Global Anti Counterfeit Cosmetic Packaging Market

Market Size in USD Billion

CAGR :

%

USD

43.76 Billion

USD

89.78 Billion

2025

2033

USD

43.76 Billion

USD

89.78 Billion

2025

2033

| 2026 –2033 | |

| USD 43.76 Billion | |

| USD 89.78 Billion | |

|

|

|

|

What is the Global Anti-Counterfeit Cosmetic Packaging Market Size and Growth Rate?

- The global anti-counterfeit cosmetic packaging market size was valued at USD 43.76 billion in 2025 and is expected to reach USD 89.78 billion by 2033, at a CAGR of9.4% during the forecast period

- The anti-counterfeit cosmetic packaging market is rising in demand due to increasing laws and regulations enforced by governments. Also, the high growth of the parent industry and track and trace technology to preserve a proficient supply chain across the world is also highly impacting the growth of the anti-counterfeit cosmetic packaging

What are the Major Takeaways of Anti-Counterfeit Cosmetic Packaging Market?

- The rapid increase in the focus of manufacturers on brand protection and the innovative technologies for the verification of the original cosmetics products are also anticipated to flourish the demand of the anti-counterfeit cosmetic packaging market owing to the above mentioned reasons and is also is projected to grow substantially during the forecast period

- Furthermore, the rise in the concerns regarding the dilution of brand identity by the leading manufacturers across the world and the increasing technological innovation for the production of highly secure packaging for use in application industries are also expected to push the growth of anti-counterfeit cosmetic packaging market

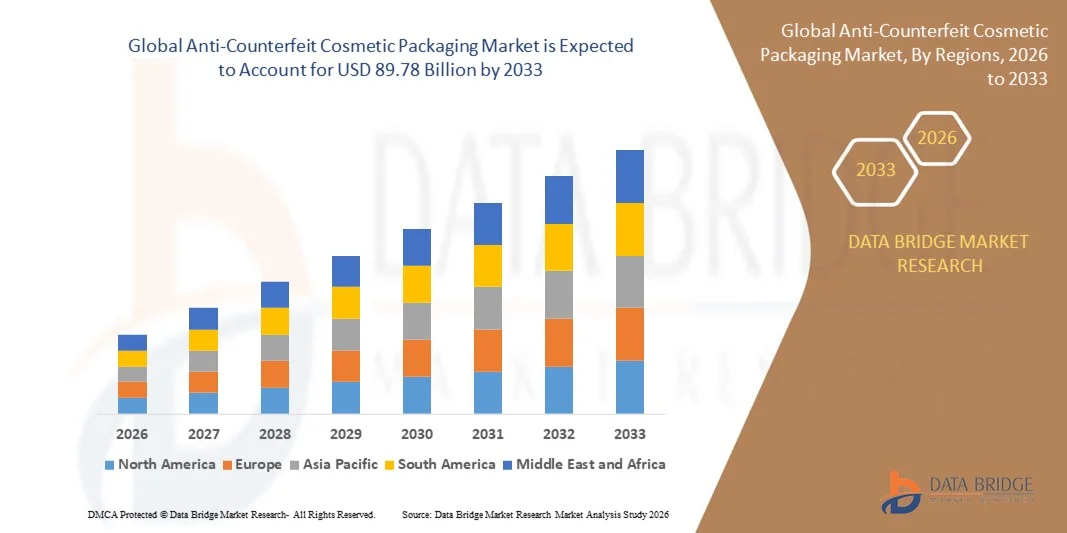

- North America dominated the anti-counterfeit cosmetic packaging market with a 43.24% revenue share in 2025, driven by high consumption of premium cosmetics, strong brand protection regulations, and widespread adoption of advanced authentication and track-and-trace technologies across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 9.21% from 2026 to 2033, driven by rapid growth in cosmetics consumption, expanding middle-class population, and increasing counterfeit incidents across China, India, Japan, South Korea, and Southeast Asia

- Authentication Packaging Technology dominated the market with an estimated 58.6% share in 2025, driven by widespread use of holograms, security inks, tamper-evident seals, QR codes, and digital watermarks to enable instant product verification by consumers and retailers

Report Scope and Anti-Counterfeit Cosmetic Packaging Market Segmentation

|

Attributes |

Anti-Counterfeit Cosmetic Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Anti-Counterfeit Cosmetic Packaging Market?

Increasing Shift Toward Smart, Track-and-Trace, and Digitally Enabled Anti-Counterfeit Cosmetic Packaging Solutions

- The anti-counterfeit cosmetic packaging market is witnessing rising adoption of smart packaging technologies such as QR codes, RFID, NFC, holograms, and digital watermarks to enhance product authentication and brand protection

- Manufacturers are integrating serialization, tamper-evident features, and mobile-based verification tools to enable real-time tracking and consumer-level authentication

- Growing demand for lightweight, cost-effective, and scalable security solutions is driving adoption across mass-market and premium cosmetic brands

- For instance, companies such as Avery Dennison, SICPA, AlpVision, 3M, and CCL Industries are expanding portfolios with advanced inks, labels, and digital authentication platforms

- Increasing need for end-to-end supply chain transparency, counterfeit detection, and regulatory compliance is accelerating adoption of connected and cloud-enabled packaging

- As cosmetic products face rising counterfeiting risks, Anti-Counterfeit Cosmetic Packaging will remain critical for brand integrity, consumer trust, and regulatory adherence

What are the Key Drivers of Anti-Counterfeit Cosmetic Packaging Market?

- Rising incidents of counterfeit cosmetics, which pose serious risks to consumer safety and brand reputation, are driving demand for secure packaging solutions

- For instance, in 2024–2025, leading cosmetic brands and packaging providers adopted serialization and digital authentication technologies to comply with global brand protection initiatives

- Growing expansion of e-commerce, cross-border trade, and online beauty platforms increases vulnerability to fake products, boosting demand for anti-counterfeit packaging

- Advancements in printing technologies, forensic markers, and smart labels have improved security performance while reducing implementation costs

- Increasing consumer awareness regarding product authenticity, ingredient safety, and brand transparency supports market growth

- Supported by stringent regulations and rising brand protection investments, the Anti-Counterfeit Cosmetic Packaging market is expected to witness sustained long-term growth

Which Factor is Challenging the Growth of the Anti-Counterfeit Cosmetic Packaging Market?

- High costs associated with advanced authentication technologies such as RFID, forensic inks, and blockchain-based tracking limit adoption among small and mid-sized cosmetic brands

- For instance, during 2024–2025, rising raw material and technology integration costs increased overall packaging expenses for several manufacturers

- Complexity in integrating digital authentication systems with existing packaging lines and supply chains creates operational challenges

- Limited awareness and technical expertise in emerging markets slow adoption of advanced anti-counterfeit solutions

- Availability of low-cost imitation security features reduces differentiation and effectiveness of genuine solutions

- To address these challenges, companies are focusing on cost-optimized security designs, modular solutions, and consumer-friendly verification platforms to expand global adoption of Anti-Counterfeit Cosmetic Packaging

How is the Anti-Counterfeit Cosmetic Packaging Market Segmented?

The market is segmented on the basis of technology, packaging format, material, and application.

- By Technology

On the basis of technology, the anti-counterfeit cosmetic packaging market is segmented into Authentication Packaging Technology and Track and Trace Packaging Technology. Authentication Packaging Technology dominated the market with an estimated 58.6% share in 2025, driven by widespread use of holograms, security inks, tamper-evident seals, QR codes, and digital watermarks to enable instant product verification by consumers and retailers. These solutions are cost-effective, easy to integrate into existing packaging lines, and widely adopted across mass and premium cosmetic brands.

The Track and Trace Packaging Technology segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by rising adoption of serialization, RFID, NFC, and blockchain-enabled systems. Increasing regulatory focus on supply chain transparency and growing e-commerce penetration are accelerating demand for real-time product tracking solutions.

- By Packaging Format

On the basis of packaging format, the market is segmented into Bottles, Jars, Tubes, Sachets, Pumps and Dispensers, and Others. Bottles dominated the market with a 34.2% share in 2025, as they are extensively used in skincare, hair care, and fragrance products and offer ample surface area for integrating security labels, holograms, and smart tags. Bottles are preferred for premium cosmetic products where brand protection and visual authentication are critical.

The Pumps and Dispensers segment is anticipated to register the fastest growth from 2026 to 2033, driven by increasing use in premium skincare and dermatological products. Rising demand for tamper-resistant, hygienic, and refill-controlled dispensing systems further supports adoption of advanced anti-counterfeit features in this segment.

- By Material

On the basis of material, the anti-counterfeit cosmetic packaging market is segmented into Glass, Paperboard, Metal, Plastic, Polyethylene (PE), Polypropylene (PP), Polyethylene Terephthalate (PET), and Others. Plastic, including PE, PP, and PET, dominated the market with a 46.9% share in 2025, owing to its lightweight nature, cost efficiency, design flexibility, and compatibility with advanced security features such as embedded tags and digital printing. Plastic packaging supports high-volume cosmetic production while maintaining effective brand protection.

The Glass segment is expected to grow at the fastest CAGR during the forecast period, driven by increasing demand for luxury, sustainable, and premium cosmetic packaging. Glass offers superior protection against tampering and enhances perceived product authenticity and brand value.

- By Application

On the basis of application, the market is segmented into Skincare, Hair Care, Makeup, Fragrance, and Nail Care. The Skincare segment dominated the market with a 41.7% share in 2025, supported by high product consumption, premium product launches, and strong consumer concern regarding product safety and authenticity. Anti-counterfeit solutions are widely used in serums, creams, and dermatological products to prevent imitation and ensure consumer trust.

The Makeup segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by rapid product innovation, high brand visibility, and increasing counterfeit incidents in color cosmetics. Expanding online sales and influencer-driven demand further accelerate the need for advanced anti-counterfeit cosmetic packaging solutions.

Which Region Holds the Largest Share of the Anti-Counterfeit Cosmetic Packaging Market?

- North America dominated the anti-counterfeit cosmetic packaging market with a 43.24% revenue share in 2025, driven by high consumption of premium cosmetics, strong brand protection regulations, and widespread adoption of advanced authentication and track-and-trace technologies across the U.S. and Canada. Rising concerns over counterfeit beauty products, coupled with strict regulatory oversight and strong consumer awareness, continue to fuel demand for secure cosmetic packaging solutions

- Leading companies in North America are actively deploying RFID, NFC, QR codes, tamper-evident seals, and digital authentication technologies to safeguard brand integrity and consumer safety. Continuous investments in smart packaging, digital printing, and serialization technologies strengthen the region’s market leadership

- Strong presence of global cosmetic brands, advanced packaging infrastructure, and sustained innovation in packaging materials and security features further reinforce North America’s dominance

U.S. Anti-Counterfeit Cosmetic Packaging Market Insight

The U.S. is the largest contributor in North America, supported by a robust cosmetics industry, high premium product penetration, and strict enforcement against counterfeit goods. Growing demand for secure packaging in skincare, makeup, and fragrance products, along with rapid adoption of smart labels and digital verification tools, continues to drive market growth.

Canada Anti-Counterfeit Cosmetic Packaging Market Insight

Canada contributes significantly to regional growth, driven by increasing demand for clean-label cosmetics, rising e-commerce sales, and growing awareness of product authenticity. Supportive regulatory frameworks and adoption of advanced packaging technologies strengthen market expansion.

Asia-Pacific Anti-Counterfeit Cosmetic Packaging Market

Asia-Pacific is projected to register the fastest CAGR of 9.21% from 2026 to 2033, driven by rapid growth in cosmetics consumption, expanding middle-class population, and increasing counterfeit incidents across China, India, Japan, South Korea, and Southeast Asia. Rising demand for secure, smart, and traceable packaging solutions accelerates adoption.

China Anti-Counterfeit Cosmetic Packaging Market Insight

China leads the Asia-Pacific market due to large-scale cosmetic production, strong domestic brands, and government initiatives to combat counterfeit goods. Increasing use of digital authentication and serialization technologies boosts market demand.

Japan Anti-Counterfeit Cosmetic Packaging Market Insight

Japan shows steady growth supported by premium cosmetic consumption, strong focus on quality assurance, and adoption of advanced packaging technologies to ensure product authenticity.

India Anti-Counterfeit Cosmetic Packaging Market Insight

India is emerging as a high-growth market, driven by rapid expansion of the cosmetics sector, rising online sales, and increasing awareness of counterfeit risks. Government initiatives and growing brand investments further support adoption.

Which are the Top Companies in Anti-Counterfeit Cosmetic Packaging Market?

The anti-counterfeit cosmetic packaging industry is primarily led by well-established companies, including:

- Avery Dennison Corporation (U.S.)

- CCL Industries (Canada)

- 3M (U.S.)

- DuPont (U.S.)

- SICPA HOLDING SA (Switzerland)

- Systech International (U.S.)

- ITL – Intelligent Label Solutions (U.K.)

- SML Group (Hong Kong)

- ACG (India)

- TruTag Technologies, Inc. (U.S.)

- Applied DNA Sciences (U.S.)

- MicroTag Temed Ltd. (Israel)

- Avient Corporation (U.S.)

- VINSAK (India)

- Engineered Printing Solutions (U.S.)

- Ampacet Corporation (U.S.)

- AlpVision (Switzerland)

- Arjo Solutions (France)

- Origin Pharma Packaging (U.K.)

- NeuroTags (U.K.)

What are the Recent Developments in Global Anti-Counterfeit Cosmetic Packaging Market?

- In April 2024, Avery Dennison announced the expansion of its AD Pure range, introducing a portfolio of inlays and tags that are entirely free from PET plastic and produced using innovative antenna manufacturing technology where antennas and chips are applied directly on paper, making them 100% plastic-free, a move that significantly strengthens the company’s sustainability-driven packaging and labeling strategy

- In January 2024, Avery Dennison launched the AD 2Metal Rock M781 RFID tag, designed to perform reliably in harsh environments and enable tagging of metal, liquid, and difficult non-metal surfaces, with a thin, flexible structure suitable for both curved and flat applications, reinforcing its leadership in high-performance RFID solutions

- In October 2023, Avery Dennison Corporation signed an agreement to acquire Silver Crystal Group, a well-established sports apparel customization company serving in-venue, direct-to-business, and e-commerce channels, enhancing Avery Dennison’s capabilities in apparel branding and digital customization services

- In May 2023, SATO Holdings Corporation announced that its subsidiary SATO International America, Inc., acquired Stafford Press, Inc., a Redmond-based specialist in inkjet color on-demand horticulture tags and labels, strengthening SATO’s position in the North American specialty labeling market

- In April 2023, Avery Dennison Corporation acquired LG Group, Inc., also known as Lion Brothers, a Maryland-based designer and manufacturer of apparel brand embellishments, expanding its footprint in premium garment decoration and branding solutions

- In April 2023, CCL Industries Inc., announced the acquisition of eAgile Inc. along with the intellectual property of Alert Systems ApS, broadening its portfolio of intelligent labeling and security-driven packaging technologies

- In January 2023, Avery Dennison Corporation announced the acquisition of Thermopatch, a leader in industrial laundry labeling, heat transfers, and textile emblems, supporting the company’s strategy to accelerate growth in external embellishment solutions

- In November 2022, SATO partnered with Loftware to launch the world’s first cloud-based RFID tag encoding and logging solution, marking a major advancement in connected labeling, traceability, and enterprise-level RFID management

- In May 2022, CCL Industries Inc., announced the acquisition of Floramedia Group B.V., a Westzaan-based company specializing in tag and label creation with operations across seven countries, strengthening CCL’s global horticulture and labeling presence

- In March 2022, Zebra Technologies Corporation announced the acquisition of Matrox Imaging, a developer of advanced machine vision components and systems, enhancing Zebra’s capabilities in automation, inspection, and intelligent data capture

- In February 2022, Avery Dennison Corporation announced the acquisition of TexTrace AG, a technology developer specializing in woven and knitted RFID products for garments, reinforcing its leadership in embedded RFID solutions for apparel and textiles

- In January 2022, Avery Dennison Corporation announced the acquisition of Rietveld (RTVPRINT), a European full-service provider of embellishment solutions and advanced printing methods for performance and team sports brands, further expanding its global apparel branding and application capabilities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Anti Counterfeit Cosmetic Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Anti Counterfeit Cosmetic Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Anti Counterfeit Cosmetic Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.