Europe Premium Wine Market Analysis and Insights

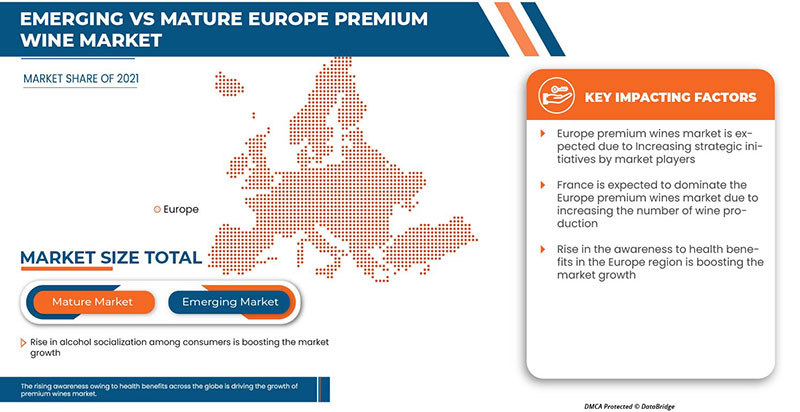

The growing demand of wine owing to different health benefits is helping to boost the overall market growth. The rising e-commerce, courier, wine delivery services are also attributing in the growth of the market. The major market players are highly focusing on various new wine launches. In addition, the rise in the alcohol socialization among consumers also contributing in the rising demand for the market.

The Europe premium wine market is growing in the forecast year due to the rise in market players and the availability of various premium wine brands in the market. Along with this, manufacturers are engaged in producing different wines in the market. The increasing bars and restaurants is further boosting the market growth. However, the high cost of wine production and gradual shift of consumers toward other alcoholic beverages might hamper the growth of the Europe premium wine market in the forecast period.

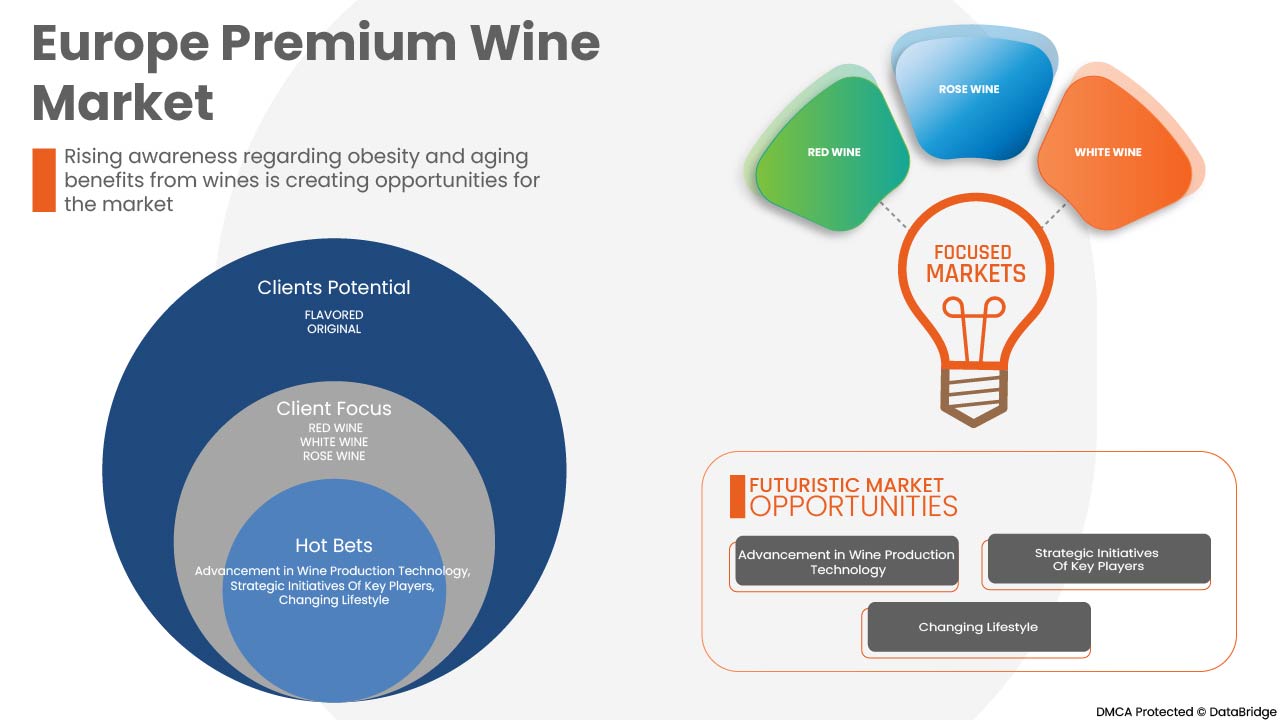

The various health benefits, changing lifestyle, strategic initiatives by market players are giving opportunities to the market. However, the over consumption of wine hampering to the various serious diseases, completion and complications in completing the consumer demand are key challenges for the market growth.

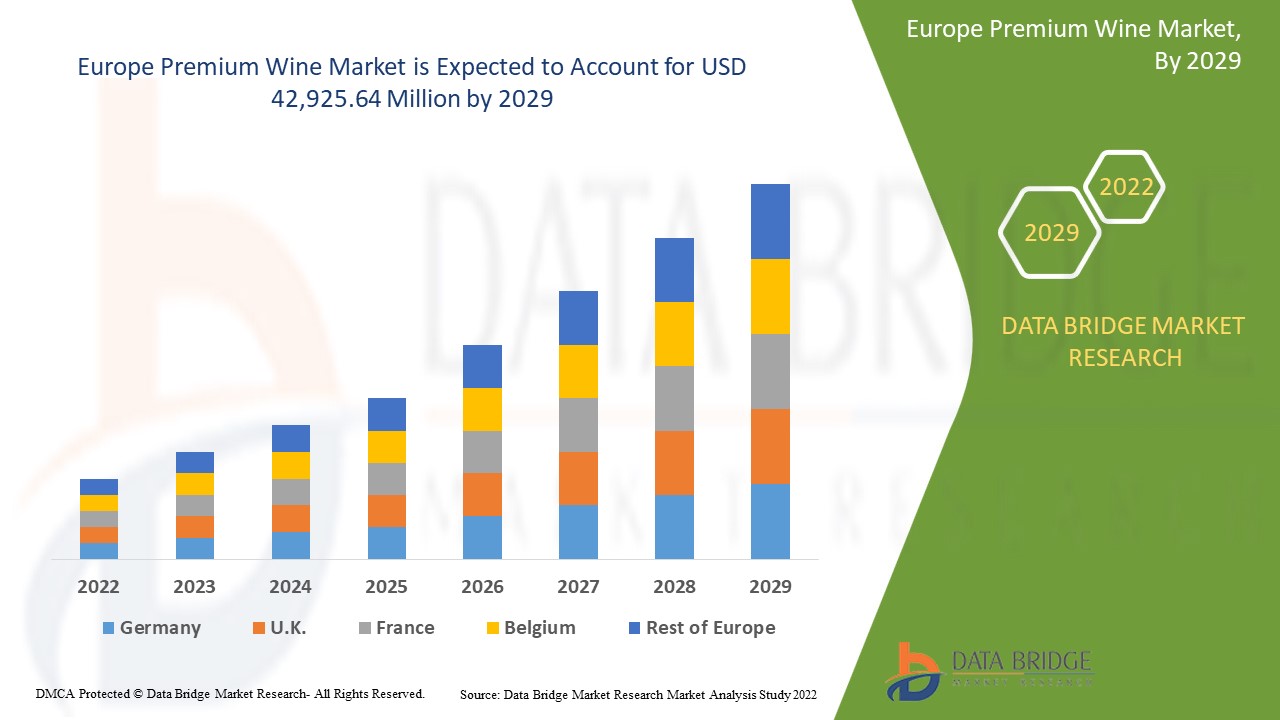

Europe premium wine market is expected to gain market growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 6.7% in the forecast period of 2022 to 2029 and is expected to reach USD 42,925.64 million by 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customisable to 2019-2014) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

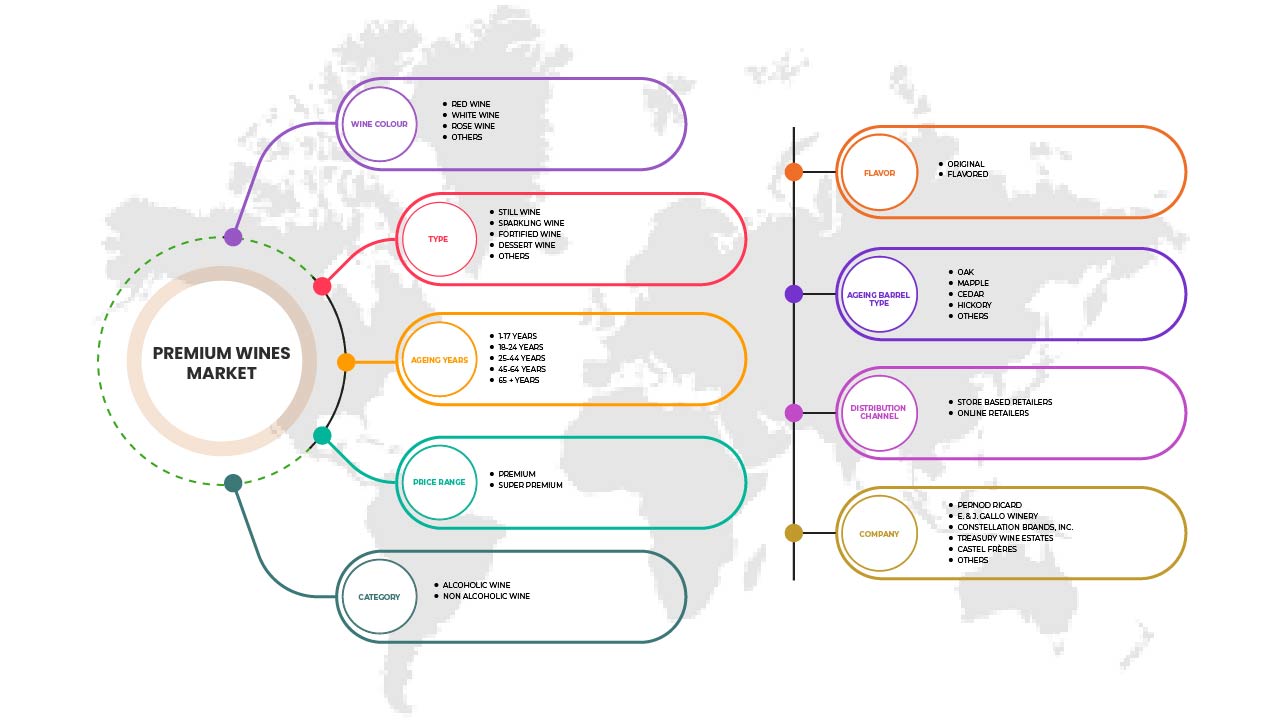

By Wine Colour (Red Wine, White Wine, Rose Wine, and Others), Product Type (Still Wine, Fortified Wine, Sparkling Wine, Dessert Wine), Product Category (Alcoholic Wine and Non-Alcoholic Wine), Flavour (Original and Flavoured), Aging Years (1-17 Years, 18-24 Years, 25-44 Years, 45-64 Years and 65+ Years), Ageing Barrel Type (Oak, Maple, Cedar, Hickory and Others), Price Range (Premium and Super Premium), Distribution Channel (Store Based Retailers and Online Retailers) |

|

Countries Covered |

Germany, France, U.K., Italy, Spain, Netherlands, Russia, Denmark, Switzerland, Turkey, Sweden, Poland, Sweden, Rest of Europe |

|

Market Players Covered |

The major companies which are dealing in the market are Vina Concha Y Toro, Treasury Wine Estates, Mount Mary Vineyard, Vins Grands Crus, Sula Vineyards, Moss Wood, Leeuwin Estate, E. & J. Gallo Winery, Constellation Brands, Inc., Castel Freres, The Wine Group, Accolade Wines, Pernod Ricard, Rockford, Henschke Cellars, Gioconda, Cullen Wines, Bass Philip, Changyu Pioneer Wine Company, Casella, Chateau Cheval Blanc, Miguel Torres S.A., Fetzer, GRUPO PENFLOR and among others. |

Premium Wine Market Definition

Wine is an alcoholic beverage in which the alcohol is produced naturally through fermentation. Fermentation is the first step in the process, which is carried out by bacteria found on the skin of grapes. After that, a specific strain of yeast is added to the main fermented product to get the desired result. The sugar in grapes is converted to carbon dioxide and ethanol by yeast or bacteria in wine. Wines with a lot of sugar in them have a different taste, and desert wine is one of them. Crushing, alcoholic fermentation, malolactic fermentation, pulling the wine off the lees, stabilisation and ageing, and refining in bottle are the six fundamental processes involved in wine production.

Premium Wine Market Dynamics

Drivers

- Growing demand for wine owing to different health benefits

Wine consumption has increased in the past few years due to increased awareness about its different health benefits. According to researchers, moderate consumption of wine, which has an alcohol content of 12% -15% daily, helps prevent several diseases. Following are some of the health benefits of wine:

Wine has antioxidant properties. Antioxidants are compounds that prevent cellular damage caused by inflammation and oxidative stress. Grapes have high levels of polyphenols and antioxidants that have been shown to reduce oxidative stress and inflammation.

- Rising e-commerce, courier, and wine delivery services

The e-commerce industry is always changing and plays a vital role in our daily lives. E-commerce provides a platform for people to buy or sell whatever they want, whenever they want. Merchants are continuously creating and improving their e-commerce businesses' strategies and approaches to meet the changing demand of consumers.

E-commerce has transformed the way of business around the world. Much of the growth for the industry has been triggered by an increase in internet and smartphone penetration. Also, technological advancements and the growth of available marketplaces have made it easier to buy and sell goods through online portals. The Merchants and the delivery services continue to follow consumer demand in online platforms, flocking to e-commerce in record numbers.

- Rise in alcohol socialization among consumers

Wine production and consumption have grown rapidly in recent decades, increasing consumption. Nowadays, social engagements, modernization, and the rising embrace of western culture are some elements that encourage consumers to socialize with alcohol, which will further accelerate the market growth.

Alcohol consumption is becoming a sign of social status, supporting the market's growth of low alcoholic beverages. It is also gaining huge popularity among millennials and youngsters, owing to its refreshing appeal and low ABV (Alcohol by Volume) offerings. It is majorly associated with several occasions and served as a table drink with regular food in developing countries.

The increasing demand further encourages manufacturers to launch and introduce innovative products, which is also expected to boost market growth in upcoming years.

Opportunities

-

Changing lifestyle

People prefer premium wine because of its authentic taste. The wines have become the social status and generic thing for parties and various occasions despite both healthful and unhealthful compounds. Epidemiologic studies from numerous disparate populations reveal that individuals with the habit of daily moderate wine consumption enjoy significant reductions in all-cause and particularly cardiovascular mortality compared to individuals who abstain or drink alcohol excessively

-

Increasing number of bars and lounges

The demand for premium wine is increasing due to the rise in restaurants, bars, and special wine bars all around the globe. As these premium wines are easily available in the bars and lounges, the demand for particular wine bars is also increasing. The wine bars and lounges offering the annual subscription for authenticated premium wines are making people more indulged

Restraints/Challenges

- Increased cost of wine production

Worldwide, the costs of wine production have increased. Wine industries are facing several challenges, like the cost of goods and shipping them due to the rise in gas prices. The actual wine bottle is becoming more difficult to get, especially with challenges in the supply chain and increased gas prices. Because of Covid, increased gas prices, and inflation, it is not easy to get bottles of wine. The wine industry saw a 30-percent increase in costs in the year 2022. Hence, the increased cost of wine production is hampering the market growth

- Gradual shift of consumers toward other alcoholic beverages

The growing modernization and rise in alcohol consumption are ongoing trends across the globe, which has nudged alcohol producers to launch innovative and bold variants in alcoholic beverages. Consumers are gradually shifting preferences towards various alcoholic beverages such as liqueurs, spirits, beer, and others due to their availability at economical prices.

Post COVID-19 Impact on Premium Wine Market

The COVID-19 has negatively affected the market. Lockdowns and isolation during pandemics caused the closure for most of the bars and restaurants and thus, affected the sale of wine. Online wine purchase increased as compared to vendor purchase. Thus COVID-19 affected premium wine market negatively.

Recent Developments

- In June 2022, Pernod Ricard announced the launch of a digital label system to better inform consumers about the products they purchase as well as responsible drinking. This initiative aims to offer consumers an efficient solution to their desire for more transparency on product content and health information. A European pilot program has been launched in July 2022, before being rolled out globally across all brands in the Group’s portfolio by 2024. This has helped company to provide better services to consumers through such innovations in the organization.

- In August 2022, E. & J. Gallo Winery announced that the Gallo is the official Wine Sponsor of the National Football League (NFL). This has helped company to increase their Europe presence in the market

Europe Premium Wine Market Scope

Europe premium wine market is segmented into wine colour, product type, product category, ageing barrel type, by price range, distribution channel. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Wine Colour

- Red Wine

- White Wine

- Rose Wine

- Others

On the basis of wine colour, the Europe premium wine market is segmented into red wine, white wine, rose wine and others.

Product Type

- Still Wine

- Sparkling Wine

- Fortified Wine and

- Dessert Wine

Based on product type, the Europe premium wine market is segmented into still wine, sparkling wine, fortified wine and dessert wine.

Product Category

- Alcoholic Wine

- Non-Alcoholic Wine

Based on product category, the Europe premium wine market is segmented into alcoholic wine and non-alcoholic wine.

Flavour

- Original

- Flavored

Based on flavour, the Europe premium wine market is segmented into original and flavoured.

Aging Years

- 1-7 Years

- 18-24 Years

- 25-44 Years

- 45-64 Years

- 65+ Years

Based on aging years, the Europe premium wine market is segmented into 1-7 years, 18-24 years, 25-44 years, 45-64 years and 65+ years.

Ageing Barrel Type

- Oak

- Maple

- Cedar

- Hickory

- Others

Based on barrel type, the Europe premium wine market is segmented into oak, maple, cedar, hickory and others.

By Price Range

- Premium

- Super Premium

Based on price range, the Europe premium wine market is segmented into premium and super premium.

Distribution Channel

- Store Based Retailers

- Online Retailers

Based on distribution channel, the Europe premium wine market is segmented into store based retailers and online retailers.

Premium Wine Market Regional Analysis/Insights

The premium wine market is analysed and market size insights and trends are provided by country, wine colour, product type, product category, ageing barrel type, by price range, distribution channel.

The countries in the premium wine market are Germany, France, U.K., Italy, Spain, Netherlands, Russia, Denmark, Switzerland, Turkey, Sweden, Poland, Sweden, Rest of Europe.

France dominates the premium wine marketing terms of market share and market revenue and will continue to flourish its dominance during the forecast period.

The France premium wine market is expected to grow due to a rise in wine consumption with meals, consumption of premium wine at social gatherings and celebrations, an increase in consumer preference for premium wines, increase in options to customize the flavor, color, and packaging of premium wine are expected to drive the regional market in the forecasted period.

The rapid technological advancements and perfection in traditional art of wine making are increasing the demand for premium wine. The growing population of alcohol consuming adults is further fuelling the market growth. Moreover, the different packaging options of premium wine, along with its customization, online availability, presence of major market players in the region, and high living standards, are also boosting the market's growth.

Competitive Landscape and Premium Wine Market Share Analysis

The premium wine market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on premium wine market.

Some of the major players operating in the premium wine market are Vina Concha Y Toro, Treasury Wine Estates, Mount Mary Vineyard, Vins Grands Crus, Sula Vineyards, Moss Wood, Leeuwin Estate, E. & J. Gallo Winery, Constellation Brands, Inc., Castel Freres, The Wine Group, Accolade Wines, Pernod Ricard, Rockford, Henschke Cellars, Gioconda, Cullen Wines, Bass Philip, Changyu Pioneer Wine Company, Casella, Chateau Cheval Blanc, Miguel Torres S.A., Fetzer, GRUPO PENFLOR and among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analysed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Europe vs. Regional and Vendor Share Analysis. Please request analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE PREMIUM WINE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 WINE COLOUR LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET WINE COLOUR COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 IMPORT EXPORT ANALYSIS

4.2 INDUSTRY TRENDS AND FUTURE PERSPECTIVES

4.3 REGULATORY FRAMEWORK AND GUIDELINES

4.3.1 ADVERTISING & PROMOTIONS –

4.4 TAXATION AND DUTY LEVIES

4.5 COMPARATIVE ANALYSIS OF TYPES OF WINE

4.6 DEMOGRAPHIC PREFERENCES

4.7 BRAND COMPETITIVE ANALYSIS

5 PRICING INDEX

6 PRODUCTION CAPACITY OF KEY MANUFACTURERS

7 EUROPE PREMIUM WINE MARKET: REGULATIONS

8 IMPACT OF ECONOMIC SLOWDOWN ON MARKET

8.1 IMPACT ON PRICE

8.2 IMPACT ON SUPPLY CHAIN

8.3 IMPACT ON SHIPMENT

8.4 IMPACT ON COMPANY'S STRATEGIC DECISIONS

9 BRAND OUTLOOK –

9.1 COMPARATIVE BRAND ANALYSIS

9.2 PRODUCT VS BRAND OVERVIEW –

10 MARKET OVERVIEW

10.1 DRIVERS

10.1.1 GROWING DEMAND FOR WINE OWING TO DIFFERENT HEALTH BENEFITS

10.1.2 RISING E-COMMERCE, COURIER, AND WINE DELIVERY SERVICES

10.1.3 RISE IN ALCOHOL SOCIALIZATION AMONG CONSUMERS

10.2 RESTRAINTS

10.2.1 INCREASED COST OF WINE PRODUCTION

10.2.2 GRADUAL SHIFT OF CONSUMERS TOWARD OTHER ALCOHOLIC BEVERAGES

10.3 OPPORTUNITIES

10.3.1 CHANGING LIFESTYLE

10.3.2 INCREASING NUMBER OF BARS AND LOUNGES

10.3.3 RISING AWARENESS REGARDING OBESITY AND AGING BENEFITS FROM WINES

10.4 CHALLENGES

10.4.1 HIGH CONSUMPTION LEADING SEVERE HEALTH PROBLEMS

10.4.2 LABOUR-INTENSIVE AND TIME-CONSUMING

11 EUROPE PREMIUM WINE MARKET, BY WINE COLOR

11.1 OVERVIEW

11.2 RED WINE

11.2.1 FULL-BODIED

11.2.2 MEDIUM-BODIED

11.2.3 LIGHT-BODIED

11.3 WHITE WINE

11.4 ROSE WINE

11.5 OTHERS

12 EUROPE PREMIUM WINE MARKET, BY PRODUCT TYPE

12.1 OVERVIEW

12.2 STILL WINE

12.3 SPARKLING WINE

12.4 FORTIFIED WINE

12.5 DESSERT WINE

12.5.1 LIGHT SWEET

12.5.2 RICHLY SWEET

12.5.3 SWEET RED WINE

13 EUROPE PREMIUM WINE MARKET, BY PRODUCT CATEGORY

13.1 OVERVIEW

13.2 ALCOHOLIC

13.3 NON-ALCOHOLIC

13.3.1 0.5% ABV

13.3.2 MORE THAN 0.05% ABV

13.3.3 0.05% ABV

13.3.4 LESS THAN 0.05% ABV

14 EUROPE PREMIUM WINE MARKET, BY FLAVOR

14.1 OVERVIEW

14.2 FLAVORED

14.2.1 FRUITS

14.2.1.1 CHERRY

14.2.1.2 PEACH

14.2.1.3 LEMON

14.2.1.4 GREEN APPLE

14.2.1.5 ORANGE

14.2.1.6 POMOGRANATE

14.2.1.7 MELON

14.2.1.8 FIG

14.2.1.9 MANGO

14.2.1.10 PINEAPPLE

14.2.1.11 OTHERS

14.2.2 BERRY

14.2.2.1 CRANBERRIES

14.2.2.2 BLUEBERRY

14.2.2.3 RASPBERRY

14.2.2.4 STRAWBERRY

14.2.2.5 OTHERS

14.2.3 FLORAL

14.2.3.1 ROSE

14.2.3.2 HIBISCUS

14.2.3.3 OTHERS

14.2.4 HERBAL

14.2.4.1 SMOKED TOBACCO

14.2.4.2 TRUFFLE

14.2.4.3 OTHERS

14.2.5 SPICES

14.2.5.1 CINNAMON

14.2.5.2 NUTMEG

14.2.5.3 PEPPER

14.2.5.4 GINGER

14.2.5.5 CLOVES

14.2.5.6 OTHERS

14.2.6 CHOCOLATE

14.2.7 MAPLE

14.2.8 HONEY

14.2.9 VANILLA

14.2.10 CARAMEL

14.3 ORIGINAL

15 EUROPE PREMIUM WINE MARKET, BY AGEING YEARS

15.1 OVERVIEW

15.2 1-17 YEARS

15.3 18-24 YEARS

15.4 25-44 YEARS

15.5 45-64 YEARS

15.6 65+ YEARS

16 EUROPE PREMIUM WINE MARKET, BY AGEING BARREL TYPE

16.1 OVERVIEW

16.2 OAK

16.3 HICKORY

16.4 MAPLE

16.5 CEDAR

16.6 OTHERS

17 EUROPE PREMIUM WINE MARKET, BY PRICE RANGE

17.1 OVERVIEW

17.2 PREMIUM

17.3 SUPER PREMIUM

18 EUROPE PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL

18.1 OVERVIEW

18.2 STORE BASED RETAILERS

18.2.1 LIQUOR STORES

18.2.2 CONVENIENCE STORE

18.2.3 SUPERMARKETS/HYPERMARKETS

18.2.4 WHOLESALERS

18.2.5 SPECIALITY STORES

18.2.6 GROCERY STORES

18.2.7 OTHERS

18.3 ONLINE RETAILERS

19 EUROPE PREMIUM WINE MARKET, BY REGION

19.1 EUROPE

19.1.1 FRANCE

19.1.2 ITALY

19.1.3 UK

19.1.4 GERMANY

19.1.5 RUSSIA

19.1.6 SPAIN

19.1.7 NETHERLANDS

19.1.8 SWITZERLAND

19.1.9 BELGIUM

19.1.10 SWEDEN

19.1.11 POLAND

19.1.12 DENMARK

19.1.13 TURKEY

19.1.14 REST OF EUROPE

20 COMPANY LANDSCAPE

20.1 EUROPE PREMIUM WINE MARKET: COMPANY LANDSCAPE

20.1.1 COMPANY SHARE ANALYSIS: EUROPE

21 SWOT ANALYSIS

22 COMPANY PROFILE

22.1 PERNOD RICARD

22.1.1 COMPANY SNAPSHOT

22.1.2 REVENUE ANALYSIS

22.1.3 COMPANY SHARE ANALYSIS

22.1.4 PRODUCT PORTFOLIO

22.1.5 RECENT DEVELOPMENT

22.2 E. & J. GALLO WINERY

22.2.1 COMPANY SNAPSHOT

22.2.2 COMPANY SHARE ANALYSIS

22.2.3 PRODUCT PORTFOLIO

22.2.4 RECENT DEVELOPMENTS

22.3 CONSTELLATION BRANDS, INC.

22.3.1 COMPANY SNAPSHOT

22.3.2 REVENUE ANALYSIS

22.3.3 COMPANY SHARE ANALYSIS

22.3.4 PRODUCT PORTFOLIO

22.3.5 RECENT DEVELOPMENTS

22.4 TREASURY WINE ESTATES

22.4.1 COMPANY SNAPSHOT

22.4.2 REVENUE ANALYSIS

22.4.3 COMPANY SHARE ANALYSIS

22.4.4 PRODUCT PORTFOLIO

22.4.5 RECENT DEVELOPMENTS

22.5 CASTEL FRÈRES

22.5.1 COMPANY SNAPSHOT

22.5.2 PRODUCT PORTFOLIO

22.5.3 RECENT DEVELOPMENTS

22.6 ACCOLADE WINES

22.6.1 COMPANY SNAPSHOT

22.6.2 PRODUCT PORTFOLIO

22.6.3 RECENT DEVELOPMENTS

22.7 BASS PHILLIP WINES

22.7.1 COMPANY SNAPSHOT

22.7.2 PRODUCT PORTFOLIO

22.7.3 RECENT DEVELOPMENT

22.8 CASELLA

22.8.1 COMPANY SNAPSHOT

22.8.2 PRODUCT PORTFOLIO

22.8.3 RECENT DEVELOPMENT

22.9 CHANGYU

22.9.1 COMPANY SNAPSHOT

22.9.2 REVENUS ANALYSIS

22.9.3 PRODUCT PORTFOLIO

22.9.4 RECENT DEVELOPMENT

22.1 CHATEAU CHEVAL BLANC

22.10.1 COMPANY SNAPSHOT

22.10.2 PRODUCT PORTFOLIO

22.10.3 RECENT DEVELOPMENTS

22.11 CULLEN WINES

22.11.1 COMPANY SNAPSHOT

22.11.2 PRODUCT PORTFOLIO

22.11.3 RECENT DEVELOPMENTS

22.12 FETZER

22.12.1 COMPANY SNAPSHOT

22.12.2 PRODUCT PORTFOLIO

22.12.3 RECENT DEVELOPMENTS

22.13 GIACONDA MARKETING PTY. LTD.

22.13.1 COMPANY SNAPSHOT

22.13.2 PRODUCT PORTFOLIO

22.13.3 RECENT DEVELOPMENTS

22.14 GRUPO PEÑAFLOR

22.14.1 COMPANY SNAPSHOT

22.14.2 PRODUCT PORTFOLIO

22.14.3 RECENT DEVELOPMENTS

22.15 HENSCHKE

22.15.1 COMPANY SNAPSHOT

22.15.2 PRODUCT PORTFOLIO

22.15.3 RECENT DEVELOPMENTS

22.16 LEEUWIN ESTATE

22.16.1 COMPANY SNAPSHOT

22.16.2 PRODUCT PORTFOLIO

22.16.3 RECENT DEVELOPMENT

22.17 MIGUEL TORRES S.A

22.17.1 COMPANY SNAPSHOT

22.17.2 PRODUCT PORTFOLIO

22.17.3 RECENT DEVELOPMENTS

22.18 MOSS WOOD

22.18.1 COMANY SNAPSHOT

22.18.2 PRODUCT PORTFOLIO

22.18.3 RECENT DEVELOPMENT

22.19 MOUNT MARY VINEYARD

22.19.1 COMPANY SNAPSHOT

22.19.2 PRODUCT PORTFOLIO

22.19.3 RECENT DEVELOPMENTS

22.2 ROCKFORD

22.20.1 COMPANY SNAPSHOT

22.20.2 PRODUCT PORTFOLIO

22.20.3 RECENT DEVELOPMENTS

22.21 SULA VINEYARDS PVT. LTD.

22.21.1 COMPANY SNAPSHOT

22.21.2 PRODUCT PORTFOLIO

22.21.3 RECENT DEVELOPMENT

22.22 THE WINE GROUP

22.22.1 COMPANY SNAPSHOT

22.22.2 PRODUCT PORTFOLIO

22.22.3 RECENT DEVELOPMENTS

22.23 VINA CONCHA Y TORO

22.23.1 COMPANY SNAPSHOT

22.23.2 REVENUE ANALYSIS

22.23.3 PRODUCT PORTFOLIO

22.23.4 RECENT DEVELOPMENT

22.24 VINS GRAND CRUS

22.24.1 COMPANY SNAPSHOT

22.24.2 PRODUCT PORTFOLIO

22.24.3 RECENT DEVELOPMENTS

23 QUESTIONNAIRE

24 RELATED REPORTS

List of Table

TABLE 1 BELOW ARE THE MOST COMMON RED WINE TYPES BY AROMA, BODY, AND SWEETNESS:

TABLE 2 BELOW ARE THE MOST COMMON WHITE WINE TYPES BY AROMA, BODY, AND SWEETNESS:

TABLE 3 BELOW IS THE TABULAR REPRESENTATION OF THE OVERALL TOTAL CONSUMPTION OF WINE IN DIFFERENT COUNTRIES :

TABLE 4 THE PRICES OF THESE WINES VARY FROM REGION TO REGION. BELOW ARE THE PRICES OF SOME OF THE MOST POPULAR RED WINES ACROSS THE GLOBE.

TABLE 5 BELOW ARE THE PRICES OF SOME OF THE WORLD’S BEST WHITE WINES ACROSS THE GLOBE.

TABLE 6 EUROPE PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 7 EUROPE RED WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 EUROPE RED WINE IN PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 9 EUROPE WHITE WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 EUROPE ROSE WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 EUROPE OTHERS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 EUROPE PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 13 EUROPE STILL WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE SPARKLING WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 EUROPE FORTIFIED WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 EUROPE DESSERT WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 EUROPE DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 18 EUROPE PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 19 EUROPE ALCOHOLIC IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 EUROPE NON-ALCOHOLIC IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 EUROPE NON-ALCOHOLIC IN PREMIUM WINE MARKET, BY ABV %, 2020-2029 (USD MILLION)

TABLE 22 EUROPE PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 23 EUROPE FLAVORED IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 EUROPE FRUITS IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 25 EUROPE BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 26 EUROPE FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 27 EUROPE HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 28 EUROPE SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 29 EUROPE ORIGINAL IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 EUROPE PREMIUM WINE MARKET, BY AGEING, 2020-2029 (USD MILLION)

TABLE 31 EUROPE 1-17 YEARS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 EUROPE 18-24 YEARS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 EUROPE 25-44 YEARS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 EUROPE 45-64 YEARS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 EUROPE 65+ YEARS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 EUROPE PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 37 EUROPE OAK IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 EUROPE HICKORY IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 EUROPE MAPLE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 EUROPE CEDAR IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 EUROPE OTHERS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 EUROPE PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 43 EUROPE PREMIUM WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 EUROPE SUPER PREMIUM WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 EUROPE PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 46 EUROPE STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 EUROPE STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 48 EUROPE ONLINE RETAILERS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 EUROPE PREMIUM WINE MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 50 EUROPE PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 51 EUROPE RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 EUROPE PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 53 EUROPE DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 54 EUROPE PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 55 EUROPE NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 56 EUROPE PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 57 EUROPE FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 58 EUROPE FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 59 EUROPE BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 60 EUROPE FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 61 EUROPE HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 62 EUROPE SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 63 EUROPE PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 64 EUROPE PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 65 EUROPE PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 66 EUROPE PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 67 EUROPE STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 68 FRANCE PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 69 FRANCE RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 FRANCE PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 71 FRANCE DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 72 FRANCE PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 73 FRANCE NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 74 FRANCE PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 75 FRANCE FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 76 FRANCE FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 77 FRANCE BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 78 FRANCE FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 79 FRANCE HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 80 FRANCE SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 81 FRANCE PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 82 FRANCE PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 83 FRANCE PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 84 FRANCE PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 85 FRANCE STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 86 ITALY PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 87 ITALY RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 ITALY PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 89 ITALY DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 90 ITALY PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 91 ITALY NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 92 ITALY PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 93 ITALY FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 94 ITALY FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 95 ITALY BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 96 ITALY FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 97 ITALY HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 98 ITALY SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 99 ITALY PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 100 ITALY PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 101 ITALY PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 102 ITALY PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 103 ITALY STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 104 U.K. PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 105 U.K. RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 U.K. PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 107 U.K. DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 108 U.K. PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 109 U.K. NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 110 U.K. PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 111 U.K. FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 112 U.K. FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 113 U.K. BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 114 U.K. FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 115 U.K. HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 116 U.K. SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 117 U.K. PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 118 U.K. PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 119 U.K. PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 120 U.K. PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 121 U.K. STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 122 GERMANY PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 123 GERMANY RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 GERMANY PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 125 GERMANY DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 126 GERMANY PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 127 GERMANY NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 128 GERMANY PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 129 GERMANY FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 130 GERMANY FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 131 GERMANY BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 132 GERMANY FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 133 GERMANY HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 134 GERMANY SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 135 GERMANY PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 136 GERMANY PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 137 GERMANY PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 138 GERMANY PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 139 GERMANY STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 140 RUSSIA PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 141 RUSSIA RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 RUSSIA PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 143 RUSSIA DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 144 RUSSIA PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 145 RUSSIA NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 146 RUSSIA PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 147 RUSSIA FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 148 RUSSIA FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 149 RUSSIA BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 150 RUSSIA FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 151 RUSSIA HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 152 RUSSIA SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 153 RUSSIA PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 154 RUSSIA PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 155 RUSSIA PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 156 RUSSIA PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 157 RUSSIA STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 158 SPAIN PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 159 SPAIN RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 160 SPAIN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 161 SPAIN DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 162 SPAIN PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 163 SPAIN NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 164 SPAIN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 165 SPAIN FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 166 SPAIN FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 167 SPAIN BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 168 SPAIN FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 169 SPAIN HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 170 SPAIN SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 171 SPAIN PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 172 SPAIN PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 173 SPAIN PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 174 SPAIN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 175 SPAIN STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 176 NETHERLANDS PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 177 NETHERLANDS RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 178 NETHERLANDS PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 179 NETHERLANDS DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 180 NETHERLANDS PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 181 NETHERLANDS NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 182 NETHERLANDS PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 183 NETHERLANDS FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 184 NETHERLANDS FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 185 NETHERLANDS BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 186 NETHERLANDS FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 187 NETHERLANDS HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 188 NETHERLANDS SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 189 NETHERLANDS PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 190 NETHERLANDS PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 191 NETHERLANDS PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 192 NETHERLANDS PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 193 NETHERLANDS STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 194 SWITZERLAND PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 195 SWITZERLAND RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 196 SWITZERLAND PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 197 SWITZERLAND DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 198 SWITZERLAND PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 199 SWITZERLAND NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 200 SWITZERLAND PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 201 SWITZERLAND FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 202 SWITZERLAND FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 203 SWITZERLAND BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 204 SWITZERLAND FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 205 SWITZERLAND HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 206 SWITZERLAND SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 207 SWITZERLAND PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 208 SWITZERLAND PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 209 SWITZERLAND PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 210 SWITZERLAND PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 211 SWITZERLAND STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 212 BELGIUM PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 213 BELGIUM RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 214 BELGIUM PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 215 BELGIUM DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 216 BELGIUM PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 217 BELGIUM NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 218 BELGIUM PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 219 BELGIUM FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 220 BELGIUM FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 221 BELGIUM BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 222 BELGIUM FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 223 BELGIUM HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 224 BELGIUM SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 225 BELGIUM PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 226 BELGIUM PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 227 BELGIUM PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 228 BELGIUM PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 229 BELGIUM STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 230 SWEDEN PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 231 SWEDEN RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 232 SWEDEN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 233 SWEDEN DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 234 SWEDEN PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 235 SWEDEN NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 236 SWEDEN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 237 SWEDEN FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 238 SWEDEN FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 239 SWEDEN BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 240 SWEDEN FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 241 SWEDEN HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 242 SWEDEN SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 243 SWEDEN PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 244 SWEDEN PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 245 SWEDEN PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 246 SWEDEN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 247 SWEDEN STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 248 POLAND PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 249 POLAND RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 250 POLAND PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 251 POLAND DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 252 POLAND PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 253 POLAND NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 254 POLAND PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 255 POLAND FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 256 POLAND FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 257 POLAND BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 258 POLAND FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 259 POLAND HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 260 POLAND SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 261 POLAND PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 262 POLAND PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 263 POLAND PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 264 POLAND PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 265 POLAND STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 266 DENMARK PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 267 DENMARK RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 268 DENMARK PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 269 DENMARK DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 270 DENMARK PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 271 DENMARK NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 272 DENMARK PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 273 DENMARK FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 274 DENMARK FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 275 DENMARK BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 276 DENMARK FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 277 DENMARK HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 278 DENMARK SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 279 DENMARK PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 280 DENMARK PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 281 DENMARK PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 282 DENMARK PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 283 DENMARK STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 284 TURKEY PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 285 TURKEY RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 286 TURKEY PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 287 TURKEY DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 288 TURKEY PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 289 TURKEY NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 290 TURKEY PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 291 TURKEY FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 292 TURKEY FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 293 TURKEY BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 294 TURKEY FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 295 TURKEY HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 296 TURKEY SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 297 TURKEY PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 298 TURKEY PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 299 TURKEY PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 300 TURKEY PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 301 TURKEY STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 302 REST OF EUROPE PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 EUROPE PREMIUM WINE MARKET: SEGMENTATION

FIGURE 2 EUROPE PREMIUM WINE MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE PREMIUM WINE MARKET: DROC ANALYSIS

FIGURE 4 EUROPE PREMIUM WINE MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE PREMIUM WINE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE PREMIUM WINE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE PREMIUM WINE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE PREMIUM WINE MARKET: MARKET WINE COLOUR COVERAGE GRID

FIGURE 9 EUROPE PREMIUM WINE MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE PREMIUM WINE MARKET: SEGMENTATION

FIGURE 11 THE GROWING DEMAND OF WINE OWING TO DIFFERENT HEALTH BENEFITS AND RISING E-COMMERCE, COURIER AND WINE DELIVERY SERVICES ARE EXPECTED TO DRIVE THE EUROPE PREMIUM WINE MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 RED WINE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE PREMIUM WINE MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE PREMIUM WINE MARKET

FIGURE 14 THE FOLLOWING GRAPH SHOWCASES THE INCREASE IN THE CONSUMPTION OF WINE IN THE U.S.

FIGURE 15 TOP FIVE LARGEST E-COMMERCE MARKETS IN 2019 (USD BILLION)

FIGURE 16 EUROPE PREMIUM WINE MARKET: BY WINE COLOR, 2021

FIGURE 17 EUROPE PREMIUM WINE MARKET: BY WINE COLOR, 2022-2029 (USD MILLION)

FIGURE 18 EUROPE PREMIUM WINE MARKET: BY WINE COLOR, CAGR (2022-2029)

FIGURE 19 EUROPE PREMIUM WINE MARKET: BY WINE COLOR, LIFELINE CURVE

FIGURE 20 EUROPE PREMIUM WINE MARKET: BY PRODUCT TYPE, 2021

FIGURE 21 EUROPE PREMIUM WINE MARKET: BY PRODUCT TYPE, 2022-2029 (USD MILLION)

FIGURE 22 EUROPE PREMIUM WINE MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 23 EUROPE PREMIUM WINE MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 24 EUROPE PREMIUM WINE MARKET: BY PRODUCT CATEGORY, 2021

FIGURE 25 EUROPE PREMIUM WINE MARKET: BY PRODUCT CATEGORY, 2022-2029 (USD MILLION)

FIGURE 26 EUROPE PREMIUM WINE MARKET: BY PRODUCT CATEGORY, CAGR (2022-2029)

FIGURE 27 EUROPE PREMIUM WINE MARKET: BY PRODUCT CATEGORY, LIFELINE CURVE

FIGURE 28 EUROPE PREMIUM WINE MARKET: BY FLAVOR, 2021

FIGURE 29 EUROPE PREMIUM WINE MARKET: BY FLAVOR, 2022-2029 (USD MILLION)

FIGURE 30 EUROPE PREMIUM WINE MARKET: BY FLAVOR, CAGR (2022-2029)

FIGURE 31 EUROPE PREMIUM WINE MARKET: BY FLAVOR, LIFELINE CURVE

FIGURE 32 EUROPE PREMIUM WINE MARKET: BY AGEING YEARS, 2021

FIGURE 33 EUROPE PREMIUM WINE MARKET: BY AGEING YEARS, 2022-2029 (USD MILLION)

FIGURE 34 EUROPE PREMIUM WINE MARKET: BY AGEING YEARS, CAGR (2022-2029)

FIGURE 35 EUROPE PREMIUM WINE MARKET: BY AGEING YEARS, LIFELINE CURVE

FIGURE 36 EUROPE PREMIUM WINE MARKET: BY AGEING BARREL TYPE, 2021

FIGURE 37 EUROPE PREMIUM WINE MARKET: BY AGEING BARREL TYPE, 2022-2029 (USD MILLION)

FIGURE 38 EUROPE PREMIUM WINE MARKET: BY AGEING BARREL TYPE, CAGR (2022-2029)

FIGURE 39 EUROPE PREMIUM WINE MARKET: BY AGEING BARREL TYPE, LIFELINE CURVE

FIGURE 40 EUROPE PREMIUM WINE MARKET: BY PRICE RANGE, 2021

FIGURE 41 EUROPE PREMIUM WINE MARKET: BY PRICE RANGE, 2022-2029 (USD MILLION)

FIGURE 42 EUROPE PREMIUM WINE MARKET: BY PRICE RANGE, CAGR (2022-2029)

FIGURE 43 EUROPE PREMIUM WINE MARKET: BY PRICE RANGE, LIFELINE

FIGURE 44 EUROPE PREMIUM WINE MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 45 EUROPE PREMIUM WINE MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 46 EUROPE PREMIUM WINE MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 47 EUROPE PREMIUM WINE MARKET: BY DISTRIBUTION CHANNEL, LIFELINE

FIGURE 48 EUROPE PREMIUM WINE MARKET: SNAPSHOT (2021)

FIGURE 49 EUROPE PREMIUM WINE MARKET: BY COUNTRY (2021)

FIGURE 50 EUROPE PREMIUM WINE MARKET: BY COUNTRY (2022 & 2029)

FIGURE 51 EUROPE PREMIUM WINE MARKET: BY COUNTRY (2021 & 2029)

FIGURE 52 EUROPE PREMIUM WINE MARKET: BY WINE COLOR (2022-2029)

FIGURE 53 EUROPE PREMIUM WINE MARKET: COMPANY SHARE 2021 (%)

Europe Premium Wine Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Premium Wine Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Premium Wine Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.