Global Antibiotic Resistance Market

Market Size in USD Billion

CAGR :

%

USD

9.08 Billion

USD

14.15 Billion

2024

2032

USD

9.08 Billion

USD

14.15 Billion

2024

2032

| 2025 –2032 | |

| USD 9.08 Billion | |

| USD 14.15 Billion | |

|

|

|

|

Antibiotic Resistance Market Size

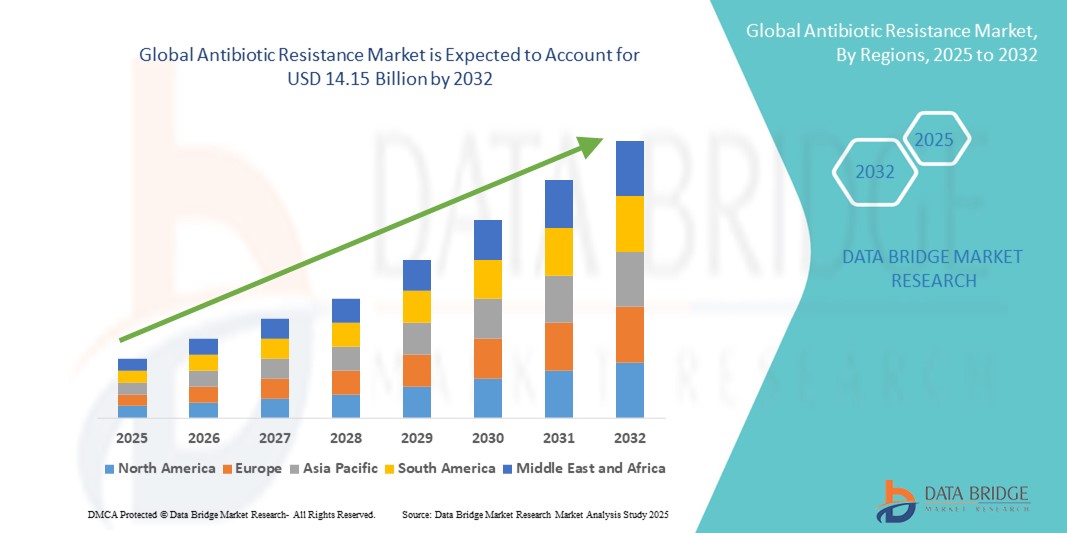

- The global antibiotic resistance market size was valued at USD 9.08 billion in 2024 and is expected to reach USD 14.15 billion by 2032, at a CAGR of5.70% during the forecast period

- The market growth is largely fueled by the increasing prevalence of antibiotic-resistant infections, rising global awareness of antimicrobial resistance, and significant investments in research and development of novel therapeutics and diagnostic tools

- Furthermore, growing demand for effective treatment options, improved infection management, and rapid diagnostic solutions is driving the adoption of innovative antibiotic resistance interventions. These converging factors are accelerating the development and deployment of advanced therapies and diagnostic platforms, thereby significantly boosting the growth of the Antibiotic Resistance market

Antibiotic Resistance Market Analysis

- The global antibiotic resistance market is witnessing significant growth due to the rising prevalence of drug-resistant infections and the increasing focus on antimicrobial stewardship across healthcare systems. The market is driven by the urgent need for rapid diagnostic tools, novel antibiotics, and alternative therapeutic approaches to combat multidrug-resistant pathogens in both hospital and community settings

- The rising prevalence of antibiotic-resistant infections and the growing awareness of antimicrobial stewardship are driving the demand for innovative solutions in the global Antibiotic Resistance market. The need for rapid diagnostics, novel therapeutics, and effective infection control strategies is increasingly recognized across healthcare settings worldwide

- North America dominated the antibiotic resistance market with the largest revenue share of 38.00% in 2024, supported by well-established healthcare infrastructure, advanced research initiatives, and the presence of leading pharmaceutical and biotech companies focusing on antibiotic development and resistance mitigation. The U.S. contributes significantly to market growth due to high adoption of cutting-edge diagnostic tools, increased surveillance programs, and regulatory support for antimicrobial resistance strategies

- Asia-Pacific is expected to be the fastest-growing region in the antibiotic resistance market during the forecast period, with a CAGR of 25%, driven by rising incidences of resistant infections, expanding healthcare access, increasing government initiatives to curb antimicrobial resistance, and growing investments in research and development in countries such as China, India, and Japan

- Oxazolidinones dominated the antibiotic resistance market with a revenue share of 41.6% in 2024, driven by their well-established efficacy against Gram-positive resistant bacteria, including MRSA and VRE. These drugs have become a cornerstone in hospital protocols for managing severe infections due to their reliable therapeutic outcomes and broad acceptance among clinicians

Report Scope and Antibiotic Resistance Market Segmentation

|

Attributes |

Antibiotic Resistance Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Antibiotic Resistance Market Trends

Advancements in Rapid Diagnostics and AI-Enabled Solutions

- A significant and accelerating trend in the global antibiotic resistance market is the integration of artificial intelligence (AI) and machine learning technologies into diagnostic and surveillance tools. These advanced solutions enable faster detection of resistant pathogens, predictive modeling of resistance trends, and optimization of antibiotic prescribing practices

- For instance, AI-powered platforms such as IBM Watson Health and BioMind are being increasingly deployed in hospitals and laboratories to analyze complex microbiological data, identify resistance patterns, and provide actionable insights for clinicians, improving patient outcomes and reducing the misuse of antibiotics

- AI integration also facilitates the development of rapid point-of-care diagnostics that can accurately distinguish between bacterial and viral infections, thereby minimizing unnecessary antibiotic prescriptions. These solutions help healthcare providers make informed decisions quickly, reducing the overall burden of antibiotic resistance

- The use of AI-driven surveillance systems allows healthcare institutions and public health agencies to monitor the spread of resistant infections in real time, detect emerging resistance hotspots, and implement targeted infection control strategies

- This trend toward intelligent, data-driven, and automated resistance management is reshaping expectations for antibiotic stewardship programs. Consequently, companies such as Thermo Fisher Scientific, bioMérieux, and Cepheid are advancing AI-enabled diagnostic platforms that provide rapid, reliable, and cost-effective solutions for combating antibiotic resistance

- The demand for AI-enhanced diagnostic tools and predictive analytics is growing rapidly across hospitals, clinics, and research laboratories, as stakeholders increasingly prioritize accurate detection, timely intervention, and effective antibiotic management

Antibiotic Resistance Market Dynamics

Driver

Growing Need Due to Rising Antibiotic Resistance and Infection Prevalence

- The increasing prevalence of antibiotic-resistant infections across healthcare settings and the rising incidence of multi-drug resistant (MDR) pathogens are significant drivers for the heightened demand for innovative antibiotic resistance solutions

- For instance, in 2024, several key players, including Pfizer, Merck, and Novartis, announced advancements in next-generation antibiotics and rapid diagnostic platforms to combat resistant bacterial strains. Such strategic developments are expected to drive the Antibiotic Resistance market growth during the forecast period

- As healthcare providers and governments become increasingly aware of the public health threat posed by antimicrobial resistance (AMR), there is a growing emphasis on early detection, effective treatment protocols, and stewardship programs, creating strong market demand for novel therapeutics and diagnostic solutions

- Furthermore, the expansion of healthcare infrastructure, the establishment of specialized infectious disease centers, and the integration of innovative treatment regimens are supporting the adoption of advanced antibiotic resistance interventions

- The rising focus on patient outcomes, hospital-acquired infection management, and the prevention of treatment failures are key factors propelling the adoption of new antibiotics, combination therapies, and rapid diagnostic technologies in both developed and emerging markets

Restraint/Challenge

Concerns Regarding High Costs, Regulatory Hurdles, and Limited Awareness

- The high cost associated with developing, producing, and commercializing novel antibiotics and diagnostic tools poses a significant challenge to broader market penetration. Developing multi-drug resistant therapies requires substantial R&D investment, extended clinical trials, and complex regulatory approvals, which can delay market entry

- For instance, stringent regulatory frameworks in regions such as North America and Europe necessitate comprehensive efficacy and safety data, which can increase time-to-market and cost burdens for new antibiotic resistance solutions

- Limited awareness among healthcare providers and patients regarding new treatment options and diagnostic technologies can hinder adoption, especially in regions with less-developed healthcare infrastructure

- Addressing these challenges through government incentives, public-private partnerships, improved reimbursement policies, and educational initiatives is critical for market expansion.

- In addition, while prices for certain rapid diagnostic solutions and next-generation antibiotics are gradually becoming more accessible, affordability remains a barrier for many hospitals and healthcare facilities in developing countries. Overcoming these financial and regulatory constraints will be vital for sustained growth of the Antibiotic Resistance market

Antibiotic Resistance Market Scope

The market is segmented on the basis of disease type, pathogen type, drug class, and end users.

- By Disease Type

On the basis of disease type, the antibiotic resistance market is segmented into urinary tract infections (UTIs), intra-abdominal infections, bloodstream infections, Clostridium difficile infections, and others. The urinary tract infection segment dominated the largest market revenue share of 38.5% in 2024, driven by the widespread global prevalence of UTIs, particularly among women, elderly patients, and immunocompromised individuals. The growing emergence of multidrug-resistant strains in both community and hospital environments has intensified the need for novel therapeutic solutions and advanced diagnostic technologies to manage resistant infections effectively. In addition, increasing patient awareness, routine screening, and preventative healthcare measures are further fueling the demand for targeted interventions in UTIs.

Clostridium difficile infections are expected to witness the fastest CAGR of 22.1% from 2025 to 2032, supported by the rising incidence of recurrent and severe infections, heightened awareness of infection control practices in healthcare facilities, and the implementation of specialized treatment protocols aimed at reducing hospital-acquired infection risks. The segment growth is also bolstered by ongoing research into microbiome-based therapies and targeted antibiotics to combat C. difficile effectively.

- By Pathogen Type

On the basis of pathogen type, the market is segmented into Acinetobacter baumannii, Pseudomonas aeruginosa, Staphylococcus aureus, Streptococcus pneumoniae, and others. Staphylococcus aureus held the largest market revenue share of 35.8% in 2024, attributable to its high prevalence in both hospital and community settings and its notorious resistance to multiple conventional antibiotics, including methicillin and vancomycin. The persistent threat of MRSA (methicillin-resistant Staphylococcus aureus) infections across various clinical environments continues to drive the development and adoption of advanced therapeutic and diagnostic strategies.

Acinetobacter baumannii is anticipated to register the fastest CAGR of 23.4% from 2025 to 2032, fueled by the rising number of hospital-acquired infections, particularly in intensive care units, ventilator-associated complications, and outbreaks of multidrug-resistant strains. The critical need for effective treatment options against this pathogen has spurred research into novel antibiotic classes, combination therapies, and hospital infection control measures to curb its rapid proliferation.

- By Drug Class

On the basis of drug class, the market is segmented into oxazolidinones, lipoglycopeptides, tetracyclines, and others. Oxazolidinones maintained the largest market revenue share of 41.6% in 2024, driven by their well-established efficacy against Gram-positive resistant bacteria, including MRSA and VRE. These drugs have become a cornerstone in hospital protocols for managing severe infections due to their reliable therapeutic outcomes and broad acceptance among clinicians. In addition, the growing prevalence of hospital-acquired infections has further reinforced the widespread adoption of oxazolidinones.

Lipoglycopeptides are projected to witness the fastest CAGR of 24.0% from 2025 to 2032, owing to advancements in next-generation formulations that enhance potency and reduce adverse effects. Their increasing utilization in severe and multidrug-resistant infections—where traditional antibiotics fail—along with regulatory approvals for novel compounds, is expected to drive significant market expansion during the forecast period.

- By End Users

On the basis of end users, the market is segmented into hospitals, homecare, specialty clinics, and others. Hospitals accounted for the largest market revenue share of 48.2% in 2024, supported by the high patient load of complex infections, the rising incidence of multidrug-resistant pathogens, and the presence of advanced diagnostic and treatment facilities capable of managing severe cases. The adoption of antibiotic stewardship programs and infection control protocols in hospitals also contributes to their dominant share.

Specialty clinics are expected to witness the fastest CAGR of 21.7% from 2025 to 2032, driven by the increasing prevalence of outpatient care models, rising awareness about appropriate antibiotic use, and the implementation of targeted therapeutic regimens. These clinics are increasingly focusing on individualized patient care, offering specialized treatments for resistant infections that require close monitoring and expert intervention, thereby boosting market growth.

Antibiotic Resistance Market Regional Analysis

- North America dominated the antibiotic resistance market with the largest revenue share of 38.00% in 2024, supported by well-established healthcare infrastructure, advanced research initiatives, and the presence of leading pharmaceutical and biotech companies focusing on antibiotic development and resistance mitigation. The region’s emphasis on early diagnosis, infection control programs, and adoption of novel therapeutics has further strengthened market growth

- Strong government and regulatory support, including initiatives by the CDC and FDA to monitor and control antimicrobial resistance, is accelerating the adoption of advanced diagnostic tools and novel therapies

- Widespread presence of state-of-the-art research centers, clinical trial networks, and biotechnology clusters in the U.S. and Canada is fostering rapid development and commercialization of new antibiotics and combination therapies

U.S. Antibiotic Resistance Market Insight

The U.S. antibiotic resistance market captured the largest revenue share within North America, driven by high adoption of cutting-edge diagnostic tools, increased surveillance programs, and regulatory support for antimicrobial resistance strategies. Rapid uptake of next-generation antibiotics, ongoing clinical trials, and investment in personalized medicine are fueling the market. In addition, growing awareness among healthcare professionals and patients regarding antibiotic stewardship is enhancing the demand for effective resistance management solutions.

Europe Antibiotic Resistance Market Insight

The Europe antibiotic resistance market is projected to expand at a substantial CAGR during the forecast period, fueled by increasing healthcare investment, rising prevalence of antibiotic-resistant infections, and the growing availability of innovative therapeutics. Countries such as Germany, France, and the U.K. are witnessing strong adoption of advanced diagnostics, rapid testing solutions, and targeted treatment options, supported by well-established healthcare infrastructure, proactive government initiatives, and active clinical research programs. Enhanced hospital infection control measures and the integration of antimicrobial stewardship programs are further driving the demand for effective resistance management solutions.

U.K. Antibiotic Resistance Market Insight

The U.K. antibiotic resistance market is expected to grow at a noteworthy CAGR, driven by increasing awareness of antimicrobial resistance, the adoption of advanced treatment protocols, and government-backed healthcare initiatives. Substantial investment in clinical research, hospital infrastructure, and specialized infectious disease programs ensures the steady growth of novel antibiotic adoption and resistance management solutions. In addition, public health campaigns and collaborative efforts between the NHS, private healthcare providers, and research institutions are contributing to the development and uptake of innovative therapeutic strategies.

Germany Antibiotic Resistance Market Insight

The Germany antibiotic resistance market is projected to expand at a considerable CAGR, supported by advanced healthcare systems, rising patient awareness, and government programs promoting the development of innovative antibiotics. The country’s emphasis on infection control, research-driven healthcare policies, and technological innovation is enhancing the uptake of antimicrobial resistance solutions across hospitals, specialized care centers, and research institutions. Germany’s strong pharmaceutical and biotech ecosystem, combined with robust regulatory support, is also facilitating the introduction of new diagnostics and therapies to tackle resistant pathogens effectively.

Asia-Pacific Antibiotic Resistance Market Insight

The Asia-Pacific antibiotic resistance market is expected to be the fastest-growing region, with a CAGR of 25% during the forecast period of 2025 to 2032. Growth is driven by the rising incidence of resistant infections, expanding healthcare access, increasing government initiatives to curb antimicrobial resistance, and growing investments in research and development in countries such as China, India, and Japan. Rapid improvements in diagnostic infrastructure, expansion of healthcare facilities, and enhanced awareness among healthcare providers and patients are further supporting regional market growth. In addition, increased funding for clinical trials and local manufacturing capabilities are enabling broader availability of innovative therapeutics.

Japan Antibiotic Resistance Market Insight

The Japan antibiotic resistance market is gaining momentum due to advanced healthcare systems, strong emphasis on precision medicine, and increasing patient and clinician awareness of antimicrobial resistance. The country’s aging population, rising demand for targeted treatments, and the presence of well-established research institutions and active clinical trials are boosting adoption of novel antibiotics and resistance management solutions. Furthermore, government initiatives promoting antimicrobial stewardship and investment in high-tech diagnostic technologies are supporting sustained market growth.

China Antibiotic Resistance Market Insight

The China antibiotic resistance market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, increasing healthcare expenditure, and high adoption of innovative therapeutics. Supportive government policies targeting antimicrobial resistance, expansion of healthcare infrastructure, and growing domestic pharmaceutical manufacturing capabilities are key factors propelling market growth. In addition, heightened awareness among healthcare providers and patients, along with initiatives to enhance early diagnosis and treatment of resistant infections, is contributing to the sustained expansion of the market in China.

Antibiotic Resistance Market Share

The Antibiotic Resistance industry is primarily led by well-established companies, including:

- Achaogen Inc (U.S.)

- Nabriva Therapeutics plc (Ireland)

- BioVersys AG (Switzerland)

- Destiny Pharma plc (U.K.)

- Armata Pharmaceuticals, Inc. (U.S.)

- West Way Health (Ireland)

- The Medicines Company (U.S.)

- Merck & Co., Inc. (Germany)

- Pfizer Inc. (U.S.)

- CARB-X (U.S.)

- Melinta Therapeutics LLC (U.S.)

- Novartis AG (Switzerland)

- GSK plc. (U.K.)

- F. Hoffmann-La Roche Ltd (Switzerland)

Latest Developments in Global Antibiotic Resistance Market

- In February 2025, AbbVie announced that the U.S. Food and Drug Administration (FDA) approved EMBLAVEO (aztreonam and avibactam), a novel antibiotic combination for the treatment of adults with complicated intra-abdominal infections (cIAI) caused by Gram-negative bacteria. This approval marks the first and only monobactam/β-lactamase inhibitor combination therapy authorized by the FDA for such infections, addressing a critical need in the fight against antimicrobial resistance

- In July 2024, the Centers for Disease Control and Prevention (CDC) released updated data on antimicrobial resistance threats in the United States, covering the years 2021 and 2022. The report highlighted the continued rise in infections caused by resistant pathogens, underscoring the urgent need for enhanced surveillance and intervention strategies to combat antibiotic resistance

- In June 2024, the Coalition for Epidemic Preparedness Innovations (CEPI) and the World Health Organization (WHO) launched a global initiative to accelerate the development of new antibiotics targeting multidrug-resistant bacteria. The initiative aims to support the discovery and clinical development of novel antibiotics, with a focus on addressing critical gaps in the current antimicrobial pipeline

- In March 2023, the U.S. Congress passed the PASTEUR Act, a landmark legislation designed to incentivize the development of new antibiotics. The act establishes a subscription-style payment model for antibiotics, ensuring that pharmaceutical companies receive consistent funding regardless of the volume of drug use, thereby encouraging innovation in antibiotic development

- In May 2022, the European Commission announced a EUR 100 million funding program to support research and development in the field of antimicrobial resistance. The program aims to foster innovation in the development of new antibiotics and alternative therapies, as well as to enhance diagnostic tools and surveillance systems to combat the growing threat of antibiotic resistance

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL ANTIBIOTIC RESISTANCE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL ANTIBIOTIC RESISTANCE MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 EPIDEMIOLOGY BASED MODEL

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL ANTIBIOTIC RESISTANCE MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S 5 FORCES MODEL

6 EPIDEMIOLOGY

7 INDUSTRY INSIGHTS

8 THE EVOLVING RESPONSE TO ANTIBIOTIC RESISTANCE IN HOSPITALS

9 REGULATORY SCENARIO

10 PIPELINE ANALYSIS

10.1 PHASE III CANDIDATE

10.2 PHASE II CANDIDATE

10.3 PHASE I CANDIDATE

10.4 OTHERS

11 GLOBAL ANTIBIOTIC RESISTANCE MARKET, BY TYPE, 2022-2031, (USD MILLION)

11.1 OVERVIEW

11.2 METHICILLIN-RESISTANT STAPHYLOCOCCUS AUREUS

11.3 VANCOMYCIN-RESISTANT ENTEROCOCCI

11.4 DRUG-RESISTANT STREPTOCOCCUS PNEUMONIAE

11.5 DRUG-RESISTANT MYCOBACTERIUM TUBERCULOSIS

11.6 CARBAPENEM-RESISTANT ENTEROBACTERIACEAE (CRE)

11.7 MDR PSEUDOMONAS AERUGINOSA

11.8 MDR ACINETOBACTER

11.9 ESBL-PRODUCING ENTEROBACTERIACEAE

11.1 DRUG-RESISTANT NEISSERIA GONORRHOEAE

11.11 OTHERS

12 GLOBAL ANTIBIOTIC RESISTANCE MARKET, BY RESISTANCE TYPE, 2022-2031, (USD MILLION)

12.1 OVERVIEW

12.2 NATURAL RESISTANCE

12.2.1 INTRINSIC

12.2.2 INDUCED

12.3 ACQUIRED RESISTANCE

13 GLOBAL ANTIBIOTIC RESISTANCE MARKET, BY DRUGS, 2022-2031, (USD MILLION)

13.1 OVERVIEW

13.2 PRETOMANID

13.3 RECARBRIO

13.4 OMADACYCLINE

13.5 ARIKAYCE

13.6 ERAVACYCLIN

13.7 OZENOXACIN

13.8 DELAFLOXACIN

13.9 DAPTOMYCIN

13.1 DALBAVANCIN

13.11 OTHERS

14 GLOBAL ANTIBIOTIC RESISTANCE MARKET, BY RESISTANCE MECHANISMS, 2022-2031, (USD MILLION)

14.1 OVERVIEW

14.2 LIMITING UPTAKE OF A DRUG

14.3 MODIFYING A DRUG TARGET

14.4 INACTIVATING A DRUG

14.5 ACTIVE DRUG EFFLUX

15 GLOBAL ANTIBIOTIC RESISTANCE MARKET, BY ROUTE OF ADMINISTRATION, 2022-2031, (USD MILLION)

15.1 OVERVIEW

15.2 ORAL

15.3 PARENTERAL

15.4 TOPICAL

15.5 OTHERS

16 GLOBAL ANTIBIOTIC RESISTANCE MARKET, BY END USER, 2022-2031, (USD MILLION)

16.1 OVERVIEW

16.2 HOSPITALS

16.2.1 HOSPITALS, BY DRUGS

16.2.1.1. PRETOMANID

16.2.1.2. RECARBRIO

16.2.1.3. OMADACYCLINE

16.2.1.4. ARIKAYCE

16.2.1.5. ERAVACYCLIN

16.2.1.6. OZENOXACIN

16.2.1.7. DELAFLOXACIN

16.2.1.8. DAPTOMYCIN

16.2.1.9. DALBAVANCIN

16.2.1.10. OTHERS

16.3 SPECIALTY CLINICS

16.3.1 HOSPITALS, BY DRUGS

16.3.1.1. PRETOMANID

16.3.1.2. RECARBRIO

16.3.1.3. OMADACYCLINE

16.3.1.4. ARIKAYCE

16.3.1.5. ERAVACYCLIN

16.3.1.6. OZENOXACIN

16.3.1.7. DELAFLOXACIN

16.3.1.8. DAPTOMYCIN

16.3.1.9. DALBAVANCIN

16.3.1.10. OTHERS

16.4 HOME HEALTHCARE

16.4.1 HOSPITALS, BY DRUGS

16.4.1.1. PRETOMANID

16.4.1.2. RECARBRIO

16.4.1.3. OMADACYCLINE

16.4.1.4. ARIKAYCE

16.4.1.5. ERAVACYCLIN

16.4.1.6. OZENOXACIN

16.4.1.7. DELAFLOXACIN

16.4.1.8. DAPTOMYCIN

16.4.1.9. DALBAVANCIN

16.4.1.10. OTHERS

16.5 OTHERS

17 GLOBAL ANTIBIOTIC RESISTANCE MARKET, BY DISTRIBUTION CHANNEL, 2022-2031, (USD MILLION)

17.1 OVERVIEW

17.2 DIRECT TENDER

17.3 RETAIL SALES

17.3.1 ONLINE STORES

17.3.2 PHARMACIES

17.3.3 OTHERS

17.4 OTHERS

18 GLOBAL ANTIBIOTIC RESISTANCE MARKET, COMPANY LANDSCAPE, 2022-2031, (USD MILLION)

18.1 COMPANY SHARE ANALYSIS: GLOBAL

18.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

18.3 COMPANY SHARE ANALYSIS: EUROPE

18.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

18.5 MERGERS & ACQUISITIONS

18.6 NEW PRODUCT DEVELOPMENT & APPROVALS

18.7 EXPANSIONS

18.8 REGULATORY CHANGES

18.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

19 GLOBAL ANTIBIOTIC RESISTANCE MARKET, BY GEOGRAPHY

GLOBAL ANTIBIOTIC RESISTANCE MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

19.1.1 NORTH AMERICA

19.1.1.1. U.S.

19.1.1.2. CANADA

19.1.1.3. MEXICO

19.1.2 EUROPE

19.1.2.1. GERMANY

19.1.2.2. FRANCE

19.1.2.3. U.K.

19.1.2.4. HUNGARY

19.1.2.5. LITHUANIA

19.1.2.6. AUSTRIA

19.1.2.7. IRELAND

19.1.2.8. NORWAY

19.1.2.9. POLAND

19.1.2.10. ITALY

19.1.2.11. SPAIN

19.1.2.12. RUSSIA

19.1.2.13. TURKEY

19.1.2.14. BELGIUM

19.1.2.15. NETHERLANDS

19.1.2.16. SWITZERLAND

19.1.2.17. REST OF EUROPE

19.1.3 ASIA-PACIFIC

19.1.3.1. JAPAN

19.1.3.2. CHINA

19.1.3.3. SOUTH KOREA

19.1.3.4. INDIA

19.1.3.5. AUSTRALIA

19.1.3.6. SINGAPORE

19.1.3.7. THAILAND

19.1.3.8. MALAYSIA

19.1.3.9. INDONESIA

19.1.3.10. PHILIPPINES

19.1.3.11. VIETNAM

19.1.3.12. REST OF ASIA-PACIFIC

19.1.4 SOUTH AMERICA

19.1.4.1. BRAZIL

19.1.4.2. ARGENTINA

19.1.4.3. PERU

19.1.4.4. REST OF SOUTH AMERICA

19.1.5 MIDDLE EAST AND AFRICA

19.1.5.1. SOUTH AFRICA

19.1.5.2. SAUDI ARABIA

19.1.5.3. UAE

19.1.5.4. EGYPT

19.1.5.5. KUWAIT

19.1.5.6. ISRAEL

19.1.5.7. REST OF MIDDLE EAST AND AFRICA

19.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

20 GLOBAL ANTIBIOTIC RESISTANCE MARKET, SWOT AND DBMR ANALYSIS

21 GLOBAL ANTIBIOTIC RESISTANCE MARKET, COMPANY PROFILE

21.1 PARATEK PHARMACEUTICALS, INC.( NOVO HOLDINGS A/S)

21.1.1 COMPANY OVERVIEW

21.1.2 REVENUE ANALYSIS

21.1.3 GEOGRAPHIC PRESENCE

21.1.4 PRODUCT PORTFOLIO

21.1.5 RECENT DEVELOPMENTS

21.2 MERCK SHARP & DOHME CORP., A SUBSIDIARY OF MERCK & CO., INC.

21.2.1 COMPANY OVERVIEW

21.2.2 REVENUE ANALYSIS

21.2.3 GEOGRAPHIC PRESENCE

21.2.4 PRODUCT PORTFOLIO

21.2.5 RECENT DEVELOPMENTS

21.3 INSMED INCORPORATED

21.3.1 COMPANY OVERVIEW

21.3.2 REVENUE ANALYSIS

21.3.3 GEOGRAPHIC PRESENCE

21.3.4 PRODUCT PORTFOLIO

21.3.5 RECENT DEVELOPMENTS

21.4 TETRAPHASE PHARMACEUTICALS, INC.

21.4.1 COMPANY OVERVIEW

21.4.2 REVENUE ANALYSIS

21.4.3 GEOGRAPHIC PRESENCE

21.4.4 PRODUCT PORTFOLIO

21.4.5 RECENT DEVELOPMENTS

21.5 MELINTA THERAPEUTICS, LLC

21.5.1 COMPANY OVERVIEW

21.5.2 REVENUE ANALYSIS

21.5.3 GEOGRAPHIC PRESENCE

21.5.4 PRODUCT PORTFOLIO

21.5.5 RECENT DEVELOPMENTS

21.6 THE TB ALLIANCE

21.6.1 COMPANY OVERVIEW

21.6.2 REVENUE ANALYSIS

21.6.3 GEOGRAPHIC PRESENCE

21.6.4 PRODUCT PORTFOLIO

21.6.5 RECENT DEVELOPMENTS

21.7 ABBVIE

21.7.1 COMPANY OVERVIEW

21.7.2 REVENUE ANALYSIS

21.7.3 GEOGRAPHIC PRESENCE

21.7.4 PRODUCT PORTFOLIO

21.7.5 RECENT DEVELOPMENTS

21.8 ACCORD HEALTHCARE

21.8.1 COMPANY OVERVIEW

21.8.2 REVENUE ANALYSIS

21.8.3 GEOGRAPHIC PRESENCE

21.8.4 PRODUCT PORTFOLIO

21.8.5 RECENT DEVELOPMENTS

21.9 MEITHEAL PHARMACEUTICALS

21.9.1 COMPANY OVERVIEW

21.9.2 REVENUE ANALYSIS

21.9.3 GEOGRAPHIC PRESENCE

21.9.4 PRODUCT PORTFOLIO

21.9.5 RECENT DEVELOPMENTS

21.1 TEVA PHARMACEUTICALS USA, INC.

21.10.1 COMPANY OVERVIEW

21.10.2 REVENUE ANALYSIS

21.10.3 GEOGRAPHIC PRESENCE

21.10.4 PRODUCT PORTFOLIO

21.10.5 RECENT DEVELOPMENTS

21.11 XELLIA PHARMACEUTICALS

21.11.1 COMPANY OVERVIEW

21.11.2 REVENUE ANALYSIS

21.11.3 GEOGRAPHIC PRESENCE

21.11.4 PRODUCT PORTFOLIO

21.11.5 RECENT DEVELOPMENTS

21.12 FRESENIUS KABI USA

21.12.1 COMPANY OVERVIEW

21.12.2 REVENUE ANALYSIS

21.12.3 GEOGRAPHIC PRESENCE

21.12.4 PRODUCT PORTFOLIO

21.12.5 RECENT DEVELOPMENTS

21.13 SAGENT PHARMACEUTICALS, INC.

21.13.1 COMPANY OVERVIEW

21.13.2 REVENUE ANALYSIS

21.13.3 GEOGRAPHIC PRESENCE

21.13.4 PRODUCT PORTFOLIO

21.13.5 RECENT DEVELOPMENTS

21.14 PFIZER INC.

21.14.1 COMPANY OVERVIEW

21.14.2 REVENUE ANALYSIS

21.14.3 GEOGRAPHIC PRESENCE

21.14.4 PRODUCT PORTFOLIO

21.14.5 RECENT DEVELOPMENTS

21.15 THERAVANCE BIOPHARMA

21.15.1 COMPANY OVERVIEW

21.15.2 REVENUE ANALYSIS

21.15.3 GEOGRAPHIC PRESENCE

21.15.4 PRODUCT PORTFOLIO

21.15.5 RECENT DEVELOPMENTS

21.16 CUMBERLAND PHARMACEUTICALS INC.

21.16.1 COMPANY OVERVIEW

21.16.2 REVENUE ANALYSIS

21.16.3 GEOGRAPHIC PRESENCE

21.16.4 PRODUCT PORTFOLIO

21.16.5 RECENT DEVELOPMENTS

21.17 ENDO PHARMACEUTICALS INC.

21.17.1 COMPANY OVERVIEW

21.17.2 REVENUE ANALYSIS

21.17.3 GEOGRAPHIC PRESENCE

21.17.4 PRODUCT PORTFOLIO

21.17.5 RECENT DEVELOPMENTS

21.18 CARB-X

21.18.1 COMPANY OVERVIEW

21.18.2 REVENUE ANALYSIS

21.18.3 GEOGRAPHIC PRESENCE

21.18.4 PRODUCT PORTFOLIO

21.18.5 RECENT DEVELOPMENTS

21.19 NOVITIUM PHARMA

21.19.1 COMPANY OVERVIEW

21.19.2 REVENUE ANALYSIS

21.19.3 GEOGRAPHIC PRESENCE

21.19.4 PRODUCT PORTFOLIO

21.19.5 RECENT DEVELOPMENTS

21.2 AXONICS INC.

21.20.1 COMPANY OVERVIEW

21.20.2 REVENUE ANALYSIS

21.20.3 GEOGRAPHIC PRESENCE

21.20.4 PRODUCT PORTFOLIO

21.20.5 RECENT DEVELOPMENTS

21.21 ENDOVENTURE

21.21.1 COMPANY OVERVIEW

21.21.2 REVENUE ANALYSIS

21.21.3 GEOGRAPHIC PRESENCE

21.21.4 PRODUCT PORTFOLIO

21.21.5 RECENT DEVELOPMENTS

21.22 VITACON

21.22.1 COMPANY OVERVIEW

21.22.2 REVENUE ANALYSIS

21.22.3 GEOGRAPHIC PRESENCE

21.22.4 PRODUCT PORTFOLIO

21.22.5 RECENT DEVELOPMENTS

21.23 BTL GROUP OF COMPANIES

21.23.1 COMPANY OVERVIEW

21.23.2 REVENUE ANALYSIS

21.23.3 GEOGRAPHIC PRESENCE

21.23.4 PRODUCT PORTFOLIO

21.23.5 RECENT DEVELOPMENTS

21.24 JUNE MEDICAL

21.24.1 COMPANY OVERVIEW

21.24.2 REVENUE ANALYSIS

21.24.3 GEOGRAPHIC PRESENCE

21.24.4 PRODUCT PORTFOLIO

21.24.5 RECENT DEVELOPMENTS

21.25 BOEHRINGER INGELHEIM GMBH

21.25.1 COMPANY OVERVIEW

21.25.2 REVENUE ANALYSIS

21.25.3 GEOGRAPHIC PRESENCE

21.25.4 PRODUCT PORTFOLIO

21.25.5 RECENT DEVELOPMENTS

21.26 CARBON MEDICAL TECHNOLOGIES, INC.

21.26.1 COMPANY OVERVIEW

21.26.2 REVENUE ANALYSIS

21.26.3 GEOGRAPHIC PRESENCE

21.26.4 PRODUCT PORTFOLIO

21.26.5 RECENT DEVELOPMENTS

21.27 MEDTRONIC

21.27.1 COMPANY OVERVIEW

21.27.2 REVENUE ANALYSIS

21.27.3 GEOGRAPHIC PRESENCE

21.27.4 PRODUCT PORTFOLIO

21.27.5 RECENT DEVELOPMENTS

21.28 BOSTON SCIENTIFIC CORPORATION

21.28.1 COMPANY OVERVIEW

21.28.2 REVENUE ANALYSIS

21.28.3 GEOGRAPHIC PRESENCE

21.28.4 PRODUCT PORTFOLIO

21.28.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

22 RELATED REPORTS

23 CONCLUSION

24 QUESTIONNAIRE

25 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.