Saudi Arabia Turkey And Egypt In Vitro Diagnostics Ivd Quality Control Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

867.09 Thousand

USD

1,260.66 Thousand

2022

2030

USD

867.09 Thousand

USD

1,260.66 Thousand

2022

2030

| 2023 –2030 | |

| USD 867.09 Thousand | |

| USD 1,260.66 Thousand | |

|

|

|

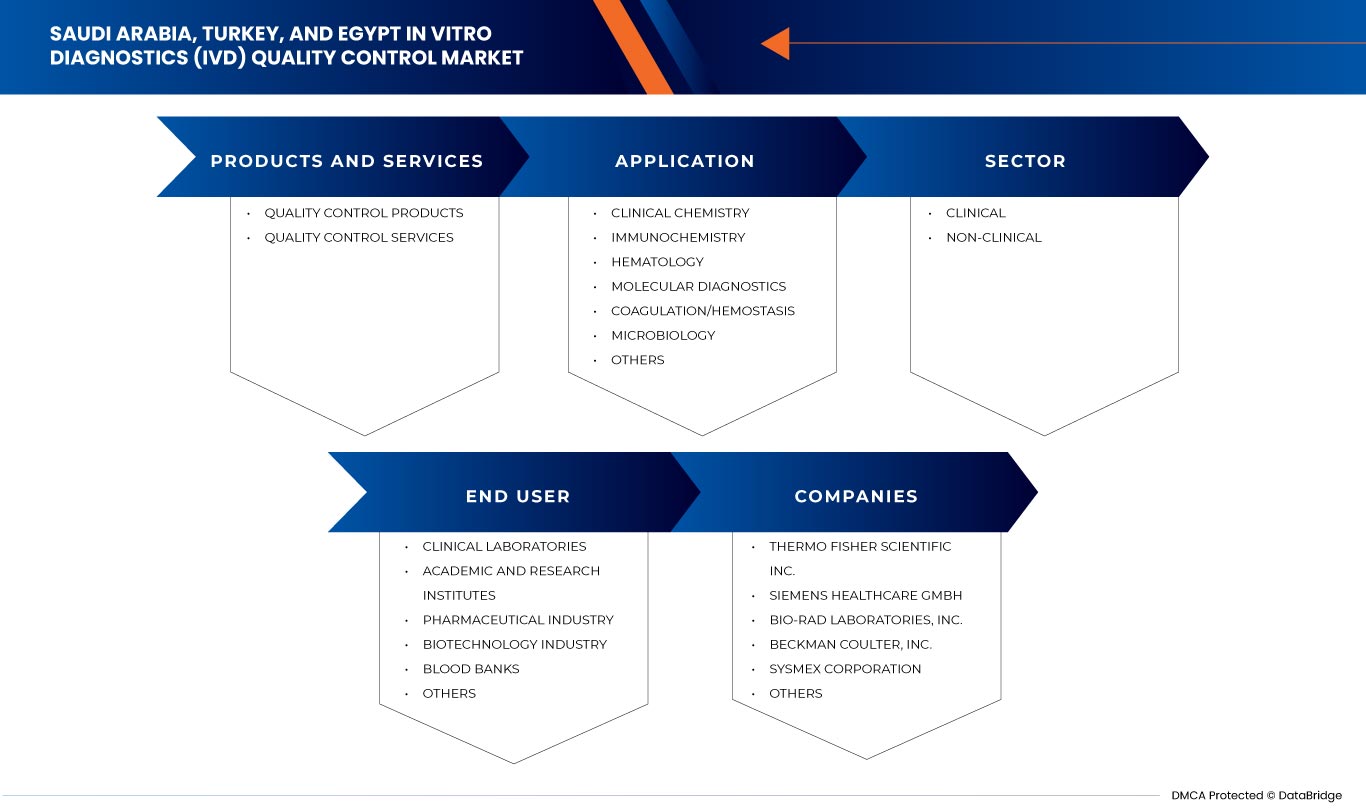

Saudi Arabia, Turkey, and Egypt In Vitro Diagnostics (IVD) Quality Control Market, By Product and Services (Quality Control Products and Quality Control Services), Application (Clinical Chemistry, Immunochemistry, Hematology, Molecular Diagnostics, Coagulation/Hemostasis, Microbiology, and Others), Sector (Clinical and Non-Clinical), End User (Clinical Laboratories, Academic and Research Institutes, Blood Banks, Biotechnology Industry, Pharmaceutical Industry, and Others)-Industry Trends and Forecast to 2030.

Saudi Arabia, Turkey, and Egypt in Vitro Diagnostics (IVD) Quality Control Market Analysis and Size

The rising prevalence of chronic diseases across Saudi Arabia, Turkey, and Egypt has enhanced the market demand. The rising healthcare expenditure for better health services also contributes to the market's growth. The major market players focus on various product launches and approvals during this crucial period. In addition, the increase in improved quality control services also contributes to the rising demand for the IVD quality control market.

Saudi Arabia, Turkey, and Egypt In vitro diagnostics (IVD) quality control market is expected to gain market growth in the forecast period of 2023 to 2030. Data Bridge Market Research analyses that the market is growing with a CAGR of 4.8% in the forecast period of 2023 to 2030 and is expected to reach USD 1,260.66 thousand by 2030 from USD 867.09 thousand in 2022.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Thousand |

|

Segments Covered |

Product and Services (Quality Control Products and Quality Control Services), Application (Clinical Chemistry, Immunochemistry, Hematology, Molecular Diagnostics, Coagulation/Hemostasis, Microbiology, and Others), Sector (Clinical and Non-Clinical), End User (Clinical Laboratories, Academic and Research Institutes, Blood Banks, Biotechnology Industry, Pharmaceutical Industry, and Others) |

|

Countries Covered |

Saudi Arabia, Turkey, and Egypt |

|

Market Players Covered |

The major companies which are dealing in the market are Bio-Rad Laboratories, Inc, Siemens Healthcare Private Limited, Sysmex Europe SE, Randox Laboratories Ltd., Sera Care, Thermo Fisher Scientific Inc., Beckman Coulter, Inc., Technopath Clinical Diagnostics, DiaSorin S.p.A., Agappe Diagnostics Ltd, and Spectrum Diagnostics. among others |

Market Definition

In vitro diagnostic products are those reagents, instruments, and systems intended for use in the diagnosis of disease or other conditions, including a determination of the state of health, in order to cure, mitigate, treat, or prevent disease or its sequelae. Such products are intended for use in the collection, preparation, and examination of specimens taken from the human body.

IVD quality controls are samples/materials used to validate the reliability of the IVD testing system to ensure the accuracy of test results and evaluate the impact of factors such as environmental conditions and operator’s performance on test results. Moreover, they can also be used to monitor a patient’s health, cure diseases, and also enable medical professionals to identify the most effective treatment procedure or therapy for the patient.

In Vitro Diagnostics (IVD) Quality Control Market Dynamics

This section deals with understanding the market drivers, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Rising Prevalence of Chronic Diseases Across Saudi Arabia, Turkey, and Egypt

Chronic diseases and conditions are on the rise globally. An aging population and a sedentary lifestyle are contributing to a steady increase in long-term health problems. An increasing prevalence of chronic and infectious diseases has led to the launch of rapid diagnostic and testing tools by leading market players. Besides, the rising adoption of self-test and point-of-care devices is further accelerating the growth of in-vitro diagnostics devices across the globe

Thus, the increasing number of chronic disease are expected to accelerate the growth of the IVD quality control market significantly in the nearby future.

- Rising Adoption of Quality Control Solutions in Laboratories and Hospitals

Laboratory testing of patient samples can be a complex procedure, depending on clinical analysis, microbiological study, or blood banking testing among other facets of the clinical laboratory. Quality control (QC) is one of the most important impacts on laboratory testing-it ensures both the precision and accuracy of patient sample results. The integrity of quality control samples is important to both management of overall quality as well as to meeting requirements of proficiency testing.

Thus, the rising adoption of quality control solutions in laboratories and hospitals is expected to drive the market growth.

Opportunities

-

Rise in Strategic Acquisition and Partnership among Organizations

Recently, different organizations are stepping forward for partnership and collaboration to develop IVDs that are essential for detecting diseases. Not only can this, with the help of partnerships and agreements, both the companies develop a new suite of technologies and platforms that will help to detect diseases.

With the help of a long-term agreement, both companies can provide dimensional pricing IVDs in response to consumer demand in the market. Such partnership and mutual agreement not only benefit both the companies but are also creating a lot of opportunities for the market to grow.

-

Rising Research and Development Activities

Across the globe, the spending on research and development activities is escalating owing to public health expenditure with economic performance. Whereas, the healthcare industry ranks second among all industries when it comes to the amount it spends on research and development. Rising healthcare expenditure has further resulted in better provision of research and development opportunities. Consequently, it has enhanced the demand for IVD regulatory affairs outsourcing services across the region.

Restraints/Challenges

- High Cost Related to Quality Control and Maintenance of IVD

In vitro diagnostics (IVD) are tests done on samples such as blood or tissue that have been taken from the human body. In vitro diagnostics can detect diseases or other conditions, and can be used to monitor a person's overall health to help cure, treat, or prevent diseases.

IVD of analytes originating from body specimens, including blood and tissue biopsies, is used alone or in combination with clinical investigations and is perceived as an important tool for high-quality medical outcomes, hence maintaining of IVD and quality control of IVD devices costs high for carrying out accurate tests.

Hence, the rising cost of the maintenance of IVD has become a deciding factor for the companies in the servicing process, which is further restraining the growth of the market to an extent.

- Stringent Regulations Regarding IVD in Saudi Arabia, Turkey, and Egypt

The use of IVDs across the globe is rapidly increasing, with the growth of the aged population and several chronic diseases which are preventable by early diagnosis and timely treatments. At the same time, the players of the IVD devices in the market have to follow certain regulations to get approval from the upper authorities for the launching of the product in a region. These stringent guidelines need to be followed, and this is one of the most difficult tasks among all the steps. The pre-market approval of various medical devices varies from one country to another.

Therefore, the stringent rules & regulations for product approval act as restraints for the growth of the market.

Recent Development

- In February 2023, Siemens Healthineers, a leading medical technology company, and Unilabs, a leading diagnostic services provider, announced a multi-year agreement valued at over €200 thousand. Unilabs has invested in Siemens Healthineers top-notch technology and will acquire more than 400 laboratory analyzers to further improve its laboratory infrastructure to offer an unparalleled service to its customers. This partnership has helped for latest diagnostic testing infrastructure to improve patients’ care.

- In July 2021, Thermo Fisher Scientific, the world leader in serving science, announced a collaboration with Ortho Clinical Diagnostics to promote and distribute Thermo Scientific MAS Quality Controls and LabLink xL Quality Assurance Software for use with Ortho Clinical Diagnostics VITROS analyzers. This has helped the company to increase their global presence in the market.

Saudi Arabia, Turkey, and Egypt in Vitro Diagnostics (IVD) Quality Control Market Scope

Saudi Arabia, Turkey, and Egypt in vitro diagnostics (IVD) quality control market is segmented into four notable segments such as product and services, application, type, sector and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Product and Services

- Quality Control Products

- Quality Control Services

On the basis of products and services, the Saudi Arabia, Turkey, and Egypt In vitro diagnostics (IVD) quality control market is segmented into quality control products and quality control services.

Applications

- Clinical Chemistry

- Immunochemistry

- Hematology

- Molecular Diagnostics

- Coagulation/Hemostasis

- Microbiology

- Others

Based on applications, the Saudi Arabia, Turkey, and Egypt In vitro diagnostics (IVD) quality control market is segmented into clinical chemistry, immunochemistry, hematology, molecular diagnostics, coagulation/hemostasis, microbiology, and others.

Sector

- Clinical

- Non-Clinical

Based on sector, the Saudi Arabia, Turkey, and Egypt In vitro diagnostics (IVD) quality control market is segmented into clinical and non-clinical.

End User

- Clinical Laboratories

- Academic And Research Institutes

- Blood Banks

- Biotechnology Industry

- Pharmaceutical Industry

- Others

Based on end users, the Saudi Arabia, Turkey, and Egypt In vitro diagnostics (IVD) quality control market is segmented into clinical laboratories, academic and research institutes, blood banks, biotechnology industry, pharmaceutical industry, and others.

Competitive Landscape and In Vitro Diagnostics (IVD) Quality Control Market Share Analysis

The in vitro diagnostics (IVD) quality control market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on the ataxia market.

Some of the major players operating in the In vitro diagnostics (IVD) quality control market are Bio-Rad Laboratories, Inc, Siemens Healthcare Private Limited, Sysmex Europe SE, Randox Laboratories Ltd., Sera Care, Thermo Fisher Scientific Inc., Beckman Coulter, Inc., Technopath Clinical Diagnostics, DiaSorin S.p.A., Agappe Diagnostics Ltd, and Spectrum Diagnostics. among others.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF SAUDI ARABIA, TURKEY, AND EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 SAUDI ARABIA PRODUCTS AND SERVICES, LIFELINE CURVE

2.8 EGYPT PRODUCTS AND SERVICES, LIFELINE CURVE

2.9 TURKEY PRODUCTS AND SERVICES, LIFELINE CURVE

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET TESTING TYPE COVERAGE GRID

2.13 VENDOR SHARE ANALYSIS

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL'S MODEL

4.2 PORTER'S 5 FORCES

4.3 INDUSTRY INSIGHTS

5 REGULATORY GUIDELINES FOR IN VITRO DIAGNOSTICS QUALITY CONTROL

5.1 REGULATIONS IN SAUDI ARABIA

5.2 REGULATIONS IN TURKEY

5.3 REGULATIONS IN EGYPT

5.3.1 MEDICAL DEVICE REGISTRATION IN EGYPT, THE PROCESS IN BRIEF:

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING PREVALENCE OF CHRONIC DISEASES ACROSS SAUDI ARABIA, TURKEY, AND EGYPT

6.1.2 RISING ADOPTION OF QUALITY CONTROL SOLUTIONS IN LABORATORIES AND HOSPITALS

6.1.3 ADVANCEMENTS IN TECHNOLOGY LEADING TO THE DEVELOPMENT OF NEW AND ADVANCED DIAGNOSTIC PRODUCTS

6.1.4 RISING USE OF QUALITY CONTROL IN MOLECULAR DIAGNOSTICS

6.2 RESTRAINTS

6.2.1 HIGH COST RELATED TO QUALITY CONTROL AND MAINTENANCE OF IVD

6.2.2 STRINGENT REGULATIONS REGARDING IVD IN SAUDI ARABIA, TURKEY, AND EGYPT

6.3 OPPORTUNITIES

6.3.1 RISE IN STRATEGIC ACQUISITION AND PARTNERSHIP AMONG ORGANIZATIONS

6.3.2 RISING RESEARCH AND DEVELOPMENT ACTIVITIES

6.4 CHALLENGES

6.4.1 LACK OF INFRASTRUCTURE IN HEALTHCARE SERVICE

6.4.2 SHORTAGE OF SKILLED PERSONNEL FOR HANDLING QUALITY CONTROL OF IN VITRO DIAGNOSTIC DEVICES.

7 SAUDI ARABIA, TURKEY, AND EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY PRODUCT AND SERVICES

7.1 OVERVIEW

7.2 QUALITY CONTROL PRODUCTS

7.2.1 SERUM/PLASMA-BASED CONTROL

7.2.2 WHOLE BLOOD-BASED CONTROLS

7.2.3 URINE-BASED CONTROLS

7.2.4 OTHER CONTROLS

7.2.5 INTERNAL QUALITY CONTROL

7.2.6 EXTERNAL QUALITY CONTROL

7.3 QUALITY CONTROL SERVICES

8 SAUDI ARABIA, TURKEY, AND EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 CLINICAL CHEMISTRY

8.3 IMMUNOCHEMISTRY

8.4 HEMATOLOGY

8.5 MOLECULAR DIAGNOSTICS

8.5.1 QUALITY CONTROL PRODUCTS

8.5.1.1 INTERNAL QUALITY CONTROL

8.5.1.2 EXTERNAL QUALITY CONTROL

8.5.2 QUALITY CONTROL SERVICES

8.6 COAGULATION/HEMOSTASIS

8.7 MICROBIOLOGY

8.8 OTHERS

9 SAUDI ARABIA, TURKEY, AND EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY SECTOR

9.1 OVERVIEW

9.2 CLINICAL

9.3 NON-CLINICAL

10 SAUDI ARABIA, TURKEY, AND EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY END USER

10.1 OVERVIEW

10.2 CLINICAL LABORATORIES

10.3 ACADEMIC AND RESEARCH INSTITUTES

10.4 PHARMACEUTICAL INDUSTRY

10.5 BIOTECHNOLOGY INDUSTRY

10.6 BLOOD BANKS

10.7 OTHERS

11 SAUDI ARABIA, TURKEY, AND EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: SAUDI ARABIA

11.2 COMPANY SHARE ANALYSIS: EGYPT

11.3 COMPANY SHARE ANALYSIS: TURKEY

12 SWOT ANALYSIS

13 TURKEY IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, COMPANY PROFILES

13.1 THERMO FISHER SCIENTIFIC INC.

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT DEVELOPMENTS

13.2 SIEMENS HEALTHCARE GMBH

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT DEVELOPMENT

13.3 BIO-RAD LABORATORIES, INC.

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT DEVELOPMENT

13.4 BECKMAN COULTER, INC.

13.4.1 COMPANY SNAPSHOT

13.4.2 PRODUCT PORTFOLIO

13.4.3 RECENT DEVELOPMENT

13.5 SYSMEX CORPORATION

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT DEVELOPMENT

13.6 AGAPPE DIAGNOSTICS LTD

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENT

13.7 DIASORIN MOLECULAR LLC.

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENT

13.8 RANDOX LABORATORIES LTD.

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENT

13.9 SERA CARE

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 SPECTRUM DIAGNOSTICS

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENT

13.11 TECHNOPATH CLINICAL DIAGNOSTICS

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

Lista de Figura

FIGURE 1 SAUDI ARABIA, TURKEY, AND EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET: SEGMENTATION

FIGURE 2 SAUDI ARABIA, TURKEY, AND EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET: DATA TRIANGULATION

FIGURE 3 SAUDI ARABIA, TURKEY, AND EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET: DROC ANALYSIS

FIGURE 4 SAUDI ARABIA IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET: COUNTRY MARKET ANALYSIS

FIGURE 5 EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET: COUNTRY MARKET ANALYSIS

FIGURE 6 TURKEYS IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET: COUNTRY MARKET ANALYSIS

FIGURE 7 SAUDI ARABIA, TURKEY, AND EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 8 SAUDI ARABIA, TURKEY, AND EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 SAUDI ARABIA, TURKEY, AND EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET: DBMR MARKET POSITION GRID

FIGURE 10 SAUDI ARABIA, TURKEY, AND EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET: MARKET TESTING TYPE COVERAGE GRID

FIGURE 11 SAUDI ARABIA, TURKEY, AND EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 SAUDI ARABIA, TURKEY, AND EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET: SEGMENTATION

FIGURE 13 RISING PREVALENCE OF CHRONIC DISEASES ACROSS SAUDI ARABIA IS EXPECTED TO DRIVE THE SAUDI ARABIA IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET IN THE FORECAST PERIOD

FIGURE 14 RISING ADOPTION OF QUALITY CONTROL SOLUTIONS IN LABORATORIES AND HOSPITALS IS EXPECTED TO DRIVE THE TURKEY IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET IN THE FORECAST PERIOD IN THE FORECAST PERIOD

FIGURE 15 ADVANCEMENTS IN TECHNOLOGY LEADING TO THE DEVELOPMENT OF NEW AND ADVANCED DIAGNOSTIC PRODUCTS ARE EXPECTED TO DRIVE THE EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET IN THE FORECAST PERIOD IN THE FORECAST PERIOD

FIGURE 16 THE PRODUCT AND SERVICES TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE SAUDI ARABIA IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET IN 2023 & 2030

FIGURE 17 THE PRODUCT AND SERVICES TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE TURKEY IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET IN 2023 & 2030

FIGURE 18 THE PRODUCT AND SERVICES TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET IN 2023 & 2030

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF SAUDI ARABIA, TURKEY, AND EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET

FIGURE 20 SAUDI ARABIA, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY PRODUCTS AND SERVICES, 2022

FIGURE 21 TURKEY, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY PRODUCTS AND SERVICES, 2022

FIGURE 22 EGYPT, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY PRODUCTS AND SERVICES, 2022

FIGURE 23 SAUDI ARABIA IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY PRODUCTS AND SERVICES, 2023-2030 (USD THOUSAND)

FIGURE 24 TURKEY IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY PRODUCTS AND SERVICES, 2023-2030 (USD THOUSAND)

FIGURE 25 EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY PRODUCTS AND SERVICES, 2023-2030 (USD THOUSAND)

FIGURE 26 SAUDI ARABIA IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY PRODUCTS AND SERVICES, CAGR (2023-2030)

FIGURE 27 TURKEY IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY PRODUCTS AND SERVICES, CAGR (2023-2030)

FIGURE 28 EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY PRODUCTS AND SERVICES, CAGR (2023-2030)

FIGURE 29 SAUDI ARABIA, TURKEY AND EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY PRODUCTS AND SERVICES, LIFELINE CURVE

FIGURE 30 TURKEY IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY PRODUCTS AND SERVICES, LIFELINE CURVE

FIGURE 31 EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY PRODUCTS AND SERVICES, LIFELINE CURVE

FIGURE 32 SAUDI ARABIA IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY APPLICATION, 2022

FIGURE 33 TURKEY IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY APPLICATION, 2022

FIGURE 34 EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY APPLICATION, 2022

FIGURE 35 SAUDI ARABIA IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY APPLICATION, 2023-2030 (USD THOUSAND)

FIGURE 36 TURKEY IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY APPLICATION, 2023-2030 (USD THOUSAND)

FIGURE 37 EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY APPLICATION, 2023-2030 (USD THOUSAND)

FIGURE 38 SAUDI ARABIA, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY APPLICATION, CAGR (2023-2030)

FIGURE 39 TURKEY, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY APPLICATION, CAGR (2023-2030)

FIGURE 40 EGYPT, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY APPLICATION, CAGR (2023-2030)

FIGURE 41 SAUDI ARABIA, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY APPLICATION, LIFELINE CURVE

FIGURE 42 TURKEY, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY APPLICATION, LIFELINE CURVE

FIGURE 43 EGYPT, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY APPLICATION, LIFELINE CURVE

FIGURE 44 SAUDI ARABIA, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY SECTOR, 2022

FIGURE 45 TURKEY, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY SECTOR, 2022

FIGURE 46 EGYPT, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY SECTOR, 2022

FIGURE 47 SAUDI ARABIA, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY SECTOR, 2023-2030 (USD THOUSAND)

FIGURE 48 TURKEY, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY SECTOR, 2023-2030 (USD THOUSAND)

FIGURE 49 EGYPT, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY SECTOR, 2023-2030 (USD THOUSAND)

FIGURE 50 SAUDI ARABIA IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY SECTOR, CAGR (2023-2030)

FIGURE 51 TURKEY IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY SECTOR, CAGR (2023-2030)

FIGURE 52 EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY SECTOR, CAGR (2023-2030)

FIGURE 53 SAUDI ARABIA, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY SECTOR, LIFELINE CURVE

FIGURE 54 TURKEY IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY SECTOR, LIFELINE CURVE

FIGURE 55 EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY SECTOR, LIFELINE CURVE

FIGURE 56 SAUDI ARABIA, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY END USER, 2022

FIGURE 57 TURKEY IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY END USER, 2022

FIGURE 58 EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY END USER, 2022

FIGURE 59 SAUDI ARABIA, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY END USER, 2023-2030 (USD THOUSAND)

FIGURE 60 TURKEY, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY END USER, 2023-2030 (USD THOUSAND)

FIGURE 61 EGYPT, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY END USER, 2023-2030 (USD THOUSAND)

FIGURE 62 SAUDI ARABIA IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY END USER, CAGR (2023-2030)

FIGURE 63 TURKEY IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY END USER, CAGR (2023-2030)

FIGURE 64 EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY END USER, CAGR (2023-2030)

FIGURE 65 SAUDI ARABIA, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY END USER, LIFELINE CURVE

FIGURE 66 TURKEY, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY END USER, LIFELINE CURVE

FIGURE 67 EGYPT, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY END USER, LIFELINE CURVE

FIGURE 68 SAUDI ARABIA IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET: COMPANY SHARE 2022 (%)

FIGURE 69 EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET: COMPANY SHARE 2022 (%)

FIGURE 70 TURKEY IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET: COMPANY SHARE 2022 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.