Asia-Pacific Helium-3 Market Analysis and Insights

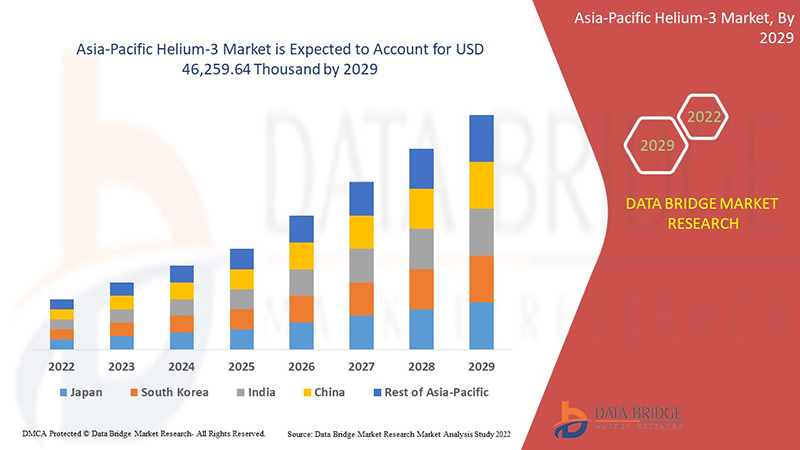

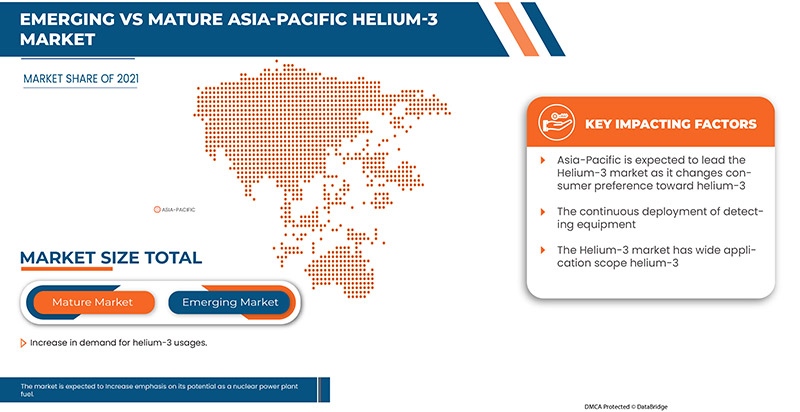

Asia-Pacific helium-3 market is expected to grow significantly in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 2.7% in the forecast period of 2022 to 2029 and is expected to reach USD 46,259.64 thousand by 2029. The major factor driving the growth of the helium-3 market is the continuous deployment of detecting equipment. Magnetic Resonance Imaging (MRI) and other medical imaging modalities are gaining prominence and wide application scope of helium-3.

Helium-3 is a primordial substance found in Earth's mantle and is a light and stable isotope of helium comprising two protons and one neutron. Helium-3 comprises more protons than neutrons, making it the only stable isotope of any element. Helium-3 is considered to be a naturally nucleogenic and cosmogenic nuclide. Helium-3, an isotope of helium, is a nonradioactive, nontoxic and inert gas. Helium-3 accounts for about 0.0001% of the helium on earth. However, it is present in abundance on the moon. The sun has been emitting helium-3 as a waste product for billions of years. Helium-3 is used in national security, medicine, research and homeland security.

Asia-Pacific helium-3 market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an Analyst Brief. Our team will help you create a revenue impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Thousand |

|

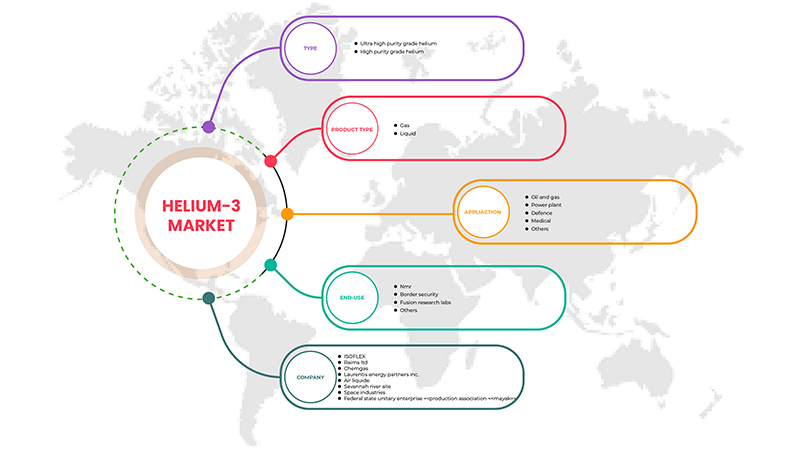

Segments Covered |

By Type (Ultra high purity grade helium, High purity grade helium, and Others), Product Type (Liquid and Gas), Application (Oil and Gas, Defence, Power Plant, Medical, and Others), End-Use (NMR, Border Security, Fusion Research Labs, and Others). |

|

Countries Covered |

China |

|

Market Players Covered |

ISOFLEX, Air Liquide |

Market Definition

The continuous deployment of detecting equipment is an important driver for the Asia-Pacific helium-3 market. Magnetic Resonance Imaging (MRI) and other medical imaging modalities are gaining prominence, and the wide application scope of helium-3 is expected to propel the growth of the Asia-Pacific helium-3 market. The major restraints that may negatively impact the Asia-Pacific helium-3 market are the scarcity of helium-3 on the planet, and the extraction of helium-3 necessitates a large quantity of energy and heavy mining equipment. The extraction of helium-3 from the lunar surface is becoming more important and is expected to provide an opportunity in the Asia-Pacific helium-3 market. However, a rising number of issues regarding the extraction of helium-3 from lunar surfaces is projected to challenge the Asia-Pacific helium-3 market growth.

Asia-Pacific Helium-3 Market Dynamics

Drivers

- The continuous deployment of detecting equipment

Helium-3 is essential in neutron detection apparatus based on the absorption principle. He-3 filled proportional counters are common neutron detectors best suited for detecting thermal neutrons. Helium-3 absorbs neutrons and emits high-energy particles detected as a current and converted to neutron counts. Larger kinds are also employed for pulse height spectroscopy of epithermal and fast neutrons. This detector is extremely sensitive to photon radiation, and the residual quantity may be well differentiated using electrical techniques. He-3 proportional counters have a wide range of applications, including monitoring substrates rich in hydrogen, such as water and oil, where the measured substrate functions as a moderator. TGM's He-3 detectors, for example, are commonly employed in conjunction with a fast neutron source to assess moisture content in soil and concrete. They are also used to determine the amount of oil in the stratum of an oil well while it is being drilled.

- Magnetic Resonance Imaging (MRI) and other medical imaging modalities are gaining prominence

Helium-3 is widely employed in medical imaging methods, including magnetic resonance imaging (MRI), in clinical respiratory implications such as asthma, chronic obstructive pulmonary disease, cystic fibrosis, radiation-induced lung damage, and transplantation. Helium is most often used as a cryogen in MRI equipment. Cryogens are substances that sustain extremely low temperatures, such as ice in a cooler. Helium has a liquid temperature of more than 450 degrees below zero. Because the coils in MRI machines must be kept close to this temperature to generate the intense magnetic field required to take pictures, the coils are surrounded by liquid helium in MRI machines.

- Wide application scope of Helium-3

Helium-3 has a wide range of applications, allowing it to flourish worldwide. Almost all helium-3 is being employed for security purposes across the world. Other uses include cryogenics, quantum computers, neutron scattering facilities, oil and gas exploration, and various medical applications. Helium-3 is used by space organizations as an inert purge gas for hydrogen systems and as a pressurizing agent for ground and flight fluid systems. Helium is also used as a cryogenic agent to cool various materials and in precision welding operations. Helium's usage as a non-toxic, inert gas makes it excellent for use in controlled atmosphere conditions. Helium is a liquid at temperatures below 269 degrees Celsius, making it a suitable coolant for quantum computing research. In modern medicine, MRI technology is indispensable. The superconductive magnets within MRI scanners reach extremely high temperatures and are cooled by helium. Each year, a single MRI scanner consumes 700 liters of helium. Used as a coolant in thermographic quantum detectors, purge gas in missile propulsion systems, and fuel pressurizing agent.

Opportunities

- The extraction of Helium-3 from lunar surfaces is becoming more important

In recent decades, science fiction and fact have been motivated by the concept of collecting a clean and efficient kind of energy from the Moon. The solar wind has assaulted the Moon with massive amounts of Helium-3, unlike Earth, which is shielded by its magnetic field. Because it is not radioactive and does not create hazardous waste, it is anticipated that this isotope might supply safer nuclear energy in a fusion reactor. Helium-3 concentrations on the Moon's surface are on the order of 0.01 ppm. Several people have advocated exploring the moon, mining lunar regolith, and utilizing helium-3 for fusion. Because of the low quantities of helium-3, any mining equipment would have to handle a vast amount of regolith. Some ideas have recommended that helium-3 extraction be tacked onto a bigger mining and development project.

- Increased emphasis on its potential as a nuclear power plant fuel

Helium-3 (He3) is employed as a nuclear fusion fuel in current fusion research. Scientists have been striving to develop nuclear power using nuclear fusion rather than nuclear fission due to radioactivity and nuclear waste. The same energy source that powers the Sun and other stars are used in nuclear fusion. One possible approach is to employ helium-3 and deuterium as fuel in "aneutronic" (no neutron) fusion reactors. When helium-3 and deuterium fuse to form regular helium and a proton, less energy is wasted, and the process is simpler to manage. Nuclear fusion reactors employing helium-3 might thus provide a very efficient kind of nuclear power with almost little waste or radiation, even though the protons produced have a charge. Because the proton can be confined using electric and magnetic fields, direct electric generation is twice as efficient as thermal power generation.

Restraints/Challenges

- The scarcity of Helium-3 on the planet

Helium-3, a helium isotope, is a nonradioactive, harmless, and inert gas. On Earth, there is a limited supply of helium-3. The unexpectedly large amounts of helium-3 observed near volcanic hotspots may indicate the presence of a rare helium-bearing chemical complex deep below the Earth. Helium-3 accounts for around 0.0001% of all helium on Earth. Cryogenics, homeland security, quantum computing, neutron scattering facilities, oil and gas exploration, and various medical uses are among the applications. With the increased use of Helium-3, the world is running out of it.

- A rising number of issues have been raised regarding the extraction of helium-3 from lunar surfaces

The prospect of mining helium-3 on the Moon as a fuel source for future clean, safe nuclear power plants is intriguing and poses several issues. Some of these problems are quite technical, relating to the viability of the nuclear physics involved. Other concerns surround the significant realities of traveling to the Moon, mining and superheating vast quantities of lunar rock, and then returning the valuable cargo to Earth. Three issues of feasibility have been considered. The task is technically demanding and complex. Politically and legally, present international accords do not offer a foundation for lunar mining activity. In terms of finances, the mission only makes a net profit in the best-case scenario and only for medium- to large-scale activities that need significant initial investment.

Further study should focus on the mining operation and prices of fusion reactors to make lunar Helium-3 consumption practical since their influence considerably outweighs all other mission parts. Nonetheless, several modes of transportation may be examined. Many issues, not only technological ones, remain to be resolved in mining helium-3.

Recent Development

- In October 2018, according to VacuTec MeBtechnik GmbH, the neutron detectors 70 060 - 70 065 were proportional counter tubes filled with Helium-3 for optimal thermal neutron sensitivity. Because of its great neutron sensitivity and relatively low Gamma-radiation sensitivity, it is excellent for portable neutron detectors as well as neutron measurements in tiny cavities or pipelines

- In September 2021, Laurentis Energy Partners began production of a Helium-3 isotope used in medical imaging. He-3 is a non-toxic inhalant used to assess lung function. After inhaling the hyperpolarized He-3 gas, gas mixes may be scanned using a Magnetic Resonance Imaging (MRI) scanner to generate detailed anatomical and functional pictures of lung breathing. This innovative approach enables the identification and treatment of a wide range of chronic respiratory disorders

Asia-Pacific Helium-3 market Scope

Asia-Pacific helium-3 market is categorized based on type, product type, application, and end-use. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Type

- Ultra-high purity grade helium

- High purity grade helium

Based on type, the Asia-Pacific helium-3 market is classified into two segments: ultra high purity grade helium and high purity grade helium.

Product Type

- Gas

- Liquid

Based on product type, the Asia-Pacific helium-3 market is classified into gas and liquid.

Application

- Oil and Gas

- Defense

- Power Plant

- Medical

- Others

Based on the application, the Asia-Pacific helium-3 market is classified into oil and gas, defense, power plant, medical, and others.

End-Use

- NMR

- Border Security

- Fusion Research Labs

- Others

Based on end-use, the Asia-Pacific helium-3 market is segmented into NMR, border security, fusion research labs, and others.

Asia-Pacific Helium-3 Market Regional Analysis/Insights

Asia-Pacific helium-3 market is segmented on the basis of type, product type, application, and end-use.

The country in the Asia-Pacific helium-3 market is China, which is dominating the Asia-Pacific helium-3 market in terms of market share and market revenue because of the continuous deployment of detecting equipment in the region.

The country section of the report also provides individual market-impacting factors and regulation changes that impact the market's current and future trends. Data points downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Helium-3 Market Share Analysis

Asia-Pacific helium-3 market competitive landscape provides details on competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points are only related to the companies focus on the Asia-Pacific Helium-3 market.

Some of the prominent participants operating in the Asia-Pacific Helium-3 market are ISOFLEX, Air Liquide

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Data models include Vendor Positioning grids, Market Time Line Analysis, Market Overview and Guide, Company Positioning grids, Company Market Share Analysis, Standards of Measurement, Asia-Pacific Vs. Regional and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA PACIFIC HELIUM-3 MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DBMR MARKET CHALLENGE MATRIX

2.11 DBMR VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 ASIA PACIFIC HELIUM-3 MARKET, PESTEL ANALYSIS

4.1.1 OVERVIEW

4.1.2 POLITICAL FACTORS

4.1.3 ENVIRONMENTAL FACTORS

4.1.4 SOCIAL FACTORS

4.1.5 TECHNOLOGICAL FACTORS

4.1.6 ECONOMIC FACTORS

4.1.7 LEGAL FACTORS

4.1.8 CONCLUSION

4.2 PORTER’S FIVE FORCES:

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 THREAT OF SUBSTITUTES

4.2.3 CUSTOMER BARGAINING POWER

4.2.4 SUPPLIER BARGAINING POWER

4.2.5 INTERNAL COMPETITION (RIVALRY)

4.3 HELIUM-3 PRODUCTION CAPACITY

4.4 HELIUM-3 PRODUCTION METHOD

4.4.1 TRITIUM-HELIUM-3 METHOD

4.4.2 PRODUCTION OF HELIUM-3 USING A HYDROGENATED LATTICE (RED FUSION)

4.4.3 MINING HELIUM-3 FROM THE LUNAR SURFACE

4.5 ASIA PACIFIC HELIUM-3 MARKET, PRODUCTION AND CONSUMPTION ANALYSIS

4.5.1 OVERVIEW

4.6 RUSSIAN UKRAINE WAR IMPACT ANALYSIS

4.6.1 ANALYSIS OF THE IMPACT OF RUSSIA UKRAINE WAR IMPACT ON THE MARKET

4.6.2 IMPACT ON ASIA PACIFIC SUPPLY CHAIN

4.6.3 CONCLUSION

4.7 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.7.1 LAURENTIS ENERGY PARTNERS

4.7.2 SPACE INDUSTRIES

4.7.3 SAVANNAH RIVER SITE

4.8 SUPPLY CHAIN ANALYSIS

4.8.1 OVERVIEW

4.8.2 LOGISTICS COST SCENARIO

4.8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS (LSPS)

4.9 VENDOR SELECTION CRITERIA

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 CONTINUOUS DEPLOYMENT OF DETECTING EQUIPMENT

5.1.2 MAGNETIC RESONANCE IMAGING (MRI) AND OTHER MEDICAL IMAGING MODALITIES ARE GAINING PROMINENCE

5.1.3 WIDE APPLICATION SCOPE OF HELIUM-3

5.2 RESTRAINTS

5.2.1 SCARCITY OF HELIUM-3 ON THE PLANET

5.2.2 EXTRACTION OF HELIUM-3 NECESSITATES A LARGE QUANTITY OF ENERGY AND HEAVY MINING EQUIPMENT

5.3 OPPORTUNITIES

5.3.1 EXTRACTION OF HELIUM-3 FROM LUNAR SURFACES IS BECOMING MORE IMPORTANT

5.3.2 INCREASED EMPHASIS ON ITS POTENTIAL AS A NUCLEAR POWER PLANT FUEL

5.4 CHALLENGE

5.4.1 RISING NUMBER OF ISSUES BEING RAISED REGARDING EXTRACTION OF HELIUM-3 FROM LUNAR SURFACES

6 ASIA PACIFIC HELIUM-3 MARKET, BY TYPE

6.1 OVERVIEW

6.2 ULTRA-HIGH PURITY GRADE HELIUM

6.3 HIGH PURITY GRADE HELIUM

7 ASIA PACIFIC HELIUM-3 MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 GAS

7.3 LIQUID

8 ASIA PACIFIC HELIUM-3 MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 DEFENCE

8.3 POWER PLANT

8.4 OIL AND GAS

8.5 MEDICAL

8.6 OTHERS

9 ASIA PACIFIC HELIUM-3 MARKET, BY END-USE

9.1 OVERVIEW

9.2 BORDER SECURITY

9.2.1 ULTRA-HIGH PURITY GRADE HELIUM

9.2.2 HIGH PURITY GRADE HELIUM

9.3 NMR

9.3.1 ULTRA-HIGH PURITY GRADE HELIUM

9.3.2 HIGH PURITY GRADE HELIUM

9.4 FUSION RESEARCH LABS

9.4.1 ULTRA-HIGH PURITY GRADE HELIUM

9.4.2 HIGH PURITY GRADE HELIUM

9.5 OTHERS

9.5.1 ULTRA-HIGH PURITY GRADE HELIUM

9.5.2 HIGH PURITY GRADE HELIUM

10 ASIA PACIFIC HELIUM-3 MARKET, BY REGION

10.1 ASIA-PACIFIC

10.1.1 CHINA

11 ASIA PACIFIC HELIUM-3 MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

11.2 AGREEMENTS

11.3 PARTNERSHIP

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 AIR LIQUIDE

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT DEVELOPMENT

13.2 ISOFLEX

13.2.1 COMPANY SNAPSHOT

13.2.2 PRODUCT PORTFOLIO

13.2.3 RECENT DEVELOPMENT

13.3 SPACE INDUSTRIES

13.3.1 COMPANY SNAPSHOT

13.3.2 PRODUCT PORTFOLIO

13.3.3 RECENT DEVELOPMENT

13.4 LAURENTIS ENERGY PARTNERS INC.

13.4.1 COMPANY SNAPSHOT

13.4.2 PRODUCT PORTFOLIO

13.4.3 RECENT DEVELOPMENTS

13.5 SAVANNAH RIVER SITE

13.5.1 COMPANY SNAPSHOT

13.5.2 PRODUCT PORTFOLIO

13.5.3 RECENT DEVELOPMENT

13.6 FEDERAL STATE UNITARY ENTERPRISE

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENT

13.7 RAIMS LTD

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENT

13.8 CHEMGAS

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

List of Table

TABLE 1 ASIA PACIFIC HELIUM-3 MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 2 ASIA PACIFIC HELIUM-3 MARKET, BY TYPE, 2020-2029 (THOUSAND LITRES)

TABLE 3 ASIA PACIFIC ULTRA-HIGH PURITY GRADE HELIUM IN HELIUM-3 MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 4 ASIA PACIFIC ULTRA-HIGH PURITY GRADE HELIUM IN HELIUM-3 MARKET, BY REGION, 2020-2029 (THOUSAND LITRES)

TABLE 5 ASIA PACIFIC HIGH PURITY GRADE HELIUM IN HELIUM-3 MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 6 ASIA PACIFIC HIGH PURITY GRADE HELIUM IN HELIUM-3 MARKET, BY REGION, 2020-2029 (THOUSAND LITRES)

TABLE 7 ASIA PACIFIC HELIUM-3 MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 8 ASIA PACIFIC HELIUM-3 MARKET, BY PRODUCT TYPE, 2020-2029 (THOUSAND LITRES)

TABLE 9 ASIA PACIFIC GAS IN HELIUM-3 MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 10 ASIA PACIFIC GAS IN HELIUM-3 MARKET, BY REGION, 2020-2029 (THOUSAND LITRES)

TABLE 11 ASIA PACIFIC LIQUID IN HELIUM-3 MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 ASIA PACIFIC LIQUID IN HELIUM-3 MARKET, BY REGION, 2020-2029 (THOUSAND LITRES)

TABLE 13 ASIA PACIFIC HELIUM-3 MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 14 ASIA PACIFIC HELIUM-3 MARKET, BY APPLICATION, 2020-2029 (THOUSAND LITRES)

TABLE 15 ASIA PACIFIC DEFENCE IN HELIUM-3 MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 ASIA PACIFIC DEFENCE IN HELIUM-3 MARKET, BY REGION, 2020-2029 (THOUSAND LITRES)

TABLE 17 ASIA PACIFIC POWER PLANT IN HELIUM-3 MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 ASIA PACIFIC POWER PLANT IN HELIUM-3 MARKET, BY REGION, 2020-2029 (THOUSAND LITRES)

TABLE 19 ASIA PACIFIC OIL AND GAS IN HELIUM-3 MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 ASIA PACIFIC OIL AND GAS IN HELIUM-3 MARKET, BY REGION, 2020-2029 (THOUSAND LITRES)

TABLE 21 ASIA PACIFIC MEDICAL IN HELIUM-3 MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 ASIA PACIFIC MEDICAL IN HELIUM-3 MARKET, BY REGION, 2020-2029 (THOUSAND LITRES)

TABLE 23 ASIA PACIFIC OTHERS IN HELIUM-3 MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 24 ASIA PACIFIC OTHERS IN HELIUM-3 MARKET, BY REGION, 2020-2029 (THOUSAND LITRES)

TABLE 25 ASIA PACIFIC HELIUM-3 MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 26 ASIA PACIFIC HELIUM-3 MARKET, BY END-USE, 2020-2029 (THOUSAND LITRES)

TABLE 27 ASIA PACIFIC BORDER SECURITY IN HELIUM-3 MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 ASIA PACIFIC BORDER SECURITY IN HELIUM-3 MARKET, BY REGION, 2020-2029 (THOUSAND LITRES)

TABLE 29 ASIA PACIFIC BORDER SECURITY IN HELIUM-3 MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 30 ASIA PACIFIC NMR IN HELIUM-3 MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 ASIA PACIFIC NMR IN HELIUM-3 MARKET, BY REGION, 2020-2029 (THOUSAND LITRES)

TABLE 32 ASIA PACIFIC NMR IN HELIUM-3 MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 33 ASIA PACIFIC FUSION RESEARCH LABS IN HELIUM-3 MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 ASIA PACIFIC FUSION RESEARCH LABS IN HELIUM-3 MARKET, BY REGION, 2020-2029 (THOUSAND LITRES)

TABLE 35 ASIA PACIFIC FUSION RESEARCH LABS IN HELIUM-3 MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 36 ASIA PACIFIC OTHERS IN HELIUM-3 MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 37 ASIA PACIFIC OTHERS IN HELIUM-3 MARKET, BY REGION, 2020-2029 (THOUSAND LITRES)

TABLE 38 ASIA PACIFIC OTHERS IN HELIUM-3 MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 39 ASIA-PACIFIC HELIUM-3 MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 40 ASIA-PACIFIC HELIUM-3 MARKET, BY TYPE, 2020-2029 (THOUSAND LITRES)

TABLE 41 ASIA-PACIFIC HELIUM-3 MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 42 ASIA-PACIFIC HELIUM-3 MARKET, BY PRODUCT TYPE, 2020-2029 (THOUSAND LITRES)

TABLE 43 ASIA-PACIFIC HELIUM-3 MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 44 ASIA-PACIFIC HELIUM-3 MARKET, BY APPLICATION, 2020-2029 (THOUSAND LITRES)

TABLE 45 ASIA-PACIFIC HELIUM-3 MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 46 ASIA-PACIFIC HELIUM-3 MARKET, BY END-USE, 2020-2029 (THOUSAND LITRES)

TABLE 47 ASIA-PACIFIC BORDER SECURITY IN HELIUM-3 MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 48 ASIA-PACIFIC NMR IN HELIUM-3 MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 49 ASIA-PACIFIC FUSION RESEARCH LABS IN HELIUM-3 MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 50 ASIA-PACIFIC OTHERS IN HELIUM-3 MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 51 CHINA HELIUM-3 MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 52 CHINA HELIUM-3 MARKET, BY TYPE, 2020-2029 (THOUSAND LITRES)

TABLE 53 CHINA HELIUM-3 MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 54 CHINA HELIUM-3 MARKET, BY PRODUCT TYPE, 2020-2029 (THOUSAND LITRES)

TABLE 55 CHINA HELIUM-3 MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 56 CHINA HELIUM-3 MARKET, BY APPLICATION, 2020-2029 (THOUSAND LITRES)

TABLE 57 CHINA HELIUM-3 MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 58 CHINA HELIUM-3 MARKET, BY END-USE, 2020-2029 (THOUSAND LITRES)

TABLE 59 CHINA BORDER SECURITY IN HELIUM-3 MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 60 CHINA NMR IN HELIUM-3 MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 61 CHINA FUSION RESEARCH LABS IN HELIUM-3 MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 62 CHINA OTHERS IN HELIUM-3 MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

List of Figure

FIGURE 1 ASIA PACIFIC HELIUM-3 MARKET

FIGURE 2 ASIA PACIFIC HELIUM-3 MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC HELIUM-3 MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC HELIUM-3 MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC HELIUM-3 MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC HELIUM-3 MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 ASIA PACIFIC HELIUM-3 MARKET: MULTIVARIATE MODELLING

FIGURE 8 ASIA PACIFIC HELIUM-3 MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 ASIA PACIFIC HELIUM-3 MARKET: DBMR MARKET POSITION GRID

FIGURE 10 ASIA PACIFIC HELIUM-3 MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 ASIA PACIFIC HELIUM-3 MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 ASIA PACIFIC HELIUM-3 MARKET: SEGMENTATION

FIGURE 13 WIDE APPLICATION SCOPE OF HELIUM-3 IS EXPECTED TO DRIVE THE ASIA PACIFIC HELIUM-3 MARKET IN THE FORECAST PERIOD

FIGURE 14 DEFENCE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC HELIUM-3 MARKET IN 2022 & 2029

FIGURE 15 ASIA PACIFIC HELIUM-3 MARKET: PESTEL ANALYSIS

FIGURE 16 ASIA PACIFIC HELIUM-3 MARKET: PRODUCTION AND CONSUMPTION ANALYSIS, 2020-2021 (USD THOUSAND)

FIGURE 17 ASIA PACIFIC HELIUM-3 MARKET - SUPPLY CHAIN ANALYSIS

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF ASIA PACIFIC HELIUM-3 MARKET

FIGURE 19 ASIA PACIFIC HELIUM-3 MARKET, BY TYPE, 2021

FIGURE 20 ASIA PACIFIC HELIUM-3 MARKET, BY PRODUCT TYPE, 2021

FIGURE 21 ASIA PACIFIC HELIUM-3 MARKET, BY APPLICATION, 2021

FIGURE 22 ASIA PACIFIC HELIUM-3 MARKET, BY END-USE, 2021

FIGURE 23 ASIA-PACIFIC HELIUM-3 MARKET: SNAPSHOT (2021)

FIGURE 24 ASIA-PACIFIC HELIUM-3 MARKET: BY TYPE (2022-2029)

FIGURE 25 ASIA PACIFIC HELIUM-3 MARKET: COMPANY SHARE 2021 (%)

Asia Pacific Helium 3 Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Helium 3 Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Helium 3 Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.