Global Aerospace 3d Printing Materials Market

Market Size in USD Billion

CAGR :

%

USD

4.96 Billion

USD

18.91 Billion

2025

2033

USD

4.96 Billion

USD

18.91 Billion

2025

2033

| 2026 –2033 | |

| USD 4.96 Billion | |

| USD 18.91 Billion | |

|

|

|

|

Aerospace 3D Printing Materials Market Size

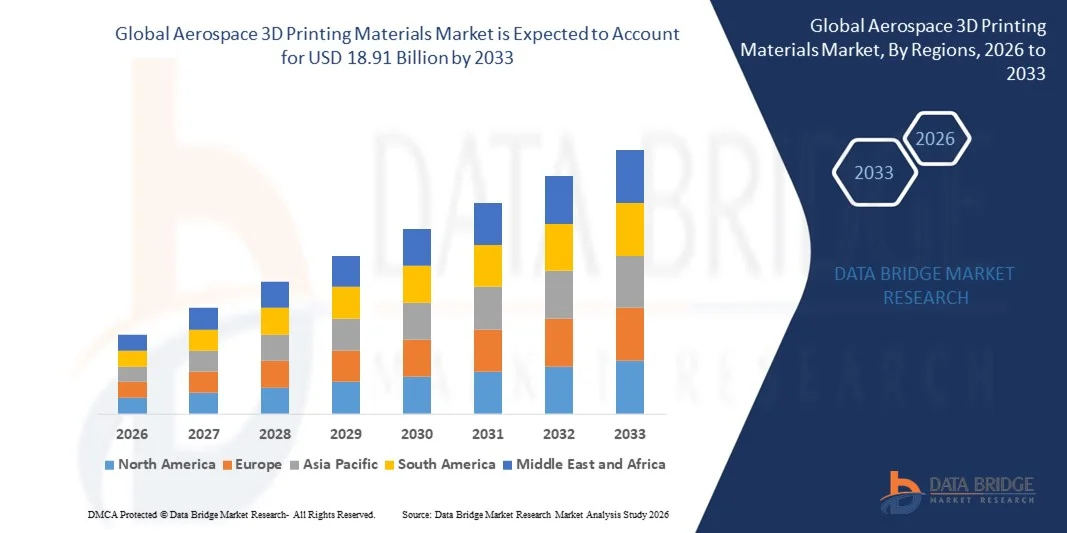

- The global aerospace 3D printing materials market size was valued at USD 4.96 billion in 2025 and is expected to reach USD 18.91 billion by 2033, at a CAGR of 18.20% during the forecast period

- The market growth is largely fueled by the increasing adoption of additive manufacturing in the aerospace industry, driven by the need for lightweight, high-performance components, rapid prototyping, and cost-efficient production of complex geometries

- Furthermore, advancements in 3D printing materials, including high-strength metals, aerospace-grade polymers, and specialized composites, are enabling manufacturers to produce mission-critical components with enhanced durability and precision, thereby accelerating market expansion

Aerospace 3D Printing Materials Market Analysis

- Aerospace 3D printing materials, including metal powders, polymers, and composites, are becoming integral to the production of structural components, engine parts, and tooling, as they offer design flexibility, reduced weight, and faster turnaround times compared to conventional manufacturing methods

- The rising demand for additive manufacturing is primarily driven by aerospace OEMs and suppliers seeking fuel-efficient, lightweight aircraft components, increasing adoption of advanced materials, and the integration of digital design and simulation technologies to optimize performance and reduce production cycles

- North America dominated the aerospace 3D printing materials market with a share of 40.70% in 2025, due to the presence of leading aerospace manufacturers, high adoption of advanced manufacturing technologies, and strong R&D investments

- Asia-Pacific is expected to be the fastest growing region in the aerospace 3D printing materials market during the forecast period due to increasing investments in aerospace manufacturing, rapid urbanization, and technological advancements in countries such as China, Japan, and India

- Metals segment dominated the market with a market share of 57.6% in 2025, due to the critical requirement for high-strength, lightweight, and heat-resistant parts in aerospace manufacturing. Metals such as titanium, aluminum, and Inconel provide superior mechanical performance for engines, structural components, and critical aerospace assemblies

Report Scope and Aerospace 3D Printing Materials Market Segmentation

|

Attributes |

Aerospace 3D Printing Materials Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Aerospace 3D Printing Materials Market Trends

Adoption of Metal and High-Performance Polymer 3D Printing Materials

- A key trend in the aerospace 3D printing materials market is the growing use of metal powders and high-performance polymers for additive manufacturing of critical aircraft components, driven by the need for lightweight structures, complex geometries, and improved fuel efficiency. These materials are enabling designers and engineers to reduce production lead times and increase design flexibility in aerospace manufacturing

- For instance, companies such as GE Additive and EOS supply titanium and nickel-based metal powders for 3D printing structural components and engine parts that meet stringent aerospace standards. Such materials allow for weight reduction while maintaining mechanical strength and thermal resistance in operational environments

- High-performance polymers such as PEKK and PEEK are increasingly incorporated in the fabrication of interior cabin parts and structural elements where weight savings and chemical resistance are critical. The adoption of these polymers is expanding the range of aerospace applications suitable for additive manufacturing

- The trend toward hybrid manufacturing approaches that combine 3D-printed metal or polymer parts with traditional machining is gaining traction. This approach supports enhanced material utilization, cost optimization, and improved component performance

- The aerospace sector is integrating additive manufacturing for prototyping, tooling, and low-volume production where complex geometries or customized designs are required. This practice is accelerating innovation cycles and reducing overall development costs in aircraft and spacecraft programs

- Rising investments in R&D for new 3D printing materials with higher temperature tolerance, corrosion resistance, and improved mechanical properties are reinforcing the adoption of additive manufacturing in aerospace. These developments are positioning 3D printing materials as essential enablers of next-generation aircraft design and production

Aerospace 3D Printing Materials Market Dynamics

Driver

Rising Demand for Lightweight and Complex Aerospace Components

- The demand for lighter, more fuel-efficient aircraft and spacecraft is driving adoption of 3D printing materials that support complex geometries and reduced component weight. These materials allow aerospace manufacturers to optimize performance while adhering to strict safety and regulatory standards

- For instance, Boeing leverages titanium and aluminum 3D-printed parts in its 787 Dreamliner and other aircraft programs to reduce weight and enhance structural efficiency. These components contribute to lower fuel consumption and increased payload capacity

- The need for rapid prototyping and faster production of low-volume, highly specialized components is expanding the use of additive manufacturing in aerospace supply chains. 3D printing materials support iterative design, customization, and accelerated time-to-market

- Manufacturers are increasingly focusing on high-strength metals and polymers to produce engine parts, brackets, and structural components that were previously impossible to fabricate efficiently. This capability is enabling more advanced designs and higher component integration

- The requirement for continuous innovation in aerospace systems and the expansion of commercial and defense aerospace programs are reinforcing the importance of 3D printing materials. These materials are central to achieving performance, safety, and efficiency objectives across aircraft and spacecraft

Restraint/Challenge

High Material Costs and Certification Requirements

- The aerospace 3D printing materials market faces challenges due to the high cost of metal powders and high-performance polymers that meet strict aerospace standards. These costs impact production budgets and slow widespread adoption of additive manufacturing across the industry

- For instance, companies such as Safran utilize rigorous testing and certification protocols for 3D-printed titanium engine components, which increase material selection constraints and development timelines. Compliance with FAA and EASA regulations adds complexity and cost

- Ensuring repeatability, traceability, and quality assurance for critical flight components requires specialized manufacturing environments and extensive validation procedures. This further elevates operational expenses and limits scalability

- Limited availability of certified aerospace-grade 3D printing powders and filaments can create supply bottlenecks, especially for high-demand alloys and polymers. Manufacturers must carefully manage material sourcing to maintain production schedules

- Balancing material performance with economic feasibility continues to challenge aerospace manufacturers. Overcoming cost and certification hurdles is essential to broaden the adoption of 3D printing materials across commercial, defense, and space applications

Aerospace 3D Printing Materials Market Scope

The market is segmented on the basis of vertical, printer technology, material, application, aircraft parts, and end-use.

- By Vertical

On the basis of vertical, the aerospace 3D printing materials market is segmented into material and printer. The material segment dominated the market with the largest revenue share in 2025, driven by the increasing demand for advanced aerospace-grade materials that can withstand extreme temperatures, high stress, and corrosion. Aerospace manufacturers are prioritizing high-performance materials to achieve weight reduction and fuel efficiency, making material innovations central to market growth. The growing adoption of additive manufacturing for producing complex components has further amplified the need for specialized materials, as they enable the production of parts with precise mechanical properties and geometries. In addition, partnerships between material suppliers and aerospace companies are fostering continuous development and availability of next-generation 3D printing materials.

The printer segment is expected to witness the fastest growth from 2026 to 2033, fueled by advancements in 3D printer technologies tailored for aerospace applications. For instance, companies such as Stratasys and EOS are introducing high-precision printers that support multiple materials, allowing manufacturers to create lightweight and structurally robust parts efficiently. Increasing investments in in-house 3D printing facilities by aerospace OEMs to reduce lead times and production costs are further accelerating printer adoption. The expansion of industrial-scale 3D printing services for aerospace also contributes to the segment’s rapid growth, enabling flexible and on-demand production of critical components.

- By Printer Technology

On the basis of printer technology, the market is segmented into Stereolithography (SLA), Fusion Deposition Modelling (FDM), Direct Metal Laser Sintering (DMLS), Selective Laser Sintering (SLS), Continuous Liquid Interface Production (CLIP), and others. The DMLS segment dominated the market in 2025 due to its capability to produce high-strength metal parts with complex geometries, meeting the stringent structural and safety requirements of aerospace applications. DMLS allows precise control over material properties, enabling lightweight, high-performance components that reduce fuel consumption and operational costs. Its established track record for reliability in producing structural aerospace parts also reinforces its dominance. In addition, collaborations between aerospace companies and DMLS printer manufacturers have facilitated optimized workflows and material integration, driving consistent demand.

The FDM segment is projected to experience the fastest CAGR from 2026 to 2033, driven by its cost-effectiveness, versatility, and suitability for rapid prototyping. For instance, companies such as Stratasys are expanding their FDM offerings to accommodate larger aerospace components with enhanced accuracy. The ability to quickly iterate designs and produce functional prototypes reduces development timelines, which is critical for aerospace R&D. Moreover, FDM printers’ compatibility with a wide range of thermoplastic materials allows manufacturers to test material performance efficiently, accelerating product development cycles.

- By Material

On the basis of material, the market is segmented into plastic, metals, ceramic, and others. The metals segment dominated the market with the largest share of 57.6% in 2025 due to the critical requirement for high-strength, lightweight, and heat-resistant parts in aerospace manufacturing. Metals such as titanium, aluminum, and Inconel provide superior mechanical performance for engines, structural components, and critical aerospace assemblies. The rising need for weight reduction in aircraft and spacecraft to enhance fuel efficiency and payload capacity further drives the adoption of metal 3D printing materials. In addition, metal powders compatible with advanced 3D printing technologies are increasingly available through partnerships between material suppliers and aerospace manufacturers, reinforcing the segment’s dominance.

The plastics segment is expected to witness the fastest growth from 2026 to 2033, fueled by the increasing use of high-performance thermoplastics for tooling, jigs, and rapid prototyping. For instance, Stratasys offers aerospace-grade thermoplastics that provide dimensional stability and chemical resistance, allowing manufacturers to produce functional prototypes and low-volume parts efficiently. The cost-effectiveness of plastic materials and the ability to reduce production lead times make them an attractive option for non-structural components. Growing innovation in reinforced plastics with improved thermal and mechanical properties is further supporting their adoption in aerospace applications.

- By Application

On the basis of application, the market is segmented into rapid prototyping, tooling, and part production. The part production segment dominated the market in 2025 due to the increasing use of 3D printing to produce functional, end-use aerospace components with reduced weight and complex geometries. Manufacturers are leveraging additive manufacturing to replace traditional subtractive processes for producing engine components, structural parts, and flight-critical assemblies, which reduces material wastage and production time. The ability to print customized components and integrate advanced materials with precise mechanical properties enhances the appeal of 3D printing for aerospace part production. In addition, regulatory approvals for additive-manufactured end-use components by aviation authorities have strengthened confidence in this application.

The rapid prototyping segment is anticipated to witness the fastest growth from 2026 to 2033, driven by the need for accelerated design validation and testing. For instance, Boeing utilizes rapid prototyping for functional testing of complex components before committing to full-scale production. The speed, flexibility, and lower cost of prototyping with 3D printing allow aerospace manufacturers to innovate faster and reduce product development cycles. Integration with simulation and digital twin technologies further enhances prototyping efficiency, supporting the segment’s growth trajectory.

- By Aircraft Parts

On the basis of aircraft parts, the market is segmented into engine, structural components, and jigs & fixtures. The structural components segment dominated the market in 2025 due to the high demand for lightweight, high-strength parts that improve aircraft performance and fuel efficiency. Additive manufacturing enables the production of geometrically complex structures that reduce weight without compromising structural integrity. The use of 3D-printed structural components also allows manufacturers to consolidate multiple assemblies into single parts, reducing assembly time and costs. In addition, partnerships between aerospace OEMs and 3D printing specialists facilitate the certification and production of critical structural components, sustaining market dominance.

The jigs & fixtures segment is projected to witness the fastest growth from 2026 to 2033, driven by the need for customized, cost-effective tooling solutions in aircraft assembly and maintenance. For instance, Airbus employs 3D-printed jigs and fixtures to streamline assembly lines and reduce production downtime. The flexibility of additive manufacturing allows rapid design modifications and faster production of specialized tools, improving operational efficiency. Growth in small- and medium-scale aerospace facilities investing in in-house 3D printing also contributes to the increasing adoption of jigs & fixtures.

- By End-Use

On the basis of end-use, the market is segmented into aircraft and spacecraft. The aircraft segment dominated the market in 2025 due to the substantial production volume of commercial and military aircraft and the extensive adoption of 3D printing for weight reduction and cost optimization. Additive manufacturing allows aircraft manufacturers to produce engine parts, structural components, and interior assemblies with enhanced performance and reduced material wastage. Regulatory approvals for additive-manufactured components in commercial aircraft have further strengthened market adoption. Collaborations between aerospace OEMs and 3D printing material suppliers also enhance component reliability and certification compliance, reinforcing dominance.

The spacecraft segment is expected to witness the fastest growth from 2026 to 2033, driven by the increasing investment in satellite launches, space exploration missions, and private aerospace ventures. For instance, companies such as SpaceX and Blue Origin are leveraging 3D printing to produce rocket engines, propulsion components, and lightweight spacecraft structures. The ability to manufacture complex geometries that are otherwise difficult with traditional methods allows for improved fuel efficiency and mission flexibility. Growing adoption of additive manufacturing in emerging space programs globally is further fueling market expansion in this segment.

Aerospace 3D Printing Materials Market Regional Analysis

- North America dominated the aerospace 3D printing materials market with the largest revenue share of 40.70% in 2025, driven by the presence of leading aerospace manufacturers, high adoption of advanced manufacturing technologies, and strong R&D investments

- Aerospace companies in the region are increasingly integrating additive manufacturing to produce lightweight, high-performance components for aircraft and spacecraft

- This adoption is further supported by a robust industrial infrastructure, availability of skilled workforce, and favorable government policies promoting advanced manufacturing solutions

U.S. Aerospace 3D Printing Materials Market Insight

The U.S. aerospace 3D printing materials market captured the largest revenue share in North America in 2025, fueled by widespread adoption of metal and high-performance polymer materials in aircraft and spacecraft production. For instance, companies such as Boeing and Lockheed Martin are utilizing additive manufacturing to reduce component weight, enhance fuel efficiency, and produce complex geometries that are difficult to achieve with traditional methods. The focus on cost reduction, faster prototyping, and customization of parts for both military and commercial aerospace applications further drives market expansion. In addition, the growing integration of 3D printing with digital design and simulation tools enhances process accuracy and component reliability.

Europe Aerospace 3D Printing Materials Market Insight

The Europe aerospace 3D printing materials market is projected to expand at a substantial CAGR during the forecast period, driven by the region’s emphasis on innovation, sustainable manufacturing, and the production of lightweight aerospace components. Aerospace OEMs and tier-1 suppliers in Germany, France, and Italy are increasingly adopting additive manufacturing for engine parts, structural components, and tooling. The European market is also supported by stringent quality standards, increasing demand for fuel-efficient aircraft, and government initiatives to promote digital manufacturing technologies. The incorporation of 3D printing in both new aircraft programs and retrofitting of existing fleets is further strengthening market growth.

Germany Aerospace 3D Printing Materials Market Insight

The Germany aerospace 3D printing materials market is expected to grow at a significant CAGR, fueled by the country’s strong aerospace industry, technological expertise, and focus on precision engineering. Germany’s aerospace sector is increasingly leveraging additive manufacturing for structural components, engine parts, and jigs & fixtures to reduce weight, enhance performance, and shorten production timelines. The adoption is further supported by collaborations between material suppliers and aerospace manufacturers to develop high-performance metals and polymers suitable for 3D printing. In addition, Germany’s emphasis on sustainability and eco-friendly manufacturing promotes the use of advanced 3D printing materials in aerospace applications.

Asia-Pacific Aerospace 3D Printing Materials Market Insight

The Asia-Pacific aerospace 3D printing materials market is poised to grow at the fastest CAGR during the forecast period, driven by increasing investments in aerospace manufacturing, rapid urbanization, and technological advancements in countries such as China, Japan, and India. The region is witnessing rising adoption of additive manufacturing to produce lightweight and complex components for both commercial and defense aerospace applications. Government initiatives promoting digitalization and smart manufacturing are further supporting market growth. Furthermore, Asia-Pacific is emerging as a key hub for aerospace 3D printing material production, making high-performance metals and polymers more accessible and affordable to local manufacturers.

Japan Aerospace 3D Printing Materials Market Insight

The Japan aerospace 3D printing materials market is gaining momentum due to the country’s high-tech culture, demand for precision manufacturing, and strong aerospace R&D capabilities. Japanese aerospace manufacturers are increasingly using 3D printing to produce lightweight structural components and engine parts that improve fuel efficiency and performance. The integration of additive manufacturing with digital design, simulation, and quality assurance tools is enhancing production accuracy and reducing development cycles. In addition, Japan’s aging workforce and the need for automation in manufacturing processes are driving the adoption of 3D printing solutions for both commercial and defense aerospace applications.

China Aerospace 3D Printing Materials Market Insight

The China aerospace 3D printing materials market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to the country’s rapidly growing aerospace industry, expanding middle-class demand for air travel, and strong domestic manufacturing capabilities. China is increasingly leveraging additive manufacturing to produce engine components, structural parts, and tooling for commercial aircraft and spacecraft. The push towards smart manufacturing and the availability of cost-effective high-performance 3D printing materials are key factors driving market adoption. Collaboration between local material suppliers, printer manufacturers, and aerospace OEMs further strengthens the ecosystem and supports rapid market growth in China.

Aerospace 3D Printing Materials Market Share

The aerospace 3D printing materials industry is primarily led by well-established companies, including:

- Stratasys Ltd (U.S.)

- 3D Systems, Inc (U.S.)

- ExOne (U.S.)

- EOS GmbH (Germany)

- GENERAL ELECTRIC (U.S.)

- Ultimaker BV (Netherlands)

- Höganäs AB (Sweden)

- Materialise NV (Belgium)

- Solvay (Belgium)

- Sandvik AB (Sweden)

- Arconic (U.S.)

- MTU Aero Engines AG (Germany)

- Moog Inc (U.S.)

- Norsk Titanium AS (Norway)

- Renishaw plc (U.K.)

- SLM Solutions Group AG (Germany)

- Carpenter Technology Corporation (U.S.)

- LPW Technology Ltd (U.K.)

- UBE Industries, Ltd (Japan)

Latest Developments in Global Aerospace 3D Printing Materials Market

- In March 2025, Stratasys launched two new aerospace‑grade validated materials — AIS Antero 800NA and AIS Antero 840CN03 — for its F900 3D printing system, developed in collaboration with leading aerospace and defense manufacturers. These materials are specifically designed to withstand high temperatures, chemical exposure, and mechanical stress, making them suitable for mission-critical aerospace components. The launch enhances material reliability, reduces the cost and time required for part qualification, and accelerates the adoption of additive manufacturing in highly regulated aerospace segments, enabling manufacturers to produce more complex and durable parts for both aircraft and spacecraft

- In March 2024, 3DEO secured an investment from IHI Aerospace Co., Ltd., focusing on integrating its Intelligent Layering metal 3D printing technology into Japan’s precision-oriented aerospace sector. This collaboration aims to combine advanced additive manufacturing capabilities with Japan’s engineering expertise, improving production efficiency and enabling the creation of high-strength, lightweight metal components. The partnership is expected to expand manufacturing opportunities and enhance productivity in Japan and also for North American aerospace operations, strengthening global supply chains and fostering innovation in aerospace material applications

- In November 2023, Markforged introduced the FX10 and Vega 3D printing systems, equipped with dual printhead-mounted optical sensors and an advanced vision module for quality assurance. These systems allow aerospace manufacturers to produce precise, composite-based components that can replace traditional aluminum parts, reducing weight and improving part performance. By integrating enhanced sensing and quality monitoring, the systems streamline production workflows, minimize material waste, and shorten manufacturing timelines, supporting the broader adoption of additive manufacturing across aerospace design and production processes

- In July 2022, The Peekay Group partnered with Bengaluru Airport City Limited to establish a dedicated 3D printing facility focusing on engineering, design, and metal additive manufacturing. This initiative aims to transform the Airport City into a technology and innovation hub, fostering research and development in aerospace materials and component production. The facility is expected to accelerate the development of specialized aerospace-grade metal 3D printing solutions, support prototyping and tooling needs, and expand India’s capabilities in the aerospace additive manufacturing supply chain

- In May 2022, EOS collaborated with Hyperganic to integrate AI-powered algorithmic design software with its laser powder bed fusion 3D printers. This integration allows aerospace engineers to generate complex, optimized designs for propulsion and structural components without relying on conventional part design methods. By automating design processes and enabling more efficient use of advanced materials, the collaboration enhances manufacturing flexibility, reduces development cycles, and supports the production of high-performance, lightweight aerospace parts, further driving additive manufacturing adoption in critical aerospace applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.