Global Aircraft Health Monitoring Market

Market Size in USD Billion

CAGR :

%

USD

5.97 Billion

USD

10.50 Billion

2025

2033

USD

5.97 Billion

USD

10.50 Billion

2025

2033

| 2026 –2033 | |

| USD 5.97 Billion | |

| USD 10.50 Billion | |

|

|

|

|

Aircraft Health Monitoring Market Size

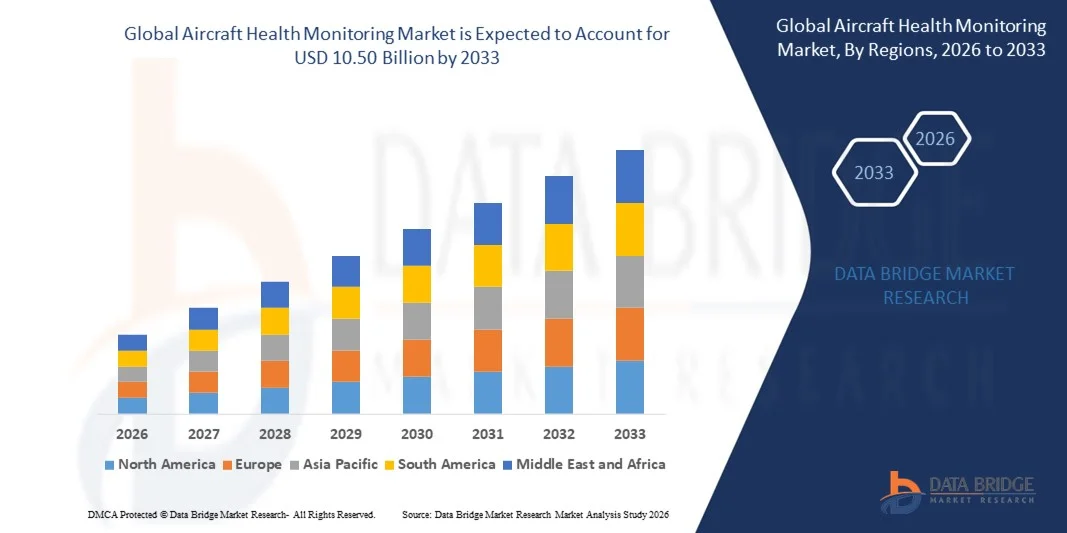

- The global aircraft health monitoring market size was valued at USD 5.97 billion in 2025 and is expected to reach USD 10.50 billion by 2033, at a CAGR of 7.30% during the forecast period

- The market growth is largely fueled by the increasing adoption of predictive maintenance and advanced analytics within the aviation sector, leading to enhanced operational efficiency, reduced unscheduled downtime, and improved aircraft reliability across commercial, business, and military fleets

- Furthermore, rising demand from airlines, OEMs, and MRO providers for real-time monitoring and actionable insights into engine, structural, and component health is establishing aircraft health monitoring systems as an essential tool for modern fleet management. These converging factors are accelerating the deployment of AHMS solutions, thereby significantly boosting market growth

Aircraft Health Monitoring Market Analysis

- Aircraft health monitoring systems, offering real-time or non-real-time monitoring of engines, structures, and components, are increasingly vital for modern aviation operations due to their ability to optimize maintenance schedules, enhance safety, and extend aircraft lifecycle

- The escalating demand for AHMS solutions is primarily driven by fleet expansion, growing focus on predictive maintenance, increasing integration of IoT and AI-based analytics, and regulatory emphasis on operational safety and efficiency across global aviation sectors

- North America dominated the aircraft health monitoring market with a share of 40.62% in 2025, due to the high adoption of advanced aviation technologies and a growing focus on predictive maintenance for commercial and military fleets

- Asia-Pacific is expected to be the fastest growing region in the aircraft health monitoring market during the forecast period due to rapid fleet expansion, increasing air traffic, and technological advancements in countries such as China, Japan, and India

- Line fit segment dominated the market with a market share of 62.38% in 2025, due to its integration during aircraft manufacturing, ensuring seamless compatibility with onboard systems and optimized performance from the outset. Aircraft OEMs prefer line-fit installations to reduce post-production modifications and ensure compliance with certification standards. The segment also benefits from early integration with digital twins and predictive maintenance systems, enhancing aircraft lifecycle management

Report Scope and Aircraft Health Monitoring Market Segmentation

|

Attributes |

Aircraft Health Monitoring Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Aircraft Health Monitoring Market Trends

Growing Adoption of Real-Time Predictive Maintenance

- A significant trend in the aircraft health monitoring market is the increasing adoption of real-time predictive maintenance solutions that enable airlines and aerospace operators to monitor aircraft systems continuously and forecast potential failures before they occur. This trend is enhancing operational efficiency, reducing unscheduled downtime, and supporting safer flight operations

- For instance, Honeywell Aerospace provides predictive maintenance solutions that collect and analyze in-flight data to anticipate component wear and system anomalies, allowing airlines to schedule maintenance proactively and optimize fleet availability

- Integration of advanced sensors and data analytics platforms is expanding across commercial and military aircraft to support condition-based monitoring of engines, avionics, and structural components. This integration is positioning aircraft health monitoring systems as essential for modern fleet management strategies

- The adoption of AI and machine learning algorithms in health monitoring systems is increasing, enabling more accurate diagnostics and anomaly detection from large volumes of flight and engine data. This is driving faster decision-making and improving overall reliability of aircraft operations

- Airlines and MRO (Maintenance, Repair, and Overhaul) providers are leveraging cloud-based and IoT-enabled monitoring platforms to gain real-time insights into aircraft health, supporting efficient maintenance planning and reducing turnaround times

- The market is experiencing strong growth in advanced monitoring solutions that provide predictive alerts for critical systems, enhancing safety standards and operational readiness. This rising adoption is shaping a proactive approach to aircraft maintenance and lifecycle management

Aircraft Health Monitoring Market Dynamics

Driver

Rising Demand for Operational Efficiency and Reduced Downtime

- The growing need for higher operational efficiency and minimized aircraft downtime is driving the adoption of aircraft health monitoring systems that provide continuous data analysis for preventive maintenance and scheduling

- For instance, General Electric Aviation offers the Flight Efficiency Services platform that delivers predictive insights and maintenance recommendations, enabling airlines to reduce delays and optimize engine performance

- Fleet operators are increasingly focusing on reducing maintenance-related disruptions, which increases demand for monitoring systems that provide actionable intelligence on component health and aircraft performance

- The rise in global air travel and fleet expansion is intensifying pressure on airlines to maintain high aircraft availability, fueling investments in integrated health monitoring solutions

- Operators seek solutions that combine sensor data, analytics, and reporting tools to streamline maintenance workflows, reduce costs, and extend aircraft lifecycle, reinforcing the market’s growth trajectory

Restraint/Challenge

High Costs and Integration Complexity

- The aircraft health monitoring market faces challenges due to high implementation costs and the complexity involved in integrating monitoring systems with legacy aircraft platforms and avionics

- For instance, Collins Aerospace implements sophisticated health monitoring solutions that require extensive calibration, software integration, and certification processes, increasing deployment costs for operators

- Developing and maintaining real-time analytics platforms necessitates advanced IT infrastructure and specialized expertise, which can be a barrier for smaller airlines or operators with older fleets

- The cost of sensors, data processing units, and ongoing software updates adds to the total cost of ownership, limiting widespread adoption

- Ensuring interoperability across different aircraft types and maintaining data accuracy and security remains a key challenge, which operators must address to fully realize the benefits of predictive maintenance and aircraft health monitoring

Aircraft Health Monitoring Market Scope

The market is segmented on the basis of system, solution, fit, operation mode, installation, platform, and end-user.

- By System

On the basis of system, the Aircraft Health Monitoring market is segmented into Engine Health Monitoring, Structural Health Monitoring, and Component Monitoring. The Engine Health Monitoring segment dominated the market with the largest revenue share in 2025, driven by the critical need to ensure engine reliability, optimize fuel efficiency, and reduce unplanned maintenance costs. Airlines and OEMs prioritize engine health solutions for predictive maintenance, as engine failures have significant operational and financial consequences. The demand is further bolstered by integration with advanced sensors and analytics, enabling real-time monitoring of engine performance and early detection of anomalies.

The Structural Health Monitoring segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing adoption in aging fleets and advanced composite aircraft. For instance, Honeywell’s structural monitoring solutions are being integrated into commercial aircraft to detect fatigue and stress in real time. Growing regulatory emphasis on structural safety and the need to extend aircraft lifecycle contribute to the rising adoption of structural monitoring systems.

- By Solution

On the basis of solution, the market is segmented into Hardware, Software, and Services. The Hardware segment dominated the market in 2025 due to the essential role of sensors, data acquisition units, and embedded devices in capturing and transmitting aircraft health data. High-quality hardware ensures accurate, reliable measurements, which are critical for predictive maintenance and regulatory compliance. Hardware demand is further supported by continuous innovation in lightweight, durable, and highly sensitive sensors suitable for aviation environments.

The Software segment is expected to witness the fastest CAGR from 2026 to 2033, driven by the increasing reliance on AI-driven analytics and cloud-based platforms for real-time monitoring. For instance, GE Aviation’s Predix software provides predictive insights and performance optimization for engines and components. Software solutions enable data visualization, anomaly detection, and actionable insights, enhancing operational efficiency and reducing downtime.

- By Fit

On the basis of fit, the market is segmented into Line Fit and Retro Fit. The Line Fit segment dominated the market with the largest share of 62.38% in 2025 due to its integration during aircraft manufacturing, ensuring seamless compatibility with onboard systems and optimized performance from the outset. Aircraft OEMs prefer line-fit installations to reduce post-production modifications and ensure compliance with certification standards. The segment also benefits from early integration with digital twins and predictive maintenance systems, enhancing aircraft lifecycle management.

The Retro Fit segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by the need to upgrade existing fleets with modern health monitoring capabilities. For instance, Lufthansa Technik provides retrofit AHM kits for commercial aircraft to enhance safety and reduce unscheduled maintenance. Aging aircraft and increased focus on operational efficiency drive airlines to adopt retrofit solutions for cost-effective upgrades.

- By Operation Mode

On the basis of operation mode, the market is segmented into Real-Time and Non-Real-Time monitoring. The Real-Time segment dominated the market in 2025, driven by the growing demand for immediate insights into aircraft performance and predictive maintenance. Airlines and OEMs value real-time monitoring for reducing in-flight risks, improving turnaround times, and optimizing scheduling decisions. Integration with cloud platforms and IoT devices enhances the ability to monitor engine and system health continuously, providing actionable data during flight.

The Non-Real-Time segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by post-flight data analysis and trend monitoring. For instance, Rolls-Royce offers non-real-time analytics solutions for maintenance planning and fleet performance assessment. This approach allows operators to evaluate historical data, schedule preventive maintenance, and improve long-term operational efficiency.

- By Installation

On the basis of installation, the market is segmented into On Board and On Ground. The On Board segment dominated the market in 2025 due to the ability to continuously monitor critical aircraft systems during operation. Onboard AHM enables immediate detection of anomalies, enhances safety, and reduces unscheduled downtime. Integration with aircraft avionics and predictive algorithms ensures accurate, real-time insights critical for airlines and OEMs.

The On Ground segment is anticipated to witness the fastest growth rate from 2026 to 2033, driven by the increasing use of ground-based diagnostic tools for maintenance and fleet optimization. For instance, Airbus employs on-ground monitoring stations to analyze aircraft data post-flight. This approach allows operators to perform predictive maintenance efficiently and improve turnaround time while minimizing flight disruptions.

- By Platform

On the basis of platform, the market is segmented into Commercial Aviation, Business & General Aviation, and Military Aviation. The Commercial Aviation segment dominated the market in 2025 due to the large fleet size, high utilization rates, and strict maintenance requirements of airlines. Predictive health monitoring helps reduce operational costs, prevent flight delays, and comply with stringent aviation regulations. The segment benefits from partnerships between OEMs and airlines to implement integrated AHM solutions across fleets.

The Business & General Aviation segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by rising adoption in private jets and corporate fleets. For instance, Honeywell provides integrated health monitoring solutions for business aircraft, enhancing safety and operational efficiency. Increasing investment in high-end business aircraft and growing awareness of predictive maintenance solutions drive the segment growth.

- By End User

On the basis of end user, the market is segmented into OEMs, MRO, and Airlines. The OEM segment dominated the market in 2025 due to their role in incorporating health monitoring systems during aircraft manufacturing. OEMs leverage AHM solutions to ensure safety, reliability, and regulatory compliance while offering value-added services to customers. Continuous innovation and integration with digital twins and predictive analytics further strengthen OEM dominance.

The Airlines segment is anticipated to witness the fastest growth rate from 2026 to 2033, driven by the need to optimize operations, reduce downtime, and enhance fleet reliability. For instance, Delta Airlines has implemented predictive health monitoring across its fleet to minimize unscheduled maintenance. The rising focus on operational efficiency and cost savings encourages airlines to adopt advanced AHM solutions extensively.

Aircraft Health Monitoring Market Regional Analysis

- North America dominated the aircraft health monitoring market with the largest revenue share of 40.62% in 2025, driven by the high adoption of advanced aviation technologies and a growing focus on predictive maintenance for commercial and military fleets

- Airlines and OEMs in the region prioritize reducing unscheduled maintenance costs, optimizing aircraft performance, and ensuring regulatory compliance

- This widespread adoption is further supported by the presence of major aircraft manufacturers, high investments in aviation R&D, and increasing integration of digital monitoring solutions across fleets

U.S. Aircraft Health Monitoring Market Insight

The U.S. aircraft health monitoring market captured the largest revenue share within North America in 2025, fueled by extensive fleet operations and the growing focus on predictive maintenance to minimize operational disruptions. Operators are increasingly adopting real-time monitoring solutions to track engine, structural, and component performance. The rise of connected aircraft and integration with AI-driven analytics enhances operational efficiency and safety. Strong support from the federal aviation authorities and active collaborations between OEMs and MRO providers further drive market expansion.

Europe Aircraft Health Monitoring Market Insight

The Europe aircraft health monitoring market is projected to expand at a substantial CAGR throughout the forecast period, driven by the increasing modernization of fleets and stringent aviation safety regulations. Airlines and OEMs in the region are investing in real-time monitoring systems to improve aircraft availability and reduce maintenance costs. Countries such as Germany, France, and the U.K. are witnessing higher adoption due to technologically advanced infrastructures and growing emphasis on predictive analytics for aircraft operations. Europe’s focus on sustainability and operational efficiency is also fostering the deployment of integrated AHM solutions across commercial and military aircraft.

U.K. Aircraft Health Monitoring Market Insight

The U.K. aircraft health monitoring market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising adoption of smart aviation solutions and a focus on enhancing fleet reliability. Airlines and MRO providers are increasingly integrating digital health monitoring systems for engines and structural components to minimize downtime. The U.K.’s strong aviation and aerospace industry, along with government initiatives supporting innovation and safety, is further contributing to market growth. Collaboration between OEMs and technology providers enhances deployment across both commercial and defense aircraft.

Germany Aircraft Health Monitoring Market Insight

The Germany aircraft health monitoring market is expected to expand at a considerable CAGR during the forecast period, fueled by advancements in aerospace technology and the modernization of commercial and military fleets. The country’s well-established aviation sector prioritizes predictive maintenance and real-time health monitoring for optimizing aircraft lifecycle. Integration of AHM solutions with digital twins and AI-based analytics is becoming increasingly prevalent, supporting operational efficiency and safety. Germany’s focus on sustainable aviation and innovation drives continued adoption across key aerospace players.

Asia-Pacific Aircraft Health Monitoring Market Insight

The Asia-Pacific aircraft health monitoring market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rapid fleet expansion, increasing air traffic, and technological advancements in countries such as China, Japan, and India. Airlines and MRO providers are adopting predictive and real-time monitoring systems to improve safety, reduce maintenance costs, and optimize operations. Government initiatives promoting digital aviation infrastructure and smart airport systems are further accelerating adoption. The growing presence of aircraft manufacturers and affordable monitoring solutions in the region supports wider implementation across commercial and business aviation fleets.

Japan Aircraft Health Monitoring Market Insight

The Japan aircraft health monitoring market is gaining momentum due to the country’s advanced aviation technology ecosystem, high air traffic, and demand for operational efficiency. Airlines and OEMs prioritize real-time engine and component monitoring to reduce unscheduled maintenance and enhance flight safety. Integration with IoT-based analytics and predictive maintenance platforms supports timely decision-making. Japan’s aging fleet and focus on next-generation aircraft further drive the adoption of advanced AHM systems across both commercial and business aviation sectors.

China Aircraft Health Monitoring Market Insight

The China aircraft health monitoring market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid fleet expansion, government support for aviation modernization, and the increasing adoption of predictive maintenance solutions. Airlines and OEMs in China are deploying AHM systems for engines, structural components, and critical subsystems to improve aircraft reliability and operational efficiency. The country’s position as a growing aerospace manufacturing hub, coupled with domestic technology providers offering cost-effective solutions, further strengthens market growth. The push towards smart airports and connected aviation ecosystems also drives widespread adoption.

Aircraft Health Monitoring Market Share

The aircraft health monitoring industry is primarily led by well-established companies, including:

- Airbus S.A.S. (France)

- Safran (France)

- Raytheon Technologies Corporation (U.S.)

- Honeywell International Inc. (U.S.)

- Teledyne Technologies Incorporated (U.S.)

- Boeing (U.S.)

- GENERAL ELECTRIC (U.S.)

- Meggitt PLC (U.K.)

- Rolls-Royce plc (U.K.)

- FLYHT Aerospace Solutions Ltd. (Canada)

- Curtiss-Wright Corporation (U.S.)

- AIR FRANCE KLM (France)

- Lufthansa (Germany)

- Acellent Technologies, Inc. (U.S.)

- SITA (Switzerland)

- Embraer (Brazil)

- Intelsat (U.S.)

- AMETEK, Inc. (U.S.)

- Tech Mahindra Limited (India)

- Ventura Aerospace (U.S.)

Latest Developments in Global Aircraft Health Monitoring Market

- In September 2024, Asia Digital Engineering (ADE) partnered with Liebherr‑Aerospace to integrate advanced predictive maintenance algorithms into ADE’s ELEVADE™ aircraft health management platform. This collaboration enhances real-time monitoring of critical aircraft components, enabling airlines and MRO providers to anticipate potential failures before they occur. The development strengthens the adoption of digital health monitoring solutions across Asia-Pacific fleets and drives market growth by offering operators more reliable, data-driven insights for operational efficiency

- In April 2024, Global Crossing Airlines (GlobalX) implemented Airbus’ Skywise Health Monitoring solution for its Airbus A319, A320, and A321 fleet. The adoption allows the airline to track real-time aircraft performance, manage in-service events proactively, and minimize Aircraft on Ground (AOG) scenarios. This deployment demonstrates the growing reliance of airlines on predictive maintenance platforms to reduce operational disruptions and optimize fleet availability, positively influencing demand for aircraft health monitoring solutions in commercial aviation

- In October 2023, Korean Air upgraded to Airbus’ Skywise Fleet Performance+ digital solution to unify and enhance its predictive maintenance and health monitoring systems across its expanded fleet following the Asiana Airlines merger. The integration provides real-time analytics, enabling more accurate fault detection, faster maintenance scheduling, and improved aircraft uptime. This move underscores the market trend of airlines consolidating digital health monitoring platforms to boost efficiency and strengthen competitive advantage

- In September 2023, Airbus extended its Skywise Health Monitoring service to the A220 aircraft family, offering carriers real-time fault detection, predictive maintenance alerts, and enhanced operational reliability. By making the platform available for a broader range of aircraft, Airbus enables more airlines to benefit from integrated health monitoring, fostering wider adoption of advanced monitoring systems. This expansion contributes to market growth by demonstrating the scalability of health monitoring platforms across different aircraft models

- In 2023, Boeing introduced an advanced Aircraft Health Monitoring System (AHMS) for its 737 MAX fleet, incorporating predictive analytics and continuous data collection for real-time performance monitoring. This system allows airlines to identify potential component failures in advance, significantly reducing unscheduled maintenance and operational delays. Boeing’s launch highlights the increasing emphasis on predictive and data-driven solutions in the AHMS market, boosting overall adoption of smart monitoring technologies across global fleets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.