Europe Dental Radiology Equipment Market

Market Size in USD Billion

CAGR :

%

USD

1.06 Billion

USD

1.97 Billion

2025

2033

USD

1.06 Billion

USD

1.97 Billion

2025

2033

| 2026 –2033 | |

| USD 1.06 Billion | |

| USD 1.97 Billion | |

|

|

|

|

Europe Dental Radiology Equipment Market Size

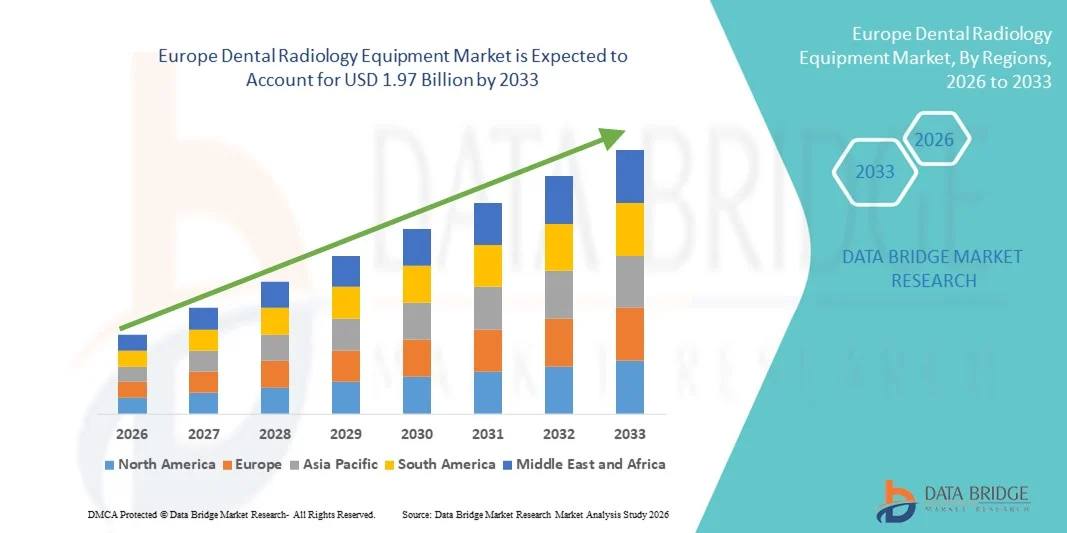

- The Europe dental radiology equipment market size was valued at USD 1.06 billion in 2025 and is expected to reach USD 1.97 billion by 2033, at a CAGR of 8.10% during the forecast period

- The market growth is largely fueled by the increasing prevalence of dental disorders, rising awareness regarding oral health, and the growing demand for advanced diagnostic imaging solutions across dental clinics and hospitals, leading to higher digitalization of dental practices in both developed and emerging economies

- Furthermore, rising patient preference for accurate, minimally invasive, and quick diagnostic procedures, along with continuous technological advancements such as digital X-ray systems, cone-beam computed tomography (CBCT), and portable radiology equipment, is establishing dental radiology equipment as an essential component of modern dental care. These converging factors are accelerating the adoption of Dental Radiology Equipment solutions, thereby significantly boosting overall market growth

Europe Dental Radiology Equipment Market Analysis

- Dental radiology equipment, including digital X-ray systems, intraoral sensors, panoramic imaging systems, and cone-beam computed tomography (CBCT) devices, is increasingly vital to modern dental practices across hospitals and clinics due to its ability to provide high-resolution imaging, accurate diagnosis, and improved treatment planning in both routine and complex dental procedures

- The escalating demand for dental radiology equipment is primarily fueled by the growing prevalence of dental disorders, rising awareness of preventive dental care, increasing cosmetic dentistry procedures, and a strong shift toward digital imaging solutions that enhance workflow efficiency and patient safety through reduced radiation exposure

- The U.K. dominated the dental radiology equipment market with the largest revenue share of 29.3% in 2025, characterized by advanced dental healthcare infrastructure, high adoption of digital imaging technologies, favorable reimbursement frameworks, and strong presence of specialized dental clinics integrating CBCT and AI-assisted diagnostic systems

- Germany is expected to be the fastest growing country in the dental radiology equipment market during the forecast period, driven by increasing demand for cosmetic and implant dentistry, rising investments in advanced imaging technologies, expanding private dental practices, and growing emphasis on early and precise diagnosis

- . The digital dental radiology systems segment held the largest market revenue share of 64.7% in 2025, driven by superior image quality and reduced radiation exposure

Report Scope and Dental Radiology Equipment Market Segmentation

|

Attributes |

Dental Radiology Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Europe Dental Radiology Equipment Market Trends

Integration of AI-Powered Imaging and Digital Workflow Solutions

- A significant and accelerating trend in the dental radiology equipment market is the integration of artificial intelligence (AI) with advanced digital imaging systems to enhance diagnostic precision and clinical efficiency

- AI-powered software is increasingly being embedded into intraoral sensors, panoramic systems, and cone-beam computed tomography (CBCT) platforms to assist dentists in detecting caries, periodontal disease, periapical lesions, and bone abnormalities with greater accuracy

- For instance, in 2023, Dentsply Sirona expanded the capabilities of its digital imaging portfolio by integrating AI-driven diagnostic support tools within its radiography systems, enabling automated image enhancement and pathology detection to support faster clinical decision-making

- The adoption of cloud-based image management systems and seamless integration with dental practice management software is streamlining workflow across clinics. These connected systems allow practitioners to securely store, retrieve, and share radiographic data, improving collaboration between general dentists, orthodontists, and oral surgeons

- Technological advancements such as low-dose radiation protocols, 3D imaging capabilities, and compact, portable radiography units are further transforming dental diagnostics. The shift from conventional film-based radiography to fully digital systems is accelerating due to improved image quality, reduced radiation exposure, and enhanced patient communication through real-time visualization

- The growing emphasis on preventive dentistry and early diagnosis is reinforcing demand for high-resolution imaging systems that enable precise treatment planning for implants, endodontics, and orthodontic procedures

- Overall, the transition toward intelligent, digital, and minimally invasive imaging technologies is reshaping the dental radiology landscape across hospitals, dental clinics, and specialty centers

Europe Dental Radiology Equipment Market Dynamics

Driver

Rising Prevalence of Dental Disorders and Growing Demand for Cosmetic Dentistry

- The increasing incidence of dental disorders such as cavities, periodontal disease, edentulism, and oral infections is a major driver for the Dental Radiology Equipment market. As oral health awareness improves globally, more patients are seeking routine diagnostic imaging for early detection and preventive care

- For instance, in 2024, several European dental associations reported an increase in routine dental check-ups and orthodontic consultations, leading to higher demand for digital intraoral and panoramic radiography systems in private clinics and group dental practices

- The rapid growth of cosmetic and restorative dentistry, including dental implants, aligners, and smile design procedures, is further accelerating the need for advanced 3D imaging systems such as CBCT. Accurate radiographic assessment is essential for implant placement planning, bone density evaluation, and treatment outcome monitoring

- Expanding dental tourism in emerging markets and increasing healthcare expenditure in developed regions are also supporting equipment adoption. Government initiatives promoting oral health programs and improved reimbursement policies for diagnostic imaging in certain countries contribute to market expansion

- Furthermore, the growing number of dental clinics, corporate dental chains, and specialized orthodontic centers is creating sustained demand for technologically advanced radiology systems

Restraint/Challenge

High Equipment Costs and Radiation Safety Concern

- The high initial cost associated with advanced dental radiology equipment, particularly CBCT and 3D imaging systems, remains a key challenge for market growth. Small and independent dental clinics may face financial constraints when investing in premium digital imaging platforms

- For instance, the installation of a high-end CBCT system requires substantial capital investment, including equipment costs, software integration, and operator training, which may limit adoption in cost-sensitive regions

- Concerns regarding radiation exposure, despite advancements in low-dose imaging technology, also influence patient perception and regulatory scrutiny. Strict compliance with radiation safety standards and licensing requirements can increase operational complexity for dental facilities

- In addition, the need for skilled professionals to operate sophisticated imaging systems and interpret complex radiographic data may pose a barrier in regions experiencing workforce shortages

- Addressing affordability challenges through flexible financing models, leasing options, and technological innovations aimed at reducing radiation dose while maintaining image clarity will be critical for sustained growth in the Dental Radiology Equipment market

Europe Dental Radiology Equipment Market Scope

The market is segmented on the basis of product, type, treatment, and end user.

- By Product

On the basis of product, the Dental Radiology Equipment market is segmented into extraoral radiology equipment and intraoral radiology equipment. The intraoral radiology equipment segment dominated the largest market revenue share of 58.4% in 2025, driven by its widespread use in routine dental diagnostics and treatment planning. Intraoral systems such as periapical and bitewing X-ray units are essential tools in general dentistry practices. Their compact size, cost-effectiveness, and high-resolution imaging capabilities support strong adoption across dental clinics. Increasing prevalence of dental caries and periodontal diseases further fuels demand. Technological advancements improving image clarity and reducing radiation exposure enhance clinical preference. Growing number of dental visits globally strengthens equipment utilization rates. Integration with digital imaging software also streamlines workflow efficiency. Continuous upgrades in sensor technology and portability ensure sustained dominance of intraoral systems in 2025.

The extraoral radiology equipment segment is anticipated to witness the fastest growth rate of 21.8% CAGR from 2026 to 2033, fueled by rising demand for comprehensive diagnostic imaging. Extraoral systems such as panoramic and cone-beam computed tomography (CBCT) units provide broader anatomical views, supporting complex procedures. Increasing adoption of CBCT in implantology and orthodontics significantly drives growth. Dental professionals prefer extraoral imaging for advanced treatment planning and surgical precision. Growing awareness regarding cosmetic dentistry further supports demand. Technological advancements offering 3D imaging capabilities enhance diagnostic accuracy. Expanding dental infrastructure in emerging markets accelerates equipment procurement. Higher investments by multi-specialty dental hospitals also contribute to rapid adoption. As demand for advanced imaging grows, extraoral systems are expected to expand at the fastest pace during the forecast period.

- By Type

On the basis of type, the Dental Radiology Equipment market is segmented into analog dental radiology systems and digital dental radiology systems. The digital dental radiology systems segment held the largest market revenue share of 64.7% in 2025, driven by superior image quality and reduced radiation exposure. Digital systems allow instant image acquisition and easy storage, improving clinical workflow. Increasing shift toward paperless dental practices supports segment growth. Integration with electronic health records enhances data management efficiency. Growing demand for accurate and early diagnosis of oral diseases further strengthens adoption. Technological advancements such as wireless sensors and cloud-based imaging platforms improve convenience. High patient awareness regarding safer imaging procedures also boosts preference. Supportive reimbursement policies in developed regions contribute to revenue expansion. Continuous innovation ensures digital systems maintain market leadership in 2025.

The analog dental radiology systems segment is expected to witness the fastest CAGR of 19.6% from 2026 to 2033, primarily in cost-sensitive and developing markets. Lower initial investment costs make analog systems accessible to small dental practices. Increasing establishment of new clinics in emerging economies drives demand. Manufacturers are introducing improved film-based systems with enhanced efficiency. Training familiarity among practitioners in certain regions supports continued usage. Government initiatives to expand dental care services in rural areas also promote adoption. Although digital conversion is rising, analog systems remain relevant due to affordability. Incremental upgrades and hybrid integration solutions further sustain growth. As dental access expands in underserved regions, analog systems are projected to grow steadily during the forecast period.

- By Treatment

On the basis of treatment, the Dental Radiology Equipment market is segmented into endodontic, orthodontic, periodontic, prosthodontics, and others. The orthodontic segment accounted for the largest market revenue share of 34.9% in 2025, driven by increasing demand for corrective dental procedures among adolescents and adults. Rising awareness regarding dental aesthetics significantly supports orthodontic imaging needs. Advanced imaging technologies such as CBCT enhance precision in orthodontic planning. Growing disposable income and cosmetic dentistry trends further boost demand. Dental radiology plays a crucial role in monitoring tooth alignment and jaw structure. Increasing prevalence of malocclusion globally strengthens segment growth. Technological improvements in 3D visualization improve treatment outcomes. Expanding orthodontic specialty clinics contribute to higher equipment utilization. The orthodontic segment continues to dominate due to sustained aesthetic and clinical demand.

The endodontic segment is projected to register the fastest CAGR of 22.3% from 2026 to 2033, fueled by the rising incidence of root canal treatments. Increasing cases of dental decay and pulp infections significantly drive imaging requirements. Endodontic procedures rely heavily on precise intraoral radiographs for treatment accuracy. Growing awareness regarding tooth preservation over extraction further accelerates growth. Technological advancements enabling high-resolution imaging improve procedural success rates. Expansion of dental insurance coverage in emerging markets supports patient access. Rising geriatric population also increases demand for restorative treatments. Dental practitioners increasingly adopt advanced imaging for improved clinical efficiency. As restorative dentistry gains prominence, the endodontic segment is expected to expand rapidly during the forecast period.

- By End User

On the basis of end user, the Dental Radiology Equipment market is segmented into hospitals, diagnostic centers, dental clinics, and others. The dental clinics segment dominated the largest market revenue share of 49.2% in 2025, driven by the high volume of routine dental procedures conducted in clinic settings. Most dental imaging procedures are performed directly within clinics for convenience and efficiency. Increasing number of private dental practices globally strengthens segment leadership. Clinics increasingly invest in digital radiography systems to enhance patient care. Rising patient preference for outpatient dental treatments further supports dominance. Technological integration within clinics improves workflow and reduces turnaround time. Growing urbanization and awareness regarding oral health boost patient visits. Expansion of franchise-based dental chains also contributes to revenue growth. The segment remains dominant due to accessibility and high procedural frequency.

The diagnostic centers segment is anticipated to witness the fastest CAGR of 20.9% from 2026 to 2033, driven by increasing referrals for advanced imaging such as CBCT scans. Diagnostic centers offer specialized imaging services with high-end equipment. Rising complexity of dental implant and surgical cases boosts demand. Investments in advanced imaging infrastructure strengthen growth potential. Collaborative partnerships between dentists and diagnostic labs enhance service efficiency. Growing awareness regarding accurate diagnostics supports referral rates. Technological upgrades and automation improve image analysis capabilities. Expansion in emerging markets further accelerates segment growth. As demand for specialized imaging services increases, diagnostic centers are projected to grow at the fastest pace during the forecast period.

Europe Dental Radiology Equipment Market Regional Analysis

- The Europe dental radiology equipment market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the rising prevalence of dental disorders and increasing awareness regarding early and accurate oral diagnosis. Growing demand for advanced imaging technologies such as digital radiography and cone-beam computed tomography (CBCT) is significantly contributing to regional market growth

- Europe benefits from well-established dental healthcare infrastructure and strong reimbursement frameworks in several countries. Increasing adoption of AI-assisted diagnostic tools and digital workflow integration in dental practices further accelerates market expansion. The region is witnessing steady growth in cosmetic and implant dentistry, which heavily relies on high-precision imaging systems. In addition, supportive regulatory standards ensuring radiation safety and technological quality enhance equipment upgrades

- Rising geriatric population and expanding preventive dental care programs are further strengthening demand. Across hospitals, diagnostic centers, and private dental clinics, Europe continues to demonstrate strong and consistent adoption of modern dental radiology equipment

U.K. Dental Radiology Equipment Market Insight

The U.K. dental radiology equipment market dominated the Dental Radiology Equipment market with the largest revenue share of 29.3% in 2025, characterized by advanced dental healthcare infrastructure and high procedural volumes. The country demonstrates strong adoption of digital imaging technologies, including CBCT and panoramic radiography systems. Favorable reimbursement frameworks and structured dental care pathways support equipment procurement across public and private sectors. The presence of specialized dental clinics integrating AI-assisted diagnostic systems further strengthens technological penetration. Increasing focus on minimally invasive and cosmetic dental procedures drives demand for high-resolution imaging. Growing awareness regarding early caries detection and orthodontic planning also supports consistent utilization. Continuous investments in upgrading radiology systems enhance clinical efficiency. In addition, robust regulatory standards ensure radiation safety and equipment quality. With a mature dental ecosystem and strong innovation uptake, the U.K. maintains its leading position within the European market.

Germany Dental Radiology Equipment Market Insight

Germany dental radiology equipment market is expected to be the fastest growing country in the Dental Radiology Equipment market during the forecast period, supported by rising demand for cosmetic and implant dentistry. The country is projected to register a significant CAGR, driven by increasing investments in advanced imaging technologies such as 3D CBCT systems. Expanding private dental practices and specialty implant centers are accelerating equipment adoption. Germany’s strong healthcare expenditure and technologically progressive environment encourage rapid integration of digital radiology platforms. Growing emphasis on early and precise diagnosis of periodontal and endodontic conditions further fuels demand. The presence of leading dental equipment manufacturers strengthens product innovation and distribution networks. Increasing patient preference for aesthetic treatments also contributes to imaging system upgrades. In addition, strong focus on digital workflow and paperless clinics supports market expansion. With sustained innovation and rising clinical demand, Germany is positioned as the fastest growing market in Europe during the forecast period.

Europe Dental Radiology Equipment Market Share

The Dental Radiology Equipment industry is primarily led by well-established companies, including:

- Dentsply Sirona Inc. (U.S.)

- Carestream Dental LLC (U.S.)

- Planmeca Oy (Finland)

- Vatech Co., Ltd. (South Korea)

- Danaher Corporation (U.S.)

- Acteon Group (France)

- Midmark Corporation (U.S.)

- Owandy Radiology (France)

- Cefla S.C. (Italy)

- Asahi Roentgen Ind. Co., Ltd. (Japan)

- Yoshida Dental Mfg. Co., Ltd. (Japan)

- J. Morita Corporation (Japan)

- Air Techniques, Inc. (U.S.)

- NewTom (Italy)

- Trident S.r.l. (Italy)

Latest Developments in Europe Dental Radiology Equipment Market

- In March 2023, Planmeca introduced the Viso G3 CBCT imaging unit in European markets, expanding its advanced extraoral imaging lineup to support both 2D and 3D dental diagnostics. The Viso® G3 brought comprehensive imaging capabilities for implant planning, endodontics, and orthodontics, enhancing diagnostic accuracy in clinics across Europe

- In July 2024, Align Technology, Inc. launched Align X-ray Insights, an AI-based computer-aided detection (CADe) software for 2D dental radiographs in the European Union and the United Kingdom. This new software helps dental professionals automatically analyze X-ray images to aid early disease identification and treatment planning, reflecting the region’s increasing adoption of AI-enhanced radiology tools

- In August 2024, the Acteon Group launched its X-MIND PRIME 2D panoramic dental X-ray system in Europe. The new system features a patented Adaptive Collimation System designed to lower radiation dose while maintaining high-quality panoramic imaging, addressing both safety and diagnostic needs in dental radiography

- In March 2025, DEXIS introduced the all-new DEXIS Ti2 Sensor as part of its digital dental radiology portfolio in Europe. The Ti2 sensor enhances image quality and integrates AI-powered workflows, enabling streamlined imaging processes and better diagnostic outcomes in dental practices

- In March 2025, Align Technology, Inc. also launched its Align X-ray Insights CADe solution across the European Union and UK, marking a significant step in integrating artificial intelligence into routine dental radiology imaging workflows. The software’s launch underscores a broader industry trend toward smarter diagnostic tools combining hardware and AI capabilities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.