22.5 SOUTH AMERICA

12.23 GLOBAL PACKAGING IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.23.1 ASIA-PACIFIC

12.23.2 NORTH AMERICA

12.23.3 EUROPE

12.23.4 MIDDLE EAST & AFRICA

12.23.5 SOUTH AMERICA

12.24 GLOBAL ELECTRICAL AND ELECTRONICS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.24.1 ASIA-PACIFIC

12.24.2 NORTH AMERICA

12.24.3 EUROPE

12.24.4 MIDDLE EAST & AFRICA

12.24.5 SOUTH AMERICA

12.25 GLOBAL OIL AND GAS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.25.1 ASIA-PACIFIC

12.25.2 NORTH AMERICA

12.25.3 EUROPE

12.25.4 MIDDLE EAST & AFRICA

12.25.5 SOUTH AMERICA

12.26 GLOBAL OTHERS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.26.1 ASIA-PACIFIC

12.26.2 NORTH AMERICA

12.26.3 EUROPE

12.26.4 MIDDLE EAST & AFRICA

12.26.5 SOUTH AMERICA

13 GLOBAL GLYOXAL MARKET, BY REGION

13.1 OVERVIEW

13.2 ASIA PACIFIC

13.2.1 CHINA

13.2.2 INDIA

13.2.3 JAPAN

13.2.4 SOUTH KOREA

13.2.5 TAIWAN

13.2.6 VIETNAM

13.2.7 INDONESIA

13.2.8 THAILAND

13.2.9 AUSTRALIA

13.2.10 MALAYSIA

13.2.11 SINGAPORE

13.2.12 PHILIPPINES

13.2.13 REST OF ASIA-PACIFIC

13.3 NORTH AMERICA

13.3.1 U.S.

13.3.2 CANADA

13.3.3 MEXICO

13.4 EUROPE

13.4.1 GERMANY

13.4.2 U.K.

13.4.3 ITALY

13.4.4 FRANCE

13.4.5 RUSSIA

13.4.6 SPAIN

13.4.7 SWITZERLAND

13.4.8 NETHERLANDS

13.4.9 TURKEY

13.4.10 BELGIUM

13.4.11 DENMARK

13.4.12 SWEDEN

13.4.13 NORWAY

13.4.14 REST OF EUROPE

13.5 MIDDLE EAST AND AFRICA

13.5.1 SAUDI ARABIA

13.5.2 U.A.E

13.5.3 EGYPT

13.5.4 IRAN

13.5.5 SOUTH AFRICA

13.5.6 KUWAIT

13.5.7 QATAR

13.5.8 REST OF MIDDLE EAST & AFRICA

13.6 SOUTH AMERICA

13.6.1 BRAZIL

13.6.2 ARGENTINA

13.6.3 REST OF SOUTH AMERICA

14 GLOBAL GLYOXAL MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 BASF

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENT

16.2 MERCK KGAA

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENT

16.3 THERMO FISHER SCIENTIFIC INC.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENT

16.4 WEYLCHEM INTERNATIONAL GMBH

16.4.1 COMPANY SNAPSHOT

16.4.2 PRODUCT PORTFOLIO

16.4.3 RECENT DEVELOPMENT

16.5 ALPHA CHEMIKA.

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT DEVELOPMENT

16.6 AMZOLE INDIA PVT. LTD

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 EMCO DYESTUFF

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 FLUOROCHEM LIMITED

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 FUJIFILM WAKO PURE CHEMICAL CORPORATION

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 GETCHEM CO., LTD.

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 GLENTHAM LIFE SCIENCES LIMITED

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 HANNA EQUIPMENTS (INDIA) PVT. LTD.

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 HEZE RUNQUAN CHEMICAL CO., LTD.

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 HIMEDIA LABORATORIES

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 HUBEI SHUNHUI BIO-TECHNOLOGY CO., LTD.

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 KANTO KAGAKU

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 KEMIRA

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 PRODUCT PORTFOLIO

16.17.4 RECENT DEVELOPMENT

16.18 LOBACHEMIE PVT. LTD.

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 MERU CHEM PVT.LTD.

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 MULTICHEM SPECIALITIES PRIVATE LIMITED

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 OTTO CHEMIE PVT. LTD

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENT

16.22 OXFORD LAB FINE CHEM LLP.

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENT

16.23 SANTA CRUZ BIOTECHNOLOGY INC.

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENT

16.24 SHANDONG ZHISHANG CHEMICAL CO.LTD,

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENT

16.25 SIHAULI CHEMICALS PRIVATE LIMITED

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENT

16.26 SILVER FERN CHEMICAL LLC

16.26.1 COMPANY SNAPSHOT

16.26.2 PRODUCT PORTFOLIO

16.26.3 RECENT DEVELOPMENT

16.27 SIMSON PHARMA LIMITED

16.27.1 COMPANY SNAPSHOT

16.27.2 PRODUCT PORTFOLIO

16.27.3 RECENT DEVELOPMENT

16.28 TOKYO CHEMICAL INDUSTRY UK LTD.

16.28.1 COMPANY SNAPSHOT

16.28.2 PRODUCT PORTFOLIO

16.28.3 RECENT DEVELOPMENT

16.29 UNIVAR SOLUTIONS LLC

16.29.1 COMPANY SNAPSHOT

16.29.2 PRODUCT PORTFOLIO

16.29.3 RECENT DEVELOPMENT

16.3 WUXI LANSEN CHEMICALS CO., LTD.

16.30.1 COMPANY SNAPSHOT

16.30.2 PRODUCT PORTFOLIO

16.30.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tabela

TABLE 1 MAJOR END USE PRODUCTS FOR GLYOXAL

TABLE 2 GLOBAL GLYOXAL MARKET, BY GRADE, 2018-2033 (USD THOUSAND)

TABLE 3 GLOBAL GLYOXAL MARKET, BY GRADE, 2018-2033 (THOUSAND TONS )

TABLE 4 GLOBAL INDUSTRIAL GRADE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 5 GLOBAL PHARMACEUTICAL GRADE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 6 GLOBAL GLYOXAL MARKET, BY PURITY, 2018-2033 (USD THOUSAND)

TABLE 7 GLOBAL 40%-60% IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 8 GLOBAL 90%-99% IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 9 GLOBAL OTHERS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 10 GLOBAL GLYOXAL MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 11 GLOBAL CATALYTIC OXIDATION OF ETHYLENE GLYCOL IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 12 GLOBAL OXIDATION OF ACETYLENE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 13 GLOBAL OTHERS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 14 GLOBAL GLYOXAL MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 15 GLOBAL DRUMS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 16 GLOBAL DRUMS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 17 GLOBAL COMPOSITE IBC IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 18 GLOBAL COMPOSITE IBC IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 19 GLOBAL BULK IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 20 GLOBAL JERRYCANS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 21 GLOBAL JERRYCANS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 22 GLOBAL BOTTLES IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 23 GLOBAL BOTTLES IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 24 GLOBAL GLYOXAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 25 GLOBAL CROSS-LINKING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 26 GLOBAL CROSS-LINKING IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 27 GLOBAL CHEMICAL INTERMEDIATES, IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 28 GLOBAL BULK CHEMICALS MANUFACTURING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 29 GLOBAL POLYMER PROCESSING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 30 GLOBAL CHEMICAL INTERMEDIATES IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 31 GLOBAL OTHERS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 32 GLOBAL OTHERS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 33 GLOBAL GLYOXAL MARKET, BY END-USE CHEMICALS, 2018-2033 (USD THOUSAND)

TABLE 34 GLOBAL DIHYDROXYETHYLENE UREA (DHEU) IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 35 GLOBAL 2-IMIDAZOLIDINONE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 36 GLOBAL GLYOXALATED POLYACRYLAMIDE (GPAM) IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 37 GLOBAL GLYOXYLIC ACID IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 38 GLOBAL GLYOXALATED STARCH IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 39 GLOBAL GLYOXAL PHENOL RESIN IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 40 GLOBAL GLYOXAL UREA RESIN IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 41 GLOBAL ETHYLENE GLYCOL DIFORMATE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 42 GLOBAL UREA-GLYOXAL CONCENTRATE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 43 GLOBAL QUINOXALINE DERIVATIVES IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 44 GLOBAL METHYLOL GLYOXAL IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 45 GLOBAL GLYOXAL-BIS(2-HYDROXYANIL) IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 46 GLOBAL GLYOXAL SODIUM BISULFITE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 47 GLOBAL QUINOXALINE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 48 GLOBAL 2-METHYLIMIDAZOLE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 49 GLOBAL IMIDAZOLE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 50 GLOBAL GLYCOLURIL IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 51 GLOBAL ALLANTOIN IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 52 GLOBAL TETRAMETHYLOL ACETYLENEDIUREA IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 53 GLOBAL GLYOXAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 54 GLOBAL TEXTILE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 55 GLOBAL PULP AND PAPER IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 56 GLOBAL LEATHER IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 57 GLOBAL PAINTS AND COATINGS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 58 GLOBAL WATER TREATMENT IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 59 GLOBAL PHARMACEUTICALS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 60 GLOBAL HOUSEHOLD PRODUCTS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 61 GLOBAL COSMETICS AND PERSONAL CARE IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 62 GLOBAL COSMETICS AND PERSONAL CARE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 63 GLOBAL PACKAGING IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 64 GLOBAL ELECTRICAL AND ELECTRONICS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 65 GLOBAL OIL AND GAS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 66 GLOBAL OTHERS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 67 GLOBAL GLYOXAL MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 68 GLOBAL GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 69 GLOBAL GLYOXAL MARKET, 2018-2033, (THOUSAND TONS )

TABLE 70 GLOBAL GLYOXAL MARKET, BY GRADE, 2018-2033 (USD THOUSAND)

TABLE 71 GLOBAL GLYOXAL MARKET, BY GRADE, 2018-2033 (THOUSAND TONS )

TABLE 72 GLOBAL INDUSTRIAL GRADE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 73 GLOBAL PHARMACEUTICAL GRADE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 74 GLOBAL GLYOXAL MARKET, BY PURITY, 2018-2033 (USD THOUSAND)

TABLE 75 GLOBAL 40%-60% IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 76 GLOBAL 90%-99% IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 77 GLOBAL OTHERS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 78 GLOBAL GLYOXAL MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 79 GLOBAL CATALYTIC OXIDATION OF ETHYLENE GLYCOL IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 80 GLOBAL OXIDATION OF ACETYLENE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 81 GLOBAL OTHERS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 82 GLOBAL GLYOXAL MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 83 GLOBAL DRUMS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 84 GLOBAL DRUMS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 85 GLOBAL COMPOSITE IBC IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 86 GLOBAL COMPOSITE IBC IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 87 GLOBAL BULK IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 88 GLOBAL JERRYCANS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 89 GLOBAL JERRYCANS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 90 GLOBAL BOTTLES IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 91 GLOBAL BOTTLES IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 92 GLOBAL GLYOXAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 93 GLOBAL CROSS-LINKING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 94 GLOBAL CROSS-LINKING IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 95 GLOBAL CHEMICAL INTERMEDIATES, IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 96 GLOBAL BULK CHEMICALS MANUFACTURING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 97 GLOBAL POLYMER PROCESSING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 98 GLOBAL CHEMICAL INTERMEDIATES IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 99 GLOBAL OTHERS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 100 GLOBAL OTHERS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 101 GLOBAL GLYOXAL MARKET, BY END-USE CHEMICALS, 2018-2033 (USD THOUSAND)

TABLE 102 GLOBAL DIHYDROXYETHYLENE UREA (DHEU) IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 103 GLOBAL 2-IMIDAZOLIDINONE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 104 GLOBAL GLYOXALATED POLYACRYLAMIDE (GPAM) IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 105 GLOBAL GLYOXYLIC ACID IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 106 GLOBAL GLYOXALATED STARCH IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 107 GLOBAL GLYOXAL PHENOL RESIN IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 108 GLOBAL GLYOXAL UREA RESIN IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 109 GLOBAL ETHYLENE GLYCOL DIFORMATE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 110 GLOBAL UREA-GLYOXAL CONCENTRATE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 111 GLOBAL QUINOXALINE DERIVATIVES IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 112 GLOBAL METHYLOL GLYOXAL IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 113 GLOBAL GLYOXAL-BIS(2-HYDROXYANIL) IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 114 GLOBAL GLYOXAL SODIUM BISULFITE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 115 GLOBAL QUINOXALINE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 116 GLOBAL 2-METHYLIMIDAZOLE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 117 GLOBAL IMIDAZOLE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 118 GLOBAL GLYCOLURIL IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 119 GLOBAL ALLANTOIN IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 120 GLOBAL TETRAMETHYLOL ACETYLENEDIUREA IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 121 GLOBAL GLYOXAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 122 GLOBAL TEXTILE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 123 GLOBAL PULP AND PAPER IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 124 GLOBAL LEATHER IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 125 GLOBAL PAINTS AND COATINGS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 126 GLOBAL WATER TREATMENT IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 127 GLOBAL PHARMACEUTICALS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 128 GLOBAL HOUSEHOLD PRODUCTS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 129 GLOBAL COSMETICS AND PERSONAL CARE IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 130 GLOBAL COSMETICS AND PERSONAL CARE IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 131 GLOBAL PACKAGING IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 132 GLOBAL ELECTRICAL AND ELECTRONICS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 133 GLOBAL OIL AND GAS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 134 GLOBAL OTHERS IN GLYOXAL MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 135 ASIA-PACIFIC GLYOXAL MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 136 ASIA-PACIFIC GLYOXAL MARKET, BY COUNTRY, 2018-2033 (THOUSAND TONS)

TABLE 137 USD THOUSAND

TABLE 138 ASIA-PACIFIC GLYOXAL MARKET, BY GRADE, 2018-2033 (USD THOUSAND)

TABLE 139 ASIA-PACIFIC GLYOXAL MARKET, BY GRADE, 2018-2033 (THOUSAND TONS )

TABLE 140 ASIA-PACIFIC GLYOXAL MARKET, BY PURITY, 2018-2033 (USD THOUSAND)

TABLE 141 ASIA-PACIFIC GLYOXAL MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 142 ASIA-PACIFIC GLYOXAL MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 143 ASIA-PACIFIC DRUMS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 144 ASIA-PACIFIC COMPOSITE IBC IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 145 ASIA-PACIFIC JERRYCANS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 146 ASIA-PACIFIC BOTTLES IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 147 ASIA-PACIFIC GLYOXAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 148 ASIA-PACIFIC CROSS-LINKING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 149 ASIA-PACIFIC CHEMICAL INTERMEDIATES, IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 150 ASIA-PACIFIC BULK CHEMICALS MANUFACTURING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 151 ASIA-PACIFIC POLYMER PROCESSING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 152 ASIA-PACIFIC OTHERS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 153 ASIA-PACIFIC GLYOXAL MARKET, BY END-USE CHEMICALS, 2018-2033 (USD THOUSAND)

TABLE 154 ASIA-PACIFIC GLYOXAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 155 ASIA-PACIFIC COSMETICS AND PERSONAL CARE IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 156 CHINA GLYOXAL MARKET, BY GRADE, 2018-2033 (USD THOUSAND)

TABLE 157 CHINA GLYOXAL MARKET, BY GRADE, 2018-2033 (THOUSAND TONS)

TABLE 158 CHINA GLYOXAL MARKET, BY PURITY, 2018-2033 (USD THOUSAND)

TABLE 159 CHINA GLYOXAL MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 160 CHINA GLYOXAL MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 161 CHINA DRUMS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 162 CHINA COMPOSITE IBC IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 163 CHINA JERRYCANS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 164 CHINA BOTTLES IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 165 CHINA GLYOXAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 166 CHINA CROSS-LINKING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 167 CHINA CHEMICAL INTERMEDIATES, IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 168 CHINA BULK CHEMICALS MANUFACTURING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 169 CHINA POLYMER PROCESSING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 170 CHINA OTHERS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 171 CHINA GLYOXAL MARKET, BY END-USE CHEMICALS, 2018-2033 (USD THOUSAND)

TABLE 172 CHINA GLYOXAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 173 CHINA COSMETICS AND PERSONAL CARE IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 174 INDIA GLYOXAL MARKET, BY GRADE, 2018-2033 (USD THOUSAND)

TABLE 175 INDIA GLYOXAL MARKET, BY GRADE, 2018-2033 (THOUSAND TONS)

TABLE 176 INDIA GLYOXAL MARKET, BY PURITY, 2018-2033 (USD THOUSAND)

TABLE 177 INDIA GLYOXAL MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 178 INDIA GLYOXAL MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 179 INDIA DRUMS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 180 INDIA COMPOSITE IBC IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 181 INDIA JERRYCANS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 182 INDIA BOTTLES IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 183 INDIA GLYOXAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 184 INDIA CROSS-LINKING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 185 INDIA CHEMICAL INTERMEDIATES, IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 186 INDIA BULK CHEMICALS MANUFACTURING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 187 INDIA POLYMER PROCESSING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 188 INDIA OTHERS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 189 INDIA GLYOXAL MARKET, BY END-USE CHEMICALS, 2018-2033 (USD THOUSAND)

TABLE 190 INDIA GLYOXAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 191 INDIA COSMETICS AND PERSONAL CARE IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 192 JAPAN GLYOXAL MARKET, BY GRADE, 2018-2033 (USD THOUSAND)

TABLE 193 JAPAN GLYOXAL MARKET, BY GRADE, 2018-2033 (THOUSAND TONS)

TABLE 194 JAPAN GLYOXAL MARKET, BY PURITY, 2018-2033 (USD THOUSAND)

TABLE 195 JAPAN GLYOXAL MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 196 JAPAN GLYOXAL MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 197 JAPAN DRUMS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 198 JAPAN COMPOSITE IBC IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 199 JAPAN JERRYCANS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 200 JAPAN BOTTLES IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 201 JAPAN GLYOXAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 202 JAPAN CROSS-LINKING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 203 JAPAN CHEMICAL INTERMEDIATES, IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 204 JAPAN BULK CHEMICALS MANUFACTURING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 205 JAPAN POLYMER PROCESSING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 206 JAPAN OTHERS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 207 JAPAN GLYOXAL MARKET, BY END-USE CHEMICALS, 2018-2033 (USD THOUSAND)

TABLE 208 JAPAN GLYOXAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 209 JAPAN COSMETICS AND PERSONAL CARE IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 210 SOUTH KOREA GLYOXAL MARKET, BY GRADE, 2018-2033 (USD THOUSAND)

TABLE 211 SOUTH KOREA GLYOXAL MARKET, BY GRADE, 2018-2033 (THOUSAND TONS)

TABLE 212 SOUTH KOREA GLYOXAL MARKET, BY PURITY, 2018-2033 (USD THOUSAND)

TABLE 213 SOUTH KOREA GLYOXAL MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 214 SOUTH KOREA GLYOXAL MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 215 SOUTH KOREA DRUMS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 216 SOUTH KOREA COMPOSITE IBC IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 217 SOUTH KOREA JERRYCANS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 218 SOUTH KOREA BOTTLES IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 219 SOUTH KOREA GLYOXAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 220 SOUTH KOREA CROSS-LINKING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 221 SOUTH KOREA CHEMICAL INTERMEDIATES, IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 222 SOUTH KOREA BULK CHEMICALS MANUFACTURING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 223 SOUTH KOREA POLYMER PROCESSING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 224 SOUTH KOREA OTHERS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 225 SOUTH KOREA GLYOXAL MARKET, BY END-USE CHEMICALS, 2018-2033 (USD THOUSAND)

TABLE 226 SOUTH KOREA GLYOXAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 227 SOUTH KOREA COSMETICS AND PERSONAL CARE IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 228 TAIWAN GLYOXAL MARKET, BY GRADE, 2018-2033 (USD THOUSAND)

TABLE 229 TAIWAN GLYOXAL MARKET, BY GRADE, 2018-2033 (THOUSAND TONS)

TABLE 230 TAIWAN GLYOXAL MARKET, BY PURITY, 2018-2033 (USD THOUSAND)

TABLE 231 TAIWAN GLYOXAL MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 232 TAIWAN GLYOXAL MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 233 TAIWAN DRUMS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 234 TAIWAN COMPOSITE IBC IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 235 TAIWAN JERRYCANS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 236 TAIWAN BOTTLES IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 237 TAIWAN GLYOXAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 238 TAIWAN CROSS-LINKING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 239 TAIWAN CHEMICAL INTERMEDIATES, IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 240 TAIWAN BULK CHEMICALS MANUFACTURING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 241 TAIWAN POLYMER PROCESSING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 242 TAIWAN OTHERS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 243 TAIWAN GLYOXAL MARKET, BY END-USE CHEMICALS, 2018-2033 (USD THOUSAND)

TABLE 244 TAIWAN GLYOXAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 245 TAIWAN COSMETICS AND PERSONAL CARE IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 246 VIETNAM GLYOXAL MARKET, BY GRADE, 2018-2033 (USD THOUSAND)

TABLE 247 VIETNAM GLYOXAL MARKET, BY GRADE, 2018-2033 (THOUSAND TONS)

TABLE 248 VIETNAM GLYOXAL MARKET, BY PURITY, 2018-2033 (USD THOUSAND)

TABLE 249 VIETNAM GLYOXAL MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 250 VIETNAM GLYOXAL MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 251 VIETNAM DRUMS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 252 VIETNAM COMPOSITE IBC IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 253 VIETNAM JERRYCANS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 254 VIETNAM BOTTLES IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 255 VIETNAM GLYOXAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 256 VIETNAM CROSS-LINKING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 257 VIETNAM CHEMICAL INTERMEDIATES, IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 258 VIETNAM BULK CHEMICALS MANUFACTURING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 259 VIETNAM POLYMER PROCESSING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 260 VIETNAM OTHERS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 261 VIETNAM GLYOXAL MARKET, BY END-USE CHEMICALS, 2018-2033 (USD THOUSAND)

TABLE 262 VIETNAM GLYOXAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 263 VIETNAM COSMETICS AND PERSONAL CARE IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 264 INDONESIA GLYOXAL MARKET, BY GRADE, 2018-2033 (USD THOUSAND)

TABLE 265 INDONESIA GLYOXAL MARKET, BY GRADE, 2018-2033 (THOUSAND TONS)

TABLE 266 INDONESIA GLYOXAL MARKET, BY PURITY, 2018-2033 (USD THOUSAND)

TABLE 267 INDONESIA GLYOXAL MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 268 INDONESIA GLYOXAL MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 269 INDONESIA DRUMS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 270 INDONESIA COMPOSITE IBC IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 271 INDONESIA JERRYCANS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 272 INDONESIA BOTTLES IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 273 INDONESIA GLYOXAL MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 274 INDONESIA CROSS-LINKING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 275 INDONESIA CHEMICAL INTERMEDIATES, IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 276 INDONESIA BULK CHEMICALS MANUFACTURING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 277 INDONESIA POLYMER PROCESSING IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 278 INDONESIA OTHERS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 279 INDONESIA GLYOXAL MARKET, BY END-USE CHEMICALS, 2018-2033 (USD THOUSAND)

TABLE 280 INDONESIA GLYOXAL MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 281 INDONESIA COSMETICS AND PERSONAL CARE IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 282 THAILAND GLYOXAL MARKET, BY GRADE, 2018-2033 (USD THOUSAND)

TABLE 283 THAILAND GLYOXAL MARKET, BY GRADE, 2018-2033 (THOUSAND TONS)

TABLE 284 THAILAND GLYOXAL MARKET, BY PURITY, 2018-2033 (USD THOUSAND)

TABLE 285 THAILAND GLYOXAL MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 286 THAILAND GLYOXAL MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 287 THAILAND DRUMS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 288 THAILAND COMPOSITE IBC IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 289 THAILAND JERRYCANS IN GLYOXAL MARKET, BY TYPE, 2018-2033 (USD THOUSAND)