Global Veterinary Care Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

83.77 Billion

USD

132.51 Billion

2022

2030

USD

83.77 Billion

USD

132.51 Billion

2022

2030

| 2023 –2030 | |

| USD 83.77 Billion | |

| USD 132.51 Billion | |

|

|

|

|

Global Veterinary Care Market, By Medicalization Type (No Medicalization, Basic Medicalization, Under Long Term Veterinary Care), Animal Type (Dogs, Cats, Horses, Cattle, Pigs, Poultry), End User (Veterinary Hospitals, Veterinary Clinics, Veterinary Laboratory Testing Services, Others), Product (Therapeutics, Diagnostics), Type of Care (Primary, Critical) – Industry Trends and Forecast to 2030.

Veterinary Care Market Analysis and Size

According to the American Pet Products Association's National Pet Owner Survey, the United States spent a total of USD 69.5 billion on the pet sector in 2017, and that figure is expected to rise to USD 103.6 billion by the end of 2020. This consistent increase in pet product spending in the U.S. reflects a growing trend among pet owners to spend more money to provide the finest experiences for their companion animals.

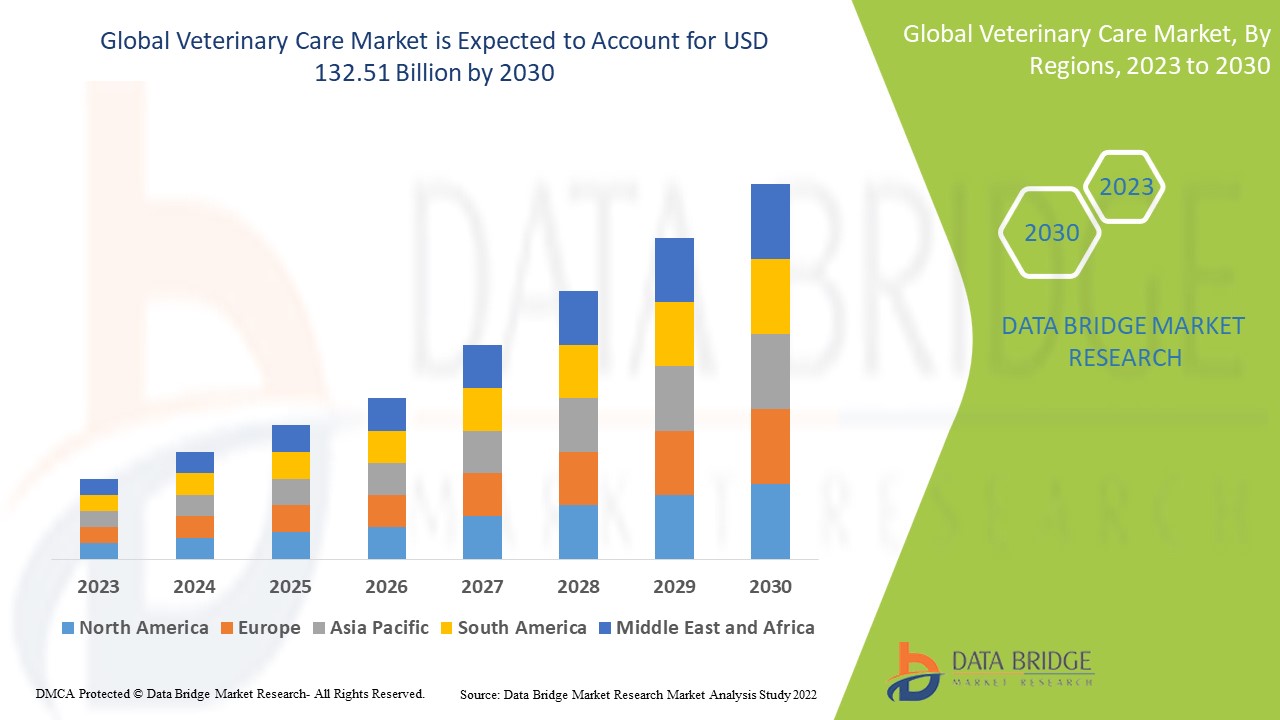

Data Bridge Market Research analyses that the veterinary care market which was USD 83.77 billion in 2022, is expected to reach USD 132.51 billion by 2030, at a CAGR of 5.9% during the forecast period 2023 to 2030. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Veterinary Care Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Medicalization Type (No Medicalization, Basic Medicalization, Under Long Term Veterinary Care), Animal Type (Dogs, Cats, Horses, Cattle, Pigs, Poultry), End User (Veterinary Hospitals, Veterinary Clinics, Veterinary Laboratory Testing Services, Others), Product (Therapeutics, Diagnostics, Type Of Care (Primary, Critical), Animal Type (Companion, Production) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

Zoetis (U.S.), Merck KGaA (Germany), Boehringer Ingelheim International GmbH. (Germany), Elanco (U.S.), Ceva (France), Phibro Animal Health Corporation (U.S.), Abaxis (U.S.), Virbac (France), IDEXX Laboratories, Inc. (U.S.), NEOGEN CORPORATION (U.S.), Heska Corporation (U.S.), MSD Animal Health (U.S.), Novartis AG (Switzerland), Cargill, Incorporated. (U.S.), DSM (Netherlands), Mars, Incorporated (U.S.) |

|

Market Opportunities |

|

Market Definition

Veterinary care is an essential component of any animal care and use programme. The veterinarian's primary responsibility is to monitor animals' health and clinical care in research, testing, teaching, and production. This includes monitoring and promoting animal well-being at all times during animal use and throughout the animal's life.

Global Veterinary Care Market Dynamics

Drivers

- Rise in veterinary services

According to an AmerisourceBergen Corporation report, veterinary services in the United States decreased by 31% in the first quarter of 2020 compared to the previous year. The vaccination programme has also been reduced by 19% over the last year. However, the market showed a V-shaped recovery in the second quarter of 2020, and clinics began to rebound as services increased by 10% in the second quarter of 2020 compared to last year. Senior wellness bloodwork showed the greatest positive growth of 24% over the previous year. The above-mentioned factors are boosting the market growth.

- Rising pet population

An increase in dog population and an increase in rabies deaths are expected to result in a large number of vaccination programmes, driving segment growth. Domestic dogs are among the most common virus reservoirs. They are the primary cause of human rabies deaths, accounting for nearly 99% of all rabies transmissions to individuals. Diagnostic services accounted for a sizable portion of the market, owing to rising demand for rapid tests and portable devices for Point-of-Care (POC) services. The aforementioned factors are anticipated to drive market growth during the forecast period.

Opportunities

- Collaborations and initiatives

The collaborative initiative brings together clinical care, disease surveillance, control, and education and research to improve epidemic management. During the forecast period, the rising number of government initiatives to promote better veterinary care are fuelling the market's overall growth. For instances, Ruminant Health and Welfare Group in September 2019 to provide an organized approach to addressing sheep and cattle health issues. Similarly, the Los Angeles County Department of Public Health's Veterinary Public Health Program launched the 2020 Healthy Pets Healthy Families Initiative to track trends in animal health and improve both animal and human health.

Restraints/Challenges

- High cost of tonometer devices

High cost of veterinary care and the low adoption rate in emerging and underdeveloped countries will obstruct the market's growth rate.

This veterinary care market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the veterinary care market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on the Veterinary Care Market

COVID-19 had a negative impact on the market. Furthermore, during the COVID-19 pandemic, many veterinary laboratories received a low number of animal samples for testing, negatively impacting market growth. Veterinary visits were also reduced in the first two quarters of 2020. Long before COVID-19, veterinary practises were confronted with an unhealthy level of attrition in the profession, with one-third of vets quitting just five years after qualifying due to the challenge of an unhealthy work/life balance. "COVID-19 has only heightened the risk factors." Vets were forced to close clinics except for emergencies and conduct phone consultations around family and other commitments at home. This compelled traditional brick-and-mortar veterinary practices to accelerate the implementation of online consultations and digital diagnosis.

Recent Developments

- In January 2021, Davies Veterinary Specialists in Hitchin and Southfields Veterinary Specialists in Essex, both in the United Kingdom, launched advanced veterinary dentistry and maxillofacial surgery services for pets. Such developments will also fuel market growth over the forecast period.

- In May 2022, Sri YS Jagan Mohan Reddy, Chief Minister of Andhra Pradesh, launched 175 Mobile Ambulatory Veterinary Clinics (MAVCs) with a Rs 278 crore investment. The State government intended to establish 340 Dr. YSR Sanchaara Pasu Aarogya Seva or Mobile Ambulatory Veterinary Clinics (MAVC) throughout the state to improve service delivery and make veterinary services provided by the animal husbandry department more easily accessible to the public.

Global Veterinary Care Market Scope

The veterinary care market is segmented on the basis of product, medicalization type, animal type, and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Medicalization Type

- No Medicalization

- Basic Medicalization

- Under Long Term Veterinary Care

Animal Type

- Dogs

- Cats

- Horses

- Cattle

- Pigs

- Poultry

End User

- Veterinary Hospitals

- Veterinary Clinics

- Veterinary Laboratory Testing Services

- Others

Product

- Therapeutics

- Vaccines

- Parasiticides

- Anti-infectives

- Medical Feed Additives

- Other Therapeutics

- Diagnostics

- Immunodiagnostic Tests

- Molecular Diagnostics

- Diagnostic Imaging

- Clinical Chemistry

- Other Diagnostics

Veterinary Care Market Regional Analysis/Insights

The veterinary care market is analyzed and market size insights and trends are provided by country, product, medicalization type, animal type, and end user as referenced above.

The countries covered in the veterinary care market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the veterinary care market due to the increasing advancement in animal healthcare facilities along with rising number of pet ownership.

Asia-Pacific is expected to grow at the highest growth rate in the forecast period of 2023 to 2030 due to the prevalence of various market players along with growth of the animal health industry in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Veterinary Care Market Share Analysis

The veterinary care market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to veterinary care market.

Some of the major players operating in the veterinary care market are:

- Zoetis (U.S.)

- Merck KGaA (Germany)

- Boehringer Ingelheim International GmbH. (Germany)

- Elanco (U.S.)

- Ceva (France)

- Phibro Animal Health Corporation (U.S.)

- Abaxis (U.S.)

- Virbac (France)

- IDEXX Laboratories, Inc. (U.S.)

- NEOGEN CORPORATION (U.S.)

- Heska Corporation (U.S.)

- MSD Animal Health (U.S.)

- Novartis AG (Switzerland)

- Cargill Incorporated (U.S.)

- DSM (Netherlands)

- Mars, Incorporated (U.S.)

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.