Global Alpaca Fiber Market

Market Size in USD Billion

CAGR :

%

USD

119.94 Billion

USD

160.39 Billion

2022

2030

USD

119.94 Billion

USD

160.39 Billion

2022

2030

| 2023 –2030 | |

| USD 119.94 Billion | |

| USD 160.39 Billion | |

|

|

|

|

Alpaca Fiber Market Analysis and Size

The growing consumer demand for natural fashion accessories and clothing, increasing awareness amongst consumers regarding the product benefits, rapidly augmenting alpaca fiber fashion stores which offer the easy approachability of the products, increasing trends of highly sustainable and eco-friendly garments, rising standard of living of the people are some of the major as well as important factors which will likely to accelerate the growth of the alpaca fiber market. On the other hand, the increasing popularity in the fashion apparel industry and rising demand for warm and soft fiber will further contribute by generating immense opportunities that will lead to the growth of the alpaca fiber market in the forecasted period.

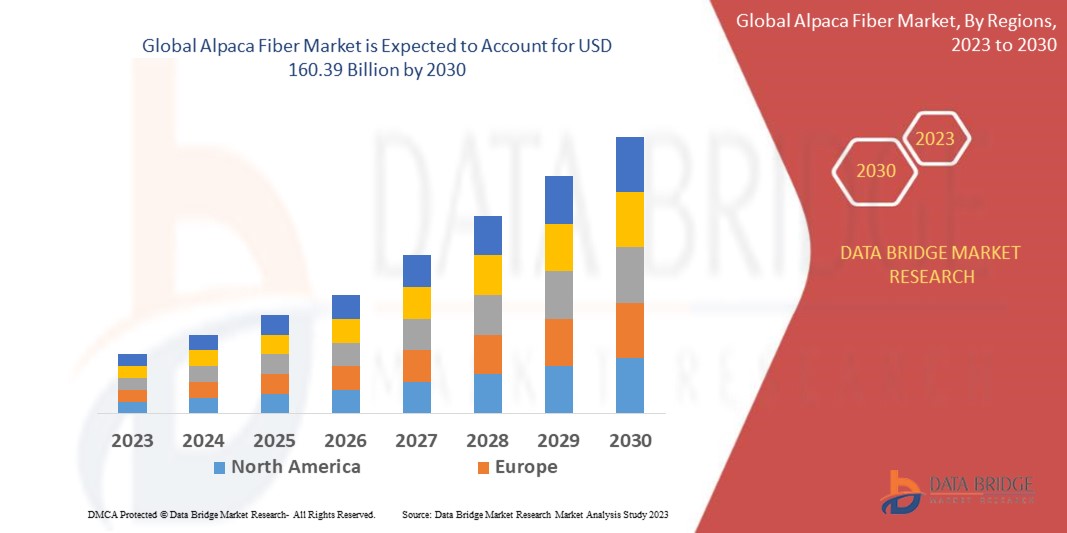

Data Bridge Market Research analyses that the global alpaca fiber market which was USD 119.94 Billion in 2022, would rocket up to USD 160.39 Billion by 2030, and is expected to undergo a CAGR of 3.20% during the forecast period. This indicates that the market value. The Apparels segment is expected to dominate the market due to the high demand for luxurious, soft, and warm alpaca fiber clothing products. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Alpaca Fiber Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2023 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Wool Type (Huacaya Fiber, Suri Fiber), Grade (Ultra Fine (Royal baby) (< 20 Microns), Superfine (Baby) (20-22.9 Microns), Fine (23-25.9 Microns), Medium (26-28.9 Microns), Intermediate (Adult) (29-32 Microns), Robust (32.1-35 Microns)), Application (Apparels, Interior Textiles, Floorings, Industrial Felting) |

|

Countries Covered |

U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, U.A.E, Saudi Arabia, Egypt, South Africa, Israel, Rest of Middle East and Africa |

|

Market Players Covered |

The Alpaca Yarn Company (United States), AHA Bolivia (Bolivia), New Era Fiber (United States), The Natural Fiber Company (United Kingdom), Coopecan (Bolivia), Zeilinger Wool Company (United States), Plymouth Yarn Company, Inc. (United States), Fil Katia (Spain), Cascade Yarns (United States), Malabrigo Yarn (Uruguay), AndeanSun Yarns (Peru), Berroco, Inc. (United States), Mary Maxim, Inc. (Canada), Laughing Hens (United Kingdom), Lion Brand Yarn (United States), Alpaca Owners Association, Inc. (United States), White Frost Farms (United States), Yarns and Fibers (YnFx) (India), Classi Alpaca (Peru), Altifibers S.A. (Peru). |

|

Market Opportunities |

|

Market Definition.

A natural fiber obtained from an alpaca is alpaca fiber. It's stronger, more hypoallergenic, lighter, warmer, and stretchable than fur. Compared to conventional wool, alpaca fiber is not scratchy, which gives the benefit of alpaca fiber so people who cannot wear sheep wool can wear alpaca fiber clothing. Alpaca fiber is considered to be one of the world's most luxurious and finest natural fiber, making it a common choice for leisure and lavish clothing.

Global Alpaca Fiber Market Dynamics

Drivers:

- Growing Demand for Sustainable and Ethical Fibers:

The global alpaca fiber market is driven by the increasing consumer preference for sustainable and ethical products. Alpaca fiber is known for its eco-friendliness, as alpacas have a low environmental impact compared to other livestock. This demand is bolstered by the rising awareness of the negative impacts of synthetic fibers on the environment.

- Increasing Awareness and Popularity of Alpaca Fiber Products:

Alpaca fiber products, such as clothing, accessories, and home textiles, are gaining popularity worldwide. The luxurious feel, exceptional softness, and natural warmth of alpaca fiber are highly appreciated by consumers. As awareness about the unique qualities of alpaca fiber grows, it drives the demand for alpaca-based products in the global market.

Opportunity:

- Expansion of Alpaca Fiber Market in Emerging Economies:

The alpaca fiber market presents significant growth opportunities in emerging economies. As disposable incomes rise and consumer preferences shift towards high-quality and sustainable products, emerging markets provide a large consumer base for alpaca fiber products. By tapping into these markets, alpaca fiber producers can expand their customer reach and boost their sales.

Restraints/Challenges:

- Limited Supply and Cost Constraints:

The global alpaca fiber market faces challenges related to the limited supply of alpaca fiber. Alpaca herds are smaller compared to other livestock, and the fiber yield per animal is relatively low. This limited supply can lead to higher prices, making alpaca fiber products more expensive for consumers. Additionally, factors such as fluctuations in alpaca population, weather conditions, and production costs can affect the availability and cost of alpaca fiber.

- Competition from Synthetic and Artificial Fibers:

The alpaca fiber market faces competition from synthetic fibers, which are often more affordable and readily available. Manufacturers of synthetic fibers continuously innovate to mimic the qualities of natural fibers, including alpaca. This poses a challenge for the alpaca fiber market in terms of maintaining its market share and highlighting the unique characteristics of alpaca fiber that set it apart from synthetic alternatives.

This alpaca fiber market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the Alpaca fiber market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Development

- On November 2022, according to the article published by Dow Jones and Company, Inc., fallPaka is launching a new platform to include creators of sustainable products around the world which includes Alpaca fiber made products.

Global Alpaca Fiber Market Scope

The alpaca fiber market is segmented on the basis of wool type, grade and application. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Segments:

Type

- Huacaya fiber

- Suri fiber

Grade

- Ultra-fine (royal baby) (< 20 Microns)

- Superfine (baby) (20-22.9 Microns)

- Fine (23-25.9 Microns)

- Medium (26-28.9 Microns)

- Intermediate (adult) (29-32 Microns)

- Robust (32.1-35 Microns)

Application

- Apparels

- Interior Textiles

- Floorings

- Industrial Felting

ALPACA FIBER Market Regional Analysis/Insights

The alpaca fiber market is analysed and market size insights and trends are provided by country, wool type, grade, and application as referenced above.

The countries covered in the alpaca fiber market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

U.S. is expected to dominate the North America alpaca fiber market due to the increasing popularity of naturally sourced fabric, increasing the number of manufacturing activities along with rising preferences towards the usage of high quality products in the region. Asia-Pacific region is expected to hold the largest growth rate due to the adoption of groundbreaking strategies to enhance the growth of the market in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends, and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Alpaca fiber Market Share Analysis

The alpaca fiber market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to alpaca fiber market.

Some of the major players operating in the alpaca fiber market are:

- The Alpaca Yarn Company (United States)

- AHA Bolivia (Bolivia)

- New Era Fiber (United States)

- The Natural Fiber Company (United Kingdom)

- Coopecan (Bolivia)

- Zeilinger Wool Company (United States)

- Plymouth Yarn Company, Inc. (United States)

- Fil Katia (Spain)

- Cascade Yarns (United States)

- Malabrigo Yarn (Uruguay)

- AndeanSun Yarns (Peru)

- Berroco, Inc. (United States)

- Mary Maxim, Inc. (Canada)

- Laughing Hens (United Kingdom)

- Lion Brand Yarn (United States)

- Alpaca Owners Association, Inc. (United States)

- White Frost Farms (United States)

- Yarns and Fibers (YnFx) (India)

- Classi Alpaca (Peru)

- Altifibers S.A. (Peru)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL ALPACA FIBER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL ALPACA FIBER MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 IMPORT AND EXPORT DATA

2.15 SECONDARY SOURCES

2.16 GLOBAL ALPACA FIBER MARKET : RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 RAW MATERIAL COVERAGE

5.2 PRODUCTION CONSUMPTION ANALYSIS

5.3 IMPORT EXPORT SCENARIO

5.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5.5 PORTER’S FIVE FORCES

5.6 VENDOR SELECTION CRITERIA

5.7 PESTEL ANALYSIS

5.8 REGULATION COVERAGE

5.8.1 PRODUCT CODES

5.8.2 CERTIFIED STANDARDS

5.8.3 SAFETY STANDARDS

5.8.3.1. MATERIAL HANDLING & STORAGE

5.8.3.2. TRANSPORT & PRECAUTIONS

5.8.3.3. HARAD IDENTIFICATION

6 PRICE INDEX

7 PRODUCTION CAPACITY OVERVIEW

8 SUPPLY CHAIN ANALYSIS

8.1 OVERVIEW

8.2 LOGISTIC COST SCENARIO

8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

9 CLIMATE CHANGE SCENARIO

9.1 ENVIRONMENTAL CONCERNS

9.2 INDUSTRY RESPONSE

9.3 GOVERNMENT’S ROLE

9.4 ANALYST RECOMMENDATIONS

10 INDUSTRY INSIGHTS

11 GLOBAL ALPACA FIBER MARKET, BY WOOL TYPE, (2021-2030), (USD MILLION) (TONS)

11.1 OVERVIEW

11.2 HUACAYA FIBER

11.2.1 ASP

11.2.2 VALUE

11.2.3 VOLUME

11.2.4 BY PRODUCTS

11.2.4.1. HOME INSULATION

11.2.4.2. HIKING GEAR

11.2.4.3. SUMMER WEAR

11.2.4.4. DUVETS

11.2.4.5. THERMAL UNDERWEAR

11.2.4.6. DRYER BALLS

11.2.4.7. SOCKS

11.2.4.8. TOYS

11.2.4.9. FELTING

11.2.4.10. BABY CLOTHES

11.2.4.11. EXCLUSIVE FASHION

11.2.4.12. PONCHOS

11.2.4.13. RUANAS

11.2.4.14. COATS

11.2.4.15. KNITTING

11.2.4.16. SWEATERS

11.2.4.17. CARDIGANS

11.2.4.18. HATS

11.2.4.19. MITTENS

11.2.4.20. BLANKETS

11.2.4.21. SCARVES

11.2.4.22. COLLAR SCARVES

11.2.4.23. SHAWLS

11.3 SURI FIBER

11.3.1 ASP

11.3.2 VALUE

11.3.3 VOLUME

11.3.4 BY PRODUCTS

11.3.4.1. HOME INSULATION

11.3.4.2. HIKING GEAR

11.3.4.3. SUMMER WEAR

11.3.4.4. DUVETS

11.3.4.5. THERMAL UNDERWEAR

11.3.4.6. DRYER BALLS

11.3.4.7. SOCKS

11.3.4.8. TOYS

11.3.4.9. FELTING

11.3.4.10. BABY CLOTHES

11.3.4.11. EXCLUSIVE FASHION

11.3.4.12. PONCHOS

11.3.4.13. RUANAS

11.3.4.14. COATS

11.3.4.15. KNITTING

11.3.4.16. SWEATERS

11.3.4.17. CARDIGANS

11.3.4.18. HATS

11.3.4.19. MITTENS

11.3.4.20. BLANKETS

11.3.4.21. SCARVES

11.3.4.22. COLLAR SCARVES

11.3.4.23. SHAWLS

12 GLOBAL ALPACA FIBER MARKET, BY GRADE, (2021-2030), (USD MILLION)

12.1 OVERVIEW

12.2 ULTRA FINE (ROYAL BABY) (< 20 MICRONS)

12.3 SUPERFINE (BABY) (20-22.9 MICRONS)

12.4 FINE (23-25.9 MICRONS)

12.5 MEDIUM (26-28.9 MICRONS)

12.6 INTERMEDIATE (ADULT) (29-32 MICRONS)

12.7 ROBUST (32.1-35 MICRONS)

13 GLOBAL ALPACA FIBER MARKET, BY APPLICATION, (2021-2030), (USD MILLION)

13.1 OVERVIEW

13.2 APPARELS

13.2.1 BY WOOL TYPE

13.2.1.1. HUACAYA FIBER

13.2.1.2. SURI FIBER

13.2.2 BY GRADE

13.2.2.1. ULTRA FINE (ROYAL BABY) (< 20 MICRONS)

13.2.2.2. SUPERFINE (BABY) (20-22.9 MICRONS)

13.2.2.3. FINE (23-25.9 MICRONS)

13.2.2.4. MEDIUM (26-28.9 MICRONS)

13.2.2.5. INTERMEDIATE (ADULT) (29-32 MICRONS)

13.2.2.6. ROBUST (32.1-35 MICRONS)

13.3 INTERIOR TEXTILES

13.3.1 BY WOOL TYPE

13.3.1.1. HUACAYA FIBER

13.3.1.2. SURI FIBER

13.3.2 BY GRADE

13.3.2.1. ULTRA FINE (ROYAL BABY) (< 20 MICRONS)

13.3.2.2. SUPERFINE (BABY) (20-22.9 MICRONS)

13.3.2.3. FINE (23-25.9 MICRONS)

13.3.2.4. MEDIUM (26-28.9 MICRONS)

13.3.2.5. INTERMEDIATE (ADULT) (29-32 MICRONS)

13.3.2.6. ROBUST (32.1-35 MICRONS)

13.4 FLOORINGS

13.4.1 BY WOOL TYPE

13.4.1.1. HUACAYA FIBER

13.4.1.2. SURI FIBER

13.4.2 BY GRADE

13.4.2.1. ULTRA FINE (ROYAL BABY) (< 20 MICRONS)

13.4.2.2. SUPERFINE (BABY) (20-22.9 MICRONS)

13.4.2.3. FINE (23-25.9 MICRONS)

13.4.2.4. MEDIUM (26-28.9 MICRONS)

13.4.2.5. INTERMEDIATE (ADULT) (29-32 MICRONS)

13.4.2.6. ROBUST (32.1-35 MICRONS)

13.5 INDUSTRIAL FELTING

13.5.1 BY WOOL TYPE

13.5.1.1. HUACAYA FIBER

13.5.1.2. SURI FIBER

13.5.2 BY GRADE

13.5.2.1. ULTRA FINE (ROYAL BABY) (< 20 MICRONS)

13.5.2.2. SUPERFINE (BABY) (20-22.9 MICRONS)

13.5.2.3. FINE (23-25.9 MICRONS)

13.5.2.4. MEDIUM (26-28.9 MICRONS)

13.5.2.5. INTERMEDIATE (ADULT) (29-32 MICRONS)

13.5.2.6. ROBUST (32.1-35 MICRONS)

14 GLOBAL ALPACA FIBER MARKET , BY GEOGRAPHY

GLOBAL ALPACA FIBER MARKET , (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

14.2 EUROPE

14.2.1 GERMANY

14.2.2 U.K.

14.2.3 ITALY

14.2.4 FRANCE

14.2.5 SPAIN

14.2.6 SWITZERLAND

14.2.7 RUSSIA

14.2.8 TURKEY

14.2.9 BELGIUM

14.2.10 NETHERLANDS

14.2.11 REST OF EUROPE

14.3 ASIA-PACIFIC

14.3.1 JAPAN

14.3.2 CHINA

14.3.3 SOUTH KOREA

14.3.4 INDIA

14.3.5 SINGAPORE

14.3.6 THAILAND

14.3.7 INDONESIA

14.3.8 MALAYSIA

14.3.9 PHILIPPINES

14.3.10 AUSTRALIA AND NEW ZEALAND

14.3.11 HONG KONG

14.3.12 TAIWAN

14.3.13 REST OF ASIA-PACIFIC

14.4 SOUTH AMERICA

14.4.1 BRAZIL

14.4.2 ARGENTINA

14.4.3 REST OF SOUTH AMERICA

14.5 MIDDLE EAST AND AFRICA

14.5.1 SOUTH AFRICA

14.5.2 EGYPT

14.5.3 SAUDI ARABIA

14.5.4 UNITED ARAB EMIRATES

14.5.5 ISRAEL

14.5.6 REST OF MIDDLE EAST AND AMERICA

15 GLOBAL ALPACA FIBER MARKET , COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: GLOBAL

15.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

15.3 COMPANY SHARE ANALYSIS: EUROPE

15.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15.5 MERGERS & ACQUISITIONS

15.6 NEW PRODUCT DEVELOPMENT & APPROVALS

15.7 EXPANSIONS

15.8 REGULATORY CHANGES

15.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

16 SWOT ANALYSIS AND DATA BRIDGE MARKET RESEARCH ANALYSIS

17 GLOBAL ALPACA FIBER MARKET - COMPANY PROFILE

17.1 THE ALPACA YARN COMPANY

17.1.1 COMPANY SNAPSHOT

17.1.2 PRODUCT PORTFOLIO

17.1.3 SWOT ANALYSIS

17.1.4 REVENUE ANALYSIS

17.1.5 RECENT UPDATES

17.2 AHA BOLIVIA.

17.2.1 COMPANY SNAPSHOT

17.2.2 PRODUCT PORTFOLIO

17.2.3 SWOT ANALYSIS

17.2.4 REVENUE ANALYSIS

17.2.5 RECENT UPDATES

17.3 NEW ERA FIBER

17.3.1 COMPANY SNAPSHOT

17.3.2 PRODUCT PORTFOLIO

17.3.3 SWOT ANALYSIS

17.3.4 REVENUE ANALYSIS

17.3.5 RECENT UPDATES

17.4 THE NATURAL FIBRE COMPANY

17.4.1 COMPANY SNAPSHOT

17.4.2 PRODUCT PORTFOLIO

17.4.3 SWOT ANALYSIS

17.4.4 REVENUE ANALYSIS

17.4.5 RECENT UPDATES

17.5 COOPECAN

17.5.1 COMPANY SNAPSHOT

17.5.2 PRODUCT PORTFOLIO

17.5.3 SWOT ANALYSIS

17.5.4 REVENUE ANALYSIS

17.5.5 RECENT UPDATES

17.6 ZEILINGER WOOL COMPANY

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 SWOT ANALYSIS

17.6.4 REVENUE ANALYSIS

17.6.5 RECENT UPDATES

17.7 PLYMOUTH YARN COMPANY, INC.

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 SWOT ANALYSIS

17.7.4 REVENUE ANALYSIS

17.7.5 RECENT UPDATES

17.8 FIL KATIA

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 SWOT ANALYSIS

17.8.4 REVENUE ANALYSIS

17.8.5 RECENT UPDATES

17.9 CASCADE YARNS

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 SWOT ANALYSIS

17.9.4 REVENUE ANALYSIS

17.9.5 RECENT UPDATES

17.1 MALABRIGO YARN

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 SWOT ANALYSIS

17.10.4 REVENUE ANALYSIS

17.10.5 RECENT UPDATES

17.11 ANDEANSUN YARNS

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 SWOT ANALYSIS

17.11.4 REVENUE ANALYSIS

17.11.5 RECENT UPDATES

17.12 BERROCO, INC

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 SWOT ANALYSIS

17.12.4 REVENUE ANALYSIS

17.12.5 RECENT UPDATES

17.13 MARY MAXIM, INC.

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 SWOT ANALYSIS

17.13.4 REVENUE ANALYSIS

17.13.5 RECENT UPDATES

17.14 LAUGHING HENS

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 SWOT ANALYSIS

17.14.4 REVENUE ANALYSIS

17.14.5 RECENT UPDATES

17.15 LION BRAND YARN

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 SWOT ANALYSIS

17.15.4 REVENUE ANALYSIS

17.15.5 RECENT UPDATES

17.16 ALPACA OWNERS ASSOCIATION, INC.

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 SWOT ANALYSIS

17.16.4 REVENUE ANALYSIS

17.16.5 RECENT UPDATES

17.17 WHITE FROST FARMS

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 SWOT ANALYSIS

17.17.4 REVENUE ANALYSIS

17.17.5 RECENT UPDATES

17.18 YARNS AND FIBERS (YNFX)

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 SWOT ANALYSIS

17.18.4 REVENUE ANALYSIS

17.18.5 RECENT UPDATES

17.19 CLASSI ALPACA.

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 SWOT ANALYSIS

17.19.4 REVENUE ANALYSIS

17.19.5 RECENT UPDATES

17.2 ALTIFIBERS S.A.

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 SWOT ANALYSIS

17.20.4 REVENUE ANALYSIS

17.20.5 RECENT UPDATES

18 QUESTIONNAIRE

19 CONCLUSION

20 RELATED REPORTS

21 ABOUT DATA BRIDGE MARKET RESEARCH

Global Alpaca Fiber Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Alpaca Fiber Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Alpaca Fiber Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.