Global Ruminant Methane Reduction Market

Market Size in USD Billion

CAGR :

%

USD

3.18 Billion

USD

5.72 Billion

2024

2932

USD

3.18 Billion

USD

5.72 Billion

2024

2932

| 2025 –2932 | |

| USD 3.18 Billion | |

| USD 5.72 Billion | |

|

|

|

|

Ruminant Methane Reduction Market Size

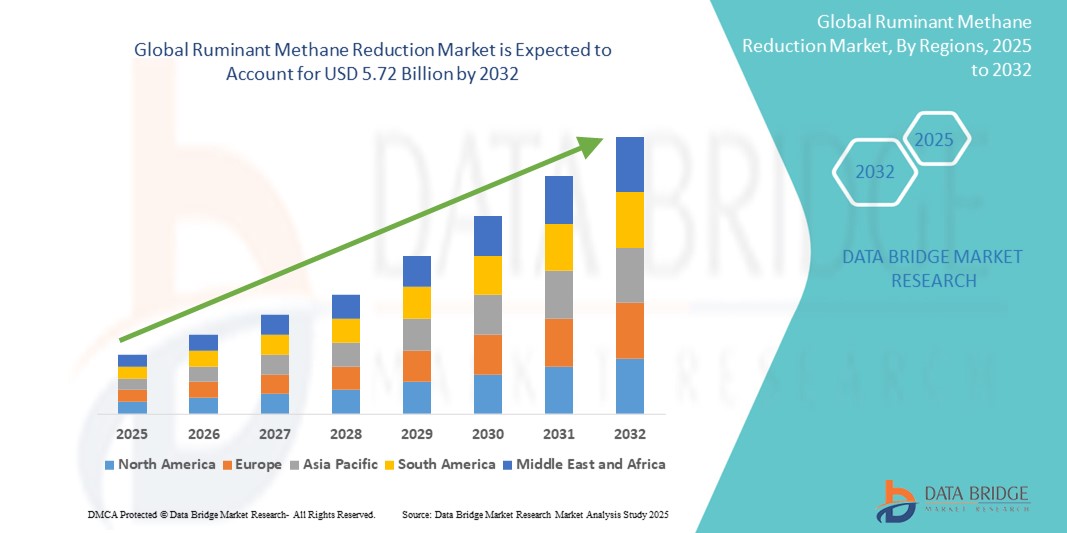

- The global ruminant methane reduction market size was valued at USD 3.18 billion in 2024 and is expected to reach USD 5.72 billion by 2032, at a CAGR of 7.6% during the forecast period

- The market growth is primarily driven by increasing global awareness of climate change, stringent regulations on greenhouse gas emissions, and advancements in feed additives and biotechnology solutions aimed at reducing methane emissions from ruminant livestock

- Growing demand for sustainable livestock farming practices and rising investments in agricultural innovation are further propelling the adoption of methane reduction solutions across commercial and small-scale farming operations

Ruminant Methane Reduction Market Analysis

- Ruminant methane reduction solutions, including feed additives, genetic modifications, and improved management practices, are critical for mitigating greenhouse gas emissions from livestock, particularly cattle, which are a significant source of methane due to enteric fermentation

- The market is fueled by rising environmental concerns, government initiatives to achieve net-zero emissions, and consumer demand for sustainably produced meat and dairy products

- North America dominated the ruminant methane reduction market with the largest revenue share of 38.5% in 2024, driven by advanced agricultural research, widespread adoption of innovative feed additives, and supportive regulatory frameworks in the U.S. and Canada

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, propelled by increasing livestock production, rising awareness of sustainable farming, and growing investments in agricultural technology in countries like China, India, and Australia

- The feed additives segment dominated the largest market share of 45.3% in 2024, attributed to their proven efficacy in reducing methane emissions and ease of integration into existing livestock feeding systems

Report Scope and Ruminant Methane Reduction Market Segmentation

|

Attributes |

Ruminant Methane Reduction Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ruminant Methane Reduction Market Trends

“Increasing Integration of Precision Livestock Farming and Advanced Feed Technologies”

- The global ruminant methane reduction market is experiencing a notable trend toward the integration of precision livestock farming (PLF) and advanced feed technologies

- These technologies enable precise monitoring and management of livestock diets, optimizing feed formulations to reduce methane emissions while maintaining animal health and productivity

- AI-driven platforms and IoT-based solutions are being developed to analyze rumen fermentation patterns and adjust feed additives in real time, enhancing methane reduction efficiency

- For instance, companies are leveraging data analytics to tailor feed additives, such as methane inhibitors such as 3-nitrooxypropanol (3-NOP), to specific animal types or environmental conditions, improving outcomes for cattle, sheep, and goats

- This trend is increasing the appeal of methane reduction solutions for both large-scale livestock operations and smaller farms, driving adoption across diverse agricultural systems

- Advanced sensors and monitoring systems can track methane output, feed intake, and animal behavior, enabling farmers to make data-driven decisions to minimize environmental impact

Ruminant Methane Reduction Market Dynamics

Driver

“Rising Demand for Sustainable Agriculture and Regulatory Support for Emissions Reduction”

- Growing global awareness of climate change and the environmental impact of livestock farming is a key driver for the ruminant methane reduction market

- Methane, a potent greenhouse gas with a global warming potential 28 times greater than carbon dioxide, is produced during enteric fermentation in ruminants such as cattle, sheep, and goats, prompting demand for reduction solutions

- Government regulations and incentives, particularly in North America and Europe, are promoting the adoption of methane-reducing technologies, such as feed additives and dietary supplements, to meet emissions reduction targets

- The proliferation of precision agriculture technologies and advancements in feed formulations, including plant-based and chemical methane inhibitors, are enabling more effective and sustainable livestock management

- Major companies, such as DSM and Elanco Animal Health, are increasingly offering innovative feed additives such as Bovaer, which can reduce methane emissions by up to 30% in dairy cattle, aligning with consumer and regulatory expectations for eco-friendly farming practices

Restraint/Challenge

“High Costs of Methane Reduction Solutions and Adoption Barriers in Small-Scale Farming”

- The high initial costs of developing, producing, and implementing methane-reducing feed additives, supplements, and monitoring technologies pose a significant barrier, particularly for small-scale farmers in emerging markets

- Integrating advanced solutions, such as IoT-based methane monitoring systems or specialized feed formulations, into existing livestock operations can be complex and expensive

- Concerns about the long-term effects of methane inhibitors, such as 3-NOP or Asparagopsis seaweed, on animal health and productivity may deter adoption, as farmers prioritize maintaining livestock performance

- The lack of standardized global regulations for methane reduction technologies and varying levels of awareness about their benefits create challenges for market expansion, especially in regions with less developed agricultural infrastructure

- These factors can limit the scalability of methane reduction solutions, particularly in Asia-Pacific and other regions where smallholder farms dominate, despite the region's rapid market growth

Ruminant Methane Reduction market Scope

The market is segmented on the basis of product, type, application, and end use.

- By Product

On the basis of product, the global ruminant methane reduction market is segmented into feed additives, genetic & breeding solutions, management practices, biotechnology solutions, and other solutions. The feed additives segment dominated the largest market share of 45.3% in 2024, attributed to their proven efficacy in reducing methane emissions and ease of integration into existing livestock feeding systems.

The biotechnology solutions segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by advancements in microbial interventions and rumen microbiome manipulation. Innovations targeting methanogenic bacteria and enzyme inhibition are driving adoption, offering sustainable and precise methane reduction without compromising animal productivity.

- By Type

On the basis of type, the global ruminant methane reduction market is segmented into cattle, sheep, goats, buffalo, and others. The cattle segment dominated the market with a revenue share of 80.08% in 2024, driven by the significantly larger global cattle population and their substantial contribution to methane emissions. The high adoption of methane reduction solutions in cattle farming, particularly in dairy and beef production, supports this dominance.

The goats segment is anticipated to experience the fastest growth rate from 2025 to 2032, driven by increasing demand for goat meat and milk, coupled with innovations in methane-reducing feed additives and management practices tailored to goat farming. This segment is gaining traction in regions with expanding goat populations, such as Asia-Pacific.

- By Application

On the basis of application, the global ruminant methane reduction market is segmented into commercial livestock operations, small & medium farms, pasture-based systems, and research & development. The commercial livestock operations segment held the largest market revenue share of 60% in 2024, driven by the scale of operations and the critical need for efficient fleet management, emissions reduction, and compliance with stringent environmental regulations in large-scale dairy and beef production.

The research & development segment is expected to witness robust growth from 2025 to 2032, propelled by increasing investments in innovative solutions like precision livestock farming technologies and seaweed-based supplements. Collaborative efforts between governments, research institutions, and industry players are accelerating the development of scalable methane reduction strategies.

- By End Use

On the basis of end use, the global ruminant methane reduction market is segmented into livestock farmers, feed manufacturers, food & beverage companies, government & research institutions, and others. The livestock farmers segment dominated the market with a revenue share of 55% in 2024, driven by their direct adoption of methane reduction technologies, such as feed additives and improved grazing management, to meet sustainability goals and regulatory requirements.

The government & research institutions segment is anticipated to witness significant growth from 2025 to 2032, fueled by increasing public and private investments in sustainable agriculture research and policy-driven incentives for methane reduction. Initiatives like the USDA’s programs in North America and collaborative projects in Asia-Pacific are key growth drivers.

Ruminant Methane Reduction Market Regional Analysis

- North America dominated the ruminant methane reduction market with the largest revenue share of 38.5% in 2024, driven by advanced agricultural research, widespread adoption of innovative feed additives, and supportive regulatory frameworks in the U.S. and Canada

- Growth is supported by innovations in feed additives, such as chemical and plant-based methane inhibitors, alongside increasing adoption in both large-scale and small-scale farming operations

U.S. Ruminant Methane Reduction Market Insight

The U.S. ruminant methane reduction market captured the largest revenue share of 74.7% in 2024 within North America, fueled by strong demand for sustainable livestock solutions and growing awareness of methane’s environmental impact. The trend towards precision livestock farming and increasing regulations promoting lower emissions boost market expansion. Major companies’ integration of methane-reducing feed additives, such as Bovaer, complements research and development efforts, creating a robust product ecosystem.

Europe Ruminant Methane Reduction Market Insight

The Europe ruminant methane reduction market is expected to witness significant growth, supported by stringent regulatory frameworks focused on reducing agricultural emissions and enhancing sustainability. Farmers seek solutions that balance environmental impact with animal productivity. The growth is prominent in both large-scale livestock operations and smaller farms, with countries such as Germany and France showing significant uptake due to environmental concerns and government incentives.

U.K. Ruminant Methane Reduction Market Insight

The U.K. market for ruminant methane reduction is expected to witness rapid growth, driven by demand for sustainable farming practices and increasing awareness of methane’s role in climate change. Farmers prioritize feed additives and methane inhibitors to meet regulatory standards and consumer demand for eco-friendly products. Evolving environmental policies influence adoption, balancing efficacy with compliance.

Germany Ruminant Methane Reduction Market Insight

Germany is expected to witness rapid growth in the ruminant methane reduction market, attributed to its advanced agricultural sector and high consumer focus on sustainability and environmental efficiency. German farmers prefer technologically advanced solutions, such as plant-based methane inhibitors, that reduce emissions while maintaining productivity. The integration of these solutions in large-scale livestock operations and aftermarket applications supports sustained market growth.

Asia-Pacific Ruminant Methane Reduction Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding livestock production and rising environmental awareness in countries such as China, India, and Japan. Increasing demand for sustainable farming practices, coupled with government initiatives promoting emission reductions, boosts market growth. The adoption of advanced feed additives and methane inhibitors is fueled by rising livestock populations and consumer focus on eco-friendly agriculture.

Japan Ruminant Methane Reduction Market Insight

Japan’s ruminant methane reduction market is expected to witness rapid growth due to strong consumer preference for high-quality, technologically advanced solutions that enhance sustainability and livestock health. The presence of major agricultural research institutions and integration of methane-reducing technologies in large-scale farming accelerate market penetration. Rising interest in sustainable practices also contributes to growth.

China Ruminant Methane Reduction Market Insight

China holds the largest share of the Asia-Pacific ruminant methane reduction market, propelled by rapid urbanization, rising livestock ownership, and increasing demand for sustainable farming solutions. The country’s growing middle class and focus on environmental sustainability support the adoption of advanced feed additives and methane inhibitors. Strong domestic research capabilities and competitive pricing enhance market accessibility.

Ruminant Methane Reduction Market Share

The ruminant methane reduction industry is primarily led by well-established companies, including:

- Alltech Co., Ltd. (Japan)

- Blue Ocean Barns (U.S.)

- CH4 Global, Inc. (Australia)

- Cargill, Incorporated (U.S.)

- DSM-Firmenich (Netherlands)

- Elanco Animal Health Incorporated (U.S.)

- Fonterra Co-operative Group Limited (New Zealand)

- FutureFeed Pty Ltd (Australia)

- Mootral (U.K.)

- Rumin8 Ltd (Australia)

- Symbrosia Inc. (U.S.)

- ZELP Ltd (U.K.)

What are the Recent Developments in Global Ruminant Methane Reduction Market?

- In May 2024, Elanco Animal Health announced that the U.S. FDA had completed its multi-year review of Bovaer®, a first-in-class methane-reducing feed ingredient for lactating dairy cows. The FDA confirmed that Bovaer meets all safety and efficacy requirements, paving the way for its U.S. market launch in Q3 2024. Just one tablespoon per cow per day can reduce enteric methane emissions by approximately 30%, equivalent to 1.2 metric tons of CO₂e per cow annually. This milestone supports Elanco’s vision for climate-neutral dairy farming, while also offering carbon credit opportunities for producers

- In May 2024, the U.S. FDA approved Bovaer® (3-nitrooxypropanol or 3-NOP), a methane-reducing feed additive developed by DSM-Firmenich, for use in lactating dairy cows. This approval followed a multi-year safety and efficacy review, enabling its U.S. launch through strategic partner Elanco Animal Health. Bovaer works by inhibiting methane production in cows’ digestive systems, reducing emissions by up to 30% per cow annually. To support demand, a new production facility in Scotland is expected to begin operations in 2025, with capacity to treat 4–5 million cows per year

- In March 2024, Royal DSM advanced its climate-focused innovations by launching a methane-reducing feed additive in collaboration with leading U.S. dairy farms. This initiative aimed to cut enteric methane emissions by up to 30%, aligning with global efforts to decarbonize agriculture. The additive—Bovaer® (3-nitrooxypropanol)—works by inhibiting an enzyme in the cow’s rumen responsible for methane production, delivering results within 30 minutes of ingestion. This rollout marked a significant milestone in DSM’s strategy to scale sustainable livestock solutions and support climate-neutral dairy farming in the U.S.

- In November 2023, UPL, a global leader in sustainable agriculture, entered a multi-year strategic partnership with CH4 Global to distribute Methane Tamer™, a seaweed-based feed supplement designed to reduce enteric methane emissions in cattle by up to 90%. The collaboration targets major cattle-producing regions—India, Brazil, Argentina, Uruguay, and Paraguay—which collectively represent over 40% of the world’s cattle population. By integrating Methane Tamer™ into UPL’s existing feed formulations and leveraging its vast distribution network, the initiative aims to scale climate-smart livestock practices and significantly reduce agriculture’s greenhouse gas footprint

- In May 2023, Alltech acquired a majority stake in Agolin, a Swiss company renowned for its plant-based nutrition solutions aimed at improving livestock performance and sustainability. Agolin’s flagship product, Agolin Ruminant, was the first feed additive certified by The Carbon Trust for methane reduction in ruminants, making it a key asset in global efforts to combat climate change. This strategic acquisition enhances Alltech’s portfolio of eco-friendly feed technologies, enabling farmers to boost milk and meat production while reducing their environmental footprint. The partnership also opens doors for new innovations combining Alltech’s nutritional expertise with Agolin’s essential oil blends

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.