Global Anti Transpirant Market

Market Size in USD Billion

CAGR :

%

USD

14.87 Billion

USD

21.31 Billion

2025

2033

USD

14.87 Billion

USD

21.31 Billion

2025

2033

| 2026 –2033 | |

| USD 14.87 Billion | |

| USD 21.31 Billion | |

|

|

|

|

Anti-Transpirant Market Size

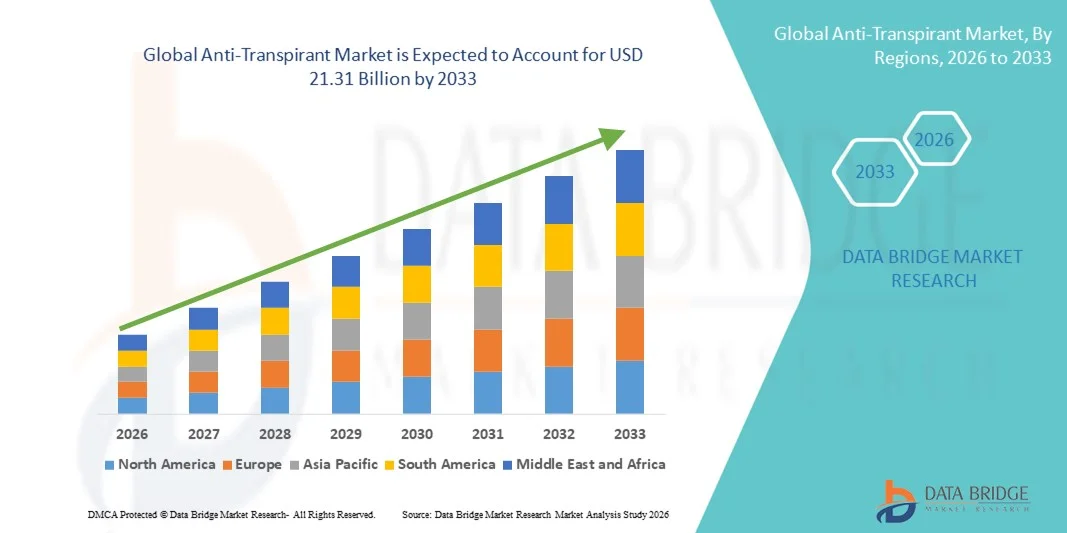

- The global anti-transpirant market size was valued at USD 14.87 billion in 2025 and is expected to reach USD 21.31 billion by 2033, at a CAGR of 4.6% during the forecast period

- The market growth is largely fueled by the increasing adoption of anti-transpirants in agriculture and horticulture, driven by the need to improve crop resilience, reduce water loss, and enhance yield quality under varying environmental conditions

- Furthermore, rising awareness of climate-resilient farming practices and sustainable water management is encouraging growers to incorporate anti-transpirants into crop protection routines. These converging factors are accelerating the adoption of anti-transpirants across staple crops, high-value horticulture, and ornamental plants, thereby significantly boosting the industry's growth

Anti-Transpirant Market Analysis

- Anti-transpirants, which reduce water loss and protect plants from abiotic stress such as heat, drought, and sunburn, are becoming essential components of modern agricultural management practices. Their use supports improved water-use efficiency and healthier crop development in both commercial farming and landscaping applications

- The escalating demand for anti-transpirants is primarily fueled by increasing water scarcity, the need for sustainable crop protection solutions, and the growing emphasis on environmentally friendly agricultural inputs. These factors are driving farmers and horticulturists to adopt anti-transpirants to maintain crop yield and quality while promoting resource-efficient farming practices

- North America dominated the anti-transpirant market with a share of 42.5% in 2025, due to the adoption of advanced agricultural practices and increasing awareness of water conservation techniques

- Asia-Pacific is expected to be the fastest growing region in the anti-transpirant market during the forecast period due to rising urbanization, increasing water scarcity, and adoption of modern agricultural techniques in countries such as China, Japan, and India

- Film-forming type segment dominated the market with a market share of 46.1% in 2025, due to its ability to create a protective barrier on plant surfaces, reducing water loss and improving drought resistance. Farmers and horticulturists often prioritize film-forming anti-transpirants for their immediate efficacy and compatibility with a wide range of crops and ornamental plants. The demand for this segment is further supported by its ease of application using conventional spraying equipment and the enhanced stress tolerance it provides under extreme weather conditions

Report Scope and Anti-Transpirant Market Segmentation

|

Attributes |

Anti-Transpirant Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Anti-Transpirant Market Trends

Rising Adoption of Sustainable and Climate-Resilient Crop Protection Solutions

- A key trend in the anti-transpirant market is the growing adoption of sustainable and climate-resilient crop protection solutions, driven by the increasing focus on minimizing crop stress and improving yield stability under changing climatic conditions. Farmers and agribusinesses are seeking solutions that reduce water loss and protect plants from heat, drought, and salinity stress

- For instance, companies such as BASF and Nufarm provide anti-transpirant formulations that enhance plant tolerance to environmental stress while supporting sustainable farming practices. These solutions help maintain crop quality and productivity under adverse weather conditions

- The rising emphasis on precision agriculture is encouraging the integration of anti-transpirants into broader crop management systems where sensor-based irrigation and plant monitoring optimize water use efficiency. This trend positions anti-transpirants as integral tools in climate-smart agriculture

- Anti-transpirants are increasingly utilized in horticulture and high-value crops such as fruits, vegetables, and ornamentals to improve shelf life, minimize transpiration, and ensure consistent quality during storage and transport. This application strengthens their role in enhancing post-harvest management

- Research and innovation in formulation technologies are supporting the development of bio-based and environmentally safe anti-transpirants that reduce chemical residues and improve farmer acceptance. This is expanding the scope of adoption across both conventional and organic farming

- The market is witnessing steady growth as governments and agricultural institutions promote water-efficient practices and climate-resilient farming, positioning anti-transpirants as essential solutions for sustainable crop production

Anti-Transpirant Market Dynamics

Driver

Increasing Need for Water-Use Efficiency and Crop Stress Management

- The growing need for water-use efficiency and effective crop stress management is driving demand for anti-transpirants, as they help reduce plant water loss and protect crops from heat, drought, and other environmental stresses. This is especially critical in regions facing water scarcity and erratic weather patterns

- For instance, companies such as Syngenta offer anti-transpirant products that support efficient water management and enhance plant resilience in commercial agriculture. These solutions enable farmers to maintain yield stability while conserving critical water resources

- The rising adoption of precision irrigation practices is complementing the use of anti-transpirants by optimizing the timing and amount of water applied to crops, improving overall farm resource efficiency. This synergy strengthens their importance in modern crop management

- Increasing awareness of climate change impacts and the economic losses associated with crop stress is encouraging large-scale growers to incorporate anti-transpirants into standard cultivation practices. These measures support long-term productivity and sustainability goals

- Government programs and agricultural extension services are promoting anti-transpirant adoption to improve crop survival rates, especially in drought-prone and arid regions. This driver is expected to continue influencing market expansion

Restraint/Challenge

Limited Awareness and Adoption Among Small-Scale Farmers

- The anti-transpirant market faces challenges due to limited awareness and adoption among small-scale farmers who often lack access to information, technical guidance, and affordable products. This constrains widespread use, particularly in developing regions

- For instance, in India, smallholder farmers in rural areas often do not utilize anti-transpirants due to lack of awareness of brands such as Bayer CropScience and their benefits for water conservation and crop protection. This limits market penetration and regional growth potential

- High initial costs and perceived complexity of application further discourage adoption among resource-constrained farmers. Many prefer traditional methods of crop protection and irrigation management

- Distribution gaps in rural and remote areas restrict access to anti-transpirant products, reducing the ability of farmers to implement them effectively across their fields. This challenge impacts overall market expansion

- The market continues to face obstacles in educating and engaging small-scale growers on the benefits, application methods, and long-term economic value of anti-transpirants. Addressing these issues is critical for achieving broader adoption and sustainable growth

Anti-Transpirant Market Scope

The market is segmented on the basis of product type and application.

- By Product Type

On the basis of product type, the anti-transpirant market is segmented into film-forming type, metabolic inhibitors type, and others. The film-forming type segment dominated the market with the largest market revenue share of 46.1% in 2025, driven by its ability to create a protective barrier on plant surfaces, reducing water loss and improving drought resistance. Farmers and horticulturists often prioritize film-forming anti-transpirants for their immediate efficacy and compatibility with a wide range of crops and ornamental plants. The demand for this segment is further supported by its ease of application using conventional spraying equipment and the enhanced stress tolerance it provides under extreme weather conditions.

The metabolic inhibitors type segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing adoption in high-value crops and commercial horticulture. Metabolic inhibitors work by regulating plant physiological processes to minimize transpiration, offering targeted water conservation without affecting plant growth. For instance, companies such as Tessenderlo Kerley have developed advanced formulations that are increasingly preferred in regions facing prolonged droughts. The segment’s growth is also supported by rising awareness of precision agriculture practices and sustainable water management solutions.

- By Application

On the basis of application, the anti-transpirant market is segmented into garden, turf and ornamental, crops, and others. The crops segment dominated the market with the largest market revenue share in 2025, driven by the need to improve water-use efficiency and protect yield quality under water-deficit conditions. Farmers rely on anti-transpirants for staple crops and horticultural produce to reduce transpiration stress, especially in arid and semi-arid regions. The widespread adoption is also supported by the compatibility of anti-transpirants with various irrigation practices and integrated crop management systems.

The turf and ornamental segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by rising investments in landscaping, golf courses, and urban greenery projects. Turf managers and landscaping companies increasingly use anti-transpirants to maintain aesthetics and plant health during dry spells or seasonal water restrictions. For instance, Syngenta has introduced formulations specifically tailored for ornamental plants that enhance foliage resilience without affecting growth. The growth is further driven by the increasing demand for low-maintenance, water-efficient landscapes in urban and commercial spaces.

Anti-Transpirant Market Regional Analysis

- North America dominated the anti-transpirant market with the largest revenue share of 42.5% in 2025, driven by the adoption of advanced agricultural practices and increasing awareness of water conservation techniques

- Growers in the region highly value the efficacy of anti-transpirants in improving crop resilience, reducing water loss, and enhancing yield quality

- This widespread adoption is further supported by well-developed agricultural infrastructure, government incentives for sustainable farming, and the growing demand for high-value horticultural and ornamental plants, establishing anti-transpirants as a preferred solution for water-stressed regions

U.S. Anti-Transpirant Market Insight

The U.S. anti-transpirant market captured the largest revenue share in North America in 2025, fueled by the integration of modern irrigation systems and precision agriculture practices. Farmers increasingly prioritize water-use efficiency and crop protection against heat and drought stress. Rising investments in high-value crops and the adoption of eco-friendly formulations further drive the market’s growth. Moreover, the increasing awareness of climate change impacts on agriculture and government initiatives supporting sustainable water management contribute significantly to market expansion.

Europe Anti-Transpirant Market Insight

The Europe anti-transpirant market is projected to expand at a steady CAGR during the forecast period, primarily driven by stringent regulations on water usage and the adoption of sustainable farming practices. The increase in greenhouse cultivation, urban landscaping, and ornamental gardening is fostering the use of anti-transpirants. European growers are also attracted to the ability of these products to enhance plant resilience under variable weather conditions. The market is witnessing growth across horticulture, turf management, and high-value crop applications, with anti-transpirants being increasingly integrated into both conventional and organic farming systems.

U.K. Anti-Transpirant Market Insight

The U.K. anti-transpirant market is anticipated to grow at a notable CAGR during the forecast period, driven by the rising trend of ornamental gardening and commercial landscaping. In addition, the need to conserve water and protect crops from seasonal stressors encourages widespread adoption. The U.K.’s focus on sustainable agriculture and urban greenery projects, combined with the availability of advanced formulations, is expected to continue stimulating market growth.

Germany Anti-Transpirant Market Insight

The Germany anti-transpirant market is expected to expand at a significant CAGR during the forecast period, fueled by increasing awareness of climate-resilient agriculture and the use of protective solutions for high-value crops. Germany’s advanced horticulture infrastructure, coupled with government initiatives promoting sustainable water use, supports adoption. The integration of anti-transpirants into crop management practices and landscaping projects is also becoming prevalent, with a preference for environmentally friendly solutions aligning with local agricultural policies.

Asia-Pacific Anti-Transpirant Market Insight

The Asia-Pacific anti-transpirant market is poised to grow at the fastest CAGR during 2026–2033, driven by rising urbanization, increasing water scarcity, and adoption of modern agricultural techniques in countries such as China, Japan, and India. The region’s growing focus on sustainable horticulture, government initiatives for water management, and awareness of climate-resilient farming are driving adoption. Moreover, APAC’s emergence as a key production hub for agricultural inputs ensures wider availability and affordability of anti-transpirants, expanding their use across crops, turf, and ornamental applications.

Japan Anti-Transpirant Market Insight

The Japan anti-transpirant market is gaining momentum due to the country’s advanced agricultural practices, high-value crop production, and focus on water conservation. Japanese growers prioritize anti-transpirants for improving plant stress tolerance and protecting yields in both horticulture and ornamental applications. Integration with precision irrigation and greenhouse cultivation techniques is fueling demand. The aging farming population is also likely to increase preference for easy-to-apply, efficient anti-transpirant solutions across residential and commercial horticulture sectors.

China Anti-Transpirant Market Insight

The China anti-transpirant market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to the country’s rapid urbanization, large-scale horticulture, and increasing awareness of water-use efficiency. Anti-transpirants are widely adopted across staple crops, high-value horticulture, and urban landscaping projects. The push towards smart and sustainable agriculture, coupled with government support and the availability of cost-effective formulations from domestic manufacturers, are key factors driving market growth in China.

Anti-Transpirant Market Share

The anti-transpirant industry is primarily led by well-established companies, including:

- Miller Chemical & Fertilizer, LLC (U.S.)

- AgroBest Australia (Australia)

- Yates (Australia)

- Wilt-Pruf Products Inc. (U.S.)

- ADAMA India Private Limited (India)

- PBI/Gordon Corporation (U.S.)

- Coastal AgroBusiness (U.S.)

- Bonide Products LLC (U.S.)

- Wilbur-Ellis Holdings, Inc. (U.S.)

- Summit Agro Holdings Limited (Japan)

- Precision Laboratories, LLC (U.S.)

- Gallivan Corporation (U.S.)

- Osho Chemicals (India)

- Aquatrols (U.S.)

- Beijing Shenlanlin (China)

- Shanghai Zhilv (China)

- Zhengzhou Love Parker Chemical (China)

Latest Developments in Global Anti-Transpirant Market

- In January 2026, Dove unveiled its first refillable anti‑perspirant collection, marking its entry into the fast-growing refill deodorants segment. This launch addresses the rising consumer demand for sustainable and eco-friendly personal care products while reducing plastic waste. The refillable system encourages repeat usage of the same container, aligning with circular economy principles. By introducing this collection, Dove strengthens its market positioning among environmentally conscious consumers and taps into the increasing preference for premium, zero-waste personal care solutions

- In January 2026, Shield, one of South Africa’s top-selling deodorant and antiperspirant brands, launched Shield MotionSense, the world’s first antiperspirant featuring microcapsules activated by movement. This technology ensures enhanced sweat protection during active moments, delivering personalized performance throughout the day. The innovation reflects a broader market trend toward high-performance, technologically advanced personal care products that prioritize user convenience and efficacy. It also allows Shield to differentiate itself in a competitive market by offering scientifically backed, movement-responsive protection

- In December 2025, Coromandel International introduced Guard‑5, a non-film forming reflective anti-transpirant designed to reduce water loss in crops by improving leaf reflectance and mitigating stress from heat and drought. This product caters to the growing adoption of precision agriculture practices and climate-resilient farming techniques. By enabling farmers to optimize water usage and maintain crop yield under adverse environmental conditions, Guard‑5 reinforces the role of anti-transpirants in sustainable agriculture and highlights the market’s focus on science-based, crop-specific solutions

- In September 2025, the anti-transpirant market saw a significant shift toward biodegradable and eco-friendly formulations. Growers increasingly adopted these products to align with water-use efficiency goals, regulatory compliance, and sustainable farming practices. These solutions reduce environmental impact without compromising crop performance, reflecting the market’s broader emphasis on sustainable and climate-conscious agricultural inputs. This trend strengthens the adoption of anti-transpirants among environmentally conscious farmers and helps companies differentiate their offerings in a growing green-agriculture segment

- In February 2021, Secret and Old Spice launched innovative refillable antiperspirant cases and expanded their aluminum-free deodorant range in recyclable paper tube packaging made of 90% recycled paperboard. These initiatives targeted plastic waste reduction and appealed to consumers seeking eco-conscious personal care alternatives. By combining sustainability with product efficacy, both brands reinforced their commitment to responsible manufacturing practices and created a competitive advantage in a market increasingly driven by environmental awareness and consumer preference for recyclable, low-impact packaging

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.