Market Analysis and Size

Companies in the agricultural tractor market are conducting data-driven research before investing in new manufacturing technologies, as many people's financial situations have been strained as a result of the coronavirus crisis. Although India offers lucrative incremental opportunities for agricultural tractors companies, farmers are slow to adopt new technologies such as driverless tractors. Nonetheless, this trend is changing as an increasing number of non-governmental organisations (NGOs) empower the agricultural sector, increasing farmers' acceptance of smart agricultural tractors, machinery, and other equipment.

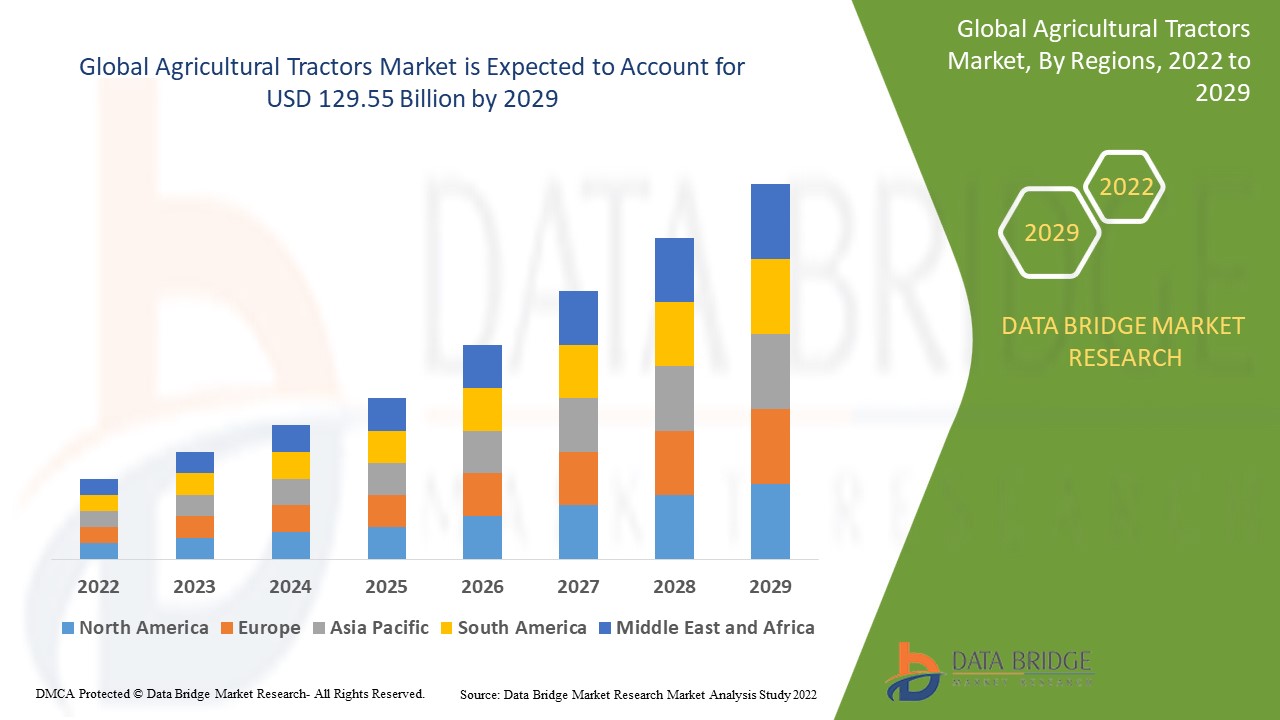

Data Bridge Market Research analyses that the agricultural tractors market which was growing at a value of 60.00 billion in 2021 and is expected to reach the value of USD 129.55 billion by 2029, at a CAGR of 10.10% during the forecast period of 2022-2029.

Market Definition

A tractor is a vehicle with one or two small wheels in front and two large wheels in back. It is used to move attached implements such as rotators, ploughing, tilling, sowing, cultivation, and harvesting in agriculture, construction, and logistics applications. Tractors come in two sizes: two wheels and four wheels. It is also available in a range of power outputs ranging from 20 HP to more than 20 HP.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Engine Power (Below 40 HP, 40 HP–120 HP, 121 HP–180 HP, 181 HP–250 HP and More Than 250 HP), By Application (Harvesting, Seed Sowing, Irrigation and others), By Type (ICE and Electric), By Operation (Manual Tractor Vehicle and Autonomous Tractor Vehicle), By Driver Type (2-Wheel Drive and 4-Wheel Drive) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

Deere & Company (U.S), Tractors and Farm Equipment Limited (India), Kubota Corporation (Japan), CLAAS KGaA GmbH (Germany), AGCO Corporation (U.S), CNH Industrial N.V (UK), Enerpac Tool Group (U.S), JCB (UK), Mahindra & Mahindra Ltd. (India), SDF Group (Italy), Bucher Industries (Switzerland), Alamo Group, Inc. (U.S |

|

Opportunities |

|

Agricultural Tractors Market Dynamics

Drivers

- Government support to the growing trend of farm mechanisation

Government policies, such as loan waivers, schemes, and policies, are driving the growing trend of farm mechanisation, which is expected to drive the growth of the agricultural tractors market in developing countries around the world. Farm mechanisation is a rapidly growing phenomenon in the agricultural tractor market, as emerging economies benefit from government efforts to revolutionise the agriculture industry.

- Growing prevalence of smart farming and growing farm training programmes

Precision farming and the increasing adoption of farm mechanisation to increase productivity are driving up demand for tractors. The growing number of farm training programmes promoting the use of agricultural machinery on a large scale is also driving the tractor market. Aside from that, the growing number of building and construction projects is increasing demand for tractors in the construction industry. Furthermore, various technological advancements have introduced advanced tractors equipped with GPS and telematics devices. The growing popularity of automated commercial vehicles and the widespread use of wireless connectivity for remote monitoring are expected to drive the global agricultural tractor market.

Opportunity

There is a growing demand for low-cost innovations in the agricultural tractor market. This demand has resulted in advancements in driverless tractors. Companies are expected to form talent pools in their R&D centres by collaborating with researchers who conduct science experiments outside of the academic setting. First-year engineering students are developing driverless tractors, which are gaining attention from popular news outlets. Companies in the agricultural tractor market are becoming aware of driverless tractors and benefiting from innovations in these tractors, as they have the potential to eliminate the costs associated with hiring a driver. As a result, companies in the agricultural tractor market should work with engineering talent to further innovate in driverless tractors.

Restraints

The implementation of emission standards may have an impact on the sales of construction and agricultural machinery. Significant R&D investments are required to comply with amendments to emission regulations. Each market has its own emission standards, which adds to the complexity of designing components, particularly engines.

This agricultural tractors market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the agricultural tractors market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Agricultural Tractors Market

COVID-19 disrupted the entire supply chain; however, the agricultural industry appeared to be the least affected of all industries. This was primarily due to government efforts to classify agricultural activities as essential services. During COVID-19, the agricultural industry faced four major challenges: a lack of farm equipment parts, a drop in new tractor sales in the first half of 2020, the closure of production facilities, and a drop in working capital. Despite the impact of COVID-19 on the agricultural tractor market, it is expected to rebound by the end of 2021.

Recent developments

- New Holland North America added the T7 Heavy-duty Tractor with PLM Intelligence to its agricultural tractor lineup in July 2021. The new tractor is designed to help farmers be more productive by allowing them to multitask in a variety of field and transport applications.

- TAFE (Tractors and Farm Equipment), the manufacturer of Massey Ferguson tractors, introduced its new DYNATRACK Series in February 2021, which is an advanced range of tractors that offer dynamic performance, sophisticated technology, unrivalled utility, and versatility, all engineered into a single powerful tractor.

Global Agricultural Tractors Market Scope

The agricultural tractors market is segmented on the basis of engine power, application, type, operation, and driver type. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Engine power

- Below 40 HP

- 40 HP–120 HP

- 121 HP–180 HP

- 181 HP–250 HP

- More than 250 HP

Type

- ICE

- Electric

Application

- Harvesting

- Seed Sowing

- Irrigation

- others

Operations

- Manual Tractor Vehicle

- Autonomous Tractor Vehicle

Driver type

- 2-Wheel Drive

- 4-Wheel Drive

Agricultural Tractors Market Regional Analysis/Insights

The agricultural tractors market is analysed and market size insights and trends are provided by country, of engine power, application, type, operation, and driver type as referenced above.

The countries covered in the agricultural tractors market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

China and India are the leading country-level markets for agricultural products such as crops and vegetables. Because of the availability of agricultural fields, Asia-Pacific countries are among the most appealing markets for agricultural tractors. According to the India Brand Equity Foundation, the agricultural sector is the primary source of income for nearly 58 percent of the country's population. The rising demand for agricultural machinery in the agricultural industry is expected to propel the agricultural tractors market in North America forward. Furthermore, the rising demand for agricultural implement modernization is expected to provide lucrative opportunities to the agricultural tractors market during the forecast period.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Agricultural Tractors Market Share Analysis

The agricultural tractors market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to agricultural tractors market.

Some of the major players operating in the agricultural tractors market are:

- Deere & Company (U.S)

- Tractors and Farm Equipment Limited (India)

- Kubota Corporation (Japan)

- CLAAS KGaA GmbH (Germany)

- AGCO Corporation (U.S)

- CNH Industrial N.V (UK)

- Enerpac Tool Group (U.S)

- JCB (UK)

- Mahindra & Mahindra Ltd. (India)

- SDF Group (Italy)

- Bucher Industries (Switzerland)

- Alamo Group, Inc. (U.S

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1. INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL AGRICULTURAL TRACTORS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2. MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL AGRICULTURAL TRACTORS MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 DEMAND AND SUPPLY-SIDE VARIABLES

2.2.8 CONSUMPTION TREND OF END PRODUCTS

2.2.9 TOP TO BOTTOM ANALYSIS

2.2.10 STANDARDS OF MEASUREMENT

2.2.11 VENDOR SHARE ANALYSIS

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL AGRICULTURAL TRACTORS MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3. MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4. EXECUTIVE SUMMARY

5. PREMIUM INSIGHTS

5.1 PRODUCTION ANALYSIS

5.2 IMPORT-EXPORT ANALYSIS

5.3 UPCOMING TRACTOR TECHNOLOGIES

5.3.1 HIGH PRECISION POSITIONING SYSTEM

5.3.2 GPS & GNSS

5.3.3 AUTOMATED STEERING SYSTEMS

5.3.4 GEO MAPPING

5.3.5 SENSORS & REMOTE SENSING

5.3.6 VARIABLE RATE TECHNOLOGY (VRT)

5.3.7 INTEGRATED ELECTRONIC COMMUNICATION

5.4 SUPPLY CHAIN ANALYSIS

5.5 VALUE CHAIN ANALYSIS

5.6 PRODUCTION COST ANALYSIS

5.7 GOVERNMENT SUPPORT FOR DEVELOPMENT OF AGRICULTURAL ACTIVITIES

5.8 INCREASE IN ADOPTION OF PRECISION FARMING

5.9 INCREASE IN DEMAND FOR FUEL EFFICIENT TRACTORS

5.10 ENGINE POWER INSIGHTS

6. REGULATORY FRAMEWORK

7. GLOBAL AGRICULTURAL TRACTORS MARKET, BY TYPE, 2020-2029, (USD MILLION), (UNITS)

8. (ASP, VALUE & VOLUME WILL BE PROVIDED FOR ALL THE SEGMENTS)

8.1 OVERVIEW

8.2 ORCHARD TRACTORS

8.2.1 ASP (USD)

8.2.2 VALUE (USD MILLION)

8.2.3 VOLUME (UNITS)

8.2.4 BY STEERING TYPE

8.2.4.1. MECHANICAL STEERING

8.2.4.2. HYDRAULIC STEERING

8.2.5 BY ENGINE HORSE POWER

8.2.5.1. LESSER THAN 50 HP

8.2.5.2. 51 HP TO 100 HP

8.2.5.3. 101 HP TO 200 HP

8.2.5.4. 201 HP TO 300 HP

8.2.5.5. 301 HP TO 400 HP

8.2.5.6. 401 HP TO 500 HP

8.2.5.7. GREATER THAN 500 HP

8.3 ROW-CROP TRACTORS

8.3.1 BY STEERING TYPE

8.3.1.1. MECHANICAL STEERING

8.3.1.2. HYDRAULIC STEERING

8.3.2 BY ENGINE HORSE POWER

8.3.2.1. LESSER THAN 50 HP

8.3.2.2. 51 HP TO 100 HP

8.3.2.3. 101 HP TO 200 HP

8.3.2.4. 201 HP TO 300 HP

8.3.2.5. 301 HP TO 400 HP

8.3.2.6. 401 HP TO 500 HP

8.3.2.7. GREATER THAN 500 HP

8.4 UTILITY TRACTORS

8.4.1 BY STEERING TYPE

8.4.1.1. MECHANICAL STEERING

8.4.1.2. HYDRAULIC STEERING

8.4.2 BY ENGINE HORSE POWER

8.4.2.1. LESSER THAN 50 HP

8.4.2.2. 51 HP TO 100 HP

8.4.2.3. 101 HP TO 200 HP

8.4.2.4. 201 HP TO 300 HP

8.4.2.5. 301 HP TO 400 HP

8.4.2.6. 401 HP TO 500 HP

8.4.2.7. GREATER THAN 500 HP

8.5 COMPACT TRACTORS

8.5.1 BY STEERING TYPE

8.5.1.1. MECHANICAL STEERING

8.5.1.2. HYDRAULIC STEERING

8.5.2 BY ENGINE HORSE POWER

8.5.2.1. LESSER THAN 50 HP

8.5.2.2. 51 HP TO 100 HP

8.5.2.3. 101 HP TO 200 HP

8.5.2.4. 201 HP TO 300 HP

8.5.2.5. 301 HP TO 400 HP

8.5.2.6. 401 HP TO 500 HP

8.5.2.7. GREATER THAN 500 HP

8.6 GARDEN TRACTORS

8.6.1 BY STEERING TYPE

8.6.1.1. MECHANICAL STEERING

8.6.1.2. HYDRAULIC STEERING

8.6.2 BY ENGINE HORSE POWER

8.6.2.1. LESSER THAN 50 HP

8.6.2.2. 51 HP TO 100 HP

8.6.2.3. 101 HP TO 200 HP

8.6.2.4. 201 HP TO 300 HP

8.6.2.5. 301 HP TO 400 HP

8.6.2.6. 401 HP TO 500 HP

8.6.2.7. GREATER THAN 500 HP

8.7 IMPLEMENT CARRIER TRACTORS

8.7.1 BY STEERING TYPE

8.7.1.1. MECHANICAL STEERING

8.7.1.2. HYDRAULIC STEERING

8.7.2 BY ENGINE HORSE POWER

8.7.2.1. LESSER THAN 50 HP

8.7.2.2. 51 HP TO 100 HP

8.7.2.3. 101 HP TO 200 HP

8.7.2.4. 201 HP TO 300 HP

8.7.2.5. 301 HP TO 400 HP

8.7.2.6. 401 HP TO 500 HP

8.7.2.7. GREATER THAN 500 HP

8.8 TWO WHEEL TRACTORS

8.8.1 BY STEERING TYPE

8.8.1.1. MECHANICAL STEERING

8.8.1.2. HYDRAULIC STEERING

8.8.2 BY ENGINE HORSE POWER

8.8.2.1. LESSER THAN 50 HP

8.8.2.2. 51 HP TO 100 HP

8.8.2.3. 101 HP TO 200 HP

8.8.2.4. 201 HP TO 300 HP

8.8.2.5. 301 HP TO 400 HP

8.8.2.6. 401 HP TO 500 HP

8.8.2.7. GREATER THAN 500 HP

8.9 SPECIALTY TRACTORS

8.9.1 BY STEERING TYPE

8.9.1.1. MECHANICAL STEERING

8.9.1.2. HYDRAULIC STEERING

8.9.2 BY ENGINE HORSE POWER

8.9.2.1. LESSER THAN 50 HP

8.9.2.2. 51 HP TO 100 HP

8.9.2.3. 101 HP TO 200 HP

8.9.2.4. 201 HP TO 300 HP

8.9.2.5. 301 HP TO 400 HP

8.9.2.6. 401 HP TO 500 HP

8.9.2.7. GREATER THAN 500 HP

8.10 TRACK TRACTORS

8.10.1 BY STEERING TYPE

8.10.1.1. MECHANICAL STEERING

8.10.1.2. HYDRAULIC STEERING

8.10.2 BY ENGINE HORSE POWER

8.10.2.1. LESSER THAN 50 HP

8.10.2.2. 51 HP TO 100 HP

8.10.2.3. 101 HP TO 200 HP

8.10.2.4. 201 HP TO 300 HP

8.10.2.5. 301 HP TO 400 HP

8.10.2.6. 401 HP TO 500 HP

8.10.2.7. GREATER THAN 500 HP

8.11 OTHER TYPES

8.11.1 BY STEERING TYPE

8.11.1.1. MECHANICAL STEERING

8.11.1.2. HYDRAULIC STEERING

8.11.2 BY ENGINE HORSE POWER

8.11.2.1. LESSER THAN 50 HP

8.11.2.2. 51 HP TO 100 HP

8.11.2.3. 101 HP TO 200 HP

8.11.2.4. 201 HP TO 300 HP

8.11.2.5. 301 HP TO 400 HP

8.11.2.6. 401 HP TO 500 HP

8.11.2.7. GREATER THAN 500 HP

9. GLOBAL AGRICULTURAL TRACTORS MARKET, BY ENGINE HORSE POWER, 2020-2029, (USD MILLION), (UNITS)

(ASP, VALUE & VOLUME WILL BE PROVIDED FOR ALL THE SEGMENTS)

9.1 OVERVIEW

9.2 LESSER THAN 50 HP

9.2.1 BY TRANSMISSION TYPE

9.2.1.1. MECHANICAL TRANSMISSION

9.2.1.2. HST (HYDRO STATIC TRANSMISSION)

9.2.1.3. GST (GLIDE SHIFT TRANSMISSION)

9.2.1.4. POWERSHIFT TRANSMISSION

9.2.1.5. CVT (CONTINUOUSLY VARIABLE TRANSMISSION)

9.2.2 BY AUTONOMOUS SYSTEM

9.2.2.1. AUTOMATIC

9.2.2.1.1. SEMI-AUTOMATIC

9.2.2.1.2. FULLY AUTOMATIC

9.2.2.2. MANUAL

9.2.3 BY DRIVE TYPE

9.2.3.1. 2 WD

9.2.3.2. 4 WD

9.3 51 HP TO 100 HP

9.3.1 BY TRANSMISSION TYPE

9.3.1.1. MECHANICAL TRANSMISSION

9.3.1.2. HST (HYDRO STATIC TRANSMISSION)

9.3.1.3. GST (GLIDE SHIFT TRANSMISSION)

9.3.1.4. POWERSHIFT TRANSMISSION

9.3.1.5. CVT (CONTINUOUSLY VARIABLE TRANSMISSION)

9.3.2 BY AUTONOMOUS SYSTEM

9.3.2.1. AUTOMATIC

9.3.2.1.1. SEMI-AUTOMATIC

9.3.2.1.2. FULLY AUTOMATIC

9.3.2.2. MANUAL

9.3.3 BY DRIVE TYPE

9.3.3.1. 2 WD

9.3.3.2. 4 WD

9.4 101 HP TO 200 HP

9.4.1 BY TRANSMISSION TYPE

9.4.1.1. MECHANICAL TRANSMISSION

9.4.1.2. HST (HYDRO STATIC TRANSMISSION)

9.4.1.3. GST (GLIDE SHIFT TRANSMISSION)

9.4.1.4. POWERSHIFT TRANSMISSION

9.4.1.5. CVT (CONTINUOUSLY VARIABLE TRANSMISSION)

9.4.2 BY AUTONOMOUS SYSTEM

9.4.2.1. AUTOMATIC

9.4.2.1.1. SEMI-AUTOMATIC

9.4.2.1.2. FULLY AUTOMATIC

9.4.2.2. MANUAL

9.4.3 BY DRIVE TYPE

9.4.3.1. 2 WD

9.4.3.2. 4 WD

9.5 201 HP TO 300 HP

9.5.1 BY TRANSMISSION TYPE

9.5.1.1. MECHANICAL TRANSMISSION

9.5.1.2. HST (HYDRO STATIC TRANSMISSION)

9.5.1.3. GST (GLIDE SHIFT TRANSMISSION)

9.5.1.4. POWERSHIFT TRANSMISSION

9.5.1.5. CVT (CONTINUOUSLY VARIABLE TRANSMISSION)

9.5.2 BY AUTONOMOUS SYSTEM

9.5.2.1. AUTOMATIC

9.5.2.1.1. SEMI-AUTOMATIC

9.5.2.1.2. FULLY AUTOMATIC

9.5.2.2. MANUAL

9.5.3 BY DRIVE TYPE

9.5.3.1. 2 WD

9.5.3.2. 4 WD

9.6 301 HP TO 400 HP

9.6.1 BY TRANSMISSION TYPE

9.6.1.1. MECHANICAL TRANSMISSION

9.6.1.2. HST (HYDRO STATIC TRANSMISSION)

9.6.1.3. GST (GLIDE SHIFT TRANSMISSION)

9.6.1.4. POWERSHIFT TRANSMISSION

9.6.1.5. CVT (CONTINUOUSLY VARIABLE TRANSMISSION)

9.6.2 BY AUTONOMOUS SYSTEM

9.6.2.1. AUTOMATIC

9.6.2.1.1. SEMI-AUTOMATIC

9.6.2.1.2. FULLY AUTOMATIC

9.6.2.2. MANUAL

9.6.3 BY DRIVE TYPE

9.6.3.1. 2 WD

9.6.3.2. 4 WD

9.7 401 HP TO 500 HP

9.7.1 BY TRANSMISSION TYPE

9.7.1.1. MECHANICAL TRANSMISSION

9.7.1.2. HST (HYDRO STATIC TRANSMISSION)

9.7.1.3. GST (GLIDE SHIFT TRANSMISSION)

9.7.1.4. POWERSHIFT TRANSMISSION

9.7.1.5. CVT (CONTINUOUSLY VARIABLE TRANSMISSION)

9.7.2 BY AUTONOMOUS SYSTEM

9.7.2.1. AUTOMATIC

9.7.2.1.1. SEMI-AUTOMATIC

9.7.2.1.2. FULLY AUTOMATIC

9.7.2.2. MANUAL

9.7.3 BY DRIVE TYPE

9.7.3.1. 2 WD

9.7.3.2. 4 WD

9.8 GREATER THAN 500 HP

9.8.1 BY TRANSMISSION TYPE

9.8.1.1. MECHANICAL TRANSMISSION

9.8.1.2. HST (HYDRO STATIC TRANSMISSION)

9.8.1.3. GST (GLIDE SHIFT TRANSMISSION)

9.8.1.4. POWERSHIFT TRANSMISSION

9.8.1.5. CVT (CONTINUOUSLY VARIABLE TRANSMISSION)

9.8.2 BY AUTONOMOUS SYSTEM

9.8.2.1. AUTOMATIC

9.8.2.1.1. SEMI-AUTOMATIC

9.8.2.1.2. FULLY AUTOMATIC

9.8.2.2. MANUAL

9.8.3 BY DRIVE TYPE

9.8.3.1. 2 WD

9.8.3.2. 4 WD

10. GLOBAL AGRICULTURAL TRACTORS MARKET, BY ENGINE CAPACITY, 2020-2029, (USD MILLION)

10.1 OVERVIEW

10.2 LOW POWER

10.3 MID POWER

10.4 HIGH POWER

11. GLOBAL AGRICULTURAL TRACTORS MARKET, BY DRIVE TYPE, 2020-2029, (USD MILLION)

11.1 OVERVIEW

11.2 2 WD

11.3 4 WD

12. GLOBAL AGRICULTURAL TRACTORS MARKET, BY PROPULSION, 2020-2029, (USD MILLION)

12.1 OVERVIEW

12.2 ICE

12.3 ELECTRIC & HYBRID

13. GLOBAL AGRICULTURAL TRACTORS MARKET, BY AUTONOMOUS SYSTEM, 2020-2029, (USD MILLION)

13.1 OVERVIEW

13.2 AUTOMATIC

13.2.1 SEMI-AUTOMATIC

13.2.2 FULLY AUTOMATIC

13.3 MANUAL

14. GLOBAL AGRICULTURAL TRACTORS MARKET, BY WEIGHT, 2020-2029, (USD MILLION)

14.1 OVERVIEW

14.2 LESS THAN 1000 KG

14.3 1001-1200 KG

14.4 1201-1400 KG

14.5 1401-1600 KG

14.6 1601-1800 KG

14.7 1801-2000 KG

14.8 MORE THAN 2000 KG

15. GLOBAL AGRICULTURAL TRACTORS MARKET, BY TRANSMISSION TYPE, 2020-2029, (USD MILLION)

15.1 OVERVIEW

15.2 MECHANICAL TRANSMISSION

15.3 HST (HYDRO STATIC TRANSMISSION)

15.4 GST (GLIDE SHIFT TRANSMISSION)

15.5 POWERSHIFT TRANSMISSION

15.6 CVT (CONTINUOUSLY VARIABLE TRANSMISSION)

16. GLOBAL AGRICULTURAL TRACTORS MARKET, BY STEERING TYPE, 2020-2029, (USD MILLION)

16.1 OVERVIEW

16.2 MECHANICAL STEERING

16.3 HYDRAULIC STEERING

17. GLOBAL AGRICULTURAL TRACTORS MARKET, BY RIDE COMFORT, 2020-2029, (USD MILLION)

17.1 OVERVIEW

17.2 HYDRA CUSHION

17.3 AIR CUSHION

17.4 CAP SUSPENSION

18. GLOBAL AGRICULTURAL TRACTORS MARKET, BY AGRICULTURAL APPLICATION, 2020-2029, (USD MILLION)

18.1 OVERVIEW

18.2 HARVESTING

18.2.1 BY TYPE

18.2.1.1. ORCHARD TRACTORS

18.2.1.2. ROW-CROP TRACTORS

18.2.1.3. UTILITY TRACTORS

18.2.1.4. COMPACT TRACTORS

18.2.1.5. GARDEN TRACTORS

18.2.1.6. IMPLEMENT CARRIER TRACTORS

18.2.1.7. TWO WHEEL TRACTORS

18.2.1.8. SPECIALTY TRACTORS

18.2.1.9. TRACK TRACTORS

18.2.1.10. OTHER TYPES

18.3 SEED SOWING

18.3.1 BY TYPE

18.3.1.1. ORCHARD TRACTORS

18.3.1.2. ROW-CROP TRACTORS

18.3.1.3. UTILITY TRACTORS

18.3.1.4. COMPACT TRACTORS

18.3.1.5. GARDEN TRACTORS

18.3.1.6. IMPLEMENT CARRIER TRACTORS

18.3.1.7. TWO WHEEL TRACTORS

18.3.1.8. SPECIALTY TRACTORS

18.3.1.9. TRACK TRACTORS

18.3.1.10. OTHER TYPES

18.4 IRRIGATION

18.4.1 BY TYPE

18.4.1.1. ORCHARD TRACTORS

18.4.1.2. ROW-CROP TRACTORS

18.4.1.3. UTILITY TRACTORS

18.4.1.4. COMPACT TRACTORS

18.4.1.5. GARDEN TRACTORS

18.4.1.6. IMPLEMENT CARRIER TRACTORS

18.4.1.7. TWO WHEEL TRACTORS

18.4.1.8. SPECIALTY TRACTORS

18.4.1.9. TRACK TRACTORS

18.4.1.10. OTHER TYPES

18.5 SPRAYING

18.5.1 BY TYPE

18.5.1.1. ORCHARD TRACTORS

18.5.1.2. ROW-CROP TRACTORS

18.5.1.3. UTILITY TRACTORS

18.5.1.4. COMPACT TRACTORS

18.5.1.5. GARDEN TRACTORS

18.5.1.6. IMPLEMENT CARRIER TRACTORS

18.5.1.7. TWO WHEEL TRACTORS

18.5.1.8. SPECIALTY TRACTORS

18.5.1.9. TRACK TRACTORS

18.5.1.10. OTHER TYPES

18.6 DRILLING

18.6.1 BY TYPE

18.6.1.1. ORCHARD TRACTORS

18.6.1.2. ROW-CROP TRACTORS

18.6.1.3. UTILITY TRACTORS

18.6.1.4. COMPACT TRACTORS

18.6.1.5. GARDEN TRACTORS

18.6.1.6. IMPLEMENT CARRIER TRACTORS

18.6.1.7. TWO WHEEL TRACTORS

18.6.1.8. SPECIALTY TRACTORS

18.6.1.9. TRACK TRACTORS

18.6.1.10. OTHER TYPES

18.7 LOADING

18.7.1 BY TYPE

18.7.1.1. ORCHARD TRACTORS

18.7.1.2. ROW-CROP TRACTORS

18.7.1.3. UTILITY TRACTORS

18.7.1.4. COMPACT TRACTORS

18.7.1.5. GARDEN TRACTORS

18.7.1.6. IMPLEMENT CARRIER TRACTORS

18.7.1.7. TWO WHEEL TRACTORS

18.7.1.8. SPECIALTY TRACTORS

18.7.1.9. TRACK TRACTORS

18.7.1.10. OTHER TYPES

18.8 ROTARY SWEEPING

18.8.1 BY TYPE

18.8.1.1. ORCHARD TRACTORS

18.8.1.2. ROW-CROP TRACTORS

18.8.1.3. UTILITY TRACTORS

18.8.1.4. COMPACT TRACTORS

18.8.1.5. GARDEN TRACTORS

18.8.1.6. IMPLEMENT CARRIER TRACTORS

18.8.1.7. TWO WHEEL TRACTORS

18.8.1.8. SPECIALTY TRACTORS

18.8.1.9. TRACK TRACTORS

18.8.1.10. OTHER TYPES

18.9 DRILLING SEEDS

18.9.1 BY TYPE

18.9.1.1. ORCHARD TRACTORS

18.9.1.2. ROW-CROP TRACTORS

18.9.1.3. UTILITY TRACTORS

18.9.1.4. COMPACT TRACTORS

18.9.1.5. GARDEN TRACTORS

18.9.1.6. IMPLEMENT CARRIER TRACTORS

18.9.1.7. TWO WHEEL TRACTORS

18.9.1.8. SPECIALTY TRACTORS

18.9.1.9. TRACK TRACTORS

18.9.1.10. OTHER TYPES

18.10 WEED CONTROLLING

18.10.1 BY TYPE

18.10.1.1. ORCHARD TRACTORS

18.10.1.2. ROW-CROP TRACTORS

18.10.1.3. UTILITY TRACTORS

18.10.1.4. COMPACT TRACTORS

18.10.1.5. GARDEN TRACTORS

18.10.1.6. IMPLEMENT CARRIER TRACTORS

18.10.1.7. TWO WHEEL TRACTORS

18.10.1.8. SPECIALTY TRACTORS

18.10.1.9. TRACK TRACTORS

18.10.1.10. OTHER TYPES

18.11 PULLING HEAVY IMPLEMENTS.

18.11.1 BY TYPE

18.11.1.1. ORCHARD TRACTORS

18.11.1.2. ROW-CROP TRACTORS

18.11.1.3. UTILITY TRACTORS

18.11.1.4. COMPACT TRACTORS

18.11.1.5. GARDEN TRACTORS

18.11.1.6. IMPLEMENT CARRIER TRACTORS

18.11.1.7. TWO WHEEL TRACTORS

18.11.1.8. SPECIALTY TRACTORS

18.11.1.9. TRACK TRACTORS

18.11.1.10. OTHER TYPES

18.12 PLOUGHING

18.12.1 BY TYPE

18.12.1.1. ORCHARD TRACTORS

18.12.1.2. ROW-CROP TRACTORS

18.12.1.3. UTILITY TRACTORS

18.12.1.4. COMPACT TRACTORS

18.12.1.5. GARDEN TRACTORS

18.12.1.6. IMPLEMENT CARRIER TRACTORS

18.12.1.7. TWO WHEEL TRACTORS

18.12.1.8. SPECIALTY TRACTORS

18.12.1.9. TRACK TRACTORS

18.12.1.10. OTHER TYPES

18.13 HARROWING

18.13.1 BY TYPE

18.13.1.1. ORCHARD TRACTORS

18.13.1.2. ROW-CROP TRACTORS

18.13.1.3. UTILITY TRACTORS

18.13.1.4. COMPACT TRACTORS

18.13.1.5. GARDEN TRACTORS

18.13.1.6. IMPLEMENT CARRIER TRACTORS

18.13.1.7. TWO WHEEL TRACTORS

18.13.1.8. SPECIALTY TRACTORS

18.13.1.9. TRACK TRACTORS

18.13.1.10. OTHER TYPES

18.14 TRANSPORTING

18.14.1 BY TYPE

18.14.1.1. ORCHARD TRACTORS

18.14.1.2. ROW-CROP TRACTORS

18.14.1.3. UTILITY TRACTORS

18.14.1.4. COMPACT TRACTORS

18.14.1.5. GARDEN TRACTORS

18.14.1.6. IMPLEMENT CARRIER TRACTORS

18.14.1.7. TWO WHEEL TRACTORS

18.14.1.8. SPECIALTY TRACTORS

18.14.1.9. TRACK TRACTORS

18.14.1.10. OTHER TYPES

18.15 OTHERS

18.15.1 BY TYPE

18.15.1.1. ORCHARD TRACTORS

18.15.1.2. ROW-CROP TRACTORS

18.15.1.3. UTILITY TRACTORS

18.15.1.4. COMPACT TRACTORS

18.15.1.5. GARDEN TRACTORS

18.15.1.6. IMPLEMENT CARRIER TRACTORS

18.15.1.7. TWO WHEEL TRACTORS

18.15.1.8. SPECIALTY TRACTORS

18.15.1.9. TRACK TRACTORS

18.15.1.10. OTHER TYPES

19. GLOBAL AGRICULTURAL TRACTORS MARKET, BY COUNTRY, 2020-2029, (USD MILLION)

GLOBAL AGRICULTURAL TRACTORS MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

19.1 NORTH AMERICA

19.1.1 U.S.

19.1.2 CANADA

19.1.3 MEXICO

19.2 EUROPE

19.2.1 GERMANY

19.2.2 U.K.

19.2.3 ITALY

19.2.4 FRANCE

19.2.5 SPAIN

19.2.6 RUSSIA

19.2.7 SWITZERLAND

19.2.8 TURKEY

19.2.9 BELGIUM

19.2.10 NETHERLANDS

19.2.11 DENMARK

19.2.12 SWEDEN

19.2.13 POLAND

19.2.14 NORWAY

19.2.15 FINLAND

19.2.16 REST OF EUROPE

19.3 ASIA-PACIFIC

19.3.1 JAPAN

19.3.2 CHINA

19.3.3 SOUTH KOREA

19.3.4 INDIA

19.3.5 SINGAPORE

19.3.6 THAILAND

19.3.7 INDONESIA

19.3.8 MALAYSIA

19.3.9 PHILIPPINES

19.3.10 AUSTRALIA

19.3.11 NEW ZEALAND

19.3.12 VIETNAM

19.3.13 TAIWAN

19.3.14 REST OF ASIA-PACIFIC

19.4 SOUTH AMERICA

19.4.1 BRAZIL

19.4.2 ARGENTINA

19.4.3 REST OF SOUTH AMERICA

19.5 MIDDLE EAST AND AFRICA

19.5.1 SOUTH AFRICA

19.5.2 EGYPT

19.5.3 BAHRAIN

19.5.4 UNITED ARAB EMIRATES

19.5.5 KUWAIT

19.5.6 OMAN

19.5.7 QATAR

19.5.8 SAUDI ARABIA

19.5.9 REST OF MEA

20. GLOBAL AGRICULTURAL TRACTORS MARKET, COMPANY LANDSCAPE

20.1 COMPANY SHARE ANALYSIS: GLOBAL

20.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

20.3 COMPANY SHARE ANALYSIS: EUROPE

20.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

20.5 MERGERS & ACQUISITIONS

20.6 NEW PRODUCT DEVELOPMENT & APPROVALS

20.7 EXPANSIONS & PARTNERSHIP

20.8 REGULATORY CHANGES

21. GLOBAL AGRICULTURAL TRACTORS MARKET, SWOT & DBMR ANALYSIS

22. GLOBAL AGRICULTURAL TRACTORS MARKET, COMPANY PROFILE

22.1 DEERE & COMPANY

22.1.1 COMPANY OVERVIEW

22.1.2 REVENUE ANALYSIS

22.1.3 GEOGRAPHIC PRESENCE

22.1.4 PRODUCT PORTFOLIO

22.1.5 RECENT DEVELOPMENTS

22.2 MAHINDRA TRACTORS

22.2.1 COMPANY OVERVIEW

22.2.2 REVENUE ANALYSIS

22.2.3 GEOGRAPHIC PRESENCE

22.2.4 PRODUCT PORTFOLIO

22.2.5 RECENT DEVELOPMENTS

22.3 KUBOTA CORPORATION

22.3.1 COMPANY OVERVIEW

22.3.2 REVENUE ANALYSIS

22.3.3 GEOGRAPHIC PRESENCE

22.3.4 PRODUCT PORTFOLIO

22.3.5 RECENT DEVELOPMENTS

22.4 YANMAR HOLDINGS CO., LTD

22.4.1 COMPANY OVERVIEW

22.4.2 REVENUE ANALYSIS

22.4.3 GEOGRAPHIC PRESENCE

22.4.4 PRODUCT PORTFOLIO

22.4.5 RECENT DEVELOPMENTS

22.5 MASSEY FERGUSON

22.5.1 COMPANY OVERVIEW

22.5.2 REVENUE ANALYSIS

22.5.3 GEOGRAPHIC PRESENCE

22.5.4 PRODUCT PORTFOLIO

22.5.5 RECENT DEVELOPMENTS

22.6 FARMTRAC

22.6.1 COMPANY OVERVIEW

22.6.2 REVENUE ANALYSIS

22.6.3 GEOGRAPHIC PRESENCE

22.6.4 PRODUCT PORTFOLIO

22.6.5 RECENT DEVELOPMENTS

22.7 DONGFENG

22.7.1 COMPANY OVERVIEW

22.7.2 REVENUE ANALYSIS

22.7.3 GEOGRAPHIC PRESENCE

22.7.4 PRODUCT PORTFOLIO

22.7.5 RECENT DEVELOPMENTS

22.8 DAEDONG CORPORATION

22.8.1 COMPANY OVERVIEW

22.8.2 REVENUE ANALYSIS

22.8.3 GEOGRAPHIC PRESENCE

22.8.4 PRODUCT PORTFOLIO

22.8.5 RECENT DEVELOPMENTS

22.9 CNH INDUSTRIAL N.V.

22.9.1 COMPANY OVERVIEW

22.9.2 REVENUE ANALYSIS

22.9.3 GEOGRAPHIC PRESENCE

22.9.4 PRODUCT PORTFOLIO

22.9.5 RECENT DEVELOPMENTS

22.10 SDF GROUP

22.10.1 COMPANY OVERVIEW

22.10.2 REVENUE ANALYSIS

22.10.3 GEOGRAPHIC PRESENCE

22.10.4 PRODUCT PORTFOLIO

22.10.5 RECENT DEVELOPMENTS

22.11 VALTRA INC.

22.11.1 COMPANY OVERVIEW

22.11.2 REVENUE ANALYSIS

22.11.3 GEOGRAPHIC PRESENCE

22.11.4 PRODUCT PORTFOLIO

22.11.5 RECENT DEVELOPMENTS

22.12 ARGO TRACTORS S.P.A

22.12.1 COMPANY OVERVIEW

22.12.2 REVENUE ANALYSIS

22.12.3 GEOGRAPHIC PRESENCE

22.12.4 PRODUCT PORTFOLIO

22.12.5 RECENT DEVELOPMENTS

22.13 AGCO CORPORATION

22.13.1 COMPANY OVERVIEW

22.13.2 REVENUE ANALYSIS

22.13.3 GEOGRAPHIC PRESENCE

22.13.4 PRODUCT PORTFOLIO

22.13.5 RECENT DEVELOPMENTS

22.14 ESCORTS LIMITED

22.14.1 COMPANY OVERVIEW

22.14.2 REVENUE ANALYSIS

22.14.3 GEOGRAPHIC PRESENCE

22.14.4 PRODUCT PORTFOLIO

22.14.5 RECENT DEVELOPMENTS

22.15 JORDAN TRACTOR & EQUIPMENT CO.

22.15.1 COMPANY OVERVIEW

22.15.2 REVENUE ANALYSIS

22.15.3 GEOGRAPHIC PRESENCE

22.15.4 PRODUCT PORTFOLIO

22.15.5 RECENT DEVELOPMENTS

22.16 CAPTAIN TRACTORS PVT. LTD.

22.16.1 COMPANY OVERVIEW

22.16.2 REVENUE ANALYSIS

22.16.3 GEOGRAPHIC PRESENCE

22.16.4 PRODUCT PORTFOLIO

22.16.5 RECENT DEVELOPMENTS

22.17 EICHER TRACTORS

22.17.1 COMPANY OVERVIEW

22.17.2 REVENUE ANALYSIS

22.17.3 GEOGRAPHIC PRESENCE

22.17.4 PRODUCT PORTFOLIO

22.17.5 RECENT DEVELOPMENTS

22.18 FORCE MOTORS LTD

22.18.1 COMPANY OVERVIEW

22.18.2 REVENUE ANALYSIS

22.18.3 GEOGRAPHIC PRESENCE

22.18.4 PRODUCT PORTFOLIO

22.18.5 RECENT DEVELOPMENTS

22.19 GROMAX AGRI EQUIPMENT LIMITED

22.19.1 COMPANY OVERVIEW

22.19.2 REVENUE ANALYSIS

22.19.3 GEOGRAPHIC PRESENCE

22.19.4 PRODUCT PORTFOLIO

22.19.5 RECENT DEVELOPMENTS

22.20 ZIMENO INC DBA MONARCH TRACTOR

22.20.1 COMPANY OVERVIEW

22.20.2 REVENUE ANALYSIS

22.20.3 GEOGRAPHIC PRESENCE

22.20.4 PRODUCT PORTFOLIO

22.20.5 RECENT DEVELOPMENTS

22.21 SOLECTRAC

22.21.1 COMPANY OVERVIEW

22.21.2 REVENUE ANALYSIS

22.21.3 GEOGRAPHIC PRESENCE

22.21.4 PRODUCT PORTFOLIO

22.21.5 RECENT DEVELOPMENTS

22.22 SONALIKA

22.22.1 COMPANY OVERVIEW

22.22.2 REVENUE ANALYSIS

22.22.3 GEOGRAPHIC PRESENCE

22.22.4 PRODUCT PORTFOLIO

22.22.5 RECENT DEVELOPMENTS

22.23 STANDARD CORPORATION INDIA LIMITED

22.23.1 COMPANY OVERVIEW

22.23.2 REVENUE ANALYSIS

22.23.3 GEOGRAPHIC PRESENCE

22.23.4 PRODUCT PORTFOLIO

22.23.5 RECENT DEVELOPMENTS

22.24 JCB

22.24.1 COMPANY OVERVIEW

22.24.2 REVENUE ANALYSIS

22.24.3 GEOGRAPHIC PRESENCE

22.24.4 PRODUCT PORTFOLIO

22.24.5 RECENT DEVELOPMENTS

22.25 CLAAS KGAA MBH

22.25.1 COMPANY OVERVIEW

22.25.2 REVENUE ANALYSIS

22.25.3 GEOGRAPHIC PRESENCE

22.25.4 PRODUCT PORTFOLIO

22.25.5 RECENT DEVELOPMENTS

22.26 ISEKI & CO.,LTD.

22.26.1 COMPANY OVERVIEW

22.26.2 REVENUE ANALYSIS

22.26.3 GEOGRAPHIC PRESENCE

22.26.4 PRODUCT PORTFOLIO

22.26.5 RECENT DEVELOPMENTS

22.27 SHIBAURA EUROPE BV

22.27.1 COMPANY OVERVIEW

22.27.2 REVENUE ANALYSIS

22.27.3 GEOGRAPHIC PRESENCE

22.27.4 PRODUCT PORTFOLIO

22.27.5 RECENT DEVELOPMENTS

22.28 HINOMOTO

22.28.1 COMPANY OVERVIEW

22.28.2 REVENUE ANALYSIS

22.28.3 GEOGRAPHIC PRESENCE

22.28.4 PRODUCT PORTFOLIO

22.28.5 RECENT DEVELOPMENTS

22.29 PREET GROUP

22.29.1 COMPANY OVERVIEW

22.29.2 REVENUE ANALYSIS

22.29.3 GEOGRAPHIC PRESENCE

22.29.4 PRODUCT PORTFOLIO

22.29.5 RECENT DEVELOPMENTS

22.30 MITSUBISHI

22.30.1 COMPANY OVERVIEW

22.30.2 REVENUE ANALYSIS

22.30.3 GEOGRAPHIC PRESENCE

22.30.4 PRODUCT PORTFOLIO

22.30.5 RECENT DEVELOPMENTS

22.31 TILMOR LLC

22.31.1 COMPANY OVERVIEW

22.31.2 REVENUE ANALYSIS

22.31.3 GEOGRAPHIC PRESENCE

22.31.4 PRODUCT PORTFOLIO

22.31.5 RECENT DEVELOPMENTS

*NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

23. RELATED REPORTS

24. QUESTIONNAIRE

25. ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.