Global Alfalfa Hay Market

Market Size in USD Billion

CAGR :

%

USD

27.36 Billion

USD

43.28 Billion

2025

2033

USD

27.36 Billion

USD

43.28 Billion

2025

2033

| 2026 –2033 | |

| USD 27.36 Billion | |

| USD 43.28 Billion | |

|

|

|

|

Alfalfa Hay Market Size

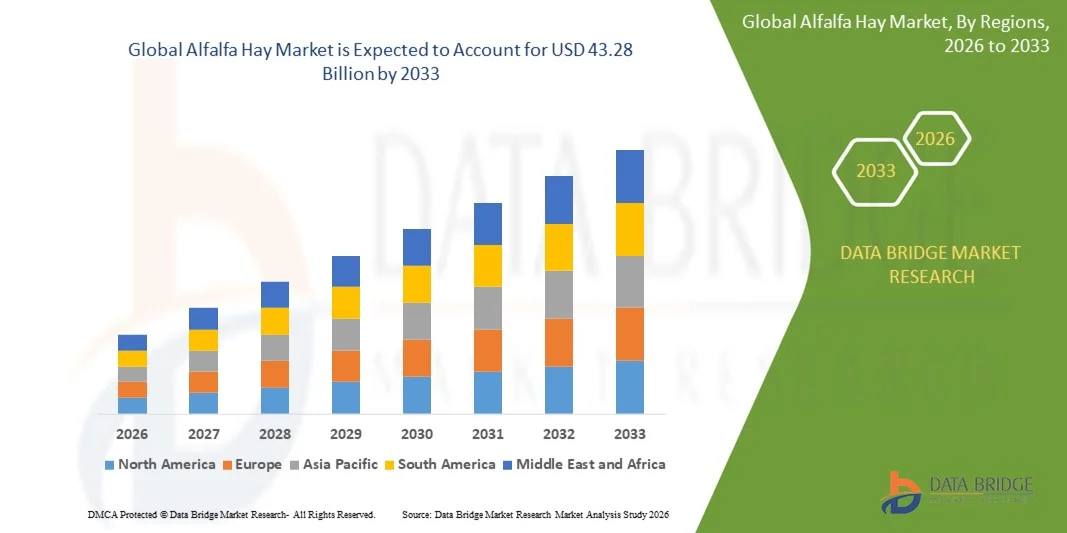

- The global alfalfa hay market size was valued at USD 27.36 billion in 2025 and is expected to reach USD 43.28 billion by 2033, at a CAGR of 5.90% during the forecast period

- The market growth is largely fueled by the rising demand for high-quality animal feed across meat, dairy, and poultry industries, driven by increasing livestock production and the need for nutrient-rich forage to enhance productivity and animal health

- Furthermore, expanding international trade, particularly the import of U.S. alfalfa by countries such as China, and growing awareness of the benefits of alfalfa hay in improving feed efficiency and livestock performance are strengthening market demand. These factors are collectively accelerating the adoption of alfalfa hay, thereby significantly boosting the industry’s growth

Alfalfa Hay Market Analysis

- Alfalfa hay, valued for its high protein content, digestibility, and suitability for multiple livestock types, is a critical component of modern animal feed practices. Its use in meat, dairy, and equine nutrition ensures consistent growth, improved milk yields, and better overall livestock health

- The escalating demand for alfalfa hay is primarily driven by increasing livestock populations, the shift toward intensive farming practices, and the preference for premium feed products that optimize animal performance. In addition, technological advancements in hay processing, storage, and transportation are enhancing the supply chain and supporting broader market expansion

- North America dominated the alfalfa hay market with a share of 36.7% in 2025, due to extensive livestock farming activities, strong dairy and beef production, and high adoption of nutritionally rich forage crops

- Asia-Pacific is expected to be the fastest growing region in the alfalfa hay market during the forecast period due to rising livestock populations, increasing dairy consumption, and growing awareness of high-nutrition animal feed

- Bales segment dominated the market with a market share of 43.5% in 2025, due to their widespread use across dairy farms, cattle ranches, and export-oriented hay trade. Baled alfalfa hay is favored for its cost-effectiveness, ease of storage, and suitability for large-scale feeding operations. Farmers prefer bales due to minimal processing requirements and better retention of natural fiber structure. The strong export demand for compressed alfalfa bales further contributes to segment dominance. In addition, bales offer flexibility in feeding practices across different livestock categories. These advantages continue to sustain the leading position of the bales segment

Report Scope and Alfalfa Hay Market Segmentation

|

Attributes |

Alfalfa Hay Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Alfalfa Hay Market Trends

Growing Adoption of High-Quality Alfalfa Hay in Livestock Nutrition

- A significant trend in the alfalfa hay market is the increasing adoption of high-quality, nutrient-rich alfalfa across meat, dairy, and equine industries, driven by the growing need for enhanced animal productivity, milk yield, and overall livestock health. The rising focus on precision nutrition and sustainable farming practices is encouraging livestock producers to incorporate alfalfa hay as a staple component in feed formulations

- For instance, Al Dahra ACX Global Inc. supplies premium dehydrated alfalfa hay to global markets, ensuring consistent quality and high protein content that meet the nutritional requirements of dairy and meat animals. Such offerings strengthen livestock growth performance and reduce dependency on lower-quality forage alternatives

- The trend toward processed alfalfa formats, such as pellets and cubes, is growing as these forms improve storage, transport, and feeding efficiency. Companies such as Standlee Premium Products, LLC are increasingly supplying pelletized alfalfa, catering to farms that require convenient, high-nutrient feed options for large-scale operations

- The global expansion of trade in premium alfalfa hay, particularly exports from the U.S. to China, Saudi Arabia, and other high-demand regions, is further reinforcing this trend. This international demand incentivizes producers to maintain high-quality standards and adopt innovative processing and storage technologies

- Livestock producers are also prioritizing feed consistency and quality to optimize animal performance in intensive farming systems. High-quality alfalfa hay meets this requirement by providing essential proteins, vitamins, and minerals, making it a preferred choice across various animal segments

- Technological advancements in harvesting, dehydration, and baling are improving alfalfa quality and shelf life, enabling suppliers to meet both domestic and export demand efficiently. This development is positioning alfalfa hay as a critical component in modern livestock nutrition strategies

Alfalfa Hay Market Dynamics

Driver

Rising Demand from Meat, Dairy, and Poultry Industries

- The rising demand for alfalfa hay is primarily fueled by the expansion of meat, dairy, and poultry production globally. Livestock producers are increasingly seeking nutrient-rich forage to enhance animal growth, milk yields, and overall productivity, which is positioning alfalfa hay as an essential feed component

- For instance, Almarai, a leading dairy and poultry producer in Saudi Arabia, relies heavily on imported U.S. alfalfa hay to ensure consistent feed quality for its large-scale livestock operations. This demand drives both production and export activities, encouraging suppliers to scale operations and maintain high-quality standards

- The growth of intensive and commercial livestock farming is increasing the need for high-quality feed with optimal protein content and digestibility, which alfalfa hay provides. This requirement spans multiple animal types, including dairy cows, beef cattle, horses, and poultry, broadening the market base

- In addition, livestock producers are increasingly implementing precision feeding practices to optimize feed conversion ratios and animal health. Alfalfa hay, with its nutrient-dense profile, supports these strategies effectively, making it a preferred feed component

- Sustainability considerations are also influencing demand, as alfalfa hay is seen as a natural, environmentally friendly feed option that can reduce reliance on synthetic supplements. This perception enhances its adoption across farms committed to sustainable practices

Restraint/Challenge

Price Volatility and Supply Constraints of Premium Alfalfa Hay

- The alfalfa hay market faces challenges due to fluctuations in pricing and limitations in supply, particularly for premium-grade hay that meets the high nutritional standards required by intensive livestock operations. Seasonal factors, climate variability, and changes in international trade policies can significantly affect the availability and cost of alfalfa hay

- For instance, in March 2025, the average price of Premium and Supreme alfalfa hay reached USD 242 per ton, reflecting dynamic supply-demand shifts and impacting livestock producers’ feed procurement strategies. Price instability creates uncertainty for both buyers and suppliers, affecting long-term planning

- High demand from major importers such as China and the Middle East can create competition for limited supply, further exacerbating price volatility. U.S. exporters, including companies such as COABA and SL Follen Company, must navigate these market pressures while ensuring timely delivery to maintain customer confidence

- Transportation and logistics constraints, including storage requirements for high-quality dehydrated hay, add complexity to supply management. This increases costs for producers and distributors, potentially limiting market accessibility for smaller farms

- Maintaining consistent quality under varying environmental conditions and across different suppliers also poses a challenge. Ensuring nutrient content, moisture levels, and overall forage integrity requires careful monitoring, which can increase operational expenses and limit scalability

Alfalfa Hay Market Scope

The market is segmented on the basis of application and product type.

- By Application

On the basis of application, the Alfalfa Hay market is segmented into meat/dairy animal feed, horse feed, poultry, and others. The meat and dairy animal feed segment dominated the market with the largest revenue share in 2025, driven by the high nutritional value of alfalfa hay, including protein, fiber, and digestible energy essential for improving milk yield and meat quality. Large-scale dairy and cattle farms increasingly prefer alfalfa hay to enhance animal productivity and overall herd health. Its consistent demand is further supported by the rising consumption of dairy products and beef across key agricultural economies. In addition, alfalfa hay supports rumen health, which makes it a preferred forage in intensive livestock operations. The availability of different grades of alfalfa hay also allows farmers to optimize feed formulations based on animal growth stages. These factors collectively reinforce the strong dominance of meat and dairy animal feed applications.

The horse feed segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by the growing equine population and increasing spending on premium nutrition for sport, racing, and recreational horses. Horse owners prioritize alfalfa hay due to its palatability, high calcium content, and ability to support muscle development and stamina. Rising participation in equestrian sports and recreational riding is further strengthening demand for high-quality forage. In addition, veterinary recommendations often support alfalfa-based diets for specific performance and breeding needs. The shift toward specialized and nutritionally balanced horse feed programs is accelerating adoption. These trends position horse feed as the fastest-growing application segment.

- By Product Type

On the basis of product type, the Alfalfa Hay market is segmented into bales, pellets, and cubes. The bales segment dominated the market with the largest share of 43.5% in 2025, supported by their widespread use across dairy farms, cattle ranches, and export-oriented hay trade. Baled alfalfa hay is favored for its cost-effectiveness, ease of storage, and suitability for large-scale feeding operations. Farmers prefer bales due to minimal processing requirements and better retention of natural fiber structure. The strong export demand for compressed alfalfa bales further contributes to segment dominance. In addition, bales offer flexibility in feeding practices across different livestock categories. These advantages continue to sustain the leading position of the bales segment.

The pellets segment is expected to register the fastest growth from 2026 to 2033, driven by rising demand for convenient, uniform, and easy-to-handle feed formats. Alfalfa pellets offer consistent nutritional content and reduced wastage compared to loose hay, making them attractive for commercial feed operations. Their compact size supports efficient transportation and storage, especially in regions with limited space. Growing adoption among horse owners and small-scale livestock farms is also accelerating demand. In addition, pellets are increasingly used in blended feed formulations for precise ration control. These factors collectively support the rapid growth of the pellets segment.

Alfalfa Hay Market Regional Analysis

- North America dominated the alfalfa hay market with the largest revenue share of 36.7% in 2025, driven by extensive livestock farming activities, strong dairy and beef production, and high adoption of nutritionally rich forage crops

- Producers in the region prioritize alfalfa hay due to its high protein content, digestibility, and consistent quality, which support improved milk yield and animal health

- This dominance is further reinforced by advanced agricultural practices, large-scale hay exports, and strong demand from commercial dairy farms, establishing North America as a key supplier in the global alfalfa hay market

U.S. Alfalfa Hay Market Insight

The U.S. alfalfa hay market captured the largest revenue share within North America in 2025, supported by widespread dairy and cattle farming and strong export demand. Farmers increasingly prefer alfalfa hay to enhance feed efficiency and livestock productivity. The presence of well-established hay production regions, combined with growing shipments to Asia and the Middle East, continues to strengthen market performance. In addition, the use of advanced harvesting and storage techniques ensures consistent quality, further supporting market expansion.

Europe Alfalfa Hay Market Insight

The Europe alfalfa hay market is projected to expand at a steady CAGR during the forecast period, driven by rising demand for high-quality forage in dairy and livestock farming. Increasing emphasis on sustainable agriculture and animal nutrition is encouraging the adoption of alfalfa hay. The region is witnessing growing utilization across dairy, beef, and equine applications. In addition, supportive agricultural policies and increasing focus on feed quality are contributing to market growth across European countries.

U.K. Alfalfa Hay Market Insight

The U.K. alfalfa hay market is expected to grow at a notable CAGR over the forecast period, driven by rising awareness of balanced animal nutrition and increasing demand from dairy and equine sectors. Livestock owners are gradually shifting toward nutrient-dense forage to improve animal performance. The growing interest in premium feed solutions for horses further supports market growth. In addition, imports of high-quality alfalfa hay play a role in meeting domestic demand.

Germany Alfalfa Hay Market Insight

The Germany alfalfa hay market is anticipated to witness moderate growth during the forecast period, supported by strong dairy production and a focus on feed efficiency. German farmers emphasize consistent forage quality to enhance milk output and livestock health. The integration of alfalfa hay into structured feeding programs is becoming increasingly common. In addition, Germany’s focus on sustainable and efficient agricultural practices supports continued adoption of high-quality forage crops.

Asia-Pacific Alfalfa Hay Market Insight

The Asia-Pacific alfalfa hay market is expected to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rising livestock populations, increasing dairy consumption, and growing awareness of high-nutrition animal feed. Rapid urbanization and rising disposable incomes are boosting demand for milk and meat products, which in turn supports alfalfa hay imports. The region’s dependence on imported premium forage further accelerates market growth. Expanding dairy industries across major economies are key contributors to this rapid expansion.

Japan Alfalfa Hay Market Insight

The Japan alfalfa hay market is experiencing steady growth due to strong demand from the dairy and cattle sectors. Limited domestic forage production encourages reliance on imported high-quality alfalfa hay. Japanese livestock farmers emphasize consistent nutrition and feed efficiency, driving sustained demand. In addition, the focus on maintaining high milk quality standards continues to support market growth.

China Alfalfa Hay Market Insight

The China alfalfa hay market accounted for the largest revenue share in Asia-Pacific in 2025, driven by rapid expansion of large-scale dairy farms and increasing milk consumption. China’s growing middle-class population and rising demand for dairy products are accelerating the adoption of premium forage. The country relies heavily on imports to meet quality requirements, further strengthening market value. Government support for modernizing the dairy sector also plays a significant role in boosting alfalfa hay demand.

Alfalfa Hay Market Share

The alfalfa hay industry is primarily led by well-established companies, including:

- COABA (U.S.)

- ALFALFA MONEGROS, S.L (Spain)

- SL Follen Company (U.S.)

- Nafosa (Spain)

- Al Dahra ACX Global Inc (U.A.E.)

- BORDER VALLEY HAY (U.S.)

- Almarai (Saudi Arabia)

- Anderson Hay & Grain, Co., Inc (U.S.)

- Bailey Farms Inc (U.S.)

- Green Prairie International Inc (U.S.)

- Cubeit Hay Company (U.S.)

- Standlee Premium Products, LLC (U.S.)

- Riverina (Australia) Pty Ltd (Australia)

- Glenvar Hay Pty Ltd (Australia)

Latest Developments in Global Alfalfa Hay Market

- In June 2025, Al Dahra ACX Global expanded its alfalfa hay processing capacity in California, increasing dehydration and export throughput by 28% to meet rising demand from China and the United Arab Emirates. This expansion strengthened the company’s market position, enabling more consistent supply of high-quality hay to key international buyers. The increased capacity also helps stabilize global prices, reduces logistical bottlenecks, and supports growth in premium feed segments for dairy and meat production

- In May 2025, global industry trends showed that alfalfa hay pellets captured nearly 48% share of the market, reflecting a growing preference for value-added and nutrient-dense formats. The shift toward pellets improves storage stability, transport efficiency, and feeding convenience for livestock producers. This trend is encouraging producers to invest in pellet production, enhancing profitability while meeting rising demand from modern livestock farms that prioritize optimized feed nutrition and operational efficiency

- In March 2025, the average price of Premium and Supreme alfalfa hay reached USD 242 per ton, which was USD 12 higher than December 2024 but USD 32 lower than January 2024. These price fluctuations highlight dynamic supply-demand shifts, impacting producer margins and strategic purchasing decisions. The movement also signals the need for efficient inventory and logistics planning by exporters and importers, especially for high-quality feed used in dairy and meat production

- In July 2024, China imported 886,661 metric tons of U.S. alfalfa hay, maintaining its position as the top buyer despite a 47% reduction in volumes. This continued reliance on U.S. exports reinforces China’s role as a key driver of global trade for alfalfa hay, shaping production priorities and export strategies. It also underscores the market’s sensitivity to geopolitical and regulatory developments that influence cross-border trade flows

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Alfalfa Hay Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Alfalfa Hay Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Alfalfa Hay Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.