Global Agriculture Compact Tractor Market

Market Size in USD Billion

CAGR :

%

USD

18.19 Billion

USD

25.09 Billion

2025

2033

USD

18.19 Billion

USD

25.09 Billion

2025

2033

| 2026 –2033 | |

| USD 18.19 Billion | |

| USD 25.09 Billion | |

|

|

|

|

What is the Global Agriculture Compact Tractor Market Size and Growth Rate?

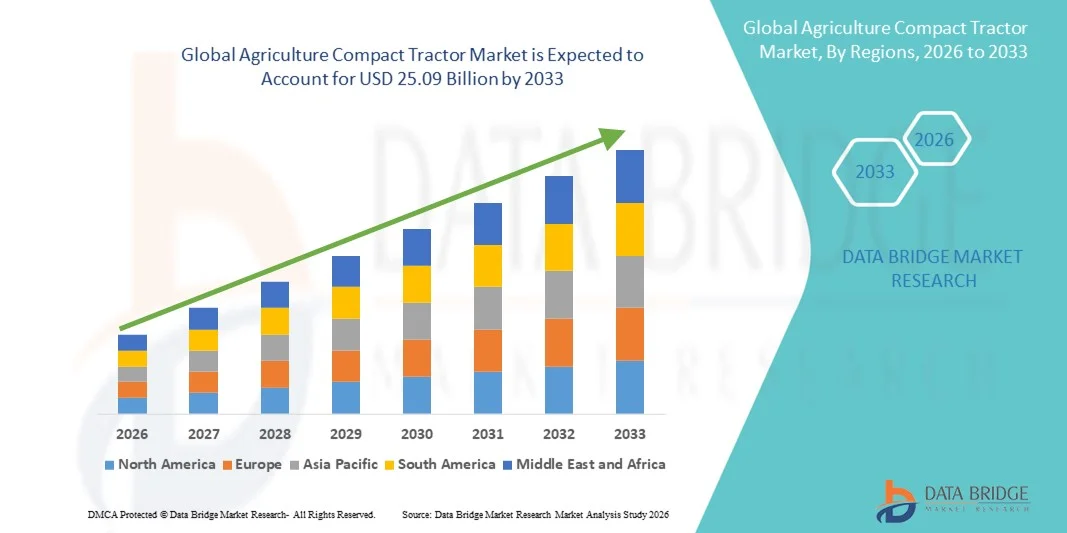

- The global agriculture compact tractor market size was valued at USD 18.19 billion in 2025 and is expected to reach USD 25.09 billion by 2033, at a CAGR of4.10% during the forecast period

- Major factors that are expected to boost the growth of the agricultural compact tractor market in the forecast period are the rise in the development in the agricultural sector

What are the Major Takeaways of Agriculture Compact Tractor Market?

- The increase in the need agricultural productivity is further anticipated to propel the growth of the agricultural compact tractor market. Moreover, the increase in the labour scarcity is further estimated to cushion the growth of the agricultural compact tractor market

- On the other hand, the occurrence of the coronavirus outbreak pandemic is further projected to impede the growth of the agricultural compact tractor market in the timeline period

- Asia-Pacific dominated the agriculture compact tractor market with a 44.2% revenue share in 2025, driven by a large agricultural workforce, high concentration of small and marginal farms, and rapid mechanization across China, India, Japan, and Southeast Asia

- North America is expected to register the fastest CAGR of 9.47% from 2026 to 2033, driven by rising adoption of compact tractors for landscaping, hobby farming, property maintenance, and specialty agriculture across the U.S. and Canada

- The 20–40 HP segment dominated the market with a 43.6% share in 2025, as it offers an optimal balance between power, fuel efficiency, and versatility

Report Scope and Agriculture Compact Tractor Market Segmentation

|

Attributes |

Agriculture Compact Tractor Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Agriculture Compact Tractor Market?

Increasing Shift Toward High-Performance, Compact, and Multi-Functional Agriculture Compact Tractors

- The agriculture compact tractor market is witnessing strong adoption of compact, high-horsepower, and technologically advanced tractors designed to support small farms, orchards, vineyards, landscaping, and municipal applications

- Manufacturers are introducing multi-functional compact tractors equipped with advanced hydraulics, front loaders, PTO compatibility, and attachment versatility to improve operational efficiency

- Growing demand for lightweight, maneuverable, and fuel-efficient tractors is driving adoption across smallholder farms, hobby farms, and specialty crop cultivation

- For instance, companies such as Kubota, Deere & Company, Mahindra & Mahindra, CNH Industrial, and AGCO have expanded their compact tractor portfolios with enhanced engine performance, ergonomic designs, and precision farming features

- Increasing integration of GPS guidance, telematics, and smart control systems is accelerating the shift toward digitally enabled compact tractors

- As farming operations prioritize flexibility, productivity, and cost efficiency, Agriculture Compact Tractors will remain critical for modern small-scale and precision farming operations

What are the Key Drivers of Agriculture Compact Tractor Market?

- Rising demand for affordable, easy-to-operate, and versatile tractors to support mechanization among small and medium-sized farms

- For instance, in 2025, leading manufacturers such as Kubota, Mahindra & Mahindra, Yanmar, and TAFE launched upgraded compact tractor models with improved fuel efficiency, lower emissions, and enhanced operator comfort

- Growing adoption of precision agriculture, smart farming practices, and mechanized equipment is boosting demand across the U.S., Europe, and Asia-Pacific

- Advancements in engine technology, transmission systems, hydraulics, and attachment compatibility have strengthened tractor performance and durability

- Rising labor shortages and increasing farm operational costs are creating strong demand for compact tractors capable of multi-tasking across farming and non-farming applications

- Supported by government incentives, rural mechanization programs, and steady investments in agricultural modernization, the Agriculture Compact Tractor market is expected to witness sustained long-term growth

Which Factor is Challenging the Growth of the Agriculture Compact Tractor Market?

- High upfront costs associated with technologically advanced compact tractors limit adoption among smallholder and marginal farmers

- For instance, during 2024–2025, fluctuations in raw material prices, supply chain disruptions, and emission compliance costs increased manufacturing expenses for global tractor manufacturers

- Limited access to financing options, subsidies, and after-sales service networks in emerging and rural markets restrict market penetration

- Complexity in operating and maintaining digitally enabled and electronically controlled tractors increases the need for skilled operators and training

- Competition from used tractors, rental equipment, and low-cost regional manufacturers creates pricing pressure for established brands

- To address these challenges, companies are focusing on cost-optimized models, localized manufacturing, financing partnerships, and farmer training initiatives to enhance global adoption of agriculture compact tractors

How is the Agriculture Compact Tractor Market Segmented?

The market is segmented on the basis of engine capacity, transmission, and application.

- By Engine Capacity

On the basis of engine capacity, the agriculture compact tractor market is segmented into Below 20 HP, 20–40 HP, 21–30 HP, 41–50 HP, and Less than 60 HP. The 20–40 HP segment dominated the market with a 43.6% share in 2025, as it offers an optimal balance between power, fuel efficiency, and versatility. Tractors in this range are widely used for small to medium-sized farms, orchards, vineyards, and utility operations, supporting multiple attachments such as loaders, mowers, and tillers. Their affordability, ease of operation, and suitability for diverse farming activities drive strong adoption across Asia-Pacific, Europe, and North America.

The 41–50 HP segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for higher lifting capacity, improved hydraulic performance, and increased mechanization among commercial farms. Growing adoption of technologically advanced compact tractors with enhanced PTO power and precision farming features is further supporting segment growth.

- By Transmission

On the basis of transmission, the agriculture compact tractor market is segmented into Hydrostatic and Mechanical transmission systems. The Hydrostatic transmission segment dominated the market with a 52.1% share in 2025, owing to its superior ease of use, smooth speed control, and reduced operator fatigue. Hydrostatic tractors are highly preferred for landscaping, mowing, loader operations, and applications requiring frequent speed changes, making them popular among hobby farmers, municipalities, and landscaping service providers. Their low learning curve and enhanced maneuverability significantly support adoption.

The Mechanical transmission segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by demand for cost-effective, durable, and fuel-efficient tractors in emerging markets. Mechanical systems offer higher torque efficiency, lower maintenance costs, and better suitability for heavy-duty agricultural operations. Increasing adoption among price-sensitive farmers and expanding rural mechanization initiatives are accelerating growth of this segment.

- By Application

On the basis of application, the agriculture compact tractor market is segmented into Agriculture, Mowing, Snow Clearing, Landscaping, and Others. The Agriculture segment dominated the market with a 38.9% share in 2025, driven by widespread use of compact tractors for plowing, tilling, seeding, spraying, and material handling in small and medium-sized farms. Their versatility, compatibility with multiple implements, and ability to operate in confined spaces make them essential for modern agricultural practices.

The Landscaping segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by rising urbanization, expansion of commercial landscaping services, and increased investments in public infrastructure and green spaces. Growing demand from municipalities, golf courses, residential complexes, and commercial facilities for compact, maneuverable tractors is further driving segment growth globally.

Which Region Holds the Largest Share of the Agriculture Compact Tractor Market?

- Asia-Pacific dominated the agriculture compact tractor market with a 44.2% revenue share in 2025, driven by a large agricultural workforce, high concentration of small and marginal farms, and rapid mechanization across China, India, Japan, and Southeast Asia. Strong demand for affordable, fuel-efficient, and versatile compact tractors supports widespread adoption across crop farming, horticulture, orchards, and utility operations

- Regional manufacturers are introducing cost-optimized compact tractors with improved fuel efficiency, higher durability, and compatibility with multiple implements, strengthening market penetration in rural and semi-urban areas

- Government subsidies, rural development programs, and increasing awareness of farm mechanization further reinforce Asia-Pacific’s leadership in the global Agriculture Compact Tractor market

China Agriculture Compact Tractor Market Insight

China is the largest contributor in Asia-Pacific, supported by extensive agricultural activity, rapid modernization of farming practices, and strong domestic tractor manufacturing capacity. Increasing adoption of compact tractors for orchard farming, greenhouse operations, and small landholdings is driving market growth. Government-backed mechanization initiatives, competitive pricing by local manufacturers, and expanding rural infrastructure continue to support sustained demand.

India Agriculture Compact Tractor Market Insight

India contributes significantly to regional dominance, driven by a large base of smallholder farmers, rising labor shortages, and increasing government incentives for farm mechanization. Compact tractors are widely adopted for multi-purpose agricultural activities, irrigation support, and haulage operations. Expanding dealer networks, localized manufacturing, and easy financing options further accelerate adoption across the country.

Japan Agriculture Compact Tractor Market Insight

Japan shows steady demand due to fragmented land holdings, aging farming population, and strong preference for compact, easy-to-operate machinery. Advanced engineering standards, high reliability requirements, and increasing adoption of technologically advanced compact tractors support long-term market stability.

North America Agriculture Compact Tractor Market

North America is expected to register the fastest CAGR of 9.47% from 2026 to 2033, driven by rising adoption of compact tractors for landscaping, hobby farming, property maintenance, and specialty agriculture across the U.S. and Canada. Increasing demand for high-horsepower compact tractors with hydrostatic transmission, ergonomic designs, and precision farming features is accelerating regional growth. Strong presence of leading manufacturers, expanding rural lifestyle farming, and growing investments in smart and sustainable agriculture further boost market expansion

U.S. Agriculture Compact Tractor Market Insight

The U.S. leads North America, supported by high demand from residential landowners, landscaping companies, municipalities, and specialty crop farms. Growing focus on productivity, operator comfort, and technology-enabled farming solutions continues to drive adoption of advanced compact tractors.

Canada Agriculture Compact Tractor Market Insight

Canada contributes steadily due to increasing use of compact tractors for snow clearing, land maintenance, and small-scale farming. Supportive government policies, rising mechanization, and demand for durable equipment suitable for diverse climatic conditions strengthen market growth.

Which are the Top Companies in Agriculture Compact Tractor Market?

The agriculture compact tractor industry is primarily led by well-established companies, including:

- AGCO Corporation (U.S.)

- CNH Industrial N.V. (Netherlands)

- Deere & Company (U.S.)

- Doosan Corporation (South Korea)

- Escorts Limited (India)

- Kubota Corporation (Japan)

- Mahindra & Mahindra Ltd. (India)

- Sonalika (India)

- Tractors and Farm Equipment Limited (India)

- Yanmar Holdings Co. Ltd. (Japan)

- CLAAS KGaA mbH (Germany)

- Massey Ferguson Limited (U.K.)

- TAFE Ltd. (India)

- Iseki & Co. Ltd. (Japan)

- STEYR ARMS USA, Inc. (U.S.)

- New Holland Agriculture (Italy)

What are the Recent Developments in Global Agriculture Compact Tractor Market?

- In September 2024, Kubota Corporation, through its subsidiary Kubota North America Corporation, acquired Bloomfield Robotics, Inc., with the objective of integrating advanced AI-driven technologies into its established agricultural equipment portfolio to address practical on-field challenges and enhance operational efficiency, strengthening Kubota’s long-term strategy to deliver end-to-end smart agriculture solutions

- In August 2024, YANMAR HOLDINGS Co., Ltd., via its subsidiary Yanmar America Corporation, launched the SM series tractors in the North American market, introducing three new models, namely the SM240, SM475, and SM240H, featuring fuel-efficient Yanmar TNV engines and advanced operator-centric designs aimed at high-load and demanding applications, reinforcing Yanmar’s commitment to performance, safety, and user comfort in the compact tractor segment

- In August 2024, TYM Corporation announced that its North American subsidiary, TYM North America, inaugurated the TYM Northeast Campus in Bloomsburg, Pennsylvania, as part of a strategic investment to enhance operational capabilities and regional presence in its largest international market, supporting long-term sales growth and strengthening the company’s distribution and service infrastructure in North America

- In June 2024, CNH Industrial N.V. brand New Holland Agriculture partnered with autonomous technology company Bluewhite to distribute, manufacture, and integrate autonomous solutions into New Holland Agriculture tractors across North America, targeting applications in vineyards, orchards, and specialty crops through a phased, multi-year implementation plan, accelerating the adoption of autonomous farming technologies and expanding smart tractor capabilities across its product portfolio

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.