Asia Pacific Warm Water Aquaculture Feed Market

Market Size in USD Billion

CAGR :

%

USD

5.08 Billion

USD

6.75 Billion

2024

2032

USD

5.08 Billion

USD

6.75 Billion

2024

2032

| 2025 –2032 | |

| USD 5.08 Billion | |

| USD 6.75 Billion | |

|

|

|

|

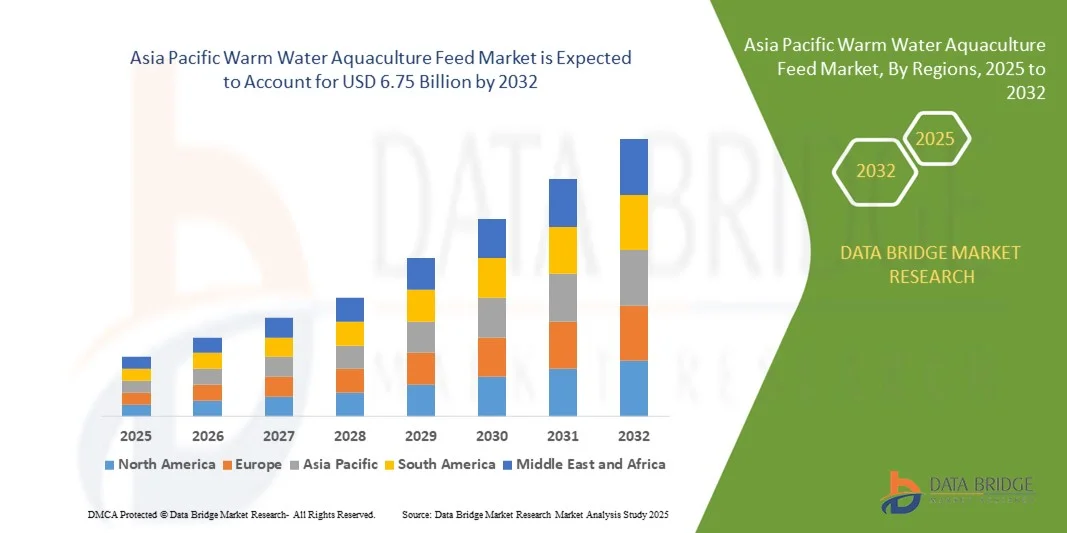

What is the Asia Pacific Warm Water Aquaculture Feed Market Size and Growth Rate?

- The Asia Pacific warm water aquaculture feed market size was valued at USD 5.08 billion in 2024 and is expected to reach USD 6.75 billion by 2032, at a CAGR of3.62% during the forecast period

- Rising fish farming activities worldwide and increasing expenditure on analysis and development proficiencies are the main factors fostering the expansion of the warm water aquaculture feed market

- Rising demand for combined meals to take care of the health of aquatic species and growing awareness concerning heat water cultivation feed are another factors acting as warm water aquaculture feed market growth determinant

What are the Major Takeaways of Warm Water Aquaculture Feed Market?

- The rise in the focus of the manufacturers on innovative product offerings associated with increased restrictions on animal-based food products produce profitable growth opportunities for the warm water cultivation feed market

- However, fluctuations within the costs of raw materials can cause a serious challenge to the expansion of heat water cultivation feed market. Stringent laws obligatory by the government on product approvals can any derail the warm water cultivation feed market rate

- China dominated the Asia-Pacific warm water aquaculture Feed market in 2024, holding the largest revenue share of 46.3%, driven by extensive aquaculture operations, growing seafood consumption, and favorable climatic conditions for warm-water species farming

- The India warm water aquaculture feed market is growing at a fastest CAGR of 10.58%, supported by increasing aquaculture output and rising adoption of nutrient-dense, species-specific feed formulations

- The Freshwater segment dominated the market in 2024, accounting for a market revenue share of 58.7%, driven by the large-scale cultivation of species such as tilapia, carp, and catfish in inland aquaculture systems

Report Scope and Warm Water Aquaculture Feed Market Segmentation

|

Attributes |

Warm Water Aquaculture Feed Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Warm Water Aquaculture Feed Market?

Sustainable Sourcing and Functional Feed Formulations

- A major trend shaping the warm water aquaculture feed market is the shift toward sustainably sourced ingredients and functional feed formulations that enhance fish health, growth, and immunity. This transition is driven by increasing consumer and industry awareness of environmental sustainability and traceable aquaculture production

- Manufacturers are increasingly incorporating alternative proteins such as insect meal, single-cell proteins, and algae-based ingredients to reduce dependency on traditional fishmeal and fish oil. These innovations help lower the industry’s ecological footprint

- Feed producers are also investing in nutraceutical additives such as probiotics, prebiotics, and bioactive compounds to improve disease resistance and water quality

- A notable instance is Cargill, Incorporated (U.S.), which launched its “Ewos Optiline” functional feed series to optimize feed conversion ratios and sustainability across tropical aquaculture systems

- This movement toward eco-efficient and health-oriented feed formulations is reshaping product innovation, promoting transparency, and strengthening the industry’s alignment with global sustainability goals

What are the Key Drivers of Warm Water Aquaculture Feed Market?

- The rising demand for protein-rich seafood and the expansion of aquaculture production in Asia-Pacific and Latin America are primary growth drivers of the warm water aquaculture feed market

- For instance, in April 2025, BioMar Group introduced a high-performance sustainable feed line made from certified marine and plant ingredients to reduce carbon footprint in shrimp and tilapia farming

- Advancements in precision aquaculture technologies, including automated feeding systems and real-time nutrient monitoring, are enabling better feed efficiency and yield optimization

- Growing government support for sustainable aquaculture practices and circular economy initiatives is also boosting investment in environmentally responsible feed production

- Furthermore, increasing demand for functional ingredients such as omega-3, antioxidants, and enzymes is expanding feed innovation, positioning the market for robust growth over the next decade

Which Factor is Challenging the Growth of the Warm Water Aquaculture Feed Market?

- A major challenge for the warm water aquaculture feed market lies in the volatility of raw material prices and environmental limitations linked to marine resource utilization. Seasonal fluctuations in fish catch and rising costs of alternative proteins are impacting supply consistency and profitability

- For instance, disruptions in global trade and climatic variability have caused shortages in key inputs such as fishmeal and soybean meal, raising production costs for feed manufacturers

- Moreover, compliance with stringent sustainability certifications such as ASC (Aquaculture Stewardship Council) and regional environmental policies increases operational and traceability costs

- Companies such as Nutreco N.V. (Netherlands) and Evonik Industries AG (Germany) are addressing these concerns by investing in biotechnology-based protein alternatives and localized supply chains

- However, maintaining the balance between economic viability and ecological responsibility remains a key hurdle, making innovation and resource optimization vital for long-term industry stability

How is the Warm Water Aquaculture Feed Market Segmented?

The warm water aquaculture feed market is segmented on the basis of water type, species, feed type, and nature.

- By Water Type

On the basis of water type, the warm water aquaculture feed market is segmented into Freshwater and Saltwater. The Freshwater segment dominated the market in 2024, accounting for a market revenue share of 58.7%, driven by the large-scale cultivation of species such as tilapia, carp, and catfish in inland aquaculture systems. The availability of freshwater resources, lower operational costs, and favorable breeding conditions contribute to its widespread adoption across Asia-Pacific, Africa, and Latin America. Freshwater aquaculture plays a vital role in meeting the growing global seafood demand while supporting food security and rural livelihoods.

The Saltwater segment is expected to grow at the fastest CAGR from 2025 to 2032, propelled by the rising farming of high-value species such as sea bass, grouper, and barramundi. Increasing coastal aquaculture initiatives and advancements in offshore farming technologies are expanding saltwater feed demand globally.

- By Species

Based on species, the warm water aquaculture feed market is categorized into Carps, Catfish, Barramundi, Pike Perch, Tilapia, Sturgeon, Yellow Tail Kingfish, Eel, Sea Bass, Sea Bream, Grouper, Meagre, Rockfish, Sole, Turbot, Milk Fish, and Others. The Tilapia segment dominated the market in 2024, capturing a market share of 29.4%, owing to its high adaptability, fast growth rate, and widespread consumption in developing regions. Tilapia’s popularity as an affordable protein source and its tolerance to variable water conditions make it a cornerstone of warm-water aquaculture globally.

Meanwhile, the Barramundi segment is projected to witness the fastest CAGR during 2025–2032, driven by increasing demand for premium seafood and sustainable aquaculture expansion in Australia and Southeast Asia. Growing adoption of advanced nutrition formulations and biosecure rearing systems is further enhancing productivity and feed utilization in barramundi farming.

- By Feed Type

On the basis of feed type, the warm water aquaculture feed market is segmented into Starters, Grower Feed, Fry Feed, Functional Feed, Broodstock Feed, Organic Feed, and Others. The Grower Feed segment held the dominant market position in 2024 with a revenue share of 37.8%, as it is essential for achieving optimal weight gain and feed efficiency during the growth phase of fish and shrimp. The increasing focus on balanced nutrition and feed conversion efficiency among aquaculture farmers supports this segment’s leadership.

The Functional Feed segment is expected to grow at the fastest CAGR from 2025 to 2032, propelled by its ability to enhance immunity, stress resistance, and disease prevention. The incorporation of probiotics, prebiotics, and enzymes in functional feed is gaining traction, particularly in regions emphasizing sustainable and antibiotic-free aquaculture practices.

- By Nature

Based on nature, the warm water aquaculture feed market is divided into Conventional and Organic. The Conventional segment dominated the market in 2024, capturing a market share of 82.1%, primarily due to its cost-effectiveness, wide availability, and established use in large-scale aquaculture operations. Conventional feeds are formulated using fishmeal, soy protein, and other readily available raw materials to ensure consistent nutrient delivery at lower production costs.

The Organic segment is anticipated to record the fastest CAGR from 2025 to 2032, fueled by the rising consumer preference for clean-label, sustainable seafood products and eco-friendly farming practices. Increasing certifications for organic aquaculture and growing regulatory support in regions such as the European Union and North America are encouraging manufacturers to develop certified organic feed formulations, marking a key shift toward sustainable aquaculture production.

Which Region Holds the Largest Share of the Warm Water Aquaculture Feed Market?

- China dominated the Asia-Pacific warm water aquaculture Feed market in 2024, holding the largest revenue share of 46.3%, driven by extensive aquaculture operations, growing seafood consumption, and favorable climatic conditions for warm-water species farming

- The region’s dominance is further supported by strong governmental support for sustainable aquaculture, technological innovation in feed formulation, and rising demand for high-protein diets among consumers

- In addition, Asia-Pacific’s large coastal area, low production costs, and abundant availability of fish by-products have positioned it as the leading producer and exporter of aquaculture feed globally, reinforcing its dominance in the overall market landscape

India Warm Water Aquaculture Feed Market Insight

The India warm water aquaculture feed market is growing at a fastest CAGR of 10.58%, supported by increasing aquaculture output and rising adoption of nutrient-dense, species-specific feed formulations. The country’s tropical climate favors the farming of species such as carp, catfish, and tilapia, driving steady feed demand. Rising awareness about sustainable aquaculture practices, along with government schemes such as Pradhan Mantri Matsya Sampada Yojana (PMMSY), is enhancing feed quality and farmer profitability. Furthermore, India’s growing seafood exports and the development of integrated aquafeed facilities are propelling the country’s prominence in the Asia-Pacific Warm Water Aquaculture Feed market.

Vietnam Warm Water Aquaculture Feed Market Insight

The Vietnam warm water aquaculture feed market is expanding significantly, fueled by its status as one of the world’s largest exporters of seafood products such as pangasius and shrimp. The nation’s strong aquaculture infrastructure, government incentives, and investment in eco-friendly feed formulations are key drivers of market growth. The increasing adoption of functional and organic feeds to improve fish health and reduce environmental impact aligns with global sustainability goals. In addition, partnerships with international feed companies and advancements in extrusion and fermentation technologies are enabling Vietnam to strengthen its feed production efficiency and export competitiveness.

Indonesia Warm Water Aquaculture Feed Market Insight

The Indonesia warm water aquaculture feed market is witnessing steady growth, supported by abundant marine biodiversity and increasing aquaculture activity in both freshwater and coastal zones. The government’s initiatives to promote self-sufficiency in fish feed production and reduce import dependency are driving domestic industry expansion. Rising seafood consumption and export-oriented shrimp and tilapia farming are further boosting feed demand. Moreover, investments in research and development for high-performance and disease-resistant feed formulations are improving production yields. As a result, Indonesia is emerging as a vital contributor to Asia-Pacific’s aquaculture feed supply chain and sustainable seafood industry.

Which are the Top Companies in Warm Water Aquaculture Feed Market?

The warm water aquaculture feed industry is primarily led by well-established companies, including:

- Cargill, Incorporated (U.S.)

- Evonik Industries AG (Germany)

- Nutreco N.V. (Netherlands)

- ADM (U.S.)

- Alltech (U.S.)

- BioMarg Group (Denmark)

- BIOMIN Holding GmbH (Austria)

- Aller Aqua Group (Denmark)

- Charoen Pokphand Foods PCL (Thailand)

- Adisseo (France)

- Purina Animal Nutrition LLC. (U.S.)

- Rangen Inc. (U.S.)

- THAN VUONG COMPANY LTD (Vietnam)

- BRF (Brazil)

- Calysta, Inc. (U.S.)

- Spectrum Brands, Inc. (U.S.)

- Solvay (Belgium)

- Kemin Industries, Inc. (U.S.)

- Bio-Oregon (U.S.)

- TECHNA SA (France)

- Avanti Feeds Ltd (India)

What are the Recent Developments in Asia Pacific Warm Water Aquaculture Feed Market?

- In May 2025, SHV Holdings subsidiary Skretting China inaugurated its first LifeStart production line in Asia, marking a significant expansion into China’s thriving aquaculture industry. Located in Zhuhai, the facility introduced five new hatchery feed products catering to salmon, tilapia, golden pompano, snakehead, and catfish. This strategic move strengthens Skretting’s foothold in Asia and supports the region’s growing demand for high-quality aquaculture nutrition solutions

- In April 2025, Ridley Corporation finalized the sale of its Wasleys feedmill assets in Australia, optimizing its operational efficiency and redirecting investments toward high-growth aquaculture and specialty feed sectors. This strategic consolidation aims to enhance profitability and foster innovation in premium feed formulations designed to meet the evolving demands of modern aquaculture systems

- In March 2025, Cargill showcased its latest feed formulation technologies at VIV Asia 2025, emphasizing sustainable protein development and collaboration with regional aquaculture producers. The initiative focuses on reducing the environmental footprint per unit of animal protein, reinforcing Cargill’s commitment to advancing eco-friendly feed solutions and improving food security across the Asia-Pacific region

- In January 2024, Calysta’s FeedKind protein received official approval from China’s Ministry of Agriculture and Rural Affairs (MARA) for inclusion in aquaculture feeds, marking a breakthrough for sustainable protein innovation. Distributed by Calysseo, a joint venture between Calysta and Adisseo, the single-cell protein will support the development of nutritionally balanced fish and shrimp feeds, boosting China’s sustainable aquaculture ecosystem

- In February 2024, ADM completed the acquisition of PT Trouw Nutrition Indonesia, enhancing its presence in Southeast Asia’s aquaculture feed market. The acquisition expands ADM’s access to specialized marine protein ingredients and functional additives, positioning the company to serve the rising demand for high-value finfish and shrimp feed in the region. This strategic move further solidifies ADM’s global leadership in aquaculture nutrition

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Asia Pacific Warm Water Aquaculture Feed Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Warm Water Aquaculture Feed Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Warm Water Aquaculture Feed Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.