Global Aloe Vera Market

Market Size in USD Million

CAGR :

%

USD

724.20 Million

USD

1,485.92 Million

2024

2032

USD

724.20 Million

USD

1,485.92 Million

2024

2032

| 2025 –2032 | |

| USD 724.20 Million | |

| USD 1,485.92 Million | |

|

|

|

|

Aloe Vera Market Size

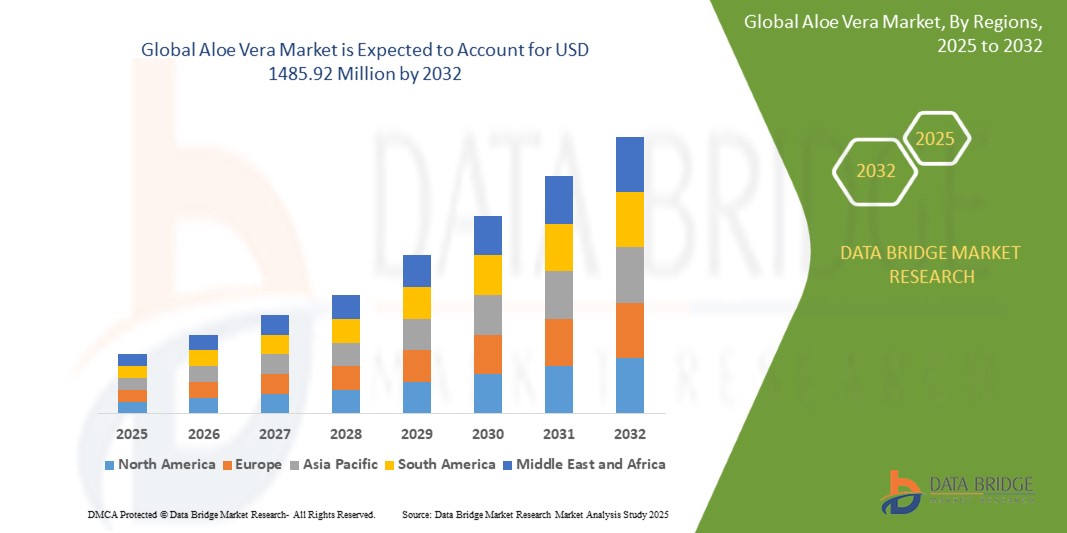

- The global aloe vera market was valued at USD 724.20 million in 2024 and is expected to reach USD 1485.92 million by 2032

- During the forecast period of 2025 to 2032 the market is such is likely to grow at a CAGR of 9.40%, primarily driven by increasing health and wellness trends

- This growth is driven by factors such as preference for natural remedies, growth in nutraceuticals, demand in skincare, and popularity of plant-based lifestyles

Aloe Vera Market Analysis

- Aloe Vera is a key component of the global health and wellness industry, offering a diverse range of products, including skincare, haircare, dietary supplements, and beverages. These products play a significant role in personal care, healthcare, and the functional food and beverage sectors worldwide

- The market growth is significantly driven by rising consumer awareness of natural and organic ingredients, coupled with increasing applications of aloe vera in pharmaceutical and cosmetic formulations. As consumers seek plant-based and chemical-free alternatives, the demand for aloe vera-based products continues to expand, influencing industry trends and brand strategies

- In addition, sustainability and ethical sourcing play a crucial role in shaping consumer preferences. Many brands are adopting eco-friendly cultivation practices, organic certifications, and transparent supply chains to cater to environmentally and health-conscious consumers

- For instance, L'Oréal has incorporated aloe vera into its skincare and haircare product lines to meet the growing demand for natural ingredients. The company focuses on research-driven product development and sustainable sourcing to maintain quality and efficacy, reinforcing aloe vera’s role in the cosmetics industry

- Globally, aloe vera ranks among the most sought-after natural ingredients in the personal care and wellness industries, following essential oils and herbal extracts. Its continuous innovation and increasing applications in skincare, food, and pharmaceuticals ensure sustained market growth

Report Scope and Aloe Vera Market Segmentation

|

Attributes |

Aloe Vera Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Aloe Vera Market Trends

“Rising Demand for Aloe Vera-Based Skincare & Wellness Products”

- One prominent trend in the global aloe vera market is the rising demand for aloe vera-based skincare & wellness products

- This trend is evident in the consumers' increasing preference for natural and organic ingredients. Aloe vera, renowned for its soothing, hydrating, and anti-inflammatory properties, has become a go-to ingredient in personal care products such as moisturizers, face masks, anti-aging creams, and sun care solutions

- For instance, brands such as Lily of the Desert and Aloe Vera of America have seen success by expanding their portfolios to include wellness-focused products such as aloe vera-infused herbal teas, gels, dietary supplements, and juices

- As consumers continue to prioritize clean, natural, and sustainable options in their beauty and wellness routines, the market for aloe vera-based products is set to grow exponentially

- This trend is driving innovation in product formulations and contributing to the premiumization of aloe vera offerings, with luxury skincare brands incorporating aloe vera into their high-end product lines. As a result, aloe vera’s position as a key ingredient in the personal care and wellness sectors is set to strengthen, creating significant growth opportunities for brands in this evolving market

Aloe Vera Market Dynamics

Driver

“Expansion in the Personal Care Industry”

- The personal care industry has increasingly adopted aloe vera as a key ingredient due to its versatile and beneficial properties. Aloe vera is well-regarded for its soothing, moisturizing, and anti-inflammatory effects, making it ideal for skincare, haircare, and beauty products

- The demand for aloe vera-based personal care products has surged, driven by the growing consumer preference for natural and organic ingredients

- The increasing popularity of aloe vera in high-demand products such as moisturizers, shampoos, sunscreens, and face masks has contributed to its widespread adoption in the personal care industry

- The global trend toward holistic wellness and self-care has prompted both established brands and new entrants to create aloe vera-infused products that cater to a health-conscious audience

- In addition, the growing demand for cruelty-free, vegan, and environmentally-friendly products has made aloe vera an even more attractive option, as it is naturally derived and sustainable

For instance,

- The Body Shop has incorporated aloe vera into several of its skincare products, highlighting its ability to relieve sensitive skin and enhance hydration

- Herbivore Botanicals has developed a line of aloe-based facial mists and masks, tapping into the demand for natural skincare solutions

- As the demand for natural and clean beauty products increases, the expansion of aloe vera in the personal care market offers immense opportunities for innovation and growth, allowing both established brands and new entrants to meet evolving consumer preferences and capitalize on this growing trend

Opportunity

“Advances in extraction techniques”

- Recent advancements in aloe vera extraction techniques have opened up significant opportunities for the aloe vera market. These innovations in extraction methods have improved both the yield and quality of aloe vera, making it more accessible for a wider range of applications across industries such as personal care, food and beverages, and pharmaceuticals

- These new techniques have enhanced the extraction of bioactive compounds such as aloin, acemannan, and polysaccharides, which are highly sought after for their health benefits, such as immune system support, anti-inflammatory properties, and skin healing

- The ability to maintain the integrity of these bioactive components without compromising quality has spurred the development of more effective and potent aloe vera-based products

For instance,

- Aloe Farms in (U.S.) has pioneered the use of cold-press extraction for producing aloe vera gel. This method maintains the high levels of vitamins, minerals, and amino acids in the aloe, ensuring superior product quality for use in skincare and wellness products

- Aloe Vera Company from India company has adopted enzymatic extraction techniques that enhance the bioavailability of aloe vera's beneficial compounds. The technique increases the effectiveness of aloe vera in cosmetics and pharmaceuticals, enabling manufacturers to create products with higher therapeutic efficacy

- As demand for aloe vera continues to grow across multiple industries, companies that leverage advanced extraction technologies will be well-positioned to meet evolving consumer preferences for purity, potency, and sustainability

Restraint/Challenge

“Environmental and Climatic Factors”

- Aloe vera cultivation faces several challenges, particularly due to environmental and climatic factors. Aloe vera is a hardy plant, but its growth is highly dependent on specific climatic conditions, particularly warm and dry climates

- These conditions are becoming increasingly difficult to maintain due to global climate change, including erratic rainfall patterns, rising temperatures, and drought conditions

- Such environmental challenges can directly affect the quantity and quality of aloe vera production, leading to supply shortages and increased production costs for manufacturers

For instance,

- In 2020, several aloe vera farms in southern India faced a significant reduction in their crop yields due to an extended drought, resulting in a lower supply of aloe vera for both the domestic and international markets. This shortage forced many manufacturers to source aloe vera from other regions, leading to higher raw material costs and disruptions in the production cycle

- As the demand for aloe vera continues to rise, especially in the personal care and wellness sectors, ensuring a stable supply chain becomes critical. Companies may need to explore alternative cultivation regions, invest in climate-resilient agricultural techniques, or develop more sustainable farming practices to mitigate the effects of climate change

Aloe Vera Market Scope

The market is segmented on the basis of type, form, and end user industry.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Form |

|

|

By End User Industry

|

|

Aloe Vera Market Regional Analysis

“Asia-Pacific is the Dominant Region in the Aloe Vera Market”

- Asia-Pacific dominates the aloe vera market, driven by rapid growth of the pharmaceutical and cosmetic industries, which have increasingly incorporated aloe vera due to its healing, anti-inflammatory, and moisturizing properties

- China and India, are expected to continue driving the demand for aloe vera-based products, fueled by an expanding middle class, rising consumer awareness of health and wellness, and an increasing preference for natural and organic products

- The region's growing awareness of the benefits of aloe vera, alongside rising disposable incomes and an expanding population, is expected to lead to higher consumption of skincare, personal care, and wellness products

- In addition, as per capita income levels rise, more consumers in the region are expected to invest in premium and high-quality aloe vera products, further promoting market growth

“North America is Projected to Register the Highest Growth Rate”

- The North America region is expected to witness the highest growth rate in the Aloe Vera market, driven by an increasing demand for aloe vera products used in the treatment of various diseases, including cancer, diabetes, and other chronic health conditions

- The rising trend of clean-label, plant-based, and organic skincare products is further fueling the adoption of aloe vera, which is perceived as a natural, sustainable, and effective ingredient for improving health and beauty

- Global aloe vera market is expected to expand further, driven by regional trends and the increasing appeal of aloe vera as a versatile, natural ingredient

Aloe Vera Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Aloe Vera of Australia (Australia)

- Aloe Plus Lanzarote S.L (Spain)

- Lily of the Desert (U.S.)

- NOW foods. (U.S.)

- Forever Living.com, L.L.C. (U.S.)

- Real Aloe (U.S.)

- Patanjali Ayurved (India)

- Herbalife International of America, Inc. (U.S.)

- Green Leaf (U.S.)

- Warren Laboratories LLC (U.S.)

- Lakewood Construction LLC (U.S.)

- LR Health & Beauty (Germany)

Latest Developments in Global Aloe Vera Market

- In April 2021, Veganic, a Dublin-based company, has announced plans to bring Ireland's 100% organic and 100% plant-based Aloe Vera fruit juices to US markets. According to company officials, they will be launching their 100 percent organic and plant-based Aloe Vera with Apple juice across the United States. Aloe vera fruit juices can be traced back to ancient Egypt, where it was known as the "plant of immortality"

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Aloe Vera Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Aloe Vera Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Aloe Vera Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.