Europe Hydrogen Sulfide Scavengers Market

Market Size in USD Million

CAGR :

%

USD

59.84 Million

USD

76.85 Million

2024

2032

USD

59.84 Million

USD

76.85 Million

2024

2032

| 2025 –2032 | |

| USD 59.84 Million | |

| USD 76.85 Million | |

|

|

|

Europe Hydrogen Sulfide (H2S) Scavengers Market Analysis

The history of Hydrogen Sulfide (H₂S) scavenger chemicals dates back to the mid-20th century, when industrialization led to the recognition of hydrogen sulfide as a major pollutant and safety hazard in industries like oil and gas, wastewater treatment, and petrochemicals. Early methods to manage H₂S focused on mechanical and physical removal techniques, which proved insufficient for large-scale operations. This prompted the development of chemical solutions designed to neutralize H₂S effectively. In the 1970s and 1980s, increasing environmental awareness and stricter emission regulations drove the innovation of more efficient and specialized H₂S scavengers, such as triazine-based compounds and metal chelates. These advancements allowed industries to comply with environmental standards while improving operational efficiency. Over the years, the demand for environmentally friendly and sustainable scavengers has further accelerated innovation. Today, hydrogen scavengers play a critical role in mitigating H₂S risks, ensuring safety, and protecting the environment in various industrial processes.

Europe Hydrogen Sulfide (H2S) Scavengers Market Size

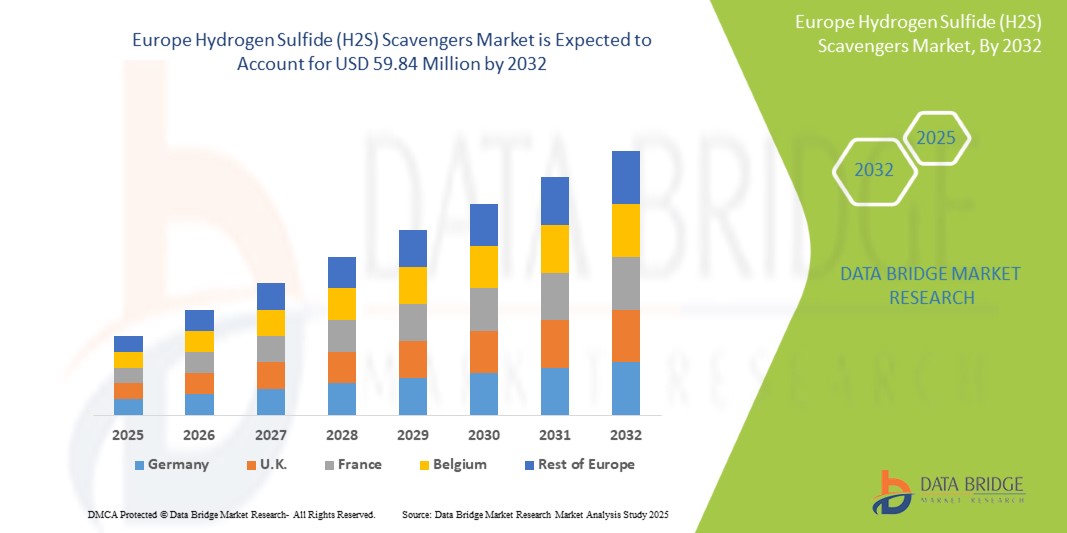

Europe hydrogen sulfide (H2S) scavengers market size was valued at USD 59.84 million in 2024 and is projected to reach USD 76.85 million by 2032, with a CAGR of 3.4% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Europe Hydrogen Sulfide (H2S) Scavengers Market Trends

“Growing Exploration and Production Activities in Oil and Gas Industry”

The growing Exploration and Production (E&P) activities in the Europe oil and gas industry are significantly driving the demand for Hydrogen Sulfide (H₂S) scavengers. As oil and gas companies continue to expand their exploration efforts, particularly in sour gas fields, the need for effective H₂S management becomes increasingly critical. Hydrogen sulfide, a toxic and corrosive gas often present in natural gas and crude oil, poses serious safety, environmental, and operational risks. As a result, the oil and gas industry are increasingly relying on H₂S scavengers to mitigate these risks, ensure compliance with safety regulations, and enhance operational efficiency as exploration and production activities in the oil and gas industry intensify, the need for reliable and efficient hydrogen sulfide scavengers is growing, driving market expansion and innovation.

Report Scope and Europe Hydrogen Sulfide (H2S) Scavengers Market Segmentation

|

Attributes |

Europe Hydrogen Sulfide (H2S) Scavengers Market Insights |

|

Segments Covered |

|

|

Region Covered |

Germany, France, U.K., Spain, Italy, Turkey, Denmark, Russia, Netherlands, Norway, Poland, Belgium, Switzerland, Sweden, Finland, Kazakhstan, and Rest of Europe |

|

Key Market Players |

Baker Hughes Company (U.S.), Ecolab (U.S.), SLB (U.S.), BASF (Germany), Arkema (France), The Lubrizol Corporation (U.S.), Veolia (France), Innospec (U.S.), HEXION INC. (U.S.), Shepherd Chemicals (U.S.), Zirax (Russia), Chemical Products Industries, Inc. (U.S.), Q2Technologies (U.S.), International Chemical Group (U.S.), Al Moghera Petroleum Chem Ind LLC (U.A.E.), Osprey Specialty Group, LLC (U.S.), BERRYMAN CHEMICAL (U.S.), Europe Drilling Fluids & Chemicals Limited (India), Imperial Oilfield Chemicals Pvt. Ltd (India), and NuGenTec (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Hydrogen Sulfide (H2S) Scavengers Market Definition

Hydrogen Sulfide (H₂S) scavengers are chemical agents specifically designed to neutralize and remove hydrogen sulfide, a highly toxic and corrosive gas, from industrial processes, environments, and products. These scavengers work by chemically reacting with H₂S, converting it into non-toxic and stable compounds, thereby mitigating its harmful effects on human health, infrastructure, and the environment. H₂S scavengers are widely utilized in industries such as oil and gas, refining, petrochemicals, wastewater treatment, and pulp and paper, where hydrogen sulfide is commonly produced as a byproduct. They are integral in sour gas processing, refining operations, and wastewater odor control. Scavengers can be categorized into regenerative and non-regenerative types, depending on whether the scavenger can be reused.

Europe Hydrogen Sulfide (H2S) Scavengers Market Definition Dynamics

Drivers

- Increasing Demand for Clean Energy and Natural Gas Processing

The Europe shift towards clean energy solutions and the growing demand for natural gas as a cleaner alternative to traditional fossil fuels are driving the demand for Hydrogen Sulfide (H₂S) scavengers. Natural gas, which is widely regarded as an efficient and environmentally friendly energy source, often contains hydrogen sulfide, a toxic and corrosive compound that must be removed to ensure safety, compliance with environmental regulations, and equipment longevity. This need is a significant factor propelling the growth of the hydrogen sulfide scavengers market.

Beyond oil and gas, other industries such as pulp and paper, wastewater treatment, and chemical manufacturing are also adopting H₂S scavengers to meet local and international environmental standards. For instance, wastewater treatment facilities are utilizing H₂S scavengers to control odor and reduce the corrosive effects of sulfur compounds on infrastructure, ensuring compliance with municipal regulations

For instance, In July 2024, according to article published on EPA website the Clean Air Act (CAA), enforced by the Environmental Protection Agency (EPA), has strict mandates on hazardous air pollutants, including H₂S. Industries like oil & gas and wastewater treatment are required to implement advanced gas treatment solutions to comply with emission limits.

Therefore, the Europe hydrogen sulfide scavengers market is experiencing significant growth driven by the escalating enforcement of environmental regulations aimed at reducing H₂S emissions. Industries across oil and gas, wastewater treatment, and chemical manufacturing are adopting advanced H₂S scavenger technologies to ensure regulatory compliance, safeguard public health, and protect the environment.

- Rising Demand For Clean Water And Wastewater Treatment

Urbanization, industrialization, and population growth have increased the stress on water resources, driving the need for advanced treatment solutions. Hydrogen sulfide not only creates foul odors but also leads to the corrosion of treatment infrastructure and pipelines, escalating maintenance costs. Consequently, municipalities and industries are investing heavily in H₂S scavengers to mitigate these challenges, reduce downtime, and enhance the lifespan of their facilities. In emerging economies across Asia-Pacific, governments are initiating large-scale wastewater treatment projects to combat water scarcity and pollution. For instance, India’s Namami Gange Program and China’s Three-Year Action Plan for Clean Water emphasize improving wastewater treatment infrastructure, fostering the adoption of H₂S scavengers to combat sulfide-related issues

For instance, In July 2021 an article published on The White House official website, the USD 55 billion investment in clean drinking water infrastructure in the United States marks the largest in history, addressing the needs of up to 10 million households and 400,000 schools and childcare centers without safe water. This initiative includes replacing lead service lines and tackling hazardous chemicals like PFAS, ensuring access to safe water for rural, urban, and disadvantaged communities. As Hydrogen Sulfide (H₂S), a common contaminant in wastewater, poses health and environmental risks. The need to eliminate H₂S to meet stringent water safety standards significantly propels the market for H₂S scavengers, critical in ensuring a clean and safe water supply.

As Europe water scarcity intensifies and environmental regulations tighten, the role of H₂S scavengers in enabling clean water and efficient wastewater treatment will continue to grow. This rising demand underscores a lucrative opportunity for manufacturers to develop innovative, eco-friendly, and cost-effective scavenging solutions tailored to diverse treatment needs.

Opportunities

- Technological Advancements and Innovations in Scavenger Formulations

One major innovation is the development of more efficient and cost-effective liquid and solid scavengers. These newer formulations offer superior performance in removing hydrogen sulfide, even in challenging environments with varying concentrations of H₂S. Liquid scavengers, such as amine-based and glyoxal-based solutions, have been optimized to ensure faster reaction times and higher absorption rates, making them suitable for a broader range of industrial applications. Solid scavengers, including metal oxide and iron sponge formulations, have also seen improvements, offering longer-lasting performance with minimal regeneration requirements.

For Instance, In June 2018, according to an article published by Crambeth Allen Publishing Ltd, triazine-based liquid scavengers, combined with advanced equipment, provide cost-effective solutions for removing Hydrogen Sulfide (H₂S) at various production stages. Triazine effectively reduces H₂S concentrations to low levels, with formulations tailored for specific applications, helping producers meet regulatory standards and optimize costs, especially during North America's shale boom

Therefore, ongoing technological advancements and innovations in scavenger formulations are helping industries address the growing challenges of H₂S management. These developments contribute to safer operations, reduced environmental impact, and cost savings, positioning the market for continued growth and evolution.

- Government-Backed Initiatives and Funding in Clean Energy, Environmental Conservation, and Industrial Safety

In clean energy, governments are investing heavily in renewable energy sources like wind, solar, and hydrogen, all of which can produce H₂S emissions during production, extraction, or transportation. To mitigate the environmental impact, these initiatives often include funding for H₂S management solutions, such as advanced scavenger technologies. This encourages the development of more efficient and eco-friendly scavenger formulations, reducing harmful emissions in the process and aligning with Europe sustainability goals.

For instance, In January 2024, according to a blog published by Chemical Products Industries, Inc., hydrogen sulfide scavengers, such as water-based, oil-soluble, regenerative, and solid types, are essential for managing H2S in industrial settings. Each type serves a unique role, from wastewater treatment to oil processing, ensuring worker safety, environmental preservation, and cost-effective, sustainable solutions for H2S removal in various applications

Therfore, government-backed initiatives and funding play a pivotal role in fostering advancements in H₂S scavenger technologies, supporting the growth of cleaner, safer, and more sustainable industrial operations.

Restraints/Challenges

- Environmental Concerns and Impact of Improper Disposal of Some H₂S Scavengers

In industries such as oil and gas, where H₂S scavengers are commonly employed, improper disposal practices can lead to significant ecological damage. For instance, in oilfields and refineries, scavenge used to neutralize H₂S in the production process may contain toxic compounds like heavy metals or other chemicals that are harmful to the environment. If these scavengers are improperly discarded without following proper environmental regulations, they can contaminate local ecosystems, affecting aquatic life, flora, and fauna and posing long-term environmental risks.

For instance, In April 2024 according to an article published on EPA website, the U.S., the Environmental Protection Agency (EPA) regulates the disposal of hazardous waste, including spent hydrogen sulfide scavengers. This prompted a reevaluation of disposal processes across the industry, leading to increased operational costs due to the need to comply with stricter waste disposal standards and invest in environmentally friendly alternatives.

As a result, the market is facing resistance from companies looking for cost-effective solutions while meeting environmental standards. This restraint is particularly felt in price-sensitive regions and industries where environmental compliance adds significant operational costs, affecting the growth potential of the Europe hydrogen sulfide scavenger market.

- Advances in Alternative Gas Treatment and Filtration Technologies

One of the most significant developments in gas treatment is the use of advanced filtration systems, such as molecular sieves, activated carbon, and zeolite-based materials. These materials can efficiently capture and remove H₂S from gas streams, providing a potential alternative to traditional chemical scavengers. These filtration systems often have longer service lives and lower maintenance requirements, making them attractive to industries seeking to minimize downtime and reduce operating costs..

For instance, In June 2022, an article by ResearchGate reviews recent advancements in Hydrogen Sulfide (H₂S) removal, highlighting emerging trends in scavenging technologies. One notable development is the use of solid sorbents for H₂S capture, offering high efficiency and reusability. Such technologies address the challenges of conventional chemical scavengers, reducing operational costs and environmental impact, thus making them an appealing alternative in industrial applications

While these alternative gas treatment technologies offer promising benefits, they also present challenges. For example, the initial capital investment for some filtration or catalytic systems may be higher than traditional scavenger methods. Furthermore, not all alternative technologies are suitable for every industrial application, especially in environments where H₂S concentrations vary or are difficult to predict.

Europe Hydrogen Sulfide (H2S) Scavengers Market Scope

The market is segmented on the basis of product, type, application, and end use. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Non-Regenerative

- Regenerative

Type

- Water Soluble

- Oil-Soluble

- Metal-Based

Application

- Onshore

- Offshore

End-Use

- Natural Gas

- Crude Oil

- Waste Water Treatment

- Intermediates

- Refined Products

Europe Hydrogen Sulfide (H2S) Scavengers Market Regional Analysis

The market is analyzed and market size insights and trends are provided country, product, type, application, and end-user as referenced above.

The region covered in the market are Germany, France, U.K., Spain, Italy, Turkey, Denmark, Russia, Netherlands, Norway, Poland, Belgium, Switzerland, Sweden, Finland, Kazakhstan, and Rest of Europe.

Germany is expected to dominate the market and be the fastest growing country as well as the country benefits from advanced technologies, innovation, and research in chemical processes. Its well-developed infrastructure supports the efficient distribution and application of H2S scavengers.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Europe brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Europe Hydrogen Sulfide (H2S) Scavengers Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Europe Hydrogen Sulfide (H2S) Scavengers Market Leaders Operating in the Market Are:

- Baker Hughes Company (U.S.)

- Ecolab (U.S.)

- SLB (U.S.)

- BASF (Germany)

- Arkema (France)

- The Lubrizol Corporation (U.S.)

- Veolia (France)

- Innospec (U.S.)

- HEXION INC. (U.S.)

- Shepherd Chemicals (U.S.)

- Zirax (Russia)

- Chemical Products Industries, Inc. (U.S.)

- Q2Technologies (U.S.)

- International Chemical Group (U.S.)

- Al Moghera Petroleum Chem Ind LLC (U.A.E.)

- Osprey Specialty Group, LLC (U.S.)

- BERRYMAN CHEMICAL (U.S.)

- Europe Drilling Fluids & Chemicals Limited (India)

- Imperial Oilfield Chemicals Pvt. Ltd (India)

- NuGenTec (U.S.)

Latest Developments in Europe Hydrogen Sulfide (H2S) Scavengers Market

- In May 2024, Baker Hughes has expanded its Dammam facility in Saudi Arabia, adding new manufacturing capabilities and creating 60 jobs. The expansion will enhance compression train production, seal gas panels, vibration monitoring systems, and gear repairs to support major gas and hydrogen projects

- In November 2024, Ecolab has acquired Barclay Water Management, a provider of water safety and digital monitoring solutions. This acquisition enhances Ecolab's offerings, including the iChlor Monochloramine System, and supports growth in North America through improved water safety and operational performance

- In April 2024, BASF and Youyi Group signed a Letter of Intent , to strengthen their strategic partnership. The agreement focuses on supplying butyl acrylate and 2-ethylhexyl acrylate from BASF's Zhanjiang Verbund site to support the growing adhesive materials market in China

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET END-USE COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES ANALYSIS

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREAT OF SUBSTITUTES

4.2.5 INTERNAL COMPETITION

4.3 IMPORT EXPORT SCENARIO

4.4 PRODUCTION CONSUMPTION ANALYSIS

4.5 VENDOR SELECTION CRITERIA

4.5.1 PRODUCT QUALITY AND PERFORMANCE

4.5.2 TECHNOLOGY AND INNOVATION

4.5.3 REGULATORY COMPLIANCE AND SAFETY STANDARDS

4.5.4 COST EFFICIENCY AND VALUE PROPOSITION

4.5.5 CUSTOMER SUPPORT AND SERVICE

4.5.6 REPUTATION AND INDUSTRY EXPERIENCE

4.5.7 SUPPLY CHAIN AND DELIVERY CAPABILITIES

4.5.8 CONCLUSION

4.6 CLIMATE CHANGE SCENARIO OF THE EUROPE HYDROGEN SULFIDE SCAVENGERS MARKET

4.6.1 IMPACT OF CLIMATE CHANGE ON THE OIL AND GAS INDUSTRY

4.6.2 ENVIRONMENTAL REGULATIONS AND SUSTAINABILITY CONCERNS

4.6.3 INCREASED DEMAND FOR CARBON CAPTURE AND STORAGE (CCS)

4.6.4 CLIMATE CHANGE AND THE AVAILABILITY OF RAW MATERIALS

4.6.5 RENEWABLE ENERGY TRANSITION AND IMPACT ON DEMAND

4.6.6 CONCLUSION

4.7 PRICING ANALYSIS OF THE EUROPE HYDROGEN SULFIDE SCAVENGERS MARKET

4.7.1 KEY FACTORS INFLUENCING PRICING

4.7.2 PRICE TRENDS

4.7.3 CONCLUSION

4.8 PRODUCTION CAPACITY OVERVIEW OF THE EUROPE HYDROGEN SULFIDE SCAVENGERS MARKET

4.8.1 MARKET DRIVERS AND DEMAND FOR HYDROGEN SULFIDE SCAVENGERS

4.8.2 KEY TYPES OF HYDROGEN SULFIDE SCAVENGERS

4.8.3 REGIONAL MARKET OVERVIEW

4.8.4 PRODUCTION CAPACITY TRENDS

4.8.5 CONCLUSION

4.9 SUPPLY CHAIN ANALYSIS OF THE EUROPE HYDROGEN SULFIDE SCAVENGERS MARKET

4.9.1 KEY STAGES OF THE SUPPLY CHAIN

4.9.2 CHALLENGES IN THE HYDROGEN SULFIDE SCAVENGERS SUPPLY CHAIN

4.1 EUROPE HYDROGEN SULFIDE SCAVENGERS MARKET: RAW MATERIAL COVERAGE

4.10.1 TYPES OF RAW MATERIALS USED IN H2S SCAVENGER PRODUCTION

4.10.2 RAW MATERIAL SOURCING AND AVAILABILITY

4.10.3 SUSTAINABILITY AND ENVIRONMENTAL CONCERNS

4.10.4 CHALLENGES IN RAW MATERIAL SOURCING

4.10.5 CONCLUSION

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING DEMAND FOR CLEAN ENERGY AND NATURAL GAS PROCESSING

6.1.2 GROWING EXPLORATION AND PRODUCTION ACTIVITIES IN OIL AND GAS INDUSTRY

6.1.3 RISING DEMAND FOR CLEAN WATER AND WASTEWATER TREATMENT

6.2 RESTRAINTS

6.2.1 HIGH COSTS OF HIGH-QUALITY HYDROGEN SULFIDE SCAVENGERS

6.2.2 ENVIRONMENTAL CONCERNS AND IMPACT OF IMPROPER DISPOSAL OF SOME H₂S SCAVENGERS

6.3 OPPORTUNITIES

6.3.1 TECHNOLOGICAL ADVANCEMENTS AND INNOVATIONS IN SCAVENGER FORMULATIONS

6.3.2 GOVERNMENT-BACKED INITIATIVES AND FUNDING IN CLEAN ENERGY, ENVIRONMENTAL CONSERVATION, AND INDUSTRIAL SAFETY

6.3.3 EXPANSION OF THE CHEMICAL AND INDUSTRIAL MANUFACTURING SECTORS

6.4 CHALLENGES

6.4.1 RAPID DEGRADATION AND LIMITED EFFECTIVENESS OF CERTAIN HYDROGEN SULFIDE SCAVENGERS

6.4.2 ADVANCES IN ALTERNATIVE GAS TREATMENT AND FILTRATION TECHNOLOGIES

7 EUROPE HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 NON-REGENERATIVE

7.3 REGENERATIVE

8 EUROPE HYDROGEN SULFIDE SCAVENGERS MARKET, BY TYPE

8.1 OVERVIEW

8.2 WATER SOLUBLE

8.3 OIL-SOLUBLE

8.4 METAL-BASED

9 EUROPE HYDROGEN SULFIDE SCAVENGERS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 ONSHORE

9.3 OFFSHORE

10 EUROPE HYDROGEN SULFIDE SCAVENGERS MARKET, BY END-USE

10.1 OVERVIEW

10.2 NATURAL GAS

10.3 CRUDE OIL

10.4 WASTE WATER TREATMENT

10.5 INTERMEDIATES

10.6 REFINED PRODUCTS

10.7 OTHERS

11 EUROPE HYDROGEN SULFIDE SCAVENGERS MARKET, BY REGION

11.1 EUROPE

11.1.1 GERMANY

11.1.2 FRANCE

11.1.3 U.K.

11.1.4 SPAIN

11.1.5 ITALY

11.1.6 TURKEY

11.1.7 DENMARK

11.1.8 RUSSIA

11.1.9 NETHERLANDS

11.1.10 NORWAY

11.1.11 POLAND

11.1.12 BELGIUM

11.1.13 SWITZERLAND

11.1.14 SWEDEN

11.1.15 FINLAND

11.1.16 KAZAKHSTAN

11.1.17 REST OF EUROPE

12 EUROPE HYDROGEN SULFIDE SCAVENGERS MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: EUROPE

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 BAKER HUGHES COMPANY

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 ECOLAB

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 SLB

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENT

14.4 BASF

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 ARKEMA

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 AL MOGHERA PETROLEUM CHEMICALS INDUSTRY LLC

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 BERRYMAN CHEMICAL.

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 CHEMICAL PRODUCTS INDUSTRIES, INC.

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 EUROPE DRILLING FLUIDS & CHEMICALS LIMITED

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 HEXION INC.

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 IMPERIAL OILFIELD CHEMICALS PVT LTD.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 INNOSPEC

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENT

14.13 INTERNATIONAL CHEMICAL SERVICE LTD.

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 NUGENTEC

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 OSPREY SPECIALTY GROUP, LLC

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 Q2TECHNOLOGIES

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 SHEPHERD CHEMICALS

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENT

14.18 THE LUBRIZOL CORPORATION

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENT

14.19 VEOLIA

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENT

14.2 ZIRAX

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 REGULATORY COVERAGE

TABLE 2 EUROPE HYDROGEN SULFIDE SCAVENGERS MARKET: BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 3 EUROPE HYDROGEN SULFIDE SCAVENGERS MARKET: BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 4 EUROPE NON-REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 5 EUROPE NON-REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 6 EUROPE NON-REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 7 EUROPE TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 8 EUROPE TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 9 EUROPE REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 EUROPE REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 11 EUROPE REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 12 EUROPE HYDROGEN SULFIDE SCAVENGERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 EUROPE WATER-SOLUBLE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 EUROPE OIL-SOLUBLE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 EUROPE METAL-BASED IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 EUROPE HYDROGEN SULFIDE SCAVENGERS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 17 EUROPE ONSHORE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 EUROPE OFFSHORE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 EUROPE HYDROGEN SULFIDE SCAVENGERS MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 20 EUROPE NATURAL GAS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 EUROPE NATURAL GAS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 22 EUROPE CRUDE OIL IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 EUROPE CRUDE OIL IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 24 EUROPE WASTE WATER TREATMENT IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 EUROPE WASTE WATER TREATMENT IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 26 EUROPE INTERMEDIATES IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 EUROPE INTERMEDIATES IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 28 EUROPE REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 EUROPE REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 30 EUROPE REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 31 EUROPE OTHERS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 EUROPE OTHERS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 33 EUROPE HYDROGEN SULFIDE SCAVENGERS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 34 EUROPE HYDROGEN SULFIDE SCAVENGERS MARKET, BY COUNTRY, 2018-2032 (KILO TONS)

TABLE 35 EUROPE HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 36 EUROPE HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 37 EUROPE NON-REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 38 EUROPE TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 39 EUROPE TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 40 EUROPE REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 41 EUROPE HYDROGEN SULFIDE SCAVENGERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 EUROPE HYDROGEN SULFIDE SCAVENGERS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 43 EUROPE HYDROGEN SULFIDE SCAVENGERS MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 44 EUROPE NATURAL GAS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 45 EUROPE CRUDE OIL IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 46 EUROPE WASTE WATER TREATMENT IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 47 EUROPE INTERMEDIATES IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 48 EUROPE REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 49 EUROPE REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 50 EUROPE OTHERS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 51 GERMANY HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 52 GERMANY HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 53 GERMANY NON-REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 54 GERMANY TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 55 GERMANY TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 56 GERMANY REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 57 GERMANY HYDROGEN SULFIDE SCAVENGERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 GERMANY HYDROGEN SULFIDE SCAVENGERS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 59 GERMANY HYDROGEN SULFIDE SCAVENGERS MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 60 GERMANY NATURAL GAS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 61 GERMANY CRUDE OIL IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 62 GERMANY WASTE WATER TREATMENT IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 63 GERMANY INTERMEDIATES IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 64 GERMANY REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 65 GERMANY REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 66 GERMANY OTHERS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 67 FRANCE HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 68 FRANCE HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 69 FRANCE NON-REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 70 FRANCE TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 71 FRANCE TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 72 FRANCE REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 73 FRANCE HYDROGEN SULFIDE SCAVENGERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 FRANCE HYDROGEN SULFIDE SCAVENGERS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 75 FRANCE HYDROGEN SULFIDE SCAVENGERS MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 76 FRANCE NATURAL GAS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 77 FRANCE CRUDE OIL IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 78 FRANCE WASTE WATER TREATMENT IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 79 FRANCE INTERMEDIATES IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 80 FRANCE REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 81 FRANCE REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 82 FRANCE OTHERS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 83 U.K. HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 84 U.K. HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 85 U.K. NON-REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 86 U.K. TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 87 U.K. TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 88 U.K. REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 89 U.K. HYDROGEN SULFIDE SCAVENGERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 U.K. HYDROGEN SULFIDE SCAVENGERS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 91 U.K. HYDROGEN SULFIDE SCAVENGERS MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 92 U.K. NATURAL GAS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 93 U.K. CRUDE OIL IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 94 U.K. WASTE WATER TREATMENT IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 95 U.K. INTERMEDIATES IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 96 U.K. REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 97 U.K. REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 98 U.K. OTHERS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 99 SPAIN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 100 SPAIN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 101 SPAIN NON-REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 102 SPAIN TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 103 SPAIN TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 104 SPAIN REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 105 SPAIN HYDROGEN SULFIDE SCAVENGERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 SPAIN HYDROGEN SULFIDE SCAVENGERS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 107 SPAIN HYDROGEN SULFIDE SCAVENGERS MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 108 SPAIN NATURAL GAS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 109 SPAIN CRUDE OIL IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 110 SPAIN WASTE WATER TREATMENT IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 111 SPAIN INTERMEDIATES IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 112 SPAIN REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 113 SPAIN REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 114 SPAIN OTHERS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 115 ITALY HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 116 ITALY HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 117 ITALY NON-REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 118 ITALY TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 119 ITALY TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 120 ITALY REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 121 ITALY HYDROGEN SULFIDE SCAVENGERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 ITALY HYDROGEN SULFIDE SCAVENGERS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 123 ITALY HYDROGEN SULFIDE SCAVENGERS MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 124 ITALY NATURAL GAS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 125 ITALY CRUDE OIL IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 126 ITALY WASTE WATER TREATMENT IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 127 ITALY INTERMEDIATES IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 128 ITALY REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 129 ITALY REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 130 ITALY OTHERS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 131 TURKEY HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 132 TURKEY HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 133 TURKEY NON-REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 134 TURKEY TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 135 TURKEY TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 136 TURKEY REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 137 TURKEY HYDROGEN SULFIDE SCAVENGERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 TURKEY HYDROGEN SULFIDE SCAVENGERS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 139 TURKEY HYDROGEN SULFIDE SCAVENGERS MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 140 TURKEY NATURAL GAS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 141 TURKEY CRUDE OIL IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 142 TURKEY WASTE WATER TREATMENT IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 143 TURKEY INTERMEDIATES IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 144 TURKEY REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 145 TURKEY REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 146 TURKEY OTHERS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 147 DENMARK HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 148 DENMARK HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 149 DENMARK NON-REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 150 DENMARK TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 151 DENMARK TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 152 DENMARK REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 153 DENMARK HYDROGEN SULFIDE SCAVENGERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 DENMARK HYDROGEN SULFIDE SCAVENGERS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 155 DENMARK HYDROGEN SULFIDE SCAVENGERS MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 156 DENMARK NATURAL GAS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 157 DENMARK CRUDE OIL IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 158 DENMARK WASTE WATER TREATMENT IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 159 DENMARK INTERMEDIATES IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 160 DENMARK REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 161 DENMARK REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 162 DENMARK OTHERS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 163 RUSSIA HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 164 RUSSIA HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 165 RUSSIA NON-REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 166 RUSSIA TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 167 RUSSIA TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 168 RUSSIA REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 169 RUSSIA HYDROGEN SULFIDE SCAVENGERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 RUSSIA HYDROGEN SULFIDE SCAVENGERS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 171 RUSSIA HYDROGEN SULFIDE SCAVENGERS MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 172 RUSSIA NATURAL GAS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 173 RUSSIA CRUDE OIL IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 174 RUSSIA WASTE WATER TREATMENT IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 175 RUSSIA INTERMEDIATES IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 176 RUSSIA REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 177 RUSSIA REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 178 RUSSIA OTHERS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 179 NETHERLANDS HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 180 NETHERLANDS HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 181 NETHERLANDS NON-REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 182 NETHERLANDS TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 183 NETHERLANDS TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 184 NETHERLANDS REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 185 NETHERLANDS HYDROGEN SULFIDE SCAVENGERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 NETHERLANDS HYDROGEN SULFIDE SCAVENGERS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 187 NETHERLANDS HYDROGEN SULFIDE SCAVENGERS MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 188 NETHERLANDS NATURAL GAS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 189 NETHERLANDS CRUDE OIL IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 190 NETHERLANDS WASTE WATER TREATMENT IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 191 NETHERLANDS INTERMEDIATES IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 192 NETHERLANDS REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 193 NETHERLANDS REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 194 NETHERLANDS OTHERS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 195 NORWAY HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 196 NORWAY HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 197 NORWAY NON-REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 198 NORWAY TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 199 NORWAY TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 200 NORWAY REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 201 NORWAY HYDROGEN SULFIDE SCAVENGERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 NORWAY HYDROGEN SULFIDE SCAVENGERS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 203 NORWAY HYDROGEN SULFIDE SCAVENGERS MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 204 NORWAY NATURAL GAS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 205 NORWAY CRUDE OIL IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 206 NORWAY WASTE WATER TREATMENT IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 207 NORWAY INTERMEDIATES IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 208 NORWAY REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 209 NORWAY REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 210 NORWAY OTHERS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 211 POLAND HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 212 POLAND HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 213 POLAND NON-REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 214 POLAND TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 215 POLAND TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 216 POLAND REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 217 POLAND HYDROGEN SULFIDE SCAVENGERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 POLAND HYDROGEN SULFIDE SCAVENGERS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 219 POLAND HYDROGEN SULFIDE SCAVENGERS MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 220 POLAND NATURAL GAS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 221 POLAND CRUDE OIL IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 222 POLAND WASTE WATER TREATMENT IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 223 POLAND INTERMEDIATES IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 224 POLAND REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 225 POLAND REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 226 POLAND OTHERS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 227 BELGIUM HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 228 BELGIUM HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 229 BELGIUM NON-REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 230 BELGIUM TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 231 BELGIUM TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 232 BELGIUM REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 233 BELGIUM HYDROGEN SULFIDE SCAVENGERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 BELGIUM HYDROGEN SULFIDE SCAVENGERS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 235 BELGIUM HYDROGEN SULFIDE SCAVENGERS MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 236 BELGIUM NATURAL GAS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 237 BELGIUM CRUDE OIL IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 238 BELGIUM WASTE WATER TREATMENT IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 239 BELGIUM INTERMEDIATES IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 240 BELGIUM REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 241 BELGIUM REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 242 BELGIUM OTHERS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 243 SWITZERLAND HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 244 SWITZERLAND HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 245 SWITZERLAND NON-REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 246 SWITZERLAND TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 247 SWITZERLAND TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 248 SWITZERLAND REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 249 SWITZERLAND HYDROGEN SULFIDE SCAVENGERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 250 SWITZERLAND HYDROGEN SULFIDE SCAVENGERS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 251 SWITZERLAND HYDROGEN SULFIDE SCAVENGERS MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 252 SWITZERLAND NATURAL GAS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 253 SWITZERLAND CRUDE OIL IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 254 SWITZERLAND WASTE WATER TREATMENT IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 255 SWITZERLAND INTERMEDIATES IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 256 SWITZERLAND REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 257 SWITZERLAND REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 258 SWITZERLAND OTHERS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 259 SWEDEN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 260 SWEDEN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 261 SWEDEN NON-REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 262 SWEDEN TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 263 SWEDEN TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 264 SWEDEN REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 265 SWEDEN HYDROGEN SULFIDE SCAVENGERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 266 SWEDEN HYDROGEN SULFIDE SCAVENGERS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 267 SWEDEN HYDROGEN SULFIDE SCAVENGERS MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 268 SWEDEN NATURAL GAS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 269 SWEDEN CRUDE OIL IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 270 SWEDEN WASTE WATER TREATMENT IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 271 SWEDEN INTERMEDIATES IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 272 SWEDEN REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 273 SWEDEN REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 274 SWEDEN OTHERS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 275 FINLAND HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 276 FINLAND HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 277 FINLAND NON-REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 278 FINLAND TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 279 FINLAND TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 280 FINLAND REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 281 FINLAND HYDROGEN SULFIDE SCAVENGERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 282 FINLAND HYDROGEN SULFIDE SCAVENGERS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 283 FINLAND HYDROGEN SULFIDE SCAVENGERS MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 284 FINLAND NATURAL GAS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 285 FINLAND CRUDE OIL IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 286 FINLAND WASTE WATER TREATMENT IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 287 FINLAND INTERMEDIATES IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 288 FINLAND REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 289 FINLAND REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 290 FINLAND OTHERS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 291 KAZAKHSTAN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 292 KAZAKHSTAN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 293 KAZAKHSTAN NON-REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 294 KAZAKHSTAN TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 295 KAZAKHSTAN TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 296 KAZAKHSTAN REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 297 KAZAKHSTAN HYDROGEN SULFIDE SCAVENGERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 298 KAZAKHSTAN HYDROGEN SULFIDE SCAVENGERS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 299 KAZAKHSTAN HYDROGEN SULFIDE SCAVENGERS MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 300 KAZAKHSTAN NATURAL GAS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 301 KAZAKHSTAN CRUDE OIL IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 302 KAZAKHSTAN WASTE WATER TREATMENT IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 303 KAZAKHSTAN INTERMEDIATES IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 304 KAZAKHSTAN REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 305 KAZAKHSTAN REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 306 KAZAKHSTAN OTHERS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 307 REST OF EUROPE HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 308 REST OF EUROPE HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

List of Figure

FIGURE 1 EUROPE HYDROGEN SULFIDE SCAVENGERS MARKET

FIGURE 2 EUROPE HYDROGEN SULFIDE SCAVENGERS MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE HYDROGEN SULFIDE SCAVENGERS MARKET: DROC ANALYSIS

FIGURE 4 EUROPE HYDROGEN SULFIDE SCAVENGERS MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE HYDROGEN SULFIDE SCAVENGERS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE HYDROGEN SULFIDE SCAVENGERS MARKET: MULTIVARIATE MODELLING

FIGURE 7 EUROPE HYDROGEN SULFIDE SCAVENGERS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 EUROPE HYDROGEN SULFIDE SCAVENGERS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE HYDROGEN SULFIDE SCAVENGERS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE HYDROGEN SULFIDE SCAVENGERS MARKET, END-USE COVERAGE GRID

FIGURE 11 EUROPE HYDROGEN SULFIDE SCAVENGERS MARKET: SEGMENTATION

FIGURE 12 TWO SEGMENTS COMPRISE THE EUROPE HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT (2024)

FIGURE 13 EXECUTIVE SUMMARY

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 INCREASING DEMAND FOR CLEAN ENERGY AND NATURAL GAS PROCESSING IS EXPECTED TO DRIVE THE EUROPE HYDROGEN SULFIDE SCAVENGERS MARKET IN THE FORECAST PERIOD (2025-2032)

FIGURE 16 THE NON-REGENERATIVE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE HYDROGEN SULFIDE SCAVENGERS MARKET IN 2025 AND 2032

FIGURE 17 PESTEL ANALYSIS

FIGURE 18 PORTER’S FIVE FORCES ANALYSIS

FIGURE 19 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 20 PRODUCTION CONSUMPTION ANALYSIS

FIGURE 21 VENDOR SELECTION CRITERIA

FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR EUROPE HYDROGEN SULFIDE SCAVENGERS MARKET

FIGURE 23 EUROPE HYDROGEN SULFIDE SCAVENGERS MARKET: BY PRODUCT, 2024

FIGURE 24 EUROPE HYDROGEN SULFIDE SCAVENGERS MARKET, BY TYPE, 2024

FIGURE 25 EUROPE HYDROGEN SULFIDE SCAVENGERS MARKET, BY APPLICATION, 2024

FIGURE 26 EUROPE HYDROGEN SULFIDE SCAVENGERS MARKET, BY END-USE, 2024

FIGURE 27 EUROPE HYDROGEN SULFIDE SCAVENGERS MARKET: SNAPSHOT (2024)

FIGURE 28 EUROPE HYDROGEN SULFIDE SCAVENGERS MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.