Global 3d Metrology Market

Market Size in USD Billion

CAGR :

%

USD

13.88 Billion

USD

29.98 Billion

2024

2032

USD

13.88 Billion

USD

29.98 Billion

2024

2032

| 2025 –2032 | |

| USD 13.88 Billion | |

| USD 29.98 Billion | |

|

|

|

|

3D Metrology Market Size

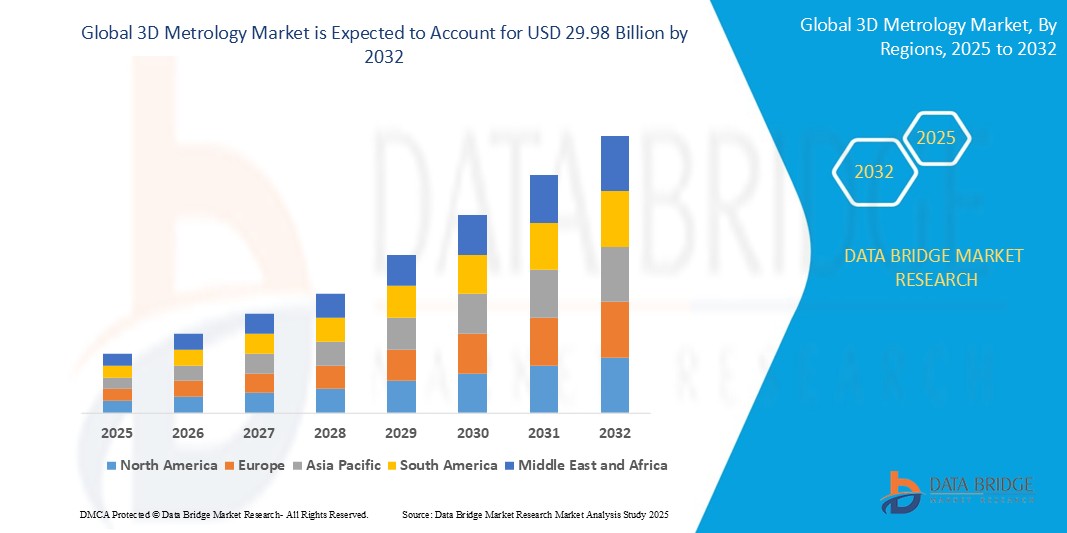

- The global 3D metrology market size was valued at USD 13.88 billion in 2024 and is expected to reach USD 29.98 billion by 2032, at a CAGR of 10.10% during the forecast period

- This growth is driven by factors such as increasing demand for precision engineering across manufacturing sectors, rising adoption of automated quality control systems, and continuous technological advancements in measurement solutions such as laser scanners and coordinate measuring machines (CMMs)

3D Metrology Market Analysis

- 3D metrology solutions are essential tools used across various industries for precise dimensional analysis, quality control, and product inspection. They are critical in applications such as automotive part verification, aerospace component inspection, and electronics manufacturing

- The demand for 3D metrology systems is significantly driven by the increasing emphasis on accuracy in manufacturing processes, automation in quality assurance, and the integration of Industry 4.0 technologies

- North America is expected to dominate the 3D metrology market with largest market share of 34.9%, due to strong industrial automation adoption, technological advancements, and a well-established manufacturing base

- Asia-Pacific is expected to be the fastest growing region in the 3D metrology market during the forecast period due to expanding industrial sectors, rising investments in precision manufacturing, and the growth of automotive and electronics production hubs

- Hardware segment is expected to dominate the market with a largest market share of 67.2% due to rising demand for high-precision measurement for quality control in the automotive, aerospace, and electronics industries is fueling the growth of this segment. The demand for high-precision measurement solutions in these sectors underscores the critical role of hardware in meeting stringent quality standards and enhancing overall product performance

Report Scope and 3D Metrology Market Segmentation

|

Attributes |

3D Metrology Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

3D Metrology Market Trends

“Adoption of Automation and AI-Driven 3D Metrology Solutions”

- One prominent trend in the evolution of 3D metrology is the increasing integration of automation and artificial intelligence (AI) to enhance measurement speed, accuracy, and decision-making in manufacturing environments

- These innovations enable real-time quality control by allowing systems to automatically detect deviations and optimize processes without manual intervention

- For instance, AI-powered 3D scanning systems can automatically identify defects or inconsistencies in complex components, making them highly valuable in sectors such as aerospace, automotive, and medical device manufacturing

- These advancements are transforming traditional metrology practices, reducing human error, increasing operational efficiency, and driving demand for intelligent, automated 3D metrology systems across global industries

3D Metrology Market Dynamics

Driver

“Growing Demand for Precision and Quality in Manufacturing”

- The increasing demand for high-precision components across industries such as automotive, aerospace, electronics, and healthcare is significantly driving the adoption of 3D metrology solutions

- As manufacturing processes become more advanced and tolerances tighter, companies are prioritizing dimensional accuracy and real-time quality control to reduce defects, optimize performance, and meet stringent regulatory standards

- In the automotive industry, complex parts like engine components, transmission systems, and safety features require precise measurements to ensure operational reliability and compliance with international safety norms

For instance,

- According to a 2023 report by the International Federation of Robotics, smart manufacturing and quality assurance systems are being rapidly deployed globally to improve production yields and reduce operational costs

- As a result, industries are increasingly turning to 3D metrology technologies—such as coordinate measuring machines (CMMs), laser scanners, and optical digitizers—to enhance measurement speed, accuracy, and integration within automated production lines

Opportunity

“Rising Adoption of Industry 4.0 and Smart Manufacturing Practices”

- The global shift toward Industry 4.0 is creating significant opportunities for the 3D metrology market, as manufacturers increasingly implement smart technologies to streamline operations and enhance precision

- 3D metrology systems, integrated with IoT, robotics, and cloud-based platforms, are being used for real-time monitoring, in-line inspection, and digital twin creation, enabling better process control and faster decision-making

- These systems support fully automated and connected production environments, reducing manual intervention and improving traceability across the product lifecycle

For instance,

- In the automotive sector, smart factories are leveraging 3D metrology to automate inspection of chassis, engine components, and safety-critical systems—significantly improving quality and reducing cycle time

- As more industries adopt digital manufacturing ecosystems, the demand for advanced 3D measurement solutions is expected to surge, offering strong growth prospects for technology providers

Restraint/Challenge

“High Equipment and Implementation Costs Limiting Market Adoption”

- The high initial investment required for 3D metrology equipment, such as coordinate measuring machines (CMMs), laser scanners, and optical digitizers, presents a substantial barrier for small- and medium-sized enterprises (SMEs), particularly in cost-sensitive regions

- In addition to hardware costs, the expenses associated with software integration, employee training, and ongoing system maintenance further amplify the financial burden for companies considering adoption

- These challenges can deter businesses from upgrading traditional measurement techniques or integrating advanced metrology into their production lines, slowing down the pace of digital transformation in quality control

For instance,

- According to industry reports, the cost of high-end 3D metrology solutions can exceed USD 100,000, excluding installation and training costs, making it difficult for smaller manufacturers to justify the ROI within a short timeframe

- As a result, limited affordability and lengthy implementation cycles can hinder market penetration, particularly in emerging economies, restricting the widespread adoption of 3D metrology technologies across diverse industrial sectors

3D Metrology Market Scope

The market is segmented on the basis of offerings, product type, application, and end use

|

Segmentation |

Sub-Segmentation |

|

By Offerings |

|

|

By Product Type |

|

|

By Application |

|

|

By End Use |

|

In 2025, the hardware is projected to dominate the market with a largest share in offerings segment

The hardware segment is expected to dominate the 3D metrology market with the largest share of 67.2%, due to rising demand for high-precision measurement for quality control in the automotive, aerospace, and electronics industries is fueling the growth of this segment. The demand for high-precision measurement solutions in these sectors underscores the critical role of hardware in meeting stringent quality standards and enhancing overall product performance

The aerospace and defense is expected to account for the largest share during the forecast period in end use segment

In 2025, the aerospace and defense segment is expected to dominate the market with the largest market share of approximately 30%, due to growing demand for precision in the manufacturing and assembly of complex aerospace and defense components. The need for high-accuracy measurements to ensure the structural integrity and performance of critical systems, such as aircraft and military equipment, is a significant factor

3D Metrology Market Regional Analysis

“North America Holds the Largest Share in the 3D Metrology Market”

- North America is the dominant region in the global 3D metrology market with largest market share of 34.9%, driven by well-established industries, cutting-edge manufacturing technologies, and strong adoption of advanced metrology solutions across key sectors such as aerospace, automotive, and electronics

- The U.S. holds a significant share of approximately 27.3%, due to its robust industrial base, increasing demand for precision measurements in sectors like aerospace and automotive, and continuous advancements in manufacturing technologies

- The availability of strong R&D investments, government initiatives to support high-tech manufacturing, and well-established infrastructure further strengthen the market

- In addition, the rising trend of automation and smart manufacturing in North America is fueling the demand for high-precision 3D metrology systems, which can offer real-time data and enhanced accuracy in production lines

“Asia-Pacific is Projected to Register the Highest CAGR in the3D Metrology Market”

- The Asia-Pacific region is expected to register the highest growth rate in the 3D metrology market, driven by rapid industrialization, increasing investments in manufacturing technologies, and growing awareness about quality control and precision

- Countries like China, India, and Japan are emerging as key markets, with Japan leading in the adoption of high-precision 3D metrology solutions, particularly in the automotive and electronics industries

- China and India, with their large-scale manufacturing capabilities and growing demand for quality control in production, are witnessing increased investments in 3D metrology technologies to enhance product quality and manufacturing efficiency

- The region’s expanding presence of global market players and the rapid adoption of advanced metrology solutions in key industries further contribute to market growth

3D Metrology Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Hexagon (Sweden)

- FARO (U.S.)

- Nikon Corporation (Japan)

- Carl Zeiss AG (Germany)

- KLA Corporation (U.S.)

- KEYENCE CORPORATION. (Japan)

- JENOPTIK AG (Germany)

- Renishaw plc. (U.K.)

- Mitutoyo South Asia Pvt. Ltd. (Japan)

- CREAFORM. (U.S.)

- GOM & COMPANY. (Germany)

- CHOTEST TECHNOLOGY INC. (China)

- Baker Hughes Company (U.S.)

- CyberOptics (U.S.)

- Trimble Inc. (U.S.)

- SGS SA (Switzerland)

- IKUSTEC (Spain)

Latest Developments in Global 3D Metrology Market

- In November 2023, Carl Zeiss AG introduced the Zeiss Inspect 3D metrology software, a state-of-the-art solution aimed at optimizing the inspection and analysis of 3D measurement data. The software integrates advanced functionalities that accelerate data acquisition and enhance evaluation efficiency for metrological applications. This innovation is expected to play a significant role in advancing the global 3D metrology market by improving precision and operational productivity across various sectors, such as aerospace, automotive, and manufacturing

- In October 2023, Creaform unveiled the HandySCAN 3D|MAX Series, a highly portable, metrology-grade 3D scanner designed for large parts. This groundbreaking technology incorporates advanced features that improve its performance and usability across various industries, including aerospace, transportation, energy, mining, and heavy industries. The launch of this portable solution is poised to significantly impact the global 3D metrology market by enhancing precision and efficiency in scanning large components, further driving the adoption of 3D metrology solutions in industries requiring high accuracy and reliability

- In April 2023, InnovMetric, a leading software development company, introduced PolyWorks 2023, a major upgrade designed to accelerate the digital transformation of 3D measurement processes for manufacturers. The latest version of PolyWorks enhances the efficiency of 3D measurement teams through comprehensive platform improvements, streamlining operations and reducing costs associated with 3D measurement tasks. This innovation is expected to have a significant impact on the global 3D metrology market by improving the scalability, affordability, and accessibility of 3D measurement technologies, driving further adoption across various manufacturing sectors

- In April 2024, Hexagon's Production Intelligence business unveiled the PRESTO System, an innovative modular suite of automated robotic inspection cells set to revolutionize 3D measurement within the automotive and aerospace production industries. This advancement is poised to drive the growth of the global 3D metrology market by enhancing automation, improving efficiency, and enabling more precise quality control in high-demand manufacturing sectors

- In January 2024, HighRES Inc. announced that its flagship product, ReverseEngineering.com, successfully met the new SolidWorks 2024 Gold Certification criteria. This achievement highlights the company's leadership in direct CAD reverse engineering and measurement software solutions, underscoring its dedication to quality and its ability to meet the stringent standards set by Dassault Systèmes. This milestone further strengthens the company's position in the global 3D metrology market, as it enhances the capabilities of reverse engineering and measurement tools, contributing to more accurate, efficient, and seamless 3D measurement processes across industries

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global 3d Metrology Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global 3d Metrology Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global 3d Metrology Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.