Global Smart Insulin Pen Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

31.20 Million

USD

62.63 Million

2021

2029

USD

31.20 Million

USD

62.63 Million

2021

2029

| 2022 –2029 | |

| USD 31.20 Million | |

| USD 62.63 Million | |

|

|

|

|

Global Smart Insulin Pen Market, By Product (Smart Insulin Pens, Adaptors for Conventional Pens, Disposable, Reusable), Type (First Generation Pens, Second Generation Pens), Usability (Prefilled, Reusable), Connectivity Type (Bluetooth, USB), Application (Type 1 Diabetes, Type 2 Diabetes), Distribution Channel (Hospital Pharmacies, Online Sales, Retail Pharmacies, Diabetes Clinics / Centers) – Industry Trends and Forecast to 2029

Smart Insulin Pen Market Analysis and Size

This smart insulin pen calculates and tracks doses and provides helpful reminders, alerts, and reports. The smart insulin pens also come with extra functions including data transfer, time and dose recorder, and memory function. In the coming years, a crucial aspect that is anticipated to propel the global market for smart insulin pen is the rise in prevalence of the two forms of diabetes in both children and adults, which is caused by obesity and changing lifestyle and dietary habits.

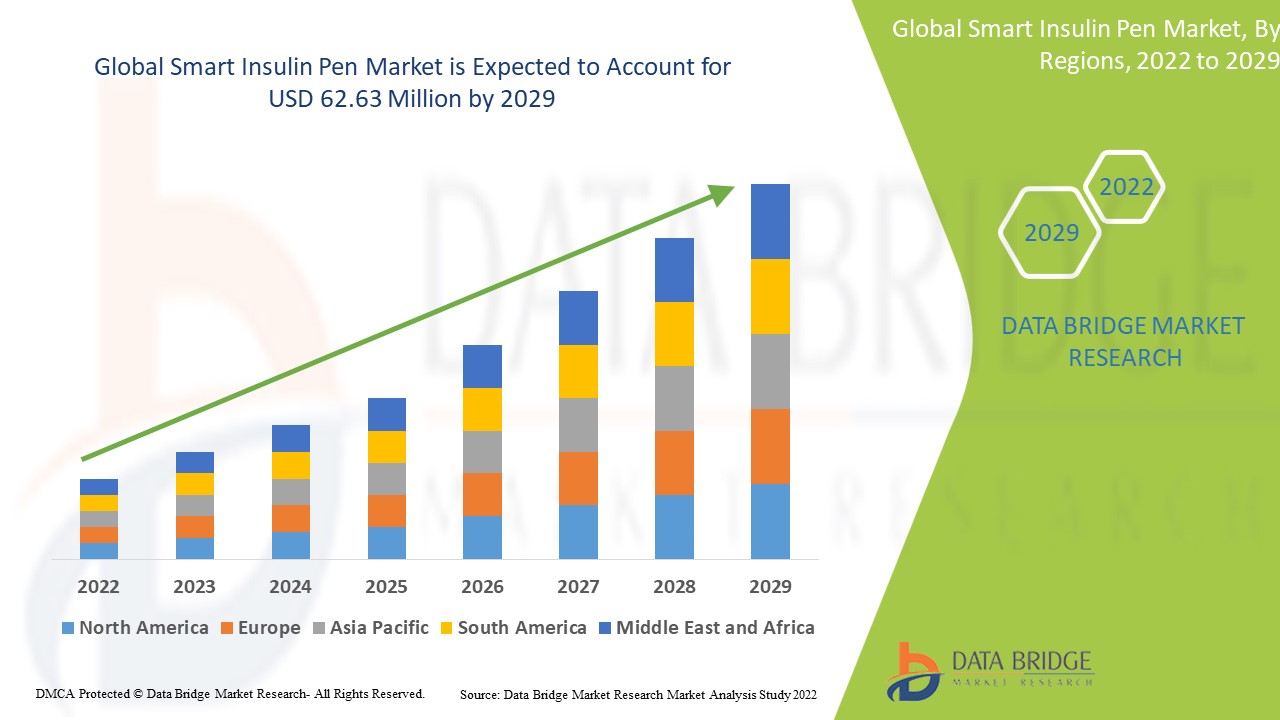

Data Bridge Market Research analyses that the smart insulin pen market which was USD 31.2 million in 2021, would rocket up to USD 62.63 million by 2029, and is expected to undergo a CAGR of 9.10% during the forecast period 2022 to 2029. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team also includes in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Product (Smart Insulin Pens, Adaptors for Conventional Pens, Disposable, Reusable), Type (First Generation Pens, Second Generation Pens), Usability (Prefilled, Reusable) Connectivity Type (Bluetooth, USB), Application (Type 1 Diabetes, Type 2 Diabetes), Distribution Channel (Hospital Pharmacies, Online Sales, Retail Pharmacies, Diabetes Clinics / Centers) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

Emperra GmbH E-Health Technologies (Germany), Medtronic (Ireland), Novo Nordisk A/S (Denmark), Pendiq (Germany), Sanofi (France), Berlin-Chemie AG (Germany), Bigfoot Biomedical Inc. (U.S.), Digital Medics Pty Ltd. (Australia), Eli Lilly and Company (U.S.) |

|

Market Opportunities |

|

Market Definition

Smart insulin pens are reusable injector pens that can be connected to smartphone apps. The majority of diabetic patients face difficulty to calculate their insulin dosage. The result could be insulin stacking. It helps you to improve insulin administration by managing your diabetes. These "second-generation" pens pair with USB or Bluetooth technology to enable wireless transmission of data to your app.

Global Smart Insulin Pen Market Dynamics

Drivers

- Technological advancements

Emerging technologies in smart insulin pens are projected to drive the global smart insulin pen market during the forecast period. To detect the insulin level, an iSenz adaptor is used for smart insulin pens. It offers injection angles for diabetic injection site optimization. For insulin pens connected to the internet, there is an adaptor called Easylog. In order to manage chronic illnesses such as diabetes, it gives patient the proper dosage and delivers improved comfort. InsulCheck is a cap that fits insulin pens and has a sensor to monitor temperature and consumption. And these are some of the examples of smart insulin pens which accelerate the market growth.

- Integration of monitoring and therapeutic features

Smart insulin pens have many benefits for diabetes management. These pens have extra features that make it easier to keep track of the previous insulin dose. Daily injections of insulin with a syringe and needle are challenging and unpleasant. With improvements in device communication technology, more people are using their smartphones and the internet to track their records and drives the market's growth.

Opportunities

Integrated technology measuring blood glucose levels and determining insulin dosage. Patients can provide their information to doctors or other healthcare experts through sophisticated technological tools and apps. For instance, In pen insulin pens are linked to smartwatches, armbands, and smart apps, which assist in tracking physical activity and transmitting the information to doctors. The US market has seen increased competition from a number of manufacturers. For instance, Novo Nordisk's NovoPen® 6 and NovoPen Echo® Plus, which can record and save the past 800 injection doses, including airshots, and enable optimal insulin management, were approved for use in 2019.

Restraints/Challenges

- Increased adoption of refurbished systems

On the other hand, the high cost of insulin pens, poor reimbursement rates will obstruct the market's growth rate. It's common for refurbished systems to cost less than brand-new ones. For industry participants, particularly small manufacturers, the rising demand for refurbished products poses a significant challenge.

This smart insulin pen market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the smart insulin pen market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Development

- In February 2020, A partnership between Senseonics and Companion Medical was announced. Senseonics is a US-based medical technology firm that primarily focuses on designing, developing, and marketing glucose monitoring systems. The relationship will benefit both businesses by fusing the Eversense CGM Technology with the InPenT smart system for precise insulin delivery.

- In March 2022, Novo Nordisk announced the Novo Pen 6 and Novo Pen Echo Plus, two smart linked insulin pens that are currently available in the UK on prescription for those with diabetes who use Novo Nordisk insulin. These two new smart insulin pens, the Novo Pen 6 and Novo Pen Echo Plus, record each injection's insulin dosage automatically.

Global Smart Insulin Pen Market Scope

The smart insulin pen market is segmented on the basis of usability, product type, connectivity type, application and distribution-channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Usability

- Prefilled

- Reusable

Product

- Smart Insulin Pens

- Adaptors for Conventional Pens

- Disposable

- Reusable

Connectivity Type

- Bluetooth

- USB

Application

- Type 1 Diabetes

- Type 2 Diabetes

Distribution Channel

- Hospital Pharmacies

- Online Sales

- Retail Pharmacies

- Diabetes Clinics / Centers

Smart Insulin Pen Market Regional Analysis/Insights

The smart insulin pen market is analysed and market size insights and trends are provided by country, product type, connectivity type, application and distribution-channel as referenced above.

The countries covered in the smart insulin pen market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the smart insulin pen market due to rise in prevalence of diabetes, new product launches and high cost of smart insulin pen are also expected to contribute to the regional market growth.

Asia-Pacific is expected to grow at the highest growth rate in the forecast period of 2022 to 2029 owing to the increase in geriatric population with diabetes in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure growth Installed base and New Technology Penetration

The smart insulin pen market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for smart insulin pen market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the smart insulin pen market. The data is available for historic period 2010-2020.

Competitive Landscape and Smart Insulin Pen Market Share Analysis

The smart insulin pen market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to smart insulin pen market.

Some of the major players operating in the smart insulin pen market are:

- Emperra GmbH E-Health Technologies (Germany)

- Medtronic (Ireland)

- Novo Nordisk A/S (Denmark)

- Pendiq (Germany)

- Sanofi (France)

- Berlin-Chemie AG (Germany)

- Bigfoot Biomedical Inc. (U.S.)

- Digital Medics Pty Ltd. (Australia)

- Eli Lilly and Company (U.S.)

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1.INTRODUCTION

1.1OBJECTIVES OF THE STUDY

1.2MARKET DEFINITION

1.3OVERVIEW OF GLOBAL SMART INSULIN PEN MARKET

1.4CURRENCY AND PRICING

1.5LIMITATION

1.6MARKETS COVERED

2.MARKET

2.1KEY TAKEAWAYS

2.2ARRIVING AT THE GLOBAL SMART INSULIN PEN MARKET SIZE

2.2.1VENDOR POSITIONING GRID

2.2.2TECHNOLOGY LIFE LINE CURVE

2.2.3TRIPOD DATA VALIDATION MODEL

2.2.4MARKET GUIDE

2.2.5MULTIVARIATE MODELLING

2.2.6TOP TO BOTTOM ANALYSIS

2.2.7CHALLENGE MATRIX

2.2.8APPLICATION COVERAGE GRID

2.2.9STANDARDS OF MEASUREMENT

2.2.10VENDOR SHARE ANALYSIS

2.2.11EPIDEMIOLOGY

2.2.12DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13DATA POINTS FROM KEY SECONDARY DATABASES

2.3GLOBAL SMART INSULIN PEN MARKET: RESEARCH SNAPSHOT

2.4ASSUMPTIONS

3.MARKET OVERVIEW

3.1DRIVERS

3.2RESTRAINTS

3.3OPPORTUNITIES

3.4CHALLENGES

4.EXECUTIVE SUMMARY

5.PREMIUM INSIGHTS

6.EPIDEMIOLOGY

6.1INCIDENCE OF ALL BY GENDER

6.2TREATMENT RATE

6.3MORTALITY RATE

6.4DRUG ADHERENCE AND THERAPY SWITCH MODEL

6.5PATEINT TREATMENT SUCCESS RATES

7.INDUSTRY INSIGHTS

7.1PATENT ANALYSIS

7.2DRUG TREATMENT RATE BY MATURED MARKETS

7.3DEMOGRAPHIC TRENDS: IMPACTS ON ALL INCIDENCE RATES

7.4PATIENT FLOW DIAGRAM

7.5KEY PRICING STRATEGIES

7.6KEY PATIENT ENROLLMENT STRATEGIES

7.7INTERVIEWS WITH CARDIOLOGIST

7.8OTHER KOL SNAPSHOTS

8.REGULATORY SCENARIO

9.PIPELINE ANALYSIS

9.1PHASE III CANDIDATES

9.2PHASE II CANDIDATES

9.3PHASE I CANDIDATES

9.4OTHERS (PRE-CLINICAL AND RESEARCH)

10.GLOBAL SMART INSULIN PEN MARKET, BY PRODUCT TYPE

10.1OVERVIEW

10.2INTEGRATED SMART INSULIN PENS

10.3ADAPTORS FOR CONVETIONAL PENS

10.3.1REUSABLE

10.3.2DISPOSABLE

10.4OTHERS

11.GLOBAL SMART INSULIN PEN MARKET, BY USABILITY

11.1OVERVIEW

11.2PREFILLED

11.3REUSABLE

12.GLOBAL SMART INSULIN PEN MARKET, BY TYPE

12.1OVERVIEW

12.2FIRST GENERATION PENS

12.3SECOND GENERATION PENS

13.GLOBAL SMART INSULIN PEN MARKET, BY CONNECTIVITY

13.1OVERVIEW

13.2BLUETOOTH

13.2.1BY COMPATIBILITY

13.2.1.1.ANDROID

13.2.1.2.IOS

13.2.2BY BRAND

13.2.2.1.INPEN

13.2.2.2.VIGIPEN

13.2.2.3.ESYSTA

13.2.2.4.YPSOMATE SMARTPILOT

13.2.2.5.OTHERS

13.3USB

13.3.1BY COMPATIBILITY

13.3.1.1.ANDROID

13.3.1.2.IOS

13.3.2BY BRAND

13.3.2.1.PENDIQ 2.0

13.3.2.2.OTHERS

13.4NFC

13.4.1BY COMPATIBILITY

13.4.1.1.ANDROID

13.4.1.2.IOS

13.4.2BY BRAND

13.4.2.1.NOVOPEN 6

13.4.2.2.NOVOPEN ECHO

13.4.2.3.OTHERS

13.5OTHERS

14.GLOBAL SMART INSULIN PEN MARKET, BY DISEASE TYPE

14.1OVERVIEW

14.2TYPE 1 DIABETES

14.2.1PREFILLED

14.2.2REUSABLE

14.3TYPE 2 DIABETES

14.3.1PREFILLED

14.3.2REUSABLE

15.GLOBAL SMART INSULIN PEN MARKET, BY END USER

15.1OVERVIEW

15.2HOSPITAL

15.3SPECIALITY CLINICS

15.4HOME HEALTHCARE

15.5OTHERS

16.GLOBAL SMART INSULIN PEN MARKET, BY DISTRIBUTION CHANNEL

16.1OVERVIEW

16.2HOSPITAL PHARMACY

16.3RETAIL PHARMACY

16.4ONLINE PHARMACY

16.5OTHERS

17.GLOBAL SMART INSULIN PEN MARKET, BY GEOGRAPHY

17.1GLOBAL SMART INSULIN PEN MARKET (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

17.1.1NORTH AMERICA

17.1.1.1.U.S.

17.1.1.2.CANADA

17.1.1.3.MEXICO

17.1.2EUROPE

17.1.2.1.GERMANY

17.1.2.2.FRANCE

17.1.2.3.U.K.

17.1.2.4.HUNGARY

17.1.2.5.LITHUANIA

17.1.2.6.AUSTRIA

17.1.2.7.IRELAND

17.1.2.8.NORWAY

17.1.2.9.POLAND

17.1.2.10.ITALY

17.1.2.11.SPAIN

17.1.2.12.RUSSIA

17.1.2.13.TURKEY

17.1.2.14.NETHERLANDS

17.1.2.15.SWITZERLAND

17.1.2.16.REST OF EUROPE

17.1.3ASIA-PACIFIC

17.1.3.1.JAPAN

17.1.3.2.CHINA

17.1.3.3.SOUTH KOREA

17.1.3.4.INDIA

17.1.3.5.AUSTRALIA

17.1.3.6.SINGAPORE

17.1.3.7.THAILAND

17.1.3.8.MALAYSIA

17.1.3.9.INDONESIA

17.1.3.10.PHILIPPINES

17.1.3.11.VIETNAM

17.1.3.12.REST OF ASIA-PACIFIC

17.1.4SOUTH AMERICA

17.1.4.1.BRAZIL

17.1.4.2.ARGENTINA

17.1.4.3.PERU

17.1.4.4.REST OF SOUTH AMERICA

17.1.5MIDDLE EAST AND AFRICA

17.1.5.1.SOUTH AFRICA

17.1.5.2.SAUDI ARABIA

17.1.5.3.UAE

17.1.5.4.EGYPT

17.1.5.5.KUWAIT

17.1.5.6.ISRAEL

17.1.5.7.REST OF MIDDLE EAST AND AFRICA

17.1.6KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

18.GLOBAL SMART INSULIN PEN MARKET, SWOT AND DBMR ANALYSIS

19.GLOBAL SMART INSULIN PEN MARKET, COMPANY LANDSCAPE

19.1COMPANY SHARE ANALYSIS: GLOBAL

19.2COMPANY SHARE ANALYSIS: NORTH AMERICA

19.3COMPANY SHARE ANALYSIS: EUROPE

19.4COMPANY SHARE ANALYSIS: ASIA-PACIFIC

19.5MERGERS & ACQUISITIONS

19.6NEW PRODUCT DEVELOPMENT & APPROVALS

19.7EXPANSIONS

19.8REGULATORY CHANGES

19.9PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

20.GLOBAL SMART INSULIN PEN MARKET, COMPANY PROFILE

20.1PENDIQ

20.1.1COMPANY OVERVIEW

20.1.2REVENUE ANALYSIS

20.1.3GEOGRAPHIC PRESENCE

20.1.4PRODUCT PORTFOLIO

20.1.5RECENT DEVELOPMENTS

20.2NOVO NORDISK

20.2.1COMPANY OVERVIEW

20.2.2REVENUE ANALYSIS

20.2.3GEOGRAPHIC PRESENCE

20.2.4PRODUCT PORTFOLIO

20.2.5RECENT DEVELOPMENTS

20.3MEDTRONIC

20.3.1COMPANY OVERVIEW

20.3.2REVENUE ANALYSIS

20.3.3GEOGRAPHIC PRESENCE

20.3.4PRODUCT PORTFOLIO

20.3.5RECENT DEVELOPMENTS

20.4US MED

20.4.1COMPANY OVERVIEW

20.4.2REVENUE ANALYSIS

20.4.3GEOGRAPHIC PRESENCE

20.4.4PRODUCT PORTFOLIO

20.4.5RECENT DEVELOPMENTS

20.5INSULCLOUD S.L.

20.5.1COMPANY OVERVIEW

20.5.2REVENUE ANALYSIS

20.5.3GEOGRAPHIC PRESENCE

20.5.4PRODUCT PORTFOLIO

20.5.5RECENT DEVELOPMENTS

20.6TIMESULIN (PATIENTS PENDING LTD)

20.6.1COMPANY OVERVIEW

20.6.2REVENUE ANALYSIS

20.6.3GEOGRAPHIC PRESENCE

20.6.4PRODUCT PORTFOLIO

20.6.5RECENT DEVELOPMENTS

20.7EMPERRA GMBH E-HEALTH TECHNOLOGIES

20.7.1COMPANY OVERVIEW

20.7.2REVENUE ANALYSIS

20.7.3GEOGRAPHIC PRESENCE

20.7.4PRODUCT PORTFOLIO

20.7.5RECENT DEVELOPMENTS

20.8YPSOMED

20.8.1COMPANY OVERVIEW

20.8.2REVENUE ANALYSIS

20.8.3GEOGRAPHIC PRESENCE

20.8.4PRODUCT PORTFOLIO

20.8.5RECENT DEVELOPMENTS

20.9BIGFOOT BIOMEDICAL, INC.

20.9.1COMPANY OVERVIEW

20.9.2REVENUE ANALYSIS

20.9.3GEOGRAPHIC PRESENCE

20.9.4PRODUCT PORTFOLIO

20.9.5RECENT DEVELOPMENTS

20.10BIOCORP

20.10.1COMPANY OVERVIEW

20.10.2REVENUE ANALYSIS

20.10.3GEOGRAPHIC PRESENCE

20.10.4PRODUCT PORTFOLIO

20.10.5RECENT DEVELOPMENTS

20.11JIANGSU DELFU MEDICAL DEVICE CO.,LTD

20.11.1COMPANY OVERVIEW

20.11.2REVENUE ANALYSIS

20.11.3GEOGRAPHIC PRESENCE

20.11.4PRODUCT PORTFOLIO

20.11.5RECENT DEVELOPMENTS

20.12ELI LILLY AND COMPANY

20.12.1COMPANY OVERVIEW

20.12.2REVENUE ANALYSIS

20.12.3GEOGRAPHIC PRESENCE

20.12.4PRODUCT PORTFOLIO

20.12.5RECENT DEVELOPMENTS

20.13BIOCORP

20.13.1COMPANY OVERVIEW

20.13.2REVENUE ANALYSIS

20.13.3GEOGRAPHIC PRESENCE

20.13.4PRODUCT PORTFOLIO

20.13.5RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

21.RELATED REPORTS

22.CONCLUSION

23.QUESTIONNAIRE

24.ABOUT DATA BRIDGE MARKET RESEARCH

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.