Global Aircraft Carbon Brake Disc Market

Market Size in USD Billion

CAGR :

%

USD

1.27 Billion

USD

2.04 Billion

2025

2033

USD

1.27 Billion

USD

2.04 Billion

2025

2033

| 2026 –2033 | |

| USD 1.27 Billion | |

| USD 2.04 Billion | |

|

|

|

|

What is the Global Aircraft Carbon Brake Disc Market Size and Growth Rate?

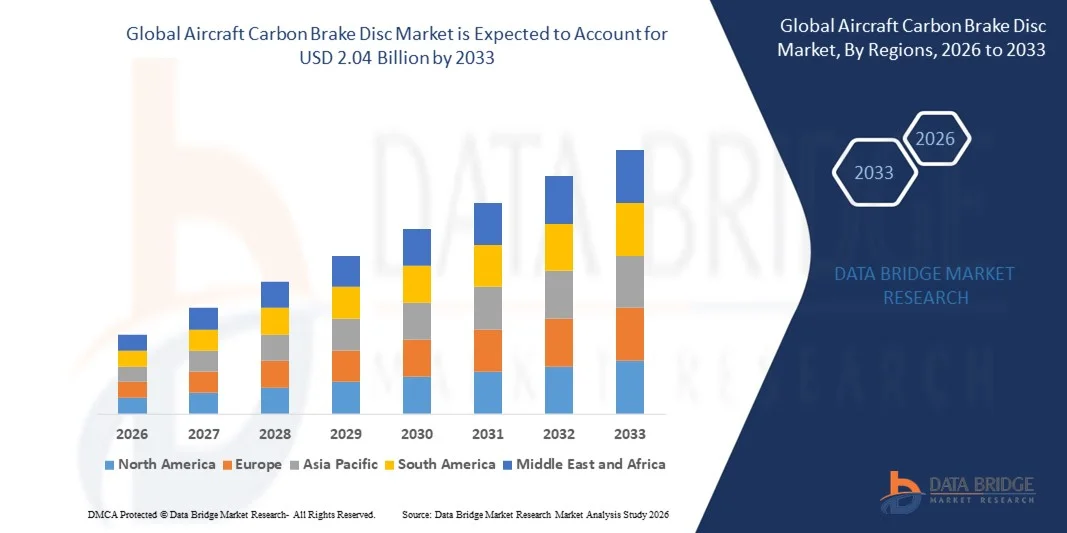

- The global aircraft carbon brake disc market size was valued at USD 1.27 billion in 2025 and is expected to reach USD 2.04 billion by 2033, at a CAGR of6.10% during the forecast period

- The increase in air travels surging the demand for air crafts and rising preference towards these brake discs owning to their enhanced performance and lightweight act as the major factors driving the growth of aircraft carbon brake disc market

- The increasing need for reducing fuel consumption and efficient aircrafts encouraging manufacturers to adopt the advanced brake discs and upsurge in commercial aircraft operations across developed and developing countries accelerate the aircraft carbon brake disc market growth

What are the Major Takeaways of Aircraft Carbon Brake Disc Market?

- The introduction of aircraft carbon brake disc made of carbon sink material as it allows the aircraft in push backing without the use of aircraft engines and is designed for the purpose of reducing greenhouse gas emission and fuel volumes utilized by an aircraft during ground operations further influence the aircraft carbon brake disc market

- In addition, the increase in demand for lightweight aircraft components for enhanced fuel and cost-effectiveness, blockchain technology, rise in disposable income of people and surge in investment positively affects the aircraft carbon brake disc market

- Furthermore, development of carbon and aircraft monitoring system for efficient maintenance of aircraft carbon brake disc and manufacturing of carbon disc made for commercial narrow-body aircraft extends profitable opportunities to the aircraft carbon brake disc market players

- North America dominated the aircraft carbon brake disc market with a 41.25% revenue share in 2025, driven by a strong presence of commercial and military aircraft manufacturers, advanced aerospace supply chains, and high aircraft fleet utilization across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 9.39% from 2026 to 2033, driven by rapid expansion of commercial aviation, rising defense budgets, and increasing aircraft procurement across China, Japan, India, South Korea, and Southeast Asia

- The Carbon–Carbon segment dominated the market with a 62.4% share in 2025, owing to its superior thermal stability, high energy absorption capacity, lightweight properties, and proven performance in commercial and military aircraft

Report Scope and Aircraft Carbon Brake Disc Market Segmentation

|

Attributes |

Aircraft Carbon Brake Disc Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Aircraft Carbon Brake Disc Market?

Increasing Shift Toward Lightweight, High-Performance, and Long-Life Carbon Brake Disc Technologies

- The aircraft carbon brake disc market is witnessing growing adoption of lightweight, high-thermal-resistance carbon–carbon composite brake discs designed to improve aircraft fuel efficiency, reduce landing distance, and enhance braking reliability under extreme operating conditions

- Manufacturers are increasingly focusing on advanced carbon fiber architectures, improved oxidation resistance coatings, and enhanced friction stability, enabling brake discs to perform consistently across wide temperature ranges

- Rising demand for cost-efficient, longer-life brake systems is driving airlines to replace traditional steel brakes with carbon brake discs, reducing maintenance cycles and overall operating costs

- For instance, companies such as Safran, Honeywell, Raytheon Technologies, Meggitt, and Crane Co. are advancing carbon brake technologies with higher energy absorption capacity and reduced wear rates

- Increasing need for shorter turnaround times, higher landing frequency capability, and improved aircraft availability is accelerating adoption across commercial, military, and business aviation platforms

- As aircraft designs prioritize weight reduction, fuel efficiency, and operational reliability, aircraft carbon brake discs will remain critical for next-generation aviation braking systems

What are the Key Drivers of Aircraft Carbon Brake Disc Market?

- Rising demand for fuel-efficient aircraft and lower operating costs is driving widespread adoption of carbon brake discs over conventional steel braking systems

- For instance, during 2024–2025, leading aerospace OEMs and brake suppliers expanded carbon brake installations across narrow-body, wide-body, and military aircraft fleets to meet efficiency and performance goals

- Growing global commercial aviation traffic, fleet expansion, and aircraft replacement programs are boosting demand for advanced braking solutions across North America, Europe, and Asia-Pacific

- Advancements in carbon composite manufacturing, thermal management, and friction material engineering have improved brake life, heat dissipation, and safety performance

- Rising deployment of high-landing-cycle aircraft, including short-haul commercial jets and military transport aircraft, is increasing demand for durable, high-energy-absorption brake discs

- Supported by steady investments in aerospace R&D, fleet modernization, and aircraft safety standards, the Aircraft Carbon Brake Disc market is expected to witness strong long-term growth

Which Factor is Challenging the Growth of the Aircraft Carbon Brake Disc Market?

- High manufacturing and material costs associated with carbon–carbon composites restrict adoption among smaller aircraft operators and cost-sensitive aviation segments

- For instance, during 2024–2025, carbon fiber price volatility, energy-intensive production processes, and extended manufacturing lead times increased overall brake system costs

- Complexity in carbon composite fabrication, oxidation protection, and quality assurance requires advanced technical expertise and specialized production facilities

- Limited availability of certified suppliers and long certification timelines under stringent aviation safety regulations slow product commercialization

- Competition from advanced steel brake systems in regional aircraft and smaller platforms creates pricing pressure in certain market segments

- To address these challenges, manufacturers are focusing on process optimization, cost-efficient composite materials, extended brake life designs, and aftermarket service solutions to expand global adoption of aircraft carbon brake discs

How is the Aircraft Carbon Brake Disc Market Segmented?

The market is segmented on the basis of material type, fit type, aircraft type, and sales outlook.

- By Material Type

On the basis of material type, the aircraft carbon brake disc market is segmented into Carbon–Carbon and Carbon-Composite. The Carbon–Carbon segment dominated the market with a 62.4% share in 2025, owing to its superior thermal stability, high energy absorption capacity, lightweight properties, and proven performance in commercial and military aircraft. Carbon–carbon brake discs offer longer service life, reduced brake fade, and consistent friction performance under extreme landing conditions, making them the preferred choice for high-cycle aircraft operations.

The Carbon-Composite segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by ongoing advancements in composite material engineering aimed at improving oxidation resistance, cost efficiency, and durability. Increasing adoption in regional aircraft and emerging aviation platforms is further supporting segment growth.

- By Fit Type

On the basis of fit type, the aircraft carbon brake disc market is segmented into First Fit and Retro Fit. The First Fit segment dominated the market with a 58.7% share in 2025, driven by strong demand from aircraft OEMs integrating carbon brake discs during new aircraft production. Aircraft manufacturers increasingly adopt carbon brake systems to meet fuel efficiency targets, reduce aircraft weight, and comply with stringent safety and performance standards.

The Retro Fit segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by rising fleet modernization, increasing aircraft utilization rates, and airline focus on reducing maintenance costs. Replacement of traditional steel brakes with carbon brake discs during maintenance, repair, and overhaul (MRO) cycles is accelerating retrofitting demand across commercial and military fleets.

- By Aircraft Type

On the basis of aircraft type, the aircraft carbon brake disc market is segmented into General Aviation and Military Aircrafts. The Military Aircrafts segment dominated the market with a 55.2% share in 2025, driven by high braking energy requirements, frequent landings, and stringent performance demands in fighter jets, transport aircraft, and surveillance platforms. Carbon brake discs offer superior durability and heat dissipation, making them ideal for military operations.

The General Aviation segment is expected to witness the fastest growth from 2026 to 2033, fueled by rising business jet deliveries, regional aviation expansion, and increased adoption of lightweight braking systems to improve operational efficiency and reduce lifecycle costs.

- By Sales Outlook

On the basis of sales outlook, the aircraft carbon brake disc market is segmented into OEM Sales and Aftermarket. The OEM Sales segment accounted for the largest market share of 60.9% in 2025, supported by increasing aircraft production rates and long-term supply agreements between brake manufacturers and aircraft OEMs.

The Aftermarket segment is anticipated to grow at the fastest CAGR during the forecast period, driven by rising aircraft fleet sizes, shorter brake replacement cycles, and growing demand for maintenance and overhaul services. Increasing aircraft utilization and emphasis on minimizing downtime are significantly boosting aftermarket sales.

Which Region Holds the Largest Share of the Aircraft Carbon Brake Disc Market?

- North America dominated the aircraft carbon brake disc market with a 41.25% revenue share in 2025, driven by a strong presence of commercial and military aircraft manufacturers, advanced aerospace supply chains, and high aircraft fleet utilization across the U.S. and Canada. Continuous demand for lightweight, high-performance braking systems to improve fuel efficiency, safety, and landing performance supports market leadership in the region

- Leading aerospace OEMs and brake system manufacturers in North America are investing in advanced carbon–carbon and carbon-composite brake technologies to enhance durability, heat resistance, and lifecycle performance. Ongoing aircraft modernization programs and defense spending further strengthen regional demand

- High concentration of aerospace engineering expertise, robust MRO infrastructure, and sustained investment in aviation R&D reinforce North America’s dominant market position

U.S. Aircraft Carbon Brake Disc Market Insight

The U.S. is the largest contributor in North America, supported by strong commercial aircraft production, large military fleets, and extensive MRO activities. Rising aircraft deliveries, frequent landing cycles, and fleet upgrades drive sustained demand for advanced carbon brake discs. Presence of major aircraft OEMs, defense contractors, and certified MRO providers accelerates market growth.

Canada Aircraft Carbon Brake Disc Market Insight

Canada contributes steadily through its growing aerospace manufacturing base and expanding MRO services. Increasing regional aircraft operations and defense aviation programs support adoption of durable carbon brake disc solutions.

Asia-Pacific Aircraft Carbon Brake Disc Market

Asia-Pacific is projected to register the fastest CAGR of 9.39% from 2026 to 2033, driven by rapid expansion of commercial aviation, rising defense budgets, and increasing aircraft procurement across China, Japan, India, South Korea, and Southeast Asia. Growth in low-cost carriers, airport infrastructure development, and fleet modernization programs is significantly increasing demand for high-performance aircraft braking systems. Expanding regional MRO capabilities further accelerate aftermarket demand for carbon brake discs.

China Aircraft Carbon Brake Disc Market Insight

China leads Asia-Pacific growth due to rising domestic aircraft production, expanding airline fleets, and strong government support for aerospace manufacturing. Increasing military aircraft deployment also boosts demand.

Japan Aircraft Carbon Brake Disc Market Insight

Japan shows stable growth supported by advanced aerospace engineering capabilities and strong focus on aircraft safety, reliability, and performance enhancement.

India Aircraft Carbon Brake Disc Market Insight

India is emerging as a key growth hub, driven by rising aircraft orders, defense aviation expansion, and growing MRO investments under government-backed aerospace initiatives.

South Korea Aircraft Carbon Brake Disc Market Insight

South Korea contributes significantly through increasing military aircraft programs and steady commercial aviation growth, supporting long-term demand for advanced carbon brake disc technologies.

Which are the Top Companies in Aircraft Carbon Brake Disc Market?

The aircraft carbon brake disc industry is primarily led by well-established companies, including:

- Safran (France)

- SGL Carbon (Germany)

- Meggitt PLC (U.K.)

- Honeywell International Inc. (U.S.)

- Raytheon Technologies Corporation (U.S.)

- CFCCARBON CO. LTD (China)

- Thermocoax (France)

- MERSEN PROPERTY (France)

- Rubin Aviation Corporation (U.S.)

- Baimtec Material Co., Ltd (China)

- Crane Co. (U.S.)

- Dawin Friction Corporation (South Korea)

- DACC Carbon (China)

- AECC Beijing Institute of Aeronautical Materials (China)

- Xi’an Aviation Brake Technology Co., Ltd. (China)

- Yantai Luhang Carbon Materials Technology Co. Ltd. (China)

- Shaanxi Lantai Aviation Equipment Limited (China)

What are the Recent Developments in Global Aircraft Carbon Brake Disc Market?

- In October 2023, Safran launched its next-generation carbon brake disc designed to enhance commercial aircraft braking performance while significantly reducing maintenance costs and lifecycle expenses, reinforcing its leadership in advanced aircraft braking technologies

- In August 2023, Honeywell acquired a leading carbon brake system manufacturer to expand its aerospace division and broaden its braking system portfolio, strengthening its competitive position and accelerating innovation in aircraft brake solutions

- In June 2023, a joint venture between Boeing and a brake system manufacturer focused on developing advanced carbon brake technologies aimed at improving sustainability, efficiency, and performance in future aircraft platforms, supporting long-term advancements in next-generation aviation systems

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.