Europe Digital Signage Market

Market Size in USD Billion

CAGR :

%

USD

4.39 Billion

USD

7.38 Billion

2025

2033

USD

4.39 Billion

USD

7.38 Billion

2025

2033

| 2026 –2033 | |

| USD 4.39 Billion | |

| USD 7.38 Billion | |

|

|

|

|

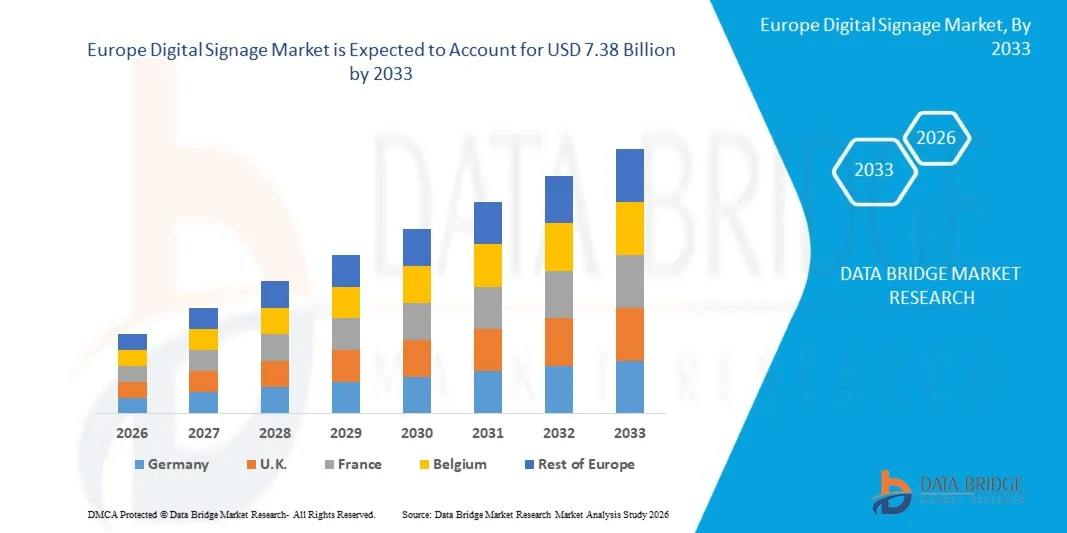

What is the Europe Digital Signage Market Size and Growth Rate?

- The Europe digital signage market size was valued at USD 4.39 billion in 2025 and is expected to reach USD 7.38 billion by 2033, at a CAGR of 6.70% during the forecast period

- The market growth is largely fueled by the growing rapidly thanks to businesses seeking more dynamic and engaging ways to communicate with customers. Advances in display technology, such as LED and OLED screens, offer vibrant visuals that attract attention

- Furthermore, increasing use of digital signage in retail, transportation, and hospitality sectors is boosting demand. The rise of smart cities and interactive displays is also fueling growth. In addition, easy integration with social media and real-time content updates make digital signage more appealing. Overall, businesses value digital signage for its ability to enhance customer experience and drive sales

What are the Major Takeaways of Europe Digital Signage Market?

- Also known as dynamic signage, digital signage involves advertising and marketing on an electronic screen and works on hardware components to ensure the delivery of high-quality content. Digital signage involves the advertising and marketing of products and services over advanced technological screens such as LED and LCD. Nowadays, digital signage is used by both public and private institutions to engage their customers/audiences with its wider viewing angle.

- Germany dominates the Digital Signage market with the largest revenue share of 51.67% in 2025, characterized by growing demand for bright and power-efficient display panels and decline in demand for traditional billboards

- U.K. is projected to register the fastest CAGR of 9.6% from 2026 to 2033, fueled by the strong investments in retail and transportation sectors. Increasing adoption of advanced digital displays in public spaces and smart city initiatives has driven growth

- The Kiosks segment is expected to dominate the Digital Signage market with a market share of 49.11% in 2025, driven by its growing demand for self-service solutions across retail, transportation, and healthcare sectors

Report Scope and Digital Signage Market Segmentation

|

Attributes |

Europe Digital Signage Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Digital Signage Market?

“Integration of Augmented Reality (AR) for Immersive Experiences”

- Augmented Reality (AR) is adding a fresh, interactive twist to digital signage by blending virtual visuals with the real world. Instead of just showing static ads, AR lets users see and engage with digital content right where they stand—such as trying on clothes virtually or exploring products in 3D. This makes ads more fun and memorable. Retailers love it because it grabs attention and keeps customers interested longer. It's also being used in places such as airports and museums to offer guided experiences

- By making information feel more personal and engaging, AR helps businesses connect better with their audiences. As AR tech becomes cheaper and more advanced, expect to see it used even more in digital signage. It’s not just about showing something—it’s about letting people interact with it. This trend is reshaping how brands tell their stories in public spaces

- For Instance, in 2024, Delta Airlines implemented interactive wayfinding kiosks at major airports. These kiosks utilize AR to guide passengers through terminals, providing real-time navigation and personalized information. The integration of AR technology improves the travel experience by offering intuitive and engaging assistance to travelers

What are the Key Drivers of Digital Signage Market?

- The rapid evolution of display technologies is significantly enhancing the capabilities of digital signage. Innovations such as ultra-high-definition (UHD), flexible OLED, and microLED displays are providing businesses with high-quality, visually appealing options. These advancements enable more dynamic and engaging content delivery, attracting and retaining consumer attention

- Moreover, the integration of interactive features such as touchscreens, gesture controls, and augmented reality (AR) is transforming passive displays into interactive experiences. This interactivity allows consumers to engage directly with content, leading to increased dwell time and improved customer satisfaction

- For instance, In April 2024, Shanghai Xianshi Electronic Technology Co., Ltd. introduced a new display technology to its signage products. This technology offers high resolution, ultra-thin design, curved screens for diverse applications, holographic displays, and energy efficiency

Which Factor is Challenging the Growth of the Digital Signage Market?

- High upfront costs are one of the biggest hurdles for companies wanting to adopt digital signage. Buying displays, media players, and content software isn’t cheap, especially for smaller businesses with tight budgets. On top of that, there are installation fees and ongoing maintenance to consider

- Even though digital signage can pay off in the long run by improving customer engagement and streamlining operations, the initial price tag can scare some companies away

- It’s a tough decision when resources are limited. Many businesses want the benefits but can’t justify the steep starting costs. This slows down wider adoption, particularly among local stores and startups. Until prices drop or more flexible payment models emerge, this cost barrier will such asly remain a key restraint

- For instance, In August 2021, a director of a large restaurant corporation in the USA shared on Reddit that obtaining approval for outdoor digital menu boards (DMBs) took 6–9 months, and the process didn't commence until well into construction. This delay and the associated costs highlight the financial and logistical challenges businesses face when adopting digital signage solutions

How is the Digital Signage Market Segmented?

The market is segmented on the basis of product type, technology type, component type, application and location.

- By Product Type

Based on the product type, the digital signage market is segmented into kiosks, billboards, signboards, menu boards, others. The Kiosks segment is expected to dominate the Digital Signage market with a market share of 49.11% in 2025, driven by its growing demand for self-service solutions across retail, transportation, and healthcare sectors.

The billboards segment is anticipated to witness the fastest growth rate of 20.1% from 2025 to 2032, fueled by increasing demand for large-scale, high-visibility advertising in urban areas. Advancements in LED and digital display technologies are making billboards more dynamic and engaging. Brands are turning to these eye-catching formats to reach wider audiences and boost campaign impact.

- By Technology Type

Based on the technology type, the digital signage market is segmented into LCD, LED, OLED, front projection. The LCD held the largest market revenue share in 2025 of, driven by the affordability, energy efficiency, and wide availability. They offer clear visuals and are suitable for both indoor and outdoor applications, making them a versatile choice for many industries. Their long-standing presence and continued innovation have kept them in high demand.

The LED segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its superior brightness, energy efficiency, and durability compared to other display technologies. These qualities make LED ideal for vibrant, large-format digital signage in both indoor and outdoor settings. Growing demand for eye-catching, high-quality displays is fueling this rapid expansion.

- By Component Type

Based on the component type, the digital signage market is segmented into hardware, software, service. The software held the largest market revenue share in 2025, driven by the increasing need for advanced content management systems that enable easy scheduling, customization, and real-time updates. Growing demand for interactive and personalized digital signage experiences has further boosted software adoption. In addition, cloud-based solutions have made software more accessible and scalable for businesses.

The hardware segment held a significant market share in 2025, favored for its crucial role in delivering high-quality displays and reliable performance. Advances in durable screens, media players, and connectivity options have made hardware more efficient and versatile. Strong demand from sectors such as retail and transportation has supported consistent hardware growth.

- By Application

Based on the application, the digital signage market is segmented into transportation, retail, education, government, healthcare, banking, education, entertainment and others. The transportation segment accounted for the largest market revenue share in 2024, driven by the growing use of digital signage for real-time passenger information and advertising in airports, train stations, and bus terminals. Increasing investments in smart transportation infrastructure have further boosted demand. Enhanced communication and improved passenger experience remain key factors fueling this growth.

The retail segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the rising adoption of digital signage for personalized promotions and interactive customer engagement. Retailers are leveraging advanced technologies to enhance in-store experiences and boost sales. Growing competition and demand for innovative marketing solutions are also driving this trend.

- By Location

Based on the location, the digital signage market is segmented into indoor and outdoor. The indoor segment accounted for the largest market revenue share in 2024, driven by the widespread use of digital signage in retail stores, corporate offices, and hospitality venues. Controlled indoor environments allow for better display performance and targeted content delivery. Increasing demand for interactive and dynamic indoor advertising continues to fuel growth.

The outdoor segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the advancements in weather-resistant and high-brightness display technologies that ensure visibility in all conditions. Increasing investments in smart city projects and outdoor advertising campaigns are also driving demand. This trend is fueled by the need for impactful, large-scale messaging in public spaces.

Which Region Holds the Largest Share of the Digital Signage Market?

- Germany dominates the digital signage market with the largest revenue share of 51.67% in 2025, characterized by growing demand for bright and power-efficient display panels and decline in demand for traditional billboards

- Advanced technology infrastructure and high adoption rates across various industries. Strong retail, healthcare, and transportation sectors drive widespread use of digital signage solutions.

- In addition, significant investments in smart cities and digital advertising contribute to market leadership. The presence of major technology companies and startups fosters continuous innovation. Growing consumer demand for interactive and personalized content further boosts adoption. Overall, the GERMANY market benefits from a favorable environment for digital signage growth and development

U.K. Digital Signage Market Insight

U.K. is projected to register the fastest CAGR of 9.6% from 2026 to 2033, fueled by the strong investments in retail and transportation sectors. Increasing adoption of advanced digital displays in public spaces and smart city initiatives has driven growth. Supportive government policies promoting digital transformation also contribute significantly.

Which are the Top Companies in Digital Signage Market?

The digital signage industry is primarily led by well-established companies, including:

- Koninklijke Philips N.V. (Netherlands)

- LG Display Co., Ltd. (South Korea)

- Microsoft (U.S.)

- SAMSUNG (South Korea)

- Sony Corporation (Japan)

- Panasonic Corporation (Japan)

- Planar Systems (U.S.)

- Omnivex Corporation (Canada)

- SHARP CORPORATION (Japan)

- NEC Corporation (Japan)

- AU Optronics Corp. (Taiwan)

- Goodview Company (China)

- Scala (U.S.)

- Keywest Technology, Inc. (U.S.)

- BrightSign LLC. (U.S.)

- Honeywell International Inc. (U.S.)

- NXP Semiconductors (Netherlands)

- Microchip Technology Inc. (U.S.)

- Cypress Semiconductor Corporation (U.S.)

- Texas Instruments Incorporated (U.S.)

What are the Recent Developments in Europe Digital Signage Market?

- In April 2025, Eternis Fine Chemicals and ChainCraft B.V. entered into a landmark strategic partnership to advance the development of low-carbon, bio-based Digital Signage. This collaboration combines ChainCraft’s innovative SensiCraft product line, powered by plant-based fermentation technology, with Eternis’ manufacturing expertise and robust supply chain, setting a new benchmark for sustainability in the fragrance industry. The partnership is expected to accelerate adoption of next-generation, eco-friendly fragrance ingredients

- In April 2025, BASF launched aroma ingredients with reduced Product Carbon Footprints, enabling customers to achieve their sustainability targets and reduce environmental impact across formulations. This initiative reinforces the focus on eco-conscious and high-performance Digital Signage

- In October 2024, Prigiv commenced operations at its newly established Mahad Fragrance Ingredients Plant, a joint venture between Givaudan (49%) and Privi (51%). The facility is designed to produce a broad range of enhanced fragrance products, with plans to scale up operations over the next few years, supporting market expansion in high-quality Digital Signage

- In May 2023, Firmenich International SA completed its merger with DSM, forming DSM-Firmenich, a leading innovation partner in nutrition, health, beauty, and Digital Signage. This consolidation strengthens global capabilities and expands sustainable ingredient development

- In April 2023, Bedoukian Research Inc. partnered with Inscripta to develop and commercialize natural ingredients with superior quality, consistency, and reduced environmental impact. Using Inscripta’s GenoScaler platform to optimize microbial strains, BRI can now produce high-volume, eco-friendly ingredients efficiently, reinforcing sustainable practices in the Digital Signage sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Digital Signage Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Digital Signage Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Digital Signage Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.