Asia-Pacific Mezcal Market Analysis and Size

The different agave species used, which have a wide variety of terpene compounds, the ability to use agave leaves in mezcal fermentation, variations in the ripening stage of agave, cooking of agave that can be done in ground holes with burning wood and heated stones that produce furans and smoky volatiles and are retained in the agave, and some herbs or other natural materials (such as worms) can all contribute to the flavor differences between mezcal.

The increasing consumer demand for the mezcal beverage, positive outlook towards advanced and smart packaging solutions, and rise in the number of production units are propelling the demand of the mezcal market in the forecast period. However, the heavy taxation and duties and stringent rules and regulations are expected to hamper the mezcal market growth in the forecast period.

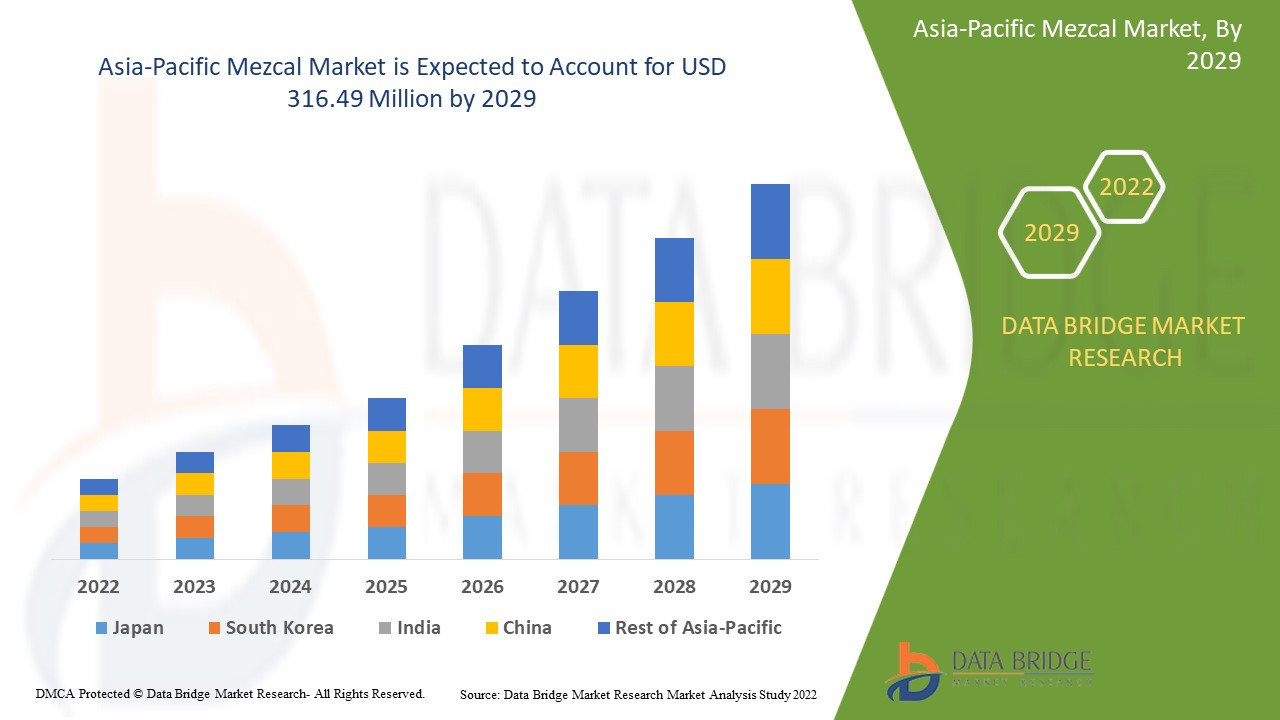

Data Bridge Market Research analyses that the mezcal market is expected to reach a value of USD 316.49 million by 2029, at a CAGR of 22.7% during the forecast period. The increasing consumer demand for the mezcal beverage, positive outlook towards advanced and smart packaging solutions, and rise in the number of production units are propelling the demand of the mezcal market. The mezcal market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019-2014) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Kilo Liters |

|

Segments Covered |

By Product Type (Mezcal Joven, Mezcal Reposado, Mezcal Anejo, Mezcal Espadin, Mezcal Tepztate, Mezcal Arroqueño, Mezcal Ensamble, And Others), Concentrate (100% Tequila And Mix Tequila), Price Category (Premium, Standard And Economy), ABV Content (40% And Above And Less Than 40%), Year (18-24 Years, 25-44 Years, 45-64 Years, 65+ Years), Packaging Type (Bottle, Cans, And Others), Size (251-500 Ml, 501-750 Ml, 751-1000 Ml, And More Than 100 Ml), Flavour Type (Plain/Original And Flavored), Producer Type (Microbrewery, Distillers, Brewpub, Contract Brewing Company, Regional Craft Brewery, Large Brewery, And Others), Product Category (Distillers Mezcan And Handicrafted Mezcan/Artisanal Mezcan), End User (Restaurants, Hotels And Bars, Café, Catering, Airlines, Household, And Others), Distribution Channel (Offline Trade And Online Trade) |

|

Countries Covered |

China, South Korea, Japan, India, Australia, Singapore, Malaysia, Indonesia, Thailand, Philippines, Rest of Asia-Pacific |

|

Market Players Covered |

The major companies which are dealing in the market are Brown-Forman, Diageo, Pernod Ricard, WILLIAM GRANT & SONS LTD, Rey Campero, Tequila & Mezcal Private Brands S.A. de C.V., Destilería Tlacolula, El Silencio Holdings, INC., Sauza Tequila Import Company, Dos Hombres LLC. , Del Maguey, Wahaka Mezcal., BOZAL MEZCAL among others. |

Market Definition

Mezcal is the name given to traditional distilled alcoholic beverages made in various rural areas of Mexico, from certain northern states up to south states, which is nahuatl mexcalli, "baked agave." These alcoholic beverages are made from the cooked stems of species of the genus Agave, also known as "maguey," which have fermented sugars. It is a traditional Mexican distilled beverage produced from the fermented juices of the cooked agave plant core. It is a type of distilled alcoholic beverage made from the cooked and fermented hearts, or piñas, of agave plants.

Mezcal Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

- AVAILABILITY OF A VARIETY OF FLAVORS IN MEZCAL

The quality and authenticity of mezcal are highly crucial because of the beverage's unique alcoholic flavor, which results from the volatile and non-volatile compounds, the direct precursors of which come from the raw agave itself. These include fatty acids, ranging from capric to lignoceric, free fatty acids, β-sitosterol, and groups of mono-, di-, and triacylglycerols, as well as fructans, the principal carbohydrate of the Agave. Due to higher temperatures and a lower pH in the agave cooking process, fructans could form Maillard compounds, such as furans, pyrans, and ketones.

Moreover, the important parameter that defines the quality of agave beverages is the distillation system used. The composition of the aroma of mezcal is extremely complex. Similarities and differences between mezcal samples can be attributed to the conditions and the raw materials used, in addition to the origin and production season.

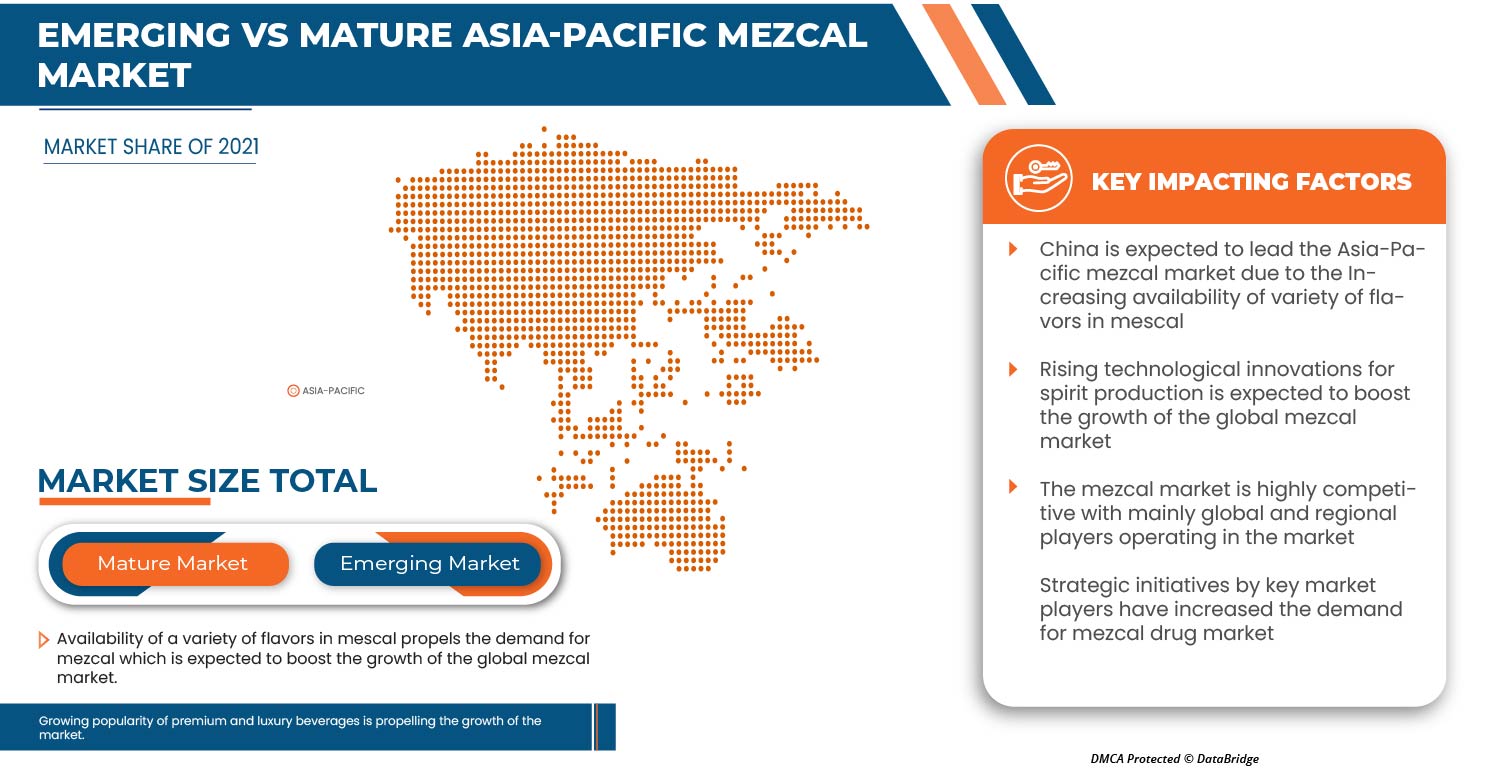

Due to the availability of various flavors in mezcal, consumers prefer it over other crafted spirits. Moreover, the growing interest among consumers regarding ethically sourced products and the tendency to promote beverages such as craft beer, cold-pressed juice, and smoothies with natural ingredients as premium is expected to drive the market growth in the forecast period.

- RISING TECHNOLOGICAL INNOVATIONS FOR SPIRIT PRODUCTION

The agave plant is extracted, which is used in spirit making, enriching the volatile profile of mezcal. The traditional extraction process often leads to higher solvent consumption, longer extraction times, lower yields, and poorer extraction quality. The distillation of fermented maguey is needed to produce several distilled alcoholic beverages, such as bacanora, tequila, and mezcal. Thus, technological advancements have created a chance for sustainable extract and spirit production. The manufacturers are engaged in product and technological innovations to reduce extraction and manufacturing costs. Companies can improve product traceability by using innovative technologies that can greatly enhance the effectiveness and efficiency of supply chains, particularly in industries such as food and beverage, pharmaceutical, and health care.

The fermentation process generates ethanol, higher alcohols, esters, organic acid, and others. Some of these volatile compounds are of greater importance than others due to their concentrations or aromatic characteristics; some could be specific to the agave species. Thus, the rising advanced technology for production is expected to drive the Asia-Pacific mezcal market.

- POSITIVE OUTLOOK TOWARDS ADVANCED AND SMART PACKAGING SOLUTIONS

The wine packaging industry is adopting smart and sustainable solutions to make product packaging more consumer-oriented and environmentally friendly. Premiumization makes a brand or product more appealing to consumers by emphasizing its superior quality and exclusivity in the agave-based beverage category, making a brand more appealing and, therefore, more expensive. This can come from new packaging, artisanal production, higher-quality ingredients, new flavors, and social/environmental messaging.

Furthermore, digitally printed packaging offers considerable potential savings over other printing processes and low setup costs. Manufacturers can dispense with bulk orders with large print runs and stock holding. Popular brand designing companies prefer glass bottles for Mezcal packaging. The benefits of digital printing are essential for today's packaging sector. Digital printing is the ideal process for small to medium print runs and enables the creation of customized printing for packaging and displays. Moreover, most of the mezcal available online is packed in glass bottles.

Thus, due to new product launches and developments, an increase in demand for advanced and smart packaging is expected to act as a driver for the Asia-Pacific mezcal market.

Restraints

- HEAVY TAXATION AND DUTIES

The increased demand for alcoholic beverage products worldwide has increased imports in the growing market. But heavy taxation and customs duties are expected to restrain this market as it limits the market growth and makes the product cost expensive. This, as a result, is expected to restrict the demand for the products.

Thus, heavy taxation and excise duty automatically increase the prices of the products and makes the alcohol costlier, due to which the demand for the product decreases. This even results in customer loss which directly hampers the overall market and is expected to restrict the market's growth.

Opportunities/ Challenges

- GROWING POPULARITY OF PREMIUM AND LUXURY BEVERAGES

The ability to keep an eye on cholesterol levels and monitor blood sugar levels. The growth of the market is further fueled by the rise in disposable income and consumer spending power, both of which enhance consumer demand for a variety of goods. The demand for mezcal is rising due to the premiumization trend, encouraging the consumption of upscale alcoholic and non-alcoholic beverages. More than drinking alcohol is part of the premiumization trend. Among millennial customers, there is a developing demand for premium mezcal products. Due to the rising disposable income in developed nations like North America and Western Europe, they are willing to spend a lot of money on high-end and super-premium goods. Due to rising consumer disposable income per person and the economy's ongoing expansion, the market for high-end premium spirits increased by 5-6% annually in volume from 2019 to 2021.

The market is anticipated to expand over the forecast period as mezcal demand has grown dramatically over the last few years. The rising demand for premium mezcal is an opportunity for the growth of the Asia-Pacific mezcal market.

- RISING POPULARITY OF DRINKING HEALTHFUL, NON-ALCOHOLIC BEVERAGES

One of the most rapidly developing industries is the beverage industry, which involves making various drinks such as mezcal. The growing consumer awareness of using natural and organic components in food and drink is predicted to create a challenge in the growth rate of the mezcal industry in the future.

Many fermented foods and beverages contain ethyl carbamate (EC), a known genotoxic carcinogen. Ethyl carbamate is not only carcinogenic but also a known liver toxic agent in humans. Moreover, carbonated beverage consumption has been linked with kidney stones, all risk factors for chronic kidney disease. The increasing number of chronic liver and kidney diseases makes consumers aware of drinking healthfully. People today prefer more non-alcoholic beverages due to such health conditions.

Thus, the rise in chronic health conditions is making consumers aware of the use of non-alcoholic beverages, and this may act as a challenge to the growth of the market.

Post COVID-19 Impact on Mezcal Market

The COVID-19 outbreak had a significant impact on the mezcal industry. The lockout hurt Asia-Pacific output and will make trade uncertainty and the current manufacturing slump worse. Comparatively speaking, the pandemic had little effect on the operations of the food and beverage sector, but its Asia-Pacific supply chain was badly disrupted, which prevented further growth. The consumer shift has negatively impacted consumer purchasing behavior. The sector saw both short-term and long-term effects due to the emergence of many obstacles, including the suspension of numerous operations, stunting corporate growth, and other issues. These issues had a significant impact on supply and demand. The food and beverage sector was among those affected by production and raw material supply interruptions.

Worldwide supply chains have been impeded by the shutdown of many industries, which has interrupted industrial activities, delivery schedules, and the sale of various products. A number of businesses have already warned that any delays in product deliveries could hurt future sales of their products. The trip disruption affects the industrial sector since it interferes with company planning and teamwork. Both offline and online retailers provide mezcal; the offline sector suffered significant losses due to closures and warnings against moving outside to lessen the COVID-19 effect, but the online industry has seen increased growth. Additionally, things are improving because there are fewer COVID cases worldwide, and the market is growing quickly and will continue to do so during the projection period. As a result, it is predicted that the market will expand significantly after COVID-19.

Recent Developments

- In January 2022, Diageo PLC acquired mezcal union through the acquisition of Casa UM. Mezcal Union is one of the leading brands of mezcal production. The company used this acquisition to expand its business of mezcal drinks

- In April 2021, Madre Mezcal, one of the fastest-growing mezcal brands in America, raised USD 3 million to apply the brand's successful growth strategy to new products and markets. The Series A round was led by Room 9, an NYC-based venture capital studio specializing in consumer sector investing

Asia-Pacific Mezcal Market Scope

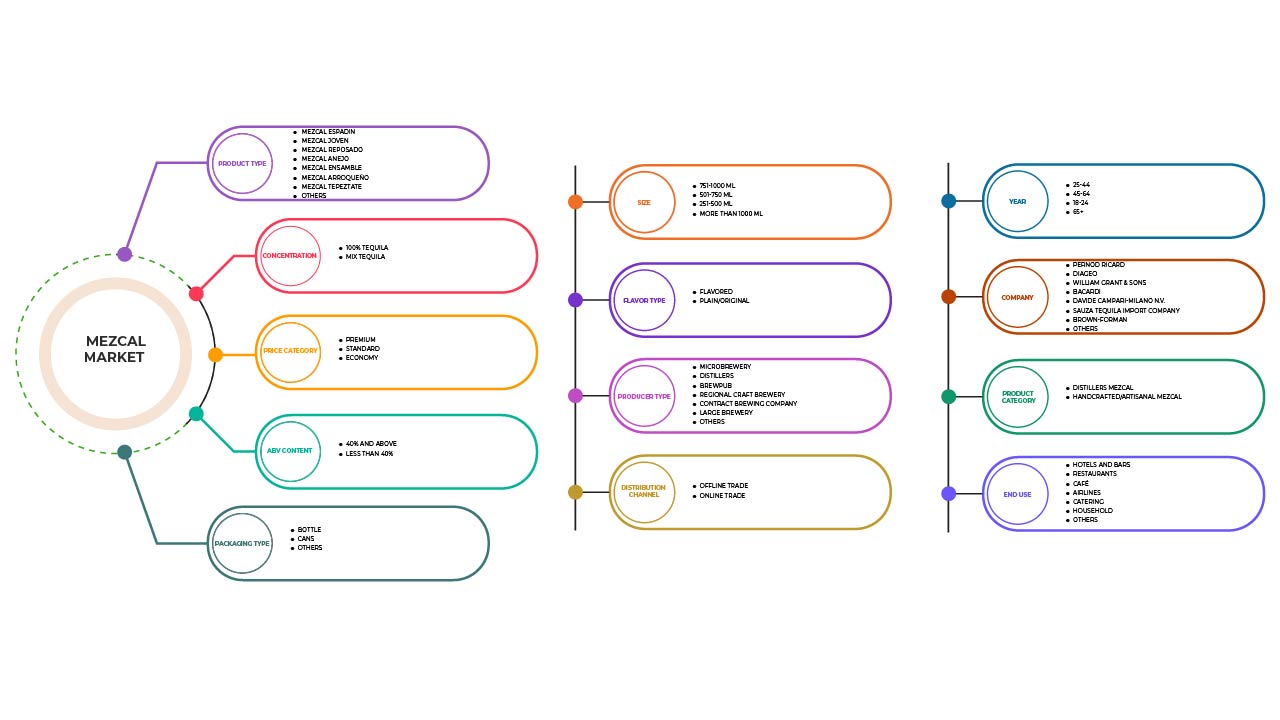

The Asia-Pacific mezcal market is segmented on the basis of product type, concentrate, price category, ABV content, year, packaging type, size, flavor type, producer type, product category, end user, and distribution channel. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Mezcal Espadin

- Mezcal Joven

- Mezcal Reposado

- Mezcal Anejo

- Mezcal Ensamble

- Mezcal Arroqueño

- Mezcal Tepeztate

- Others

On the basis of product type, the Asia-Pacific mezcal market is segmented into mezcal joven, mezcal reposado, mezcal anejo, mezcal espadin, mezcal tepztate, mezcal arroqueño, mezcal ensamble and others

CONCENTRATE

- 100% Tequila

- Mix Tequila

On the basis of concentrate, the Asia-Pacific mezcal market has been segmented into 100% tequila and mix tequila.

PRICE CATEGORY

- Premium

- Standard

- Economy

On the basis of price category, the Asia-Pacific mezcal market has been segmented into premium, standard, and economy.

ABV CONTENT

- 40% and above

- Less than 40%

On the basis of ABV content, the Asia-Pacific mezcal market has been segmented into below 40% and above and less than 40%.

YEAR

- 18-24

- 25-44

- 45-64

- 65+

On the basis of year, the Asia-Pacific mezcal market has been segmented into 18-24 Years, 25-44 Years, 45-64 Years, and 65+ Years

PACKAGING TYPE

- Bottle

- Cans

- Others

On the basis of packaging type, the Asia-Pacific mezcal market has been segmented into bottle, cans, and others.

SIZE

- 251-500 ml

- 501-750 ml

- 751-1000 ml

- more than 100 ml

On the basis of size, the Asia-Pacific mezcal market has been segmented into 251-500 ml, 501-750 ml, 751-1000 ml, more than 100 ml

FLAVOR TYPE

- Plain/Original

- Flavored

On the basis of flavor type, the Asia-Pacific mezcal market has been segmented into plain/original and flavored.

PRODUCER TYPE

- Microbrewery

- Distillers

- Brewpub

- Contract brewing company

- Regional craft brewery

- Large brewery

- Others

On the basis of producer type, the Asia-Pacific mezcal market has been segmented into microbrewery, distillers, brewpub, contract brewing company, regional craft brewery, large brewery, and others

PRODUCT CATEGORY

- Distillers mezcan

- Handcrafted mezcan/ artisanal mezcan

On the basis of product category, the Asia-Pacific mezcal market has been segmented into distillers mezcan and handcrafted mezcan

END-USE

- Restaurants

- Hotels & bars

- Café

- Catering

- Airlines

- Household

- Others

On the basis of end user, the Asia-Pacific mezcal market has been segmented into Restaurants, Hotels & bars, Café, Catering, Airlines, Household, and Others

DISTRIBUTION CHANNEL

- Offline-trade

- Online trade

On the basis of distribution channel, the Asia-Pacific mezcal market has been segmented into offline trade and online trade.

Mezcal Market Regional Analysis/Insights

The mezcal market is analyzed, and market size insights and trends are provided by country, product type, concentrate, price category, ABV content, year, packaging type, size, flavor type, producer type, product category, end user, and distribution channel, as referenced above.

The countries covered in the Asia-Pacific mezcal market report are China, South Korea, Japan, India, Australia, Singapore, Malaysia, Indonesia, Thailand, Philippines, and Rest of Asia-Pacific in Asia-Pacific (APAC)

China is dominating the Asia-Pacific mezcal market with a CAGR of around 22.7%. The broad base of the beverage industry in the country is set to drive market growth.

The country section of the report also provides individual market-impacting factors and market regulation changes that impact the market's current and future trends. Data points like downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Mezcal Market Share Analysis

The mezcal market competitive landscape provides details of the competitor. Details include company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points are only related to the companies focus on the mezcal market.

Some of the major players operating in the mezcal market are Davide Campari-Milano N.V., BACARDI, Craft Distillers, MADRE MEZCAL, Familia Camarena, Brown-Forman, Diageo, Pernod Ricard, WILLIAM GRANT & SONS LTD, Rey Campero, Tequila & Mezcal Private Brands S.A. de C.V., Destilería Tlacolula, El Silencio Holdings, INC., Sauza Tequila Import Company, Dos Hombres LLC. , Del Maguey, Wahaka Mezcal., BOZAL MEZCAL Sombra , Pensador Mezcal, Ilegal Mezcal among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA PACIFIC MEZCAL MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 MARKETING STRATEGY OPTED BY MICROBREWERIES

4.1.1 CREATING CUSTOM PACKAGING

4.1.2 PROVIDING BUSINESS PERSPECTIVES

4.1.3 SOCIAL MEDIA USE

4.1.4 DESIGNING CUSTOMER LOYALTY INITIATIVES

4.1.5 GETTING INVOLVED WITH THE COMMUNITY

4.2 KEY TRENDS SCENARIO

4.2.1 PREMIUMISATION

4.2.2 VALUE FOR MONEY

4.2.3 HEALTH AND WELL BEING

4.2.4 CONSUMER AWARENESS

4.2.5 PRODUCT INNOVATION

4.2.6 AVAILABILITY OF LOCAL PRODUCTS

4.2.7 OTHERS

4.3 FACTORS INFLUENCING PURCHASE DECISION

4.4 KEY DEMOGRAPHIC CONSUMER BASE INCLUDE:

4.5 PRICE ANALYSIS

4.6 PROMOTIONAL ACTIVITIES ADOPTED BY KEY MARKET PLAYERS

4.7 PRIVATE LABEL VS BRAND LABEL

4.8 TAXATION AND DUTY LEVIES

5 SUPPLY CHAIN OF ASIA PACIFIC MEZCAL MARKET

5.1 RAW MATERIAL PROCUREMENT

5.2 MANUFACTURING

5.3 MARKETING AND DISTRIBUTION

5.4 END USERS

5.5 LOGISTIC COST SCENARIO

5.6 IMPORTANCE OF LOGISTIC SERVICE PROVIDER

6 ASIA PACIFIC MEZCAL MARKET: SHOPPING BEHAVIOUR

6.1 RECOMMENDATIONS FROM FAMILY & FRIENDS-

6.2 RESEARCH

6.3 IMPULSIVE

6.4 ADVERTISEMENT:

6.4.1 TELEVISION ADVERTISEMENT

6.4.2 ONLINE ADVERTISEMENT

6.4.3 IN-STORE ADVERTISEMENT

7 ASIA PACIFIC MEZCAL MARKET: REGULATIONS

7.1 REGULATION IN U.S

7.2 REGULATION IN EUROPE

7.3 REGULATION IN AUSTRALIA

8 ASIA PACIFIC MEZCAL MARKET, NEW PRODUCT LAUNCH STRATEGY

8.1 OVERVIEW

8.2 NUMBER OF PRODUCT LAUNCHES

8.2.1 LINE EXTENSION

8.2.2 NEW PACKAGING

8.2.3 RE-LAUNCHED

8.2.4 NEW FORMULATION

8.3 DIFFERENTIAL PRODUCT OFFERING

8.4 MEETING CONSUMER REQUIREMENT

8.5 PACKAGE DESIGNING

8.6 PRICING ANALYSIS

8.7 PRODUCT POSITIONING

8.8 CONCLUSION

9 EXPORT AND IMPORT TRADE ANALYSIS

9.1 EXPORT ANALYSIS OF SPIRIT DRINKS

9.2 IMPORT ANALYSIS OF SPIRIT DRINKS

10 ASIA PACIFIC MEZCAL MARKET, CONSUMER DISPOSABLE INCOME DYNAMICS/SPEND DYNAMICS

10.1 OVERVIEW

10.2 SOCIAL FACTORS

10.3 CULTURAL FACTORS

10.4 PSYCHOLOGICAL FACTORS

10.5 PERSONAL FACTORS

10.6 ECONOMIC FACTORS

10.7 PRODUCT TRAITS

10.8 MARKET ATTRIBUTES

10.9 ASIA PACIFIC CONSUMERS DISPOSABLE INCOME/SPEND DYNAMICS

10.1 CONCLUSION

11 MARKET OVERVIEW

11.1 DRIVERS

11.1.1 AVAILABILITY OF A VARIETY OF FLAVORS IN MEZCAL

11.1.2 RISING TECHNOLOGICAL INNOVATIONS FOR SPIRIT PRODUCTION

11.1.3 POSITIVE OUTLOOK TOWARDS ADVANCED AND SMART PACKAGING SOLUTIONS

11.1.4 RISING INITIATIVE OF COMPANIES TO EXPAND THEIR BUSINESS ASIA PACIFICLY

11.2 RESTRAINTS

11.2.1 HEAVY TAXATION AND DUTIES

11.2.2 STRINGENT RULES AND REGULATIONS

11.3 OPPORTUNITIES

11.3.1 GROWING POPULARITY OF PREMIUM AND LUXURY BEVERAGES

11.3.2 INCREASING CUSTOMERS FOR MEZCAL PRODUCTS

11.3.3 INCREASED AVAILABILITY OF MEZCAL ON E-COMMERCE PLATFORMS

11.4 CHALLENGES

11.4.1 RISING POPULARITY OF DRINKING HEALTHFUL, NON-ALCOHOLIC BEVERAGES

11.4.2 HIGH COST OF MEZCAL

12 ASIA PACIFIC MEZCAL MARKET, BY PRODUCT TYPE

12.1 OVERVIEW

12.2 MEZCAL ESPADIN

12.2.1 BY CONCENTRATION

12.2.1.1 100% TEQUILA

12.2.1.2 MIX TEQUILA

12.2.2 BY ABV CONTENT

12.2.2.1 40% AND ABOVE

12.2.2.2 LESS THAN 40%

12.3 MEZCAL JOVEN

12.3.1 BY CONCENTRATION

12.3.1.1 100% TEQUILA

12.3.1.2 MIX TEQUILA

12.3.2 BY ABV CONTENT

12.3.2.1 40% AND ABOVE

12.3.2.2 LESS THAN 40%

12.3.3 BY DISTILLATION

12.3.3.1 COPPER

12.3.3.2 STEEL

12.4 MEZCAL REPOSADO

12.4.1 BY CONCENTRATION

12.4.1.1 100% TEQUILA

12.4.1.2 MIX TEQUILA

12.4.2 BY ABV CONTENT

12.4.2.1 40% AND ABOVE

12.4.2.2 LESS THAN 40%

12.4.3 BY DISTILLATION

12.4.3.1 COPPER

12.4.3.2 STEEL

12.5 MEZCAL ANEJO

12.5.1 BY CONCENTRATION

12.5.1.1 100% TEQUILA

12.5.1.2 MIX TEQUILA

12.5.2 BY ABV CONTENT

12.5.2.1 40% AND ABOVE

12.5.2.2 LESS THAN 40%

12.5.3 BY DISTILLATION

12.5.3.1 COPPER

12.5.3.2 STEEL

12.6 MEZCAL ENSAMBLE

12.6.1 BY CONCENTRATION

12.6.1.1 100% TEQUILA

12.6.1.2 MIX TEQUILA

12.6.2 BY ABV CONTENT

12.6.2.1 40% AND ABOVE

12.6.2.2 LESS THAN 40%

12.7 MEZCAL ARROQUEÑO

12.7.1 BY CONCENTRATION

12.7.1.1 100% TEQUILA

12.7.1.2 MIX TEQUILA

12.7.2 BY ABV CONTENT

12.7.2.1 40% AND ABOVE

12.7.2.2 LESS THAN 40%

12.8 MEZCAL TEPEZTATE

12.8.1 BY CONCENTRATION

12.8.1.1 100% TEQUILA

12.8.1.2 MIX TEQUILA

12.8.2 BY ABV CONTENT

12.8.2.1 40% AND ABOVE

12.8.2.2 LESS THAN 40%

12.9 OTHERS

12.9.1 BY CONCENTRATION

12.9.1.1 100% TEQUILA

12.9.1.2 MIX TEQUILA

12.9.2 BY ABV CONTENT

12.9.2.1 40% AND ABOVE

12.9.2.2 LESS THAN 40%

13 ASIA PACIFIC MEZCAL MARKET, BY CONCENTRATION

13.1 OVERVIEW

13.2 100% TEQUILA

13.3 MIX TEQUILA

14 ASIA PACIFIC MEZCAL MARKET, BY PRICE CATEGORY

14.1 OVERVIEW

14.2 PREMIUM

14.3 STANDARD

14.4 ECONOMY

15 ASIA PACIFIC MEZCAL MARKET, BY ABV CONTENT

15.1 OVERVIEW

15.2 40% AND ABOVE

15.3 LESS THAN 40%

16 ASIA PACIFIC MEZCAL MARKET, BY YEAR

16.1 OVERVIEW

16.2 25-44

16.3 45-64

16.4 18-24

16.5 65+

17 ASIA PACIFIC MEZCAL MARKET, BY PACKAGING TYPE

17.1 OVERVIEW

17.2 BOTTLE

17.3 CANS

17.4 OTHERS

18 ASIA PACIFIC MEZCAL MARKET, BY SIZE

18.1 OVERVIEW

18.2 751-1000 ML

18.3 501-750 ML

18.4 251-500 ML

18.5 MORE THAN 1000 ML

19 ASIA PACIFIC MEZCAL MARKET, BY FLAVOR TYPE

19.1 OVERVIEW

19.2 FLAVORED

19.2.1 CITRUS FRUITS

19.2.1.1 ORANGE

19.2.1.2 LEMON

19.2.1.3 GRAPE FRUIT

19.2.1.4 OTHERS

19.2.2 FLORALS

19.2.3 SMOKED

19.2.4 GREEN PEPPER

19.2.5 OTHERS

19.3 PLAIN/ORIGINAL

20 ASIA PACIFIC MEZCAL MARKET, BY PRODUCER TYPE

20.1 OVERVIEW

20.2 MICROBREWERY

20.3 DISTILLERS

20.4 BREWPUB

20.5 REGIONAL CRAFT BREWERY

20.6 CONTRACT BREWING COMPANY

20.7 LARGE BREWERY

20.8 OTHERS

21 ASIA PACIFIC MEZCAL MARKET, BY PRODUCT CATEGORY

21.1 OVERVIEW

21.2 DISTILLERS MEZCAL

21.3 HANDCRAFTED/ARTISANAL MEZCAL

22 ASIA PACIFIC MEZCAL MARKET, BY END USE

22.1 OVERVIEW

22.2 HOTELS AND BARS

22.3 RESTAURANTS

22.3.1 RESTAURANTS, BY TYPE

22.3.1.1 CHAIN RESTAURANTS

22.3.1.2 INDEPENDENT RESTAURANTS

22.3.2 RESTAURANTS, BY SERVICE CATEGORY

22.3.2.1 FULL SERVICE RESTAURANTS

22.3.2.2 QUICK SERVICE RESTAURANTS

22.4 CAFE

22.4.1 AIRLINES

22.4.2 CATERING

22.4.3 HOUSEHOLD

22.4.4 OTHERS

23 ASIA PACIFIC MEZCAL MARKET, BY DISTRIBUTION CHANNEL

23.1 OVERVIEW

23.2 OFFLINE TRADE

23.2.1 NON-STORE BASED RETAILERS

23.2.1.1 VENDING MACHINE

23.2.1.2 OTHERS

23.2.2 STORE BASED RETAILER

23.2.2.1 HYPERMARKET/SUPERMARKET

23.2.2.2 CONVENIENCE STORES

23.2.2.3 SPECIALTY STORES

23.2.2.4 GROCERY STORES

23.2.2.5 OTHERS

23.3 ONLINE TRADE

23.4 COMPANY OWNED WEBSITE

23.5 E-COMMERCE

24 ASIA PACIFIC MEZCAL MARKET, BY REGION

24.1 ASIA-PACIFIC

24.1.1 CHINA

24.1.2 JAPAN

24.1.3 SOUTH KOREA

24.1.4 INDIA

24.1.5 AUSTRALIA & NEW ZEALAND

24.1.6 SINGAPORE

24.1.7 THAILAND

24.1.8 MALAYSIA

24.1.9 INDONESIA

24.1.10 PHILIPPINES

24.1.11 REST OF ASIA-PACIFIC

25 ASIA PACIFIC MEZCAL MARKET: COMPANY LANDSCAPE

25.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

26 SWOT ANALYSIS

27 COMPANY PROFILE

27.1 PERNOD RICARD

27.1.1 COMPANY SNAPSHOT

27.1.2 REVENUE ANALYSIS

27.1.3 COMPANY SHARE ANALYSIS

27.1.4 PRODUCT PORTFOLIO

27.1.5 RECENT DEVELOPMENT

27.2 DIAGEO

27.2.1 COMPANY SNAPSHOT

27.2.2 REVENUE ANALYSIS

27.2.3 COMPANY SHARE ANALYSIS

27.2.4 PRODUCT PORTFOLIO

27.2.5 RECENT DEVELOPMENTS

27.3 WILLIAM GRANT & SONS

27.3.1 COMPANY SNAPSHOT

27.3.2 COMPANY SHARE ANALYSIS

27.3.3 PRODUCT PORTFOLIO

27.3.4 RECENT DEVELOPMENTS

27.4 BACARDI

27.4.1 COMPANY SNAPSHOT

27.4.2 COMPANY SHARE ANALYSIS

27.4.3 PRODUCT PORTFOLIO

27.4.4 RECENT DEVELOPMENT

27.5 DAVIDE CAMPARI-MILANO N.V.

27.5.1 COMPANY SNAPSHOT

27.5.2 REVENUE ANALYSIS

27.5.3 COMPANY SHARE ANALYSIS

27.5.4 PRODUCT PORTFOLIO

27.5.5 RECENT DEVELOPMENT

27.6 BROWN-FORMAN

27.6.1 COMPANY SNAPSHOT

27.6.2 REVENUE ANALYSIS

27.6.3 PRODUCT PORTFOLIO

27.6.4 RECENT DEVELOPMENT

27.7 BOZAL MEZCAL

27.7.1 COMPANY SNAPSHOT

27.7.2 PRODUCT PORTFOLIO

27.7.3 RECENT DEVELOPMENT

27.8 CRAFT DISTILLERS

27.8.1 COMPANY SNAPSHOT

27.8.2 PRODUCT PORTFOLIO

27.8.3 RECENT DEVELOPMENTS

27.9 DOS HOMBRES LLC.

27.9.1 COMPANY SNAPSHOT

27.9.2 PRODUCT PORTFOLIO

27.9.3 RECENT DEVELOPMENTS

27.1 DEL MAGUEY SINGLE VILLAGE MEZCAL

27.10.1 COMPANY SNAPSHOT

27.10.2 PRODUCT PORTFOLIO

27.10.3 RECENT DEVELOPMENTS

27.11 DESTILERÍA TLACOLULA

27.11.1 COMPANY SNAPSHOT

27.11.2 PRODUCT PORTFOLIO

27.11.3 RECENT DEVELOPMENT

27.12 EL SILENCIO HOLDINGS, INC.

27.12.1 COMPANY SNAPSHOT

27.12.2 PRODUCT PORTFOLIO

27.12.3 RECENT DEVELOPMENTS

27.13 FAMILIA CAMARENA

27.13.1 COMPANY SNAPSHOT

27.13.2 PRODUCT PORTFOLIO

27.13.3 RECENT DEVELOPMENTS

27.14 ILEGAL MEZCAL

27.14.1 COMPANY SNAPSHOT

27.14.2 PRODUCT PORTFOLIO

27.14.3 RECENT DEVELOPMENTS

27.15 KING CAMPERO

27.15.1 COMPANY SNAPSHOT

27.15.2 PRODUCT PORTFOLIO

27.15.3 RECENT DEVELOPMENTS

27.16 MADRE MEZCAL

27.16.1 COMPANY SNAPSHOT

27.16.2 PRODUCT PORTFOLIO

27.16.3 RECENT DEVELOPMENTS

27.17 MEZCAL SOMBRA

27.17.1 COMPANY SNAPSHOT

27.17.2 PRODUCT PORTFOLIO

27.17.3 RECENT DEVELOPMENT

27.18 PENSADOR MEZCAL

27.18.1 COMPANY SNAPSHOT

27.18.2 PRODUCT PORTFOLIO

27.18.3 RECENT DEVELOPMENTS

27.19 SAUZA TEQUILA IMPORT COMPANY

27.19.1 COMPANY SNAPSHOT

27.19.2 PRODUCT PORTFOLIO

27.19.3 RECENT DEVELOPMENTS

27.2 TEQUILA & MEZCAL PRIVATE BRANDS S.A. DE C.V.

27.20.1 COMPANY SNAPSHOT

27.20.2 PRODUCT PORTFOLIO

27.20.3 RECENT DEVELOPMENTS

27.21 WAHAKA MEZCAL

27.21.1 COMPANY SNAPSHOT

27.21.2 PRODUCT PORTFOLIO

27.21.3 RECENT DEVELOPMENT

28 QUESTIONNAIRE

29 RELATED REPORTS

List of Table

TABLE 1 THE FOLLOWING ARE THE DIFFERENT PRICES OF DIFFERENT BRANDS.

TABLE 2 ASIA PACIFIC MEZCAL MARKET, BY PRODUCT TYPE, 2020- 2029 (USD MILLION)

TABLE 3 ASIA PACIFIC MEZCAL MARKET, BY PRODUCT TYPE, 2020- 2029, VOLUME (KILO LITERS)

TABLE 4 ASIA PACIFIC MEZCAL ESPADIN IN MEZCAL MARKET, BY REGION, 2020- 2029 (USD MILLION)

TABLE 5 ASIA PACIFIC MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 6 ASIA PACIFIC MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 7 ASIA PACIFIC MEZCAL JOVEN IN MEZCAL MARKET, BY REGION, 2020- 2029 (USD MILLION)

TABLE 8 ASIA PACIFIC MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 9 ASIA PACIFIC MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 10 ASIA PACIFIC MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020- 2029 (USD MILLION)

TABLE 11 ASIA PACIFIC MEZCAL REPOSADO IN MEZCAL MARKET, BY REGION, 2020- 2029 (USD MILLION)

TABLE 12 ASIA PACIFIC MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 13 ASIA PACIFIC MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 14 ASIA PACIFIC MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020- 2029 (USD MILLION)

TABLE 15 ASIA PACIFIC MEZCAL ANEJO IN MEZCAL MARKET, BY REGION, 2020- 2029 (USD MILLION)

TABLE 16 ASIA PACIFIC MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 17 ASIA PACIFIC MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 18 ASIA PACIFIC MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020- 2029 (USD MILLION)

TABLE 19 ASIA PACIFIC MEZCAL ENSAMBLE IN MEZCAL MARKET, BY REGION, 2020- 2029 (USD MILLION)

TABLE 20 ASIA PACIFIC MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 21 ASIA PACIFIC MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 22 ASIA PACIFIC MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY REGION, 2020- 2029 (USD MILLION)

TABLE 23 ASIA PACIFIC MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 24 ASIA PACIFIC MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 25 ASIA PACIFIC MEZCAL TEPEZTATE IN MEZCAL MARKET, BY REGION, 2020- 2029 (USD MILLION)

TABLE 26 ASIA PACIFIC MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 27 ASIA PACIFIC MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 28 ASIA PACIFIC OTHERS IN MEZCAL MARKET, BY REGION, 2020- 2029 (USD MILLION)

TABLE 29 ASIA PACIFIC OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020- 2029 (USD MILLION)

TABLE 30 ASIA PACIFIC OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020- 2029 (USD MILLION)

TABLE 31 ASIA PACIFIC MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC 100% TEQUILA IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 ASIA PACIFIC MIX TEQUILA IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 ASIA PACIFIC MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 35 ASIA PACIFIC PREMIUM IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 ASIA PACIFIC STANDARD IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 ASIA PACIFIC ECONOMY IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 ASIA PACIFIC MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 39 ASIA PACIFIC 40% AND ABOVE IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 ASIA PACIFIC LESS THAN 40% IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 ASIA PACIFIC MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 42 ASIA PACIFIC 25-44 IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 ASIA PACIFIC 45-64 IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 ASIA PACIFIC 18-24 IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 ASIA PACIFIC 65+ IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 ASIA PACIFIC MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 47 ASIA PACIFIC BOTTLES IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 ASIA PACIFIC CANS IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 ASIA PACIFIC OTHERS IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 ASIA PACIFIC MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 51 ASIA PACIFIC 751-1000 ML IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 ASIA PACIFIC 501-750 ML IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 ASIA PACIFIC 251-500 ML IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 54 ASIA PACIFIC MORE THAN 1000 ML IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 55 ASIA PACIFIC MEZCAL MARKET, BY FLAVOR TYPE, 2020- 2029 (USD MILLION)

TABLE 56 ASIA PACIFIC FLAVORED IN MEZCAL MARKET, BY REGION, 2020- 2029 (USD MILLION)

TABLE 57 ASIA PACIFIC FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020- 2029 (USD MILLION)

TABLE 58 ASIA PACIFIC CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 59 ASIA PACIFIC PLAIN/ORIGINAL IN MEZCAL MARKET, BY REGION, 2020- 2029 (USD MILLION)

TABLE 60 ASIA PACIFIC MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 61 ASIA PACIFIC MICROBREWERY IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 62 ASIA PACIFIC DISTILLERS IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 63 ASIA PACIFIC BREWPUB IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 64 ASIA PACIFIC REGIONAL CRAFT BREWERY IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 65 ASIA PACIFIC CONTRACT BREWING COMPANY IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 66 ASIA PACIFIC LARGE BREWERY IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 67 ASIA PACIFIC OTHERS IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 68 ASIA PACIFIC MEZCAL MARKET, BY PRODUCT CATEGORY 2020-2029 (USD MILLION)

TABLE 69 ASIA PACIFIC DISTILLERS MEZCAL IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 70 ASIA PACIFIC HANDCRAFTED/ARTISANAL MEZCAL IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 71 ASIA PACIFIC MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 72 ASIA PACIFIC HOTELS AND BARS IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 73 ASIA PACIFIC RESTAURANTS IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 74 ASIA PACIFIC RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 ASIA PACIFIC RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 76 ASIA PACIFIC CAFÉ IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 77 ASIA PACIFIC AIRLINES IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 78 ASIA PACIFIC CATERING IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 79 ASIA PACIFIC HOUSEHOLD IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 80 ASIA PACIFIC OTHERS IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 81 ASIA PACIFIC MEZCAL MARKET, BY DISTRIBUTION CHANNEL 2020-2029 (USD MILLION)

TABLE 82 ASIA PACIFIC OFFLINE TRADE IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 83 ASIA PACIFIC OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL 2020-2029 (USD MILLION)

TABLE 84 ASIA PACIFIC NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL 2020-2029 (USD MILLION)

TABLE 85 ASIA PACIFIC STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL 2020-2029 (USD MILLION)

TABLE 86 ASIA PACIFIC ONLINE TRADE IN MEZCAL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 87 ASIA PACIFIC ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL 2020-2029 (USD MILLION)

TABLE 88 ASIA-PACIFIC MEZCAL MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 89 ASIA-PACIFIC MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 90 ASIA-PACIFIC MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 91 ASIA-PACIFIC MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 92 ASIA-PACIFIC MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 93 ASIA-PACIFIC MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 94 ASIA-PACIFIC MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 95 ASIA-PACIFIC MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 96 ASIA-PACIFIC MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 97 ASIA-PACIFIC MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 98 ASIA-PACIFIC MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 99 ASIA-PACIFIC MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 100 ASIA-PACIFIC MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 101 ASIA-PACIFIC MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 102 ASIA-PACIFIC MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 103 ASIA-PACIFIC MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 104 ASIA-PACIFIC MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 105 ASIA-PACIFIC MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 106 ASIA-PACIFIC MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 107 ASIA-PACIFIC MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 108 ASIA-PACIFIC OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 109 ASIA-PACIFIC OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 110 ASIA-PACIFIC MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 111 ASIA-PACIFIC MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 112 ASIA-PACIFIC MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 113 ASIA-PACIFIC MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 114 ASIA-PACIFIC MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 115 ASIA-PACIFIC MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 116 ASIA-PACIFIC MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 117 ASIA-PACIFIC FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 118 ASIA-PACIFIC CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 ASIA-PACIFIC MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 120 ASIA-PACIFIC MEZCAL MARKET, BY PRODUCT CATEGORY 2020-2029 (USD MILLION)

TABLE 121 ASIA-PACIFIC MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 122 ASIA-PACIFIC RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 ASIA-PACIFIC RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 124 ASIA-PACIFIC MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 125 ASIA-PACIFIC OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 126 ASIA-PACIFIC NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 127 ASIA-PACIFIC STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 128 ASIA-PACIFIC ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 129 CHINA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 130 CHINA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 131 CHINA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD)

TABLE 132 CHINA MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 133 CHINA MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 134 CHINA MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 135 CHINA MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 136 CHINA MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 137 CHINA MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 138 CHINA MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 139 CHINA MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 140 CHINA MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 141 CHINA MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 142 CHINA MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 143 CHINA MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 144 CHINA MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 145 CHINA MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 146 CHINA MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 147 CHINA MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 148 CHINA MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 149 CHINA OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 150 CHINA OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 151 CHINA MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 152 CHINA MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 153 CHINA MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 154 CHINA MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 155 CHINA MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 156 CHINA MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 157 CHINA MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 158 CHINA FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 159 CHINA CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 160 CHINA MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 161 CHINA MEZCAL MARKET, BY PRODUCT CATEGORY 2020-2029 (USD MILLION)

TABLE 162 CHINA MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 163 CHINA RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 164 CHINA RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 165 CHINA MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 166 CHINA OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 167 CHINA NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 168 CHINA STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 169 CHINA ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 170 JAPAN MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 171 JAPAN MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 172 JAPAN MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD)

TABLE 173 JAPAN MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 174 JAPAN MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 175 JAPAN MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 176 JAPAN MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 177 JAPAN MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 178 JAPAN MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 179 JAPAN MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 180 JAPAN MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 181 JAPAN MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 182 JAPAN MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 183 JAPAN MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 184 JAPAN MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 185 JAPAN MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 186 JAPAN MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 187 JAPAN MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 188 JAPAN MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 189 JAPAN MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 190 JAPAN OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 191 JAPAN OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 192 JAPAN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 193 JAPAN MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 194 JAPAN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 195 JAPAN MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 196 JAPAN MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 197 JAPAN MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 198 JAPAN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 199 JAPAN FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 200 JAPAN CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 201 JAPAN MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 202 JAPAN MEZCAL MARKET, BY PRODUCT CATEGORY 2020-2029 (USD MILLION)

TABLE 203 JAPAN MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 204 JAPAN RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 205 JAPAN RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 206 JAPAN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 207 JAPAN OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 208 JAPAN NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 209 JAPAN STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 210 JAPAN ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 211 SOUTH KOREA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 212 SOUTH KOREA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 213 SOUTH KOREA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD)

TABLE 214 SOUTH KOREA MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 215 SOUTH KOREA MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 216 SOUTH KOREA MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 217 SOUTH KOREA MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 218 SOUTH KOREA MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 219 SOUTH KOREA MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 220 SOUTH KOREA MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 221 SOUTH KOREA MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 222 SOUTH KOREA MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 223 SOUTH KOREA MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 224 SOUTH KOREA MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 225 SOUTH KOREA MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 226 SOUTH KOREA MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 227 SOUTH KOREA MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 228 SOUTH KOREA MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 229 SOUTH KOREA MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 230 SOUTH KOREA MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 231 SOUTH KOREA OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 232 SOUTH KOREA OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 233 SOUTH KOREA MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 234 SOUTH KOREA MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 235 SOUTH KOREA MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 236 SOUTH KOREA MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 237 SOUTH KOREA MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 238 SOUTH KOREA MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 239 SOUTH KOREA MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 240 SOUTH KOREA FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 241 SOUTH KOREA CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 242 SOUTH KOREA MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 243 SOUTH KOREA MEZCAL MARKET, BY PRODUCT CATEGORY 2020-2029 (USD MILLION)

TABLE 244 SOUTH KOREA MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 245 SOUTH KOREA RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 246 SOUTH KOREA RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 247 SOUTH KOREA MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 248 SOUTH KOREA OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 249 SOUTH KOREA NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 250 SOUTH KOREA STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 251 SOUTH KOREA ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 252 INDIA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 253 INDIA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 254 INDIA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD)

TABLE 255 INDIA MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 256 INDIA MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 257 INDIA MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 258 INDIA MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 259 INDIA MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 260 INDIA MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 261 INDIA MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 262 INDIA MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 263 INDIA MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 264 INDIA MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 265 INDIA MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 266 INDIA MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 267 INDIA MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 268 INDIA MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 269 INDIA MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 270 INDIA MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 271 INDIA MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 272 INDIA OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 273 INDIA OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 274 INDIA MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 275 INDIA MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 276 INDIA MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 277 INDIA MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 278 INDIA MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 279 INDIA MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 280 INDIA MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 281 INDIA FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 282 INDIA CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 283 INDIA MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 284 INDIA MEZCAL MARKET, BY PRODUCT CATEGORY 2020-2029 (USD MILLION)

TABLE 285 INDIA MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 286 INDIA RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 287 INDIA RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 288 INDIA MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 289 INDIA OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 290 INDIA NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 291 INDIA STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 292 INDIA ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 293 AUSTRALIA & NEW ZEALAND MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 294 AUSTRALIA & NEW ZEALAND MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 295 AUSTRALIA & NEW ZEALAND MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD)

TABLE 296 AUSTRALIA & NEW ZEALAND MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 297 AUSTRALIA & NEW ZEALAND MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 298 AUSTRALIA & NEW ZEALAND MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 299 AUSTRALIA & NEW ZEALAND MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 300 AUSTRALIA & NEW ZEALAND MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 301 AUSTRALIA & NEW ZEALAND MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 302 AUSTRALIA & NEW ZEALAND MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 303 AUSTRALIA & NEW ZEALAND MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 304 AUSTRALIA & NEW ZEALAND MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 305 AUSTRALIA & NEW ZEALAND MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 306 AUSTRALIA & NEW ZEALAND MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 307 AUSTRALIA & NEW ZEALAND MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 308 AUSTRALIA & NEW ZEALAND MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 309 AUSTRALIA & NEW ZEALAND MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 310 AUSTRALIA & NEW ZEALAND MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 311 AUSTRALIA & NEW ZEALAND MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 312 AUSTRALIA & NEW ZEALAND MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 313 AUSTRALIA & NEW ZEALAND OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 314 AUSTRALIA & NEW ZEALAND OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 315 AUSTRALIA & NEW ZEALAND MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 316 AUSTRALIA & NEW ZEALAND MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 317 AUSTRALIA & NEW ZEALAND MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 318 AUSTRALIA & NEW ZEALAND MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 319 AUSTRALIA & NEW ZEALAND MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 320 AUSTRALIA & NEW ZEALAND MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 321 AUSTRALIA & NEW ZEALAND MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 322 AUSTRALIA & NEW ZEALAND FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 323 AUSTRALIA & NEW ZEALAND CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 324 AUSTRALIA & NEW ZEALAND MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 325 AUSTRALIA & NEW ZEALAND MEZCAL MARKET, BY PRODUCT CATEGORY 2020-2029 (USD MILLION)

TABLE 326 AUSTRALIA & NEW ZEALAND MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 327 AUSTRALIA & NEW ZEALAND RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 328 AUSTRALIA & NEW ZEALAND RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 329 AUSTRALIA & NEW ZEALAND MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 330 AUSTRALIA & NEW ZEALAND OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 331 AUSTRALIA & NEW ZEALAND NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 332 AUSTRALIA & NEW ZEALAND STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 333 AUSTRALIA & NEW ZEALAND ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 334 SINGAPORE MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 335 SINGAPORE MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 336 SINGAPORE MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD)

TABLE 337 SINGAPORE MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 338 SINGAPORE MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 339 SINGAPORE MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 340 SINGAPORE MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 341 SINGAPORE MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 342 SINGAPORE MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 343 SINGAPORE MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 344 SINGAPORE MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 345 SINGAPORE MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 346 SINGAPORE MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 347 SINGAPORE MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 348 SINGAPORE MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 349 SINGAPORE MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 350 SINGAPORE MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 351 SINGAPORE MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 352 SINGAPORE MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 353 SINGAPORE MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 354 SINGAPORE OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 355 SINGAPORE OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 356 SINGAPORE MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 357 SINGAPORE MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 358 SINGAPORE MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 359 SINGAPORE MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 360 SINGAPORE MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 361 SINGAPORE MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 362 SINGAPORE MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 363 SINGAPORE FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 364 SINGAPORE CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 365 SINGAPORE MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 366 SINGAPORE MEZCAL MARKET, BY PRODUCT CATEGORY 2020-2029 (USD MILLION)

TABLE 367 SINGAPORE MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 368 SINGAPORE RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 369 SINGAPORE RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 370 SINGAPORE MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 371 SINGAPORE OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 372 SINGAPORE NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 373 SINGAPORE STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 374 SINGAPORE ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 375 THAILAND MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 376 THAILAND MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 377 THAILAND MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD)

TABLE 378 THAILAND MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 379 THAILAND MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 380 THAILAND MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 381 THAILAND MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 382 THAILAND MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 383 THAILAND MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 384 THAILAND MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 385 THAILAND MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 386 THAILAND MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 387 THAILAND MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 388 THAILAND MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 389 THAILAND MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 390 THAILAND MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 391 THAILAND MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 392 THAILAND MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 393 THAILAND MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 394 THAILAND MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 395 THAILAND OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 396 THAILAND OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 397 THAILAND MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 398 THAILAND MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 399 THAILAND MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 400 THAILAND MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 401 THAILAND MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 402 THAILAND MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 403 THAILAND MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 404 THAILAND FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 405 THAILAND CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 406 THAILAND MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 407 THAILAND MEZCAL MARKET, BY PRODUCT CATEGORY 2020-2029 (USD MILLION)

TABLE 408 THAILAND MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 409 THAILAND RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 410 THAILAND RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 411 THAILAND MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 412 THAILAND OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 413 THAILAND NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 414 THAILAND STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 415 THAILAND ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 416 MALAYSIA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 417 MALAYSIA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 418 MALAYSIA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD)

TABLE 419 MALAYSIA MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 420 MALAYSIA MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 421 MALAYSIA MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 422 MALAYSIA MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 423 MALAYSIA MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 424 MALAYSIA MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 425 MALAYSIA MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 426 MALAYSIA MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 427 MALAYSIA MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 428 MALAYSIA MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 429 MALAYSIA MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 430 MALAYSIA MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 431 MALAYSIA MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 432 MALAYSIA MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 433 MALAYSIA MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 434 MALAYSIA MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 435 MALAYSIA MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 436 MALAYSIA OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 437 MALAYSIA OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 438 MALAYSIA MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 439 MALAYSIA MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 440 MALAYSIA MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 441 MALAYSIA MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 442 MALAYSIA MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 443 MALAYSIA MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 444 MALAYSIA MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 445 MALAYSIA FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 446 MALAYSIA CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 447 MALAYSIA MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 448 MALAYSIA MEZCAL MARKET, BY PRODUCT CATEGORY 2020-2029 (USD MILLION)

TABLE 449 MALAYSIA MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 450 MALAYSIA RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 451 MALAYSIA RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 452 MALAYSIA MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 453 MALAYSIA OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 454 MALAYSIA NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 455 MALAYSIA STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 456 MALAYSIA ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 457 INDONESIA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 458 INDONESIA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 459 INDONESIA MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD)

TABLE 460 INDONESIA MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 461 INDONESIA MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 462 INDONESIA MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 463 INDONESIA MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 464 INDONESIA MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 465 INDONESIA MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 466 INDONESIA MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 467 INDONESIA MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 468 INDONESIA MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 469 INDONESIA MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 470 INDONESIA MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 471 INDONESIA MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 472 INDONESIA MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 473 INDONESIA MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 474 INDONESIA MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 475 INDONESIA MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 476 INDONESIA MEZCAL TEPEZTATE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 477 INDONESIA OTHERS IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 478 INDONESIA OTHERS IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 479 INDONESIA MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 480 INDONESIA MEZCAL MARKET, BY PRICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 481 INDONESIA MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 482 INDONESIA MEZCAL MARKET, BY YEAR, 2020-2029 (USD MILLION)

TABLE 483 INDONESIA MEZCAL MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 484 INDONESIA MEZCAL MARKET, BY SIZE, 2020-2029 (USD MILLION)

TABLE 485 INDONESIA MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 486 INDONESIA FLAVORED IN MEZCAL MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 487 INDONESIA CITRUS FRUITS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 488 INDONESIA MEZCAL MARKET, BY PRODUCER TYPE, 2020-2029 (USD MILLION)

TABLE 489 INDONESIA MEZCAL MARKET, BY PRODUCT CATEGORY 2020-2029 (USD MILLION)

TABLE 490 INDONESIA MEZCAL MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 491 INDONESIA RESTAURANTS IN MEZCAL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 492 INDONESIA RESTAURANTS IN MEZCAL MARKET, BY SERVICE CATEGORY, 2020-2029 (USD MILLION)

TABLE 493 INDONESIA MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 494 INDONESIA OFFLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 495 INDONESIA NON-STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 496 INDONESIA STORE BASED RETAILERS IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 497 INDONESIA ONLINE TRADE IN MEZCAL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 498 PHILIPPINES MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 499 PHILIPPINES MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029, VOLUME (KILO LITERS)

TABLE 500 PHILIPPINES MEZCAL MARKET, BY PRODUCT TYPE, 2020-2029 (USD)

TABLE 501 PHILIPPINES MEZCAL ESPADIN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 502 PHILIPPINES MEZCAL ESPADIN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 503 PHILIPPINES MEZCAL JOVEN IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 504 PHILIPPINES MEZCAL JOVEN IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 505 PHILIPPINES MEZCAL JOVEN IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 506 PHILIPPINES MEZCAL REPOSADO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 507 PHILIPPINES MEZCAL REPOSADO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 508 PHILIPPINES MEZCAL REPOSADO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 509 PHILIPPINES MEZCAL ANEJO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 510 PHILIPPINES MEZCAL ANEJO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 511 PHILIPPINES MEZCAL ANEJO IN MEZCAL MARKET, BY DISTILLATION, 2020-2029 (USD MILLION)

TABLE 512 PHILIPPINES MEZCAL ENSAMBLE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 513 PHILIPPINES MEZCAL ENSAMBLE IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 514 PHILIPPINES MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)

TABLE 515 PHILIPPINES MEZCAL ARROQUEÑO IN MEZCAL MARKET, BY ABV CONTENT, 2020-2029 (USD MILLION)

TABLE 516 PHILIPPINES MEZCAL TEPEZTATE IN MEZCAL MARKET, BY CONCENTRATION, 2020-2029 (USD MILLION)