Europe Ambulatory X Ray Devices Market

Market Size in USD Billion

CAGR :

%

USD

2.55 Billion

USD

4.96 Billion

2025

2033

USD

2.55 Billion

USD

4.96 Billion

2025

2033

| 2026 –2033 | |

| USD 2.55 Billion | |

| USD 4.96 Billion | |

|

|

|

|

Europe Ambulatory X-Ray Devices Market Size

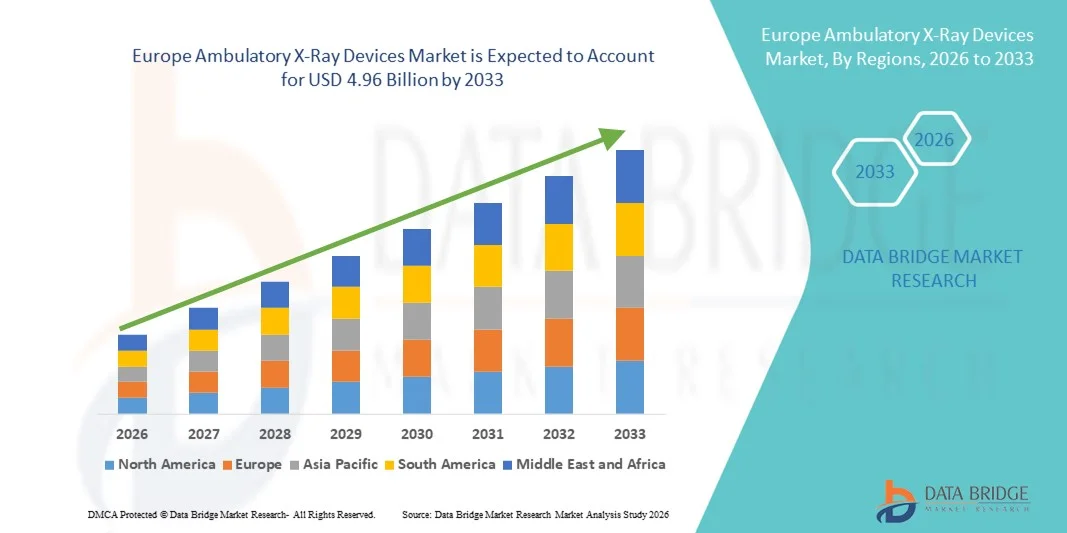

- The Europe ambulatory X-Ray devices market size was valued at USD 2.55 billion in 2025 and is expected to reach USD 4.96 billion by 2033, at a CAGR of 8.68% during the forecast period

- The market growth is largely fueled by the increasing demand for point-of-care diagnostics and the rising need for rapid imaging solutions in outpatient and emergency care settings, leading to greater adoption of ambulatory X-ray devices across clinics, ambulatory surgical centers, and mobile healthcare units

- Furthermore, growing prevalence of orthopedic disorders, trauma cases, and chronic diseases, along with technological advancements such as digital radiography, wireless detectors, and portable battery-operated systems, is establishing ambulatory X-ray devices as essential tools for decentralized and efficient diagnostic imaging. These converging factors are accelerating the uptake of Ambulatory X-Ray Devices solutions, thereby significantly boosting the industry's growth

Europe Ambulatory X-Ray Devices Market Analysis

- Ambulatory X-ray devices, including mobile and portable digital radiography systems, are increasingly vital components of modern diagnostic imaging infrastructure across ambulatory surgical centers, outpatient clinics, emergency departments, and home healthcare settings due to their flexibility, rapid imaging capabilities, and improved patient accessibility

- The escalating demand for ambulatory X-ray systems is primarily fueled by the growing need for point-of-care diagnostics, rising incidence of orthopedic injuries and chronic diseases, increasing preference for minimally invasive and outpatient procedures, and continuous advancements in compact digital imaging technologies

- The U.K. dominated the Ambulatory X-Ray Devices market with the largest revenue share of approximately 27.4% in 2025, supported by a well-established public healthcare system, increasing adoption of mobile digital radiography in outpatient and community care settings, strong investments in hospital infrastructure modernization, and rising demand for rapid diagnostic imaging solutions across NHS facilities

- Germany is expected to be the fastest-growing country in the Ambulatory X-Ray Devices market, projected to expand at a CAGR of approximately 8.9% during the forecast period, driven by advanced healthcare infrastructure, increasing adoption of AI-enabled imaging systems, rising demand for point-of-care diagnostics, and strong presence of leading medical imaging device manufacturers

- The mobile X-ray devices segment dominated the largest market revenue share of 58.6% in 2025, driven by their widespread use in ambulatory centers, diagnostic clinics, and emergency settings

Report Scope and Ambulatory X-Ray Devices Market Segmentation

|

Attributes |

Ambulatory X-Ray Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Europe Ambulatory X-Ray Devices Market Trends

Advancements in Portable Digital Radiography and Battery-Powered Imaging Systems

- A significant and accelerating trend in the global ambulatory X-Ray devices market is the growing adoption of lightweight, battery-powered digital radiography (DR) systems designed for point-of-care and mobile healthcare settings. These advanced systems enable high-quality imaging in outpatient clinics, ambulatory surgical centers, emergency departments, and even home healthcare environments

- For instance, companies such as FUJIFILM Holdings Corporation and Canon Medical Systems Corporation have introduced compact mobile X-ray systems featuring wireless flat-panel detectors, improved battery life, and enhanced image processing capabilities. These solutions allow healthcare providers to conduct diagnostic imaging in confined or resource-limited spaces without compromising image clarity

- The integration of digital imaging software with advanced image enhancement algorithms is improving diagnostic accuracy while reducing radiation exposure. Modern ambulatory X-ray systems now offer automated positioning assistance, touchscreen interfaces, and rapid image transfer to hospital PACS systems, streamlining clinical workflows

- The increasing emphasis on decentralized healthcare delivery and outpatient care models is further fueling demand for portable imaging technologies. Ambulatory centers require efficient and space-saving imaging solutions that can be easily maneuvered between patient rooms and treatment areas

- In addition, the shift from computed radiography (CR) to fully digital radiography (DR) is enhancing operational efficiency by reducing processing time and enabling immediate image availability for physicians

- This trend toward compact, digitally integrated, and mobility-focused X-ray systems is transforming diagnostic imaging accessibility and expanding the scope of ambulatory care services worldwide

Europe Ambulatory X-Ray Devices Market Dynamics

Driver

Rising Demand for Point-of-Care Diagnostics and Increasing Outpatient Procedures

- The growing preference for outpatient procedures and minimally invasive treatments is a major driver accelerating demand in the Ambulatory X-Ray Devices market

- Healthcare systems are increasingly shifting services from inpatient hospitals to ambulatory surgical centers and specialty clinics to reduce costs and improve patient convenience

- For instance, according to the World Health Organization, strengthening access to essential diagnostic imaging services is critical to achieving universal health coverage, particularly in low- and middle-income countries

- In response, several Europe governments have invested in expanding community health centers equipped with mobile radiography units to improve early diagnosis of tuberculosis and orthopedic conditions

- The rising incidence of musculoskeletal disorders, trauma injuries, and respiratory diseases is further increasing the need for immediate, on-site imaging solutions in ambulatory setting

- In addition, the expansion of private diagnostic centers and same-day surgical facilities is driving procurement of portable and cost-efficient X-ray systems

- Government healthcare modernization initiatives and public–private partnerships are also supporting wider deployment of mobile imaging infrastructure

- Collectively, these factors are significantly propelling the growth trajectory of the Ambulatory X-Ray Devices market globally

Restraint/Challenge

High Equipment Costs and Regulatory Compliance Requirements

- Despite strong growth potential, the high capital investment required for advanced ambulatory X-ray systems remains a significant restraint, particularly for small clinics and healthcare facilities with limited budgets. Modern digital radiography units incorporate sophisticated detectors, imaging software, and mobility features, increasing upfront procurement costs

- For instance, advanced mobile DR systems offered by companies such as GE HealthCare and Siemens Healthineers include premium flat-panel detectors and dose optimization technologies, which, while enhancing image quality and patient safety, may be financially challenging for smaller ambulatory centers to adopt without external funding or leasing arrangements

- In addition to equipment costs, strict radiation safety regulations, device certification requirements, and mandatory periodic inspections increase compliance expenditures for healthcare providers

- The need for skilled radiologic technologists and regular system maintenance further adds to operational costs, particularly in rural or underserved regions

- Detector replacement expenses and software upgrade requirements can also raise the total cost of ownership over time

- Addressing these challenges through cost-effective product development, flexible financing models, and government support programs will be essential for ensuring broader accessibility and sustained growth in the Ambulatory X-Ray Devices market

Europe Ambulatory X-Ray Devices Market Scope

The market is segmented on the basis of product type, accessories, technology, application, end user, and distribution channel.

- By Product Type

On the basis of product type, the Ambulatory X-Ray Devices market is segmented into handheld X-ray devices and mobile X-ray devices. The mobile X-ray devices segment dominated the largest market revenue share of 58.6% in 2025, driven by their widespread use in ambulatory centers, diagnostic clinics, and emergency settings. Mobile systems provide higher imaging power and versatility compared to handheld units, making them suitable for orthopaedic and chest imaging. Increasing demand for bedside imaging in outpatient facilities supports segment growth. Healthcare providers prefer mobile X-ray systems due to their ability to serve multiple departments efficiently. Rising trauma and fracture cases further strengthen demand. Technological advancements in digital detectors improve image quality and reduce radiation exposure. Growing investments in ambulatory surgical centers fuel installations. Integration with PACS systems enhances workflow efficiency. Favorable reimbursement in developed markets supports adoption. Expanding healthcare infrastructure in emerging economies contributes to growth. Continuous product innovation ensures improved portability and battery efficiency. Strong clinical reliability sustains market dominance.

The handheld X-ray devices segment is expected to witness the fastest CAGR of 24.3% from 2026 to 2033, driven by increasing demand for compact and point-of-care diagnostic solutions. Handheld devices are gaining traction in dental clinics and home healthcare environments. Their lightweight design and ease of use enhance practitioner convenience. Growing preference for portable imaging in remote and rural areas supports adoption. Advancements in battery technology improve device longevity. Rising demand for rapid diagnosis in emergency cases fuels growth. Handheld units reduce infrastructure dependency, making them cost-effective. Expanding telemedicine and mobile healthcare services accelerate usage. Increased focus on reducing patient movement during imaging drives demand. Dental imaging applications significantly contribute to segment expansion. Continuous innovation in wireless connectivity strengthens functionality. Growing outpatient procedures ensure sustained CAGR growth.

- By Technology

On the basis of technology, the Ambulatory X-Ray Devices market is segmented into computed radiography (CR), digital radiography (DR), and analog. The digital radiography (DR) segment dominated the largest market revenue share of 49.8% in 2025, owing to superior image quality and faster processing time. DR systems provide immediate image availability, improving diagnostic efficiency. Reduced radiation exposure compared to analog systems enhances patient safety. Hospitals and ambulatory centers increasingly prefer DR for workflow optimization. Integration with electronic medical records streamlines data management. Rising adoption of AI-assisted imaging supports segment growth. Government initiatives promoting digital healthcare strengthen adoption. Lower operational costs over time contribute to dominance. Increasing demand for high-resolution orthopedic imaging fuels growth. Technological advancements enhance detector sensitivity. Developed markets have largely transitioned to DR systems. Continuous innovation sustains long-term leadership.

The computed radiography (CR) segment is expected to witness the fastest CAGR of 20.7% from 2026 to 2033, driven by its cost-effectiveness and easy upgrade from analog systems. CR technology offers digital benefits without complete system replacement. Small and mid-sized clinics prefer CR due to lower investment requirements. Expanding healthcare facilities in emerging economies accelerate adoption. Improved image storage and retrieval capabilities enhance workflow. CR systems support diverse imaging applications. Growing awareness about digital transition fuels demand. Portable CR systems increase flexibility. Rising diagnostic imaging volumes contribute to growth. Training programs for digital imaging improve acceptance. Continuous improvements in phosphor plate technology enhance image clarity. Expanding rural healthcare infrastructure supports expansion.

- By Accessories

On the basis of accessories, the Ambulatory X-Ray Devices market is segmented into Digital Sensor Holders, Film and Phosphate Plate Holders, Film Processing Hangers, and Radiography Aprons. The Radiography Aprons segment dominated the largest market revenue share of 34.7% in 2025, driven by the mandatory requirement for radiation protection across diagnostic procedures. Increasing awareness regarding occupational safety standards and stringent regulatory guidelines significantly contribute to the demand for protective aprons. Healthcare professionals and patients rely on high-quality lead and lead-free aprons to minimize radiation exposure during imaging. The expansion of diagnostic imaging centers and ambulatory facilities further supports steady demand. Continuous product innovations focusing on lightweight and ergonomic designs enhance comfort and usability. Rising volumes of orthopaedic, dental, and cardiovascular imaging procedures also strengthen segment dominance. In addition, replacement demand due to wear and tear contributes to recurring revenue generation. Growing compliance with global radiation safety protocols ensures sustained adoption. The consistent need for radiation shielding across all imaging settings reinforces the leading market position of this segment.

The Digital Sensor Holders segment is expected to witness the fastest CAGR of 9.1% from 2026 to 2033, driven by the rapid adoption of digital radiography (DR) systems. As healthcare facilities transition from analog to digital imaging technologies, the requirement for compatible sensor holders increases substantially. Digital sensor holders improve image accuracy, positioning stability, and workflow efficiency, making them essential in modern diagnostic practices. The rising preference for minimally invasive and quick diagnostic procedures accelerates product demand. Technological advancements in sensor durability and infection control features further enhance adoption rates. Increasing investments in dental and orthopaedic digital imaging systems support segment expansion. In addition, the growth of ambulatory diagnostic centers boosts the installation of compact DR units requiring advanced holders. Enhanced patient comfort and reduced retakes due to precise positioning contribute to higher utilization. Expanding healthcare infrastructure in emerging economies is expected to sustain strong CAGR growth throughout the forecast period.

- By Application

On the basis of application, the Ambulatory X-Ray Devices market is segmented into orthopaedic, cancer, dental, cardiovascular, and other. The orthopaedic segment accounted for the largest market revenue share of 32.4% in 2025, driven by rising incidence of fractures, sports injuries, and musculoskeletal disorders. Ambulatory centers frequently perform orthopedic imaging for quick diagnosis. Increasing geriatric population prone to bone-related conditions supports growth. Mobile X-ray systems are widely used in orthopedic clinics. Demand for rapid trauma assessment strengthens adoption. Technological advancements improve bone imaging precision. Rising outpatient orthopedic surgeries boost usage. Growing awareness about early diagnosis of joint disorders contributes to dominance. Favorable insurance coverage in developed regions supports procedures. Integration with digital imaging platforms enhances reporting efficiency. Expanding rehabilitation centers drive demand. Continuous innovation in imaging software sustains leadership.

The dental segment is expected to witness the fastest CAGR of 23.1% from 2026 to 2033, fueled by growing demand for portable and handheld X-ray systems in dental clinics. Rising prevalence of dental disorders increases imaging requirements. Cosmetic dentistry trends further drive diagnostic procedures. Handheld X-ray units are particularly popular in dental applications. Increasing number of standalone dental clinics supports expansion. Technological improvements reduce radiation exposure in dental imaging. Growing awareness of oral health promotes routine checkups. Rapid urbanization fuels dental service demand. Integration with digital dental software enhances workflow. Expanding insurance coverage for dental procedures boosts growth. Rising medical tourism in emerging economies accelerates adoption. Continuous product innovation ensures sustained CAGR growth.

- By End User

On the basis of end user, the Ambulatory X-Ray Devices market is segmented into orthopaedic clinics, standalone diagnostic centers, ambulatory centers, offices, and corporate settings. The standalone diagnostic centers segment dominated the largest market revenue share of 36.9% in 2025, due to increasing demand for specialized outpatient imaging services. Diagnostic centers offer cost-effective and quick radiology services. Growing patient preference for outpatient facilities supports adoption. Expansion of private diagnostic networks strengthens market presence. Advanced DR systems are widely installed in such centers. Rising referral rates from physicians contribute to growth. Integration with tele-radiology services enhances efficiency. Increasing chronic disease burden drives imaging demand. Favorable reimbursement policies support segment expansion. Technological upgrades improve diagnostic accuracy. Growing urban healthcare infrastructure boosts installations. Continuous service diversification sustains leadership.

The ambulatory centers segment is expected to witness the fastest CAGR of 22.6% from 2026 to 2033, driven by increasing outpatient surgical procedures. Ambulatory centers require rapid imaging solutions for pre- and post-operative assessments. Rising healthcare cost containment strategies promote outpatient care. Portable and mobile X-ray systems enhance workflow flexibility. Government initiatives encouraging decentralized healthcare support growth. Increasing trauma and emergency cases in outpatient settings boost demand. Expansion of ambulatory surgical centers globally accelerates adoption. Growing focus on patient convenience strengthens preference. Integration with digital records enhances operational efficiency. Continuous infrastructure development supports expansion. Rising investments in ambulatory care facilities fuel growth. Strong demand for cost-efficient imaging solutions ensures high CAGR.

- By Distribution Channel

On the basis of distribution channel, the Ambulatory X-Ray Devices market is segmented into Direct Tenders, Distributor, and Retail. The Direct Tenders segment accounted for the largest market revenue share of 46.4% in 2025, driven by bulk procurement by hospitals, diagnostic chains, and government healthcare institutions. Large-scale healthcare providers prefer direct tendering processes to secure cost advantages and ensure product authenticity. This channel enables manufacturers to establish long-term contracts and provide customized solutions, including maintenance and technical support. Government-funded imaging programs and public healthcare expansions significantly contribute to direct tender dominance. Bulk purchasing agreements also allow competitive pricing and extended warranties. The growing installation of digital radiography systems in public hospitals strengthens this segment. Direct engagement between manufacturers and healthcare institutions enhances trust and ensures compliance with regulatory standards. In addition, direct tenders facilitate faster deployment of advanced mobile X-ray systems. The increasing modernization of healthcare infrastructure globally further supports segment leadership.

The Distributor segment is projected to witness the fastest CAGR of 7.9% from 2026 to 2033, driven by expanding market penetration in emerging economies. Distributors play a crucial role in bridging manufacturers with small and mid-sized clinics that lack direct procurement capabilities. They offer logistical support, product demonstrations, and after-sales services, making advanced imaging devices more accessible. Growing healthcare investments in rural and semi-urban regions create new opportunities for distributor networks. The rising number of private clinics and diagnostic laboratories further boosts demand through this channel. Distributors also facilitate quicker market entry for new technologies and product launches. Flexible financing options and localized technical assistance strengthen their value proposition. Increasing competition among manufacturers encourages partnerships with regional distributors. As healthcare infrastructure expands globally, the distributor channel is expected to record consistent and robust CAGR growth over the forecast period.

Europe Ambulatory X-Ray Devices Market Regional Analysis

- The Europe ambulatory X-Ray devices market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing demand for mobile and point-of-care diagnostic imaging solutions across hospitals, outpatient clinics, and community healthcare setting

- Rising healthcare expenditure, growing emphasis on early disease diagnosis, and modernization of radiology departments are significantly contributing to market growth

- The region is witnessing strong adoption of digital and portable X-ray systems due to their ability to improve workflow efficiency, reduce patient movement, and enhance imaging accuracy. In addition, increasing integration of AI-powered imaging software and expansion of ambulatory surgical centers are further supporting market expansion across European countries

U.K. Ambulatory X-Ray Devices Market Insight

The U.K. ambulatory X-Ray devices market dominated the Ambulatory X-Ray Devices market with the largest revenue share of approximately 27.4% in 2025, supported by a well-established public healthcare system, increasing adoption of mobile digital radiography in outpatient and community care settings, and strong investments in hospital infrastructure modernization. Rising demand for rapid diagnostic imaging solutions across NHS facilities, coupled with initiatives aimed at reducing patient waiting times, is accelerating the deployment of ambulatory X-ray systems. The expansion of community diagnostic centers and emphasis on decentralized healthcare delivery further strengthen market growth in the U.K.

Germany Ambulatory X-Ray Devices Market Insight

Germany is expected to be the fastest-growing country in the Ambulatory X-Ray Devices market, projected to expand at a CAGR of approximately 8.9% during the forecast period, driven by advanced healthcare infrastructure, increasing adoption of AI-enabled imaging systems, and rising demand for point-of-care diagnostics. The country’s strong presence of leading medical imaging device manufacturers, combined with continuous investments in hospital digitization and radiology upgrades, supports sustained market expansion. In addition, the growing elderly population and high prevalence of chronic conditions are increasing the need for efficient and portable imaging solutions across healthcare facilities.

Europe Ambulatory X-Ray Devices Market Share

The Ambulatory X-Ray Devices industry is primarily led by well-established companies, including:

- GE HealthCare (U.S.)

- Siemens Healthineers (Germany)

- Koninklijke Philips N.V. (Netherlands)

- Canon Medical Systems Corporation (Japan)

- Fujifilm Holdings Corporation (Japan)

- Carestream Health (U.S.)

- Shimadzu Corporation (Japan)

- Agfa-Gevaert Group (Belgium)

- Hologic, Inc. (U.S.)

- Mindray Medical International Limited (China)

- Samsung Medison (South Korea)

- Hitachi, Ltd. (Japan)

- Varex Imaging Corporation (U.S.)

- Planmed Oy (Finland)

- United Imaging Healthcare Co., Ltd. (China)

- Konica Minolta, Inc. (Japan)

- General Medical Merate S.p.A. (Italy)

- Allengers Medical Systems Limited (India)

- DRGEM Corporation (South Korea)

- MS Westfalia GmbH (Germany)

Latest Developments in Europe Ambulatory X-Ray Devices Market

- In June 2021, Oehm und Rehbein GmbH introduced the Amadeo R motorized X-ray system, a new digital ambulatory X-ray platform featuring an auto-tracking mechanism and multi-position support (seated, supine, upright), enhancing diagnostic precision and ease of use across diverse patient postures

- In July 2022, Shimadzu Corporation launched the MobileDaRt Evolution MX8 Version v, an updated digital mobile X-ray system targeted at international markets. The system enhanced mobility and imaging performance, offering more efficient diagnostic imaging across healthcare environments — highlighting ongoing technological upgrades in mobile imaging

- In May 2023, Carestream Health unveiled the DRX-Rise Mobile X-ray System, a new mobile imaging solution featuring AI-powered image processing software designed to improve image quality and dosage efficiency, directly addressing provider needs in ambulatory and point-of-care diagnostics

- In July 2024, Australian imaging innovator Micro-X announced the development of a lightweight mobile CT scanner optimized for ambulance use, capable of scanning a patient’s brain in under eight seconds and transmitting images instantly to specialists — demonstrating expanding convergence of mobile imaging technologies with ambulatory care needs

- In December 2024, Micro-X was awarded an ~USD 8.2 million contract by the U.S. Advanced Research Projects Agency for Health (ARPA-H) to develop a portable full-body CT imaging solution, signaling increasing government and research funding directed toward advanced ambulatory imaging technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.