Asia-Pacific Polyglycerol Market Analysis and Insights

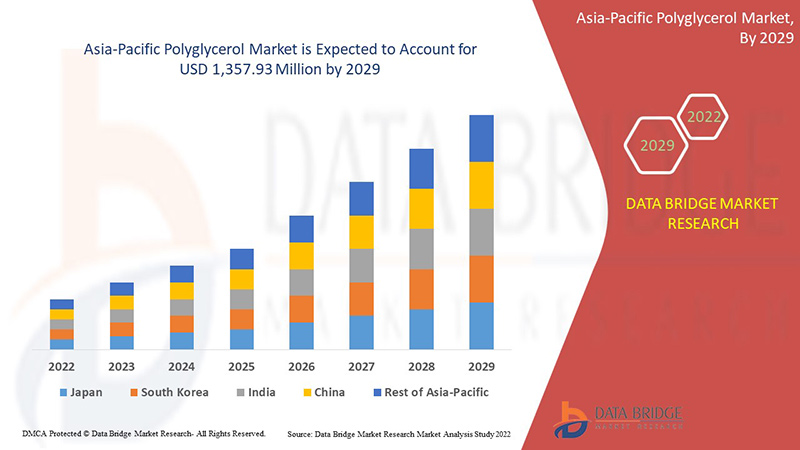

Asia-Pacific polyglycerol market is expected to grow significantly in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 5.9% in the forecast period of 2022 to 2029 and is expected to reach USD 1,357.93 million by 2029. The major factor driving the growth of the polyglycerol market is the inclination toward food additive consumption in the food & beverage industry, the rising popularity of polyglycerols in the cosmetics industry and growing awareness regarding the properties of polyglycerols.

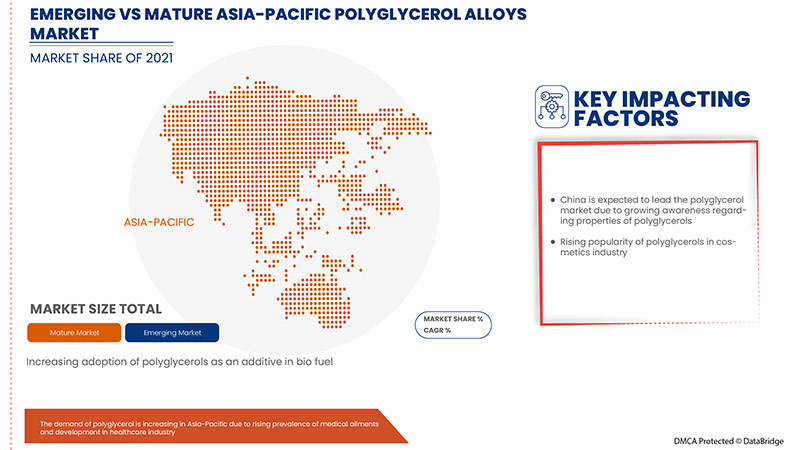

Polyglycerols have been gaining popularity and are widely used in the pharmaceutical industry as drug carriers and in the biomedical sector for regenerative medicines. On account of the rising prevalence of medical ailments and the increasing development of healthcare infrastructure, the thriving pharmaceutical industry is expected to provide the opportunity for bolstering market growth. Furthermore, several market players are investing in research and development (R&D) activities to launch new products to cater to the requirements of the healthcare industry.

Asia-Pacific polyglycerol market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an Analyst Brief. Our team will help you create a revenue impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Kilo Tons |

|

Segments Covered |

By Type (Polyglycerol Polyricinoleate, Polyglycerol Esters, Polyglycerol Sebacate and Others), Product (PG 2, PG 3, PG 4, PG 6, PG 10 and Others), Application (Emulsifiers, Food Additives, Surfactants, Stabilizers, Non-Ionic Emulsifiers, Dispersants, Emollients, Wetting Agents, Thickeners And Others), End-Use (Food, Cosmetics, Pharmaceuticals, Others) |

|

Countries Covered |

Japan, China, South Korea, India, Singapore, Thailand, Indonesia, Malaysia, Philippines, Australia & New Zealand and the Rest of Asia-Pacific |

|

Market Players Covered |

Taiyo Kagaku Co., Ltd., Estelle Chemicals Pvt. Ltd., NOVEL CHEM, SPELL ORGANICS LTD, Oleon NV., Spiga Nord S.p.A, Salamoto Yakuhin Kogyo Co., Ltd., DSM, Merck KGaA, Croda International Plc, International Flavors & Fragrances Inc. |

Market Definition

Polyglycerol is a transparent, viscous and nonvolatile liquid made by dehydrating glycerol with epoxy intermediates using an alkali catalyst. Its fatty acid esters, safe, biodegradable and nonionic surfactants, are used as antistatic and antifogging agents in food packaging in the food and beverage (F&B) business. Mold inhibitors and emulsifiers are also employed in preparing baked goods, chewing gum and low-fat spreads. Polyglycerol is also used worldwide in the pharmaceutical and cosmetics sectors due to its amphiphilic characteristics.

Asia-Pacific Polyglycerol Market Dynamics

Drivers

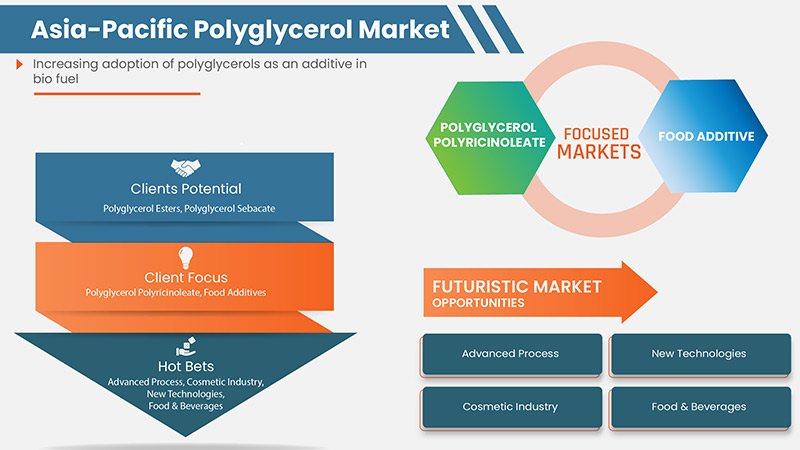

- Inclination towards food additive consumption in the food & beverage industry

Polyglyceryl-3-monostearate (PGM) is a type of polyglycerol used as a surfactant and emulsifier in food products. PGM shows good and effective results in reducing the interfacial tension between oil and water, which leads to improved emulsion stability. Fatty acid esters, safe, biodegradable, and non-ionic surfactants, are used as antistatic and anti-scale agents in food packaging in the food and beverage industry. Mold inhibitors and emulsifiers are also used to make low-fat baked goods, chewing gum, pastries, and other bakery products. Moreover, polyglycerol's properties, such as emulsifying and stabilizing agents, make it suitable for various applications, including bakery and confectionery products.

- The rising popularity of polyglycerols in the cosmetics industry

The use of polyglycerol as a humectant and thickener in the cosmetic industry also benefits from the growing preference for organic products. Sales of personal care and cosmetic products are also driven by the growing influence of social media and growing interest in health and cleanliness. Therefore, these factors are expected to drive the growth of cosmetic items. Furthermore, emulsifiers derived from polyglycerol are also used as ingredients in cosmetic products. In addition, Japan, Singapore, South Korea, Hong Kong, and China are among the top cosmetic exporters in the world.

- Growing awareness regarding the properties of polyglycerols

Growing application of polyglycerol in the pharmaceuticals sector as an excipient and tablet binder. Polyglycerol is also used in the pharmaceutical and cosmetic fields due to its amphiphilic properties. In addition, its growth is supported by cost-effective processes and the high usage of polyglycerol in the pharmaceutical industry. The increasing adoption of science and technology during the manufacturing and development of drugs is one of the critical factors responsible for the rising demand for the polyglycerol market in the pharmaceutical industry.

Opportunities

- Rising prevalence of medical ailments and development in the healthcare industry

Polyglycerols have been gaining popularity and are widely used in the pharmaceutical industry as drug carriers and in the biomedical sector for regenerative medicines. On account of the rising prevalence of medical ailments and the increasing development of healthcare infrastructure, the thriving pharmaceutical industry is expected to provide the opportunity for bolstering market growth. Furthermore, several market players are investing in research and development (R&D) activities to launch new products to cater to the requirements of the healthcare industry.

- Increasing adoption of polyglycerols as an additive in biofuel

The increasing adoption of polyglycerols as fuel additives to improve the performance of diesel engines is gaining popularity in the oil industry. A variety of diesel fuel additives are associated with bio-diesel fuel and/or petroleum-derived diesel fuel having one or more solvent(s) and one or more pour-point depressants. These pour-point depressants include polyglycerol ester, polyglycerol polyricinoleate, and/or polyglycerol esters of mixed fatty acids.

Restraints/Challenges

- Easy availability of substitutes

In pharmaceutical applications, particular use is palmitic, stearic, myristic, and short-chain fatty acids. The derivatives include monostearate, monoglycerides, propylene glycol esters, sorbitans, ethylene oxide products, isopropyl palmitic, and myristate. Specific powdered stearins and cocoa butter substitutes are also used in various formulations. Moreover, lipid-based drug delivery (LBDD) is gaining popularity as a co-emulsifying agent and in the development of Self-Emulsifying Drug Delivery Systems (SEDDS), which enhance oral delivery and absorption of lipophilic drugs. Thus, the availability of a large number of substitutes for polyglycerols has impacted the growth of the Asia-Pacific polyglycerol market and is expected to restrain the market growth.

- Adverse effects on health

When used in high concentrations in various products humans directly consume, Polyglycerols may have severe side effects. Moreover, some people may also be allergic to polyglycerols in various items such as food products, cosmetics, and personal care products and may experience skin-related allergies and rashes. Apart from this, owing to the suitable side effects of polyglycerols, various regulatory bodies and organizations have set limits for using polyglycerols in different applications.

Recent Development

- In July 2022, Oleon signed a land acquisition agreement with Central Spectrum. It was an important milestone for Oleon's continued growth in Malaysia. This will enhance the company to growth and expands its facilities

Asia-Pacific Polyglycerol Market Scope

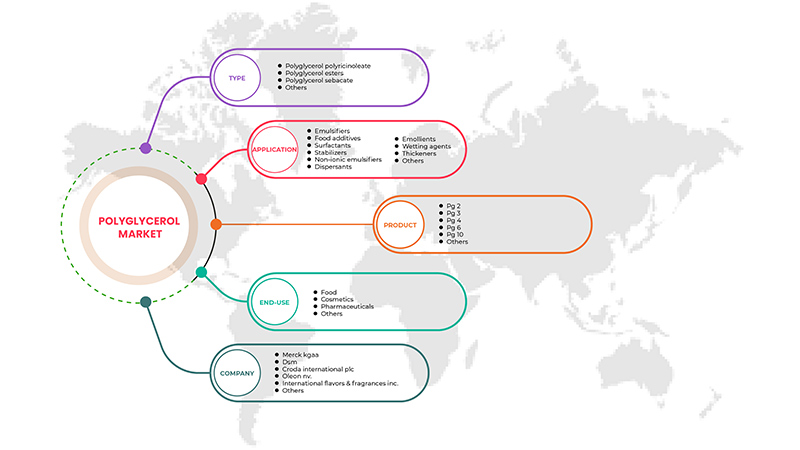

Asia-Pacific polyglycerol market is categorized based on type, product, application, and end-user. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Type

- Polyglycerol Polyricinoleate

- Polyglycerol Esters

- Polyglycerol Sebacate

- Others

Based on type, the Asia-Pacific polyglycerol market is classified into four segments polyglycerol Polyricinoleate, polyglycerol esters, polyglycerol sebacate, and others.

Product

- PG 3

- PG 4

- PG 2

- PG 6

- PG 10

- Others

Based on product, the Asia-Pacific polyglycerol market is classified into six segments PG 2, PG 3, PG 4, PG 6, PG 10, and others.

Application

- Emulsifiers

- Food Additives

- Surfactants

- Stabilizers

- Non-Ionic Emulsifiers

- Dispersants

- Emollients

- Wetting Agents

- Thickeners

- Others

Based on the application, the Asia-Pacific polyglycerol market is classified into ten segments food additives, surfactants, emulsifiers, stabilizers, nonionic emulsifiers, nonionic emulsifiers, emollients, wetting agents, thickeners, and others.

End-Use

- Cosmetics

- Food

- Pharmaceuticals

- Others

Based on end-use, the Asia-Pacific polyglycerol market is classified into four segments food, cosmetics, pharmaceuticals, and others.

Asia-Pacific Polyglycerol Market Regional Analysis/Insights

Asia-Pacific polyglycerol market is segmented on the basis of type, product, application, and end-user.

The countries in the Asia-Pacific polyglycerol market are Japan, China, South Korea, India, Singapore, Thailand, Indonesia, Malaysia, Philippines, Australia & New Zealand and the Rest of Asia-Pacific.

China is dominating the Asia-Pacific polyglycerol market in terms of market share and market revenue due to growing awareness of the excellent characteristics and properties of polyglycerol in the region.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data point downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Polyglycerol Market Share Analysis

Asia-Pacific polyglycerol market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points only relate to the company's focus on the Asia-Pacific Polyglycerol market.

Some of the prominent participants operating in the Asia-Pacific polyglycerol market are Taiyo Kagaku Co., Ltd., Estelle Chemicals Pvt. Ltd., NOVEL CHEM, SPELL ORGANICS LTD, Oleon NV., Spiga Nord S.p.A, Salamoto Yakuhin Kogyo Co., Ltd., DSM, Merck KGaA, Croda International Plc, and International Flavors & Fragrances Inc.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Data models include Vendor Positioning grids, Market Time Line Analysis, Market Overview and Guide, Company Positioning grids, Company Market Share Analysis, Standards of Measurement, Asia-Pacific Vs. Regional and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA PACIFIC POLYGLYCEROL MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFELINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USE COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES:

4.2.1 THE THREAT OF NEW ENTRANTS:

4.2.2 THE THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 CLIMATE CHANGE SCENARIO

4.3.1 ENVIRONMENTAL CONCERNS

4.3.2 INDUSTRY RESPONSE

4.3.3 GOVERNMENT'S ROLE

4.3.4 ANALYST RECOMMENDATION

4.4 IMPORT-EXPORT SCENARIO

4.5 POLYGLYCEROL USED IN THE COSMETICS INDUSTRY AS A SURFACTANT

4.6 PRODUCTION CONSUMPTION ANALYSIS- ASIA PACIFIC POLYGLYCEROL MARKET

4.7 RAW MATERIAL PRODUCTION COVERAGE

4.8 SUPPLY CHAIN ANALYSIS

4.8.1 OVERVIEW

4.8.2 LOGISTIC COST SCENARIO

4.8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.9 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.1 VENDOR SELECTION CRITERIA

5 REGULATION COVERAGE

6 COUNTRY SUMMARY - SOUTH KOREA

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCLINATION TOWARDS FOOD ADDITIVE CONSUMPTION IN THE FOOD & BEVERAGE INDUSTRY

7.1.2 RISING POPULARITY OF POLYGLYCEROLS IN THE COSMETICS INDUSTRY

7.1.3 GROWING AWARENESS REGARDING THE PROPERTIES OF POLYGLYCEROLS

7.2 RESTRAINTS

7.2.1 EASY AVAILABILITY OF SUBSTITUTES

7.2.2 ADVERSE EFFECTS ON HEALTH

7.3 OPPORTUNITIES

7.3.1 RISING PREVALENCE OF MEDICAL AILMENTS AND DEVELOPMENT IN THE HEALTHCARE INDUSTRY

7.3.2 INCREASING ADOPTION OF POLYGLYCEROLS AS AN ADDITIVE IN BIOFUEL

7.4 CHALLENGES

7.4.1 FLUCTUATING COSTS OF RAW MATERIALS

8 ASIA PACIFIC POLYGLYCEROL MARKET, BY TYPE

8.1 OVERVIEW

8.2 POLYGLYCEROL POLYRICINOLEATE

8.3 POLYGLYCEROL ESTERS

8.4 POLYGLYCEROL SEBACATE

8.5 OTHERS

9 ASIA PACIFIC POLYGLYCEROL MARKET, BY PRODUCT

9.1 OVERVIEW

9.2 PG 3

9.3 PG 4

9.4 PG 2

9.5 PG 6

9.6 PG 10

9.7 OTHERS

10 ASIA PACIFIC POLYGLYCEROL MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 EMULSIFIERS

10.3 FOOD ADDITIVES

10.4 SURFACTANTS

10.5 STABILIZERS

10.6 NON-IONIC EMULSIFIERS

10.7 DISPERSANTS

10.8 EMOLLIENTS

10.9 WETTING AGENTS

10.1 THICKENERS

10.11 OTHERS

11 ASIA PACIFIC POLYGLYCEROL MARKET, BY END-USE

11.1 OVERVIEW

11.2 COSMETICS

11.2.1 LIP GLOSS

11.2.2 FOUNDATION

11.2.3 ANTI-AGEING SERUMS

11.2.4 OIL-BASED SERUMS

11.2.5 LIP BALMS

11.2.6 MOISTURIZERS

11.2.7 HAIR CONDITIONERS

11.2.8 COLOR COSMETICS

11.2.9 MASCARA

11.2.10 CREAMS

11.2.11 OTHERS

11.3 FOOD

11.3.1 BAKERY

11.3.1.1 BREAD & ROLLS

11.3.1.2 CAKE, PASTRIES & TRUFFLE

11.3.1.3 BISCUIT, COOKIES, & CRACKERS

11.3.1.4 TART & PIES

11.3.1.5 BROWNIES

11.3.1.6 SWISS ROLLS

11.3.1.7 OTHERS

11.3.2 CONFECTIONERY

11.3.2.1 JELLY CANDIES

11.3.2.2 CANDY BARS

11.3.2.3 JAMS & JELLIES

11.3.2.4 MARMALADES

11.3.2.5 FRUIT JELLY DESSERT

11.3.2.6 TOPPINGS

11.3.2.7 OTHERS

11.3.3 OIL PRODUCTS

11.3.4 DESSERTS

11.4 PHARMACEUTICALS

11.5 OTHERS

12 ASIA PACIFIC POLYGLYCEROL MARKET, BY REGION

12.1 ASIA-PACIFIC

12.1.1 CHINA

12.1.2 INDIA

12.1.3 JAPAN

12.1.4 SOUTH KOREA

12.1.5 THAILAND

12.1.6 SINGAPORE

12.1.7 INDONESIA

12.1.8 AUSTRALIA & NEW ZEALAND

12.1.9 PHILIPPINES

12.1.10 MALAYSIA

12.1.11 REST OF ASIA-PACIFIC

13 ASIA PACIFIC POLYGLYCEROL MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

13.1.1 PARTNERSHIP

13.1.2 FACILITY EXPANSION

13.1.3 AWARD

13.2 MERGER

13.2.1 EVENT

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 MERCK KGAA

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 SWOT

15.1.5 PRODUCT PORTFOLIO

15.1.6 RECENT UPDATES

15.2 DSM

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 SWOT

15.2.5 PRODUCT PORTFOLIO

15.2.6 RECENT UPDATES

15.3 CRODA INTERNATIONAL PLC

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 SWOT

15.3.5 PRODUCT PORTFOLIO

15.3.6 RECENT UPDATES

15.4 OLEON NV.

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 SWOT

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT UPDATES

15.5 INTERNATIONAL FLAVORS & FRAGRANCES INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 SWOT

15.5.5 PRODUCT PORTFOLIO

15.5.6 RECENT UPDATES

15.6 ESTELLE CHEMICALS PVT. LTD.

15.6.1 COMPANY SNAPSHOT

15.6.2 SWOT

15.6.3 PRODUCTION CAPACITY

15.6.4 PRODUCT PORTFOLIO

15.6.5 RECENT UPDATES

15.7 NOVEL CHEM

15.7.1 COMPANY SNAPSHOT

15.7.2 SWOT

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT UPDATES

15.8 SALAMOTO YAKUHIN KOGYO CO., LTD.

15.8.1 COMPANY SNAPSHOT

15.8.2 SWOT

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT UPDATES

15.9 SPELL ORGANICS LTD

15.9.1 COMPANY SNAPSHOT

15.9.2 SWOT

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT UPDATES

15.1 SPIGA NORD S.P.A

15.10.1 COMPANY SNAPSHOT

15.10.2 SWOT

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT UPDATES

15.11 TAIYO KAGAKU CO., LTD.

15.11.1 COMPANY SNAPSHOT

15.11.2 SWOT

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT UPDATES

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF PALMITIC ACID, STEARIC ACID, THEIR SALTS AND ESTERS; HS CODE – 291570 (USD THOUSAND)

TABLE 2 EXPORT DATA OF PALMITIC ACID, STEARIC ACID, THEIR SALTS AND ESTERS; HS CODE – 291570 (USD THOUSAND)

TABLE 3 REGULATORY FRAMEWORK

TABLE 4 ASIA PACIFIC POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 6 ASIA PACIFIC POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (PRICE)

TABLE 7 ASIA PACIFIC POLYGLYCEROL POLYRICINOLEATE IN POLYGLYCEROL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC POLYGLYCEROL POLYRICINOLEATE IN POLYGLYCEROL MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 9 ASIA PACIFIC POLYGLYCEROL ESTERS IN POLYGLYCEROL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC POLYGLYCEROL ESTERS IN POLYGLYCEROL MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 11 ASIA PACIFIC POLYGLYCEROL SEBACATE IN POLYGLYCEROL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC POLYGLYCEROL SEBACATE IN POLYGLYCEROL MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 13 ASIA PACIFIC OTHERS IN POLYGLYCEROL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC OTHERS IN POLYGLYCEROL MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 15 ASIA PACIFIC POLYGLYCEROL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC POLYGLYCEROL MARKET, BY PRODUCT, 2020-2029 (KILO TONS)

TABLE 17 ASIA PACIFIC POLYGLYCEROL MARKET, BY PRODUCT, 2020-2029 (PRICE)

TABLE 18 ASIA PACIFIC PG 3 IN POLYGLYCEROL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC PG 3 IN POLYGLYCEROL MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 20 ASIA PACIFIC PG 4 IN POLYGLYCEROL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC PG 4 IN POLYGLYCEROL MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 22 ASIA PACIFIC PG 2 IN POLYGLYCEROL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC PG 2 IN POLYGLYCEROL MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 24 ASIA PACIFIC PG 6 IN POLYGLYCEROL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC PG 6 IN POLYGLYCEROL MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 26 ASIA PACIFIC PG 10 IN POLYGLYCEROL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC PG 10 IN POLYGLYCEROL MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 28 ASIA PACIFIC OTHERS IN POLYGLYCEROL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC OTHERS IN POLYGLYCEROL MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 30 ASIA PACIFIC POLYGLYCEROL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC POLYGLYCEROL MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 32 ASIA PACIFIC POLYGLYCEROL MARKET, BY APPLICATION, 2020-2029 (PRICE)

TABLE 33 ASIA PACIFIC EMULSIFIERS IN POLYGLYCEROL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 ASIA PACIFIC EMULSIFIERS IN POLYGLYCEROL MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 35 ASIA PACIFIC FOOD ADDITIVES IN POLYGLYCEROL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 ASIA PACIFIC FOOD ADDITIVES IN POLYGLYCEROL MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 37 ASIA PACIFIC SURFACTANTS IN POLYGLYCEROL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 ASIA PACIFIC SURFACTANTS IN POLYGLYCEROL MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 39 ASIA PACIFIC STABILIZERS IN POLYGLYCEROL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 ASIA PACIFIC STABILIZERS IN POLYGLYCEROL MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 41 ASIA PACIFIC NON-IONIC EMULSIFIERS IN POLYGLYCEROL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 ASIA PACIFIC NON-IONIC EMULSIFIERS IN POLYGLYCEROL MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 43 ASIA PACIFIC DISPERSANTS IN POLYGLYCEROL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 ASIA PACIFIC DISPERSANTS IN POLYGLYCEROL MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 45 ASIA PACIFIC EMOLLIENTS IN POLYGLYCEROL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 ASIA PACIFIC EMOLLIENTS IN POLYGLYCEROL MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 47 ASIA PACIFIC WETTING AGENTS IN POLYGLYCEROL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 ASIA PACIFIC WETTING AGENTS IN POLYGLYCEROL MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 49 ASIA PACIFIC THICKENERS IN POLYGLYCEROL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 ASIA PACIFIC THICKENERS IN POLYGLYCEROL MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 51 ASIA PACIFIC OTHERS IN POLYGLYCEROL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 ASIA PACIFIC OTHERS IN POLYGLYCEROL MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 53 ASIA PACIFIC POLYGLYCEROL MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 54 ASIA PACIFIC POLYGLYCEROL MARKET, BY END-USE, 2020-2029 (KILO TONS)

TABLE 55 ASIA PACIFIC POLYGLYCEROL MARKET, BY END-USE, 2020-2029 (PRICE)

TABLE 56 ASIA PACIFIC COSMETICS IN POLYGLYCEROL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 57 ASIA PACIFIC COSMETICS IN POLYGLYCEROL MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 58 ASIA PACIFIC COSMETICS IN POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 ASIA PACIFIC FOOD IN POLYGLYCEROL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 60 ASIA PACIFIC FOOD IN POLYGLYCEROL MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 61 ASIA PACIFIC FOOD IN POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 ASIA PACIFIC BAKERY IN POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 ASIA PACIFIC BAKERY IN POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 ASIA PACIFIC PHARMACEUTICALS IN POLYGLYCEROL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 65 ASIA PACIFIC PHARMACEUTICALS IN POLYGLYCEROL MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 66 ASIA PACIFIC OTHERS IN POLYGLYCEROL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 67 ASIA PACIFIC OTHERS IN POLYGLYCEROL MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 68 ASIA-PACIFIC POLYGLYCEROL MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 69 ASIA-PACIFIC POLYGLYCEROL MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 70 ASIA-PACIFIC POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 ASIA-PACIFIC POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 72 ASIA-PACIFIC POLYGLYCEROL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 73 ASIA-PACIFIC POLYGLYCEROL MARKET, BY PRODUCT, 2020-2029 (KILO TONS)

TABLE 74 ASIA-PACIFIC POLYGLYCEROL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 75 ASIA-PACIFIC POLYGLYCEROL MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 76 ASIA-PACIFIC POLYGLYCEROL MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 77 ASIA-PACIFIC POLYGLYCEROL MARKET, BY END-USE, 2020-2029 (KILO TONS)

TABLE 78 ASIA-PACIFIC FOOD IN POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 ASIA-PACIFIC BAKERY IN POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 ASIA-PACIFIC CONFECTIONERY IN POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 ASIA-PACIFIC COSMETICS IN POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 CHINA POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 CHINA POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 84 CHINA POLYGLYCEROL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 85 CHINA POLYGLYCEROL MARKET, BY PRODUCT, 2020-2029 (KILO TONS)

TABLE 86 CHINA POLYGLYCEROL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 87 CHINA POLYGLYCEROL MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 88 CHINA POLYGLYCEROL MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 89 CHINA POLYGLYCEROL MARKET, BY END-USE, 2020-2029 (KILO TONS)

TABLE 90 CHINA FOOD IN POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 CHINA BAKERY IN POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 CHINA CONFECTIONERY IN POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 93 CHINA COSMETICS IN POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 94 INDIA POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 95 INDIA POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 96 INDIA POLYGLYCEROL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 97 INDIA POLYGLYCEROL MARKET, BY PRODUCT, 2020-2029 (KILO TONS)

TABLE 98 INDIA POLYGLYCEROL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 99 INDIA POLYGLYCEROL MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 100 INDIA POLYGLYCEROL MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 101 INDIA POLYGLYCEROL MARKET, BY END-USE, 2020-2029 (KILO TONS)

TABLE 102 INDIA FOOD IN POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 INDIA BAKERY IN POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 INDIA CONFECTIONERY IN POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 INDIA COSMETICS IN POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 JAPAN POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 JAPAN POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 108 JAPAN POLYGLYCEROL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 109 JAPAN POLYGLYCEROL MARKET, BY PRODUCT, 2020-2029 (KILO TONS)

TABLE 110 JAPAN POLYGLYCEROL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 111 JAPAN POLYGLYCEROL MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 112 JAPAN POLYGLYCEROL MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 113 JAPAN POLYGLYCEROL MARKET, BY END-USE, 2020-2029 (KILO TONS)

TABLE 114 JAPAN FOOD IN POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 115 JAPAN BAKERY IN POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 JAPAN CONFECTIONERY IN POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 117 JAPAN COSMETICS IN POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 118 SOUTH KOREA POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 SOUTH KOREA POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 120 SOUTH KOREA POLYGLYCEROL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 121 SOUTH KOREA POLYGLYCEROL MARKET, BY PRODUCT, 2020-2029 (KILO TONS)

TABLE 122 SOUTH KOREA POLYGLYCEROL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 123 SOUTH KOREA POLYGLYCEROL MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 124 SOUTH KOREA POLYGLYCEROL MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 125 SOUTH KOREA POLYGLYCEROL MARKET, BY END-USE, 2020-2029 (KILO TONS)

TABLE 126 SOUTH KOREA FOOD IN POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 127 SOUTH KOREA BAKERY IN POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 SOUTH KOREA CONFECTIONERY IN POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 129 SOUTH KOREA COSMETICS IN POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 THAILAND POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 131 THAILAND POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 132 THAILAND POLYGLYCEROL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 133 THAILAND POLYGLYCEROL MARKET, BY PRODUCT, 2020-2029 (KILO TONS)

TABLE 134 THAILAND POLYGLYCEROL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 135 THAILAND POLYGLYCEROL MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 136 THAILAND POLYGLYCEROL MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 137 THAILAND POLYGLYCEROL MARKET, BY END-USE, 2020-2029 (KILO TONS)

TABLE 138 THAILAND FOOD IN POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 THAILAND BAKERY IN POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 THAILAND CONFECTIONERY IN POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 141 THAILAND COSMETICS IN POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 SINGAPORE POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 143 SINGAPORE POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 144 SINGAPORE POLYGLYCEROL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 145 SINGAPORE POLYGLYCEROL MARKET, BY PRODUCT, 2020-2029 (KILO TONS)

TABLE 146 SINGAPORE POLYGLYCEROL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 147 SINGAPORE POLYGLYCEROL MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 148 SINGAPORE POLYGLYCEROL MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 149 SINGAPORE POLYGLYCEROL MARKET, BY END-USE, 2020-2029 (KILO TONS)

TABLE 150 SINGAPORE FOOD IN POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 151 SINGAPORE BAKERY IN POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 152 SINGAPORE CONFECTIONERY IN POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 153 SINGAPORE COSMETICS IN POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 154 INDONESIA POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 155 INDONESIA POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 156 INDONESIA POLYGLYCEROL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 157 INDONESIA POLYGLYCEROL MARKET, BY PRODUCT, 2020-2029 (KILO TONS)

TABLE 158 INDONESIA POLYGLYCEROL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 159 INDONESIA POLYGLYCEROL MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 160 INDONESIA POLYGLYCEROL MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 161 INDONESIA POLYGLYCEROL MARKET, BY END-USE, 2020-2029 (KILO TONS)

TABLE 162 INDONESIA FOOD IN POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 163 INDONESIA BAKERY IN POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 164 INDONESIA CONFECTIONERY IN POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 165 INDONESIA COSMETICS IN POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 166 AUSTRALIA & NEW ZEALAND POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 167 AUSTRALIA & NEW ZEALAND POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 168 AUSTRALIA & NEW ZEALAND POLYGLYCEROL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 169 AUSTRALIA & NEW ZEALAND POLYGLYCEROL MARKET, BY PRODUCT, 2020-2029 (KILO TONS)

TABLE 170 AUSTRALIA & NEW ZEALAND POLYGLYCEROL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 171 AUSTRALIA & NEW ZEALAND POLYGLYCEROL MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 172 AUSTRALIA & NEW ZEALAND POLYGLYCEROL MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 173 AUSTRALIA & NEW ZEALAND POLYGLYCEROL MARKET, BY END-USE, 2020-2029 (KILO TONS)

TABLE 174 AUSTRALIA & NEW ZEALAND FOOD IN POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 175 AUSTRALIA & NEW ZEALAND BAKERY IN POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 176 AUSTRALIA & NEW ZEALAND CONFECTIONERY IN POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 177 AUSTRALIA & NEW ZEALAND COSMETICS IN POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 178 PHILIPPINES POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 179 PHILIPPINES POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 180 PHILIPPINES POLYGLYCEROL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 181 PHILIPPINES POLYGLYCEROL MARKET, BY PRODUCT, 2020-2029 (KILO TONS)

TABLE 182 PHILIPPINES POLYGLYCEROL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 183 PHILIPPINES POLYGLYCEROL MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 184 PHILIPPINES POLYGLYCEROL MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 185 PHILIPPINES POLYGLYCEROL MARKET, BY END-USE, 2020-2029 (KILO TONS)

TABLE 186 PHILIPPINES FOOD IN POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 187 PHILIPPINES BAKERY IN POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 188 PHILIPPINES CONFECTIONERY IN POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 189 PHILIPPINES COSMETICS IN POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 190 MALAYSIA POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 191 MALAYSIA POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 192 MALAYSIA POLYGLYCEROL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 193 MALAYSIA POLYGLYCEROL MARKET, BY PRODUCT, 2020-2029 (KILO TONS)

TABLE 194 MALAYSIA POLYGLYCEROL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 195 MALAYSIA POLYGLYCEROL MARKET, BY APPLICATION, 2020-2029 (KILO TONS)

TABLE 196 MALAYSIA POLYGLYCEROL MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 197 MALAYSIA POLYGLYCEROL MARKET, BY END-USE, 2020-2029 (KILO TONS)

TABLE 198 MALAYSIA FOOD IN POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 199 MALAYSIA BAKERY IN POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 200 MALAYSIA CONFECTIONERY IN POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 201 MALAYSIA COSMETICS IN POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 202 REST OF ASIA-PACIFIC POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 203 REST OF ASIA PACIFIC POLYGLYCEROL MARKET, BY TYPE, 2020-2029 (KILO TONS)

List of Figure

FIGURE 1 ASIA PACIFIC POLYGLYCEROL MARKET

FIGURE 2 ASIA PACIFIC POLYGLYCEROL MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC POLYGLYCEROL MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC POLYGLYCEROL MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC POLYGLYCEROL MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC POLYGLYCEROL MARKET: THE PRODUCT LIFELINE CURVE

FIGURE 7 ASIA PACIFIC POLYGLYCEROL MARKET: MULTIVARIATE MODELLING

FIGURE 8 ASIA PACIFIC POLYGLYCEROL MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 ASIA PACIFIC POLYGLYCEROL MARKET: DBMR MARKET POSITION GRID

FIGURE 10 ASIA PACIFIC POLYGLYCEROL MARKET: MARKET END-USE COVERAGE GRID

FIGURE 11 ASIA PACIFIC POLYGLYCEROL MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 ASIA PACIFIC POLYGLYCEROL MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 ASIA PACIFIC POLYGLYCEROL MARKET: SEGMENTATION

FIGURE 14 GROWING AWARENESS REGARDING THE PROPERTIES OF POLYGLYCEROLS IS EXPECTED TO DRIVE THE ASIA PACIFIC POLYGLYCEROL MARKET IN THE FORECAST PERIOD

FIGURE 15 POLYGLYCEROL POLYRICINOLEATE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC POLYGLYCEROL MARKET IN 2022 & 2029

FIGURE 16 IMPORT-EXPORT SCENARIO (USD THOUSAND)

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC POLYGLYCEROL MARKET

FIGURE 18 ASIA PACIFIC POLYGLYCEROL MARKET: BY TYPE, 2021

FIGURE 19 ASIA PACIFIC POLYGLYCEROL MARKET: BY PRODUCT, 2021

FIGURE 20 ASIA PACIFIC POLYGLYCEROL MARKET: BY APPLICATION, 2021

FIGURE 21 ASIA PACIFIC POLYGLYCEROL MARKET: BY END-USE, 2021

FIGURE 22 ASIA-PACIFIC POLYGLYCEROL MARKET: SNAPSHOT (2021)

FIGURE 23 ASIA-PACIFIC POLYGLYCEROL MARKET: BY COUNTRY (2021)

FIGURE 24 ASIA-PACIFIC POLYGLYCEROL MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 ASIA-PACIFIC POLYGLYCEROL MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 ASIA-PACIFIC POLYGLYCEROL MARKET: BY TYPE (2022-2029)

FIGURE 27 ASIA PACIFIC POLYGLYCEROL MARKET: COMPANY SHARE 2021 (%)

Asia Pacific Polyglycerol Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Polyglycerol Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Polyglycerol Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.