Europe Major Domestic Cooking Appliances Market

Market Size in USD Billion

CAGR :

%

USD

20.97 Billion

USD

36.58 Billion

2025

2033

USD

20.97 Billion

USD

36.58 Billion

2025

2033

| 2026 –2033 | |

| USD 20.97 Billion | |

| USD 36.58 Billion | |

|

|

|

|

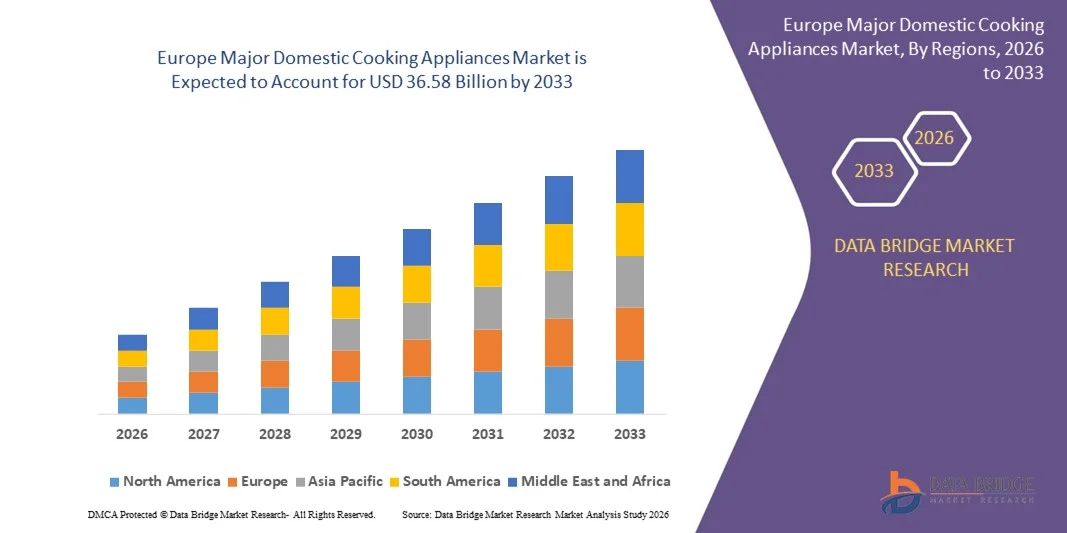

What is the Europe Major Domestic Cooking Appliances Market Size and Growth Rate?

- The Europe major domestic cooking appliances market size was valued at USD 20.97 billion in 2025 and is expected to reach USD 36.58 billion by 2033, at a CAGR of 7.20% during the forecast period

- The major domestic cooking appliances market is witnessing significant growth, driven by increasing urbanization, rising disposable incomes, and a growing demand for convenient and efficient kitchen solutions. Consumers are increasingly seeking advanced cooking appliances with innovative features such as touch-screen interfaces, smart sensors, and Wi-Fi connectivity to enhance functionality and convenience

- Technological advancements are driving innovation in the major domestic cooking appliances market, enhancing functionality and convenience. E-commerce platforms are playing a crucial role in market expansion by providing easy access to a wide range of products, catering to the preferences of tech-savvy consumers

What are the Major Takeaways of Major Domestic Cooking Appliances Market?

- The adoption of smart home technologies is also contributing to growth in the major domestic cooking appliances market. Integration with voice assistants, mobile apps, and home automation systems allows users to remotely control electric cooking appliances and receive notifications

- Smart features such as pre-programmed cooking modes and recipe suggestions further streamline meal preparation, enhancing convenience and efficiency. This trend underscores the growing consumer interest in connected living environments, driving demand for technologically advanced kitchen appliances

- Germany dominated the Europe major domestic cooking appliances market with the largest revenue share of 43.26% in 2024, driven by high household penetration of premium cooking appliances, strong consumer preference for energy-efficient and smart kitchen solutions, and the presence of leading appliance manufacturers with advanced production capabilities

- The France Major Domestic Cooking Appliances market is witnessing the fastest growth at a CAGR of 9.41%, supported by rising demand for modern kitchen upgrades, increasing adoption of smart and energy-efficient appliances, and growth in residential renovation activities

- The Cooker segment dominated the market with the largest revenue share of 31.8% in 2024, driven by its widespread use across residential households due to convenience, multi-functionality, and affordability

Report Scope and Major Domestic Cooking Appliances Market Segmentation

|

Attributes |

Major Domestic Cooking Appliances Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Major Domestic Cooking Appliances Market?

Enhanced Convenience through AI and Voice Integration

- A prominent and rapidly evolving trend in the major domestic cooking appliances market is the integration of artificial intelligence (AI) and voice-controlled ecosystems such as Amazon Alexa, Google Assistant, and Apple HomeKit. These technologies are enhancing user convenience by enabling intelligent cooking, remote control, and energy-efficient operation

- For instance, Samsung’s SmartThings Cooking platform uses AI to recommend recipes based on dietary preferences and automates cooking settings across connected ovens and microwaves, while LG ThinQ appliances can be voice-controlled and synced with other smart home devices

- AI-powered cooking appliances can learn user behavior, automate temperature control, and provide real-time alerts for overcooking or energy optimization. Brands such as Whirlpool have introduced smart ovens with AI-based sensors that automatically adjust cooking times and power levels based on the dish being prepared

- Voice integration allows users to preheat ovens, set timers, or check the cooking status using voice commands, promoting hands-free operation in busy households

- This convergence of smart technology and culinary convenience is redefining user expectations, especially in premium and urban markets, where consumers value speed, automation, and minimal effort in kitchen management

- As a result, companies are focusing on launching AI-enabled and voice-compatible cooking appliances that align with growing demand for connected kitchen ecosystems and enhance the overall smart home experience

What are the Key Drivers of Major Domestic Cooking Appliances Market?

- Growing urbanization, rising disposable incomes, and the demand for modern kitchen solutions are key drivers propelling the growth of the major domestic cooking appliances market globally

- For instance, in February 2024, Electrolux launched a new range of smart ovens and cooktops embedded with AI cooking assistants and energy-saving features, targeting premium users in Europe and North America

- Consumers are increasingly shifting towards appliances that offer efficiency, multi-functionality, and smart features, particularly in compact urban kitchens

- The rise of dual-income households and time-constrained lifestyles is boosting demand for cooking appliances that reduce preparation time and automate cooking processes

- In addition, the expansion of e-commerce platforms and online product reviews has made advanced appliances more accessible, while product innovations such as induction cooking, touch controls, and self-cleaning ovens are creating new opportunities for manufacturers

- Environmental awareness is also influencing purchase decisions, leading to higher sales of energy-efficient and eco-certified appliances, further boosting market growth across both developed and developing regions

Which Factor is Challenging the Growth of the Major Domestic Cooking Appliances Market?

- One of the main challenges facing the major domestic cooking appliances market is the high cost of smart and premium appliances, which can hinder adoption in price-sensitive markets

- For instance, while AI-powered ovens and induction cooktops offer advanced capabilities, their initial investment is significantly higher compared to traditional gas or electric models, limiting demand in low- and middle-income households

- In addition, technical complexities associated with connected cooking devices such as Wi-Fi configuration, software updates, or device interoperability can deter non-tech-savvy consumers, especially in older age groups

- Data privacy and cybersecurity are also emerging concerns, as more appliances become connected to cloud platforms and mobile applications

- Reports of data breaches in smart home devices raise skepticism about privacy and system reliability. Manufacturers must ensure robust encryption, secure connectivity, and transparent data handling practices to build consumer trust

- Lastly, limited awareness in rural regions and reliance on traditional cooking methods in emerging markets also constrain market penetration. Bridging this gap through consumer education, localized marketing, and affordable product lines will be essential for long-term, inclusive market expansion

How is the Major Domestic Cooking Appliances Market Segmented?

The market is segmented on the basis of type, power, structure, and distribution channel.

- By Type

On the basis of type, the major domestic cooking appliances market is segmented into Built-In Hobs, Cooker, Microwaves, Cooktops, Hot Plate, and Others. The Cooker segment dominated the market with the largest revenue share of 31.8% in 2024, driven by its widespread use across residential households due to convenience, multi-functionality, and affordability. Cookers are considered essential kitchen appliances, offering both pressure and electric cooking variants that cater to different consumer needs.

The Built-In Hobs segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the rise in modular kitchen installations, especially in urban settings. These hobs offer a sleek design, space efficiency, and advanced safety features, making them highly preferred in premium and modern homes.

- By Power

On the basis of power, the market is segmented into Electric Powered and Gas Powered appliances. The Electric Powered segment accounted for the largest market revenue share of 56.3% in 2024, due to increasing adoption of induction cooktops, electric ovens, and microwaves. Electric appliances are valued for their ease of use, precise temperature control, and compatibility with smart technology.

The Gas Powered segment is projected to grow at the fastest CAGR from 2025 to 2032, especially in regions with stable gas infrastructure and consumer preference for flame-based cooking, which offers visual control and traditional taste benefits.

- By Structure

On the basis of structure, the major domestic cooking appliances market is segmented into Built-in and Freestanding units. The Freestanding segment dominated the market with the largest share of 63.5% in 2024, supported by its flexibility in placement, lower installation costs, and strong presence in both developing and developed regions. These appliances are popular among renters and budget-conscious consumers.

However, the Built-in segment is anticipated to witness the fastest CAGR from 2025 to 2032, as demand for integrated, aesthetically pleasing kitchen designs grows among urban consumers and real estate developers.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Supermarket, Specialty Store, E-Commerce, and Others. The Supermarket segment held the largest market share of 37.6% in 2024, driven by the preference for physical inspection of appliances before purchase, availability of multiple brands under one roof, and attractive promotional offers.

The E-Commerce segment is expected to register the fastest CAGR from 2025 to 2032, as consumers increasingly shift toward online platforms for convenience, wider product variety, and access to reviews. Online platforms also enable brands to reach tier 2 and tier 3 cities without extensive physical retail networks.

Which Region Holds the Largest Share of the Major Domestic Cooking Appliances Market?

- Germany dominated the Europe major domestic cooking appliances market with the largest revenue share of 43.26% in 2024, driven by high household penetration of premium cooking appliances, strong consumer preference for energy-efficient and smart kitchen solutions, and the presence of leading appliance manufacturers with advanced production capabilities

- Widespread adoption of built-in ovens, induction cooktops, smart ranges, and connected cooking appliances across urban households is strengthening regional market leadership

- Stringent energy efficiency regulations, strong focus on sustainable manufacturing, and integration of IoT-enabled and AI-driven smart appliances position Europe as one of the most technology-advanced regional markets

France Major Domestic Cooking Appliances Market Insight

The France Major Domestic Cooking Appliances market is witnessing the fastest growth at a CAGR of 9.41%, supported by rising demand for modern kitchen upgrades, increasing adoption of smart and energy-efficient appliances, and growth in residential renovation activities. Expanding use of built-in cooking appliances and multifunctional ovens is improving convenience and energy savings. Strong regulatory standards, government incentives for energy-efficient appliances, and innovation by domestic and international brands are reinforcing France’s role as a high-growth market in the Europe landscape.

Italy Major Domestic Cooking Appliances Market Insight

The Italy Major Domestic Cooking Appliances market is expanding at a healthy pace, driven by strong culinary culture, rising demand for premium and design-oriented cooking appliances, and increasing urbanization. Growing deployment of induction cooktops, advanced range hoods, and integrated cooking solutions is enhancing household efficiency and aesthetics. Emphasis on product design, energy efficiency, and continuous technological innovation positions Italy as an important growth contributor within the Europe Major Domestic Cooking Appliances market.

Which are the Top Companies in Major Domestic Cooking Appliances Market?

The major domestic cooking appliances industry is primarily led by well-established companies, including:

- AB Electrolux (Sweden)

- Whirlpool Corporation (U.S.)

- Samsung Electronics (South Korea)

- LG Electronics (South Korea)

- Panasonic Corporation (Japan)

- Koninklijke Philips N.V. (Netherlands)

- Morphy Richards (U.K.)

- TTK Prestige Ltd (India)

- GE Appliances (U.S.)

- Dacor, Inc. (U.S.)

- Sichuan Changhong Electric Co., Ltd. (China)

- GREE ELECTRIC APPLIANCES, INC. (China)

- Hitachi, Ltd. (Japan)

- BSH Hausgeräte GmbH (Germany)

- Balaji Home Shop (India)

- Lords Home Solutions (India)

What are the Recent Developments in Global Major Domestic Cooking Appliances Market?

- In March 2023, Butterfly Gandhimathi Appliances merged with Crompton Greaves Consumer Electricals Ltd. (CGCEL) to strengthen its presence in the major domestic cooking appliances market. This strategic merger aims to capitalize on synergies, drive innovation in product development, and implement robust marketing strategies to enhance their competitive position in the industry

- In May 2021, Whirlpool Corporation announced a USD 15 million investment in its Oklahoma factory to expand manufacturing capabilities and foster innovation. This initiative reflects Whirlpool's dedication to delivering high-quality consumer products, stimulating job growth, and reinforcing its leadership in the major domestic cooking appliances market through advanced manufacturing capabilities

- In April 2021, Electrolux was honored with four Red Dot Design Awards for its Electrolux and AEG brands, recognizing excellence in innovation, functionality, quality, and ergonomics. This accolade highlights Electrolux's commitment to design excellence and innovation, bolstering its competitive advantage in the major domestic cooking appliances market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.