Asia Pacific Medical Device Outsourcing Market

Market Size in USD Billion

CAGR :

%

USD

76.20 Billion

USD

194.12 Billion

2025

2033

USD

76.20 Billion

USD

194.12 Billion

2025

2033

| 2026 –2033 | |

| USD 76.20 Billion | |

| USD 194.12 Billion | |

|

|

|

|

Asia-Pacific Medical Device Outsourcing Market Size

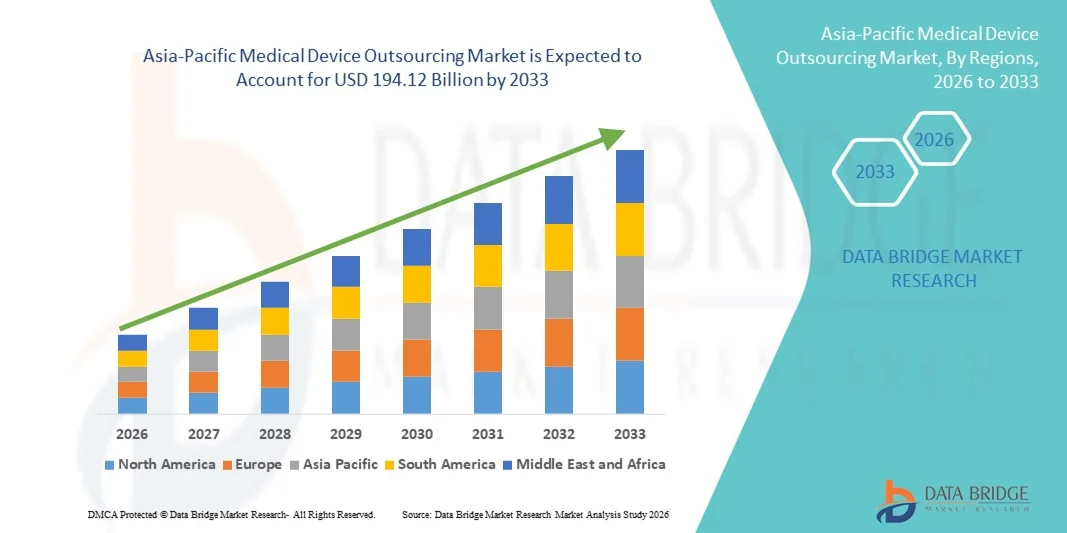

- The Asia-Pacific medical device outsourcing market size was valued at USD 76.2 billion in 2025 and is expected to reach USD 194.12 billion by 2033, at a CAGR of12.40% during the forecast period

- The market growth is largely fueled by the increasing complexity of medical devices, rising regulatory compliance requirements, and growing pressure on OEMs to reduce operational costs and time-to-market, leading to greater reliance on specialized outsourcing partners across design, manufacturing, and quality assurance activities

- Furthermore, rising demand for advanced medical technologies, increasing adoption of contract manufacturing and R&D services, and the need for scalable, high-quality production solutions are accelerating the uptake of medical device outsourcing services, thereby significantly boosting the overall market growth

Asia-Pacific Medical Device Outsourcing Market Analysis

- Medical device outsourcing, including contract manufacturing, product design & development, quality assurance, and regulatory services, has become a critical strategy for medical device OEMs due to increasing device complexity, stringent regulatory requirements, and the need to optimize costs and time-to-market

- The rising demand for medical device outsourcing is driven by growing innovation in medical technologies, increased focus on compliance with international quality standards, and OEMs’ preference to concentrate on core competencies while outsourcing non-core operations

- China dominated the medical device outsourcing market with a revenue share of approximately 32.9% in 2025, supported by its large-scale manufacturing capabilities, cost-efficient production environment, strong supply chain ecosystem, and increasing government support for domestic medical device manufacturing and export-oriented outsourcing services

- India is expected to be the fastest-growing country in the medical device outsourcing market during the forecast period, driven by a rapidly expanding medtech ecosystem, rising foreign direct investment, improving regulatory frameworks, availability of skilled engineering talent, and growing demand for end-to-end outsourcing services across design, testing, and contract manufacturing

- The Finished Goods and Electronics segment accounted for the largest market revenue share of approximately 62.1% in 2025, driven by high outsourcing volumes for complete devices and electronic subassemblies

Report Scope and Medical Device Outsourcing Market Segmentation

|

Attributes |

Medical Device Outsourcing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Asia-Pacific Medical Device Outsourcing Market Trends

Rising Adoption of End-to-End Outsourcing and Advanced Manufacturing Capabilities

- A significant and accelerating trend in the global Medical Device Outsourcing market is the increasing shift toward end-to-end outsourcing solutions, encompassing product design, prototyping, manufacturing, testing, regulatory support, and post-market services

- Medical device companies are increasingly partnering with specialized contract manufacturers to streamline operations, reduce time-to-market, and focus on core competencies such as innovation and commercialization

- For instance, leading outsourcing providers such as Integer Holdings Corporation and Jabil Healthcare are expanding their integrated service offerings to support complex medical devices, including implantable devices, diagnostic equipment, and wearable medical technologies, enabling OEMs to scale efficiently while maintaining high quality standards

- Advancements in manufacturing technologies, including precision machining, automation, additive manufacturing, and cleanroom assembly, are enhancing the capabilities of outsourcing partners. These technologies allow contract manufacturers to meet the growing demand for miniaturized, high-precision, and technologically advanced medical devices across therapeutic areas

- The increasing complexity of medical devices, driven by the integration of electronics, software, and advanced materials, is encouraging OEMs to rely on specialized outsourcing partners with multidisciplinary expertise. This trend supports improved product consistency, compliance with stringent regulatory standards, and cost optimization

- The growing emphasis on regulatory compliance and quality assurance is further strengthening outsourcing partnerships, as experienced service providers offer robust quality management systems and regulatory expertise across multiple geographies

- This trend toward strategic outsourcing relationships is reshaping the global medical device value chain, positioning outsourcing companies as critical partners in supporting innovation, scalability, and operational efficiency across the medical device industry

Asia-Pacific Medical Device Outsourcing Market Dynamics

Driver

Cost Optimization and Increasing Complexity of Medical Devices

- The growing need to reduce operational costs while managing increasing product complexity is a major driver of the global medical device outsourcing market. OEMs are under constant pressure to improve margins while complying with strict regulatory and quality requirements, making outsourcing an attractive strategic option

- For instance, many global medical device manufacturers are outsourcing labor-intensive manufacturing processes and component production to specialized contract manufacturers in cost-efficient regions, enabling significant reductions in production and overhead expenses

- As medical devices become more technologically sophisticated, incorporating advanced electronics, software, and smart components, OEMs are increasingly dependent on outsourcing partners with specialized technical capabilities and infrastructure

- In addition, the rising demand for medical devices driven by aging populations, increasing prevalence of chronic diseases, and expanding healthcare access globally is pushing manufacturers to scale production rapidly, further accelerating the adoption of outsourcing models

- The ability of outsourcing partners to provide flexible manufacturing capacity, shorten development timelines, and ensure consistent quality is a key factor propelling market growth across both developed and emerging healthcare markets

Restraint/Challenge

Regulatory Compliance Risks and Intellectual Property Concerns

- One of the major challenges facing the global Medical Device Outsourcing market is the complexity of regulatory compliance across different regions. Medical devices must meet stringent regulatory requirements set by authorities such as the U.S. FDA, European Medicines Agency (EMA), and other national regulatory bodies, increasing the compliance burden for both OEMs and outsourcing partners

- For instance, variations in regulatory standards, documentation requirements, and approval timelines across regions can create operational challenges and delay product commercialization when outsourcing activities span multiple countries

- Concerns related to intellectual property protection and data security also pose challenges, particularly when outsourcing design, software development, or proprietary manufacturing processes to third-party vendors

- Furthermore, dependency on external partners can expose OEMs to risks such as supply chain disruptions, quality inconsistencies, or limited operational control if not managed through strong contractual and governance frameworks

- Addressing these challenges requires robust quality management systems, transparent communication, strong regulatory expertise, and well-defined intellectual property protection mechanisms. Overcoming these barriers will be critical for sustaining long-term growth and trust within the global Medical Device Outsourcing market

Asia-Pacific Medical Device Outsourcing Market Scope

The market is segmented on the basis of services, product, device type, application, and end user.

- By Services

On the basis of services, the Medical Device Outsourcing market is segmented into Quality Assurance, Regulatory Affairs Services, Product Design and Development Services, Product Testing & Sterilization Services, Product Implementation Services, Product Upgrade Services, Product Maintenance Services, Raw Material Services, Medical Electrical Equipment Services, Contract Manufacturing, and Materials & Chemical Characterization. The Contract Manufacturing segment dominated the largest market revenue share of approximately 34.6% in 2025, driven by increasing pressure on OEMs to reduce operational costs and improve scalability. Medical device manufacturers are increasingly outsourcing manufacturing to specialized CMOs to focus on core competencies such as innovation and marketing. The growing complexity of Class II and Class III devices has further increased dependence on contract manufacturers with regulatory expertise. End-to-end manufacturing capabilities, including assembly, packaging, and validation, support adoption. Rising global demand for medical devices accelerates production outsourcing. Cost efficiency and faster time-to-market remain key drivers. Long-term supply agreements ensure revenue stability. Expansion of CMOs in emerging economies supports dominance. Advanced automation and quality systems further strengthen this segment’s leadership.

The Product Design and Development Services segment is expected to witness the fastest CAGR of around 23.4% from 2026 to 2033, fueled by rapid technological advancements and growing innovation cycles. Medical device companies increasingly outsource R&D to reduce development timelines and risks. Rising demand for wearable, digital, and minimally invasive devices supports growth. Outsourcing enables access to multidisciplinary expertise and advanced prototyping technologies. Regulatory complexities encourage early-stage collaboration with service providers. Startups heavily rely on outsourced design services due to capital constraints. Increasing customization requirements drive demand. Growth in patient-centric solutions accelerates adoption. Strong investment in medtech innovation sustains long-term expansion.

- By Product

On the basis of product, the Medical Device Outsourcing market is segmented into Finished Goods and Electronics and Raw Materials. The Finished Goods and Electronics segment accounted for the largest market revenue share of approximately 62.1% in 2025, driven by high outsourcing volumes for complete devices and electronic subassemblies. Rising adoption of connected medical devices has increased demand for electronics manufacturing services. OEMs prefer outsourcing to ensure compliance with global regulatory standards. Increasing complexity of embedded software and sensors supports segment dominance. High capital investment requirements favor outsourcing finished goods. Demand from diagnostic imaging and monitoring devices remains strong. Quality assurance and traceability requirements further support outsourcing. Large-scale production capabilities drive preference. Strong partnerships between OEMs and EMS providers reinforce leadership.

The Raw Materials segment is anticipated to grow at the fastest CAGR of about 21.2% from 2026 to 2033, driven by increasing demand for biocompatible and specialty materials. Growth in single-use and disposable devices fuels material outsourcing. OEMs rely on certified suppliers for regulatory compliance. Increasing customization in device design drives material innovation. Rising demand for polymers and advanced alloys supports growth. Outsourcing ensures consistency and quality. Expansion of medical device manufacturing volumes boosts raw material consumption. Technological advancements in material science accelerate adoption. Emerging markets further contribute to rapid expansion.

- By Device Type

On the basis of device type, the Medical Device Outsourcing market is segmented into Class I, Class II, and Class III devices. The Class II segment dominated the market with a revenue share of approximately 47.9% in 2025, owing to high volumes of moderately regulated devices. These include infusion pumps, diagnostic equipment, and monitoring devices. Increasing prevalence of chronic diseases supports sustained demand. Outsourcing helps manage regulatory compliance efficiently. Frequent design updates encourage external manufacturing support. Cost optimization remains a key driver. OEMs benefit from scalable production. Strong demand from hospitals and clinics supports dominance. Continuous innovation sustains market leadership.

The Class III segment is projected to register the fastest CAGR of around 24.6% from 2026 to 2033, driven by rising demand for implantable and life-sustaining devices. Stringent regulatory requirements encourage partnerships with specialized outsourcing firms. Increasing aging population boosts demand for advanced implants. Technological innovation in cardiovascular and neuro devices fuels growth. High development costs favor outsourcing models. CMOs provide validation and compliance expertise. Growing investment in high-risk devices supports expansion. Clinical trial outsourcing further drives growth. Long approval cycles sustain long-term demand.

- By Application

On the basis of application, the Medical Device Outsourcing market is segmented into Cardiology, Diagnostic Imaging, Orthopaedic, IVD, Ophthalmic, General and Plastic Surgery, Drug Delivery, Dental, Endoscopy, Diabetes Care, and Others. The Cardiology segment held the largest market revenue share of approximately 19.8% in 2025, driven by high demand for cardiovascular devices. Rising incidence of heart diseases globally fuels device production. Continuous technological advancements increase outsourcing needs. Regulatory complexity encourages reliance on experienced partners. High procedural volumes sustain demand. Implantable devices require precision manufacturing. Outsourcing ensures quality and scalability. OEMs seek faster commercialization. Strong reimbursement frameworks support dominance.

The IVD segment is expected to witness the fastest CAGR of around 25.1% from 2026 to 2033, driven by increasing diagnostic testing volumes. Growth in personalized medicine supports expansion. Rising adoption of point-of-care diagnostics fuels demand. Outsourcing supports rapid scaling of production. Regulatory compliance requirements boost reliance on service providers. Post-pandemic diagnostic awareness remains high. Technological innovation accelerates product launches. Growing healthcare access in emerging markets supports growth. Continuous R&D investments sustain momentum.

- By End User

On the basis of end user, the Medical Device Outsourcing market is segmented into Small Medical Device Companies, Medium Medical Device Companies, Large Medical Device Companies, and Others. The Large Medical Device Companies segment dominated the market with a revenue share of approximately 44.3% in 2025, driven by large-scale production requirements. These companies outsource to optimize operational efficiency. Global supply chain management supports adoption. High R&D pipelines sustain outsourcing demand. Long-term contracts ensure cost stability. Advanced regulatory expertise strengthens partnerships. Focus on innovation drives outsourcing. Expansion into emerging markets boosts volumes. Strong financial capacity reinforces dominance.

The Small Medical Device Companies segment is anticipated to grow at the fastest CAGR of about 26.3% from 2026 to 2033, driven by limited internal manufacturing capabilities. Startups increasingly rely on outsourcing to reduce capital expenditure. Growing medtech innovation ecosystems support new entrants. Regulatory support services encourage outsourcing. Faster product development cycles fuel demand. Contract partners enable scalability. Increasing venture funding supports growth. High innovation rates accelerate adoption. Outsourcing remains critical for survival and expansion.

Asia-Pacific Medical Device Outsourcing Market Regional Analysis

- The Asia-Pacific medical device outsourcing market is projected to expand at a substantial CAGR throughout the forecast period, driven by stringent regulatory standards, rising demand for high-quality medical devices, and the increasing tendency of OEMs to outsource manufacturing and R&D activities

- The region’s strong focus on cost-efficient production, combined with the availability of technologically advanced manufacturing capabilities, is encouraging medical device manufacturers to collaborate with specialized outsourcing partners

- Asia-Pacific is witnessing robust growth across device design, precision manufacturing, testing, and regulatory support services, supported by well-established healthcare infrastructure and a strong MedTech ecosystem across multiple countries

China Medical Device Outsourcing Market Insight

China medical device outsourcing market dominated the Asia-Pacific medical device outsourcing market with a revenue share of approximately 32.9% in 2025, supported by its large-scale manufacturing capabilities, cost-efficient production environment, and a well-established supply chain ecosystem. In addition, increasing government support for domestic medical device manufacturing and export-oriented outsourcing services is accelerating market growth. China’s strong industrial base, coupled with rising foreign collaborations and investment in advanced manufacturing technologies, positions the country as a central hub for OEMs seeking end-to-end outsourcing solutions across design, development, and production.

India Medical Device Outsourcing Market Insight

India medical device outsourcing market is expected to be the fastest-growing country in the Asia-Pacific medical device outsourcing market during the forecast period. Growth is driven by a rapidly expanding MedTech ecosystem, rising foreign direct investment, improving regulatory frameworks, and the availability of a skilled engineering workforce. In addition, increasing demand for end-to-end outsourcing services—including design, testing, contract manufacturing, and regulatory support—is encouraging global OEMs to collaborate with Indian outsourcing partners. Government initiatives to strengthen domestic manufacturing, coupled with competitive operational costs, further reinforce India’s position as a preferred destination for medical device outsourcing.

Asia-Pacific Medical Device Outsourcing Market Share

The Medical Device Outsourcing industry is primarily led by well-established companies, including:

- IQVIA Holdings Inc. (U.S.)

- SGS S.A. (Switzerland)

- Eurofins Scientific (Luxembourg)

- WuXi AppTec (China)

- Lonza Group AG (Switzerland)

- ICON plc (Ireland)

- Parexel International Corporation (U.S.)

- Intertek Group plc (U.K.)

- TÜV SÜD (Germany)

- Bureau Veritas (France)

- Catalent, Inc. (U.S.)

- Jabil Inc. (U.S.)

- Flex Ltd. (Singapore)

- Plexus Corp. (U.S.)

- TE Connectivity (Switzerland)

- Stryker (U.S.)

- Medtronic plc (Ireland)

- Sanmina Corporation (U.S.)

- Nemera (France)

Latest Developments in Asia-Pacific Medical Device Outsourcing Market

- In January 2023, Integer Holdings Corporation announced the acquisition of Pulse Technologies, Inc., a privately held technology, engineering, and contract manufacturing company focused on complex micromachining of medical device components, enhancing Integer’s outsourcing capabilities in structural heart, heart pump, electrophysiology, and neuromodulation device segments

- In November 2023, Jabil Inc. completed the acquisition of Retronix, an innovative provider in electronic component reclamation and refurbishment, expanding its medical device outsourcing services and reinforcing its ability to support complex medical electronics manufacturing

- In July 2023, Medical Device, Inc. (a U.S. contract manufacturing provider) acquired NextPhase Medical Devices LLC, a Mexico-based manufacturer, to form the United Group, doubling production capacity and creating seven global end-to-end outsourcing/production sites to support medical device OEMs across North America, Europe, and North Africa

- In March 2025, Flex Ltd launched a new Product Introduction (NPI) center near Boston, MA, designed to support healthcare OEMs with end-to-end product development from prototyping to production transfer, including ISO13485 certified services that accelerate outsourced medical device commercialization

- In May 2025, Quasar Medical announced the acquisition of Nordson’s contract manufacturing operations in Galway and Tecate, strengthening its global contract development and manufacturing organization (CDMO) offerings, particularly in medical balloon and catheter design

- In February 2025, Arterex Ltd. completed the acquisition of Phoenix S.r.l., a European medical device developer/manufacturer with an international sales network, expanding Arterex’s outsourcing and export capabilities for medical device products

- In June 2025, DuPont signed an agreement to acquire Donatelle Plastics Incorporated, a leading medical device contract manufacturer specializing in design, development, and production of high-precision components, boosting DuPont’s outsourced manufacturing footprint

- In May 2025, Arch Systems announced a multi-year expansion of its partnership with Flex Ltd., enhancing collaborative outsourcing services and broadening production capacity for advanced medical and diagnostic device manufacturing

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.