Market Analysis and Insights

An antibiotic is a type of antimicrobial substance active against bacteria. It is the most important type of antibacterial agent for fighting bacterial infections, and antibiotic medications are widely used in the treatment and prevention of such infections. They may either kill or inhibit the growth of bacteria.

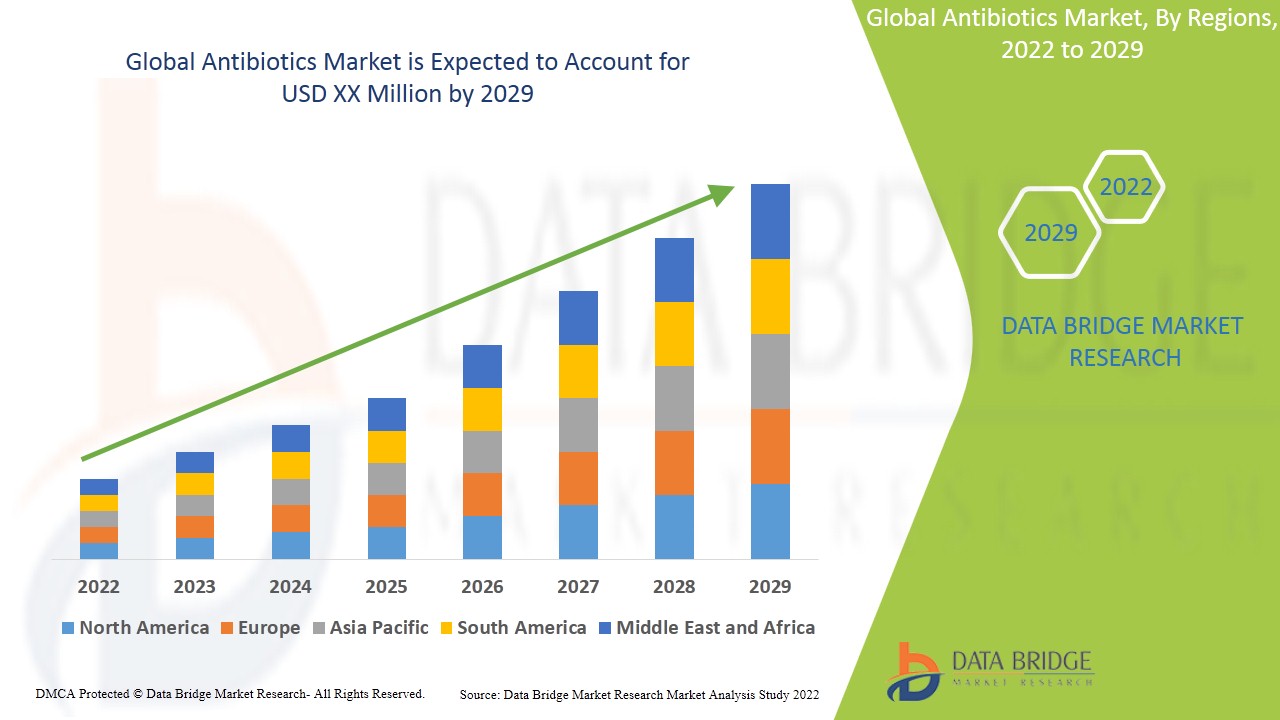

- The antibiotics is supportive and aims to destroying bacteria and curing infections. Data Bridge Market Research analyses that the antibiotics market will grow at a CAGR of 5.16% during the forecast period of 2022 to 2029. “Hospital” segment dominates the end user market.

Antibiotics Market Dynamics

Drivers

-

Increasing number of patients suffering from infectious diseases

Infections are major problem in healthcare system and with cOVID-19 is showing rise in the number of people with infection and diseases act as a major driver that will result in the expansion of the growth rate of the treatment market.

-

Advances in antibiotics drugs

Also, the pharmaceuticals companies are making much progress in the advancement of these drugs antibiotic is making much advancement than generic medicine and it will further enhance the growth of antibiotics market.

Furthermore, novel combination therapies to treat antibiotic-resistant microbial infections can advance the treatment landscape and a special designation from the regulatory authority to various potential pharmaceuticals companies and ongoing clinical trials are being conducted by many pharmaceuticals companies will result in the expansion of antibiotics market.

Opportunities

Surge volume of patients suffering from infectious diseases and development in newer diagnostics devices

Restraints/Challenges

However, antibiotic resistance and lengthy and tedious regulatory procedures will impede the growth rate of antibiotics market. The side effects of antibiotics and self-medication will further challenge the market in the forecast period mentioned above.

This antibiotics market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on antibiotics market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Patient Epidemiology Analysis

According to the United Nation's Ageing Population Report 2019, the global population aged 60 years or over was numbered at 962 million in 2017, more than twice as large as in 1980 when there were 382 million older persons worldwide. In 2018, 447,694 diagnoses of sexually transmitted infections (STIs) were made in the United Kingdom, a 5% increase compared to 2017. Additionally, 56,259 diagnoses of gonorrhea were reported in 2018, a 26% increase compared to 2017, and 7,541 diagnoses of syphilis were reported in 2018, a 5% increase compared to 2017

According to the WHO, in 2019, 10 million people were suffering from tuberculosis (TB) globally, and 1.4 million people died due to the disease.

Antibiotics market also provides you with detailed market analysis for patient analysis, prognosis and cures. Prevalence, incidence, mortality, adherence rates are some of the data variables that are available in the report. Direct or indirect impact analyses of epidemiology to market growth are analysed to create a more robust and cohort multivariate statistical model for forecasting the market in the growth period.

COVID-19 Impact on Antibiotics Market

In addition, with the high need for the development of drugs and treatment for COVID-19, antibiotics are extensively being studied. For instance, in March 2020, Pfizer announced positive data for the use of its azithromycin (Zithromax) drug, along with hydroxychloroquine, in a coronavirus (COVID-19) clinical trial performed in France. Similarly, according to a study of 368 patients, in April 2020, there was no significant difference in mechanical ventilation risks in three cohorts of patients treated with hydroxychloroquine alone, a combo of hydroxychloroquine and azithromycin, and supportive care alone.

Recent Development

- In October 2020, Pfizer Inc. announced the acquisition of Arixa Pharmaceuticals Inc., a company dedicated to developing next-generation oral antibiotics for drug-resistant Gram-negative infections.

Global Antibiotics Market Scope

The antibiotics market is segmented on the basis of indication, drug class, and drug origin, spectrum of activity, route of administration, end-users and distribution channel. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Indication

- Urinary tract infection

- Intra-abdominal infections

- Blood stream infections

- Clostridium difficile infections

- Others

On the basis of indication, the antibiotics market is segmented into urinary tract infection, intra-abdominal infections, blood stream infections, clostridium difficile infections and others.

Drug class

- Beta lactam

- Beta lactamase

- Inhibitors

- Quinolone

- Macrolide

- others

The drug class segment for antibiotics market includes beta lactam & beta lactamase inhibitors, quinolone, macrolide and others.

Drug origin

- Natural

- Semisynthetic

- Synthetic

On the basis of drug origin, the antibiotics market is segmented into natural, semisynthetic, synthetic.

Spectrum of activity

- Broad-spectrum antibiotic

- Narrow-spectrum antibiotic

Antibiotics market is segmented into broad-spectrum antibiotic and narrow-spectrum antibiotic on the basis of spectrum of activity.

Route of Administration

- Oral

- Parenteral

- Topical

- Others

Route of administration segment of antibiotics market is segmented into oral, parenteral, topical and others.

End Use

- Specialty Clinic

- Hospital

- Others

- Homecare

On the basis of end-users, the antibiotics market is segmented into hospitals, homecare, specialty clinics and others.

Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Others

Antibiotics market has also been segmented based on the distribution channel into hospital pharmacy, online pharmacy, retail pharmacy others.

Pipeline Analysis

In September 2020, Shionogi launched its new gram-negative antibiotic Fetcroja in the United Kingdom, which protects against all Gram-negative pathogens. In January 2020, Wockhardt received regulatory approval for its new antibiotics, EMROK (IV) and EMROK O (Oral), for the indication of acute bacterial skin and skin structure infections, including diabetic foot infections and concurrent bacteremia. The U.S. FDA granted Fast Track designations, Qualified Infectious Disease Product (QIDP) designation, and marketing exclusivity till 2028 for the product.

Antibiotics Market Regional Analysis/Insights

The antibiotics market is analysed and market size insights and trends are provided by country, indication, drug class, and drug origin, spectrum of activity, route of administration, end-users and distribution channel as referenced above.

The countries covered in the antibiotics market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Asia-Pacific dominates the antibiotics market in terms of market share and market revenue and will continue to flourish its dominance during the forecast period. This is due to larger population, high prevalence cases of infectious disease and lenient regulation on antibiotics drugs in this region. North America on the other hand is projected to exhibit the highest growth rate during the forecast period due to the focus of various established market players to expand their presence in this particular region.

The country section of the report also provides individual market impacting factors and changes in regulations in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, disease epidemiology and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Antibiotics Market Share Analysis

The antibiotics market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to antibiotics market.

Some of the major players operating in the antibiotics market are Johnson & Johnson Services, Inc, Sanofi, Bayer AG, Abbott, F. Hoffmann-La Roche Ltd, Melinta Therapeutics, INC, Merck & Co., Inc., Allergan, Pfizer Inc, Novartis AG, LG Chem, Mylan N.V, Lupin, Hitech, Amneal Pharmaceuticals LLC, Zydus Cadila, Bausch Health, Teva Pharmaceutical Industries Ltd, Akron Incorporated, KYORIN Holdings, Inc, MerLion Pharmaceuticals GmbH and Wockhardt among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL ANTIBIOTICS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL ANTIBIOTICS MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL ANTIBIOTICS MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES MODEL

5 INDUSTRY INSIGHTS

5.1 PATENT ANALYSIS

5.1.1 PATENT LANDSCAPE

5.1.2 USPTO NUMBER

5.1.3 PATENT EXPIRY

5.1.4 EPIO NUMBER

5.1.5 PATENT STRENGTH AND QUALITY

5.1.6 PATENT CLAIMS

5.1.7 PATENT CITATIONS

5.1.8 PATENT LITIGATION AND LICENSING

5.1.9 FILE OF PATENT

5.1.10 PATENT RECEIVED CONTRIES

5.1.11 TECHNOLOGY BACKGROUND

5.2 DRUG TREATMENT RATE BY MATURED MARKETS

5.3 DEMOGRAPHIC TRENDS: IMPACTS ON ALL INCIDENCE RATES

5.4 PATIENT FLOW DIAGRAM

5.5 KEY PRICING STRATEGIES

5.6 KEY PATIENT ENROLLMENT STRATEGIES

5.7 INTERVIEWS WITH SPECIALIST

5.8 OTHER KOL SNAPSHOTS

6 EPIDEMIOLOGY

6.1 INCIDENCE OF ALL BY GENDER

6.2 TREATMENT RATE

6.3 MORTALITY RATE

6.4 DRUG ADHERENCE AND THERAPY SWITCH MODEL

6.5 PATIENT TREATMENT SUCCESS RATES

7 MERGERS AND ACQUISITION

7.1 LICENSING

7.2 COMMERCIALIZATION AGREEMENTS

8 REGULATORY FRAMEWORK

8.1 REGULATORY APPROVAL PROCESS

8.2 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

8.3 REGULATORY APPROVAL PATHWAYS

8.4 LICENSING AND REGISTRATION

8.5 POST-MARKETING SURVEILLANCE

8.6 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

9 PIPELINE ANALYSIS

9.1 CLINICAL TRIALS AND PHASE ANALYSIS

9.2 DRUG THERAPY PIPELINE

9.3 PHASE III CANDIDATES

9.4 PHASE II CANDIDATES

9.5 PHASE I CANDIDATES

9.6 OTHERS (PRE-CLINICAL AND RESEARCH)

TABLE 1 GLOBAL CLINICAL TRIAL MARKET FOR GLOBAL ANTIBIOTICS MARKET

Company Name Therapeutic Area

XX XX

XX XX

XX XX

XX XX

XX XX

XX XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 2 DISTRIBUTION OF PRODUCTS AND PROJECTS BY PHASE

Phase Number of Projects

Preclinical/Research Projects XX

Clinical Development XX

Phase I XX

Phase II XX

Phase III XX

U.S. Filed/Approved But Not Yest Marketed XX

Total XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 3 DISTRIBUTION OF PROJECTS BY THERAPEUTIC AREA AND PHASE

Therapeutic Area Preclinical/ Research Project

XX XX

XX XX

XX XX

XX XX

XX XX

Total Projects XX

TABLE 4 DISTRIBUTION OF PROJECTS BY SCIENTIFIC APPROACH AND PHASE

Technology Preclinical/ Research Project

XX XX

XX XX

XX XX

XX XX

XX XX

Total Projects XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

FIGURE 1 TOP ENTITIES BASED ON R&D GLANCE FOR GLOBAL ANTIBIOTICS MARKET

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

10 MARKETED DRUG ANALYSIS

10.1 DRUG

10.1.1 BRAND NAME

10.1.2 GENERICS NAME

10.2 THERAPEUTIC INDIACTION

10.3 PHARACOLOGICAL CLASS OD THE DRUG

10.4 DRUG PRIMARY INDICATION

10.5 MARKET STATUS

10.6 MEDICATION TYPE

10.7 DRUG DOSAGES FORM

10.8 DOSAGES AVAILABILITY

10.9 PACKAGING TYPE

10.1 DRUG ROUTE OF ADMINISTRATION

10.11 DOSING FREQUENCY

10.12 DRUG INSIGHT

10.13 AN OVERVIEW OF THE DRUG DEVELOPMENT ACTIVITIES SUCH AS REGULATORY MILSTONE, SAFETY DATA AND EFFICACY DATA, MARKET EXCLUSIVITY DATA.

10.13.1 FORECAST MARKET OUTLOOK

10.13.2 CROSS COMPETITION

10.13.3 THERAPEUTIC PORTFOLIO

10.13.4 CURRENT DEVELOPMENT SCENARIO

11 MARKET ACCESS

11.1 10-YEAR MARKET FORECAST

11.2 CLINICAL TRIAL RECENT UPDATES

11.3 ANNUAL NEW FDA APPROVED DRUGS

11.4 DRUGS MANUFACTURER AND DEALS

11.5 MAJOR DRUG UPTAKE

11.6 CURRENT TREATMENT PRACTICES

11.7 IMPACT OF UPCOMING THERAPY

12 R & D ANALYSIS

12.1 COMPARATIVE ANALYSIS

12.2 DRUG DEVELOPMENTAL LANDSCAPE

12.3 IN-DEPTH INSIGHTS ON REGULATORY MILESTONES

12.4 THERAPEUTIC ASSESSMENT

12.5 ASSET-BASED COLLABORATIONS AND PARTNERSHIPS

13 MARKET OVERVIEW

13.1 DRIVERS

13.2 RESTRAINTS

13.3 OPPORTUNITIES

13.4 CHALLENGES

14 GLOBAL ANTIBIOTICS MARKET, SWOT AND DBMR ANALYSIS

15 GLOBAL ANTIBIOTICS MARKET, BY PRODUCT TYPE

15.1 OVERVIEW

15.2 PENICILLINS

15.2.1 AMOXICILLIN

15.2.2 AMPICILLIN

15.2.3 DICLOXACILLIN

15.2.4 OXACILLIN

15.2.5 OTHERS

15.3 TETRACYCLINES

15.3.1 DEMECLOCYCLINE

15.3.2 DOXYCYCLINE

15.3.3 OMADACYCLINE

15.3.4 SARECYCLINE

15.3.5 OTHERS

15.4 CEPHALOSPORINS

15.4.1 CEFACLOR

15.4.2 CEFPROZIL

15.4.3 CEFOTAXIME

15.4.4 CEFOTETAN

15.4.5 CEFTAZIDIME

15.4.6 CEFUROXIME

15.4.7 OTHERS

15.5 LINCOMYCINS

15.5.1 CLINDAMYCIN

15.5.2 LINCOMYCIN

15.5.3 OTHERS

15.6 FLUOROQUINOLONES

15.6.1 CIPROFLOXACIN

15.6.2 MOXIFLOXACIN

15.6.3 GEMIFLOXACIN

15.6.4 LEVOFLOXACIN

15.6.5 OTHERS

15.7 MACROLIDES

15.7.1 AZITHROMYCIN

15.7.2 CLARITHROMYCIN

15.7.3 ERYTHROMYCIN

15.7.4 OTHERS

15.8 SULFONAMIDES

15.8.1 SULFASALAZINE

15.8.2 SULFAMETHOXAZOLE AND TRIMETHOPRIM

15.8.3 OTHERS

15.9 GLYCOPEPTIDE ANTIBIOTICS

15.9.1 DALBAVANCIN

15.9.2 ORITAVANCIN

15.9.3 VANCOMYCIN

15.9.4 OTHERS

15.1 AMINOGLYCOSIDES

15.10.1 GENTAMICIN

15.10.2 TOBRAMYCIN

15.10.3 OTHERS

15.11 CARBAPENEMS

15.11.1 IMIPENEM AND CILASTATIN

15.11.2 MEROPENEM

15.11.3 ERTAPENEM

15.11.4 OTHERS

15.12 OTHERS

16 GLOBAL ANTIBIOTICS MARKET, BY INDICATION

16.1 OVERVIEW

16.2 URINARY TRACT INFECTION

16.2.1 BANDED

16.2.2 GENERICS

16.3 INTRA-ABDOMINAL INFECTIONS

16.3.1 BANDED

16.3.2 GENERICS

16.4 BLOOD STREAM INFECTIONS

16.4.1 BANDED

16.4.2 GENERICS

16.5 CLOSTRIDIUM DIFFICILE INFECTIONS

16.5.1 BANDED

16.5.2 GENERICS

16.6 OTHERS

17 GLOBAL ANTIBIOTICS MARKET, BY DRUG TYPE

17.1 OVERVIEW

17.2 BANDED

17.2.1 ZITHROMAX

17.2.2 LINCOCIN

17.2.3 AMOXIL

17.2.4 XERAVA

17.2.5 OTHERS

17.3 GENERICS

18 GLOBAL ANTIBIOTICS MARKET, BY POPULATION TYPE

18.1 OVERVIEW

18.2 ADULT

18.3 PEDIATRICS

18.4 GERIATRICS

19 GLOBAL ANTIBIOTICS MARKET, BY GENDER

19.1 OVERVIEW

19.2 MALE

19.3 FEMALE

20 GLOBAL ANTIBIOTICS MARKET, BY ROUTE OF ADMINISTRATION

20.1 OVERVIEW

20.2 ORAL

20.2.1 TABLETS

20.2.2 CAPSULES

20.2.3 OTHERS

20.3 PARENTERAL

20.4 OTHERS

21 GLOBAL ANTIBIOTICS MARKET, BY DRUG ORIGIN

21.1 OVERVIEW

21.2 NATURAL

21.3 SEMISYNTHETIC

21.4 SYNTHETIC

22 GLOBAL ANTIBIOTICS MARKET, BY SPECTRUM OF ACTIVITY

22.1 OVERVIEW

22.2 BROAD-SPECTRUM ANTIBIOTIC

22.3 NARROW-SPECTRUM ANTIBIOTIC

23 GLOBAL ANTIBIOTICS MARKET, BY END USER

23.1 OVERVIEW

23.2 HOSPITALS

23.2.1 PUBLIC

23.2.2 PRIVATE

23.3 SPECIALTY CLINICS

23.4 HOME HEALTHCARE

23.5 OTHERS

24 GLOBAL ANTIBIOTICS MARKET, BY DISTRIBUTION CHANNEL

24.1 OVERVIEW

24.2 DIRECT TENDERS

24.3 RETAIL SALES

24.3.1 HOSPITAL PHARMACY

24.3.2 ONLINE PHARAMCY

24.3.3 RETAIL PHARMACY

24.4 OTHERS

25 GLOBAL ANTIBIOTICS MARKET, COMPANY LANDSCAPE

25.1 COMPANY SHARE ANALYSIS: GLOBAL

25.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

25.3 COMPANY SHARE ANALYSIS: EUROPE

25.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

25.5 MERGERS & ACQUISITIONS

25.6 NEW PRODUCT DEVELOPMENT & APPROVALS

25.7 EXPANSIONS

25.8 REGULATORY CHANGES

25.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

26 GLOBAL ANTIBIOTICS MARKET, BY REGION

Global ANTIBIOTICS Market, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

26.1 NORTH AMERICA

26.1.1 U.S.

26.1.2 CANADA

26.1.3 MEXICO

26.2 EUROPE

26.2.1 GERMANY

26.2.2 U.K.

26.2.3 ITALY

26.2.4 FRANCE

26.2.5 SPAIN

26.2.6 RUSSIA

26.2.7 SWITZERLAND

26.2.8 TURKEY

26.2.9 BELGIUM

26.2.10 NETHERLANDS

26.2.11 DENMARK

26.2.12 SWEDEN

26.2.13 POLAND

26.2.14 NORWAY

26.2.15 FINLAND

26.2.16 REST OF EUROPE

26.3 ASIA-PACIFIC

26.3.1 JAPAN

26.3.2 CHINA

26.3.3 SOUTH KOREA

26.3.4 INDIA

26.3.5 SINGAPORE

26.3.6 THAILAND

26.3.7 INDONESIA

26.3.8 MALAYSIA

26.3.9 PHILIPPINES

26.3.10 AUSTRALIA

26.3.11 NEW ZEALAND

26.3.12 VIETNAM

26.3.13 TAIWAN

26.3.14 REST OF ASIA-PACIFIC

26.4 SOUTH AMERICA

26.4.1 BRAZIL

26.4.2 ARGENTINA

26.4.3 REST OF SOUTH AMERICA

26.5 MIDDLE EAST AND AFRICA

26.5.1 SOUTH AFRICA

26.5.2 EGYPT

26.5.3 BAHRAIN

26.5.4 UNITED ARAB EMIRATES

26.5.5 KUWAIT

26.5.6 OMAN

26.5.7 QATAR

26.5.8 SAUDI ARABIA

26.5.9 REST OF MEA

26.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

27 GLOBAL ANTIBIOTICS MARKET, COMPANY PROFILE

27.1 PACE BIOTECH

27.1.1 COMPANY OVERVIEW

27.1.2 REVENUE ANALYSIS

27.1.3 GEOGRAPHIC PRESENCE

27.1.4 PRODUCT PORTFOLIO

27.1.5 RECENT DEVELOPMENTS

27.2 LUPIN LIMITED

27.2.1 COMPANY OVERVIEW

27.2.2 REVENUE ANALYSIS

27.2.3 GEOGRAPHIC PRESENCE

27.2.4 PRODUCT PORTFOLIO

27.2.5 RECENT DEVELOPMENTS

27.3 CIPLA INC.

27.3.1 COMPANY OVERVIEW

27.3.2 REVENUE ANALYSIS

27.3.3 GEOGRAPHIC PRESENCE

27.3.4 PRODUCT PORTFOLIO

27.3.5 RECENT DEVELOPMENTS

27.4 DR. REDDY’S LABORATORIES, INC.

27.4.1 COMPANY OVERVIEW

27.4.2 REVENUE ANALYSIS

27.4.3 GEOGRAPHIC PRESENCE

27.4.4 PRODUCT PORTFOLIO

27.4.5 RECENT DEVELOPMENTS

27.5 TAIGEN BIOTECHNOLOGY CO., LTD.

27.5.1 COMPANY OVERVIEW

27.5.2 REVENUE ANALYSIS

27.5.3 GEOGRAPHIC PRESENCE

27.5.4 PRODUCT PORTFOLIO

27.5.5 RECENT DEVELOPMENTS

27.6 SUN PHARMACEUTICAL LIMITED

27.6.1 COMPANY OVERVIEW

27.6.2 REVENUE ANALYSIS

27.6.3 GEOGRAPHIC PRESENCE

27.6.4 PRODUCT PORTFOLIO

27.6.5 RECENT DEVELOPMENTS

27.7 ABBOTT

27.7.1 COMPANY OVERVIEW

27.7.2 REVENUE ANALYSIS

27.7.3 GEOGRAPHIC PRESENCE

27.7.4 PRODUCT PORTFOLIO

27.7.5 RECENT DEVELOPMENTS

27.8 MEDOPHARM

27.8.1 COMPANY OVERVIEW

27.8.2 REVENUE ANALYSIS

27.8.3 GEOGRAPHIC PRESENCE

27.8.4 PRODUCT PORTFOLIO

27.8.5 RECENT DEVELOPMENTS

27.9 ADVACARE PHARMA

27.9.1 COMPANY OVERVIEW

27.9.2 REVENUE ANALYSIS

27.9.3 GEOGRAPHIC PRESENCE

27.9.4 PRODUCT PORTFOLIO

27.9.5 RECENT DEVELOPMENTS

27.1 NOVARTIS AG

27.10.1 COMPANY OVERVIEW

27.10.2 REVENUE ANALYSIS

27.10.3 GEOGRAPHIC PRESENCE

27.10.4 PRODUCT PORTFOLIO

27.10.5 RECENT DEVELOPMENTS

27.11 MELINTA THERAPEUTICS, INC.

27.11.1 COMPANY OVERVIEW

27.11.2 REVENUE ANALYSIS

27.11.3 GEOGRAPHIC PRESENCE

27.11.4 PRODUCT PORTFOLIO

27.11.5 RECENT DEVELOPMENTS

27.12 PFIZER, INC.

27.12.1 COMPANY OVERVIEW

27.12.2 REVENUE ANALYSIS

27.12.3 GEOGRAPHIC PRESENCE

27.12.4 PRODUCT PORTFOLIO

27.12.5 RECENT DEVELOPMENTS

27.13 JOHNSON & JOHNSON SERVICES, INC.

27.13.1 COMPANY OVERVIEW

27.13.2 REVENUE ANALYSIS

27.13.3 GEOGRAPHIC PRESENCE

27.13.4 PRODUCT PORTFOLIO

27.13.5 RECENT DEVELOPMENTS

27.14 GSK

27.14.1 COMPANY OVERVIEW

27.14.2 REVENUE ANALYSIS

27.14.3 GEOGRAPHIC PRESENCE

27.14.4 PRODUCT PORTFOLIO

27.14.5 RECENT DEVELOPMENTS

27.15 BAYER AG

27.15.1 COMPANY OVERVIEW

27.15.2 REVENUE ANALYSIS

27.15.3 GEOGRAPHIC PRESENCE

27.15.4 PRODUCT PORTFOLIO

27.15.5 RECENT DEVELOPMENTS

27.16 SANOFI

27.16.1 COMPANY OVERVIEW

27.16.2 REVENUE ANALYSIS

27.16.3 GEOGRAPHIC PRESENCE

27.16.4 PRODUCT PORTFOLIO

27.16.5 RECENT DEVELOPMENTS

27.17 ALCON LABORATORIES, INC.

27.17.1 COMPANY OVERVIEW

27.17.2 REVENUE ANALYSIS

27.17.3 GEOGRAPHIC PRESENCE

27.17.4 PRODUCT PORTFOLIO

27.17.5 RECENT DEVELOPMENTS

27.18 MERCK & CO., INC.

27.18.1 COMPANY OVERVIEW

27.18.2 REVENUE ANALYSIS

27.18.3 GEOGRAPHIC PRESENCE

27.18.4 PRODUCT PORTFOLIO

27.18.5 RECENT DEVELOPMENTS

27.19 F. HOFFMANN-LA ROCHE LTD

27.19.1 COMPANY OVERVIEW

27.19.2 REVENUE ANALYSIS

27.19.3 GEOGRAPHIC PRESENCE

27.19.4 PRODUCT PORTFOLIO

27.19.5 RECENT DEVELOPMENTS

27.2 ABBVIE, INC.

27.20.1 COMPANY OVERVIEW

27.20.2 REVENUE ANALYSIS

27.20.3 GEOGRAPHIC PRESENCE

27.20.4 PRODUCT PORTFOLIO

27.20.5 RECENT DEVELOPMENTS

27.21 TEVA PHARMACEUTICAL INDUSTRIES LTD.

27.21.1 COMPANY OVERVIEW

27.21.2 REVENUE ANALYSIS

27.21.3 GEOGRAPHIC PRESENCE

27.21.4 PRODUCT PORTFOLIO

27.21.5 RECENT DEVELOPMENTS

27.22 VISTRIS, INC.

27.22.1 COMPANY OVERVIEW

27.22.2 REVENUE ANALYSIS

27.22.3 GEOGRAPHIC PRESENCE

27.22.4 PRODUCT PORTFOLIO

27.22.5 RECENT DEVELOPMENTS

27.23 ZYDUS CADILA

27.23.1 COMPANY OVERVIEW

27.23.2 REVENUE ANALYSIS

27.23.3 GEOGRAPHIC PRESENCE

27.23.4 PRODUCT PORTFOLIO

27.23.5 RECENT DEVELOPMENTS

27.24 AMNEAL PHARMACEUTICALS, LLC

27.24.1 COMPANY OVERVIEW

27.24.2 REVENUE ANALYSIS

27.24.3 GEOGRAPHIC PRESENCE

27.24.4 PRODUCT PORTFOLIO

27.24.5 RECENT DEVELOPMENTS

27.25 MERLION PHARMACEUTICALS GMBH

27.25.1 COMPANY OVERVIEW

27.25.2 REVENUE ANALYSIS

27.25.3 GEOGRAPHIC PRESENCE

27.25.4 PRODUCT PORTFOLIO

27.25.5 RECENT DEVELOPMENTS

27.26 ELI LILLY AND COMPANY

27.26.1 COMPANY OVERVIEW

27.26.2 REVENUE ANALYSIS

27.26.3 GEOGRAPHIC PRESENCE

27.26.4 PRODUCT PORTFOLIO

27.26.5 RECENT DEVELOPMENTS

28 RELATED REPORTS

29 CONCLUSION

30 QUESTIONNAIRE

31 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.