Asia Pacific Orthopedic Implants Including Dental Implants Market

Market Size in USD Billion

CAGR :

%

USD

5.52 Billion

USD

9.01 Billion

2024

2032

USD

5.52 Billion

USD

9.01 Billion

2024

2032

| 2025 –2032 | |

| USD 5.52 Billion | |

| USD 9.01 Billion | |

|

|

|

|

Asia-Pacific Orthopedic Implants Market Size

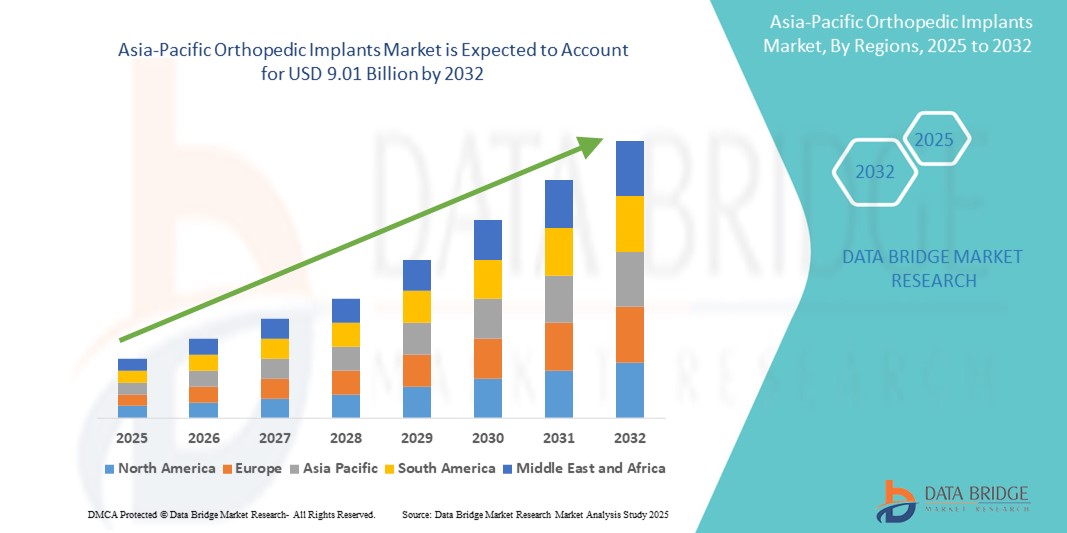

- The Asia-Pacific orthopedic implants market size was valued at USD 5.52 billion in 2024 and is expected to reach USD 9.01 billion by 2032, at a CAGR of 6.30% during the forecast period

- The market growth is largely fueled by the increasing prevalence of orthopedic disorders and a rapidly aging population across Asia-Pacific, driving the demand for advanced orthopedic implant solutions in both surgical and non-surgical treatment settings. In addition, improvements in healthcare infrastructure and rising awareness about joint replacement procedures are contributing to market expansion

- Furthermore, rising consumer demand for minimally invasive, durable, and technologically advanced implant solutions is establishing orthopedic implants as a critical component of modern musculoskeletal care. These converging factors are accelerating the uptake of orthopedic implants across hospitals and specialized clinics, thereby significantly boosting the industry's growth

Asia-Pacific Orthopedic Implants Market Analysis

- Orthopedic implants, designed to replace or support damaged bones and joints, are becoming essential in the Asia-Pacific region due to a rising prevalence of musculoskeletal disorders, growing aging population, and increasing orthopedic surgeries across both urban and rural areas

- The market demand is primarily driven by the rising incidence of osteoarthritis and osteoporosis, an expanding elderly population, and growing awareness regarding advanced orthopedic treatment options among patients and healthcare providers

- China dominated the Asia-Pacific orthopedic implants market with a market revenue share of 35% in 2024, driven by a rapidly aging population, accelerated urbanization, improved access to healthcare services, and strong domestic manufacturing capabilities supporting the growing demand for reconstructive joint replacements and trauma implants

- India is projected to witness the fastest CAGR of 17.6% from 2025 to 2032 in the Asia-Pacific orthopedic implants market, driven by a rising number of joint disorders, increasing orthopedic surgeries, and strong government focus on digital health under programs such as the Ayushman Bharat Digital Mission

- The internal fixation devices segment dominated the Asia-Pacific orthopedic implants market with a market revenue share of 64.2% in 2024, driven by their high usage in trauma and reconstructive surgeries due to their effectiveness in stabilizing broken bones

Report Scope and Asia-Pacific Orthopedic Implants Market Segmentation

|

Attributes |

Asia-Pacific Orthopedic Implants Market Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Orthopedic Implants Market Trends

“Technological Advancements Driving Orthopedic Implant Innovation”

- A significant and accelerating trend in the Asia-Pacific orthopedic implants market is the integration of advanced technologies such as robotics, computer-assisted surgical systems, and 3D printing. These innovations are significantly improving surgical precision, implant customization, and overall patient outcomes in orthopedic procedures

- For instance, robotic-assisted systems are enabling surgeons to perform joint replacement surgeries with enhanced accuracy, reducing complications and improving the longevity of implants. Similarly, the adoption of computer-navigated tools ensures better alignment and positioning during orthopedic interventions

- The use of 3D printing technologies in orthopedic implants is also on the rise, allowing manufacturers to produce patient-specific implants that cater to unique anatomical needs. This customization enhances compatibility, reduces recovery time, and increases patient satisfaction

- These technologies further support minimally invasive surgical approaches, which are gaining popularity in the region due to reduced postoperative pain, quicker recovery, and shorter hospital stays

- The trend toward smarter, patient-centric solutions is reshaping expectations in orthopedic care. As a result, companies are increasingly investing in research and development to create next-generation orthopedic implants that are not only durable and biocompatible but also enhance surgical workflows and clinical outcomes

- The demand for technologically advanced orthopedic implants is growing rapidly across both urban and rural healthcare facilities in Asia-Pacific, fueled by rising healthcare investments, an aging population, and increased access to specialized orthopedic procedures

Asia-Pacific Orthopedic Implants Market Dynamics

Driver

“Growing Need Due to Rising Orthopedic Disorders and Aging Population”

- The increasing prevalence of musculoskeletal disorders, coupled with the rapidly aging population across the Asia-Pacific region, is significantly driving the demand for orthopedic implants. Conditions such as osteoarthritis, rheumatoid arthritis, and traumatic injuries are becoming more common, necessitating joint replacements and other orthopedic interventions

- For instance, in March 2024, Zimmer Biomet expanded its presence in Asia-Pacific by launching new robotic-assisted knee replacement solutions tailored for regional orthopedic needs. Such strategic advancements by major industry players are anticipated to fuel the growth of the orthopedic implants market in the coming years

- With rising healthcare awareness and improved access to surgical care, more patients are seeking effective solutions for mobility restoration and pain reduction. Orthopedic implants, including joint replacements, spinal implants, and trauma devices, offer reliable and long-lasting outcomes, making them a preferred treatment option

- Furthermore, growing investments in healthcare infrastructure, the expansion of private hospital chains, and government-backed health insurance schemes are improving the affordability and availability of orthopedic procedures. Emerging economies such as India and Vietnam are also seeing a surge in medical tourism, which is boosting the demand for advanced orthopedic solutions

- Technological advancements such as minimally invasive surgical techniques, 3D printing of patient-specific implants, and the use of biologically compatible materials are enhancing surgical precision and patient recovery, further accelerating adoption across both urban and semi-urban healthcare settings

Restraint/Challenge

“High Procedure Costs and Uneven Access to Advanced Care”

- The relatively high cost of orthopedic implant procedures remains a significant barrier to adoption, particularly in lower-income and rural segments of the Asia-Pacific region. Joint replacement and spinal surgeries can be prohibitively expensive without comprehensive insurance coverage or government subsidies

- For instance, in many developing countries across Southeast Asia, access to specialized orthopedic care is concentrated in major metropolitan areas, leaving rural populations underserved and reliant on basic or traditional treatment methods

- Moreover, implant surgeries require advanced surgical infrastructure, trained orthopedic specialists, and post-operative rehabilitation services, all of which may be limited or unevenly distributed in several countries in the region

- In addition, concerns around implant longevity, the potential for revision surgeries, and a lack of awareness among patients about available options may hinder market growth in less developed areas

- Overcoming these challenges through public-private partnerships, broader insurance coverage, training programs for surgeons, and the development of cost-effective implant alternatives will be essential to expanding access and ensuring sustainable growth across the Asia-Pacific orthopedic implants market

Asia-Pacific Orthopedic Implants Market Scope

The market is segmented on the basis of product, device type, biomaterial, procedure, and end user.

- By Product

On the basis of product, the Asia-Pacific orthopedic implants market is segmented into reconstructive joint replacements, spinal implants, trauma and craniomaxillofacial implants, dental implants, and orthobiologics. The reconstructive joint replacements segment dominated the market with the largest revenue share of 38.6% in 2024, driven by the rising demand for hip and knee replacement surgeries, particularly among the elderly population in countries such as Japan and China. This segment benefits from technological advancements and increasing healthcare access.

The spinal implants segment is anticipated to witness the fastest growth rate of 8.7% CAGR from 2025 to 2032, owing to the increasing prevalence of spinal disorders and the growing adoption of minimally invasive spinal procedures.

- By Device Type

On the basis of device type, the Asia-Pacific orthopedic implants market is segmented into internal fixation devices and external fixation devices. The internal fixation devices segment held the largest market revenue share of 64.2% in 2024, driven by their high usage in trauma and reconstructive surgeries due to their effectiveness in stabilizing broken bones.

The external fixation devices segment is expected to grow at a CAGR of 7.9% from 2025 to 2032, fueled by increasing applications in complex fracture management and temporary stabilization of open or infected fractures.

- By Biomaterial

On the basis of biomaterial, the Asia-Pacific orthopedic implants market is segmented into metallic biomaterials, polymeric biomaterials, ceramic biomaterials, natural biomaterials, and others. The metallic biomaterials segment dominated the market with a revenue share of 52.4% in 2024, attributed to their superior strength and long-standing use in load-bearing implants such as hip and knee prosthetics.

The polymeric biomaterials segment is anticipated to witness the fastest growth rate of 9.3% CAGR from 2025 to 2032, driven by their biocompatibility, flexibility, and use in absorbable screws and soft tissue fixation.

- By Procedure

On the basis of procedure, the Asia-Pacific orthopedic implants market is segmented into open surgery and minimally invasive surgery (MIS). The open surgery segment accounted for the largest market share of 61.8% in 2024, due to its widespread application in trauma and major reconstructive surgeries where full access is necessary.

The minimally invasive surgery (MIS) segment is expected to register the fastest CAGR of 9.1% from 2025 to 2032, fueled by patient preference for shorter recovery times, reduced hospital stays, and lower surgical risks.

- By End User

On the basis of end user, the Asia-Pacific orthopedic implants market is segmented into hospitals, ambulatory care centers, specialized clinics, orthopedic centers, and others. The hospitals segment held the largest revenue share of 48.3% in 2024, attributed to the availability of comprehensive surgical facilities, skilled orthopedic professionals, and higher patient volumes.

The orthopedic centers segment is projected to witness the fastest CAGR of 8.9% from 2025 to 2032, driven by increasing demand for specialized outpatient care, rising number of standalone orthopedic clinics, and a shift toward ambulatory surgical models.

Asia-Pacific Orthopedic Implants Market Regional Analysis

- Asia-Pacific dominated the orthopedic implants market with the largest revenue share of 40.01% in 2024, driven by the growing prevalence of orthopedic conditions, rapid aging population, and increased investments in healthcare infrastructure across the region

- Countries such as China, India, and Japan are seeing a surge in orthopedic procedures due to the rise in sports injuries, traffic accidents, and degenerative joint diseases, contributing significantly to the regional market expansion

- Moreover, favorable government initiatives, rising awareness about early intervention, and increasing demand for advanced implants and minimally invasive procedures are strengthening Asia-Pacific’s position as a key growth hub for orthopedic implants

China Asia-Pacific Orthopedic Implants Market Insight

The China orthopedic implants market held the largest market revenue share with 35% in the Asia-Pacific orthopedic implants market in 2024, fueled by a rapidly aging population, urbanization, and increased access to healthcare services. The country's robust manufacturing capabilities and growing demand for reconstructive joint replacement and trauma implants have driven significant growth. Government support through health reforms and digital health programs is also aiding in faster market penetration, especially in Tier 2 and Tier 3 cities.

India Asia-Pacific Orthopedic Implants Market Insight

The India orthopedic implants market is projected to witness the fastest CAGR of 17.6% from 2025 to 2032, driven by a rising number of joint disorders, increasing orthopedic surgeries, and strong government focus on digital health under programs such as Ayushman Bharat Digital Mission. Startups and local manufacturers offering cost-effective implants, along with a growing number of private hospitals and orthopedic clinics, are facilitating the transition from conventional to technologically advanced implants.

Japan Asia-Pacific Orthopedic Implants Market Insight

The Japan orthopedic implants market is emerging as a mature yet innovative market for orthopedic implants, backed by a high-tech healthcare system and one of the world’s oldest populations. The country has shown strong demand for spinal implants, hip and knee replacements, and biocompatible implant materials. Technological innovation, precision surgical robotics, and reimbursement

Asia-Pacific Orthopedic Implants Market Share

The Asia-Pacific orthopedic implants market industry is primarily led by well-established companies, including:

- Zimmer Biomet (U.S.)

- Smith + Nephew (U.K.)

- Medtronic (Ireland)

- Stryker (U.S.)

- B. Braun SE (Germany)

- NuVasive, Inc. (U.S.)

- DJO, LLC (U.S.)

- Institut Straumann AG (Switzerland)

- OSSTEM IMPLANT CO., LTD. (South Korea)

- Narang Medical Limited (U.S.)

- Globus Medical (U.S.)

- Arthrex, Inc. (U.S.)

- CONMED Corporation (U.S.)

- Integra LifeSciences Corporation (U.S.)

- RTI Surgical (U.S.)

- W. L. Gore & Associates, Inc. (U.S.)

- Corin Group (U.K.)

- Johnson & Johnson Services, Inc. (U.S.)

Latest Developments in Asia-Pacific Orthopedic Implants Market

- In November 2022, Equinix, Inc., and VMware, Inc. expanded their partnership, introducing VMware Cloud on Equinix Metal. This collaboration enhances enterprise application performance, security, and cost-effectiveness through distributed cloud services, potentially benefiting the orthopaedic implants market by ensuring robust and secure digital infrastructure for healthcare applications

- In September 2022, Arm Ltd's launch of Neoverse V2 addresses escalating data demands, potentially benefiting the orthopedic implants market. This chip technology advancement supports data centers catering to healthcare needs, aligning with the growing technological requirements of orthopedic surgeries and treatments

- In March 2022, Elea Digital and Vertiv's collaboration in Brazil for edge data center services ensures efficient critical infrastructure management. This partnership may contribute to the orthopedic implants market by enhancing the overall healthcare data processing infrastructure, ensuring seamless access to patient information for orthopedic procedures

- In September 2020, Smith & Nephew plc's launch of the REDAPT System for revision total hip arthroplasty (rTHA) in China led to increased sales, potentially influencing the orthopedic implants market positively. The strategic expansion and market response underscore the demand for innovative hip arthroplasty solutions in the region

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.