North America Interventional Cardiology Peripheral Vascular Devices Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

11.90 Billion

USD

21.69 Billion

2025

2033

USD

11.90 Billion

USD

21.69 Billion

2025

2033

| 2026 –2033 | |

| USD 11.90 Billion | |

| USD 21.69 Billion | |

|

|

|

|

Mercado de dispositivos vasculares periféricos e cardiologia intervencionista na América do Norte, por produto ( balões de angioplastia , stents, cateteres, enxertos de stent para reparo de aneurisma endovascular, filtros de veia cava inferior (VCI), dispositivos de modificação de placa, acessórios e dispositivos de alteração de fluxo hemodinâmico), tipo (convencional e padrão), procedimento (intervenção ilíaca, intervenções femoropoplíteas, intervenções tibiais (abaixo do joelho), angioplastia periférica, trombectomia arterial e aterectomia periférica), indicação ( doença arterial periférica e intervenção coronária), faixa etária (geriátrica, adulta e pediátrica), usuário final (hospitais, centros cirúrgicos ambulatoriais , instalações de enfermagem, clínicas e outros), canal de distribuição (licitação direta, distribuidores terceirizados e outros), país (EUA, Canadá e México), tendências e previsões do setor até 2029

Análise e Insights de Mercado: Mercado de Cardiologia Intervencionista e Dispositivos Vasculares Periféricos na América do Norte

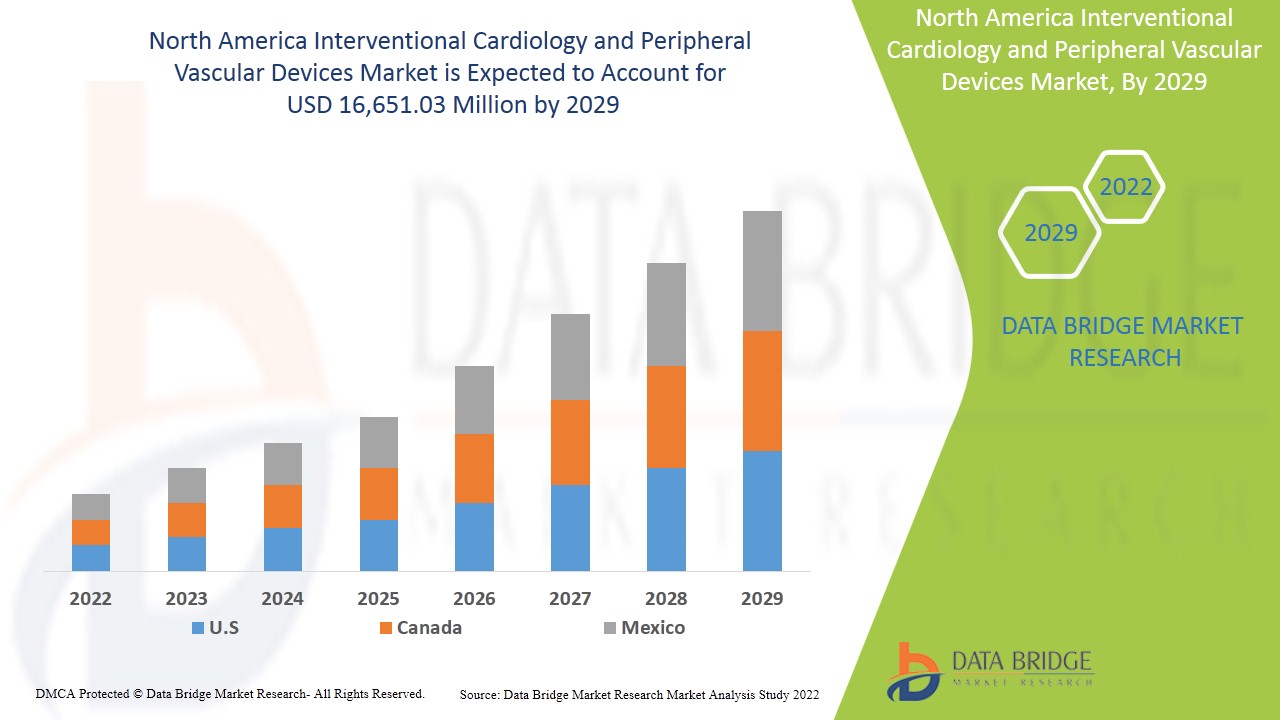

Espera-se que o mercado de cardiologia intervencionista e dispositivos vasculares periféricos da América do Norte ganhe crescimento de mercado no período previsto de 2022 a 2029. A Data Bridge Market Research analisa que o mercado está crescendo com um CAGR de 7,7% no período previsto de 2022 a 2029 e deve atingir US$ 16.651,03 milhões até 2029, de US$ 9.596,92 milhões em 2021. O aumento da prevalência de doenças arteriais coronárias , doença cardíaca isquêmica e doença vascular, o aumento da conscientização sobre o tratamento oportuno e o uso dos dispositivos provavelmente serão os principais impulsionadores que impulsionam a demanda do mercado no período previsto.

O termo cardiologia intervencionista é uma área da medicina dentro da subespecialidade de cardiologia e dispositivos vasculares periféricos que utiliza técnicas diagnósticas avançadas, convencionais e avançadas, além de outras, para avaliar o fluxo sanguíneo e a pressão nas artérias coronárias e câmaras do coração, bem como procedimentos técnicos e medicamentos para tratar anormalidades que prejudicam a função do sistema cardiovascular. A cardiologia intervencionista e os dispositivos vasculares periféricos são utilizados porque promovem mudanças no estilo de vida sedentário, reduzindo as complicações de doenças cardíacas crônicas, como doença arterial coronariana, doença cardíaca isquêmica e doenças vasculares.

A doença cardíaca coronária é a principal causa de morte entre as mulheres. O conhecimento sobre doenças cardíacas e vasculares pode contribuir para um estilo de vida saudável. A conscientização adequada sobre os sintomas e seus fatores de risco pode ajudar a reduzir a exposição da população a fatores de risco modificáveis e contribuir para estratégias de prevenção e controle. A conscientização sobre os sintomas das doenças cardiovasculares e vasculares resultaria em tratamento oportuno.

Os impulsionadores responsáveis pelo crescimento do mercado de cardiologia intervencionista e dispositivos vasculares periféricos na América do Norte são o aumento da prevalência de doenças arteriais coronárias, doença cardíaca isquêmica e doença vascular, o aumento da conscientização sobre o tratamento e uso oportunos dos dispositivos, os avanços tecnológicos na cardiologia e dispositivos vasculares periféricos, o aumento do interesse por cirurgias não invasivas e políticas de reembolso favoráveis. No entanto, os fatores que devem restringir o mercado são o aumento do custo dos dispositivos, os riscos observados durante o uso dos dispositivos, o aumento do recall de produtos e a disponibilidade de tratamentos alternativos. Por outro lado, iniciativas estratégicas de participantes do mercado, o aumento dos gastos com saúde e o aumento das atividades de pesquisa e desenvolvimento, e o crescimento da população geriátrica podem atuar como uma oportunidade para o crescimento do mercado de cardiologia intervencionista e dispositivos vasculares periféricos na América do Norte. A necessidade de expertise qualificada, a falta de infraestrutura hospitalar e aprovação regulatória podem criar desafios para o mercado de cardiologia intervencionista e dispositivos vasculares periféricos na América do Norte.

O relatório de mercado de cardiologia intervencionista e dispositivos vasculares periféricos na América do Norte fornece detalhes sobre participação de mercado, novos desenvolvimentos e análise do pipeline de produtos, impacto de participantes do mercado nacional e local, além de analisar oportunidades em termos de fontes de receita emergentes, mudanças nas regulamentações de mercado, aprovações de produtos, decisões estratégicas, lançamentos de produtos, expansões geográficas e inovações tecnológicas no mercado. Para entender a análise e o cenário de mercado, entre em contato conosco para um Briefing de Analista. Nossa equipe ajudará você a criar uma solução de impacto na receita para atingir sua meta desejada.

Escopo e tamanho do mercado de cardiologia intervencionista e dispositivos vasculares periféricos na América do Norte

O mercado de cardiologia intervencionista e dispositivos vasculares periféricos da América do Norte é categorizado em sete segmentos: produto, tipo, procedimento, indicação, faixa etária, usuário final e canal de distribuição.

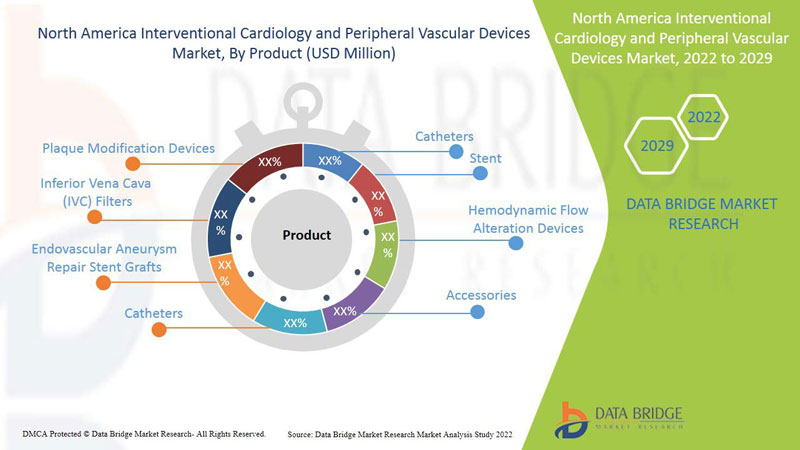

- Com base no produto, o mercado de cardiologia intervencionista e dispositivos vasculares periféricos na América do Norte é segmentado em balões de angioplastia, stents, cateteres, enxertos de stent para reparo endovascular de aneurismas, filtros de veia cava inferior (VCI), dispositivos de modificação de placa, acessórios e dispositivos de alteração do fluxo hemodinâmico. Em 2022, espera-se que o segmento de balões de angioplastia domine o mercado de cardiologia intervencionista e dispositivos vasculares periféricos na América do Norte devido ao aumento de casos de doenças arteriais periféricas, ao aumento do risco de sedentarismo, aos avanços tecnológicos nos balões de angioplastia e à existência de políticas de reembolso na área da saúde nos EUA para o tratamento de doenças cardíacas.

- Com base no tipo, o mercado de cardiologia intervencionista e dispositivos vasculares periféricos na América do Norte é segmentado em convencional e padrão. Em 2022, espera-se que o segmento convencional domine o mercado de cardiologia intervencionista e dispositivos vasculares periféricos na América do Norte devido à crescente prevalência de doenças cardiovasculares, como doenças das artérias coronárias e doenças da artéria carótida, e à disponibilidade e preferência por cardiologia intervencionista convencional e dispositivos vasculares periféricos por médicos e cardiologistas que trabalham em hospitais dos EUA e Canadá.

- Com base no procedimento, o mercado de cardiologia intervencionista e dispositivos vasculares periféricos na América do Norte é segmentado em intervenção ilíaca, intervenções femoropoplíteas, intervenções tibiais (abaixo do joelho), angioplastia periférica, trombectomia arterial e aterectomia periférica. Em 2022, espera-se que o segmento de angioplastia periférica domine o mercado de cardiologia intervencionista e dispositivos vasculares periféricos na América do Norte, devido ao avanço tecnológico da última década com dispositivos avançados de angioplastia periférica.

- Com base na indicação, o mercado de cardiologia intervencionista e dispositivos vasculares periféricos na América do Norte é segmentado em doença arterial periférica e intervenção coronária. Em 2022, espera-se que o segmento de doença arterial periférica domine o mercado de cardiologia intervencionista e dispositivos vasculares periféricos na América do Norte devido ao aumento das doenças arteriais periféricas, ao aumento da população idosa e ao aumento nas aprovações de produtos.

- Com base na faixa etária, o mercado de cardiologia intervencionista e dispositivos vasculares periféricos na América do Norte é segmentado em geriátrico, adulto e pediátrico. Em 2022, espera-se que o segmento geriátrico domine o mercado de cardiologia intervencionista e dispositivos vasculares periféricos na América do Norte. Nos EUA, esses segmentos são mais vulneráveis, com baixa imunidade a diversas doenças vasculares e disponibilidade de políticas de reembolso, como o Medicare, para tratamento da população idosa a custo mínimo.

- Com base no usuário final, o mercado de cardiologia intervencionista e dispositivos vasculares periféricos na América do Norte é segmentado em hospitais, centros cirúrgicos ambulatoriais, enfermarias, clínicas e outros. Em 2022, espera-se que o segmento hospitalar domine o mercado de cardiologia intervencionista e dispositivos vasculares periféricos na América do Norte, devido ao aumento de doenças cardíacas crônicas, como doença arterial coronariana e doenças vasculares, ao aumento de cirurgias, à disponibilidade de instalações hospitalares avançadas e ao aumento da conscientização sobre o tratamento de morbidades cardíacas crônicas em hospitais.

- Com base no canal de distribuição, o mercado de cardiologia intervencionista e dispositivos vasculares periféricos na América do Norte é segmentado em licitações diretas, distribuidores terceirizados e outros. Em 2022, espera-se que o segmento de distribuidores terceirizados domine o mercado de cardiologia intervencionista e dispositivos vasculares periféricos na América do Norte devido à crescente preferência do consumidor, aos baixos preços de aquisição e à redução de custos.

Análise do mercado de dispositivos vasculares periféricos e cardiologia intervencionista na América do Norte em nível de país

O mercado de cardiologia intervencionista e dispositivos vasculares periféricos da América do Norte é analisado e informações sobre o tamanho do mercado são fornecidas por produto, tipo, procedimento, indicação, faixa etária, usuário final e canal de distribuição.

Os países abrangidos pelo relatório de mercado de cardiologia intervencionista e dispositivos vasculares periféricos da América do Norte são EUA, Canadá e México.

- Em 2022, espera-se que os EUA dominem o mercado devido à presença do maior mercado consumidor, com PIB elevado. Além disso, os EUA têm os maiores gastos familiares do mundo e oferecem acordos comerciais com diversos países, tornando-se o maior mercado para produtos de consumo, com aumento da população de pacientes, presença de grandes players do mercado e maior avanço tecnológico na região.

A seção sobre países do relatório também apresenta fatores individuais que impactam o mercado e mudanças na regulamentação do mercado doméstico que impactam as tendências atuais e futuras do mercado. Dados como novas vendas, vendas de reposição, demografia do país, regulamentações e tarifas de importação e exportação são alguns dos principais indicadores utilizados para prever o cenário de mercado para cada país. Além disso, a presença e a disponibilidade de marcas norte-americanas e seus desafios enfrentados devido à concorrência grande ou escassa de marcas locais e nacionais, bem como o impacto dos canais de vendas, são considerados na análise de previsão dos dados do país.

O potencial de crescimento da cardiologia intervencionista e dos dispositivos vasculares periféricos nas economias emergentes e as iniciativas estratégicas dos participantes do mercado estão criando novas oportunidades no mercado de cardiologia intervencionista e dispositivos vasculares periféricos na América do Norte.

O mercado de cardiologia intervencionista e dispositivos vasculares periféricos da América do Norte também oferece uma análise detalhada do crescimento de cada país em um setor específico, com informações sobre as vendas de cardiologia intervencionista e dispositivos vasculares periféricos, o impacto dos avanços na área e as mudanças nos cenários regulatórios, com o suporte necessário para o mercado de cardiologia intervencionista e dispositivos vasculares periféricos. Os dados estão disponíveis para o período histórico de 2019 a 2021.

Análise do cenário competitivo e da participação de mercado de dispositivos vasculares periféricos e cardiologia intervencionista na América do Norte

O cenário competitivo do mercado de cardiologia intervencionista e dispositivos vasculares periféricos na América do Norte fornece detalhes por concorrente. Os detalhes incluem visão geral da empresa, finanças, receita gerada, potencial de mercado, investimento em pesquisa e desenvolvimento, novas iniciativas de mercado, locais e instalações de produção, pontos fortes e fracos da empresa, lançamento de produtos, pipelines de testes de produtos, aprovações de produtos, patentes, abrangência e amplitude do produto, domínio da aplicação e curva de vida da tecnologia. Os pontos de dados fornecidos acima referem-se apenas ao foco da empresa no mercado de cardiologia intervencionista e dispositivos vasculares periféricos.

Algumas das principais empresas que fornecem cardiologia intervencionista e dispositivos vasculares periféricos são Medtronic, BD., Cordis., Abbott., Boston Scientific Corporation, Cook, Cardiovascular Systems, Inc., AngioDynamics., Edwards Lifesciences Corporation., Biosensors International Group, Ltd., OrbusNeich Medical Company Limited, Merit Medical Systems., Terumo Medical Corporation, B. Braun Melsungen AG, MicroPort Scientific Corporation, Lepu Medical Technology(Beijing)Co.,Ltd e Koninklijke Philips NV, entre outras.

Os analistas do DBMR entendem os pontos fortes competitivos e fornecem análises competitivas para cada concorrente separadamente.

As iniciativas estratégicas dos participantes do mercado, juntamente com os novos avanços tecnológicos para cardiologia intervencionista e dispositivos vasculares periféricos na América do Norte, estão preenchendo a lacuna para o tratamento de feridas crônicas.

Por exemplo,

- Em janeiro de 2022, a OrbusNeich Medical Co. Ltd. anunciou o lançamento de seu novo produto, o "Scoreflex NC", com aprovação prévia (PMA) da Food and Drug Administration (FDA) dos EUA. Trata-se de um cateter destinado a ser utilizado como cateter de dilatação na porção estenótica da estenose da artéria coronária, expandindo assim sua linha de produtos para o mercado.

A colaboração, joint ventures e outras estratégias do participante do mercado estão aumentando o mercado da empresa no mercado de cardiologia intervencionista e dispositivos vasculares periféricos, o que também traz o benefício para a organização melhorar sua oferta para o mercado de cardiologia intervencionista e dispositivos vasculares periféricos da América do Norte.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.