Global Agricultural Coatings Market

Market Size in USD Billion

CAGR :

%

USD

2.49 Billion

USD

4.45 Billion

2025

2033

USD

2.49 Billion

USD

4.45 Billion

2025

2033

| 2026 –2033 | |

| USD 2.49 Billion | |

| USD 4.45 Billion | |

|

|

|

|

What is the Global Agricultural Coatings Market Size and Growth Rate?

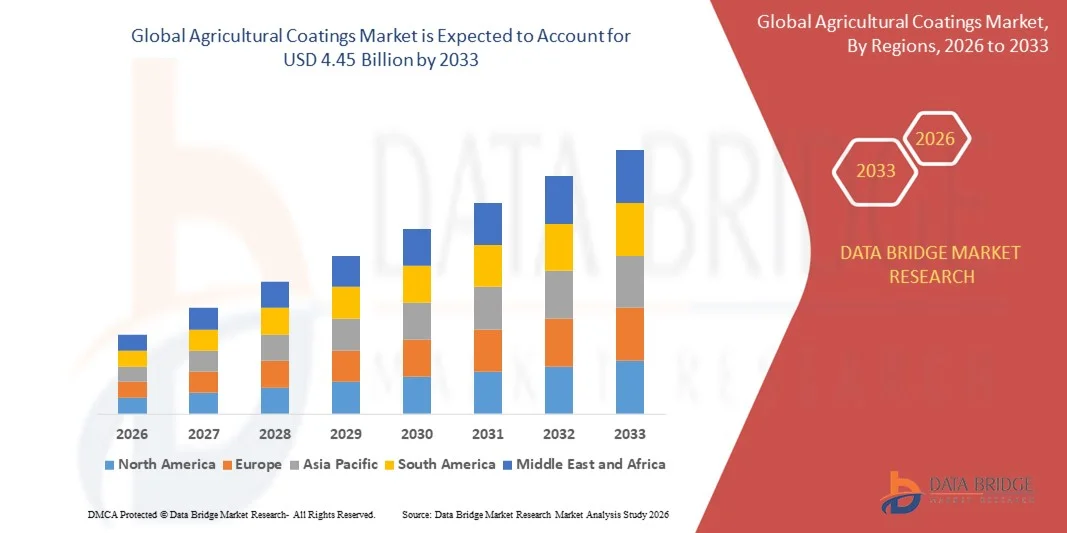

- The global agricultural coatings market size was valued at USD 2.49 billion in 2025 and is expected to reach USD 4.45 billion by 2033, at a CAGR of 7.50% during the forecast period

- Rise in demand for agricultural coatings by the agricultural industry in developed and developing economies is the root cause fuelling up the market growth rate

What are the Major Takeaways of Agricultural Coatings Market?

- Rising application areas for agricultural coatings and growth and expansion of various coatings and chemicals industry especially in the developing economies will also directly and positively impact the growth rate of the market

- Surging demand for agrochemicals, growing focus on the protection of crops from pests and diseases and increased cultivation of high quality seeds will further carve the way for the growth of the market

- North America dominated the Agricultural Coatings market with a 40.8% revenue share in 2025, driven by large-scale commercial farming, high adoption of treated seeds, and strong demand for controlled-release fertilizers across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 9.92% from 2026 to 2033, driven by expanding agricultural output and increasing adoption of high-performance inputs across China, India, Japan, and South Korea

- The Seed Coatings segment dominated the market with a 44.8% share in 2025, driven by rising adoption of treated and performance-enhanced seeds to improve germination rates, protect against soil-borne diseases, and enhance early crop establishment

Report Scope and Agricultural Coatings Market Segmentation

|

Attributes |

Agricultural Coatings Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Agricultural Coatings Market?

Rising Adoption of Sustainable, Controlled-Release, and Bio-Based Agricultural Coatings

- The agricultural coatings market is witnessing strong adoption of polymer-based and bio-based coating technologies designed to enhance seed performance, improve nutrient efficiency, and protect crops from environmental stress

- Manufacturers are introducing advanced microencapsulation, nano-coating, and controlled-release formulations that ensure precise delivery of fertilizers, crop protection agents, and micronutrients

- Growing demand for sustainable farming, improved seed germination rates, and reduced agrochemical wastage is accelerating innovation across seed treatment and fertilizer coating applications

- For instance, companies such as BASF SE, Bayer AG, Clariant, and Croda International Plc are expanding their portfolios with biodegradable polymers and performance-enhancing seed coating technologies

- Increasing regulatory focus on environmental safety and soil health is driving the shift toward low-toxicity, water-based, and biodegradable agricultural coating solutions

- As precision agriculture and climate-resilient farming practices expand globally, Agricultural Coatings will remain critical for yield optimization, input efficiency, and sustainable crop production

What are the Key Drivers of Agricultural Coatings Market?

- Rising global food demand and the need to enhance crop productivity are increasing adoption of coated seeds and controlled-release fertilizers

- For instance, in 2025, leading agrochemical and specialty chemical companies expanded production capacities for polymer-coated fertilizers and seed treatment solutions to support sustainable agriculture initiatives

- Growing awareness regarding nutrient-use efficiency, reduced environmental runoff, and improved seed shelf life is strengthening demand across developed and emerging markets

- Advancements in polymer science, encapsulation technologies, and bio-based coating materials have improved durability, adhesion, and targeted release performance

- Expansion of precision farming, smart irrigation systems, and integrated crop management practices is boosting the need for high-performance agricultural coatings

- Supported by increasing investments in agri-biotechnology, sustainable inputs, and government-backed agricultural modernization programs, the Agricultural Coatings market is expected to witness steady long-term growth

Which Factor is Challenging the Growth of the Agricultural Coatings Market?

- High development and production costs associated with advanced polymer and controlled-release technologies limit adoption among small-scale farmers

- For instance, during 2024–2025, volatility in raw material prices and supply chain disruptions for specialty polymers impacted production margins for several global suppliers

- Stringent environmental regulations regarding chemical usage, biodegradability standards, and soil impact assessments increase compliance complexity

- Limited awareness and technical knowledge among farmers in developing regions slow penetration of coated seed and fertilizer technologies

- Competition from conventional fertilizers and untreated seeds continues to create pricing pressure in cost-sensitive agricultural markets

- To address these challenges, companies are focusing on cost-effective bio-based materials, farmer education programs, strategic partnerships, and localized manufacturing to enhance global adoption of Agricultural Coatings

How is the Agricultural Coatings Market Segmented?

The market is segmented on the basis of Category, Coating, Coating Type, Application, and End Use.

- By Category

On the basis of category, the Agricultural Coatings market is segmented into Seed Coatings, Fertilizer Coatings, and Pesticide Coatings. The Seed Coatings segment dominated the market with a 44.8% share in 2025, driven by rising adoption of treated and performance-enhanced seeds to improve germination rates, protect against soil-borne diseases, and enhance early crop establishment. Increasing demand for high-yield crop varieties and precision farming practices continues to strengthen seed coating usage globally.

The Fertilizer Coatings segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by increasing adoption of controlled-release and polymer-coated fertilizers designed to improve nutrient-use efficiency and reduce environmental runoff. Growing regulatory focus on sustainable nutrient management is further accelerating demand.

- By Coating

On the basis of coating, the market is segmented into Polymers, Colorants, and Pellets. The Polymers segment dominated the market with a 52.3% share in 2025, as polymer-based coatings play a critical role in controlled nutrient release, moisture resistance, durability, and enhanced adhesion to seeds and granules. Advancements in biodegradable and bio-based polymers are further strengthening segment leadership.

The Colorants segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing demand for seed differentiation, regulatory compliance, and improved product identification in commercial agriculture. Rising focus on branding and safety labeling also supports expansion.

- By Coating Type

On the basis of coating type, the Agricultural Coatings market is segmented into Powder Coating and Liquid Coating. The Liquid Coating segment dominated the market with a 61.5% share in 2025, due to its ease of application, uniform coverage, superior adhesion, and compatibility with large-scale seed treatment and fertilizer processing equipment. Liquid coatings are widely preferred for high-throughput agricultural operations.

The Powder Coating segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by increasing demand for solvent-free, environmentally friendly solutions and improved storage stability. Rising innovation in dry coating technologies is contributing to steady adoption.

- By Application

On the basis of application, the market is segmented into Agricultural Vehicles, Agricultural Machinery, Agricultural Tools, and Others. The Agricultural Machinery segment dominated the market with a 36.7% share in 2025, driven by rising need for corrosion resistance, durability, and protective coatings for tractors, harvesters, and irrigation systems operating in harsh field conditions. Increasing mechanization in emerging economies supports segment growth.

The Agricultural Vehicles segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by expanding adoption of advanced farm vehicles and rising demand for protective and weather-resistant coating solutions.

- By End Use

On the basis of end use, the Agricultural Coatings market is segmented into Insecticides, Herbicides, Fungicides, Rodenticides, and Other Pesticide Coatings. The Insecticides segment dominated the market with a 33.9% share in 2025, driven by increasing pest resistance issues, rising crop losses, and higher demand for protective crop solutions across major agricultural economies.

The Fungicides segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by growing incidence of fungal crop diseases, climate variability, and increasing adoption of integrated pest management strategies. Continuous innovation in targeted delivery systems further strengthens long-term growth potential.

Which Region Holds the Largest Share of the Agricultural Coatings Market?

- North America dominated the Agricultural Coatings market with a 40.8% revenue share in 2025, driven by large-scale commercial farming, high adoption of treated seeds, and strong demand for controlled-release fertilizers across the U.S. and Canada. Advanced agricultural practices, precision farming technologies, and strong regulatory frameworks supporting sustainable inputs continue to fuel regional demand

- Leading companies in North America are investing in bio-based polymers, microencapsulation technologies, and environmentally compliant coating formulations, strengthening the region’s innovation advantage. Continuous expansion of high-value crops and hybrid seed production further drives coating adoption

- Strong distribution networks, high farmer awareness, and sustained investments in agri-biotechnology and crop protection solutions further reinforce regional market leadership

U.S. Agricultural Coatings Market Insight

The U.S. is the largest contributor in North America, supported by extensive use of coated seeds, polymer-coated fertilizers, and advanced crop protection products. Rising demand for improved yield, nutrient efficiency, and climate-resilient farming practices strengthens market penetration. Strong presence of leading agrochemical manufacturers and large-scale commercial farms accelerates adoption of innovative coating technologies.

Canada Agricultural Coatings Market Insight

Canada contributes significantly due to increasing demand for sustainable farming inputs and controlled nutrient-release fertilizers. Government-backed agricultural modernization programs and rising awareness of soil health management support steady market growth.

Asia-Pacific Agricultural Coatings Market

Asia-Pacific is projected to register the fastest CAGR of 9.92% from 2026 to 2033, driven by expanding agricultural output and increasing adoption of high-performance inputs across China, India, Japan, and South Korea. Rising population, food security concerns, and government initiatives supporting productivity enhancement are accelerating demand for coated seeds and fertilizers. Growth in export-oriented crop production and improving farmer education further strengthen regional expansion.

China Agricultural Coatings Market Insight

China leads the Asia-Pacific region due to large-scale fertilizer consumption, expanding hybrid seed production, and strong government support for sustainable agriculture. Rapid modernization of farming practices continues to boost coating demand.

Japan Agricultural Coatings Market Insight

Japan shows stable growth driven by advanced agricultural technologies, high-quality crop standards, and strong focus on precision nutrient management solutions.

India Agricultural Coatings Market Insight

India is emerging as a key growth hub supported by rising adoption of treated seeds, increasing fertilizer efficiency initiatives, and expanding agri-input manufacturing capacity.

South Korea Agricultural Coatings Market Insight

South Korea contributes steadily due to growing demand for specialty crops, modern greenhouse farming, and advanced crop protection solutions, supporting long-term market development.

Which are the Top Companies in Agricultural Coatings Market?

The agricultural coatings industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Bayer AG (Germany)

- Evonik Industries AG (Germany)

- Clariant (Switzerland)

- Croda International Plc (U.K.)

- Sensient Technologies Corporation (U.S.)

- Germains Seed Technology (Canada)

- Milliken & Company (U.S.)

- Precision Laboratories, LLC (U.S.)

- Pursell Agri-Tech (U.S.)

- Novochem Group (China)

- Dorf Ketal Chemicals (I) Pvt. Ltd. (India)

- Deltachem (U.S.)

- ICL (Israel)

- Arkema (France)

- SQM S.A. (Chile)

- Mosaic (U.S.)

- Nutrien Ltd. (Canada)

- Vivify (India)

- Encapsys, LLC (U.S.)

What are the Recent Developments in Global Agricultural Coatings Market?

- In March 2025, BASF SE and Boortmalt produced Europe’s first Verified Impact Units, achieving a 90% reduction in greenhouse-gas emissions in barley production, demonstrating strong commitment toward sustainable agriculture and low-carbon value chains, thereby increasing demand for environmentally friendly agricultural coatings solutions

- In January 2025, AgroSpheres raised USD 37 million in funding and secured regulatory clearance for its AgriCell biodegradable encapsulation technology designed for agricultural coating applications ahead of its 2025 launch, strengthening innovation in sustainable crop protection delivery systems and accelerating adoption of bio-based coating technologies

- In January 2025, Syngenta partnered with Intrinsyx Bio to develop endophyte-based nutrient-efficiency solutions aimed at improving crop productivity, supporting increased utilization of advanced seed treatments and protective agricultural coatings formulations

- In December 2024, Corteva and BASF SE signed agreements to co-develop herbicide-tolerant soybean trait stacks, advancing innovation in crop genetics and driving higher demand for specialized seed coating technologies compatible with next-generation herbicide systems

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Agricultural Coatings Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Agricultural Coatings Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Agricultural Coatings Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.