Global Alcoholic Beverage Packaging Market

Market Size in USD Billion

CAGR :

%

USD

88.84 Billion

USD

131.16 Billion

2025

2033

USD

88.84 Billion

USD

131.16 Billion

2025

2033

| 2026 –2033 | |

| USD 88.84 Billion | |

| USD 131.16 Billion | |

|

|

|

|

Alcoholic Beverage Packaging Market Size

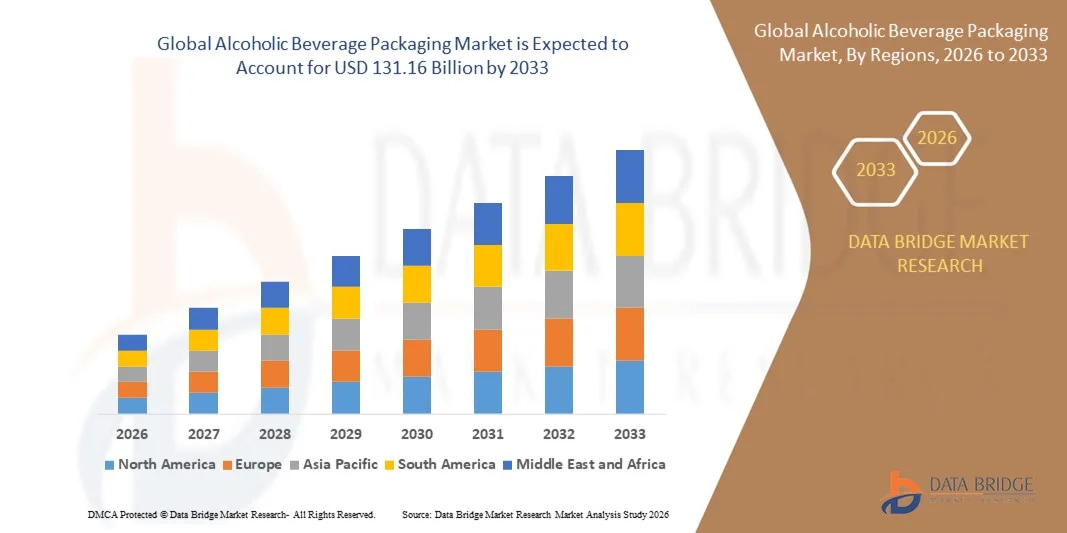

- The global alcoholic beverage packaging market size was valued at USD 88.84 billion in 2025 and is expected to reach USD 131.16 billion by 2033, at a CAGR of 4.99% during the forecast period

- The market growth is largely fuelled by rising global consumption of alcoholic beverages, including beer, wine, and spirits, supported by changing lifestyles and increasing social drinking trends across both developed and emerging economies

- Growing demand for premium and craft alcoholic beverages is driving the adoption of high-quality, visually appealing, and innovative packaging formats to enhance brand differentiation and shelf appeal

Alcoholic Beverage Packaging Market Analysis

- The market is characterized by continuous innovation in packaging design, materials, and functionality, as manufacturers focus on improving product protection, shelf life, and consumer convenience while meeting regulatory requirements

- In addition, shifting consumer preferences toward sustainable, premium, and convenient packaging, combined with advancements in lightweight and smart packaging technologies, are shaping long-term market growth dynamics

- Asia-Pacific alcoholic beverage packaging market dominated the alcoholic beverage packaging market with the largest revenue share of 33.6% in 2025, driven by rapid urbanization, rising disposable incomes, and increasing consumption of beer, wine, and spirits in countries such as China, Japan, and India

- North America region is expected to witness the highest growth rate in the global alcoholic beverage packaging market, driven by increasing consumer preference for craft and premium alcoholic beverages, along with the rising adoption of sustainable and eco-friendly packaging solutions. Advanced manufacturing capabilities and strong retail infrastructure are also supporting rapid market expansion

- The plastic segment led the market with a revenue share of 32.6% in 2024, owing to its lightweight nature, cost-effectiveness, and versatility across beer, spirits, and ready-to-drink beverages, making it ideal for mass-market and on-the-go consumption

Report Scope and Alcoholic Beverage Packaging Market Segmentation

|

Attributes |

Alcoholic Beverage Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Alcoholic Beverage Packaging Market Trends

Rising Demand for Sustainable and Premium Packaging Solutions

- The growing emphasis on sustainability and premium brand positioning is significantly shaping the alcoholic beverage packaging market, as producers increasingly focus on packaging materials that are recyclable, lightweight, and environmentally responsible. Glass bottles, aluminum cans, and paper-based secondary packaging are gaining traction due to their recyclability and premium appeal. This trend is encouraging manufacturers to redesign packaging formats that balance aesthetics, functionality, and sustainability while aligning with evolving consumer expectations

- Increasing consumer awareness around environmental impact and responsible consumption has accelerated demand for sustainable alcoholic beverage packaging across beer, wine, and spirits categories. Brands are actively adopting eco-friendly packaging to reduce carbon footprints and comply with tightening environmental regulations. This shift is particularly evident in premium and craft beverage segments, where packaging plays a crucial role in conveying brand values and quality perception

- Sustainability and premiumization trends are influencing purchasing decisions, with beverage manufacturers emphasizing lightweight designs, reusable packaging, and clear sustainability messaging. Transparent labeling, recycled content claims, and innovative bottle designs are helping brands differentiate themselves in competitive retail environments. These strategies also support stronger brand loyalty among environmentally conscious consumers and premium product buyers

- For instance, in 2024, Heineken in the Netherlands and Diageo in the U.K. expanded the use of lightweight glass bottles and recyclable secondary packaging across selected beer and spirits brands. These initiatives were launched to meet sustainability targets while maintaining premium shelf appeal. Distribution spanned retail, on-trade, and e-commerce channels, supporting broader market reach and enhanced brand perception

- While demand for sustainable and premium alcoholic beverage packaging continues to grow, long-term market expansion depends on cost optimization, supply chain efficiency, and maintaining packaging performance standards. Manufacturers are focusing on improving material strength, barrier properties, and production scalability to ensure sustainable packaging remains commercially viable. Ongoing innovation is required to balance environmental goals with cost competitiveness and brand differentiation

Alcoholic Beverage Packaging Market Dynamics

Driver

Growing Consumption of Alcoholic Beverages and Brand Premiumization

- Rising global consumption of alcoholic beverages is a key driver for the alcoholic beverage packaging market, supported by urbanization, changing lifestyles, and expanding middle-class populations. Increased demand for beer, wine, and spirits directly boosts the need for durable, attractive, and compliant packaging solutions. Packaging plays a vital role in preserving product quality and enhancing consumer experience

- Premiumization of alcoholic beverages is significantly influencing packaging demand, as brands invest in high-quality materials, unique bottle shapes, and advanced labeling techniques. Premium packaging helps convey product authenticity, heritage, and value, especially in spirits and wine categories. This trend is also driving innovation in closures, embossing, and decorative finishes

- Growth of craft breweries, distilleries, and boutique wineries is further supporting market expansion. These producers rely heavily on distinctive packaging to stand out in crowded markets and communicate brand identity. As a result, demand for customized, small-batch, and flexible packaging solutions is increasing across regions

- For instance, in 2023, Constellation Brands in the U.S. and Pernod Ricard in France reported increased investment in premium bottle designs and sustainable packaging formats for their spirits portfolios. These initiatives were aligned with rising consumer interest in high-end and craft alcoholic beverages. Enhanced packaging aesthetics and sustainability claims supported stronger brand differentiation and repeat purchases

- Although rising consumption and premiumization trends support market growth, manufacturers must continuously innovate to address regulatory requirements, cost pressures, and sustainability goals. Investments in advanced materials, automation, and design capabilities are essential to maintain competitiveness and meet evolving brand and consumer expectations

Restraint/Challenge

High Packaging Costs and Regulatory Compliance Requirements

- High costs associated with premium and sustainable packaging materials remain a major challenge in the alcoholic beverage packaging market. Glass price volatility, aluminum cost fluctuations, and investments in eco-friendly alternatives increase overall packaging expenses. These cost pressures are particularly challenging for small and mid-sized beverage producers

- Regulatory compliance across different regions adds complexity to packaging design and production. Alcohol labeling laws, recycling mandates, and packaging waste regulations require manufacturers to adapt packaging formats frequently. Compliance-related changes can increase lead times, operational costs, and design complexity

- Supply chain disruptions and logistical challenges also impact the market, especially for glass bottles and specialty packaging components. Transportation costs, energy prices, and dependency on regional suppliers affect availability and pricing stability. These issues can delay product launches and strain manufacturer margins

- For instance, in 2024, wine and spirits producers in Italy and Australia reported increased packaging costs due to rising glass prices and stricter recycling regulations. Smaller wineries faced challenges in sourcing compliant bottles at competitive prices, leading to delayed production cycles. These factors also limited the ability of some producers to fully transition to premium or sustainable packaging formats

- Addressing these challenges will require supply chain optimization, material innovation, and closer collaboration between beverage producers and packaging suppliers. Developing cost-effective sustainable materials, improving recycling infrastructure, and harmonizing regulatory standards can help unlock long-term growth potential in the global alcoholic beverage packaging market

Alcoholic Beverage Packaging Market Scope

The market is segmented on the basis of material type, packaging type, and product type.

- By Material Type

On the basis of material type, the alcoholic beverage packaging market is segmented into plastic, paper, metal, glass, and other materials. The plastic segment led the market with a revenue share of 32.6% in 2024, owing to its lightweight nature, cost-effectiveness, and versatility across beer, spirits, and ready-to-drink beverages, making it ideal for mass-market and on-the-go consumption.

The metal segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing adoption of aluminum cans and tin containers for beer, ready-to-drink cocktails, and other beverages. Metal packaging offers durability, lightweight design, and efficient cooling, making it ideal for on-the-go consumption and sustainable recycling initiatives.

- By Packaging Type

On the basis of packaging type, the market is segmented into bottles, metal cans, cartons, jars, pouches, and other package types. The bottles segment dominated the market in 2025 due to widespread use in wine, spirits, and premium beverages. Bottles are valued for their ability to preserve product quality, offer a premium consumer experience, and support decorative labeling and embossing techniques.

The pouches segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the rising popularity of flexible and lightweight packaging for ready-to-drink alcoholic beverages. Pouches provide convenience, portability, and reduced transportation costs, and are increasingly used in emerging markets and for on-the-go consumption.

- By Product Type

On the basis of product type, the market is segmented into un-distilled fermented beverages, beer, wines, cider, distilled drinks, vodka, tequila, rum, whisky, gin, and others. The beer segment held the largest market share in 2025 due to high global consumption and growing demand for craft and premium beers packaged in bottles and cans. Beer packaging emphasizes durability, freshness preservation, and attractive labeling to influence purchase decisions.

The distilled drinks segment, including vodka, whisky, rum, and gin, is expected to witness the fastest growth rate from 2026 to 2033, driven by rising premiumization trends and growing consumer preference for spirits in emerging and developed markets. Innovative bottle designs, decorative finishes, and sustainable packaging practices are key factors supporting this segment’s rapid expansion.

Alcoholic Beverage Packaging Market Regional Analysis

- Asia-Pacific alcoholic beverage packaging market dominated the alcoholic beverage packaging market with the largest revenue share of 33.6% in 2025, driven by rapid urbanization, rising disposable incomes, and increasing consumption of beer, wine, and spirits in countries such as China, Japan, and India

- The region’s growing interest in premium and craft beverages, supported by government initiatives promoting sustainable packaging, is driving adoption

- Furthermore, as APAC emerges as a major manufacturing hub for packaging materials, the affordability and accessibility of innovative packaging formats are expanding to a wider consumer base

Japan Alcoholic Beverage Packaging Market Insight

The Japan alcoholic beverage packaging market is expected to witness the fastest growth rate from 2026 to 2033 due to high consumer preference for premium and convenience-focused packaging. Japanese consumers value aesthetically appealing, functional, and sustainable bottles, cans, and cartons. The trend of on-the-go consumption, coupled with increasing adoption of ready-to-drink beverages, is driving demand for innovative packaging solutions. Moreover, strong domestic production capabilities and advanced packaging technologies are fueling market expansion in both retail and hospitality sectors.

China Alcoholic Beverage Packaging Market Insight

The China alcoholic beverage packaging market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to the country’s large and growing middle-class population, rapid urbanization, and increasing consumption of beer, wine, and spirits. China represents one of the largest markets for both premium and mass-market beverages, with packaging playing a key role in product differentiation. The rising focus on sustainable packaging, the popularity of craft beverages, and strong domestic packaging manufacturers are key factors propelling the market in China.

North America Alcoholic Beverage Packaging Market Insight

North America is expected to witness the fastest growth rate from 2026 to 2033, driven by high consumption of beer, wine, and spirits, as well as increasing demand for premium and sustainable packaging solutions. Consumers in the region highly value visually appealing, convenient, and environmentally responsible packaging, including glass bottles, cans, and recyclable materials, which enhance brand perception and product quality. This widespread adoption is further supported by strong retail infrastructure, high disposable incomes, and growing preference for craft and premium beverages, establishing innovative packaging as a key differentiator in the market

U.S. Alcoholic Beverage Packaging Market Insight

The U.S. alcoholic beverage packaging market is expected to witness the fastest growth rate from 2026 to 2033, fueled by rising consumption of craft beer, spirits, and ready-to-drink beverages. Consumers increasingly prioritize packaging that preserves quality, showcases brand identity, and supports sustainability goals. The growing trend of premiumization, coupled with demand for eco-friendly bottles, cans, and cartons, further propels the market. Moreover, the expansion of e-commerce channels and on-trade establishments is significantly contributing to the adoption of innovative packaging formats.

Europe Alcoholic Beverage Packaging Market Insight

The Europe alcoholic beverage packaging market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by increasing demand for sustainable and premium packaging across beer, wine, and spirits. Stringent environmental regulations and growing consumer preference for eco-friendly packaging are fostering market adoption. European consumers are drawn to high-quality packaging that offers recyclability, durability, and attractive design. The region is experiencing growth across retail, hospitality, and on-trade channels, with packaging innovation playing a key role in product differentiation.

U.K. Alcoholic Beverage Packaging Market Insight

The U.K. alcoholic beverage packaging market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising consumer focus on premium beverages and sustainable packaging. Concerns regarding environmental impact are encouraging brands to adopt recyclable bottles, cans, and cartons. The U.K.’s strong retail and e-commerce infrastructure, combined with growing craft beverage production, is expected to continue stimulating packaging innovations. In addition, consumer interest in convenience and portability is promoting the adoption of flexible packaging formats such as pouches and cartons.

Germany Alcoholic Beverage Packaging Market Insight

The Germany alcoholic beverage packaging market is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing demand for premium wines, spirits, and craft beer. The country’s focus on sustainability, strict regulatory standards, and high consumer awareness of eco-friendly packaging are promoting adoption. Germany’s well-developed beverage industry, combined with innovation in glass, metal, and lightweight packaging solutions, supports market expansion. Furthermore, integration of packaging with marketing and branding initiatives is helping manufacturers enhance consumer engagement and product differentiation.

Alcoholic Beverage Packaging Market Share

The Alcoholic Beverage Packaging industry is primarily led by well-established companies, including:

• Mondi (Austria)

• Amcor plc (U.K.)

• ProAmpac (U.S.)

• Crown (U.K.)

• Ardagh Group S.A. (Luxembourg)

• BALL CORPORATION (U.S.)

• Berry Global Inc. (U.S.)

• Tetra Pak Group (Sweden)

• Saint-Gobain Group (France)

• O-I Glass, Inc. (U.S.)

• Vetreria Etrusca (Italy)

• Encore Glass (U.K.)

• Orora Packaging Australia Pty Ltd (Australia)

• Creative Glass (U.K.)

• Brick Packaging (Canada)

• Bemis Manufacturing Company (U.S.)

• Nampak Ltd. (South Africa)

• Krones AG (Germany)

• Sidel Group (France)

• Sonoco Products Company (U.S.)

Latest Developments in Global Alcoholic Beverage Packaging Market

- In May 2024, Sonoco inaugurated its new Metal Packaging Technical & Engineering Center in Columbus, Ohio, a strategic development aimed at advancing sustainable metal packaging solutions. The center will focus on innovation, product testing, and customer support, enabling Sonoco to deliver enhanced packaging performance and eco-friendly options. This initiative strengthens the company’s market presence and reinforces its commitment to sustainable practices, supporting broader adoption of advanced metal packaging across the beverage and food industries

- In May 2024, Amcor plc launched its Bottles of the Year program on National Packaging Design Day 2024, highlighting innovative and responsible packaging solutions. The program recognizes designs that align with evolving consumer trends in beverages, spirits, and food products, encouraging creativity and sustainability. By showcasing excellence in packaging design, Amcor aims to influence industry standards, enhance brand differentiation, and drive adoption of environmentally conscious materials

- In April 2024, SIG collaborated with Namaqua Wines to supply carton packaging for its low-alcohol wine range. The company invested in a SIG Slimline Aseptic filling machine to expand production capacity and improve efficiency. This collaboration strengthens SIG’s position in the aseptic packaging market, enabling the delivery of high-quality, safe, and sustainable packaging solutions, while supporting Namaqua Wines’ market expansion and product innovation

- In April 2024, Berry Global Inc. acquired F&S Tool Inc., a strategic move to enhance its full plastic packaging lifecycle capabilities. The acquisition enables Berry to offer integrated solutions including design, production, and recycling services, improving operational efficiency and sustainability. This development broadens Berry’s market offerings, strengthens its competitive edge, and supports the growing demand for end-to-end plastic packaging solutions across various industries

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Alcoholic Beverage Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Alcoholic Beverage Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Alcoholic Beverage Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.