Asia Pacific Heart Valve Repair And Replacement Market

Market Size in USD Million

CAGR :

%

USD

1.50 Million

USD

3.71 Million

2025

2033

USD

1.50 Million

USD

3.71 Million

2025

2033

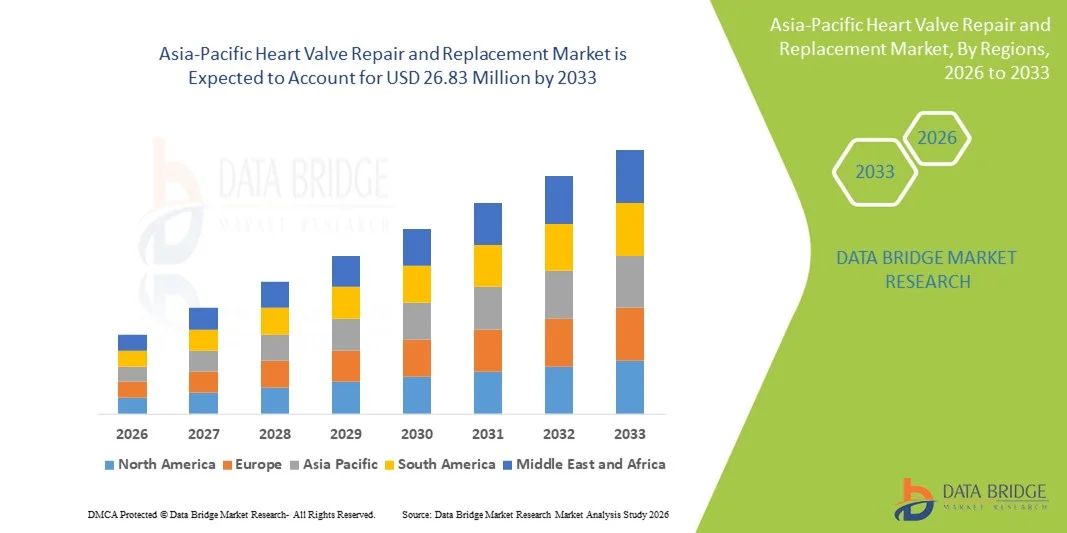

| 2026 –2033 | |

| USD 1.50 Million | |

| USD 3.71 Million | |

|

|

|

|

Asia-Pacific Heart Valve Repair and Replacement Market Size

- The Asia-Pacific heart valve repair and replacement market size was valued at USD 1.50 billion in 2025 and is expected to reach USD 3.71 billion by 2033, at a CAGR of 12.0% during the forecast period

- The market growth is largely fueled by the increasing incidence of valvular heart disorders across key Asia‑Pacific countries, rising healthcare expenditure, and expanding adoption of advanced surgical and minimally invasive valve repair and replacement procedures

- Furthermore, technological advancements in valve repair/replacement devices, growing patient awareness, and enhanced healthcare access in emerging economies such as China, India, and South Korea are driving demand for effective therapeutic interventions. These converging factors are accelerating clinical adoption and significantly boosting the overall market’s expansion

Asia-Pacific Heart Valve Repair and Replacement Market Analysis

- Heart valve repair and replacement procedures, including surgical and transcatheter interventions, are increasingly vital components of cardiovascular healthcare in both public and private hospitals across Asia‑Pacific due to their effectiveness in treating valvular heart diseases and improving patient survival rates

- The escalating demand for these procedures is primarily fueled by the rising prevalence of valvular heart disorders, aging populations, growing patient awareness, and expanding access to advanced cardiovascular care

- China dominated the Asia‑Pacific heart valve repair and replacement market with the largest revenue share of 38.5% in 2025, characterized by the large patient population, rapid adoption of minimally invasive procedures, and strong government initiatives to improve access to advanced cardiac care

- India is the fastest-growing country in the region driven by rising awareness of transcatheter aortic valve replacement (TAVR), improving healthcare infrastructure, expanding insurance coverage, and increasing disposable incomes

- The TAVI / TAVR Valves segment dominated the Asia‑Pacific market in 2025 with a market share of 46.7%, driven by its minimally invasive procedure, shorter recovery time, and growing preference among high-risk and elderly patients over traditional surgical valve replacement

Report Scope and Asia-Pacific Heart Valve Repair and Replacement Market Segmentation

|

Attributes |

Asia-Pacific Heart Valve Repair and Replacement Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Asia-Pacific Heart Valve Repair and Replacement Market Trends

Rising Adoption of Minimally Invasive TAVR Procedures

- A significant and accelerating trend in the Asia‑Pacific heart valve repair and replacement market is the increasing adoption of minimally invasive transcatheter aortic valve replacement (TAVR) procedures, which reduce surgical risk and shorten recovery time

- For instance, hospitals in India and China are increasingly offering TAVR procedures alongside traditional surgical options, enabling high-risk patients to access advanced treatment with lower complications

- Minimally invasive procedures allow cardiologists to perform valve repair or replacement with smaller incisions, leading to reduced hospital stays, faster patient recovery, and lower procedural risks compared to conventional open-heart surgery

- The integration of advanced imaging and catheter-based technologies enhances procedural precision, enabling more complex valve conditions to be treated with minimally invasive techniques across major hospitals in the region

- This trend toward less invasive, more patient-friendly procedures is reshaping clinical practice and patient expectations, driving hospitals and manufacturers to focus on innovative valve designs and delivery systems

- The demand for TAVR and other minimally invasive valve repair solutions is growing rapidly across Asia‑Pacific countries, particularly in India and China, as clinicians and patients increasingly prioritize safety, recovery speed, and improved clinical outcomes

- Telemedicine and digital health platforms are enabling pre- and post-procedure patient monitoring, which improves treatment adherence and encourages wider adoption of advanced valve repair procedures in semi-urban and rural areas.

Asia-Pacific Heart Valve Repair and Replacement Market Dynamics

Driver

Increasing Prevalence of Valvular Heart Disorders and Healthcare Awareness

- The rising prevalence of valvular heart diseases and greater patient awareness of treatment options is a significant driver for the growing demand for heart valve repair and replacement procedures

- For instance, in 2025, leading hospitals in India reported increasing TAVR adoption among elderly patients with aortic stenosis, highlighting the growth potential in emerging markets

- Patients are increasingly seeking minimally invasive interventions, faster recovery times, and safer surgical outcomes, which are driving hospitals to expand the availability of advanced valve repair and replacement solutions

- Improved healthcare infrastructure, expanding insurance coverage, and growing government initiatives to enhance access to cardiac care are further propelling market growth across Asia‑Pacific countries

- The rising number of cardiology centers and specialized cardiac surgeons, particularly in China and India, is accelerating procedural volumes and creating greater demand for innovative valve devices

- Increasing government funding and public-private partnerships for cardiovascular programs are facilitating access to advanced treatments, particularly in emerging economies within the region

- Rising patient preference for outpatient and day-care procedures, supported by faster recovery and lower complication rates, is encouraging hospitals to adopt minimally invasive valve replacement technologies

Restraint/Challenge

High Treatment Costs and Limited Access in Emerging Regions

- The high procedural and device costs associated with TAVR and advanced valve repair solutions pose a significant challenge to broader market adoption in price-sensitive Asia‑Pacific countries

- For instance, patients in rural areas of India and Southeast Asia often face limited access to hospitals capable of performing minimally invasive valve procedures, restricting market penetration

- The relatively high upfront cost of TAVR devices compared to conventional surgical valves can deter hospitals and patients in developing regions from adopting advanced technologies

- Healthcare infrastructure limitations, including a shortage of trained interventional cardiologists and specialized surgical teams, further constrain the availability of valve repair and replacement procedures

- Overcoming these challenges through government subsidies, public-private healthcare initiatives, and cost-reduction strategies for devices will be vital for sustained market growth in Asia‑Pacific

- Variability in regulatory approvals across countries can delay device introduction and adoption, affecting the speed at which innovative valve technologies reach patients

- Limited awareness among patients and caregivers regarding minimally invasive treatment options in semi-urban and rural regions continues to restrain market expansion despite increasing hospital capabilities

Asia-Pacific Heart Valve Repair and Replacement Market Scope

The market is segmented on the basis of product, procedure, indication, end user, and distribution channel.

- By Product

On the basis of product, the market is segmented into surgical heart valves replacement, surgical heart valves repair, TAVI / TAVR valves, grafts, patches, medication, and others. The TAVI / TAVR Valves segment dominated the market with a market share of 46.7% in 2025, driven by its minimally invasive nature, shorter recovery periods, and growing clinical preference among high-risk and elderly patients. Hospitals in India, China, and Japan increasingly favor TAVR over traditional surgical methods due to lower complication rates and reduced hospital stays. The segment also benefits from advancements in valve designs and catheter delivery systems, enabling treatment of complex anatomies. Rising patient awareness and preference for less invasive procedures further reinforce its dominance. In addition, government initiatives and insurance coverage improvements are supporting broader adoption across emerging Asia-Pacific economies.

The Surgical Heart Valves Replacement segment is expected to witness the fastest CAGR from 2026 to 2033, driven by increasing adoption in countries with established surgical infrastructure such as Japan, South Korea, and Australia. Surgical replacements remain the standard for younger patients and complex cases where TAVR is not suitable. Continuous innovations in bioprosthetic and mechanical valves enhance surgical outcomes, improving long-term patient prognosis. Growing investments in cardiac surgery centers and training of specialized surgeons also fuel market growth. The segment’s robust clinical evidence and established reimbursement frameworks further accelerate its adoption.

- By Procedure

On the basis of procedure, the market is segmented into surgical procedure and non-surgical procedure. The Non-Surgical Procedure segment dominated the market in 2025, largely due to the rising preference for minimally invasive approaches such as TAVR. These procedures reduce hospital stay, lower procedural risks, and provide faster recovery, making them highly appealing to elderly and high-risk patients. Hospitals in India and China are increasingly equipping cardiac units with advanced catheter labs to meet growing demand. The segment also benefits from advancements in imaging technologies, which enhance procedural precision. Rising patient awareness and government health initiatives promoting less invasive treatments further strengthen adoption. Non-surgical approaches also support outpatient management, which reduces overall healthcare costs.

The Surgical Procedure segment is anticipated to witness the fastest growth from 2026 to 2033, driven by ongoing innovations in surgical techniques and the introduction of hybrid procedures combining open surgery with catheter-based interventions. Established hospitals in Japan, South Korea, and Australia continue to rely on surgical procedures for complex cases. Increasing numbers of trained cardiac surgeons and surgical centers are expanding procedural capacity. The growth is further fueled by favorable reimbursement policies and patient preference for procedures with long-term durability. Surgical procedures remain a mainstay for younger patients with structural valve issues.

- By Indication

On the basis of indication, the market is segmented into valvular stenosis, valvular insufficiency, mitral valve prolapse, and others. The Valvular Stenosis segment dominated the market in 2025, driven by the high prevalence of aortic stenosis in the aging population across Asia-Pacific. TAVR and surgical valve replacement procedures are increasingly recommended for severe cases, fueling demand. Hospitals in China, India, and Japan report a growing number of interventions for stenosis due to improved diagnostics and echocardiography adoption. Clinical guidelines advocating timely intervention also contribute to market growth. Awareness campaigns and screening programs in emerging economies are identifying more patients early, enhancing procedural uptake. The segment’s dominance is reinforced by well-established procedural protocols and robust clinical outcomes.

The Mitral Valve Prolapse segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by rising diagnosis rates due to advanced imaging techniques. Growing awareness among cardiologists and patients regarding early intervention benefits drives demand for both surgical repair and TAVR-compatible devices. Minimally invasive repair techniques are becoming increasingly accessible in India, China, and South Korea. The segment benefits from innovations in repair devices, improving procedural safety and efficacy. Expansion of cardiac centers and availability of trained surgeons accelerate adoption. Rising patient preference for less invasive corrective procedures contributes to the segment’s rapid growth.

- By End User

On the basis of end user, the market is segmented into hospitals, specialty centers, cardiac catheterization labs, ambulatory surgical centers, and others. The Hospitals segment dominated the market in 2025, due to the availability of comprehensive cardiac care infrastructure and high procedural capacity. Hospitals provide both surgical and minimally invasive procedures, attracting a large patient base. China, India, and Japan have seen significant investments in cardiac units to meet growing demand. Hospitals also benefit from skilled cardiac surgeons and advanced diagnostic equipment. Integration of inpatient and outpatient services enhances patient convenience and drives procedural volume. Government healthcare initiatives supporting hospital-based cardiac care further reinforce this segment’s dominance.

The Specialty Centers segment is expected to witness the fastest growth from 2026 to 2033, driven by the emergence of dedicated cardiac and TAVR centers across India, China, and Southeast Asia. These centers focus exclusively on valve repair and replacement, offering specialized expertise and faster procedural turnaround. Advanced imaging, catheter labs, and post-procedure care optimize outcomes. Rising patient preference for specialized care and shorter waiting times fuels adoption. Strategic partnerships between specialty centers and device manufacturers support technology access. Specialty centers also cater to high-risk patients who may not be suitable for general hospital interventions.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender, retail sales, and others. The Direct Tender segment dominated the market in 2025, driven by bulk procurement by hospitals and government healthcare programs. Large cardiac centers and public hospitals in China, India, and Japan typically procure devices and valves via tenders to ensure cost efficiency and regulatory compliance. This channel allows for long-term partnerships with leading valve manufacturers. Direct tenders also facilitate timely delivery of devices to meet procedural demand. High-volume purchases and negotiated pricing make this the preferred route for major healthcare providers. Government initiatives promoting accessible cardiac care further strengthen dominance.

The Retail Sales segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by increasing demand from private clinics, specialty centers, and smaller hospitals seeking direct access to devices. Retail channels provide faster procurement for urgent cases and enable hospitals in emerging markets to source devices without waiting for tenders. Growing awareness among cardiologists and hospital administrators about available valve technologies supports retail growth. Expansion of medical device distributors across Asia-Pacific enhances market penetration. Retail channels also support flexible purchase volumes for new or smaller healthcare facilities.

Asia-Pacific Heart Valve Repair and Replacement Market Regional Analysis

- China dominated the Asia‑Pacific heart valve repair and replacement market with the largest revenue share of 38.5% in 2025, characterized by the large patient population, rapid adoption of minimally invasive procedures, and strong government initiatives to improve access to advanced cardiac care

- Patients and healthcare providers in China increasingly value the safety, shorter recovery times, and improved clinical outcomes offered by advanced valve repair and replacement solutions, including both surgical and transcatheter interventions

- This widespread adoption is further supported by expanding healthcare infrastructure, government initiatives to improve access to cardiac care, and growing awareness among patients and cardiologists, establishing China as the key hub for heart valve procedures in the Asia‑Pacific region

The China Heart Valve Repair and Replacement Market Insight

China dominated the Asia‑Pacific market in 2025 with the largest revenue share of 38.5%, fueled by a large geriatric population, rising prevalence of valvular disorders, and rapid adoption of minimally invasive procedures such as TAVR. Hospitals are increasingly equipped with advanced catheter labs and surgical units, enabling high procedural volumes. Government initiatives and public healthcare programs are supporting widespread access to advanced cardiac care. In addition, growing patient awareness of minimally invasive and surgical valve options is boosting adoption. The presence of global and regional valve manufacturers in China ensures continuous supply and innovation. Procedural safety, reduced recovery times, and improved clinical outcomes further drive market expansion.

India Heart Valve Repair and Replacement Market Insight

India is the fastest-growing country in the Asia‑Pacific heart valve repair and replacement market, driven by rising awareness of TAVR and surgical procedures, rapid urbanization, and increasing healthcare infrastructure. The expanding middle class, improving insurance coverage, and government-led initiatives to promote cardiac care accessibility are major growth factors. Hospitals and specialty cardiac centers in metro cities are witnessing growing patient inflow for minimally invasive procedures. Availability of affordable valve devices and partnerships with leading device manufacturers further accelerate adoption. The push for smart hospitals and advanced interventional cardiology units is also contributing to market growth.

Japan Heart Valve Repair and Replacement Market Insight

The Japan heart valve repair and replacement market is witnessing steady growth due to the country’s aging population, high healthcare expenditure, and early adoption of innovative valve repair technologies. Hospitals and specialty centers are equipped with advanced surgical and TAVR capabilities, supporting both inpatient and outpatient procedures. Growing patient awareness about minimally invasive options and better procedural outcomes is fueling adoption. Technological advancements in valve designs, coupled with a strong network of experienced cardiologists, are enhancing procedural safety and efficiency. Government support for cardiovascular programs further contributes to market expansion.

South Korea Heart Valve Repair and Replacement Market Insight

The South Korea heart valve repair and replacement market is expanding steadily, driven by increasing prevalence of valvular diseases and a strong focus on minimally invasive procedures. Specialty cardiac centers and hospitals are adopting TAVR and advanced surgical interventions. Government health initiatives and insurance coverage improvements are supporting access to high-quality cardiac care. Patient awareness campaigns and advanced diagnostic infrastructure are encouraging early interventions. Technological innovations in valve designs and catheter systems are enhancing procedural safety and efficiency. The integration of cardiac care programs with outpatient and follow-up services is accelerating adoption.

Asia-Pacific Heart Valve Repair and Replacement Market Share

The Asia-Pacific Heart Valve Repair and Replacement industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- Boston Scientific Corporation (U.S.)

- Edwards Lifesciences Corporation (U.S.)

- Abbott (U.S.)

- Siemens Healthineers AG (Germany)

- Peijia Medical Limited (China)

- Meril Life Sciences (India)

- SMT (India)

- JenaValve Technology (U.S.)

- ValveXchange (U.S.)

- Direct Flow Medical (U.S.)

- Symetis (Switzerland)

- Bracco (Italy)

- Biomedical Braile (Brazil)

- Gore Medical (U.S.)

- GE Healthcare (U.S.)

- CryoLife, Inc. (U.S.)

- LivaNova PLC (U.K.)

- Micro Interventional Devices, Inc. (U.S.)

- St. Jude Medical (U.S.)

What are the Recent Developments in Asia-Pacific Heart Valve Repair and Replacement Market?

- In August 2025, cardiologists at Rajasthan Hospital (RHL) in Jaipur performed India’s first electrosurgical valve‑in‑valve mitral procedure on a 74‑year‑old patient whose prior surgical valve had failed. This innovative, catheter‑based approach avoided open‑chest surgery, representing a significant advancement in complex valve replacement techniques for high‑risk patients

- In August 2025, India welcomed the motorised TAVR delivery system (Vitaflow Liberty) — a next‑generation transcatheter heart valve system designed for more precise, single‑operator deployment. Early successful cases marked a technological milestone in heart valve replacement, suggesting improved outcomes and broader procedural access in complex anatomies

- In June 2025, SDM Narayana Heart Centre in Dharwad, India, reported a successful advanced TAVR procedure performed on a senior patient with severe aortic stenosis and coronary artery disease. The case, which also included a combined PTCA, highlights the growing clinical capability to deliver complex minimally invasive cardiac care in regional India

- In May 2025, cardiologists in Nagpur, India, successfully completed three Transcatheter Aortic Valve Replacement (TAVR) procedures in a single day in the same operating theatre, showcasing growing local expertise in minimally invasive valve therapy. The procedures, conducted using the MyValve device, reflect increased confidence and adoption of TAVR in non‑metro regions, indicating wider accessibility of advanced heart valve treatments across India

- In February 2025, a series of non‑surgical TAVR procedures were highlighted in Chandigarh as offering new hope to elderly patients previously deemed too frail for open‑heart surgery. These minimally invasive interventions are enabling faster recovery and broader treatment access in regions with rising prevalence of aortic valve disease

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.