Europe Biotechnology Market

Market Size in USD Billion

CAGR :

%

USD

1,286.37 Billion

USD

9,211.49 Billion

2025

2033

USD

1,286.37 Billion

USD

9,211.49 Billion

2025

2033

| 2026 –2033 | |

| USD 1,286.37 Billion | |

| USD 9,211.49 Billion | |

|

|

|

|

Europe Biotechnology Market Size

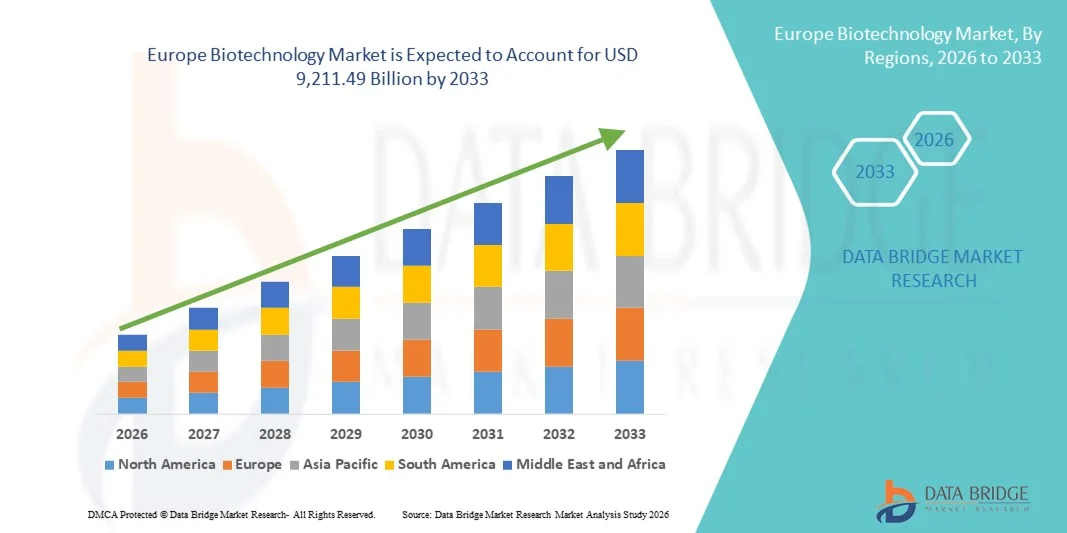

- The Europe biotechnology market size was valued at USD 1,286.37 billion in 2025 and is expected to reach USD 9,211.49 billion by 2033, at a CAGR of 27.9% during the forecast period

- The market growth is largely fueled by rising investment in research and development, increasing adoption of biotechnological innovations in health care and strong regulatory support across EU frameworks such as the European Medicines Agency (EMA) and collaborative innovation programs

- Furthermore, growing demand for advanced therapeutic solutions, integration of technologies such as genomics and AI‑driven biotech platforms, and expanding biotech clusters across countries such as Germany, the UK, and France are driving the uptake of biotechnology applications in healthcare, agriculture, and industrial sectors. These converging factors are accelerating the adoption of biotechnology solutions, thereby significantly boosting industry growth

Europe Biotechnology Market Analysis

- Biotechnology, encompassing innovations in instruments, reagents, services, and software, is becoming increasingly critical across healthcare, agriculture, and industrial applications in Europe due to its potential to improve patient outcomes, enhance crop yields, and enable sustainable industrial processes

- The growing adoption of biotechnology is primarily driven by rising R&D investments, technological advancements in PCR, DNA sequencing, tissue engineering, and cell-based assays, and strong regulatory support from EU agencies fostering innovation and commercialization of biotech solutions

- Germany dominated the biotechnology market with the largest revenue share of 28.6% in 2025, characterized by well-established biotech clusters, high healthcare expenditure, and strong collaborations between academia and industry, with significant growth in bio-pharmacy and bio-industrial applications

- France is expected to be the fastest-growing country in the European biotechnology market during the forecast period due to increasing government initiatives, expanding biotech infrastructure, and rising venture capital investments supporting startups and local biotech firms

- Instruments segment dominated the Europe biotechnology market with a market share of 42.6% in 2025, driven by growing demand from pharmaceutical and biotechnology companies, contract research organizations, and academic and research institutes for advanced laboratory equipment, reagents, and software solutions

Report Scope and Europe Biotechnology Market Segmentation

|

Attributes |

Europe Biotechnology Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Europe Biotechnology Market Trends

Advancements in Genomics and AI-Driven Bioinformatics

- A significant and accelerating trend in the European biotechnology market is the integration of genomics and AI-driven bioinformatics platforms, enhancing drug discovery, diagnostics, and personalized medicine

- For instance, Illumina’s NovaSeq sequencing systems combined with AI-powered analytics allow researchers to process large genomic datasets faster and identify potential therapeutic targets with higher precision

- AI integration in biotechnology enables predictive modeling of disease pathways, optimization of experimental protocols, and identification of novel biomarkers. For instance, companies such as Deep Genomics utilize AI to forecast the impact of genetic mutations on diseases, accelerating the development of targeted therapies

- The seamless combination of genomics and AI tools facilitates more efficient workflows in laboratories, enabling researchers to manage data, experiment outcomes, and bioinformatics analyses through centralized digital platforms

- This trend towards more intelligent, data-driven, and interconnected biotech solutions is reshaping expectations for research efficiency and therapeutic innovation. Consequently, companies such as Sophia Genetics are developing AI-enabled genomic platforms that provide actionable clinical insights for hospitals and research institutes

- The demand for biotechnology solutions integrating genomics and AI is growing rapidly across pharmaceutical, academic, and industrial sectors, as stakeholders increasingly prioritize efficiency, precision, and accelerated R&D timelines

- Increased collaboration between biotech startups and large pharmaceutical companies is fostering faster commercialization of novel therapies and industrial biotech solutions across Europe

Europe Biotechnology Market Dynamics

Driver

Rising Demand for Advanced Therapies and Industrial Biotech Applications

- The increasing need for innovative therapeutics and sustainable industrial biotechnology solutions is a major driver for the European biotechnology market

- For instance, in March 2025, BioNTech announced a collaboration with European research institutes to expand mRNA-based therapies for rare diseases, highlighting the industry’s growth potential

- Growing demand for biologics, personalized medicine, and industrial biotech products such as biofuels and enzymes is fueling market expansion, as biotech solutions offer higher efficiency and better outcomes than conventional methods

- Furthermore, supportive government policies, increased funding for R&D, and EU regulatory frameworks encouraging biotech innovation are making biotechnology an essential sector in healthcare and industry

- The ability to develop targeted therapies, optimize industrial processes, and address environmental challenges using biotech solutions is propelling adoption in pharmaceutical companies, contract research organizations, and academic institutions

- Rising public-private partnerships and EU grants for genomics, bioinformatics, and regenerative medicine research are driving increased investment and commercial growth opportunities

- Expansion of bio-agriculture applications, including genetically optimized crops and microbial solutions, is creating additional revenue streams and adoption opportunities across the European agri-biotech sector

Restraint/Challenge

High Cost and Regulatory Hurdles

- Concerns surrounding the high cost of advanced biotechnology solutions and complex EU regulatory compliance pose significant challenges to broader market penetration

- For instance, lengthy approval processes by the European Medicines Agency for novel biologics or cell-based therapies can delay commercialization and increase operational expenses for biotech firms

- Addressing these challenges requires strategic investment in regulatory expertise, clinical validation, and cost-efficient production methods. Companies such as Novartis emphasize compliance and scalable production to mitigate regulatory and cost concerns

- In addition, the expensive infrastructure required for advanced labs, instruments, and AI platforms can be a barrier for smaller biotech startups, limiting innovation in certain regions

- While funding and subsidies are gradually improving accessibility, the perceived high cost and regulatory complexity continue to restrict market adoption, particularly for emerging companies and early-stage research projects

- Overcoming these hurdles through government incentives, public-private partnerships, and process innovation will be vital for sustained growth and competitive advantage in Europe’s biotechnology sector

- Fragmented regulatory standards across European countries can create compliance challenges for companies operating transnationally, slowing product launches and increasing operational complexity

- Limited skilled workforce in specialized biotech areas such as bioinformatics, synthetic biology, and regenerative medicine poses a challenge for companies scaling operations or introducing cutting-edge therapies

Europe Biotechnology Market Scope

The market is segmented on the basis of product type, technology, application, end user, and distribution channel.

- By Product Type

On the basis of product type, the Europe biotechnology market is segmented into instruments, reagents and services, and software. The instruments segment dominated the market with the largest revenue share of 42.6% in 2025, driven by the growing adoption of advanced laboratory equipment for genomics, proteomics, and cell-based research. Laboratories and pharmaceutical companies prefer high-precision instruments for PCR, DNA sequencing, chromatography, and tissue engineering applications. Instruments are essential for R&D, quality control, and regulatory-compliant experiments, making them critical to biotech workflows. The segment also benefits from continuous technological upgrades, automation, and integration with AI-driven bioinformatics platforms, which enhance efficiency and reduce human error. Moreover, instruments often serve as a foundation for biotech operations, enabling the utilization of reagents, software, and other services effectively. Strong demand from pharmaceutical and biotechnology companies, academic research institutes, and contract research organizations continues to bolster market dominance.

The reagents and services segment is expected to witness the fastest growth during the forecast period due to increasing R&D activities across bio-pharmacy, bio-industrial, and bio-agriculture applications. Reagents enable precise experimentation, while outsourced services such as contract research and laboratory management support scalability and operational efficiency. The growing trend of collaborations between biotech startups and large pharma companies is increasing the reliance on reagent kits and service-based solutions. In addition, reagents and services are pivotal in emerging areas such as cell-based assays, tissue regeneration, and fermentation technologies, creating additional revenue streams. Accessibility to high-quality reagents and customized services accelerates adoption in smaller labs and academic settings, contributing to the rapid growth of this subsegment. The expansion of precision medicine and industrial biotechnology solutions further fuels the demand for reagents and specialized biotech services.

- By Technology

On the basis of technology, the Europe biotechnology market is segmented into nano biotechnology, PCR technology, DNA sequencing, chromatography, tissue engineering and regeneration, cell-based assays, fermentation, and others. The DNA sequencing segment dominated the market in 2025, owing to its critical role in genomics research, precision medicine, and diagnostics. DNA sequencing technologies allow researchers to analyze genetic information rapidly and accurately, facilitating the identification of disease markers and therapeutic targets. Hospitals, research institutes, and pharmaceutical companies increasingly rely on next-generation sequencing platforms for clinical applications and drug development. The segment also benefits from continuous technological advancements, automation, and AI integration, which reduce processing time and increase throughput. Widespread applications in personalized medicine, rare disease research, and industrial biotech further strengthen market dominance. The high demand for sequencing data in bioinformatics and clinical trials underpins its sustained adoption across Europe.

The cell-based assays segment is expected to witness the fastest growth during the forecast period due to the rising need for advanced drug screening, regenerative medicine, and disease modeling. Cell-based assays offer a reliable platform for studying cell behavior, toxicity testing, and efficacy of new therapeutics. The increasing adoption of tissue engineering and regenerative medicine further fuels demand for these assays, as they provide a biologically relevant model system. Growth is also supported by government funding for R&D, collaborations between academia and biotech firms, and expanding applications in bio-pharmacy, bio-industrial, and bio-agriculture sectors. The versatility and adaptability of cell-based assays make them an attractive choice for research organizations and contract research organizations seeking scalable and accurate testing platforms.

- By Application

On the basis of application, the Europe biotechnology market is segmented into bio-pharmacy, bio-industrial, bio-services, bioinformatics, and bio-agriculture. The bio-pharmacy segment dominated the market in 2025, driven by increasing demand for biologics, vaccines, gene therapies, and personalized medicines. Pharmaceutical companies are investing heavily in advanced therapeutic development, leveraging biotechnology tools for drug discovery, clinical trials, and production of biologics. Rising prevalence of chronic and rare diseases across Europe further accelerates adoption. Bio-pharmacy also benefits from regulatory incentives and government funding aimed at improving healthcare outcomes. The integration of AI, bioinformatics, and high-throughput technologies enables efficient research and reduces time-to-market for new drugs. Strong collaborations between biotech firms, hospitals, and research institutes further strengthen this segment’s market dominance.

The bio-agriculture segment is expected to witness the fastest growth during the forecast period due to increasing focus on sustainable agriculture, genetically optimized crops, and microbial-based solutions. Bio-agriculture applications improve crop yield, resistance to pests, and environmental sustainability, driving adoption among European farmers and agritech companies. Rising government initiatives supporting biotech in agriculture, coupled with demand for organic and high-nutrition products, fuel growth. Companies are investing in R&D for microbial inoculants, biofertilizers, and plant biotechnology solutions. The use of biotechnology in precision farming and agro-industrial solutions also contributes to faster adoption. Increased awareness of climate-resilient crop technologies strengthens the growth outlook for bio-agriculture.

- By End User

On the basis of end user, the Europe biotechnology market is segmented into pharmaceutical & biotechnology companies, contract research organizations (CROs), academic & research institutes, and others. The pharmaceutical & biotechnology companies segment dominated the market in 2025, driven by large-scale R&D operations, investment in drug development, and adoption of advanced technologies. Pharma and biotech companies leverage instruments, reagents, and software for clinical trials, high-throughput screening, and production of biologics. Strategic collaborations with research institutes and contract labs further support their dominance. The segment also benefits from increasing regulatory approvals for biologics and innovative therapies across Europe. Continuous investment in AI-driven bioinformatics, genomic sequencing, and tissue engineering enhances operational efficiency and therapeutic output. Rising prevalence of chronic, genetic, and rare diseases ensures sustained demand from these end users.

The academic & research institutes segment is expected to witness the fastest growth during the forecast period due to the expansion of biotechnology education, research funding, and collaborations with industry partners. Universities and research institutes are increasingly adopting advanced instruments, software, and reagents to conduct genomics, proteomics, and bioinformatics research. Growth is further supported by government grants, EU-funded projects, and the rising number of biotech startups incubated within academic campuses. Expansion in regenerative medicine, cell-based assays, and bio-agriculture research also fuels rapid adoption. Increasing collaborations with pharmaceutical companies and CROs for joint R&D projects contribute to this segment’s fast-paced growth.

- By Distribution Channel

On the basis of distribution channel, the Europe biotechnology market is segmented into direct tender, third-party distributors, and others. The direct tender segment dominated the market in 2025, driven by large-scale procurement by pharmaceutical companies, hospitals, and research institutes seeking cost-effective, high-quality instruments, reagents, and software. Direct procurement ensures compliance with regulatory standards and allows buyers to customize solutions for specific R&D or production needs. Companies benefit from long-term contracts, bulk ordering, and maintenance support, strengthening the segment’s dominance. Increasing demand for integrated laboratory solutions and centralized supply chains also fuels adoption of direct tender channels. Strong vendor relationships and established European biotech clusters further reinforce this channel.

The third-party distributors segment is expected to witness the fastest growth during the forecast period due to rising adoption among small and medium-sized laboratories and academic institutes. Distributors provide flexible procurement options, access to multiple brands, and bundled service solutions, which reduce the need for large capital investments. The growth of online marketplaces and e-commerce platforms for biotech products further enhances distributor reach. In addition, distributors often offer technical support, training, and localized services, which accelerates adoption. Expansion in emerging biotech hubs and startups across Europe contributes to the rapid growth of this distribution channel.

Europe Biotechnology Market Regional Analysis

- Germany dominated the biotechnology market with the largest revenue share of 28.6% in 2025, characterized by well-established biotech clusters, high healthcare expenditure, and strong collaborations between academia and industry, with significant growth in bio-pharmacy and bio-industrial applications

- Companies and research institutes in Germany highly value access to cutting-edge instruments, reagents, and AI-driven bioinformatics platforms, enabling efficient drug discovery, precision medicine, and industrial biotechnology applications

- This widespread adoption is further supported by strong government support, high healthcare expenditure, and extensive collaborations between pharmaceutical companies, academic institutes, and contract research organizations, establishing Germany as the leading hub for biotechnology innovation and commercial development

The Germany Biotechnology Market Insight

The Germany biotechnology market dominated Europe with the largest revenue share of 28.6% in 2025, fueled by strong R&D investment, well-established biotech clusters, and a focus on advanced therapeutic and industrial applications. Germany’s emphasis on innovation, precision medicine, and sustainability is driving the adoption of instruments, reagents, and AI-driven bioinformatics solutions. The integration of biotechnology with academic research, contract research organizations, and pharmaceutical companies is enabling faster commercialization of biologics, regenerative medicine products, and bio-industrial solutions. Germany’s regulatory framework and healthcare infrastructure support the safe and efficient deployment of novel therapies. The market also benefits from growing public-private partnerships and EU-funded initiatives, reinforcing Germany’s position as a leading biotech hub in Europe.

France Biotechnology Market Insight

The France biotechnology market is expected to grow at a noteworthy CAGR during the forecast period, driven by increasing government support for biotech research, robust healthcare infrastructure, and rising demand for biologics and bio-industrial products. Collaborative projects between French universities, research institutes, and pharmaceutical companies are enhancing innovation in personalized medicine, gene therapy, and industrial biotech applications. France’s adoption of AI-driven bioinformatics platforms and next-generation sequencing is accelerating research and development efficiency. The market is also supported by favorable regulatory frameworks and increasing venture capital investments targeting startups and biotech SMEs. Growth is evident across both healthcare and agricultural biotechnology applications.

U.K. Biotechnology Market Insight

The U.K. biotechnology market is poised for significant growth due to rising investment in genomics, personalized medicine, and bioinformatics solutions. The presence of leading pharmaceutical companies and world-class research institutes facilitates innovation and commercialization of advanced biotech therapies. Increasing government funding, R&D grants, and supportive regulatory initiatives further promote the adoption of biotech solutions in healthcare, industrial, and agricultural sectors. Collaboration between academia and industry is fostering the rapid development of biologics, regenerative medicine products, and bio-agriculture solutions. The UK’s strong focus on precision medicine, AI-driven research tools, and contract research services is contributing to the market’s growth trajectory.

Switzerland Biotechnology Market Insight

The Switzerland biotechnology market is expected to grow steadily, driven by its highly developed pharmaceutical industry, strong focus on R&D, and adoption of cutting-edge biotechnologies. Swiss biotech firms are leveraging instruments, reagents, and AI-powered platforms for drug discovery, diagnostics, and industrial biotech applications. The market benefits from favorable tax policies, government-backed innovation programs, and collaborations with leading European research institutes. Switzerland’s emphasis on high-quality standards, precision medicine, and personalized therapeutics further strengthens market growth. The country also acts as a hub for biotechnology startups and clinical research organizations, facilitating rapid commercialization of novel therapies.

Europe Biotechnology Market Share

The Europe Biotechnology industry is primarily led by well-established companies, including:

- Lonza Group (Switzerland)

- BioNTech SE (Germany)

- Genmab A/S (Denmark)

- AstraZeneca (U.K.)

- Sanofi (France)

- Novartis AG (Switzerland)

- UCB S.A. (Belgium)

- GSK plc (U.K.)

- Merck KGaA (Germany)

- Bayer AG (Germany)

- Ipsen (France)

- QIAGEN (Netherlands)

- Oxford Nanopore Technologies (U.K.)

- Novo Nordisk A/S (Denmark)

- CSL Behring (Switzerland)

- Morphosys AG (Germany)

- Genfit (France)

- Bio Rad Laboratories (Switzerland)

- Evotec SE (Germany)

What are the Recent Developments in Europe Biotechnology Market?

- In December 2025, the European Commission unveiled a new EU Biotech Plan aimed at boosting competitiveness by mobilizing around €40 billion annually for biotech research, fostering faster clinical development, enhanced regulatory pathways, and strategic industry projects to strengthen Europe’s biotech ecosystem

- In October 2025, Rezon Bio officially launched as a European contract development and manufacturing organization (CDMO) for biologics with dual facilities in Gdańsk and Warsaw‑Duchnice, offering end‑to‑end services from cell line development through GMP manufacturing and commercial supply to accelerate biologics advancement across Europe

- In June 2025, Outlook Therapeutics announced that its ophthalmic formulation LYTENAVA™ (bevacizumab gamma) became commercially available in Germany and the United Kingdom for the treatment of wet age‑related macular degeneration (wet AMD), marking the first authorized ophthalmic bevacizumab product in the EU and UK markets

- In May 2025, EuropaBio and member organizations launched the 13th annual European Biotech Week to celebrate biotechnology advances and promote innovation, collaboration, and public awareness across health, sustainability, and industrial biotech sectors

- In March 2024, the European Commission proposed targeted actions to boost biotechnology and biomanufacturing across the EU, outlining a strategic communication to enhance digital innovation, address regulatory hurdles, and support the sector’s long‑term competitiveness

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.