Market Analysis and Insights

Customer data are filtered by anti-laundering systems, classified according to a level of suspicion, and inspected for anomalies. Anti-money laundering refers to a set of laws, legislation, and procedures to prevent criminals from disguising illicit funds as legitimate income. While anti-money laundering (A.M.L.) laws cover a relatively limited range of transactions and criminal behaviors, they have far-reaching implications. Also, A.M.L. enforcement officers are appointed to supervise anti-money laundering policies and ensure compliance by banks and other financial institutions. Thus, the Increasing stringent regulations and compliance related to aml is increasing the demand for anti-money laundering software in the market. However, high device compatibility issues of aml software to hamper the growth of the market.

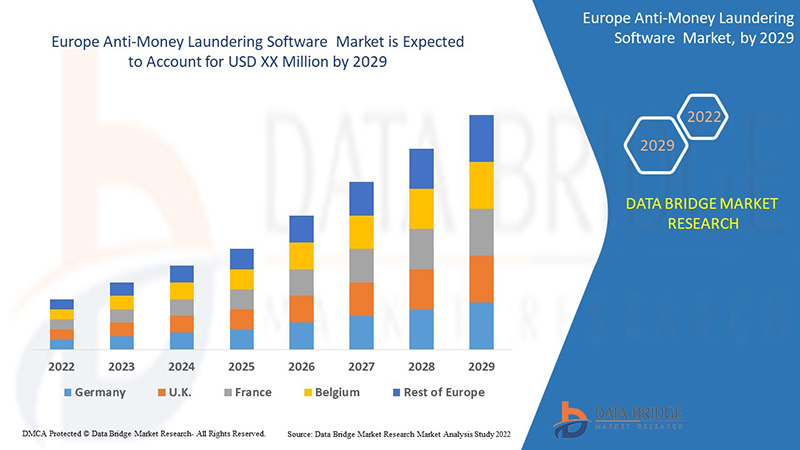

Data Bridge Market Research analyses that the anti-money laundering software market will grow at a CAGR of 14.7% from 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Year |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Offering (Solution and Services), Function (Compliance Management, Currency Transaction Reporting, Customer Identity Management, Transaction Monitoring, and Others), Deployment Mode (Cloud and On-Premises), Enterprise Size (Large Enterprises, Small & Medium Enterprises), Gambling Type (Lottery, Sports Betting, Bingo, Raffles/Pools, and Casino), Application (Offline/Land Based and Live Entertainment/Online), Gambling Entity (Organizations, Sole Trader/Partnership, and Others) |

|

Countries Covered |

U.K., Germany, France, Italy, Spain, Russia, Netherlands, Switzerland, Turkey, Belgium , Ireland , Austria , Czechia , Hungary, Slovakia and Rest of Europe |

|

Market Players Covered |

Microsoft, Intel Corporation, Fiserv, Inc., B.A.E. Systems., Wolters Kluwer N.V., Experian Information Solutions, Inc., S.A.S. Institute Inc., I.B.M., Temenos, Comarch SA., Open Text Corporation, FICO, A.C.I. Worldwide., NICE, Acuant, Inc., Featurespace Limited., Protiviti Inc., Actico GmbH , Caseware International Inc., Sanction Scanner |

Market Definition

Anti-money Laundering (A.M.L.) solutions are used to detect and warn the institutions regarding money laundering, terrorist financing, fraud, electronic crime, bribery and corruption, tax evasion, embezzlement, information security, illegal cross border transactions, among others that hugely impact the economy of the country and can hamper its reputation. A.M.L. is a term generally used to depict the fight against money laundering & financial crimes. Anti-money Laundering (A.M.L.) solutions comply with various policies, laws, and regulations that help prevent financial crimes. Global and local regulators set these guidelines, policies, and laws present worldwide, which aims to strengthen the functioning of A.M.L. solutions.

Anti-Money Laundering Software Market Dynamics

Drivers

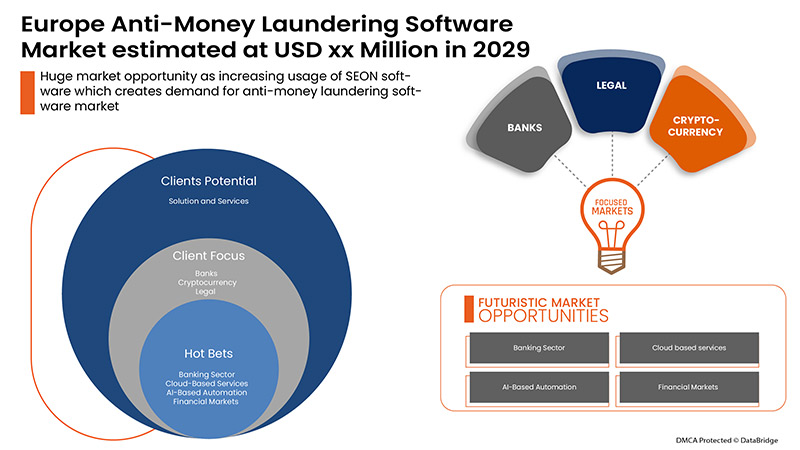

- Increase in use of seon software

Money laundering is the process of converting illegal money into a legal form. The purpose of criminals laundering money is to earn revenue. Money laundering has become a significant financial problem and crime today. Every year billions of dollars are illegally smuggled to international borders through various modes. Money Laundering has become a critical financial issue that financial authorities are trying to stop.

- Increase in stringent regulations and compliance related to AML

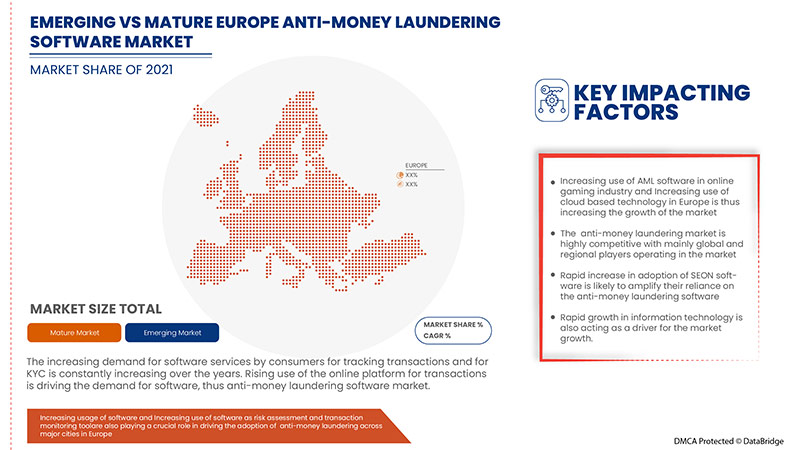

An anti-money laundering compliance program is a set of regulations or rules that a financial institution must follow to prevent and detect money laundering and terrorist funding activities. In recent times, the financial crime against financial institutions such as banks and credit unions have significantly increased. There was a ~50- 60% increment in financial fraud cases in 2019 from 2018 and it is expected to grow in coming years. The losses incurred by the banks across Europe is quite significant.

- Growth in demand for AML software

Financial institution such as central banks, retail and commercial banks, internet banks, credit unions, savings and loans associations, investment banks among others are compelled by government law to tackle various issues such as money laundering, terrorist funding activities among others by using regulation which are designed to strengthen the A.M.L. solution. Institutions such as the financial action task force, European Union – fifth anti-money laundering directives are laid regulatory guidelines. Anti-Money Laundering (A.M.L.) technologies can also be used for I.D. verification and A.M.L. solution is easier and more accurate than manual processes for I.D. verification. The A.M.L. solutions offer I.D. verification in financial institution using KYC verification. KYC is more specific towards the verification of customer identities before permitting a transaction. Thereby, it helps to validate the identity and is one of the criteria used by A.M.L. solutions.

- Growth in demand for transaction monitoring systems in the information technology (I.T.) sector

Transaction monitoring has become essential to anti-money laundering (A.M.L.) systems. All financial institutions should have transaction monitoring systems to keep an eye out for any suspicious transactions and financial crimes from customers. Transaction monitoring includes assessing of historical/current customer information to provide a complete picture of customer activity. This can include transfers, deposits, and withdrawals. Most information technology (I.T.) firms will use software tool automatically. It is very difficult to monitor these acquired data as it is a challenging task to do manually. Therefore, many I.T. companies have adopted automated systems such as anti-money laundering systems.

Opportunity

-

Increase in adoption of advanced analytics in aml

Advanced analytics is the autonomous or semi-autonomous system that analyze data or content using sophisticated techniques and tools which is quite different from the traditional business intelligence. These analytics give data which the system predicts and generates a deeper analysis using which the system predicts and generates recommendations. Advanced analytics in A.M.L. solutions can play a vital role in detecting money laundering, economic crimes, identity theft, and cross-border transactions.

Restraint/Challenge

- Change in regulation framework and guidelines for aml solution

A.M.L. compliance practices concentrate on setting the policies and norms that prevent potential violators from engaging in money laundering fraud and financial crime. In this way, criminals cannot hide money's illicit origin in any transaction.

COVID-19 Impact on Anti-Money Laundering Software Market

The confinement and lockdown period during the Covid-19 crisis has shown the importance of good, reliable internet connectivity at home. A high-speed connection at home has opened up the possibility of efficient teleworking, maintaining entertainment habits and keeping close contacts. Data traffic in all networks has increased significantly during the pandemic period. COVID-19 has increased the demand of anti-money laundering in the market. Fixed broadband networks have gained immense popularity for keeping the world connected. Traffic grew 30-40% overnight, driven primarily by working from home (video conferencing and collaboration, VPNs), learning from home (video conferencing and collaboration, e-learning platforms), and entertainment (online gaming, video streaming, social media). Moreover, limited supply and shortage of software have significantly affected anti-money laundering in the market. The flow of new equipment, such as computers, servers, switches, and customer premise equipment (C.P.E.) has either entirely stopped or is delayed, with lead times of up to 12 months for different items.

Manufacturers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple research and development activities to improve the technology involved in the anti-money laundering software. With this, the companies will bring advanced anti-money laundering to the market.

For instance,

- In June 2021, Microsoft partnered with Morgan Stanley to strengthen the financial services industry. The key feature of this partnership was digital transformation, designing new applications, and enhancing the employee and developer experience in the financial services industry. With this partnership, both the companies amid to strengthen its cloud-based financial services industry by offering innovative solutions for consumer.

Thus, the COVID-19 has increased the demand of anti-money laundering in the market but limited supply and shortage of software has significantly affected anti-money laundering process in the market.

Recent Developments

- In April 2022, Experian Information Solutions, Inc. launched a new fraud prevention solution. The key feature of this solution was to strengthen the customer identity verification by strengthening requirements such as anti-fraud measures, Know Your Customer (KYC) and Anti-money Laundering (A.M.L.). The company benefited from this solution as it helped to create a seamless on-boarding process and made the authentication process of a person easy for many businesses.

- In February 2021, NICE Systems Ltd launched an AI-powered screening solution for improving risk management capabilities. The key feature of this solution was real-time and batch screening capabilities, seamless access, use of fuzzy matching technologies, facial biometrics, and ongoing monitoring for A.M.L. value chain. This solution helps the company to offer superior data management, advanced screening capabilities and customer satisfaction.

Europe Anti-Money Laundering Software Market Scope

The anti-money laundering software market is segmented by offering, function, deployment mode, enterprise size, gambling type, application, and gambling entity. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

By Offering

- Solution

- Services

On the basis of offering, the Europe anti-money laundering software market is segmented into solution and services.

Function

- Compliance Management

- Currency Transaction Reporting

- Customer Identity Management

- Transaction Monitoring

- Others

On the basis of function, the Europe anti-money laundering software market has been segmented into compliance management, currency transaction reporting, customer identity management, transaction monitoring and others.

Deployment Mode

- Cloud

- On-Premises

On the basis of deployment mode, the Europe anti-money laundering software market has been segmented into cloud and on-premises.

Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

On the basis of enterprise size, the Europe anti-money laundering software market has been segmented into large enterprises, small & medium enterprises.

Gambling Type

- Lottery

- Sports Betting

- Bingo

- Raffles/Pools

- Casino

On the basis of gambling type, the Europe anti-money laundering software market has been segmented into lottery, sports betting, bingo, raffles/pools and casino.

Application

- Offline/Land Based Medium

- Live Entertainment/Online

On the basis of application, the Europe anti-money laundering software market has been segmented into to offline/land based medium and live entertainment/online.

Gambling Entity

- Organizations

- Sole Trader/Partnership

- Others

On the basis of gambling entity, the Europe anti-money laundering software market has been segmented into organizations, sole trader/partnership and others.

Europe Anti-Money Laundering Software Market

The anti-money laundering software market is analyzed, and market size insights and trends are provided by the offering, function, deployment mode, enterprise size, gambling type, application, gambling entity and countries as referenced above.

Europe anti-money laundering software market is covers countries such as U.K., Germany, France, Italy, Spain, Russia, Netherlands, Switzerland, Turkey, Belgium , Ireland , Austria , Czechia , Hungary, Slovakia and Rest of Europe.

U.K. is expected to dominate the Europe anti-money laundering software market as the country is witnessing increasing government's support for "KYC/CDD and Watchlist" networks, Money laundering is a type of financial crime. It involves taking criminally obtained proceeds (dirty money) and disguising their origins so they'll appear to be from a legitimate source. Anti-money laundering (A.M.L.) refers to the activities financial institutions perform to comply with legal requirements to monitor for actively and report suspicious activities and the growth of the country in the Europe anti-money laundering software market.

The country section of the anti-money laundering software market report also provides individual market impacting factors and domestic regulation changes that impact the market's current and future trends. Data points such as new sales, replacement sales, country demographics, disease epidemiology and import-export tariffs are some of the significant pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Anti-Money Laundering Software Market Share Analysis

The anti-money laundering software market competitive landscape provides details of the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, solution launch, product width and breadth, application dominance. The above data points are only related to the companies' focus on the anti-money laundering software market.

Some of the major players operating in the Europe anti-money laundering software market are Microsoft, Intel Corporation, Fiserv, Inc., B.A.E. Systems., Wolters Kluwer N.V., Experian Information Solutions, Inc., S.A.S. Institute Inc., I.B.M., Temenos, Comarch SA., Open Text Corporation, FICO, A.C.I. Worldwide., NICE, Acuant, Inc., Featurespace Limited., Protiviti Inc., Actico GmbH , Caseware International Inc., Sanction Scanner among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 OFFERING TYPE TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S FIVE FORCE ANALYSIS

4.2 PRICING ANALYSIS

5 REGULATIONS

5.1 OVERVIEW

5.2 THE FINANCIAL ACTION TASK FORCE (FATF)

5.3 THE ANTI-MONEY LAUNDERING DIRECTIVES

5.4 5AMLD – IMPLEMENTED 10 JANUARY 2020

5.5 6AMLD – IMPLEMENTED ON 3 JUNE 2021:

5.5.1 UK

5.5.2 SWITZERLAND

5.5.3 NORDIC STATES

5.6 CASE STUDIES

6 REGIONAL SUMMARY

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASING USE OF SEON SOFTWARE

7.1.2 INCREASING STRINGENT REGULATIONS AND COMPLIANCE RELATED TO AML

7.1.3 GROWING DEMAND FOR AML SOFTWARES

7.1.4 GROWING DEMAND FOR TRANSACTION MONITORING SYSTEMS IN INFORMATION TECHNOLOGY (I.T.) SECTOR

7.2 RESTRAINTS

7.2.1 HIGH DEVICE COMPATIBILITY ISSUES OF AML SOFTWARE

7.2.2 DEPLOYING AML SOFTWARE IS EXPENSIVE

7.3 OPPORTUNITIES

7.3.1 INCREASING ADOPTION OF ADVANCED ANALYTICS IN AML

7.3.2 INTEGRATION OF AI AND ML IN DEVELOPING AML SOLUTIONS

7.4 CHALLENGES

7.4.1 CHANGING REGULATION FRAMEWORK AND GUIDELINES FOR AML SOLUTION

7.4.2 LACK OF SKILLED AML PROFESSIONALS

8 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY OFFERING

8.1 OVERVIEW

8.2 SOLUTION

8.3 KYC/CDD AND WATCHLIST

8.4 CASE MANAGEMENT

8.5 REGULATORY REPORTING

8.6 TRANSACTION SCREENING AND MONITORING

8.7 RISK-BASED APPROACH

8.8 OTHERS

8.9 SERVICES

8.1 PROFESSIONAL SERVICES

8.11 CONSULTING SERVICES

8.12 TRAINING AND CONSULTING

8.13 INTEGRATION

8.14 SUPPORT AND MAINTENANCE

8.15 MANAGED SERVICES

9 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY FUNCTION

9.1 OVERVIEW

9.2 COMPLIANCE MANAGEMENT

9.3 CUSTOMER IDENTITY MANAGEMENT

9.4 TRANSACTION MONITORING

9.5 CURRENCY TRANSACTION REPORTING

9.6 OTHERS

10 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY DEPLOYMENT MODE

10.1 OVERVIEW

10.2 CLOUD

10.3 ON-PREMISE

11 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY ENTERPRISE SIZE

11.1 OVERVIEW

11.2 LARGE ENTERPRISES

11.3 SMALL & MEDIUM ENTERPRISES

12 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING TYPE

12.1 OVERVIEW

12.2 LOTTERY

12.3 SPORTS BETTING

12.4 FOOTBALL

12.5 HORSE RACING

12.6 E-SPORTS

12.7 OTHERS

12.8 CASINO

12.9 LIVE CASINOS

12.1 POKER

12.11 BLACKJACK

12.12 BACCARAT

12.13 SLOTS

12.14 OTHERS

12.15 RAFFLES/POOLS

12.16 BINGO

13 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 OFFLINE/LAND BASED

13.3 HOTELS

13.4 MULTIPLE DINING OPTIONS

13.5 OTHERS

13.6 LIVE ENTERTAINMENT/ONLINE

13.7 MOBILE

13.8 DESKTOP

14 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING ENTITY

14.1 OVERVIEW

14.2 ORGANIZATIONS

14.3 SOLE TRADES/PARTNERSHIP

14.4 OTHERS

15 EUROPE

15.1 U.K.

15.2 GERMANY

15.3 FRANCE

15.4 ITALY

15.5 SPAIN

15.6 NETHERLANDS

15.7 SWITZERLAND

15.8 RUSSIA

15.9 BELGIUM

15.1 TURKEY

15.11 IRELAND

15.12 AUSTRIA

15.13 CZECHIA

15.14 HUNGARY

15.15 SLOVAKIA

15.16 REST OF EUROPE

16 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: EUROPE

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 MICROSOFT

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 SOLUTION PORTFOLIO

18.1.4 RECENT DEVELOPMENTS

18.2 INTEL CORPORATION

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 PRODUCT PORTFOLIO

18.2.4 RECENT DEVELOPMENTS

18.3 FISERV, INC.

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 SOLUTION PORTFOLIO

18.3.4 RECENT DEVELOPMENTS

18.4 BAE SYSTEMS

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 SOLUTION PORTFOLIO

18.4.4 RECENT DEVELOPMENTS

18.5 WOLTERS KLUWER N.V.

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 SOLUTION & PRODUCT PORTFOLIO

18.5.4 RECENT DEVELOPMENT

18.6 ACUANT, A GBG COMPANY

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT & SOLUTION PORTFOLIO

18.6.3 RECENT DEVELOPMENT

18.7 ACTICO GMBH

18.7.1 COMPANY SNAPSHOT

18.7.2 SOLUTION PORTFOLIO

18.7.3 RECENT DEVELOPMENT

18.8 ACI WORLDWIDE, INC.

18.8.1 COMPANY SNAPSHOT

18.8.2 REVENUE ANALYSIS

18.8.3 SOLUTION PORTFOLIO

18.8.4 RECENT DEVELOPMENTS

18.9 COMARCH SA

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 SOLUTION & PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENT

18.1 CASEWARE INTERNATIONAL INC.

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT & SOLUTION PORTFOLIO

18.10.3 RECENT DEVELOPMENT

18.11 EXPERIAN INFORMATION SOLUTIONS, INC.

18.11.1 COMPANY SNAPSHOT

18.11.2 REVENUE ANALYSIS

18.11.3 SOLUTION PORTFOLIO

18.11.4 RECENT DEVELOPMENTS

18.12 FEATURESPACE LIMITED

18.12.1 COMPANY SNAPSHOT

18.12.2 SOLUTION PORTFOLIO

18.12.3 RECENT DEVELOPMENT

18.13 FICO

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUE ANALYSIS

18.13.3 SOLUTION & PRODUCT PORTFOLIO

18.13.4 RECENT DEVELOPMENT

18.14 IBM CORPORATION

18.14.1 COMPANY SNAPSHOT

18.14.2 REVENUE ANALYSIS

18.14.3 SOLUTION PORTFOLIO

18.14.4 RECENT DEVELOPMENT

18.15 NICE SYSTEMS LTD

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 SOLUTION PORTFOLIO

18.15.4 RECENT DEVELOPMENTS

18.16 OPEN TEXT CORPORATION

18.16.1 COMPANY SNAPSHOT

18.16.2 REVENUE ANALYSIS

18.16.3 SOLUTION PORTFOLIO

18.16.4 RECENT DEVELOPMENTS

18.17 PROTIVITI INC.

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT & SOLUTION PORTFOLIO

18.17.3 RECENT DEVELOPMENT

18.18 SAS INSTITUTE INC.

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT & SOLUTION PORTFOLIO

18.18.3 RECENT DEVELOPMENTS

18.19 SANCTION SCANNER

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT & SOLUTION PORTFOLIO

18.19.3 RECENT DEVELOPMENT

18.2 TEMENOS HEADQUARTERS SA

18.20.1 COMPANY SNAPSHOT

18.20.2 REVENUE ANALYSIS

18.20.3 SOLUTION & PRODUCT PORTFOLIO

18.20.4 RECENT DEVELOPMENTS

19 QUESTIONNAIRE

20 RELATED REPORTS

List of Table

TABLE 1 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY COUNTRY PRICE/PERSON/DAY/SERVICE, 2020-2029 (USD DOLLAR)

TABLE 2 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY COUNTRY MINIMUM AVERAGE (PRICE/PERSON/DAY/SERVICE) OFFERING, 2020-2029 (USD DOLLAR)

TABLE 3 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY COUNTRY MAXIMUM AVERAGE (PRICE/PERSON/DAY/SERVICE) , 2020-2029 (USD DOLLAR)

TABLE 4 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY COUNTRY AVERAGE (PRICE/PERSON/MONTH/SERVICE), 2020-2029 (USD DOLLAR)

TABLE 5 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY COUNTRY MINIMUM AVERAGE (PRICE/PERSON/MONTH/SERVICE), 2020-2029 (USD DOLLAR)

TABLE 6 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY COUNTRY AVERAGE MAXIMUM (PRICE/PERSON/MONTH/SERVICE), 2020-2029 (USD DOLLAR)

TABLE 7 EUROPEAN COUNTRIES FINANCIAL INTELLIGENCE UNITS (FIUS) RECEIVED SEVERAL SUSPICIOUS TRANSACTIONS LARGER THAN 20,000 IN 2018 OR 2019.

TABLE 8 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 9 EUROPE SOLUTION IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 EUROPE SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 11 EUROPE CONSULTING SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 13 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 14 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 15 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING TYPE, 2020-2029 (USD MILLION)

TABLE 16 EUROPE SPORTS BETTING IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 EUROPE CASINO IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 18 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 19 EUROPE OFFLINE/LAND BASED IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 EUROPE LIVE ENTERTAINMENT/ONLINE IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 21 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GABLING ENTITY, 2020-2029 (USD MILLION)

TABLE 22 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 23 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 24 EUROPE SOLUTION IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 25 EUROPE SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 EUROPE CONSULTING SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 28 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 29 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 30 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING TYPE, 2020-2029 (USD MILLION)

TABLE 31 EUROPE SPORTS BETTING IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 EUROPE CASINO IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 34 EUROPE OFFLINE/LAND BASED IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 EUROPE LIVE ENTERTAINMENT/ONLINE IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING ENTITY, 2020-2029 (USD MILLION)

TABLE 37 U.K. ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 38 U.K. SOLUTION IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 U.K. SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 U.K. CONSULTING SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 U.K. ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 42 U.K. ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 43 U.K. ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 44 U.K. ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING TYPE, 2020-2029 (USD MILLION)

TABLE 45 U.K. SPORTS BETTING IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 U.K. CASINO IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 U.K. ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 48 U.K. OFFLINE/LAND BASED IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 U.K. LIVE ENTERTAINMENT/ONLINE IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 U.K. ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING ENTITY, 2020-2029 (USD MILLION)

TABLE 51 GERMANY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 52 GERMANY SOLUTION IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 GERMANY SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 GERMANY CONSULTING SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 GERMANY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 56 GERMANY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 57 GERMANY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 58 GERMANY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING TYPE, 2020-2029 (USD MILLION)

TABLE 59 GERMANY SPORTS BETTING IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 GERMANY CASINO IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 GERMANY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 62 GERMANY OFFLINE/LAND BASED IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 GERMANY LIVE ENTERTAINMENT/ONLINE IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 GERMANY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING ENTITY, 2020-2029 (USD MILLION)

TABLE 65 FRANCE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 66 FRANCE SOLUTION IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 FRANCE SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 FRANCE CONSULTING SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 FRANCE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 70 FRANCE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 71 FRANCE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 72 FRANCE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING TYPE, 2020-2029 (USD MILLION)

TABLE 73 FRANCE SPORTS BETTING IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 FRANCE CASINO IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 FRANCE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 76 FRANCE OFFLINE/LAND BASED IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 FRANCE LIVE ENTERTAINMENT/ONLINE IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 FRANCE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING ENTITY, 2020-2029 (USD MILLION)

TABLE 79 ITALY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 80 ITALY SOLUTION IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 ITALY SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 ITALY CONSULTING SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 ITALY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 84 ITALY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 85 ITALY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 86 ITALY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING TYPE, 2020-2029 (USD MILLION)

TABLE 87 ITALY SPORTS BETTING IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 ITALY CASINO IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 ITALY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 90 ITALY OFFLINE/LAND BASED IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 ITALY LIVE ENTERTAINMENT/ONLINE IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 ITALY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING ENTITY, 2020-2029 (USD MILLION)

TABLE 93 SPAIN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 94 SPAIN SOLUTION IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 95 SPAIN SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 SPAIN CONSULTING SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 SPAIN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 98 SPAIN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 99 SPAIN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 100 SPAIN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING TYPE, 2020-2029 (USD MILLION)

TABLE 101 SPAIN SPORTS BETTING IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 SPAIN CASINO IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 SPAIN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 104 SPAIN OFFLINE/LAND BASED IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 SPAIN LIVE ENTERTAINMENT/ONLINE IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 SPAIN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING ENTITY, 2020-2029 (USD MILLION)

TABLE 107 NETHERLANDS ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 108 NETHERLANDS SOLUTION IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 NETHERLANDS SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 NETHERLANDS CONSULTING SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 NETHERLANDS ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 112 NETHERLANDS ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 113 NETHERLANDS ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 114 NETHERLANDS ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING TYPE, 2020-2029 (USD MILLION)

TABLE 115 NETHERLANDS SPORTS BETTING IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 NETHERLANDS CASINO IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 117 NETHERLANDS ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 118 NETHERLANDS OFFLINE/LAND BASED IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 NETHERLANDS LIVE ENTERTAINMENT/ONLINE IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 NETHERLANDS ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING ENTITY, 2020-2029 (USD MILLION)

TABLE 121 SWITZERLAND ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 122 SWITZERLAND SOLUTION IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 SWITZERLAND SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 SWITZERLAND CONSULTING SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 SWITZERLAND ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 126 SWITZERLAND ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 127 SWITZERLAND ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 128 SWITZERLAND ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING TYPE, 2020-2029 (USD MILLION)

TABLE 129 SWITZERLAND SPORTS BETTING IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 SWITZERLAND CASINO IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 131 SWITZERLAND ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 132 SWITZERLAND OFFLINE/LAND BASED IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 133 SWITZERLAND LIVE ENTERTAINMENT/ONLINE IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 134 SWITZERLAND ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING ENTITY, 2020-2029 (USD MILLION)

TABLE 135 RUSSIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 136 RUSSIA SOLUTION IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 137 RUSSIA SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 RUSSIA CONSULTING SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 RUSSIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 140 RUSSIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 141 RUSSIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 142 RUSSIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING TYPE, 2020-2029 (USD MILLION)

TABLE 143 RUSSIA SPORTS BETTING IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 144 RUSSIA CASINO IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 145 RUSSIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 146 RUSSIA OFFLINE/LAND BASED IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 147 RUSSIA LIVE ENTERTAINMENT/ONLINE IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 RUSSIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING ENTITY, 2020-2029 (USD MILLION)

TABLE 149 BELGIUM ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 150 BELGIUM SOLUTION IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 151 BELGIUM SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 152 BELGIUM CONSULTING SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 153 BELGIUM ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 154 BELGIUM ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 155 BELGIUM ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 156 BELGIUM ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING TYPE, 2020-2029 (USD MILLION)

TABLE 157 BELGIUM SPORTS BETTING IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 158 BELGIUM CASINO IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 159 BELGIUM ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 160 BELGIUM OFFLINE/LAND BASED IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 161 BELGIUM LIVE ENTERTAINMENT/ONLINE IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 162 BELGIUM ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING ENTITY, 2020-2029 (USD MILLION)

TABLE 163 TURKEY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 164 TURKEY SOLUTION IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 165 TURKEY SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 166 TURKEY CONSULTING SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 167 TURKEY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 168 TURKEY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 169 TURKEY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 170 TURKEY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING TYPE, 2020-2029 (USD MILLION)

TABLE 171 TURKEY SPORTS BETTING IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 172 TURKEY CASINO IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 173 TURKEY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 174 TURKEY OFFLINE/LAND BASED IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 175 TURKEY LIVE ENTERTAINMENT/ONLINE IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 176 TURKEY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING ENTITY, 2020-2029 (USD MILLION)

TABLE 177 IRELANDS ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 178 IRELANDS SOLUTION IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 179 IRELANDS SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 180 IRELANDS CONSULTING SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 181 IRELANDS ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 182 IRELANDS ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 183 IRELANDS ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 184 IRELANDS ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING TYPE, 2020-2029 (USD MILLION)

TABLE 185 IRELANDS SPORTS BETTING IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 186 IRELANDS CASINO IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 187 IRELANDS ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 188 IRELANDS OFFLINE/LAND BASED IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 189 IRELANDS LIVE ENTERTAINMENT/ONLINE IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 190 IRELANDS ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING ENTITY, 2020-2029 (USD MILLION)

TABLE 191 AUSTRIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 192 AUSTRIA SOLUTION IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 193 AUSTRIA SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 194 AUSTRIA CONSULTING SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 195 AUSTRIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 196 AUSTRIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 197 AUSTRIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 198 AUSTRIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING TYPE, 2020-2029 (USD MILLION)

TABLE 199 AUSTRIA SPORTS BETTING IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 200 AUSTRIA CASINO IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 201 AUSTRIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 202 AUSTRIA OFFLINE/LAND BASED IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 203 AUSTRIA LIVE ENTERTAINMENT/ONLINE IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 204 AUSTRIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING ENTITY, 2020-2029 (USD MILLION)

TABLE 205 CZECHIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 206 CZECHIA SOLUTION IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 207 CZECHIA SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 208 CZECHIA CONSULTING SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 209 CZECHIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 210 CZECHIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 211 CZECHIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 212 CZECHIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING TYPE, 2020-2029 (USD MILLION)

TABLE 213 CZECHIA SPORTS BETTING IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 214 CZECHIA CASINO IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 215 CZECHIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 216 CZECHIA OFFLINE/LAND BASED IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 217 CZECHIA LIVE ENTERTAINMENT/ONLINE IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 218 CZECHIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING ENTITY, 2020-2029 (USD MILLION)

TABLE 219 HUNGARY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 220 HUNGARY SOLUTION IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 221 HUNGARY SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 222 HUNGARY CONSULTING SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 223 HUNGARY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 224 HUNGARY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 225 HUNGARY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 226 HUNGARY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING TYPE, 2020-2029 (USD MILLION)

TABLE 227 HUNGARY SPORTS BETTING IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 228 HUNGARY CASINO IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 229 HUNGARY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 230 HUNGARY OFFLINE/LAND BASED IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 231 HUNGARY LIVE ENTERTAINMENT/ONLINE IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 232 HUNGARY ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING ENTITY, 2020-2029 (USD MILLION)

TABLE 233 SLOVAKIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 234 SLOVAKIA SOLUTION IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 235 SLOVAKIA SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 236 SLOVAKIA CONSULTING SERVICES IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 237 SLOVAKIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 238 SLOVAKIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 239 SLOVAKIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 240 SLOVAKIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING TYPE, 2020-2029 (USD MILLION)

TABLE 241 SLOVAKIA SPORTS BETTING IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 242 SLOVAKIA CASINO IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 243 SLOVAKIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 244 SLOVAKIA OFFLINE/LAND BASED IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 245 SLOVAKIA LIVE ENTERTAINMENT/ONLINE IN ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 246 SLOVAKIA ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY GAMBLING ENTITY, 2020-2029 (USD MILLION)

TABLE 247 REST OF EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET, BY TYPE, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET : SEGMENTATION

FIGURE 2 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET : DATA TRIANGULATION

FIGURE 3 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET : DROC ANALYSIS

FIGURE 4 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET : GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET : COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET : INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET : DBMR MARKET POSITION GRID

FIGURE 8 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET : VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET : SEGMENTATION

FIGURE 10 INCREASE IN DEMAND FOR SOLUTION FOR OFFERING IS EXPECTED TO DRIVE EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 OFFERING TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET IN 2022 & 2029

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET

FIGURE 13 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET: BY OFFERING, 2021

FIGURE 14 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET: BY FUNCTION, 2021

FIGURE 15 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET: BY DEPLOYMENT MODE, 2021

FIGURE 16 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET: BY ENTERPRISE SIZE, 2021

FIGURE 17 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET: BY GAMBLING TYPE, 2021

FIGURE 18 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET: BY APPLICATION, 2021

FIGURE 19 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET: BY GAMBLING ENTITY, 2021

FIGURE 20 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET: SNAPSHOT (2021)

FIGURE 21 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET: BY COUNTRY (2021)

FIGURE 22 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET: BY COUNTRY (2022 & 2029)

FIGURE 23 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET: BY COUNTRY (2021 & 2029)

FIGURE 24 EUROPE ANTI-MONEY LAUNDERING SOFTWARE MARKET: BY OFFERING (2022-2029)

FIGURE 25 EUROPE ANTI MONEY LAUNDERING MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.