Europe Full Body Scanner Market

Market Size in USD Million

CAGR :

%

USD

111.79 Million

USD

248.50 Million

2025

2033

USD

111.79 Million

USD

248.50 Million

2025

2033

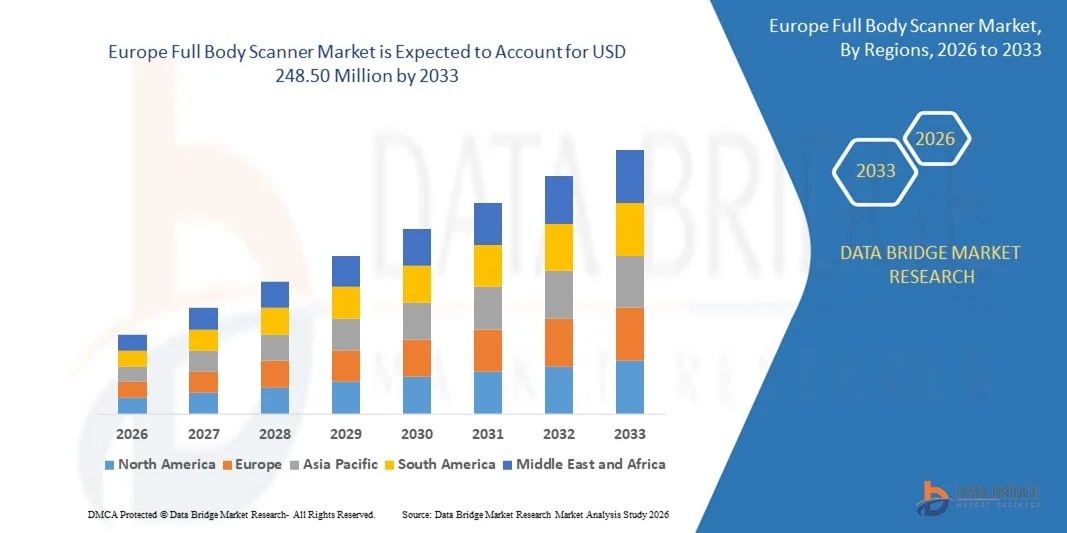

| 2026 –2033 | |

| USD 111.79 Million | |

| USD 248.50 Million | |

|

|

|

|

Europe Full Body Scanner Market Size

- The Europe full body scanner market size was valued at USD 111.79 million in 2025 and is expected to reach USD 248.50 million by 2033, at a CAGR of 10.50% during the forecast period

- The market growth is largely fuelled by the rising need for enhanced security measures at airports, government buildings, and critical infrastructure facilities

- Increasing adoption of advanced imaging technologies, including millimeter-wave and backscatter scanners, is driving demand for accurate and efficient threat detection

Europe Full Body Scanner Market Analysis

- The market is witnessing innovation in scanner technology, such as automated threat detection, AI integration, and reduced scanning times, which improve efficiency and passenger experience

- Increasing investments in airport and border security infrastructure, coupled with the expansion of public transportation networks, are contributing to steady market growth

- Germany dominated the full body scanner market with the largest revenue share of 38.7% in 2025, driven by stringent airport security regulations and increased government investments in advanced security screening solutions

- U.K. is expected to witness the highest compound annual growth rate (CAGR) in the Europe full body scanner market due to rising passenger traffic, growing adoption of advanced imaging technologies, and increasing investment in airport modernization projects

- The Millimeter Wave segment held the largest market revenue share in 2025, driven by its non-ionizing radiation, high detection accuracy, and compliance with stringent safety regulations, making it a preferred choice in airports, seaports, and government facilities. Millimeter wave scanners also enable rapid passenger screening and integration with automated threat recognition systems, enhancing operational efficiency

Report Scope and Europe Full Body Scanner Market Segmentation

|

Attributes |

Europe Full Body Scanner Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Europe Full Body Scanner Market Trends

Rising Demand For Enhanced Security And Efficient Screening

- Increasing concerns over public safety and rising incidents of terrorism, smuggling, and contraband are significantly shaping the full body scanner market. Full body scanners are gaining traction due to their ability to detect concealed weapons, explosives, and prohibited items with high accuracy and minimal manual inspection. This trend strengthens their adoption across airports, government buildings, and public transportation hubs, encouraging manufacturers to innovate with faster and more reliable scanning solutions

- Growing emphasis on efficient passenger throughput and reduced wait times is accelerating the demand for full body scanners in airports and mass transit facilities. Advanced imaging technologies, such as millimeter-wave and backscatter systems, enable quick and non-intrusive screening, improving passenger experience while maintaining security standards. This has also led to collaborations between technology providers and security agencies to enhance scanner performance and operational efficiency

- Integration of artificial intelligence (AI) and automated threat detection systems is influencing purchasing decisions, with manufacturers emphasizing accuracy, speed, and minimal false alarms. These features help differentiate products in a competitive market and ensure regulatory compliance. Companies are increasingly using marketing campaigns to highlight these technological advantages, reinforcing brand positioning and appealing to security-conscious clients

- For instance, in 2024, Smiths Detection in the U.K. expanded their full body scanner portfolios by incorporating AI-based imaging and automated threat recognition. These upgrades were introduced in response to increasing demand for safer, faster, and more reliable security screening, with deployment across airports, seaports, and government facilities. The products were also promoted as compliant with international safety standards, enhancing trust and adoption among target users

- While demand for full body scanners is growing, sustained market expansion depends on continuous R&D, cost-effective production, and compliance with international security regulations. Manufacturers are also focusing on improving scalability, software updates, and developing innovative solutions that balance performance, affordability, and regulatory compliance for broader adoption

Europe Full Body Scanner Market Dynamics

Driver

Rising Need For Enhanced Security And Screening Efficiency

- Growing concerns regarding terrorism, contraband, and smuggling incidents are major drivers for the full body scanner market. Facilities such as airports, government buildings, and mass transit hubs are increasingly adopting advanced scanning systems to ensure public safety. This trend also promotes investment in research and development to enhance scanner accuracy and throughput

- Expanding applications in airports, government institutions, border security, and public venues are influencing market growth. Full body scanners improve screening efficiency, reduce manual inspection, and maintain passenger privacy, enabling operators to meet stringent security requirements. Increasing passenger traffic globally further reinforces this trend

- Security equipment providers are actively promoting AI-integrated, automated scanning systems through product innovation, marketing campaigns, and compliance with international standards. These efforts are supported by growing demand for fast, reliable, and accurate threat detection, encouraging partnerships between technology developers and security agencies to enhance overall operational efficiency

- For instance, in 2023, Astrophysics Inc. in Italy reported increased incorporation of automated threat detection and enhanced imaging systems in full body scanners. This expansion followed rising demand for advanced, regulatory-compliant screening solutions, driving repeat adoption and system upgrades. Both companies highlighted safety, speed, and accuracy in marketing campaigns to strengthen user confidence and brand reputation

- Although rising security concerns support growth, wider adoption depends on cost optimization, regulatory approval, and scalable production processes. Investment in manufacturing efficiency, advanced software integration, and continuous technological innovation will be critical for meeting global demand and maintaining competitive advantage

Restraint/Challenge

High Cost And Regulatory Compliance Challenges

- The relatively high cost of full body scanners compared to conventional security systems remains a key challenge, limiting adoption among smaller facilities and budget-constrained operators. Advanced imaging technologies, AI integration, and stringent testing requirements contribute to elevated pricing. In addition, fluctuating compliance standards across regions can further affect market penetration

- Limited awareness and training for operators in handling advanced scanning systems can restrict adoption in certain sectors. Lack of skilled personnel and technical knowledge impacts optimal system utilization and may result in operational inefficiencies. This also slows technology adoption in emerging markets where educational initiatives and technical support are minimal

- Installation and maintenance challenges also impact market growth, as full body scanners require compliance with strict safety and operational standards. Complex calibration, software updates, and regular inspections increase operational costs. Companies must invest in operator training, technical support, and maintenance services to maintain system integrity

- For instance, in 2024, mid-sized airports and government offices in Europe reported slower adoption due to high costs and limited knowledge of automated scanning technologies. Calibration, certification, and compliance requirements were additional barriers, affecting deployment timelines. Some facilities also postponed system upgrades due to budget constraints

- Overcoming these challenges will require cost-efficient production, simplified regulatory compliance, and focused training initiatives for operators. Collaboration with security agencies, technology providers, and certification bodies can help unlock the long-term growth potential of the global full body scanner market. Furthermore, developing affordable, scalable, and user-friendly solutions will be essential for widespread adoption

Europe Full Body Scanner Market Scope

The market is segmented on the basis of technology, product type, system, and application

- By Technology

On the basis of technology, the Europe full body scanner market is segmented into Backscatter, Millimeter Wave, and Transmission X-Ray. The Millimeter Wave segment held the largest market revenue share in 2025, driven by its non-ionizing radiation, high detection accuracy, and compliance with stringent safety regulations, making it a preferred choice in airports, seaports, and government facilities. Millimeter wave scanners also enable rapid passenger screening and integration with automated threat recognition systems, enhancing operational efficiency.

The Backscatter segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by its ability to detect concealed threats with high precision at a lower operational cost. Backscatter scanners are increasingly adopted in public security and critical infrastructure applications for their reliability and ease of deployment.

- By Product Type

On the basis of product type, the market is segmented into Ground-Mounted Scanner and Vehicle-Mounted Scanner. The Ground-Mounted Scanner segment dominated in 2025 owing to its extensive deployment in airports and transit hubs, providing stable, high-resolution imaging for passenger screening. Ground-mounted systems are also favored for their compatibility with automated image analysis software.

The Vehicle-Mounted Scanner segment is projected to register the fastest growth from 2026 to 2033, supported by rising security measures at border checkpoints, military installations, and critical infrastructure, where mobility and rapid deployment are key factors.

- By System

On the basis of system, the market is segmented into Image Processing and Modelling, 3D Body Scanner, and Others. The 3D Body Scanner segment held the largest market revenue share in 2025 due to its ability to generate detailed anatomical images, enhance threat detection, and support integration with AI-powered analytics. 3D scanners are widely deployed in high-traffic areas where precise, non-invasive scanning is critical.

The Image Processing and Modelling segment is expected to witness the fastest growth from 2026 to 2033, driven by advancements in AI and machine learning that improve detection speed and accuracy while reducing false alarms.

- By Application

On the basis of application, the market is segmented into Public, Critical Infrastructure, Industrial, and Others. The Public segment dominated in 2025, fueled by increasing passenger traffic in airports, train stations, and metro hubs, necessitating efficient and safe screening processes. Public applications also benefit from enhanced user experience through faster throughput and minimal invasiveness.

The Critical Infrastructure segment is projected to witness the fastest growth from 2026 to 2033, driven by heightened security concerns at government buildings, military facilities, and power plants, where advanced full body scanning solutions are essential for threat prevention and operational safety.

Europe Full Body Scanner Market Regional Analysis

- Germany dominated the full body scanner market with the largest revenue share of 38.7% in 2025, driven by stringent airport security regulations and increased government investments in advanced security screening solutions

- Airports and government facilities in the region highly prioritize passenger safety, rapid threat detection, and compliance with international security standards

- This widespread adoption is further supported by the presence of leading scanner manufacturers, ongoing modernization of transportation hubs, and the growing deployment of AI-enabled threat recognition systems, making full body scanners a critical solution for security infrastructure

U.K. Full Body Scanner Market Insight

The U.K. full body scanner market captured the fastest growth in 2025, fueled by rising passenger traffic and the increasing adoption of advanced imaging technologies at airports and seaports. Operators are prioritizing enhanced security screening processes, including automated threat detection and reduced passenger wait times. The growing integration of AI and 3D imaging solutions, along with government initiatives to upgrade airport infrastructure, is significantly propelling market expansion. Moreover, the increasing focus on passenger privacy and low-radiation screening technology is further driving adoption in the U.K.

Europe Full Body Scanner Market Share

The Europe full body scanner industry is primarily led by well-established companies, including:

• Smiths Detection Group Ltd (U.K.)

• Westminster Group Plc (U.K.)

• QinetiQ (U.K.)

• OD Security (Netherlands)

• Rohde & Schwarz (Germany)

• VITRONIC (Germany)

• Artec Europe (Luxembourg)

• Metrasens (U.K.)

• Braun & Company Ltd (U.K.)

• LINEV Group (U.K.)

• Scan‑X Security Ltd (U.K.)

• ScioTeq (U.K.)

• CEIA SpA (Italy)

• Iscon Imaging Inc (Germany)

• Tudor Scan Tech (Switzerland)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.