Europe Chromatography Food Testing Market Analysis and Insights

Chromatography food testing can be used at various stages of the food chain, from determining the quality of food to detecting additives, pesticides, pathogens, and other harmful contaminants which can affect human health. The rise in pandemics such as COVID-19 across the regions has increased the growth of various types of food testing methods, including chromatography food testing.

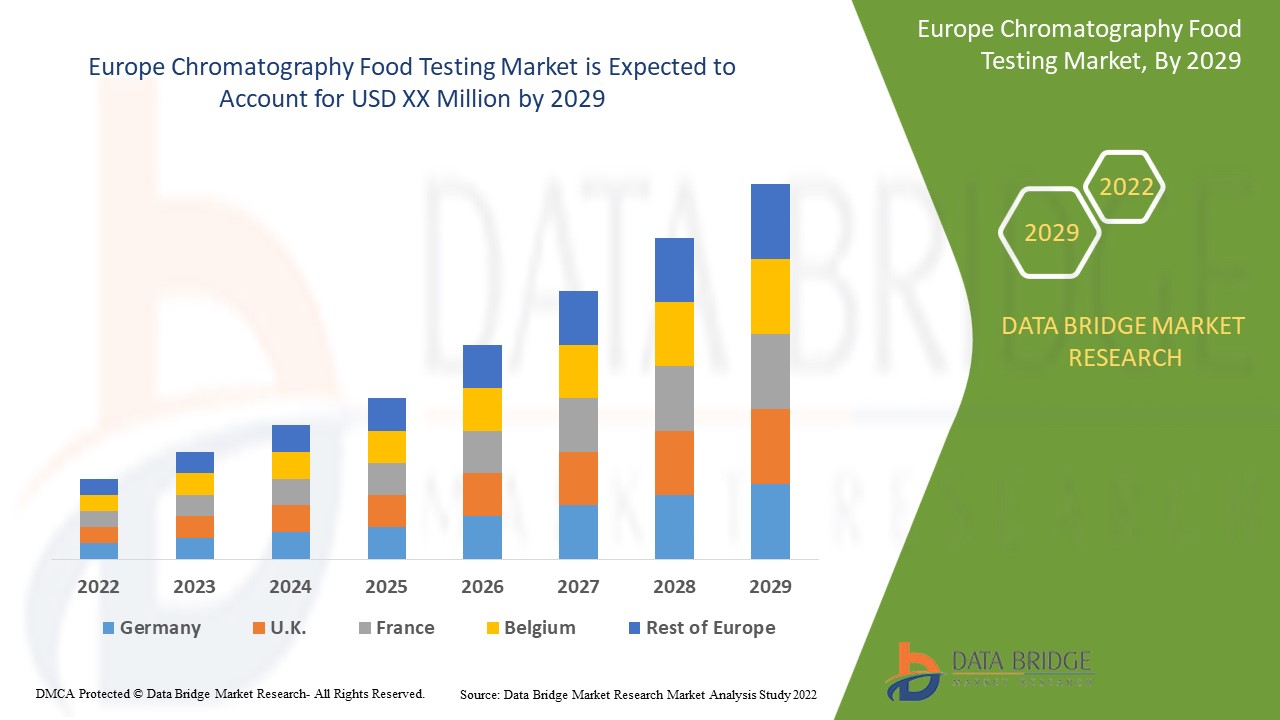

The rising number of foodborne illnesses, technological advancements in the testing industry, rigidity in food regulation and standards, and increasing investment in food safety testing services are some factors driving the market. However, the high cost of chromatography equipment and the presence of alternative food testing technologies may hinder the market's growth. Data Bridge Market Research analyses that the chromatography food testing market is expected to grow at a CAGR of 5.9% during the forecast period of 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD thousand, Volumes in Units, Pricing in USD |

|

Segments Covered |

By Chromatography Testing Type (Liquid Chromatography, Gas Chromatography, Column Chromatography, Paper Chromatography, and Thin Layer Chromatography), Type of Tests (Food Safety Testing, Food Authenticity Testing, Food Shelf Life Testing, and Others), Site (Inhouse/Internal Lab, and Commercial Service Laboratory), Application Product Phase (Testing for Product in Running Production Phase, Testing For Final Product, and Testing For Product in Research & Development Phase), Application (Food and Beverages) |

|

Countries Covered |

France, Germany, Italy, U.K., Spain, Netherlands, Poland, Switzerland, Russia, Belgium, Denmark, Sweden, Turkey, and the Rest of Europe |

|

Market Players Covered |

SGS SA, Bureau Veritas, Eurofins Scientific, TÜV SÜD, ALS, Intertek Group plc, QIMA, Merck KGaA, Cotecna, Mérieux NutriSciences Corporation, Element Materials Technology, NSF, ifp Institut für Produktqualität GmbH, Neogen Corporation, Waters Corporation, Thermo Fisher Scientific Inc., and Shimadzu Corporation among others |

Market Definition

Foodborne illness is caused by consuming spoiled or contaminated food with additives, pesticides, pathogenic bacteria, viruses, parasites, and others, leading to infection. Foodborne illnesses can be spread through various factors such as improper food handling, lack of awareness, and many more. These disease-causing factors must be tested before the consumption of the food. Chromatography can be used at various stages of the food chain, from determining the quality of food to detecting additives, pesticides, and other harmful contaminants.

Europe Chromatography Food Testing Market Dynamics

Drivers

-

Rise in number of foodborne illnesses

Foodborne diseases are caused by consuming contaminated food or drink. There are more than 250 known foodborne diseases. The majority of the infections are caused by bacteria, viruses, and parasites, and some are caused by chemicals and toxins. Escherichia coli are the major bacteria species that live in human intestines.

-

Increasing adoption of chromatography testing techniques

Chromatography is an important biophysical technique that enables the separation, identification, and purification of the components of a mixture for qualitative and quantitative analysis. Today, chromatography allows the food industry to provide accurate information about the nutrients in particular food and much more.

-

An increase in the amount of food recalls and food adulterations

A food recall is an action taken in order to remove from sale, distribution, and consumption of a particular food that may pose a safety risk to consumers. A food recall may be initiated as a result of a report or complaint from a variety of sources, such as manufacturers, wholesalers, retailers, government agencies, and consumers.

Opportunities

-

Technological advancements in the testing industry

The technological trends in chromatography food testing which is driving the market growth in recent times are Artificial intelligence (AI), digitalization, connectivity technologies, and smart automated technologies fuelled by data & machine learning. In pre-pandemic times, interest in the benefits of smart and automated technologies was high.

Restraints/Challenges

- High cost associated with chromatography testing & presence of alternative food testing technologies

However, at present, there are different types of chromatography testing, such as paper chromatography, thin-layer chromatography, gas chromatography, membrane chromatography, and dye-ligand chromatography. These chromatography testing are widely used in the food, biopharmaceutical, nutraceutical, and in bioprocessing industries among others. Chromatography testing is used in various industries for the accurate result obtained post-testing, but chromatography testing is costly and takes much time in the testing. The other factor that may impede chromatography testing used in the food industry is the cost associated with it.

COVID-19 Impact on Europe Chromatography Food Testing Market

COVID-19 had a positive effect on the market as food testing services boomed. As chromatography food testing systems and services were in high demand among consumers due to COVID-19, the need to detect contamination and pathogens was a mandate for the food industry to follow. This boosted the growth of various types of food testing services, including chromatography food testing.

Recent Development

- In June 2022, PerkinElmer, Inc. launched next generation, automated gas chromatography platform solution. The key features of this solution were its automated gas chromatography (GC), headspace sampler, and GC/mass spectrometry (GC/MS) solution

Europe Chromatography Food Testing Market Scope

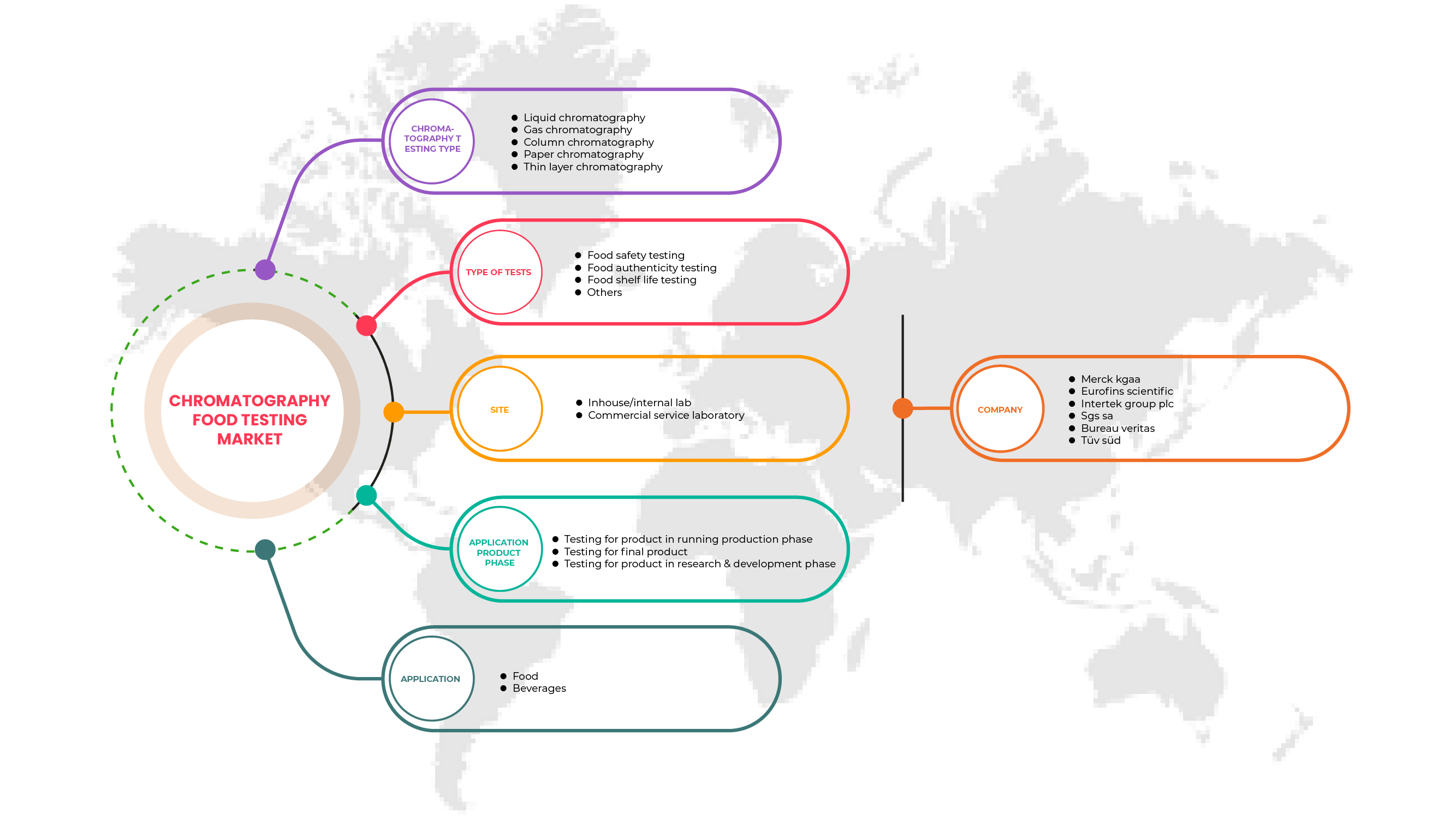

The Europe chromatography food testing market is segmented on the basis of chromatography testing type, type of tests, site, application product phase, and application. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Chromatography Testing Type

- Liquid chromatography

- Gas chromatography

- Column chromatography

- Paper chromatography

- Thin layer chromatography

On the basis of chromatography testing type, the Europe chromatography food testing market is segmented into liquid chromatography, gas chromatography, column chromatography, paper chromatography, and thin layer chromatography.

Type of Tests

- Food safety testing

- Food authenticity testing

- Food shelf life testing

- Others

On the basis of the type of tests, the Europe chromatography food testing market is segmented into food safety testing, food authenticity testing, food shelf life testing, and others.

Site

- In-house/Internal lab

- Commercial service laboratory

On the basis of site, the Europe chromatography food testing market is segmented into in-house/internal lab and commercial service laboratory.

Application Product Phase

- Testing for product in running production phase

- Testing for final product

- Testing for product in research & development phase

On the basis of the application product phase, the Europe chromatography food testing market is segmented into testing for product in running production phase, testing for final product, and testing for product in research & development phase.

Application

- Food

- Beverages

On the basis of application, the Europe chromatography food testing market is segmented into food and beverages.

Europe Chromatography Food Testing Market Regional Analysis/Insights

The Europe chromatography food testing market is analyzed, and market size insights and trends are provided by country, chromatography testing type, type of tests, site, application product phase, and application, as referenced above.

In 2022, France is expected to dominate the Europe chromatography food testing market due to the increasing adoption of chromatography testing techniques due to the widespread pandemic laying emphasis on food safety and growing technological advancements in the testing industry in the region.

The country section of the report also provides individual market impacting factors and changes in regulations in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, disease epidemiology, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Europe brands and their challenges faced due to large or scarce competition from local and domestic brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Europe Chromatography Food Testing Market Share Analysis

The chromatography food testing market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, solution launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus related to Europe chromatography food testing market.

Some of the major players operating in the Europe chromatography food testing market are SGS SA, Bureau Veritas, Eurofins Scientific, TÜV SÜD, ALS, Intertek Group plc, QIMA, Merck KGaA, Cotecna, Mérieux NutriSciences Corporation, Element Materials Technology, NSF, ifp Institut für Produktqualität GmbH, Neogen Corporation, Waters Corporation, Thermo Fisher Scientific Inc., and Shimadzu Corporation among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE CHROMATOGRAPHY FOOD TESTING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 LIQUID CHROMATOGRAPHY TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.2 GROWING FOOD ADULTERATION CASES

4.3 INDUSTRY TRENDS & FUTURE PERSPECTIVE

4.4 SUPPLY CHAIN ANALYSIS

4.5 COMPARATIVE ANALYSIS OF DIFFERENT TYPES OF CHROMATOGRAPHY FOOD TESTING TECHNOLOGIES

4.6 OVERVIEW OF TECHNOLOGICAL ADVANCEMENT IN THE FIELD

4.7 TECHNOLOGICAL TRENDS IN CHROMATOGRAPHY FOOD TESTING

4.8 EMERGING TREND ANALYSIS

4.8.1 ETHYLENE OXIDE AND 2-CHLOROETHANOL ANALYSIS

4.8.2 NEW TECHNOLOGIES WITH HIGH ACCURACY AND PRECISION

5 EUROPE CHROMATOGRAPHY FOOD TESTING MARKET, REGULATORY FRAMEWORK AND GUIDELINES

5.1 FOOD AND BEVERAGES SAFETY AND QUALITY REGULATIONS

5.2 FOOD SAFETY & STANDARDS PACKAGING & LABELLING REGULATIONS 2011

5.3 ANALYSIS OF LAWSUITS RELATED TO CHROMATOGRAPHY FOOD TESTING

5.4 FOODBORNE ILLNESS OUTBREAKS AND RELEVANT ACTIONS TAKEN BY GOVERNMENT BODIES

5.5 RECENTLY FORMED LAWS FOR CHROMATOGRAPHY FOOD TESTING BY GOVERNMENT BODIES CHANGES IN EUROPE FOOD SAFETY REGULATIONS

5.6 CHANGES IN EUROPE FOOD SAFETY REGULATIONS

5.7 FOOD PRODUCTS RECALLS

5.8 FOOD PRODUCTS WITHDRAWALS

6 REGIONAL SUMMARY

6.1 SUMMARY WRITE-UP (NORTH AMERICA)

6.1.1 OVERVIEW

6.2 SUMMARY WRITE-UP (EUROPE)

6.2.1 OVERVIEW

6.3 SUMMARY WRITE-UP (ASIA-PACIFIC)

6.3.1 OVERVIEW

6.4 SUMMARY WRITE-UP (SOUTH AMERICA)

6.4.1 OVERVIEW

6.5 SUMMARY WRITE-UP (MIDDLE EAST AND AFRICA)

6.5.1 OVERVIEW

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISE IN NUMBER OF FOODBORNE ILLNESSES

7.1.2 AN INCREASE IN THE AMOUNT OF FOOD RECALLS AND FOOD ADULTERATIONS

7.1.3 INCREASING ADOPTION OF CHROMATOGRAPHY TESTING TECHNIQUES

7.2 RESTRAINTS

7.2.1 HIGH COST ASSOCIATED WITH CHROMATOGRAPHY TESTING

7.2.2 PRESENCE OF ALTERNATIVE FOOD TESTING TECHNOLOGIES

7.3 OPPORTUNITIES

7.3.1 TECHNOLOGICAL ADVANCEMENTS IN THE TESTING INDUSTRY

7.3.2 GROWING APPLICATIONS OF CHROMATOGRAPHY IN VARIOUS FIELDS

7.3.3 INCREASING NUMBER OF FOOD SAFETY TESTING SERVICE PROVIDERS

7.3.4 RIGIDITY IN FOOD REGULATION AND STANDARDS

7.3.5 INCREASING ACQUISITIONS AND PARTNERSHIPS AMONG MARKET PLAYERS

7.4 CHALLENGES

7.4.1 LACK OF HARMONIZATION IN FOOD SAFETY STANDARDS

7.4.2 LACK OF INFRASTRUCTURE AND SKILLED PROFESSIONALS

8 EUROPE CHROMATOGRAPHY FOOD TESTING MARKET, BY CHROMATOGRAPHY TESTING TYPE

8.1 OVERVIEW

8.2 LIQUID CHROMATOGRAPHY

8.3 GAS CHROMATOGRAPHY

8.4 COLUMN CHROMATOGRAPHY

8.5 PAPER CHROMATOGRAPHY

8.6 THIN LAYER CHROMATOGRAPHY

9 EUROPE CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE OF TESTS

9.1 OVERVIEW

9.2 FOOD SAFETY TESTING

9.2.1 ALLERGEN TESTING

9.2.1.1 MILK

9.2.1.2 EGG

9.2.1.3 SEAFOOD

9.2.1.4 PEANUT & SOY

9.2.1.5 GLUTEN

9.2.1.6 TREE NUTS

9.2.1.7 OTHERS

9.2.2 PATHOGENS TESTING

9.2.2.1 SALMONELLA SPP

9.2.2.2 E. COLI

9.2.2.3 LISTERIA SPP

9.2.2.4 LISTERIA

9.2.2.5 CAMPYLOBACTER

9.2.2.6 VIBRIO SPP

9.2.2.7 OTHERS

9.2.3 HEAVY METALS TESTING

9.2.3.1 LEAD

9.2.3.2 ARSENIC

9.2.3.3 CADMIUM

9.2.3.4 MERCURY

9.2.3.5 OTHERS

9.2.4 NUTRITIONAL LABELLING

9.2.5 GMO TESTING

9.2.5.1 STACKED

9.2.5.2 HERBICIDE TOLERANCE

9.2.5.3 INSECT RESISTANCE

9.2.6 ORGANIC CONTAMINANTS TESTING

9.2.7 MYCOTOXINS TESTING

9.2.7.1 AFLATOXINS

9.2.7.2 OCHRATOXINS

9.2.7.3 PATULIN

9.2.7.4 FUMONISINS

9.2.7.5 TRICHOTHECENES

9.2.7.6 DEOXYNIVALENOL

9.2.7.7 ZEARALENONE

9.2.8 PESTICIDES TESTING

9.2.8.1 INSECTICIDES

9.2.8.2 HERBICIDES

9.2.8.3 FUNGICIDES

9.2.8.4 OTHERS

9.3 FOOD AUTHENTICITY TESTING

9.3.1 ADULTERATION TESTS

9.3.2 ORGANIC

9.3.3 ALLERGEN TESTING

9.3.4 MEAT SPECIATION

9.3.5 GMO TESTING

9.3.6 HALAL VERIFICATION

9.3.7 KOSHER VERIFICATION

9.3.8 PROTECTED GEOGRAPHICAL INDICATION (PGI)

9.3.9 PROTECTED DENOMINATION OF ORIGIN (PDO)

9.3.10 FALSE LABELLING

9.4 FOOD SHELF LIFE TESTING

9.4.1 ORGANOLEPTIC AND APPEARANCE

9.4.1.1 COLOR

9.4.1.2 TEXTURE

9.4.1.3 PACKAGING

9.4.1.4 AROMA

9.4.1.5 TASTE

9.4.1.6 SEPARATION

9.4.1.7 STRATIFICATION

9.4.2 RANCIDITY

9.4.2.1 PEROXIDE VALUE (PV)

9.4.2.2 P-ANISIDINE (P-AV)

9.4.2.3 FREE FATTY ACIDS (FFA)

9.4.3 INGREDIENT ACTIVITY

9.4.4 NUTRIENT STABILITY

9.4.5 CHEMICAL TESTS

9.4.6 ACIDITY LEVELS

9.4.7 BROWNING

9.4.7.1 ENZYMATIC BROWNING

9.4.7.2 CHEMICAL BROWNING

9.4.8 REAL-TIME SHELF TESTING

9.4.9 ACCELERATED SHELF-LIFE TESTING

9.4.10 ACCELERATED (40C/75%RH)

9.4.11 INTERMEDIATE (30C/65%RH)

9.4.12 AMBIENT (25C/60%RH)

9.4.13 TROPICAL (30C/75%RH)

9.4.14 REFRIGERATED (2C TO 8C)

9.4.15 FROZEN (-15C TO -20C)

9.4.16 OTHERS

9.5 OTHERS

10 EUROPE CHROMATOGRAPHY FOOD TESTING MARKET , BY SITE

10.1 OVERVIEW

10.2 INHOUSE/INTERNAL LAB

10.3 COMMERCIAL SERVICE LABORATORY

11 EUROPE CHROMATOGRAPHY FOOD TESTING MARKET, BY APPLICATION PRODUCT PHASE

11.1 OVERVIEW

11.2 TESTING FOR PRODUCT IN RUNNING PRODUCTION PHASE

11.3 TESTING FOR FINAL PRODUCT

11.4 TESTING FOR PRODUCT IN RESEARCH & DEVELOPMENT PHASE

12 EUROPE CHROMATOGRAPHY FOOD TESTING MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 FOOD

12.2.1 PROCESSED FOOD

12.2.1.1 PROCESSED FOOD, BY TYPE

12.2.1.1.1 CANNED FRUITS & VEGETABLES

12.2.1.1.2 JAMS, PRESERVES & MARMALADES

12.2.1.1.3 FRUIT & VEGETABLE PUREE

12.2.1.1.4 SAUCES, DRESSINGS & CONDIMENTS

12.2.1.1.5 READY MEALS

12.2.1.1.6 SOUPS

12.2.1.1.7 PICKLES

12.2.1.1.8 OTHERS

12.2.1.2 PROCESSED FOOD, BY CHROMATOGRAPHY TESTING TYPE

12.2.1.2.1 LIQUID CHROMATOGRAPHY

12.2.1.2.2 GAS CHROMATOGRAPHY

12.2.1.2.3 COLUMN CHROMATOGRAPHY

12.2.1.2.4 THIN LAYER CHROMATOGRAPHY

12.2.1.2.5 PAPER CHROMATOGRAPHY

12.2.2 DAIRY PRODUCTS

12.2.2.1 DAIRY PRODUCTS, BY TYPE

12.2.2.1.1 ICE CREAM

12.2.2.1.2 CHEESE

12.2.2.1.3 MILK DESSERT

12.2.2.1.3.1 MILK DESSERT, BY TYPE

12.2.2.1.3.2 Pudding

12.2.2.1.3.3 Custard

12.2.2.1.3.4 Others

12.2.2.1.4 YOGURT

12.2.2.1.5 CHEESE BASED DESERTS

12.2.2.1.5.1 CHEESE BASED DESERTS, BY TYPE

12.2.2.1.5.2 Cheese Cake

12.2.2.1.5.3 Cheese Pudding

12.2.2.1.5.4 Cheese Cake

12.2.2.1.5.5 Others

12.2.2.1.6 OTHERS

12.2.2.2 DAIRY PRODUCTS, BY CHROMATOGRAPHY TESTING TYPE

12.2.2.2.1 LIQUID CHROMATOGRAPHY

12.2.2.2.2 GAS CHROMATOGRAPHY

12.2.2.2.3 COLUMN CHROMATOGRAPHY

12.2.2.2.4 THIN LAYER CHROMATOGRAPHY

12.2.2.2.5 PAPER CHROMATOGRAPHY

12.2.3 MEAT & POULTRY PRODUCTS

12.2.3.1 MEAT & POULTRY PRODUCTS, BY TYPE

12.2.3.1.1 CHICKEN & EGGS

12.2.3.1.2 SEAFOOD

12.2.3.1.3 BEEF

12.2.3.1.4 LAMB & GOAT

12.2.3.1.5 PORK

12.2.3.1.6 OTHERS

12.2.3.2 MEAT & POULTRY PRODUCTS, BY CHROMATOGRAPHY TESTING TYPE

12.2.3.2.1 LIQUID CHROMATOGRAPHY

12.2.3.2.2 GAS CHROMATOGRAPHY

12.2.3.2.3 COLUMN CHROMATOGRAPHY

12.2.3.2.4 THIN LAYER CHROMATOGRAPHY

12.2.3.2.5 PAPER CHROMATOGRAPHY

12.2.4 VEGETABLES

12.2.4.1 Vegetables, BY TYPE

12.2.4.1.1 LEAFY GREENS

12.2.4.1.2 CRUCIFEROUS VEGETABLES

12.2.4.1.3 MARROW VEGETABLES

12.2.4.1.4 ROOT VEGETABLES

12.2.4.1.5 ONION

12.2.4.1.6 GARLIC

12.2.4.1.7 OTHERS

12.2.4.2 VEGETABLES, BY CHROMATOGRAPHY TESTING TYPE

12.2.4.2.1 LIQUID CHROMATOGRAPHY

12.2.4.2.2 GAS CHROMATOGRAPHY

12.2.4.2.3 COLUMN CHROMATOGRAPHY

12.2.4.2.4 THIN LAYER CHROMATOGRAPHY

12.2.4.2.5 PAPER CHROMATOGRAPHY

12.2.5 FRUITS

12.2.5.1 Fruits, BY TYPE

12.2.5.1.1 APPLE & PEARS

12.2.5.1.2 CITRUS FRUITS

12.2.5.1.3 TROPICAL FRUITS

12.2.5.1.4 BERRIES

12.2.5.1.5 MELONS

12.2.5.1.6 OTHERS

12.2.5.2 Fruits, BY CHROMATOGRAPHY TESTING TYPE

12.2.5.2.1 LIQUID CHROMATOGRAPHY

12.2.5.2.2 GAS CHROMATOGRAPHY

12.2.5.2.3 COLUMN CHROMATOGRAPHY

12.2.5.2.4 THIN LAYER CHROMATOGRAPHY

12.2.5.2.5 PAPER CHROMATOGRAPHY

12.2.6 CEREALS & GRAINS

12.2.6.1 CEREALS & GRAINS, BY TYPE

12.2.6.1.1 RICE

12.2.6.1.2 WHEAT

12.2.6.1.3 BARLEY

12.2.6.1.4 MAIZE

12.2.6.1.5 OAT

12.2.6.1.6 SORGHUM

12.2.6.1.7 OTHERS

12.2.6.2 Cereals & Grains, BY CHROMATOGRAPHY TESTING TYPE

12.2.6.2.1 LIQUID CHROMATOGRAPHY

12.2.6.2.2 GAS CHROMATOGRAPHY

12.2.6.2.3 COLUMN CHROMATOGRAPHY

12.2.6.2.4 THIN LAYER CHROMATOGRAPHY

12.2.6.2.5 PAPER CHROMATOGRAPHY

12.2.7 EDIBLE OILS

12.2.7.1 EDIBLE OILS, BY TYPE

12.2.7.1.1 SOYBEAN OIL

12.2.7.1.2 SUNFLOWER OIL

12.2.7.1.3 GROUNDNUT OIL

12.2.7.1.4 COCONUT OIL

12.2.7.1.5 OLIVE OIL

12.2.7.1.6 OTHERS

12.2.7.2 EDIBLE OILS, BY CHROMATOGRAPHY TESTING TYPE

12.2.7.2.1 LIQUID CHROMATOGRAPHY

12.2.7.2.2 GAS CHROMATOGRAPHY

12.2.7.2.3 COLUMN CHROMATOGRAPHY

12.2.7.2.4 THIN LAYER CHROMATOGRAPHY

12.2.7.2.5 PAPER CHROMATOGRAPHY

12.2.8 OILSEEDS & PULSES

12.2.8.1 OILSEEDS & PULSES, BY TYPE

12.2.8.1.1 GRAM

12.2.8.1.2 PEA

12.2.8.1.3 SUNFLOWERS

12.2.8.1.4 LENTILS

12.2.8.1.5 SOYBEANS

12.2.8.1.6 GROUNDNUT

12.2.8.1.7 SESAME

12.2.8.1.8 PALM

12.2.8.1.9 COTTON SEED

12.2.8.1.10 OTHERS

12.2.8.2 OILSEEDS & PULSES, BY CHROMATOGRAPHY TESTING TYPE

12.2.8.2.1 LIQUID CHROMATOGRAPHY

12.2.8.2.2 GAS CHROMATOGRAPHY

12.2.8.2.3 COLUMN CHROMATOGRAPHY

12.2.8.2.4 THIN LAYER CHROMATOGRAPHY

12.2.8.2.5 PAPER CHROMATOGRAPHY

12.2.9 CONFECTIONERY

12.2.9.1 CONFECTIONERY, BY TYPE

12.2.9.1.1 CHOCOLATES

12.2.9.1.2 CANDY BARS

12.2.9.1.3 JELLIES

12.2.9.1.4 MERINGUES

12.2.9.1.5 MARMALADES

12.2.9.1.6 OTHERS

12.2.9.2 CONFECTIONERY, BY CHROMATOGRAPHY TESTING TYPE

12.2.9.2.1 LIQUID CHROMATOGRAPHY

12.2.9.2.2 GAS CHROMATOGRAPHY

12.2.9.2.3 COLUMN CHROMATOGRAPHY

12.2.9.2.4 THIN LAYER CHROMATOGRAPHY

12.2.9.2.5 PAPER CHROMATOGRAPHY

12.2.10 SPICES

12.2.11 NUTS

12.2.11.1 NUTS, BY TYPE

12.2.11.1.1 ALMOND

12.2.11.1.2 WALNUT

12.2.11.1.3 CASHEWNUT

12.2.11.1.4 BRAZIL NUT

12.2.11.1.5 MACADAMIA NUTS

12.2.11.1.6 OTHERS

12.2.11.2 NUTS, BY CHROMATOGRAPHY TESTING TYPE

12.2.11.2.1 LIQUID CHROMATOGRAPHY

12.2.11.2.2 GAS CHROMATOGRAPHY

12.2.11.2.3 COLUMN CHROMATOGRAPHY

12.2.11.2.4 THIN LAYER CHROMATOGRAPHY

12.2.11.2.5 PAPER CHROMATOGRAPHY

12.2.12 HERBAL EXTRACTS AND HERBS

12.2.13 HONEY

12.2.14 BABY FOOD

12.2.15 PLANT-BASED MEAT AND MEAT ALTERNATIVES

12.2.15.1 PLANT-BASED MEAT AND MEAT ALTERNATIVES, BY TYPE

12.2.15.1.1 TOFU

12.2.15.1.2 BURGER AND PATTIES

12.2.15.1.3 SAUSAGES

12.2.15.1.4 SEITEN

12.2.15.1.5 STRIPS AND NUGGETS

12.2.15.1.6 MEATBALLS

12.2.15.1.7 TEMPEH

12.2.15.1.8 OTHERS

12.2.15.2 PLANT-BASED MEAT AND MEAT ALTERNATIVES, BY CHROMATOGRAPHY TESTING TYPE

12.2.15.2.1 LIQUID CHROMATOGRAPHY

12.2.15.2.2 GAS CHROMATOGRAPHY

12.2.15.2.3 COLUMN CHROMATOGRAPHY

12.2.15.2.4 THIN LAYER CHROMATOGRAPHY

12.2.15.2.5 PAPER CHROMATOGRAPHY

12.2.16 OTHERS

12.3 BEVERAGES

12.3.1 BEVERAGES, BY TYPE

12.3.1.1 NON-ALCOHOLIC

12.3.1.1.1 CARBONATED DRINKS

12.3.1.1.2 JUICES

12.3.1.1.3 SPORT DRINKS

12.3.1.1.4 COFFEE

12.3.1.1.5 NUTRITIONAL DRINKS

12.3.1.1.6 PLANT-BASED MILK

12.3.1.1.6.1 SOY MILK

12.3.1.1.6.2 ALMOND MILK

12.3.1.1.6.3 OAT MILK

12.3.1.1.6.4 CASHEW MILK

12.3.1.1.6.5 RICE

12.3.1.1.6.6 OTHERS

12.3.1.1.7 SMOOTHIES

12.3.1.1.8 TEA

12.3.1.1.9 MINERAL WATER

12.3.1.1.10 OTHERS

12.3.1.2 ALCOHOLIC

12.3.1.2.1 BEER

12.3.1.2.2 WINE

12.3.1.2.3 VODKA

12.3.1.2.4 WHISKEY

12.3.1.2.5 BRANDY

12.3.1.2.6 GIN

12.3.1.2.7 TEQUILA

12.3.1.2.8 OTHERS

12.3.2 BEVERAGES, BY CHROMATOGRAPHY TESTING TYPE

12.3.2.1 LIQUID CHROMATOGRAPHY

12.3.2.2 GAS CHROMATOGRAPHY

12.3.2.3 COLUMN CHROMATOGRAPHY

12.3.2.4 THIN LAYER CHROMATOGRAPHY

12.3.2.5 PAPER CHROMATOGRAPHY

13 EUROPE CHROMATOGRAPHY FOOD TESTINGMARKET, BY GEOGRAPHY

13.1 EUROPE

13.1.1 FRANCE

13.1.2 GERMANY

13.1.3 ITALY

13.1.4 U.K.

13.1.5 SPAIN

13.1.6 NETHERLANDS

13.1.7 POLAND

13.1.8 SWITZERLAND

13.1.9 RUSSIA

13.1.10 BELGIUM

13.1.11 DENMARK

13.1.12 SWEDEN

13.1.13 TURKEY

13.1.14 REST OF EUROPE

14 EUROPE CHROMATOGRAPHY FOOD TETING MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: EUROPE

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 MERCK KGAA

16.1.1 COMPANY SNAPSHOT

16.1.2 RECENT FINANCIAL

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 EUROFINS SCIENTIFIC

16.2.1 COMPANY SNAPSHOT

16.2.2 RECENT FINANCIAL

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 INTERTEK GROUP PLC

16.3.1 COMPANY SNAPSHOT

16.3.2 RECENT FINANCIAL

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 INDUSTRIES AND SERVICE PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 SGS SA

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 SERVICE PORTFOLIO

16.4.5 RECENT DEVELOPMENT

16.5 BUREAU VERITAS

16.5.1 COMPANY PROFILE

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 SERVICES PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 ADPEN LABORATORIES, INC.

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 ALS

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 SERVICE PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 ASUREQUALITY

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 BVAQ

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 COTECNA

16.10.1 COMPANY SNAPSHOT

16.10.2 SERVICES PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 ELEMENT MATERIALS TECHNOLOGY (FORMERLY AVOMEEN)

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 FOOD SAFETY NET SERVICES

16.12.1 COMPANY SNAPSHOT

16.12.2 SERVICE PORTFOLIO

16.12.3 RECENT DEVELOPMENTS

16.13 IFP INSTITUT FÜR PRODUKTQUALITÄT GMBH

16.13.1 COMPANY SNAPSHOT

16.13.2 SOLUTION PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 MÉRIEUX NUTRISCIENCES CORPORATION

16.14.1 COMPANY SNAPSHOT

16.14.2 SOLUTION PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 NEOGEN CORPORATION

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENTS

16.16 NSF.

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 PACIFIC LABS

16.17.1 COMPANY SNAPSHOT

16.17.2 SERVICES PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 QIMA

16.18.1 COMPANY SNAPSHOT

16.18.2 SOLUTION PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 R J HILL LABORATORIES LIMITED

16.19.1 COMPANY SNAPSHOT

16.19.2 SOLUTION PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 SHIMADZU CORPORATION

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 PRODUCT PORTFOLIO

16.20.4 RECENT DEVELOPMENTS

16.21 SPECTRO ANALYTICAL LABS PVT. LIMITED

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENT

16.22 SYMBIO LABORATORIES

16.22.1 COMPANY SNAPSHOT

16.22.2 SOLUTION PORTFOLIO

16.22.3 RECENT DEVELOPMENTS

16.23 THERMO FISHER SCIENTIFIC INC.

16.23.1 COMPANY SNAPSHOT

16.23.2 REVENUE ANALYSIS

16.23.3 PRODUCT PORTFOLIO

16.23.4 RECENT DEVELOPMENTS

16.24 TÜV SÜD

16.24.1 COMPANY SNAPSHOT

16.24.2 SERVICE PORTFOLIO

16.24.3 RECENT DEVELOPMENT

16.25 WATERS CORPORATION

16.25.1 COMPANY SNAPSHOT

16.25.2 REVENUE ANALYSIS

16.25.3 PRODUCT PORTFOLIO

16.25.4 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 COMPARATIVE ANALYSIS

TABLE 2 FREQUENCY OF SIGNS AND SYMPTOMS AMONG CASES OF FOODBORNE ILLNESS.

TABLE 3 CHOLERA ATTACK RATE BY AGE GROUP, MANKHOWKWE CAMP, MALAWI, MARCH–MAY 1988, SHOWS THE HIGHEST DISEASE RATES AMONG PERSONS AGED 15 YEARS AND ABOVE.

TABLE 4 THE PRICE IS ASSOCIATED WITH THE SPACE PARTS OF HPLC AND GC INSTRUMENTS

TABLE 5 EUROPE CHROMATOGRAPHY FOOD TESTING MARKET, BY CHROMATOGRAPHY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 6 EUROPE LIQUID CHROMATOGRAPHY IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 7 EUROPE GAS CHROMATOGRAPHY IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 8 EUROPE COLUMN CHROMATOGRAPHY IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 EUROPE PAPER CHROMATOGRAPHY IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 10 EUROPE THIN LAYER CHROMATOGRAPHY IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 EUROPE CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD THOUSAND)

TABLE 12 EUROPE FOOD IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 EUROPE FOOD SAFETY TESTING IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 14 EUROPE ALLERGEN TESTING IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 15 EUROPE PATHOGENS TESTING IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 16 EUROPE HEAVY METALS TESTING IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 17 EUROPE GMO TESTING IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 18 EUROPE MYCOTOXINS TESTING IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 19 EUROPE PESTICIDES TESTING IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 20 EUROPE COMMUNICATIONS SATELLITES IN CHROMATOGRAPHY FOOD TESTING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 21 EUROPE FOOD AUTHENTICITY TESTING IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 22 EUROPE FOOD SHELF LIFE TESTING IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 EUROPE FOOD SHELF LIFE TESTING IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 24 EUROPE ORGANOLEPTIC AND APPEARANCE IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 25 EUROPE RANCIDITY IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 26 EUROPE BROWNING IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 27 EUROPE FOOD SHELF LIFE TESTING IN CHROMATOGRAPHY FOOD TESTING MARKET, BY METHOD, 2020-2029 (USD THOUSAND)

TABLE 28 EUROPE FOOD SHELF LIFE TESTING IN CHROMATOGRAPHY FOOD TESTING MARKET, BY PACKAGED FOOD CONDITION, 2020-2029 (USD THOUSAND)

TABLE 29 EUROPE CHROMATOGRAPHY FOOD TESTING MARKET, BY SITE, 2020-2029 (USD THOUSAND)

TABLE 30 EUROPE INHOUSE/INTERNAL LAB IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 EUROPE COMMERCIAL SERVICE LABORATORY IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 EUROPE CHROMATOGRAPHY FOOD TESTING MARKET, BY APPLICATION PRODUCT PHASE, 2020-2029 (USD THOUSAND)

TABLE 33 EUROPE TESTING FOR PRODUCT IN RUNNING PRODUCTION PHASE IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 EUROPE TESTING FOR FINAL PRODUCT IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 35 EUROPE TESTING FOR PRODUCT IN RESEARCH & DEVELOPMENT PHASE IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 36 EUROPE CHROMATOGRAPHY FOOD TESTING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 37 EUROPE FOOD IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 38 EUROPE FOOD IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 39 EUROPE PROCESSED FOOD IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 40 EUROPE PROCESSED FOOD IN CHROMATOGRAPHY FOOD TESTING MARKET, CHROMATOGRAPHY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 41 EUROPE DAIRY PRODUCTS IN CHROMATOGRAPHY FOOD TESTING MARKET, TYPE, 2020-2029 (USD THOUSAND)

TABLE 42 EUROPE MILK DESSERT IN CHROMATOGRAPHY FOOD TESTING MARKET, TYPE, 2020-2029 (USD THOUSAND)

TABLE 43 EUROPE CHEESE BASED DESERTS IN CHROMATOGRAPHY FOOD TESTING MARKET, TYPE, 2020-2029 (USD THOUSAND)

TABLE 44 EUROPE DAIRY PRODUCTS IN CHROMATOGRAPHY FOOD TESTING MARKET, CHROMATOGRAPHY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 45 EUROPE MEAT & POULTRY PRODUCTS IN CHROMATOGRAPHY FOOD TESTING MARKET, TYPE, 2020-2029 (USD THOUSAND)

TABLE 46 EUROPE MEAT & POULTRY PRODUCTS IN CHROMATOGRAPHY FOOD TESTING MARKET, CHROMATOGRAPHY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 47 EUROPE VEGETABLES IN CHROMATOGRAPHY FOOD TESTING MARKET, TYPE, 2020-2029 (USD THOUSAND)

TABLE 48 EUROPE VEGETABLES IN CHROMATOGRAPHY FOOD TESTING MARKET, CHROMATOGRAPHY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 49 EUROPE FRUITS IN CHROMATOGRAPHY FOOD TESTING MARKET, TYPE, 2020-2029 (USD THOUSAND)

TABLE 50 EUROPE FRUITS IN CHROMATOGRAPHY FOOD TESTING MARKET, CHROMATOGRAPHY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 51 EUROPE CEREALS & GRAINS IN CHROMATOGRAPHY FOOD TESTING MARKET, TYPE, 2020-2029 (USD THOUSAND)

TABLE 52 EUROPE CEREALS & GRAINS IN CHROMATOGRAPHY FOOD TESTING MARKET, CHROMATOGRAPHY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 53 EUROPE EDIBLE OILS IN CHROMATOGRAPHY FOOD TESTING MARKET, TYPE, 2020-2029 (USD THOUSAND)

TABLE 54 EUROPE EDIBLE OILS IN CHROMATOGRAPHY FOOD TESTING MARKET, CHROMATOGRAPHY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 EUROPE OILSEEDS & PULSES IN CHROMATOGRAPHY FOOD TESTING MARKET, TYPE, 2020-2029 (USD THOUSAND)

TABLE 56 EUROPE OILSEEDS & PULSES IN CHROMATOGRAPHY FOOD TESTING MARKET, CHROMATOGRAPHY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 57 EUROPE CONFECTIONERY IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 58 EUROPE CONFECTIONERY IN CHROMATOGRAPHY FOOD TESTING MARKET, CHROMATOGRAPHY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 59 EUROPE NUTS IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 60 EUROPE NUTS IN CHROMATOGRAPHY FOOD TESTING MARKET, CHROMATOGRAPHY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 61 EUROPE PLANT-BASED MEAT AND MEAT ALTERNATIVES IN CHROMATOGRAPHY FOOD TESTING MARKET, TYPE, 2020-2029 (USD THOUSAND)

TABLE 62 EUROPE PLANT-BASED MEAT AND MEAT ALTERNATIVES IN CHROMATOGRAPHY FOOD TESTING MARKET, CHROMATOGRAPHY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 63 EUROPE BEVERAGES IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 64 EUROPE BEVERAGES IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 65 EUROPE NON-ALCOHOLIC IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 66 EUROPE PLANT-BASED MILK IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 67 EUROPE ALCOHOLIC IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 68 EUROPE BEVERAGES IN CHROMATOGRAPHY FOOD TESTING MARKET, BY CHROMATOGRAPHY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 69 EUROPE CHROMATOGRAPHY FOOD TESTING MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

List of Figure

FIGURE 1 EUROPE CHROMATOGRAPHY FOOD TESTING MARKET: SEGMENTATION

FIGURE 2 EUROPE CHROMATOGRAPHY FOOD TESTING MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE CHROMATOGRAPHY FOOD TESTING MARKET: DROC ANALYSIS

FIGURE 4 EUROPE CHROMATOGRAPHY FOOD TESTING MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE CHROMATOGRAPHY FOOD TESTING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE CHROMATOGRAPHY FOOD TESTING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE CHROMATOGRAPHY FOOD TESTING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE CHROMATOGRAPHY FOOD TESTING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE CHROMATOGRAPHY FOOD TESTING MARKET: APPLICATION COVERAGE GRID

FIGURE 10 EUROPE CHROMATOGRAPHY FOOD TESTING MARKET: SEGMENTATION

FIGURE 11 RISING NUMBER OF FOODBORNE ILLNESSES IS EXPECTED TO DRIVE EUROPE CHROMATOGRAPHY FOOD TESTING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 LIQUID CHROMATOGRAPHY SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF EUROPE CHROMATOGRAPHY FOOD TESTING MARKET IN 2022 & 2029

FIGURE 13 SUPPLY CHAIN OF CHROMATOGRAPHY FOOD TESTING MARKET

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE CHROMATOGRAPHY FOOD TESTING MARKET

FIGURE 15 EUROPE CHROMATOGRAPHY FOOD TESTING MARKET : BY CHROMATOGRAPHY TESTING TYPE, 2021

FIGURE 16 EUROPE CHROMATOGRAPHY FOOD TESTING MARKET: BY TYPE OF TESTS, 2021

FIGURE 17 EUROPE CHROMATOGRAPHY FOOD TESTING MARKET : BY SITE, 2021

FIGURE 18 EUROPE CHROMATOGRAPHY FOOD TESTING MARKET: BY APPLICATION PRODUCT PHASE, 2021

FIGURE 19 EUROPE CHROMATOGRAPHY FOOD TESTING MARKET: BY APPLICATION,2021

FIGURE 20 EUROPE CHROMATOGRAPHY FOOD TESTING MARKET: SNAPSHOT (2021)

FIGURE 21 EUROPE CHROMATOGRAPHY FOOD TESTING MARKET: BY COUNTRY (2021)

FIGURE 22 EUROPE CHROMATOGRAPHY FOOD TESTING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 23 EUROPE CHROMATOGRAPHY FOOD TESTING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 24 EUROPE CHROMATOGRAPHY FOOD TESTING MARKET: BY CHROMATOGRAPHY TESTING TYPE (2022-2029)

FIGURE 25 EUROPE CHROMATOGRAPHY FOOD TETING MARKET: COMPANY SHARE 2021 (%)

Europe Chromatography Food Testing Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Chromatography Food Testing Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Chromatography Food Testing Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.