Market Analysis and Insights

Sensors are devices or machines used to detect the presence of any physical object in the vicinity and send information about the same to the receiving end. The device is mostly used with other electronic devices. Any physical quantity, such as pressure, force, strain, light, and others, can be identified and converted into a desired electrical signal. These are classified as analogue and digital sensors. Others include temperature, ultrasonic, pressure, and proximity sensors. They use less energy and have high performance. Data is collected from the environment using sensors for the internet of things.

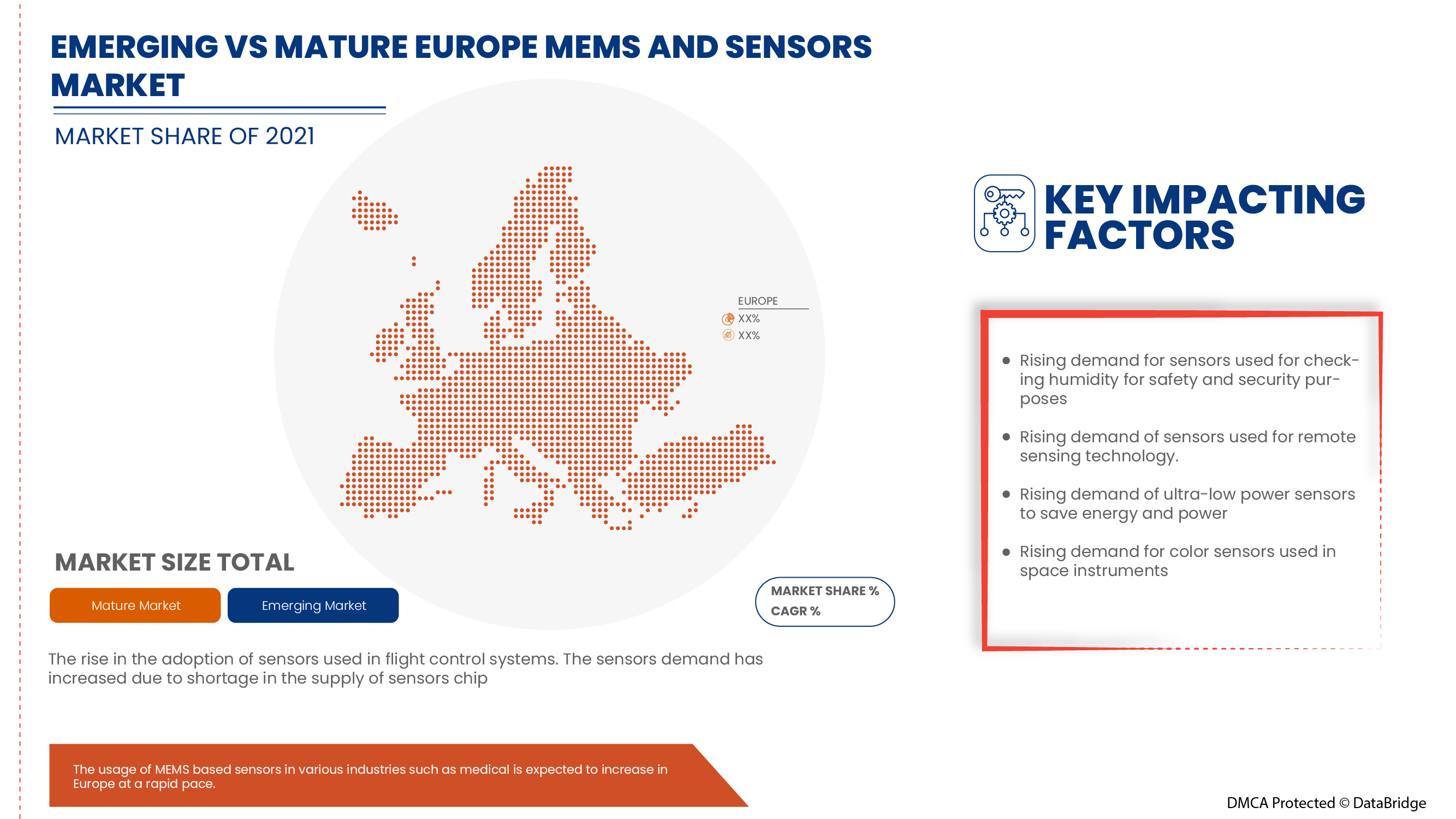

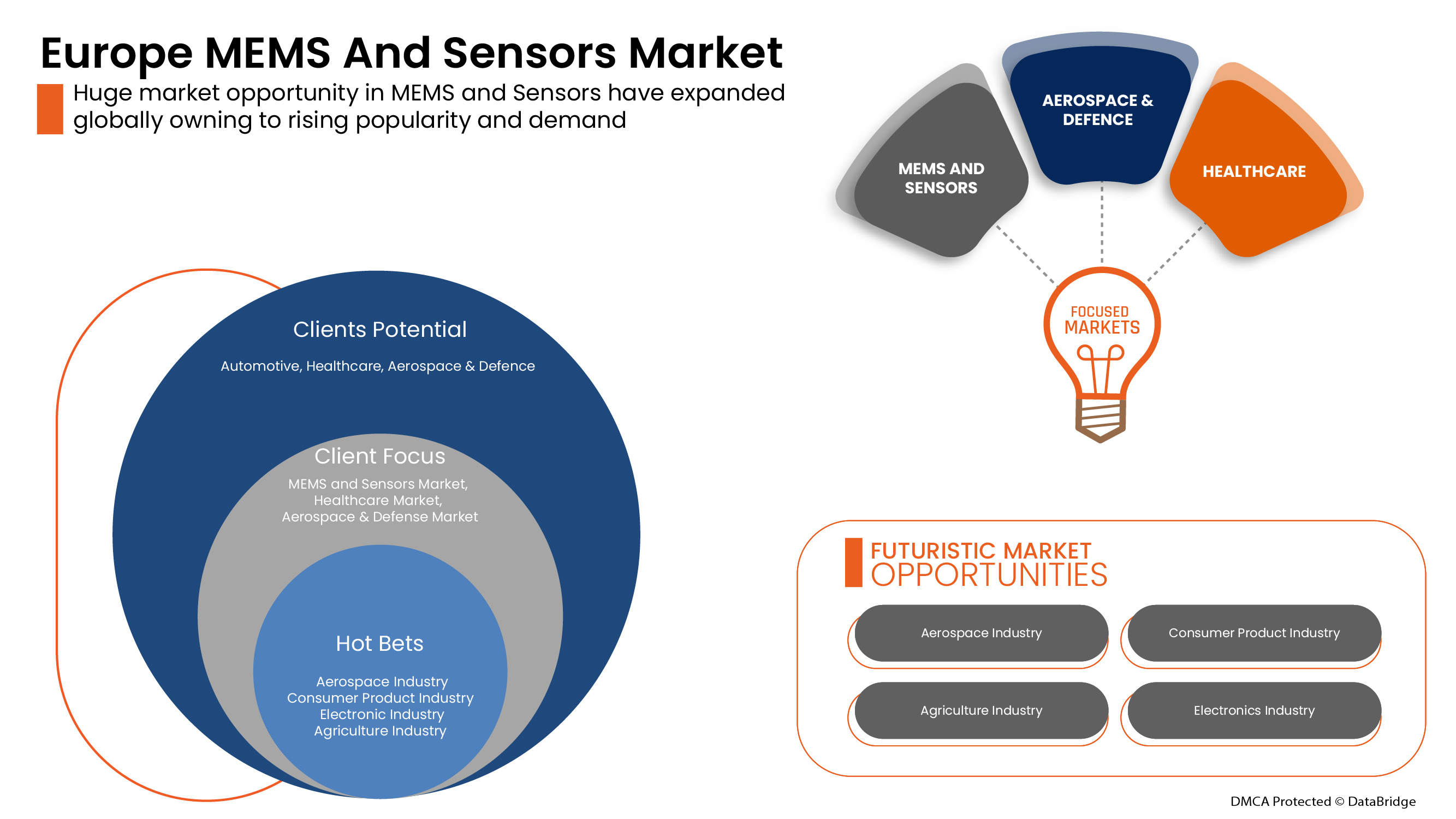

Technological developments in the semiconductor industry have increased the manufacturing of application-based and MEMS technology-based sensors used for various factors such as smart grid infrastructure, smart home appliances, and others. This has been made possible as the population is increasingly inclined toward digital platforms, internet services, and online services for their daily requirements. The growing popularity of IoT-based devices in semiconductors is increasing the demand for smart consumer electronics and wearables. It is expected that the Europe MEMS and Sensors market is going to boom in the future.

Currently, the importance of MEMS device has grown drastically, and the growth of inertial sensor, ultrasonic sensor, and packaging size based services across Europe. In addition, the growing demand for MEMS and sensor in various sectors has fuelled the market boom. Data Bridge Market Research analyses that the Europe MEMS and sensors market will grow CAGR of 8.9% during the forecast period of 2022 to 2029.

Market Definition

MEMS is an integrated system of mechanical and electro-mechanical devices and structures manufactured using micro fabrication techniques. A MEMS device consists of three-dimensional properties which sense and manipulate any physical or chemical property. Basic components using micro sensors, micro actuators, and other microstructures are fabricated on a single silicon substrate. Basic components of MEMS devices include micro-sensors and micro-actuators, which convert one form of energy into another. A MEMS device can have static or movable components whose physical dimension varies from below one micron to several millimetres.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Thousand, Pricing in USD |

|

Segments Covered |

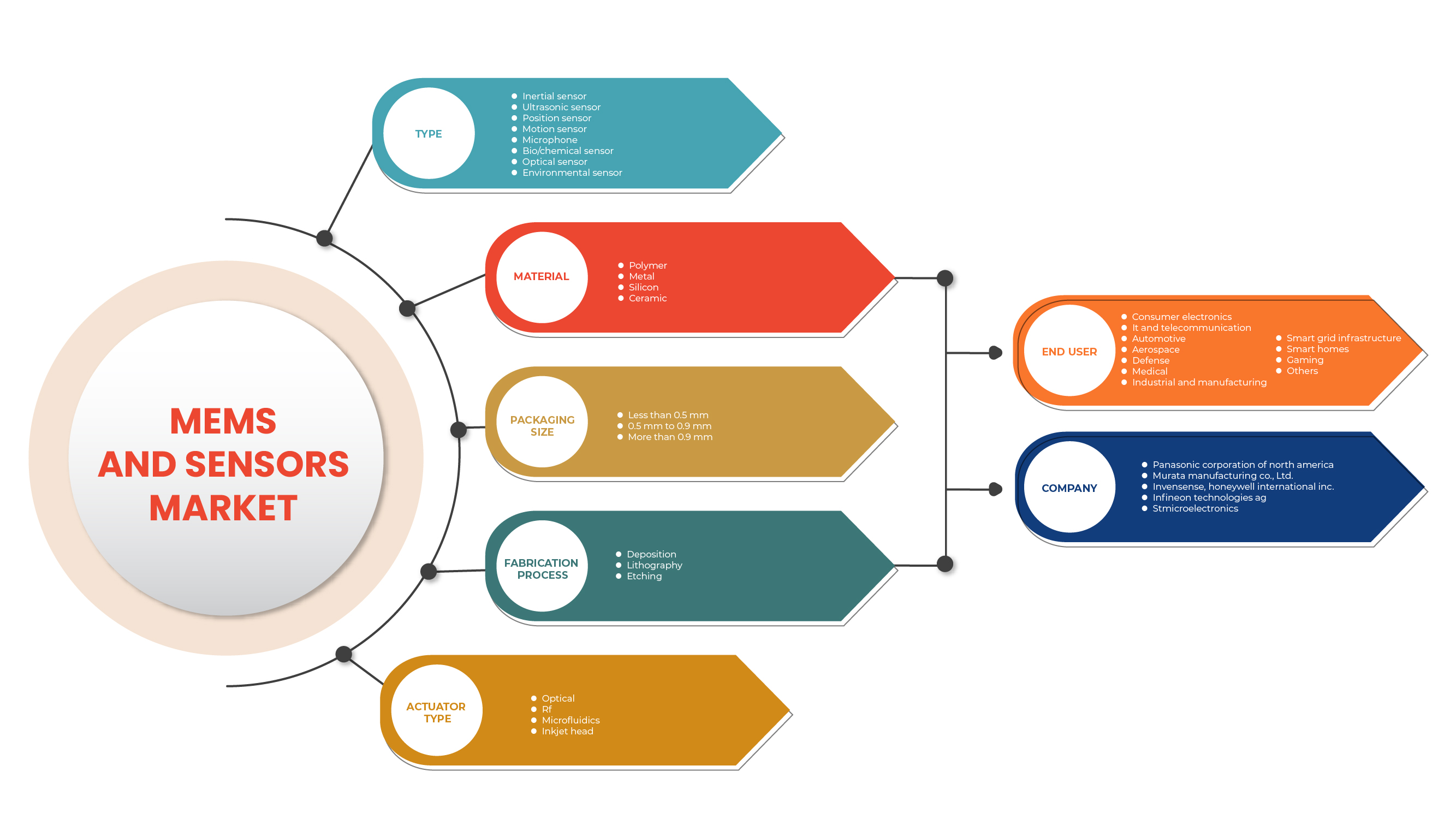

By Type (Inertial Sensor, Ultrasonic Sensor, Position Sensor, Motion Sensor, Microphone, Bio/Chemical Sensor, Optical Sensor And Environmental Sensor), Material (Polymer, Metal, Silicon and Ceramic), Packaging Size (Less Than 0.5 MM, 0.5 MM To 0.9 MM, More Than 0.9 MM), Fabrication Process (Deposition, Lithography and Etching), Actuator Type (Optical, RF, Microfluidics and Inkjet Head), End User (Consumer Electronics, IT and Telecommunication, Automotive, Aerospace, Defense, Medical, Industrial and Manufacturing, Smart Grid Infrastructure, Smart Homes, Gaming and Others) |

|

Countries Covered |

Germany, U.K., Italy, France, Spain, Netherlands, Belgium, Switzerland, Austria, Rest of Europe |

|

Market Players Covered |

Panasonic Corporation of North America, Murata Manufacturing Co., Ltd, InvenSense, Honeywell International Inc., Infineon Technologies AG, STMicroelectronics, Texas Instruments Incorporated, NXP Semiconductors, Analog Devices, Inc., ROHM CO., LTD., Teledyne Technologies Incorporated., Robert Bosch GmbH., Sensata Technologies, Inc., DENSO CORPORATION., Hitachi, Ltd., Qualcomm Technologies, Inc., Allegro MicroSystems, Inc, MegaChips Corporation., Vishay Intertechnology, Inc |

Europe MEMS and Sensors Market Dynamics

Drivers

-

Growing demand for automotive sensors for security

The world has steadily shifted its preference from conventional vehicles to electric vehicles. In vehicles, sensors and MEMS-based devices are essential parts of the electronic control system in automobiles. Modern cars, such as hybrid electric vehicles and Plug-in Hybrid vehicles (PHEV) make thousands of decisions based on the data provided by various sensors that are interfaced with the vehicle's on-board computer system. The sensors are used for security purposes in automobiles as they can operate in harsh and rough conditions involving extreme temperatures, vibrations, and exposure to environmental contaminants.

-

Rising demand for sensors in consumer electronics

The COVID-19 pandemic positively affected the consumer electronics market in 2020. The growth was driven by a lack of entertainment opportunities outside the home and an increasing number of employees working from home. Consumer electronics involves a lot of devices ranging from entertainment to recreation to communication.

Consumers are rapidly adopting new and emerging products such as wearables, voice-activated smart speakers, video game consoles, and automotive electronics. Sensors are used extensively in consumer electronics for monitoring, measuring, data logging, and control. Various applications in consumer electronics, such as television remote control systems, use infrared sensors to change the device-related settings.

-

Increasing use of (micro-electro-mechanical-system) MEMS gyroscopes

MEMS gyroscopes have been used in many different applications, including consumer, automotive, industrial, and military. MEMS gyroscopes have enabled exciting applications in portable devices, including optical image stabilization for cameras, dead reckoning, and GPS assistance. The advent of MEMS technology has controlled the development of miniaturized, low-cost, low-power sensors for various applications.

In recent years, there have been continuous improvements in semiconductors, passives, and interconnects to enable high-precision data acquisition and processing. MEMS sensors are accepted widely due to the demand for sensors that can tolerate more than 175 degrees. MEMS gyroscopes are used due to their high-temperature tolerance, smaller sizes, and low-cost maintenance.

-

Growing applications of MEMS sensors in defense and military

Sensors for defense and military applications require proven and reliable technologies. Sensors are a critical part of technologies as these provide solutions to the defense ecosystem, including monitoring and execution.

The various systems, including drones, spacecraft, missiles, military vehicles, ships, marine systems, satellites, and rockets, need sensors because these systems are used to collect data from space. The different types of sensors, such as active, smart, intelligent, camera, infrared, and nano sensors are used in military applications. Active sensors provide sensing solutions in high-performance military control and measurement applications.

Opportunities

- Growing demand for smart grid infrastructure

Smart grid infrastructure needs sensors to monitor the power line temperature and weather conditions. Sensors monitoring electrical parameters over an entire electricity network infrastructure play a fundamental role in protecting the smart grid and improving the network's energy efficiency. Smart grids include protection devices for sensing electrical faults ranging from classic analogue electro-mechanics relays to modern intelligent electronic devices. Protection systems play an essential role in maintaining smart grids' power quality and reliability.

Smart grid infrastructure is characterized by high penetration of renewable energy sources available. It mainly focuses on duration indices such as System Average Interruption Duration Index (SAIDI) or frequency indexes such as the System Average Interruption Frequency Index (SAIFI).

- Developments in environmental based sensors

Versatile environmental-based sensors for environmental condition monitoring are being adopted globally. Increasing developments in environmental-based sensors such as gas, temperature, and smoke sensors have artificial intelligence-based interfaces, which have led to the protection of environmental conditions. On an industrial scale, the technology has many benefits, such as continuous monitoring of chemical releases, which will help reduce them to protect environmental resources.

Numerous environment-based sensors such as biosensors are being introduced into the market to monitor harmful environmental substances. Various companies are taking initiatives to manufacture and develop environment-based sensors

- Rise In investments for R&D of MEMS sensors

MEMS sensors have come a long way since they were first developed in 1971. It is a chip-based technology with sensors composed of a suspended mass between a pair of capacitive plates. Their sizes have drastically reduced while their efficiency has increased exponentially. However, they still have a long way to go as the demand for ultra-thin and flexible displays is increasing. Citing this, major corporations are spending heavily researching the future potential of MEMS sensor and developing them to turn them into reality.

MEMS sensors are used and operated in extreme temperatures. They are mostly used due to their shock and vibration resistance properties. Hence, to overcome many limitations such as precision factors and increase accuracy in measurement, a lot of R&D is being initiated to enhance this technology further to reduce the sensors' cost.

Covid-19 Impact on Europe MEMS and Sensors Market

The COVID-19 pandemic positively affected the consumer electronics market in 2020. The growth was driven by a lack of entertainment opportunities outside the home and the increasing number of employees working from home. Consumer electronics involves a lot of devices ranging from entertainment to recreation to communication.

Consumers are rapidly adopting new and emerging products such as wearables, voice-activated smart speakers, video game consoles, and automotive electronics. Sensors are used extensively in consumer electronics for monitoring, measuring, data logging, and control. Various applications in consumer electronics, such as television remote control systems, use infrared sensors to change the device-related settings.

Sensors in consumer electronics and household appliances include pressure, proximity, motion, temperature, flow and level, acoustic, touch, and image sensors. In addition, sensors have undergone a drastic change as their sizes have decreased and their efficiency has increased multiple folds. A connected home has become a reality where a single gesture can control an entire house.

Recent Development

- In May 2022, Analog Devices Inc. and Synopsys collaborated to accelerate power system design. The collaboration provided model options for DC/DC ICs and µModule regulators. The collaboration will help develop electronic system innovation and meet customers' design targets. This collaboration will help the companies to increase their customer base

- In May 2022, Honeywell International Inc. announced the expansion of its in-building communication portfolio. The expansion will help the company to develop the safety spectrum and will be able to provide scalable solutions. This will help the company to target new customers

Europe MEMS and Sensors market Scope

Europe MEMS and Sensors market is segmented on the basis of the type, material, packaging size, fabrication process, actuator type and end user. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

By Type

- Inertial Sensor

- Ultrasonic Sensor

- Position Sensor

- Motion Sensor

- Microphone

- Bio/Chemical Sensor

- Optical Sensor

- Environmental Sensor

On the basis of the type, the MEMS and sensors market is segmented into inertial sensors, ultrasonic sensors, position sensors, motion sensor, microphone, bio/chemical sensor, optical sensor and environmental sensor.

Material

- Polymer

- Metal

- Silicon

- Ceramic

On the basis of the material, the MEMS and sensors market is segmented into polymer, metal, silicon and ceramic.

Packaging Size

- Less Than 0.5 MM

- 0.5 MM To 0.9 MM

- More Than 0.9 MM

On the basis of packaging size, the MEMS and sensors market is segmented into less than 0.5 mm, 0.5 mm to 0.9 mm and more than 0.9 mm.

Fabrication Process

- Deposition

- Lithography

- Etching

On the basis of the fabrication process, the MEMS and sensors market is segmented into deposition, lithography and etching.

Actuator Type

- Optical

- RF

- Microfluidics

- Inkjet Head

On the basis of actuator type, the MEMS and sensors market is segmented into optical, RF, microfluidics and inkjet head.

End User

- Consumer Electronics

- IT And Telecommunication

- Automotive

- Aerospace

- Defense

- Medical

- Industrial And Manufacturing

- Smart Grid Infrastructure

- Smart Homes

- Gaming

- Others

On the basis of end user, the MEMS and sensors market is segmented into consumer electronics, it and telecommunication, automotive, aerospace, defense, medical, industrial and manufacturing, smart grid infrastructure, smart homes, gaming and others.

Europe MEMS and Sensors Market Regional Analysis/Insights

The MEMS and sensor market is analysed by type, material, packaging size, fabrication process, actuator type, end user as referenced above.

The countries covered in Europe MEMS and sensor market are Germany, U.K., Italy, France, Spain, Netherlands, Belgium, Switzerland, Austria and Rest of Europe.

Germany is the dominating country of this region because of advancement in technology and usage.

The country section of the report also provides individual market impacting factors and domestic regulation changes that impact the current and future market trends. Data points such as new sales, replacement sales, country demographics, disease epidemiology, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Europe MEMS and Sensors Market Share Analysis

The MEMS and sensor market competitive landscape provides details of the competitor. Details include company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus on the MEMS and sensor market.

Some of the major players operating in the MEMS and sensors market are Panasonic Corporation of North America, Murata Manufacturing Co., Ltd, InvenSense, Honeywell International Inc., Infineon Technologies AG, STMicroelectronics, Texas Instruments Incorporated, NXP Semiconductors, Analog Devices, Inc., ROHM CO., LTD., Teledyne Technologies Incorporated., Robert Bosch GmbH., Sensata Technologies, Inc., DENSO CORPORATION., Hitachi, Ltd., Qualcomm Technologies, Inc., Allegro MicroSystems, Inc, MegaChips Corporation., Vishay Intertechnology, Inc among others

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE MEMS AND SENSORS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 REGULATIONS

4.1.1 OVERVIEW

4.1.2 INTERNATIONAL ORGANIZATION FOR STANDARDIZATION (ISO)

4.1.3 OCCUPATIONAL SAFETY & HEALTH ADMINISTRATION (OSHA)

4.1.4 AMERICAN NATIONAL STANDARDS INSTITUTE (ANSI)

4.1.5 UNDERWRITERS LABORATORIES (UL)

4.1.6 UNDERWRITERS LABORATORIES (UL)

4.1.7 EN ISO/IEC 17025

4.1.8 CCC CERTIFICATION

4.2 PORTER'S FIVE FORCE ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING DEMAND FOR AUTOMOTIVE SENSORS FOR SECURITY

5.1.2 RISING DEMAND FOR SENSORS IN CONSUMER ELECTRONICS

5.1.3 INCREASING USE OF (MICRO-ELECTRO-MECHANICAL-SYSTEM) MEMS GYROSCOPES

5.1.4 GROWING APPLICATIONS OF MEMS SENSORS IN DEFENSE AND MILITARY

5.2 RESTRAINT

5.2.1 LACK OF STANDARDIZED FABRICATION PROCESS OF MEMS (MICRO-ELECTRO-MECHANICAL-SYSTEM)

5.3 OPPORTUNITIES

5.3.1 GROWING DEMAND FOR SMART GRID INFRASTRUCTURE

5.3.2 DEVELOPMENTS IN ENVIRONMENTAL BASED SENSORS

5.3.3 RISE IN INVESTMENTS FOR R&D OF MEMS SENSORS

5.4 CHALLENGES

5.4.1 TECHNICAL CHALLENEGS AND HIGH COST OF END PRODUCTS

5.4.2 TOUCH SENSORS LEAD TO HIGH SENSITIVITY

6 EUROPE MEMS & SENSORS MARKET, BY TYPE

6.1 OVERVIEW

6.2 MICROPHONE

6.3 MOTION SENSOR

6.3.1 ACTIVE

6.3.1.1 ULTRASONIC SENSOR

6.3.1.2 MICROWAVE SENSOR

6.3.1.3 TOMOGRAPHIC SENSOR

6.3.2 PASSIVE

6.3.2.1 DUAL OR HYBRID TECHNOLOGY

6.3.2.2 INFRARED MOTION SENSOR

6.3.2.3 OTHERS

6.4 OPTICAL SENSOR

6.4.1 AMBIENT LIGHT SENSOR

6.4.2 MICROBOLOMETER

6.4.3 PIR AND THERMOPHILE

6.4.4 OTHERS

6.5 INERTIAL SENSOR

6.5.1 ACCELEROMETER

6.5.1.1 SINGLE AXIS

6.5.1.2 MULTI AXIS

6.5.2 GYROSCOPE

6.5.3 COMBO SENSOR

6.5.4 MAGNETOMETER

6.6 POSITION SENSOR

6.6.1 PROXIMITY SENSORS

6.6.2 LINEAR SENSORS

6.6.3 DISPLACEMENT SENSORS

6.6.4 3D SENSORS

6.6.5 PHOTOELECTRIC SENSORS

6.6.6 ROTARY SENSOR

6.7 ULTRASONIC SENSOR

6.8 ENVIRONMENTAL SENSOR

6.8.1 HUMIDITY SENSORS

6.8.1.1 ABSOLUTE HUMIDITY SENSORS

6.8.1.2 RELATIVE HUMIDITY SENSORS

6.8.1.3 OSCILLATING HYGROMETER

6.8.1.4 OPTICAL HYGROMETER

6.8.1.5 GRAVIMETRIC HYGROMETER

6.8.2 PRESSURE SENSORS

6.8.2.1 GAUGE PRESSURE SENSORS

6.8.2.2 DIFFERENTIAL PRESSURE SENSORS

6.8.2.3 ABSOLUTE PRESSURE SENSORS

6.8.2.4 VACUUM PRESSURE SENSORS

6.8.2.5 SEALED PRESSURE SENSORS

6.8.3 TEMPERATURE SENSORS

6.8.3.1 CONTACT

6.8.3.1.1 THERMOCOUPLES

6.8.3.1.2 BIMETALLIC TEMPERATURE SENSORS

6.8.3.1.3 RESISTIVE TEMPERATURE DETECTORS

6.8.3.1.4 TEMPERATURE SENSORS ICS

6.8.3.1.5 THERMISTORS

6.8.3.2 NON-CONTACT

6.8.3.2.1 FIBER OPTIC TEMPERATURE SENSORS

6.8.3.2.2 INFRARED TEMPERATURE SENSORS

6.8.4 GAS SENSORS

6.8.4.1 OXYGEN

6.8.4.2 CARBON DIOXIDE

6.8.4.3 AMMONIA

6.8.4.4 HYDROGEN

6.8.4.5 HYDROGEN SULFIDE

6.8.4.6 CARBON MONOXIDE

6.8.4.7 METHANE

6.8.4.8 NITROGEN OXIDE

6.8.4.9 CHLORINE

6.8.4.10 HYDROCARBON

6.8.4.11 VOLATILE ORGANIC COMPOUND

6.8.5 OTHERS

6.9 BIO/CHEMICAL SENSOR

6.9.1 ELECTROCHEMICAL

6.9.2 SENSOR PATCH

7 EUROPE MEMS AND SENSORS MARKET, BY ACTUATOR TYPE

7.1 OVERVIEW

7.2 OPTICAL

7.3 RF

7.3.1 SWITCH

7.3.2 FILTER

7.3.3 OSCILLATOR

7.4 MICROFLUIDICS

7.5 INKJET HEAD

8 EUROPE MEMS AND SENSORS MARKET, BY PACKAGING SIZE

8.1 OVERVIEW

8.2 LESS THAN 0.5 MM

8.3 0.5 MM TO 0.9 MM

8.4 MORE THAN 0.9 MM

9 EUROPE MEMS AND SENSORS MARKET, BY FABRICATION PROCESS

9.1 OVERVIEW

9.2 DEPOSITION

9.3 LITHOGRAPHY

9.4 ETCHING

10 EUROPE MEMS AND SENSORS MARKET, BY MATERIAL

10.1 OVERVIEW

10.2 POLYMER

10.3 METAL

10.4 SILICON

10.5 CERAMIC

11 EUROPE MEMS & SENSORS MARKET, BY END USER

11.1 OVERVIEW

11.2 CONSUMER ELECTRONICS

11.2.1 BY TYPE

11.2.1.1 SMARTPHONES

11.2.1.2 LAPTOPS

11.2.1.3 TABLETS

11.2.1.4 CAMERAS

11.2.1.5 WEARABLE DEVICES

11.2.1.6 HEADPHONES

11.2.1.7 SMART AUDIO DEVICES

11.2.1.8 TELEVISION

11.2.1.9 INKJET PRINTERS

11.2.1.10 AR/VR

11.2.1.11 OTHERS

11.2.2 BY SENSOR TYPE

11.2.2.1 MICROPHONE

11.2.2.2 MOTION SENSOR

11.2.2.3 OPTICAL SENSOR

11.2.2.4 INERTIAL SENSOR

11.2.2.5 POSITION SENSOR

11.2.2.6 ULTRASONIC SENSOR

11.2.2.7 ENVIRONMENTAL SENSOR

11.2.2.8 BIO/CHEMICAL SENSOR

11.2.2.9 OTHERS

11.3 IT AND TELECOMMUNICATION

11.4 AUTOMOTIVE

11.4.1 BY TYPE

11.4.1.1 VEHICLE COMFORT SYSTEMS

11.4.1.2 AIR CONDITIONING COMPRESSOR

11.4.1.3 BRAKE FORCE AND SUSPENSION CONTROL

11.4.1.4 FUEL AND VAPOUR LEVEL SENSOR

11.4.1.5 ENGINE MANAGEMENT SYSTEM

11.4.1.6 RESTRAINT SYSTEMS

11.4.1.7 TIRE PRESSURE

11.4.1.8 OTHERS

11.4.2 BY SENSOR TYPE

11.4.2.1 MICROPHONE

11.4.2.2 MOTION SENSOR

11.4.2.3 OPTICAL SENSOR

11.4.2.4 INERTIAL SENSOR

11.4.2.5 POSITION SENSOR

11.4.2.6 ULTRASONIC SENSOR

11.4.2.7 ENVIRONMENTAL SENSOR

11.4.2.8 BIO/CHEMICAL SENSOR

11.4.2.9 OTHERS

11.5 GAMING

11.5.1 MICROPHONE

11.5.2 MOTION SENSOR

11.5.3 OPTICAL SENSOR

11.5.4 INERTIAL SENSOR

11.5.5 POSITION SENSOR

11.5.6 ULTRASONIC SENSOR

11.5.7 ENVIRONMENTAL SENSOR

11.5.8 BIO/CHEMICAL SENSOR

11.5.9 OTHERS

11.6 AEROSPACE

11.6.1 MICROPHONE

11.6.2 MOTION SENSOR

11.6.3 OPTICAL SENSOR

11.6.4 INERTIAL SENSOR

11.6.5 POSITION SENSOR

11.6.6 ULTRASONIC SENSOR

11.6.7 ENVIRONMENTAL SENSOR

11.6.8 BIO/CHEMICAL SENSOR

11.6.9 OTHERS

11.7 DEFENSE

11.7.1 BY TYPE

11.7.1.1 AIRCRAFT CONTROL

11.7.1.2 SURVEILLANCE

11.7.1.3 ARMING SYSTEMS

11.7.1.4 EMBEDDED SENSORS

11.7.1.5 MUNITIONS GUIDANCE

11.7.1.6 DATA STORAGE

11.7.2 BY SENSOR TYPE

11.7.2.1 MICROPHONE

11.7.2.2 MOTION SENSOR

11.7.2.3 OPTICAL SENSOR

11.7.2.4 INERTIAL SENSOR

11.7.2.5 POSITION SENSOR

11.7.2.6 ULTRASONIC SENSOR

11.7.2.7 ENVIRONMENTAL SENSOR

11.7.2.8 BIO/CHEMICAL SENSOR

11.7.2.9 OTHERS

11.8 MEDICAL

11.8.1 BY TYPE

11.8.1.1 MONITORING DEVICES

11.8.1.2 SURGICAL DEVICES

11.8.1.3 DIAGNOSTIC DEVICES

11.8.1.4 THERAPEUTIC DEVICES

11.8.1.5 OTHERS

11.8.2 BY SENSOR TYPE

11.8.2.1 MICROPHONE

11.8.2.2 MOTION SENSOR

11.8.2.3 OPTICAL SENSOR

11.8.2.4 INERTIAL SENSOR

11.8.2.5 POSITION SENSOR

11.8.2.6 ULTRASONIC SENSOR

11.8.2.7 ENVIRONMENTAL SENSOR

11.8.2.8 BIO/CHEMICAL SENSOR

11.8.2.9 OTHERS

11.9 INDUSTRIAL AND MANUFACTURING

11.9.1 BY TYPE

11.9.1.1 INDUSTRIAL ROBOTS

11.9.1.2 DRONES

11.9.1.3 OTHERS

11.9.2 BY SENSOR TYPE

11.9.2.1 MICROPHONE

11.9.2.2 MOTION SENSOR

11.9.2.3 OPTICAL SENSOR

11.9.2.4 INERTIAL SENSOR

11.9.2.5 POSITION SENSOR

11.9.2.6 ULTRASONIC SENSOR

11.9.2.7 ENVIRONMENTAL SENSOR

11.9.2.8 BIO/CHEMICAL SENSOR

11.9.2.9 OTHERS

11.1 SMART GRID INFRASTRUCTURE

11.10.1 MICROPHONE

11.10.2 MOTION SENSOR

11.10.3 OPTICAL SENSOR

11.10.4 INERTIAL SENSOR

11.10.5 POSITION SENSOR

11.10.6 ULTRASONIC SENSOR

11.10.7 ENVIRONMENTAL SENSOR

11.10.8 BIO/CHEMICAL SENSOR

11.10.9 OTHERS

11.11 SMART HOMES

11.11.1 MICROPHONE

11.11.2 MOTION SENSOR

11.11.3 OPTICAL SENSOR

11.11.4 INERTIAL SENSOR

11.11.5 POSITION SENSOR

11.11.6 ULTRASONIC SENSOR

11.11.7 ENVIRONMENTAL SENSOR

11.11.8 BIO/CHEMICAL SENSOR

11.11.9 OTHERS

11.12 OTHERS

12 EUROPE MEMS AND SENSORS MARKET BY GEOGRAPHY

12.1 EUROPE

12.1.1 U.K.

12.1.2 GERMANY

12.1.3 FRANCE

12.1.4 ITALY

12.1.5 SPAIN

12.1.6 SWITZERLAND

12.1.7 NETHERLANDS

12.1.8 BELGIUM

12.1.9 AUSTRIA

12.1.10 REST OF EUROPE

13 EUROPE MEMS AND SENSORS MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: EUROPE

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 SENSATA TECHNOLOGIES, INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 ROBERT BOSCH GMBH

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 DENSO CORPORATION

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 HITACHI, LTD.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 HONEYWELL INTERNATIONAL INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 ALLEGRO MICROSYSTEMS, INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 ANALOG DEVICES, INC.

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 INVENSENSE

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 INFINEON TECHNOLOGIES AG

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 MURATA MANUFACTURING CO., LTD.

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 MEGACHIPS CORPORATION

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 NXP SEMICONDUCTORS

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENT

15.14 PANASONIC CORPORATION OF NORTH AMERICA

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENT

15.15 QUALCOMM TECHNOLOGIES, INC.

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENT

15.16 ROHM CO., LTD.

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENT

15.17 STMICROELECTRONICS

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENTS

15.18 TEXAS INSTRUMENTS INCORPORATED

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENT

15.19 TELEDYNE TECHNOLOGIES INCORPORATED

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENT

15.2 VISHAY INTERTECHNOLOGY, INC.

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 EUROPE MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 2 EUROPE MICROPHONE IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 3 EUROPE MOTION SENSORS IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 4 EUROPE MOTION SENSOR IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 5 EUROPE ACTIVE IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 6 EUROPE PASSIVE IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 7 EUROPE OPTICAL SENSOR IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 8 EUROPE OPTICAL SENSOR IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 9 EUROPE INERTIAL SENSOR IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 10 EUROPE INERTIAL SENSOR IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 11 EUROPE ACCELEROMETER IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 12 EUROPE POSITION SENSOR IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 EUROPE POSITION SENSOR IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 14 EUROPE ULTRASONIC SENSOR IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 EUROPE ENVIRONMENTAL SENSOR IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 EUROPE ENVIRONMENTAL SENSOR IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 17 EUROPE HUMIDITY SENSOR IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 18 EUROPE PRESSURE SENSORS IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 19 EUROPE TEMPERATURE SENSOR IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 20 EUROPE CONTACT IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 21 EUROPE NON-CONTACT IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 22 EUROPE GAS SENSOR IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 23 EUROPE BIO/CHEMICAL SENSOR IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 24 EUROPE BIO/CHEMICAL SENSOR IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 25 EUROPE MEMS AND SENSORS MARKET, BY ACTUATOR TYPE, 2020-2029 (USD THOUSAND)

TABLE 26 EUROPE OPTICAL IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 EUROPE RF IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 EUROPE RF IN MEMS AND SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 29 EUROPE MICROFLUIDICS IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 30 EUROPE INKJET HEAD IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 EUROPE MEMS AND SENSORS MARKET, BY PACKAGING SIZE, 2020-2029 (USD THOUSAND)

TABLE 32 EUROPE LESS THAN 0.5 MM IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 33 EUROPE 0.5MM TO 0.9 MM IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 EUROPE MORE THAN 0.9 MM IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 35 EUROPE MEMS AND SENSORS MARKET, BY FABRICATION PROCESS, 2020-2029 (USD THOUSAND)

TABLE 36 EUROPE DEPOSITION IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 37 EUROPE LITHOGRAPHY IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 38 EUROPE ETCHING IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 39 EUROPE MEMS AND SENSORS MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 40 EUROPE POLYMER IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 41 EUROPE METAL IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 42 EUROPE SILICON IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 43 EUROPE CERAMIC IN MEMS AND SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 44 EUROPE MEMS & SENSORS MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 45 EUROPE CONSUMER ELECTRONICS IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 46 EUROPE CONSUMER ELECTRONICS IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 47 EUROPE CONSUMER ELECTRONICS IN MEMS & SENSORS MARKET, BY SENSOR TYPE, 2020-2029 (USD THOUSAND)

TABLE 48 EUROPE IT AND TELECOMMUNICATION IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 49 EUROPE AUTOMOTIVE IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 50 EUROPE AUTOMOTIVE IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 51 EUROPE AUTOMOTIVE IN MEMS & SENSORS MARKET, BY SENSOR TYPE, 2020-2029 (USD THOUSAND)

TABLE 52 EUROPE GAMING IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 53 EUROPE GAMING IN MEMS & SENSORS MARKET, BY SENSOR TYPE, 2020-2029 (USD THOUSAND)

TABLE 54 EUROPE AEROSPACE IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 55 EUROPE AEROSPACE IN MEMS & SENSORS MARKET, BY SENSOR TYPE, 2020-2029 (USD THOUSAND)

TABLE 56 EUROPE DEFENSE IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 57 EUROPE DEFENSE IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 58 EUROPE DEFENSE IN MEMS & SENSORS MARKET, BY SENSOR TYPE, 2020-2029 (USD THOUSAND)

TABLE 59 EUROPE MEDICAL IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 60 EUROPE MEDICAL IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 61 EUROPE MEDICAL IN MEMS & SENSORS MARKET, BY SENSOR TYPE, 2020-2029 (USD THOUSAND)

TABLE 62 EUROPE INDUSTRIAL AND MANUFACTURING IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 63 EUROPE INDUSTRIAL AND MANUFACTURING IN MEMS & SENSORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 64 EUROPE INDUSTRIAL AND MANUFACTURING IN MEMS & SENSORS MARKET, BY SENSOR TYPE, 2020-2029 (USD THOUSAND)

TABLE 65 EUROPE SMART GRID INFRASTRUCTURE IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 66 EUROPE SMART GRID INFRASTRUCTURE IN MEMS & SENSORS MARKET, BY SENSOR TYPE, 2020-2029 (USD THOUSAND)

TABLE 67 EUROPE SMART HOMES IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 68 EUROPE SMART HOMES IN MEMS & SENSORS MARKET, BY SENSOR TYPE, 2020-2029 (USD THOUSAND)

TABLE 69 EUROPE OTHERS IN MEMS & SENSORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

List of Figure

FIGURE 1 EUROPE MEMS AND SENSORS MARKET: SEGMENTATION

FIGURE 2 EUROPE MEMS AND SENSORS MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE MEMS AND SENSORS MARKET: DROC ANALYSIS

FIGURE 4 EUROPE MEMS AND SENSORS MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE MEMS AND SENSORS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE MEMS AND SENSORS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE MEMS AND SENSORS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE MEMS AND SENSORS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE MEMS AND SENSORS MARKET: APPLICATION COVERAGE GRID

FIGURE 10 EUROPE MEMS AND SENSORS MARKET: SEGMENTATION

FIGURE 11 DEMAND FOR HIGH DEFINITION CONTENT BY CONSUMERS IS EXPECTED TO DRIVE EUROPE MEMS AND SENSORS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF EUROPE MEMS AND SENSORS MARKET IN 2022 & 2029

FIGURE 13 ASIA-PACIFIC EXPECTED TO DOMINATE, AND IS THE FASTEST-GROWING REGION IN THE EUROPE MEMS AND SENSORS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF EUROPE MEMS AND SENSORS MARKET

FIGURE 15 EUROPE MEMS & SENSORS MARKET, BY TYPE, 2021

FIGURE 16 EUROPE MEMS AND SENSORS MARKET, BY ACTUATOR TYPE, 2021

FIGURE 17 EUROPE MEMS AND SENSORS MARKET, BY PACKAGING SIZE, 2021

FIGURE 18 EUROPE MEMS AND SENSORS MARKET, BY FABRICATION PROCESS, 2021

FIGURE 19 EUROPE MEMS AND SENSORS MARKET, BY MATERIAL, 2021

FIGURE 20 EUROPE MEMS & SENSORS MARKET, BY END USER, 2021

FIGURE 21 EUROPE MEMS AND SENSORS MARKET: SNAPSHOT (2021)

FIGURE 22 EUROPE MEMS AND SENSORS MARKET: BY COUNTRY (2021)

FIGURE 23 EUROPE MEMS AND SENSORS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 24 EUROPE MEMS AND SENSORS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 25 EUROPE MEMS AND SENSORS MARKET: BY TYPE (2022-2029)

FIGURE 26 EUROPE MEMS AND SENSORS MARKET: COMPANY SHARE 2021 (%)

Europe Mems And Sensors Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Mems And Sensors Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Mems And Sensors Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.