Asia-Pacific Polyether Ether Ketone (PEEK)Market Analysis and Insights

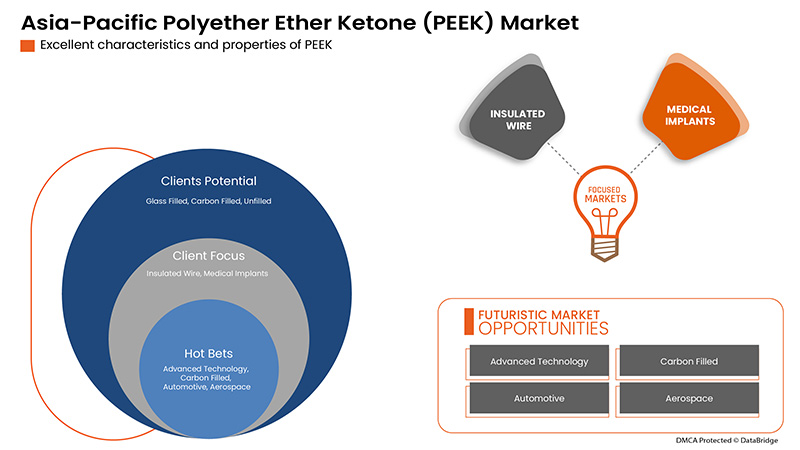

Rising polyether ether ketone (PEEK) applications in various industries are an important driver for the Asia-Pacific polyether ether ketone (PEEK) market. The excellent characteristics and properties of PEEK and PEEK as a potential alternative to metals in the automotive industry are expected to propel the Asia-Pacific polyether ether ketone (PEEK) market growth.

The major restraints that may negatively impact the Asia-Pacific polyether ether ketone (PEEK) market are the high costs of polyether ether ketone (PEEK) products and the easy availability of substitutes.

Rapid advancement in medical and healthcare applications and stringent regulations to reduce CO2 emissions are expected to provide opportunities in the Asia-Pacific polyether ether ketone (PEEK) market. However, challenging processing conditions for polyether ether ketones may challenge the Asia-Pacific polyether ether ketone (PEEK) market growth.

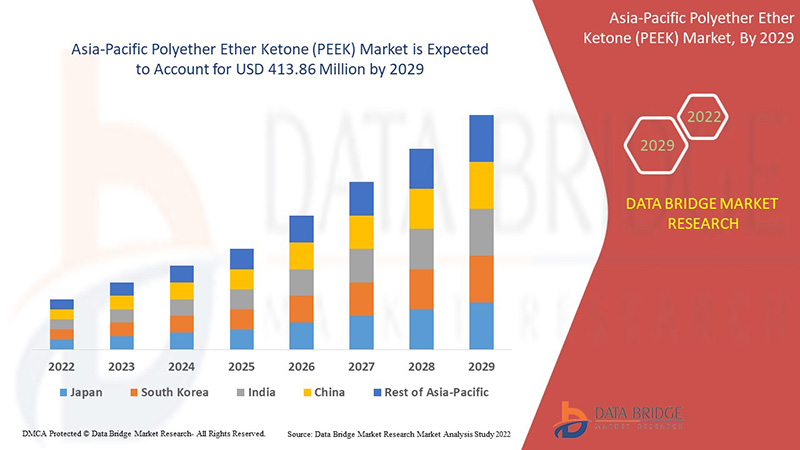

Asia-Pacific polyether ether ketone (PEEK) market is expected to gain significant growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 6.1% in the forecast period of 2022 to 2029 and is expected to reach USD 413.86 million by 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Type (Glass Filled, Carbon Filled, Unfilled and Others), Application (Bearings, Piston Parts, Pumps, HPLC Columns, Compressor Plate Valves, Cable Insulation, Biomedical and Other), End-Use (Aerospace, Automotive, Food & Beverage Processing, Oil & Gas, Electrical Industry, Energy, Medical and Others) |

|

Countries Covered |

Japan, China, South Korea, India, Singapore, Thailand, Indonesia, Malaysia, Philippines, Australia and New Zealand and Rest of Asia-Pacific |

|

Market Players Covered |

Victrex Plc, Evonik Industries AG, Solvay, Freudenberg, Arkema, Ensinger, the Mitsubishi Chemical Group of Companies (A Subsidiary of Mitsubishi Chemical Group Corporation), Avient, BARLOG Plastics GmbH, among others |

Market Definition

PEEK is a colorless organic thermoplastic polymer, a member of the poly aryl ether ketone (PAEK) family. It is a homopolymer having a single monomer. It is a semi-crystalline thermoplastic with exceptional chemical and mechanical properties that are retained even at higher temperatures. It shows resistance to deterioration during various sterilization procedures. Hence it can be sterilized with heat sterilization methods without affecting its properties. Its chemical structure makes it highly resistant to chemical and radiation damage, compatible with reinforcing agents such as glass and carbon fibers, and has greater strength than metals. These properties make it highly suitable for industrial applications.

Asia-Pacific Polyether Ether Ketone (PEEK) Market Dynamics

This section deals with understanding the market drivers, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Rising applications of polyether ether ketone (PEEK) in various industries

These polymers have many emerging applications in the aerospace, automotive, oil & gas, medical, and electronics industry in the near future, which will further enhance the growth prospects of the Asia-Pacific polyether ether ketone (PEEK) market. Moreover, polyether ether ketone (PEEK) is regarded as a leading high-performance polymer throughout the plastic industry. Metals used to be the materials of choice in the automotive, aerospace, medical devices, and other industries, but now PEEK polymer is rapidly replacing them by complying with today's Asia-Pacific emission regulations and assisting in reducing CO2 emission through more efficient technology.

- Excellent characteristics and properties of PEEK

PEEK polymers melt at a relatively high temperature compared to other thermoplastics. Its melting temperature range can be processed and enhanced more using injection molding, extrusion methods, spray forming, or pressing methods. Apart from this, the ability to process polyether ether ketone (PEEK) polymers with 3D printing makes it a desired material for its increased applications.

- PEEK as a potential alternative to metals in the automotive industry

Rising consumers' purchasing power, rapid industrialization in various countries, and rapid expansion of the automobile sector in China, India, and many other countries have propelled the growth of the automobile sector. Polyether ether ketone is increasingly used in automotive parts, such as engines, gaskets, transmission rings, friction rings, and thrust washers, which is, in turn, driving the growth of the market.

Opportunities

- Rapid advancement in medical and healthcare application

The overall market is also anticipated to experience a wide range of applications in the medical industry over the forecast period. Currently, it is used for spinal surgery and is expected to be used for more clinical applications and commercial medical products with more research and development. There is a continuous need for research and development in the medical industry to explore untapped clinical applications of PEEK. On account of the lack of long-term clinical data, currently, the PEEK product has limited application in the field, but it is expected to boost over in the near future owing to its huge potential as a replacement for other materials used.

- Stringent regulations to reduce CO2 emissions

PEEK is emerging as an environment-friendly solution in various applications. Its application leads to low carbon emissions compared to other polymers, including polyester laminate, polyvinyl chloride, and polystyrene, among others. PEEK increases the service life of the products in which it is used by providing excellent corrosion resistance. It also performs well under high temperatures. It is one of the most versatile products in terms of providing manufacturing design freedom and thus results in less dependence on labor.

Restraints/Challenges

- High costs of polyether ether ketone (PEEK) products

The polyether ether ketone (PEEK) polymer manufacturer and its products require a considerably high investment, as the manufacturing process is more complex than any other group of polymers or metals. In addition, manufacturing PEEK products that can withstand high temperatures requires a high level of technical competency, technicians, and research. Due to these factors, the production of PEEK is costly, and thus the cost of end-products is also very high.

- Easy availability of substitutes

Plastic is a lightweight, durable, inexpensive, and easily modified material. This is the reason for its usage, which has increased rapidly and is still growing. Plastic consists of polymers, which are large organic molecules. In the polymer market, various substitutes are available to be used in place of PEEK polymer. There are a variety of high-performance polymers available in the market.

- Challenging processing conditions for polyether ether ketones

There are many challenges in compression molding of PEEK. The process is time-consuming, highly sensitive, and very specific in the type of tooling required. Compression molding is known for low productivity; even a large processor can only consume 20-25 Kg per day of production. The actual process of compression molding PEEK is also not straightforward and needs to be finely tuned until a process that most suits the equipment is available. In addition, the selection of dies is critical. PEEK can be a very aggressive and reactive material in its molten form, and steel gets corroded during molding. Therefore, finding a balance between a strong die metal and the correct process is critical in obtaining a final process that is both economical and productive and which yields a high-quality final product.

- An increase in competition from composites and hybrid polymers

Moreover, fiber-reinforced polymer composites are gaining importance in various fields, from household articles to the automobile industry. Natural and synthetic fibers have low cost, are lightweight, and have high specific and mechanical strength. Fiber-reinforced hybrid composites have been emerging widely as potential materials for fabricating composites for different applications. Using such well-characterized processing techniques and modification methods helps achieve desirable product qualities.

Recent Development

- In February 2022, Arkema became the finalist at the JEC Composites Innovation Awards 2022. Arkema, in partnership with Somocap, was one of the 30 finalists for this 2022 edition in the Building and Civil Engineering category through the project led by Optimas. This has enhanced the company's reputation in the market

Asia-Pacific Polyether Ether Ketone (PEEK) Market Scope

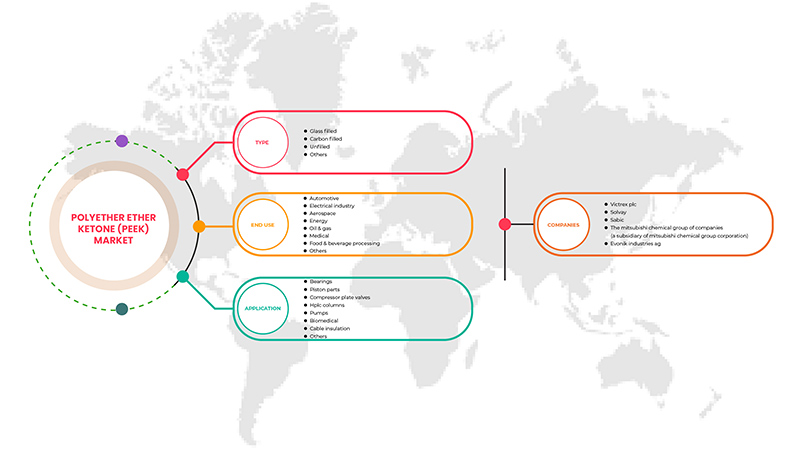

The Asia-Pacific polyether ether ketone (PEEK) market is categorized based on type, application, and end use. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Type

- Carbon Filled

- Glass Filled

- Unfilled

- Others

On the basis of type, the Asia-Pacific polyether ether ketone (PEEK) market is classified into glass filled, carbon filled, unfilled, and others.

Application

- Bearings

- Piston Parts

- Compressor Plate Valves

- HPLC Columns

- Pumps

- Biomedical

- Cable Insulation

- Others

On the basis of application, the Asia-Pacific polyether ether ketone (PEEK) market is classified into bearings, piston parts, pumps, HPLC columns, compressor plate valves, cable insulation, biomedical, and others.

End Use

- Automotive

- Electrical Industry

- Aerospace

- Energy

- Oil & Gas

- Medical

- Food & Beverage Processing

- Others

On the basis of end use, the Asia-Pacific polyether ether ketone (PEEK) market is classified into aerospace, automotive, food & beverage processing, oil & gas, electrical industry, energy, medical, and others.

Asia-Pacific Polyether Ether Ketone (PEEK) Market Regional Analysis/Insights

Asia-Pacific polyether ether ketone (PEEK) market is segmented based on country, type, application, and end use.

Some countries covered in the Asia-Pacific polyether ether ketone (PEEK) market are Japan, China, South Korea, India, Singapore, Thailand, Indonesia, Malaysia, Philippines, Australia and New Zealand and Rest of Asia-Pacific. China is expected to dominate the Asia-Pacific polyether ether ketone (PEEK) market in terms of market share and market revenue owing to the growing demand for automobiles and consumer goods in the region.

The country section of the report also provides individual market-impacting factors and market regulation changes that impact the market's current and future trends. Data point downstream and upstream value chain analysis, technical trends and porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Polyether Ether Ketone (PEEK) Market Share Analysis

Asia-Pacific polyether ether ketone (PEEK) market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies' focus related to the Asia-Pacific polyether ether ketone (PEEK) market.

Some of the prominent participants operating in the Asia-Pacific polyether ether ketone (PEEK) market are Victrex Plc, Evonik Industries AG, Solvay, Freudenberg, Arkema, Ensinger, the Mitsubishi Chemical Group of Companies (A Subsidiary of Mitsubishi Chemical Group Corporation), Avient, BARLOG Plastics GmbH, among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning grids, Market Time Line Analysis, Market Overview and Guide, Company Positioning grids, Company Market Share Analysis, Standards of Measurement, Asia-Pacific Vs Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES:

4.3 VENDOR SELECTION CRITERIA

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING APPLICATIONS OF POLYETHER ETHER KETONE (PEEK) IN VARIOUS INDUSTRIES

5.1.2 EXCELLENT CHARACTERISTICS AND PROPERTIES OF PEEK

5.1.3 PEEK AS A POTENTIAL ALTERNATIVE TO METALS IN THE AUTOMOTIVE INDUSTRY

5.2 RESTRAINTS

5.2.1 HIGH COSTS OF POLYETHER ETHER KETONE (PEEK) PRODUCTS

5.2.2 EASY AVAILABILITY OF SUBSTITUTES

5.3 OPPORTUNITIES

5.3.1 RAPID ADVANCEMENT IN MEDICAL AND HEALTHCARE APPLICATION

5.3.2 STRINGENT REGULATIONS TO REDUCE CO2 EMISSIONS

5.4 CHALLENGES

5.4.1 CHALLENGING PROCESSING CONDITIONS FOR POLYETHER ETHER KETONES

5.4.2 AN INCREASE IN COMPETITION FROM COMPOSITES AND HYBRID POLYMERS

6 ASIA PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE

6.1 OVERVIEW

6.2 CARBON FILLED

6.3 GLASS FILLED

6.4 UNFILLED

6.5 OTHERS

7 ASIA PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 BEARINGS

7.3 PISTON PARTS

7.4 COMPRESSOR PLATE VALVES

7.5 HPLC COLUMNS

7.6 PUMPS

7.7 BIOMEDICAL

7.8 CABLE INSULATION

7.9 OTHERS

8 ASIA PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET, BY END-USE

8.1 OVERVIEW

8.2 AUTOMOTIVE

8.3 ELECTRICAL INDUSTRY

8.4 AEROSPACE

8.5 ENERGY

8.6 OIL & GAS

8.7 MEDICAL

8.8 FOOD & BEVERAGE PROCESSING

8.9 OTHERS

9 ASIA PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION

9.1 ASIA PACIFIC

9.1.1 CHINA

9.1.2 INDIA

9.1.3 JAPAN

9.1.4 SOUTH KOREA

9.1.5 THAILAND

9.1.6 SINGAPORE

9.1.7 INDONESIA

9.1.8 AUSTRALIA & NEW ZEALAND

9.1.9 PHILIPPINES

9.1.10 MALAYSIA

9.1.11 REST OF ASIA-PACIFIC

10 ASIA PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

10.2 REGULATORY APPROVAL

10.3 PRODUCT LAUNCH

10.4 AWARD

10.5 MERGER

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 VICTREX PLC

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT UPDATES

12.2 SOLVAY

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT UPDATES

12.3 SABIC

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 COMPANY SHARE ANALYSIS

12.3.4 PRODUCT PORTFOLIO

12.3.5 RECENT UPDATES

12.4 THE MITSUBISHI CHEMICAL GROUP OF COMPANIES (A SUBSIDIARY OF MITSUBISHI CHEMICAL GROUP CORPORATION)

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 COMPANY SHARE ANALYSIS

12.4.4 PRODUCT PORTFOLIO

12.4.5 RECENT UPDATES

12.5 EVONIK INDUSTRIES AG

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 COMPANY SHARE ANALYSIS

12.5.4 PRODUCT PORTFOLIO

12.5.5 RECENT UPDATES

12.6 ARKEMA

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT UPDATES

12.7 AVIENT

12.7.1 COMPANY SNAPSHOT

12.7.2 REVENUE ANALYSIS

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT UPDATES

12.8 BARLOG PLASTICS GMBH

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT UPDATES

12.9 DAIKIN COMPOUNDING ITALY S.P.A

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT UPDATES

12.1 ENSINGER

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT UPDATES

12.11 FREUDENBERG

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT UPDATES

12.12 FLUOROCARBON GROUP

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 RECENT UPDATES

12.13 SAINT-GOBAIN

12.13.1 COMPANY SNAPSHOT

12.13.2 REVENUE ANALYSIS

12.13.3 PRODUCT PORTFOLIO

12.13.4 RECENT UPDATES

12.14 WESTLAKE PLASTICS

12.14.1 COMPANY SNAPSHOT

12.14.2 PRODUCT PORTFOLIO

12.14.3 RECENT UPDATES

13 QUESTIONNAIRE

14 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF SATURATED POLYESTERS IN PRIMARY FORMS (EXCLUDING POLYCARBONATES, ALKYD RESINS, POLYETHYLENE TEREPHTHALATE, AND POLYLACTIC ACID); HS CODE – 390799 (USD THOUSAND)

TABLE 2 EXPORT DATA OF SATURATED POLYESTERS IN PRIMARY FORMS (EXCLUDING POLYCARBONATES, ALKYD RESINS, POLYETHYLENE TEREPHTHALATE, AND POLYLACTIC ACID); HS CODE – 390799 (USD THOUSAND)

TABLE 3 ASIA PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 5 ASIA PACIFIC CARBON FILLED IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC CARBON FILLED IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 7 ASIA PACIFIC GLASS FILLED IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC GLASS FILLED IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 9 ASIA PACIFIC UNFILLED IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC UNFILLEDIN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 11 ASIA PACIFIC OTHERS IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC OTHERS IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 13 ASIA PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC BEARINGS IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC PISTON PARTS IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC COMPRESSOR PLATE VALVES IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC HPLC COLUMNS IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC PUMPS IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC BIOMEDICAL IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC CABLE INSULATION IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC OTHERS IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC AUTOMOTIVE IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC ELECTRICAL INDUSTRY IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC AEROSPACE IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC ENERGY IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC OIL & GAS IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC MEDICAL IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC FOOD & BEVERAGE PROCESSING IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC OTHERS IN POLYETHER ETHER KETONE (PEEK) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 ASIA-PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 32 ASIA-PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 33 ASIA-PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 ASIA-PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 35 ASIA-PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 36 ASIA-PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 37 CHINA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 CHINA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 39 CHINA POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 40 CHINA POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 41 INDIA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 INDIA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 43 INDIA POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 44 INDIA POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 45 JAPAN POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 JAPAN POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 47 JAPAN POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 48 JAPAN POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 49 SOUTH KOREA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 SOUTH KOREA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 51 SOUTH KOREA POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 52 SOUTH KOREA POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 53 THAILAND POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 THAILAND POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 55 THAILAND POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 56 THAILAND POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 57 SINGAPORE POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 SINGAPORE POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 59 SINGAPORE POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 60 SINGAPORE POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 61 INDONESIA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 INDONESIA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 63 INDONESIA POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 INDONESIA POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 65 AUSTRALIA & NEW ZEALAND POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 AUSTRALIA & NEW ZEALAND POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 67 AUSTRALIA & NEW ZEALAND POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 68 AUSTRALIA & NEW ZEALAND POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 69 PHILIPPINES POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 PHILIPPINES POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 71 PHILIPPINES POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 72 PHILIPPINES POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 73 MALAYSIA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 MALAYSIA POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 75 MALAYSIA POLYETHER ETHER KETONE (PEEK) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 76 MALAYSIA POLYETHER ETHER KETONE (PEEK) MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 77 REST OF ASIA-PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 REST OF ASIA-PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET, BY TYPE, 2020-2029 (KILO TONS)

List of Figure

FIGURE 1 ASIA PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET

FIGURE 2 ASIA PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 ASIA PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET: MULTIVARIATE MODELLING

FIGURE 8 ASIA PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 ASIA PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET: DBMR MARKET POSITION GRID

FIGURE 10 ASIA PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 ASIA PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 ASIA PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 ASIA PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET: SEGMENTATION

FIGURE 14 RISING APPLICATIONS OF POLYETHER ETHER KETONE (PEEK) IN VARIOUS INDUSTRIES ARE EXPECTED TO DRIVE THE ASIA PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET GROWTH IN THE FORECAST PERIOD

FIGURE 15 CARBON FILLED SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET IN 2022 & 2029

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET

FIGURE 17 ASIA PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET: BY TYPE, 2021

FIGURE 18 ASIA PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET: BY APPLICATION, 2021

FIGURE 19 ASIA PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET: BY END-USE, 2021

FIGURE 20 ASIA-PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET: SNAPSHOT (2021)

FIGURE 21 ASIA-PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET: BY COUNTRY (2021)

FIGURE 22 ASIA-PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 23 ASIA-PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 24 ASIA-PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET: BY TYPE (2022-2029)

FIGURE 25 ASIA PACIFIC POLYETHER ETHER KETONE (PEEK) MARKET: COMPANY SHARE 2021 (%)

Asia Pacific Polyether Ether Ketone Peek Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Polyether Ether Ketone Peek Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Polyether Ether Ketone Peek Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.